Behind the addition of FDUSD to the Binance stablecoin family, what secrets are there?

What secrets lie behind the addition of FDUSD to the Binance stablecoin family?Author: LianGuaicryptonaitive

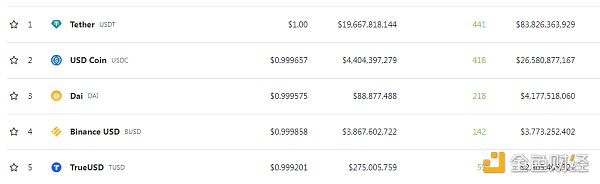

I don’t know if you’ve noticed, but Binance supports a lot of stablecoins for trading: USDT, USDC, BUSD, DAI, TUSD, USDP, making it a comprehensive collection of stablecoins.

Binance supports trading for the top five stablecoins by market capitalization.

- Messari BNB Chain Q3 2023 Performance Analysis

- Interpreting the updates of GNS and their impact on users

- Revenue Declines Year by Year, Mother Company of The Voice of China Reads the Experience of the Metaverse

Recently, Binance has added a new member to its supported stablecoin trading. On July 26, 2023, Binance announced the listing of stablecoin FDUSD.

What is FDUSD?

FDUSD is a stablecoin backed by 1:1 US dollars. It is issued by FD121 Limited, a Hong Kong-based entity, and operated under the brand First Digital Labs.

Currently, FDUSD is issued on both the Ethereum and BNB blockchains, with contract address: 0xc5f0f7b66764f6ec8c8dff7ba683102295e16409

According to public information, FD121 Limited is a subsidiary of Hong Kong trust company First Digital Trust.

First Digital Labs stated that the fiat reserves of FDUSD are held in a separate account by the custodian First Digital Trust Limited, and these reserves are monitored and audited by independent third parties such as Prescient Assurance.

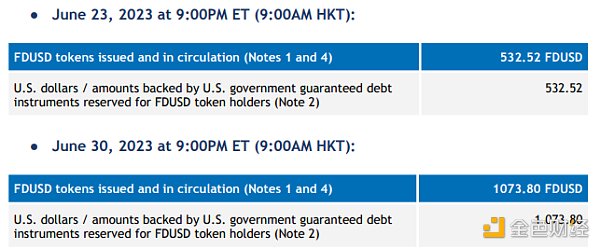

First Digital Labs has released the reserve audit report for June provided by Prescient Assurance. On June 23 and 30, First Digital Labs issued 532 and 1073 FDUSD respectively.

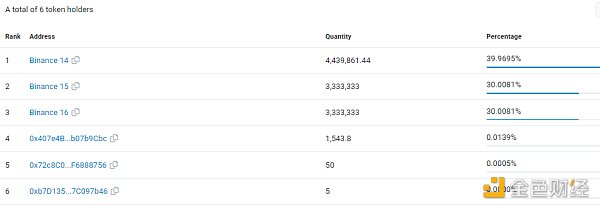

On July 26, 2023, the day before its listing on Binance, First Digital minted approximately 20 million FDUSD on the Ethereum and BNB chains, with over 99% of FDUSD flowing into Binance wallets.

FDUSD on the Ethereum chain

Why did Binance choose FDUSD?

As mentioned at the beginning of this article, as the largest cryptocurrency exchange in the industry, Binance supports the top five stablecoins by market capitalization (USDT, USDC, BUSD, DAI, TUSD) and the latest addition, FDUSD.

Looking at Binance’s strategy, Binance has always wanted to have its own easily controllable “official” stablecoin. However, the centralized stablecoins USDT, USDC, and USDP are backed by companies with a strong history or background, such as Tether, Circle, and LianGuaixos, making them difficult for Binance to control. The decentralized stablecoin DAI is backed by MakerDAO, also beyond Binance’s control.

Therefore, in September 2019, Binance personally collaborated with LianGuaixos to issue BUSD. With Binance’s support, the market capitalization of BUSD soared to $23 billion in November 2022. However, it came to a halt at the end of 2022 due to U.S. regulations.

In February 2023, it suffered another blow. In February 2023, BUSD issuer LianGuaixos announced that, at the request of the regulatory agency New York Department of Financial Services (NYDFS), BUSD minting and issuance would be suspended from February 21. The market capitalization of BUSD began to plummet.

After being blocked, Binance chose TUSD. It is widely rumored that everyone behind TUSD is related to Justin Sun, and Binance has a close relationship with Justin Su. The latest evidence of this “open secret” is that Daniel Jaiyong An, the former founder of Archblock, the developer of TUSD, sued his former colleagues on July 22, claiming that they forced him to leave the business in 2020 while An was negotiating the sale of TUSD to Tron. He claimed that Justin Sun was the secret acquirer of TUSD.

Binance is also strongly supporting TUSD, just like it did with BUSD. For example, Binance Launchpool has a dedicated TUSD Pool, BUSD can be converted to TUSD at a 1:1 ratio, and there are no fees for BTC/TUSD trading pairs.

With the support of Binance, the market value of TUSD has skyrocketed from $900 million to $3.1 billion in June. However, there are instability issues in the background of TUSD, and its market value began to decline from June.

According to media reports, most of TUSD’s reserves are held by Prime Trust, and other custodians include First Digital, Capital Union, Manual, and BitGo (note First Digital inside).

However, Prime Trust, the custodian of TUSD reserves, was reported to be facing bankruptcy crisis in June 2023.

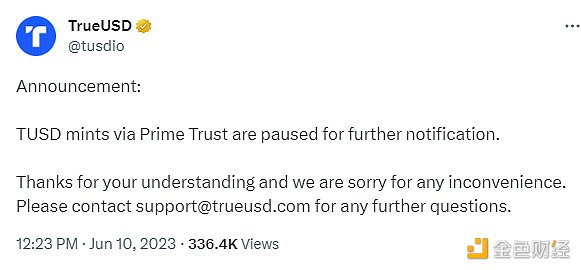

TrueUSD, the issuer of TUSD, notified users on June 10 that the minting of TUSD through Prime Trust has temporarily ceased.

On June 28, the financial department of the state of Nevada in the United States filed a petition to the Eighth Judicial District Court of Nevada, requesting the appointment of a receiver to take over the daily operations of Prime Trust and examine its financial condition.

On July 4, the proposal to freeze the TUSD reserves on the Aave V2 Ethereum pool was approved and implemented, freezing the TUSD reserves on the Aave V2 Ethereum pool.

Let’s go back to First Digital. Unlike the strict regulation in the United States, on June 1, 2023, Hong Kong officially issued new regulations for virtual asset trading. On the same day, First Digital announced the issuance of the USD stablecoin FDUSD.

On that day, Binance CEO Changpeng Zhao mentioned First Digital and FDUSD in a tweet.

On the day of issuing FDUSD, First Digital stated that due to the unclear regulations for stablecoins in Hong Kong, FDUSD will not be used in Hong Kong until stablecoin regulations in Hong Kong are fully in place.

Unlike First Digital’s caution, on July 26, 2023, Binance chose to list FDUSD.

The reason behind Binance’s choice of FDUSD is likely that it has the opportunity to become Binance’s next “official” stablecoin.

Some other information about FDUSD and First Digital Trust

Issuer of FDUSD: FD121 Limited Brand: First Digital Labs

First Digital Trust: Established in 2017 by Legacy Trust, Vincent Chok, CEO of Legacy Trust, announced on September 11, 2019, at Coin Desk Invest in Singapore that First Digital Trust would be spun off into an independent corporate entity. First Digital Trust has become a fully independent public trust company, with its headquarters still in Hong Kong.

Legacy Trust: A public trust company based in Hong Kong, established in 1992, providing trust and trustee services to safeguard various assets.

First Digital Trust CEO: Vincent Chok is the CEO of First Digital Trust. Before founding First Digital Trust in 2017, Vincent served as the CEO of Legacy Trust Company Limited.

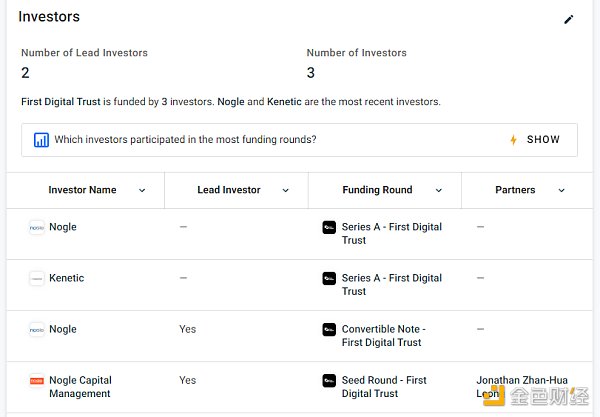

Funding: According to Crunchbase, First Digital Trust raised $25.2 million through three rounds of financing, including $2.2 million in convertible notes. The seed round and Series A investors are mainly from Nogle.

According to the Nogle official website, Jonathan Zhan-Hua Leong is the founder and CEO of Nogle. He is also the CEO of the cryptocurrency exchange BTSE.

According to the Nogle official website, Jonathan Zhan-Hua Leong is the founder and CEO of Nogle. He is also the CEO of the cryptocurrency exchange BTSE.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding the constructive and destructive aspects of stablecoin legislation on ‘DeFi+RWA

- How does Worldcoin specifically handle privacy?

- The US Senate Includes Cryptocurrency Provisions in Defense Bill

- Struggle between Ripple and the SEC What Will Happen Next? Experts Assess 4 Possible Outcomes

- Analyzing the Current State of the Solana Ecosystem from On-chain Data

- Exploring Sidechains and Rollups Differences and Similarities in Architecture, Security Guarantees, and Scalability Performance

- Fed raises interest rates to the highest level in 22 years, Powell warns that there will be no rate cuts this year.