Top 10 Web3 Events in the First Half of 2023 Inventory

Top 10 Web3 Events, H1 2023Author: Jesse Zheng, SUSS NiFT Researcher, Fishery Isla, Biteye Core Contributor

2023 is halfway through, and cryptocurrencies are leading global risk assets. However, the rise has not been smooth sailing, and the fluctuation in prices has been heart-wrenching. What breakthroughs have the industry made in the past six months? What lessons can we learn from them and find the next trend? In this issue, we will review the top ten events in the cryptocurrency market in the first half of 2023 and find the answers.

1. Shanghai Upgrade – A New Chapter for the Ethereum Network

The most important event for Ethereum in the first half of this year was the Shanghai upgrade. This was the final important step for Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS).

Seven months after the Ethereum “merge” upgrade, Ethereum simultaneously conducted the Shanghai upgrade and Capella upgrade on April 12th (which enabled stakers who did not provide withdrawal credentials at the time of initial deposit to provide credentials, thus allowing withdrawal), bringing the staking withdrawal function to the execution layer, allowing stakers to withdraw their 18 million ETH locked since 2020 from the beacon chain to the execution layer, realizing optional full withdrawal or staking income withdrawal, releasing the liquidity of staked tokens, enhancing investors’ confidence in Ethereum as an “Internet bond,” and improving the security of the Ethereum network.

- Page 181: A Complete Review of Coinbase’s Legal Documents – Strong Response to SEC Lawsuit, Seeking Dismissal of Case.

- Conversation with EthStorage founder: Data Availability and Decentralized Storage

- How infrastructure supports billions of users through account abstraction

In addition, although the Shanghai upgrade cannot reduce gas fees, the implementation of EIP-3651, EIP-3855, and EIP-3869 has reduced gas fees for Ethereum developers and block creators.

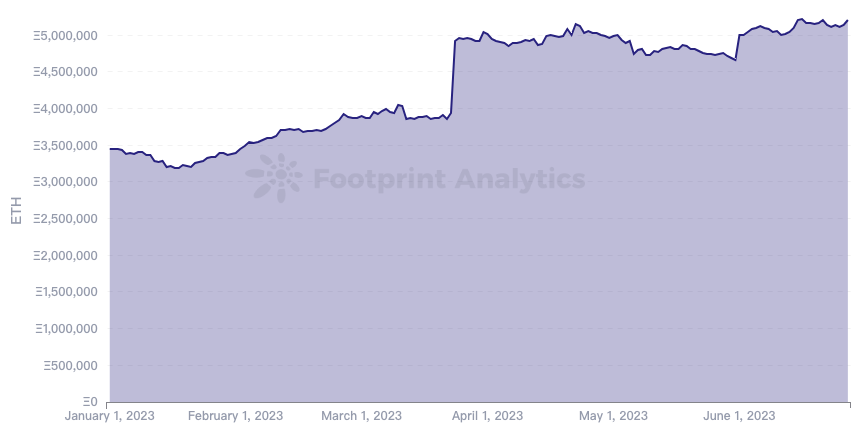

After the implementation of the Shanghai upgrade, although some early stakers made withdrawal operations, the net inflow of staking is still greater than the net outflow, and the staking volume and validator number are showing an accelerating upward trend.

Through steady technological upgrades, Ethereum continues to improve its blockchain performance, bringing confidence to users and investors. The market has also begun to build financial infrastructure around staked Ethereum, and projects such as LSD-based stablecoin issuance, lightning loan leverage, and yield enhancement have received widespread attention.

However, currently, Lido occupies 31% of the staking market share, and the Ethereum ecosystem needs to promote decentralized node technology and attract more outstanding staking service providers to participate in order to reduce the risk of network centralization.

2. Layer 2 is a necessary step for large-scale adoption

On June 12th, Ethereum co-founder Vitalik Buterin pointed out in his latest blog post that the extension of Layer 2 is one of the important technological transformations for Ethereum’s long-term sustainable development. If Ethereum is a kingdom, then Layer 2 is the city-state under this kingdom, and the development of city-states is related to the rise and fall of the kingdom.

According to L2beat data, Arbitrum and Optimism have taken the lead in the L2 market with Optimism Rollup, a more mature technology, with a market share of approximately 64.55% and 18.58%, respectively. Users received an airdrop from Arbitrum on March 23rd, which further strengthened their faith in the Ethereum community due to the huge wealth effect.

Other noteworthy events include:

1. Optimism completed the mainnet Bedrock upgrade on June 7th, which further reduces transaction fees, shortens system delays, and improves node performance.

2. Coinbase launched an L2 Base based on OP Stack, but has no plans to issue dedicated tokens and plans to release the mainnet later this year.

3. At the same time, another L2 extension solution, Zero Knowledge Rollup, has also made significant progress.

4. Type1 zkEVM: Taiko launched the Alpha-3 incentive testnet on June 7th, mainly to test the economic incentives of the protocol, interactions between proposers and verifiers, and interactions with the protocol, as well as the Taiko initial layer (L3).

5. Type-2 zkEVM: The main projects in this track are Scroll, Linea, and Polygon zkEVM.

1) Polygon zkEVM’s mainnet beta version went live as scheduled on March 27th, using ETH to pay for Gas and MATIC tokens for staking and governance.

2) Scroll and the Ethereum Foundation jointly open-sourced the development of zkEVM, which is expected to go live in the third quarter.

3) Linea is expected to go live on the mainnet in July, with a focus on Multi Prover and Layer3.

6. Type-3 zkEVM: Kakarot has achieved 100% bytecode equivalence and is about to transform into Type 2.5. Kakarot is committed to deploying zkEVM as L3 on Starknet.

7. Type-4 zkEVM: The zkSync Era mainnet was opened to everyone on March 24th, and the interaction costs are currently high and mostly native projects, with most blue-chip protocols yet to be deployed. Another Type-4 star project, StarkNet, underwent a mainnet upgrade in June, officially activating Cairo 1, updating sequencers, improving scalability and transaction latency, but the overall user experience still needs to be improved.

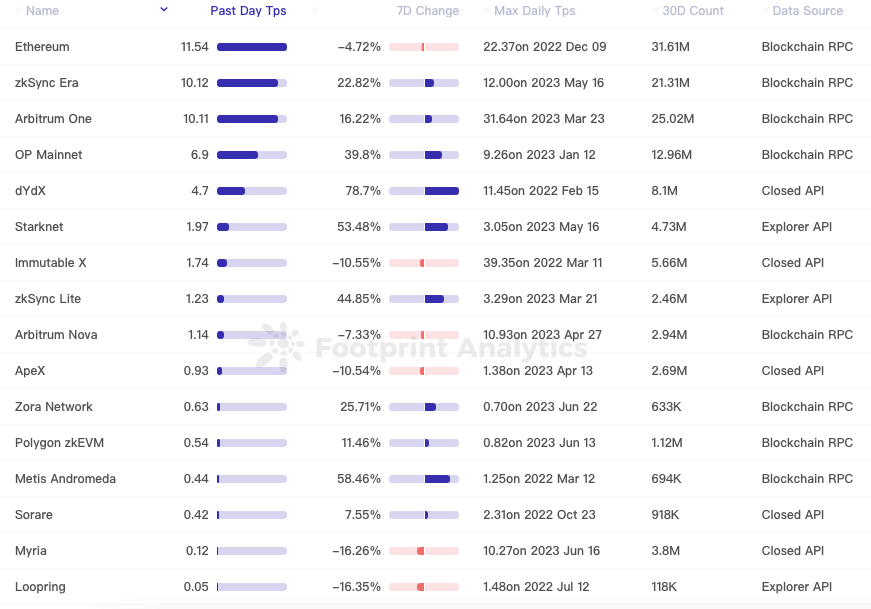

From a data perspective, the lock-up volume of L2 denominated in ETH increased from about 3.64 million at the beginning of the year to 4.82 million in mid-June, and the trend of transactions shifting to L2 continues.

However, all L2s currently have a lower transaction volume per second than Ethereum. Except for the top few L2s, most L2s have very low transaction volume. Moreover, several L2 plans are scheduled to be launched on the mainnet in the second half of the year. Whether the market needs so many L2s remains to be seen.

3. Move public chain ecosystem, rise or fall

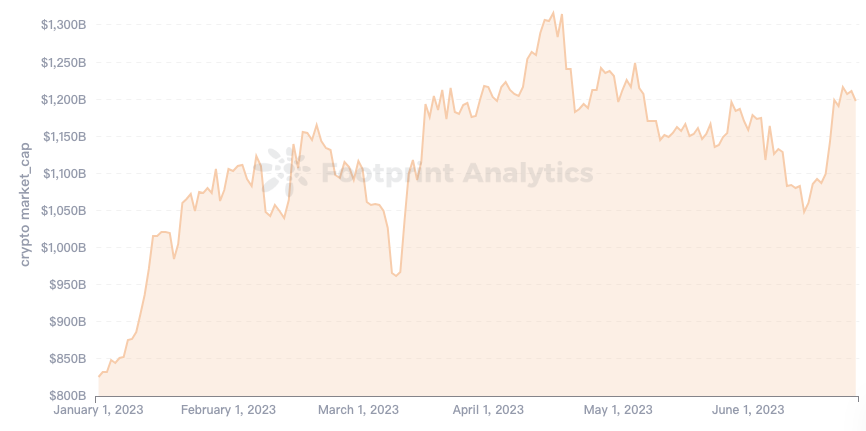

At the beginning of 2023, accompanied by the gradual improvement of the macro environment, Ethereum also released the determined time of the Shanghai upgrade, and the entire secondary market opened a small bull market for nearly a quarter.

Since the first day of the new year, the total market value of crypto has reversed its decline

The opening market mainly revolves around the secondary market speculation of CEX, and the MEME and various first-level markets are relatively weak. The Move public chain Aptos performed the most brilliantly in this wave of market, with a circulating market value of 500 million US dollars, which rose to 3 billion US dollars in just 20 days, leading a wave of “unlocking and pulling up” market. After a brief pull-up, the subsequent Aptos market continued to decline, similar to most altcoins, and has now returned to the level at the time of FTX’s explosion. Another star project in the Move series, SUI, peaked upon launch and has been in a continuous decline in price since May.

The Move series of public chains represents a different direction of expansion and development from Ethereum Layer 2. The security and flexibility of Move are among the main advantages of the new public chain. Currently, the Move series is still in a very early stage, and the projects using the Move language include: Aptos, Sui, 0L Network, and Starcoin. These four projects have all been launched on the mainnet, so Move-related developers can receive real income, which helps attract more developers and reserve strength for the next bull market. In addition, it should be noted that as a new technology, Move still needs time to prove its stability. Beosin recently discovered a critical vulnerability in the Move VM that could cause a network-wide crash in public chains such as Sui and Aptos. The vulnerability has been dealt with accordingly.

In the short term, the Move blockchain has a high concentration of chips, a large amount of token unlocking, and significant price fluctuations, which pose some risks. In the long term, considering the various advantages of Move over EVM, its market share may increase significantly in the next bull market, and as a new player, it will compete with traditional public chains that have been verified over time for market share.

4. Blur and NFT Market

The most notable event in the NFT market in February was the launch of the BLUR token. BLUR’s bid mining mechanism not only allowed a large number of users to receive BLUR airdrops, but also injected a great deal of liquidity into the NFT market, bringing a small wave of spring and having a profound impact on the subsequent NFT track.

The biggest impact is that due to the dense bidding orders, it provided early whales with an opportunity to exit. These whales previously held a huge amount of blue-chip NFT series at extremely low costs, but due to the lack of liquidity during Opensea’s monopolistic market period, the exit cost was very high. A large number of sales not only resulted in high friction costs, but also had the potential to collapse the entire NFT market. Therefore, BLUR provided a good exit opportunity for these whales. These whales may be large institutions, KOLs, etc. With their exit, the associated benefits decreased, and the publicity of BLUR also declined.

After this small spring, with the change in the psychology of new NFT holders, the impact of BLUR’s bid mining revenue becoming smaller, and other factors, the liquidity of the NFT market began to shrink again, and there was also the saying of “NFT Three Idiots (Doodles, Clone X, Moonbirds)”, which is a microcosm of the entire NFT market. In such a depressed NFT market, the market is also particularly sensitive to every move of the project party. Azuki, which was originally firmly listed as a blue-chip, was removed from the list of blue-chips in the last week of the first half of the year due to the poor quality of the new series Elementals, which affected the main series, and its price fell below two digits.

Of course, there were also some local markets in the NFT market in the first half of the year. The most surprising performances were from Milady Maker and Pudgy Penguins. The common point of these two projects is that the community is very active, and people are constantly doing things. Community culture is the core of NFT. It can be seen that the market still recognizes NFT community narratives. Although this wave of NFT market declined, it successfully screened out a group of project parties who are “doing things,” clarified the development direction of NFT, and promoted the long-term development of the industry.

5. How ChatGPT and Other AI Products are Impacting Web3

Since the release of ChatGPT at the end of last year, AI has once again become a hot topic in the technology and venture capital circles. The upstream funding sources of Web3 investment institutions partially overlap with those of AI funding, which means that if AI continues to be popular, a “siphon effect” will occur, and funding for the Web3 major track will decrease relatively. Therefore, Web3 project teams are trying to align narratives with AI as much as possible, or using AI technology to improve team productivity.

Therefore, how to use AI will be a topic that Web3 teams cannot avoid in the future, and here are some trends that are happening:

1. Smart Contract AI Auditing

Before the launch of ChatGPT, some smart contract auditing teams used AI technology to complete initial reviews of client contracts to detect some basic vulnerabilities. However, these auditing teams still had to have humans complete the full audit report, even with AI completing the initial review.

ChatGPT is more powerful than any other AI before it, so many people have rekindled hope that AI can complete a reliable smart contract audit. OpenZeppelin recently conducted an experiment comparing ChatGPT to 28 Ethernaut challenges to see if it could identify smart contract vulnerabilities. In the 23 challenges introduced before ChatGPT’s training data cut-off date of September 2021, GPT successfully solved 19. Although this is a very impressive result, GPT performed poorly on the latest Ethernaut level, failing four out of five problems. This indicates that although AI can be used as a tool to discover certain security vulnerabilities, there is still a demand for human auditors.

2. AI Replacing Positions in Web3 Teams

Just as the appearance of ChatGPT has made many people worry that their positions will be completely replaced by AI, Web3 practitioners also have the same concerns. Although it is cruel, from the perspective of Web3 industry investors who like to try new things and lead trends, the trend of using AI to replace Web3 team members may be faster than imagined. On April 23, digital artist Rhett Mankind tweeted that he provided instructions and a budget of $69 to ChatGPT, allowing it to independently issue a Memecoin. At the same time, the author detailed the process of the AI tool’s decision-making on the name of the memecoin in a YouTube video, and the AI tool also wrote the smart contract code for the project. The market is very receptive to this topic, and after a few days of hype, the project’s market value once exceeded $50 million. Although the experience of this Meme project may not be replicable, it can inspire us to optimize Web3 project positions through AI.

6. US Crypto-Friendly Bank Collapse Highlights Bitcoin Value

In March of this year, the US banking industry suffered a severe run crisis, with stock prices plummeting. Crypto-friendly banks Silvergate Bank, Silicon Valley Bank, and Signature Bank collapsed one after another, with the collapse of Silicon Valley Bank and Signature Bank being seen as the second and third largest banking collapses in US history.

Silvergate, having accepted too many deposits from the cryptocurrency industry, suffered a run after FTX’s collapse. Silicon Valley Bank, on the other hand, purchased a large number of long-term bonds during the low-interest rate period. When these bonds were heavily discounted during the interest rate hike cycle, the bank had to sell them at a discount, turning unrealized losses into reality. Signature Bank, on the other hand, was the subject of multiple investigations in the past, and entering the crypto market subjected it to stricter scrutiny.

On March 11, stablecoin service provider Circle admitted that some of its funds were in Silicon Valley Bank, causing market panic, USDC decoupling, and a crash in cryptocurrency prices. Regulators have been concerned that the development of crypto digital assets will have an impact on traditional financial markets, but this time it was a sneak attack by traditional financial markets on crypto digital assets, sounding the alarm for industry practitioners to isolate risks.

Interestingly, this bank crisis once again reminded insiders and outsiders of the reason why Satoshi Nakamoto invented Bitcoin: “Banks must make people trust that they can manage money well and allow this wealth to circulate in the form of electronic currency, but banks use currency to create credit bubbles that shrink private wealth.” It is obvious that 15 years later, these banks have repeatedly proved to the world Satoshi Nakamoto’s foresight, that banks are indeed having a hard time managing users’ money. On March 10, the collapse of Silicon Valley Bank resulted in a flow of funds into the ARK Innovation ETF associated with cryptocurrency of up to $397 million, the largest inflow to the fund since April 2021. Originally, some of the USDC positions in the market were converted by cryptocurrency investors into other stablecoins, while others directly bought Bitcoin and Ethereum to push up prices, once again starting a small bull market.

7. MEME Craze and Shiba Inu Chaos

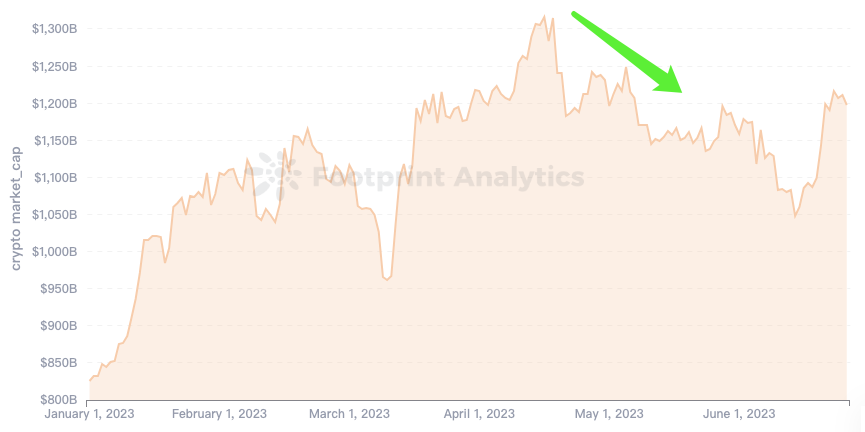

From late April to early May, the entire market was purely a showcase for MEMEs and Shiba Inu, while the overall market rallied and then corrected.

The total market cap of cryptocurrencies rose and fell after the active MEME market in mid-April (green arrow), perfectly confirming the old saying that "the last madness of the market belongs to the Chinese."

During this period, there were two most prominent projects, and after their success, a series of imitating projects appeared.

Pepe

On April 5, the Pepe project released its first tweet and launched the PEPE token on April 15. Pepe’s official Twitter account stated that they hope to redefine memecoins and change the status quo of many derivative meme tokens on the market.

Pepe’s specific mechanisms include several aspects. First, Pepe tokens are not pre-sold, which means that everyone has an equal opportunity to participate in the project. Secondly, Pepe tokens do not have a burning tax, which means that no tokens will be destroyed during the transaction. In addition, Pepe has given up contract permissions, making the issuance and trading of tokens more decentralized. The most important thing is that Pepe’s market-making team has strong funds and extensive contacts, attracting the attention of the entire market in a way of pulling up. It was finally listed on Binance on May 6 and reached its all-time high at the same time, and then gradually fell.

AIDOGE

AIDOGE was launched on April 15, and the project attracted widespread attention from the market at the beginning of its launch. The AIDOGE team grasped investors’ preferences and planned to launch the AI NFT series for training, creation, and production. In addition, AIDOGE’s operation was very powerful, and it successively launched centralized exchanges such as Matcha and Bitget.

AIDOGE’s successful approach is mainly reflected in several aspects. First, it has a decreasing “fair” launch, which is in quotation marks because the team can rely on insider information to obtain a large amount of chips at zero cost in the early stage for later operations. Secondly, AIDOGE can have a higher yield than the normal market level when providing liquidity and calculating compound interest. In addition, when users purchase AIDOGE tokens worth 100-1,000 on the chain, they can participate in a lucky draw once every half an hour. This frequency and probability stimulate users’ gambling and increase market games.

Compared with PEPE, AIDOGE lacks the price effect of being listed on Binance and peaked on April 30 and then fell all the way.

From these two representative stray dog / MEME, it can be seen that the degree of retracement of such projects is huge after the popularity reaches its peak, and the secondary risk is very high. Don’t forget the old saying, one will achieve success and ten thousand bones will wither. The trend of successful MEME is like this, and there are countless imitators behind it. The risk of taking over is even higher. If you want to invest in such projects, please be prepared to lose all your principal in advance.

8.Bitcoin Ecology’s Deadwood Meets Spring

Bitcoin is very peculiar. Whenever a hot topic is discussed, it always has a place, which is also the value of BTC. A group of pure developers are silently paying, generating electricity with love, rather than relying on financing or initial team shares like the vast majority of projects to maintain operation.

Unlike the Ethereum / EVM ecological projects that everyone is familiar with, the BTC community is very open and there is no paid small group or Ethereum Foundation. Any new dynamics in the BTC ecology will be published in public forums. However, these new developments in the community are spreading slowly to the outside world. Especially in the Chinese-speaking circle, for some king-level progress in the BTC ecology, the Chinese-speaking circle is the last place to realize.

Nostr is like this. As early as last year, when Twitter’s former CEO Jack tweeted support for Bitcoin’s 2nd layer / social layer Nostr, almost no one in the Chinese-speaking circle paid attention to it. Only Biteye published an original article last year to introduce the pioneering of Nostr. It wasn’t until February of this year that the Chinese-speaking circle gradually realized the importance of Nostr and its social app Damus, setting off a wave of mutual attention. In the past week, Damus has once again taken the forefront of the storm. On June 13th, the news that Apple’s App Store threatened to remove Damus caused concern about the future of Nostr. The global technology giant suppressed it. It was inevitable that the community was worried about the future of Nostr. However, the reversal also came very quickly. Only one day later, after the communication meeting between Damus and Apple ended, Damus stated that as long as the Zaps function was adjusted, it could continue to stay in the App Store. It is amazing that a decentralized application can communicate with Apple so smoothly. This is consistent with Biteye’s judgment in the article half a year ago. As an investor in Nostr, Twitter’s former CEO Jack dutifully helped Nostr’s ecology coordinate resources between Web2 and Web3. The story plot of “a village in the dark and a bright flower” is believed to attract more people’s attention to Nostr and raise expectations for the BTC ecological social track.

During the first half of the year, another hot topic in the BTC ecosystem was ordinal theory. Based on this theory, the groundbreaking Brc20 was created, igniting the market. Subsequent micro-innovations such as Orc20, GBRC721, and Stamp have also received attention. Although Ordinals does not have a complete decentralized solution and its technology needs to be improved, it still allows BTC users who frequently pay attention to the community and are willing to try new things to receive generous returns.

This market trend reminds us that information from the BTC community cannot be ignored, and any innovation is worth trying. We must pay attention to the BTC ecosystem track going forward.

9. Hong Kong Takes a Big Step towards Web3

Hong Kong used to be the headquarters of many important Web3 institutions, but due to policy fluctuations, some projects have moved their headquarters out of Hong Kong. Last year, during the bear market, various cryptocurrency exchanges and lending platforms went bankrupt, and regulatory tightening in countries such as the United States and Singapore caused many practitioners and investors to lose hope, believing that the future was bleak. However, at the Hong Kong Fintech Week in November 2022, the government released a “Policy Statement on the Development of Virtual Assets,” declaring an open and inclusive attitude towards virtual asset practitioners and recognizing that Web3 and distributed technology have the potential to become trends in the future development of finance and commerce. This was interpreted by the industry as the beginning of the Hong Kong government’s re-embrace of Web3, and the policy support allowed practitioners to breathe a sigh of relief.

In April of this year, Hong Kong held the Web3 Carnival, the largest cryptocurrency enthusiast exchange event in Asia after the pandemic. At the carnival, the Hong Kong government announced multiple policies to support the development of Web3, including allocating HKD 50 million in funding for industry development, a stockbroker student fintech internship program, and encouraging more outstanding talents to join the fintech industry.

Compared to Singapore, which does not encourage individual trading, Hong Kong has taken a more positive attitude, allowing exchanges to apply for digital asset retail trading licenses for individuals from June 1st. Cryptocurrency advertising slogans can be seen in public places in Hong Kong. In addition, Hong Kong has issued tokenized government green bonds and is expected to launch a stablecoin regulatory framework by the end of 2024.

On June 12, Leung Hon-king, the head of finance, finance and fintech at the Hong Kong Investment Promotion Bureau, stated at the closed-door Web3 meeting that the essence of Hong Kong’s proposal to build a Web3 center is not virtual product asset securitization, but the introduction of Hong Kong’s future economic and social transformation. This shows the importance of Web3 to Hong Kong. Hong Kong’s friendly attitude towards Web3 is expected to attract a large number of practitioners who are subject to regulatory constraints to open up new opportunities in Hong Kong.

Hong Kong and mainland China have different division of labor and positioning, leading to different development directions. Mainland China has rich technical talents and artists, which can provide Hong Kong with cultural IP and technical support. As a pioneer and demonstration point of China, Hong Kong will become a bridgehead for the development of China’s virtual economy.

10. Dragon and Tiger Fight between SEC and Crypto Community

On June 5, the SEC sued Binance, Binance US, and CEO Zhao Changpeng for allegedly violating federal securities laws by illegally offering and selling securities to US investors. In this document, multiple encrypted assets, including but not limited to BNB and BUSD, are listed as securities: SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. This is another pressure from US regulators after Binance and its CEO were sued by the US Commodity Futures Trading Commission (CFTC) in March 28 this year for allegedly violating trading and derivative rules.

This regulatory action is not only aimed at Binance, but the SEC also filed a lawsuit against Coinbase the next day, claiming that Coinbase provided multiple digital currency transactions that were considered securities without ever registering as a broker, national securities exchange, or clearing organization.

With the growth of the cryptocurrency market, reasonable regulation is beneficial to the compliance of business and the healthy development of the industry. Issuing clear and appropriate rules is not only the responsibility of regulators, but also the demand of practitioners in the cryptocurrency industry. Only when the rules are clear and clear, will the wait-and-see funds enter the market. However, the SEC has not yet released a clear rulebook, but has initiated multiple rounds of litigation, which has stirred up the cryptocurrency market. In addition, there is no unified opinion at the US regulatory level, and the SEC and CFTC have issued contradictory statements, vying for the right to manage cryptocurrencies.

According to data from Zippia, about 44.3 million people in the United States hold cryptocurrency, accounting for 13.22% of the total population, making it a country with a high acceptance of cryptocurrencies. The recent raid by the SEC on the cryptocurrency community has prompted some market makers to sell off altcoins, resulting in a sharp drop in market liquidity and heavy losses for investors. Regulators should balance their regulatory and development functions, and applying outdated regulatory systems to innovative asset classes is a form of laziness and irresponsibility. As a result, we can expect that practitioners who were originally in the United States will consider relocating to more crypto-friendly countries and regions due to regulatory pressure.

What we need to understand is that tokenization is not about circumventing securities laws. It is a product that has emerged from the application of blockchain technology in real-life situations due to demand, and is an improvement over traditional organizational systems. The decentralized nature of blockchain makes it more resistant to attacks than any centralized system. If one node is attacked, there are still thousands of nodes running. If one government is cracking down, there will be other governments supporting it. The completely opposite regulatory attitudes of the United States and Hong Kong make us wonder if this might be the beginning of a shift from the West to the East.

Conclusion

The financial market may have bubbles, but technology does not. The Bitcoin and Ethereum ecosystems have made significant progress in the first half of this year. As the cryptocurrency market expands, it will also face comprehensive regulation. Regulation may not necessarily mean the wolf is coming, but may be aimed at making the market more standardized and prepared for large-scale applications. Let us continue to participate in the construction of the cryptocurrency market and lead more people towards Web3 to enjoy a better Internet.

Note:

This article is a hotspot event section of the SUSS NiFT Blockchain Ecological Security Alliance 2023 Web3 Blockchain Security Half-Year Report. The co-creation partners of the half-year report include SUSS NiFT, Beosin, Biteye, LegalDAO, Footprint Analytis, and Shellboxes. Readers can read the rest of the half-year report through the following link.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Page 181: A Comprehensive Review of Coinbase Legal Documents: Strong Response to SEC Lawsuit and Seeking to Dismiss the Case

- The growth engine of the DeFi field: a detailed explanation of the four innovative mechanisms of Uniswap V4

- MPC+AA is the path that Crypto wallets with a billion users must go through for Mass Adoption.

- Weekly Preview | FTX Debt Claim Website to Launch; Sui to Unlock Tokens Valued at Over $20 Million

- An Interpretation of ERC6551

- Time and patience are the scarcest resources for any brand.

- Did BCH triple in two weeks? Is the resurrection of PoW narrative just a dream?