How does the on-chain intelligence platform Arkham accurately target ICP?

How does Arkham target ICP accurately?The original source of this article comes from Crypto Leaks, an investigation company that exposes scandals in the cryptocurrency industry. The first two cases they exposed were about the manipulation of ICP prices by capital and malicious short selling. In the SBF article, Crypto Leaks investigated the doubts and conditions of the market at that time and believed that the ICP token was clearly manipulated before and after its listing. As the “spokesperson” for Solana, which was extremely popular in 2021, SBF had the motive and ability to destroy its biggest competitor, the Internet Computer (IC) network (however, there is no substantial evidence, and there won’t be in the future).

This article is about Arkham and provides a large amount of video evidence showing that Arkham received sponsorship and released a research report intentionally defaming ICP. The DFINITY Foundation later cited this article to sue Arkham and The New York Times for defamation. The article was published on June 9, 2022, with some modifications made by the translator.

Summary of this article:

• Use spy dialogue videos and facts to examine the ICP report published by Arkham Intelligence in June 2021.

• The report focuses on the IC network launched by the DFINITY Foundation, with its native token named ICP.

- Analysis of the BOLD Verification Protocol How to Make Arbitrum More Decentralized?

- Assessing the Impact of EIP-4844 on Layer2 Protocol Costs and Profits

- Why is no one talking about ‘blockchain’ now?

• At that time, Arkham was just a fledgling company with no records or evident expertise related to cryptocurrency research.

• Their only publicly known team member is founder Miguel Morel—besides claiming on his LinkedIn page that he is a cryptocurrency investor and has helped create a cryptocurrency business called Reserve, we couldn’t find any information about him.

• The Arkham ICP report claimed that insiders engaged in “pumping and dumping” when the DFINITY Foundation launched the IC network, which caused the fluctuation of ICP prices. However, they didn’t provide any substantial evidence.

• The report was published on Twitter and accompanied by a video made in the style of a crime documentary.

• Due to its lack of objectivity and substantial content, the report should not have received any attention. However, it mysteriously became associated with The New York Times. The New York Times turned the report into a “lethal weapon” against the reputation of DFINITY.

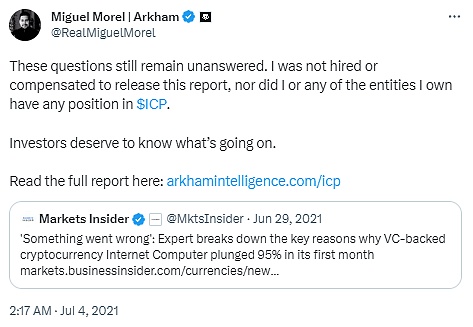

• Arkham founder Miguel claimed that the report was not paid for.

• However, the spy videos we collected show that Arkham was commissioned to produce a “defamatory” report targeting the ICP token, and the commissioning party may be a competitor of the IC network.

• The Arkham ICP report and articles from The New York Times were subsequently used as the basis for attacking the DFINITY Foundation.

• After the report was published, the Arkham team relocated to a luxury mansion in Chelsea, London, in the UK, apparently obtaining a large amount of funding from somewhere. The video shows a security team guarding the entry of unidentified goods into the mansion.

Investigation background

The Internet Computer (IC) blockchain went live on May 10, 2021, developed by a large team from the DFINITY Foundation. People were very excited before the official launch of IC because it was claimed that the IC network could play the role of a “world computer,” providing a decentralized alternative to traditional IT and supporting fully on-chain Web3 services, such as social networks.

After the mainnet went live, the native token ICP could be transferred on the network, and cryptocurrency exchanges around the world started creating spot markets where users could trade ICP tokens. In the initial hours after the mainnet launch, the price of ICP tokens remained above $450, with a fully diluted market cap of $230 billion, which was an undisputed overvaluation. However, the price started to decline.

As of June 28, 2021, the price of ICP had dropped to $50, with a fully diluted market cap of $23.5 billion, which can be considered comparable to other competing networks at that time.

Subsequently, a previously unknown research company called Arkham Intelligence, led by its unknown founder and CEO Miguel Morel, published the “Arkham ICP Report”.

The main claim of the Arkham ICP Report is that the DFINITY Foundation, along with certain insiders, somehow set a higher initial price for the ICP token and engaged in “pump and dump” when the token was listed.

However, it is highly unusual for an organization composed of hundreds of renowned computer science researchers, cryptographers, and engineers to spend years developing a blockchain network only to abandon its vision upon mainnet launch. Furthermore, the report is filled with unsubstantiated claims, inaccuracies, and obvious logical fallacies. To any experienced observer in the cryptocurrency field, this appears to be market manipulation aimed at damaging the reputation of DFINITY, potentially sponsored by competitors of the IC network or financial participants looking to short its token.

Initially, the Arkham ICP Report would not have received much attention, but thanks to New York Times columnist Andrew Ross Sorkin, the report was published simultaneously with an article and a Dealbook newsletter on The New York Times, both of which promoted the report. By providing credibility to the report, The New York Times has caused significant damage to the reputation of the DFINITY Foundation, its leaders, and the IC ecosystem. It can be said that this has led to a devaluation of the ICP token by billions of dollars. The reason why The New York Times chose to promote the “Arkham ICP Report” is unclear, but it is evidently not a reliable source of information.

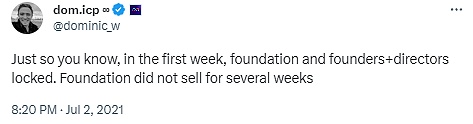

From all perspectives, the DFINITY Foundation did not sell any ICP tokens in the weeks following the mainnet launch. The project’s founder, Dom, stated that he only sold a small portion of the tokens (only 5% of his holdings). Furthermore, common sense tells us that if the market price of ICP tokens is too high after the mainnet launch, it would naturally decline through normal price discovery in any scenario, without the need for “internal dumping”.

In this article, we explore the individuals and content behind the Arkham ICP Report, as well as the perplexing decision by The New York Times to promote the report. As we have demonstrated through undercover videos and other means, the actions of The New York Times become more baffling the deeper we investigate.

Why does The New York Times support the Arkham ICP report?

The New York Times published an article titled “The Dramatic Collapse of Cryptocurrencies is Shocking,” and at the same time, they released “How Proud ICP 1C0 Collapsed” on their Dealbook newsletter and sent it to subscribers. (Note: After the publication of this article, the DFINITY Foundation filed a defamation lawsuit against The New York Times and Arkham Intelligence. The New York Times subsequently edited the title and removed the word “1C0”.)

In “How Proud ICP 1C0 Collapsed,” The New York Times referred to Arkham Intelligence as a trustworthy “cryptocurrency analysis company” and promoted the Arkham ICP report by providing a link to the report. At the same time, although Arkham had not previously published any content, as of June 2022, it has not published any other content.

In “How Proud ICP 1C0 Collapsed,” The New York Times repeatedly incorrectly referred to the IC network, which is currently undergoing mainnet launch, as the “initial coin offering” or “1C0” (involving an organization selling unusable tokens to the public to raise funds for development and promising to make the tokens usable). This has long been prohibited by regulatory agencies in many countries, and it is clearly an intentional attempt to smear the DFINITY Foundation’s involvement in illegal activities.

The main point of the article can be summarized by a quote from a short video promoting the Arkham ICP report by Miguel Morel on Twitter. The video uses the background music commonly used in crime exposés in TV shows and expresses his claim that the DFINITY Foundation and insiders are “guilty”:

Our findings lead us to believe that DFINITY insiders are constantly depositing and selling billions of dollars worth of ICP tokens on exchanges, while others watch their investments shrink. If the data in our analysis is accurate, we should propose that ICP tokens may be one of the most extreme cases of investor abuse in the history of the cryptocurrency market and the entire financial market.”

Miguel makes a clear statement about the “crimes” of the DFINITY Foundation and insiders. Although Arkham Intelligence had only 200 followers on Twitter at the time of the release, due to The New York Times’ promotion, by May 2022, this video by Arkham Intelligence had been viewed nearly 20,000 times, and their “views” became known to the world.

As we mentioned in the SBF article, the Arkham ICP report was likely created for a specific purpose of causing harm to ICP, whether by competitors or market manipulators looking to short ICP. So why would The New York Times, with its outstanding history and mission to seek the truth on behalf of its readers, provide credibility and reputation to Arkham?

Something started to go wrong from the moment our investigators began collecting spy videos and learning about what was happening…

Investigating Arkham Intelligence

The naming of Arkham Intelligence seems to pay homage to Gotham Research, a well-known and respected financial research company. However, we don’t think The New York Times confused the two when deciding to promote Arkham as a reputable “cryptocurrency analysis firm.” Arkham Intelligence has no prior records and has only publicly disclosed one employee, Miguel Morel, who also has no prior records.

Just these two points alone raised serious red flags, and we discovered even more serious issues later on.

Where exactly is the Arkham team?

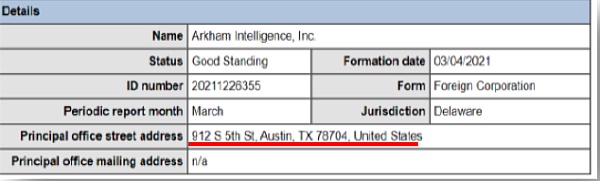

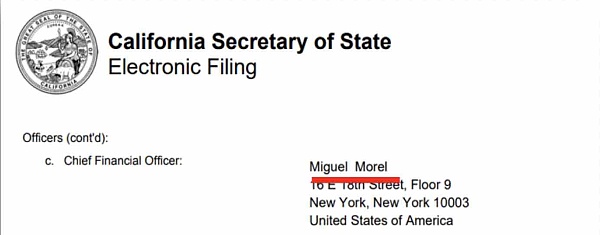

They are registered in Delaware, USA, and were established on March 4, 2021.

However, this establishment date does not match their Twitter account, which was created in May 2019, two years ago, indicating that the account was renamed. Their first tweet appeared on June 28, 2021, the same day The New York Times published the article. This date also contradicts Miguel Morel’s LinkedIn profile, which states that he joined Arkham in January 2020. But these inconsistencies with dates are just the beginning.

However, in the short period of time after publishing the ICP report, the Arkham team was still operating from its headquarters, a countryside location outside Austin, Texas, rather than the luxurious office space you would expect from a reputable research company:

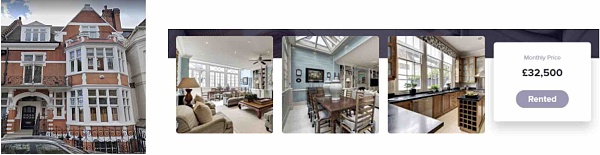

But after the ICP report went viral, this small team of individuals moved out of Texas. Perhaps they made a lot of money because they relocated to a mansion in the Chelsea area of London, UK. According to the initial advertisement, the rent for this mansion was £32,500, or $43,000 per month.

Some might think “cryptocurrency analysis” could be a simple business, but Arkham is registered across various states in the US: Delaware, California, New York, and even Colorado.

Arkham in Chelsea

Arkham’s new headquarters in Chelsea, London, accommodates many members or branches of the Arkham team. Some new members include: Henry Fisher, the head of the cryptocurrency project Reserve and current CTO of Arkham; Charlie Smith, former business development director of Reserve and co-founder of Arkham; Jonah Bennett, a journalist and co-founder of an online magazine that has hired several Arkham employees as writers; Zachary Lerangis, the current operations director of Arkham; and Keegan McNamara, former TPM of Arkham.

There are three things worth noting.

Firstly, the people here are all in their early 20s.

Secondly, Charlie Smith and Keegan McNamara have now left Arkham and are starting a new startup, reflecting the mobility of Arkham members and why it should not be seen as a traditional company.

Thirdly, three members have connections to a project called “Reserve,” which is a “stablecoin” project, and Miguel also claims to be a co-founder of the project…

What is the Reserve project?

Reserve is not a large-scale tech project like the IC network. Its goal is to provide a “stablecoin” that operates on the Ethereum network. Investors can buy stablecoins through its RSR token, which has dropped more than 96.5% in value since its peak.

Crypto enthusiasts hope to see reports written by thoroughly researched, fair, and objective professional researchers, rather than by cryptocurrency entrepreneurs, which may lead to biased and inaccurate conclusions. Particularly puzzling is that their own token, along with the ICP token, experienced a sharp decline in price at the same time, but they probably wouldn’t claim that the price drop was due to insider trading.

Due to the sharp decline in the price of Bitcoin, the prices of many tokens have also fallen, a decline that began almost from the moment the IC mainnet launched. From April 14, 2021, to July 20, 2021, BTC dropped from $63,314 to $29,807. The biggest drop occurred on May 10, 2021, the same day the IC mainnet launched. However, Arkham’s report completely overlooked the impact of BTC on ICP prices, even though it also caused their own RSR token to drop by 79.4%.

Even if they have direct experience of how market fluctuations affect token prices at the time, when Arkham produced the ICP report, they mysteriously did not mention these market trends and instead chose to weave a false narrative about improper behavior by DFINITY insiders, which is enough to prove that their actions were intentional.

Information about Miguel Morel

When the ICP report was released, founder and CEO Miguel Morel was the only publicly disclosed Arkham employee. At that time, his LinkedIn profile revealed only limited career history and qualifications. Given that university logos have been added to his resume, he appears to have graduated from high school and attended college courses. Miguel claims to be a co-founder of Reserve, but shortly after the release of the Arkham ICP report, Reserve removed all information about Miguel from their official website.

Although Reserve did not list Miguel as a co-founder when Arkham released the ICP report, their website did include a blog post attributed to Miguel Morel, which was quickly deleted.

Although it is unclear what Miguel Morel means when he claims to be a “co-founder” of Reserve, this subordinate relationship reflects the possibility that he may have pre-existing economic interests in cryptocurrencies, which could make his claims far from fair and objective.

Obviously, when promoting the ICP report, which may cause billions of dollars in losses, and endorsing it, this should not be something that The New York Times can trust as a normal person.

Has Arkham’s ICP report been paid for?

The New York Times published their article and DealBook newsletter on June 28, 2021, promoting the Arkham ICP report. A few days later, as the IC ecosystem and ICP tokens were damaged, Miguel Morel published his last tweet (at the time of writing), claiming that he was not sponsored to write the report, did not receive any form of compensation, and he did not hold ICP or short ICP:

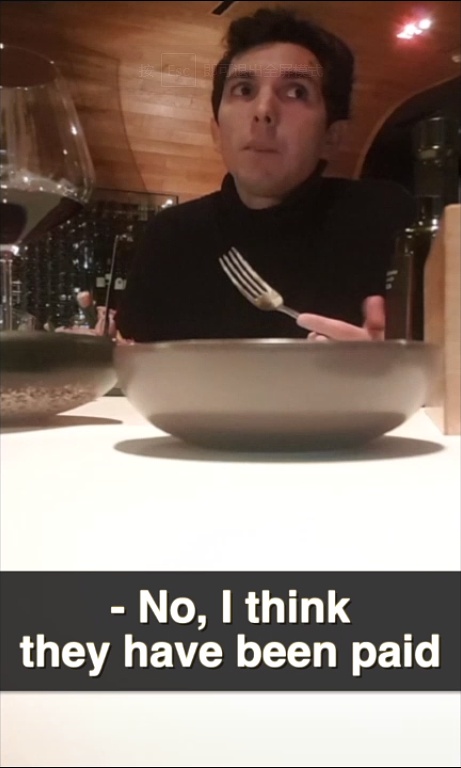

However, in a spy video we collected, Arkham employee Nick Longo said that he believed the client had paid for the report (interested readers can go to the original article to view the video, https://cryptoleaks.info/case-no-2).

Useful dialogue in the video:

Nick: This (ICP report) is a good opportunity to get attention, so we published it. I remember a client paid for it.

Mysterious person: (Payment) to investigate ICP?

Nike: ICP is the first one, there are other crypto projects.

Johan Bennett is more straightforward about the reason Arkham made the ICP report.

Mysterious person: What can Arkham get from it?

Johan: They charge for the report, they were hired to do this. That’s how they make money.

Johan: I think they were specifically hired to do this, and they definitely didn’t choose just one from so many blockchains. I think they were hired by dissatisfied users or investors.

Mysterious person: In the case of Arkham, can publishing an article in The New York Times generate income in some way? Or is it for common interests?

Johan: No, I think they were hired by the client to write it.

The video evidence suggests that the report was sponsored and aimed to blame the decline in ICP prices on the DFINITY Foundation and “insiders” involved in the ecosystem. The report arbitrarily grabbed some large ICP transactions and claimed without any other evidence that these transactions were insiders selling. The report never questioned why the initial price of ICP was so high, nor did it explain why the high price would not naturally fall.

The report not only appears to have been created for paying clients, but its strong claims are deliberately made without a reasonable basis:

Nick: We have done some investigation for clients, such as ICP, and basically inferred who owns these wallets, but these are just speculations… Insiders sold all the tokens, but we did not…

Mysterious Person: Evidence?

Nick: Yes

Arkham’s investor is Tim Draper

Tim Draper is a famous American billionaire with a large cryptocurrency portfolio. His investment in cryptocurrencies started with a significant holding of Bitcoin and later expanded to emerging projects such as Ripple, BCH, Tezos, and Aragon. His son Adam Draper “inherited” his ambition and holds a large amount of cryptocurrencies such as Bitcoin, Monero, and Ethereum through his own venture capital fund Boost VC. For the Draper family, the IC network and the DFINITY Foundation may be seen as a direct threat to their family’s wealth, as the innovative IC network can be considered a direct competitor to all common blockchains.

Nick: Did we have some angel investors at that time?

Mysterious Person: Can you give me the names?

Nick: The most important one is Tim Draper.

Miguel Morel publicly claimed that the Arkham ICP report was not sponsored and was made for the cryptocurrency community. However, it not only appears to have been commissioned by an unknown party for unknown reasons, but as revealed by Nick Longo below, it was made using Tim Draper’s funds:

Nick: When we focused on ICP (report)… we raised a lot of money, a Series A financing, several million dollars, and we still had some money left from the original angel investors.

Suspicious activities at Arkham’s Chelsea headquarters

After the publication of the ICP report, the Arkham team moved from their rural residence in Texas to a luxury mansion in Chelsea, but interesting things happened. Travel bags filled with goods arrived at the villa, containing unknown items. Miguel’s handbag is sometimes carried by security guards, but always accompanied by them. They nervously check back and forth on the road until they are taken into the house:

Arkham has caused various damages to the IC ecosystem

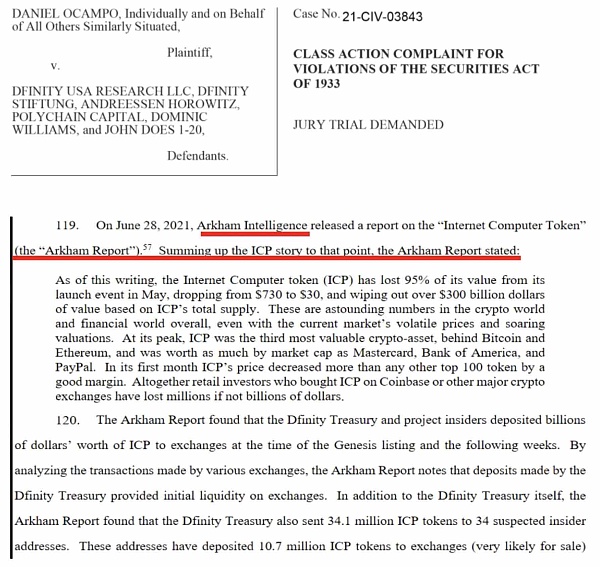

We found that many parties involved in the cases believed Arkham’s claims simply because they believed that The New York Times endorsed Arkham’s claims, and then directly engaged in actions that harmed the IC ecosystem, exacerbating reputational damage. This extended to class action lawsuits, one of which is shown below:

Investigation Summary

As shown in this investigation, The New York Times misrepresented Arkham Company as a respected “cryptocurrency analysis company,” greatly misleading cryptocurrency enthusiasts. Arkham not only appears to lack the skills required to write professional reports, but almost every aspect of the organization is highly suspicious. Although the investigation into this case has brought conclusive evidence to the world, even a basic and rough investigation of this organization would indicate that they are untrustworthy, from the strange mismatched dates in their profiles to the complete absence of any historical records about them or their founders on the internet.

Endorsing Arkham and its reports in this way could potentially reduce the market value of ICP tokens by billions of dollars. As we have shown, the report by Arkham may have been paid for by competitors or individuals shorting ICP, and the company’s main investors also invest in blockchains that compete with the IC network. While false statements may please clients and their main investors, the result clearly damages the reputation of the IC ecosystem and harms the interests of ICP holders.

Within two weeks of the publication of this article, the DFINITY Foundation filed a lawsuit against The New York Times and all members of the Arkham Intelligence team in the Southern District Court of New York, charging them with attack and defamation. The DFINITY Foundation ultimately won the lawsuit.

Risk Warning:

According to the notice issued by the central bank and other departments on “Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Trading,” the content of this article is for information sharing purposes only and does not endorse or promote any business or investment activities. Readers are strictly required to comply with local laws and regulations and not engage in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding Intent Revolutionizing the Web3 User Experience and Blockchain Order Flow

- An Overview of Coinlist’s Upcoming Native Cross-Chain DEX Chainflip Mechanism, Features, and Token Economy

- Celestia Researcher Interpreting 4 New Rollup Solutions

- Losses of over $50 million A comprehensive analysis of the cascade attack event caused by the programming language Vyper malfunction.

- Arthur Hayes In the future, humans will collaborate with AI through DAO.

- Opinion Block space is a commodity, and the growth trajectory of blockchain networks is similar to that of telecommunications networks.

- Exploring Sidechains and Rollups Differences and Similarities in Architecture, Security Assurance, and Scalability Performance