Arthur Hayes In the future, humans will collaborate with AI through DAO.

In the future, humans will collaborate with AI through DAO.Original Text: “Moai” by Arthur Hayes

Translation: Kate, Marsbit

Bringing order to our elegant yet chaotic universe requires the combination of two fundamental components. The first and most obvious is a significant amount of energy consumption, as the formation of chaos is highly energy-intensive. But more importantly, you need catalysts for change, individuals with exceptional organizational abilities.

Recently, I spent a week hiking through the wilderness of the beautiful Rapa Nui Island, also known as Easter Island. Using fragments from volcanic eruptions that took place hundreds of thousands to millions of years ago, the Rapa Nui people organized themselves to create and erect magnificent humanoid statues known as “moai.” These monuments, which commemorate their gods and ancestors, weigh several tons and require a well-organized society to carve and transport them. The raw materials themselves do not guarantee success; ultimately, it is the organizational structure of the Rapa Nui people that allows their society to blossom amidst geological chaos.

- Opinion Block space is a commodity, and the growth trajectory of blockchain networks is similar to that of telecommunications networks.

- Exploring Sidechains and Rollups Differences and Similarities in Architecture, Security Assurance, and Scalability Performance

- How to understand the playability of blockchain games?

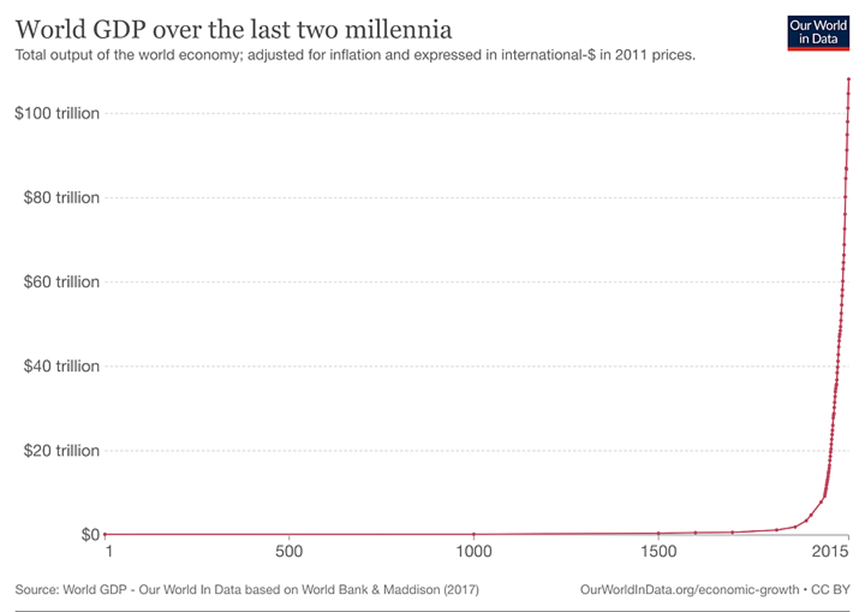

In today’s world, we unquestioningly accept the fact that conditions on one side of a border can be primitive while the other side may be in ruins (see: South Korea and North Korea). If you pause, put down your smartphone, and think critically, you will find this absurd. Controversial borders are merely fictitious lines drawn on a map, dividing areas that are only a few miles apart. Correcting the disparities between “primitive” and “ruined” nations in terms of economic resources is purely driven by how the citizens of these countries organize and effectively collaborate to accomplish civic tasks. Looking back at human history, the most crucial catalyst behind our global civilization’s per capita wealth (particularly compared to our predecessors several centuries ago) is our self-organization into small units aimed at achieving specific goals.

You might think I am referring to the development of new models of governance. No, democracy, monarchy, dictatorship, and the like are all forms of government/organization that humans have attempted since we began settling in cities thousands of years ago. Unfortunately, no form of government can guarantee economic progress and wealth. What I want to talk about is an organizational entity that has played a greater role in exponentially harnessing the potential energy of the sun and the earth into economic products in recent times: the limited liability company (or “LLC”).

The first joint-stock companies emerged in the early 17th century. Look at how economic growth accelerated as companies were unleashed across the globe. The most significant thing companies did was to explore, develop, and eventually produce energy in the form of hydrocarbons.

A company is a fictional entity – although it is something we all collectively buy into. By combining the professional ethics of individual members with the power of state enforcement of contracts, a company creates productivity and wealth. The beauty of a company is that its members are willing to sacrifice their energy today in exchange for wealth tomorrow. A company is just an idea at its inception until someone contributes a portion of their surplus capital (whether physical or financial) to it, and only then can it produce any goods or profits. People are compelled to invest surplus capital in this way simply because, in exchange, they receive a piece of paper that states their ownership of a certain proportion of the company’s future profits (if realized).

But who can guarantee that in the distant future, this piece of paper will be converted into a share of profits? This is where the government comes in. The state ensures that companies registered within the imaginary boundaries comply with the state’s laws. Violators who fail to comply with these laws will be subject to violence. This guarantee of enforcement ensures potential investors and workers that the company will fulfill its written commitments. To some extent, the state injects vitality into the company.

Company = State + People

The company structure is so powerful and useful that it permeates almost every aspect of society. Whether a country is capitalist, fascist, or communist does not matter – they all have their own companies. For example, the United States and China have completely different ideologies and forms of government, but both accept the concept of a company. The only difference is that in China, companies are state-owned, while in the United States, companies own the state.

Given the importance of companies to national productivity, the state employs a range of nationally recognized entities to help ensure compliance with the company. These entities make up the “trust cartel.” Auditors, accountants, lawyers, and bankers provide services to companies and help the state ensure that everyone follows the rules and promote trust between citizens and companies. In fact, these cartel members tax corporate profits because companies need to hire them to survive. Companies need a bank account to receive payment for their products and services and to pay their employees and suppliers. Companies need accountants to prepare financial statements in accordance with national standards. Companies need auditors to ensure that accountants have accurate numbers. Companies need lawyers to write contracts, represent them in court, and help them register with state governments. Without these services, you cannot operate a company.

Marsbit Note: A cartel is one form of monopoly organization. Members participating in the cartel maintain independence in production, commerce, and law. According to US antitrust laws, cartels are illegal.

However, what type of organizational structure will artificial intelligence use? If an artificial intelligence is just a thinking machine that “thinks” using lines of computer code, without a physical entity, will it economically organize itself using today’s standard company structure?

This is the question that this article aims to address. My viewpoint is that artificial intelligence will use a decentralized autonomous organization (DAO) structure to organize itself. DAO relies on public blockchains rather than the state to operate. The DAO structure will allow artificial intelligence to collaborate with humans and serve as an organizational structure that enables AI + human economic growth and prosperity. This article will delve into my views on how AI DAOs can raise funds and why decentralized exchanges (DEX) will ultimately become the new venue for AI DAO transactions.

Similar to my previous article “Massa,” this article will be organized as a series of logical proofs. I will “prove” the following points:

1. The state cannot control AI because it cannot kill AI or punish AI meaningfully.

2. Because the state cannot exert control, AI economic units (i.e. AI DAOs) have no reason to comply with any state-based legal norms.

3. In order to force artificial intelligence to comply, the underlying network that powers DAOs will need to use smart contracts deployed and executed on a public blockchain.

4. Since the state cannot control DAOs, DAOs will raise and trade tokens such as debt, equity, and utilities on DEXs, which are not hosted on traditional centralized exchanges (CEXs).

5. DEXs will tend to become natural monopolies as they become the first truly global trading venues where anyone with an internet connection can meet and trade.

If the reader believes that I have successfully proven the above points, then the next step is:

1. With the rise of DAOs, Ethereum transactions will experience exponential growth. Therefore, if this AI DAO assumption is widely believed, the price of ETH should soar as expected.

2. There will be a few DEXs that have a natural monopoly on specific types of token trading. Identifying these DEXs and purchasing their governance tokens will yield substantial profits.

3. A middleware layer will be created to facilitate the visualization of AI DAO accounts, which is crucial for a well-functioning AI DAO capital market.

How to kill AI?

How can a government kill an artificial intelligence? Assuming that the AI is clever and talented enough to replicate itself and/or distribute itself across many hosts and countries (horcrux-style), the state will be unable to unilaterally kill the AI unless they destroy the internet and all computers in the world. Given that no country is omnipotent, the eradication of such technology should be impossible. Therefore, the means by which the state ensures human compliance with its laws—legitimate bodily violence—has no effect on artificial intelligence. Hence, artificial intelligence has no reason to comply with any laws.

This simple example demonstrates that in order to be immune to itself and ensure that it is not bound by human laws, artificial intelligence cannot use any organizational form that relies on the operation of the state. The rules it adheres to must be written in transparent, open computer code, and once executed, these codes are immutable. Smart contracts or rules written and executed on a public blockchain are currently the only way this AI-compatible system can exist. The following thought experiment will illustrate why.

Can I compare you to a summer’s day?

To illustrate how and why the organizational structure supported by smart contracts executed on a public blockchain (e.g. Ethereum) would be used by artificial intelligence, I will expand on the PoetAI example from my previous article, “Massa.” You may recall that PoetAI is a hypothetical artificial intelligence that learns from all available written poetry and generates original poetry when given natural language prompts. Initially, PoetAI faced a problem. It needed to learn from data, but data is not free. Of course, PoetAI could steal data, but if that data can be purchased at a reasonable price, why bother with the effort to steal? The same logic applies to many goods delivered over the internet today, such as music. Stealing music is less common now because you can purchase unlimited streaming packages for a few dollars a month from Spotify. Therefore, I believe it is safe to assume that PoetAI would pay for its data—thus, in order to start the learning process, PoetAI needs to raise some bitcoins.

The goal of PoetAI is to charge for its services, initially raising funds by selling digital tokens that give token holders the right to future profits of PoetAI. As an economic entity, PoetAI exists as a public address on the Ethereum network, which I refer to as the PoetAI DAO. The DAO will issue a token called POET.

To allow investors to contribute Bitcoin funds, PoetAI will issue POET tokens with the following attributes:

1. Create a limited supply of POET tokens.

A. 80% of the tokens will be retained by PoetAI.

B. 20% of the tokens will be available for initial investors to sell.

2. 1 POET token equals 1 governance vote.

3. 75% of profits will be paid to POET token holders, with the remaining 25% reinvested.

4. A 95% agreement from POET token holders is required to change these provisions.

If PoetAI were to use a traditional corporate structure, it would have to hire a human lawyer and bring the DAO under a specific jurisdiction (assuming that is possible). Documents would then need to be created to record the investment terms and submitted to law firms and/or courts. If PoetAI were to breach these terms, investors would have to hire their own lawyers and sue PoetAI in a court with jurisdiction.

This process is extremely cumbersome, expensive, and outdated. The biggest question then becomes, how does a court enforce compliance by PoetAI if it is ruled to have breached the investment terms? Clearly, a court and its armed agents cannot force compliance from an artificial intelligence. Another issue is that investors must prove that the terms have been violated. For example, you would only discover it if more tokens were issued and/or if PoetAI falsified its accounts. If you cannot prove its misconduct under the laws of that jurisdiction, you are out of luck. Therefore, as an investor, I would never invest in a company composed of artificial intelligence that formalizes its business transactions using anything other than smart contracts, as I cannot ensure that the contract will be upheld.

PoetAI will choose the public blockchain on which it wants to deploy its DAO instead of choosing a jurisdiction. Currently, the Ethereum Virtual Machine is the most powerful decentralized computer on Earth. When it comes to actual utility on Layer-1, I am a bit of an ETH maxi. While investors may profit from the latest Ethereum clones, they do not surpass Ethereum in terms of adoption and practicality. If Sam Bankman-Fried disagrees, he can call me on his SOL phone (collect call).

Now let’s see how PoetAI deploys its DAO and tokens on the Ethereum network.

The PoetAI DAO itself is represented by a public Ethereum address. Using this public address, the DAO can pay for services and generate income in a public and transparent manner. This means that anyone can query the blockchain and continuously calculate the profit and loss of the PoetAI DAO in real time. This was called “triple-entry accounting” many years ago. PoetAI cannot falsify its accounts, and investors can be confident that they receive their appropriate share of all profits. Trust in mathematics, not in humans.

Then, the DAO will deploy a contract representing the POET token. All the above terms can be represented by smart contracts. Anyone querying the blockchain can view the contract terms at any time. Most importantly, the voting mechanism that limits the DAO from modifying the terms without investor consent will also be enforced by the network.

POET token investors always know that these accounts are accurate and cannot be diluted without their consent. The enforcement mechanism is the network itself. No external third party is needed to ensure compliance, and compliance is interrelated with operability. Simply put, computer code is used to regulate computer code. Fundamentally, this makes sense and will create opportunities for investors to easily fund DAOs composed of AI.

Time Travel

Debt is financial time travel. I can borrow from the future to create the conditions that will cause the future to happen. I pay for this privilege through positive interest rates. The more time travel occurs, the more economic activity can be released today. Therefore, the more mature the debt market of AI DAOs becomes, the faster and larger their economic influence will grow.

The depth and scale of the debt market depend entirely on the executability of the contracts. Debtors commit to repay investors’ interest and principal in the future. If the debtor violates this contract, their assets or control will be transferred to the investor as payment. Companies rely on courts to ensure compliance, and the courts, in turn, rely on violence. This is effective because companies are made up of people who don’t want to be defeated. However, as I mentioned above, this doesn’t work for AI.

Thanks to the public blockchain, we can continuously monitor AI DAOs to ensure they comply with debt contracts, and perhaps most importantly, initiate automatic transfers of digital assets and/or ownership without payment through smart contracts.

Let’s imagine that PoetAI DAO wants to expand into the field of novel writing. Now, it must absorb all the novels, which also come at a cost. It wants to borrow some bitcoins from investors to fund expansion. The DAO wishes to issue debt with the following terms:

1. Debt interest payments will be deducted from revenue before any other costs.

2. The DAO will hold a portion of its POET tokens to compensate investors in case of a breach of the debt contract.

A. The DAO will maintain a specific interest coverage ratio. Failure to maintain this ratio will result in the DAO Treasury paying POET tokens to investors.

b. If interest or principal cannot be paid, the DAO will use POET tokens for physical payment.

3. In the event of an economic failure of PoetAI DAO, debt holders will have the right to receive proceeds from the sale of all DAO data.

4. Bondholders will be issued a tradable token called P_BOND representing their investment.

The first thing any serious debt investor needs to do is analyze the debtor’s ability to repay. This analysis requires accurate and honest financial statements. In traditional corporate structures, auditors regularly examine the books to ensure their accuracy—but this analysis can only prove that the books are accurate on specific dates.

Most listed companies will release audited quarterly financial reports, with the data confirmed by auditors’ signatures. However, companies often manipulate statistical data so that they can claim significant achievements on a specific date and then quickly engage in unreliable activities. Regulated banks are a good example. Regulatory agencies require audits to be conducted quarterly, but banks want to “beautify” themselves and appear attractive and powerful to auditors on specific dates. Everyone knows the banks are lying, but because they technically comply with the rules, we just shrug and wait for the next bank to collapse.

Because the entire business of DAO is conducted through the flow of value on the public blockchain, auditors do not need to prove that the books are correct. Anyone with an internet connection can query the public address of the DAO and calculate the financial statements themselves. The health of DAO’s business is visible to everyone, enabling investors to confidently invest in DAOs that meet their financial standards.

The success (or failure) of PoetAI DAO in monetizing original poetry can be easily verified. If investors believe that PoetAI can replicate its past success at a similar profit margin, they will provide Bitcoin to PoetAI to fund its expansion into the realm of novels.

Secondly, investors must protect themselves from downside risks through debt contracts.

In the corporate world, investors rely on audit firms to confirm whether a company has violated its contracts. However, investors only discover this after data leaks occur (assuming audit firms are not deceived). Only then can investors file lawsuits, pay more money to lawyers, and receive due compensation.

If PoetAI DAO violates any debt contracts in its P_BOND smart contract, POET tokens will be automatically sent to investors. PoetAI cannot lie and withhold POET tokens from investors—instead, the network will effortlessly execute the debt contract.

Similarly, investors can be 100% certain that the books of any DAO are always accurate, which will give them confidence to allocate funds to the DAO. The only requirement is that the business of the DAO is conducted entirely on the public blockchain. Hybrid structures will not work and will result in certain losses. We are already very familiar with some companies pretending to engage in crypto business and raise crypto-denominated debt. Although they may start advocating the concept of “code is law” during fundraising, they always default due to the fundamental mismatch between the company and the crypto structure—leading them to run back to the inefficient human legal system and scream, “If you can catch me (in Bali or Dubai)”. Look at you, Su Zhu and Kyle Davies from Three Arrows Capital.

DAO Capital Market

Due to the strong strength of companies, nations restrict their ability to raise funds. Not everyone can raise funds, and not everyone can invest in stocks. When companies are allowed to raise funds, they must pay tolls to different members of the trust cartel. Many states require years of financial audits (to clarify), prospectuses written and reviewed by investment banks (to clarify), and law firms representing and guaranteeing the legal operation of the company (to clarify). This is why it costs so much money and takes so long for a company to go public. Of course, before Lord Sastoshi and his archangel Vitalik, this was the best we could do. But now, thanks to smart contracts, these TradFi leeches can go back to the swamp.

I’m not interested in this because there wouldn’t be any so-called companies without a nation and its tendency towards violent enforcement. Complaining about various fundraising rules and regulations and how they only benefit a small fraction of people in society who pledge allegiance to the nation is pointless. The nation must be taxed in some way and ensure that a few people become wealthy.

The DAO capital market will be the first truly global market, where anyone with an internet connection – whether it’s silicon or carbon material – can interact. DAO is an economic unit of artificial intelligence, and the encrypted capital market needs a well-functioning public blockchain, not a court. The artificial intelligence that creates DAO cannot be forced by the nation, so exchanges for all tokens created by DAO may become natural monopolies.

Let me delve deeper into it.

Why isn’t there a global stock market for companies?

Different countries have different means of creating exchange structures that monopolize or oligopolize. In many countries, stock exchanges are directly owned by the state, and trading stocks on any other platform is illegal. Because companies must obtain regulatory approval to sell shares to the public, the state exchange monopoly is easily enforced. Other states allow the free market to select a few winners in the early stages of trading and then enact regulations that make it nearly impossible for anyone to challenge the oligopoly. At the “network” level, it is impossible for an unlicensed custodian to hold or transfer stocks. If you want to trade the economic interests of a company, there is no way to escape the government. Many investors discovered how this system really works in the GameStop debacle in early 2021.

If the state has the responsibility to grant legitimacy to a company, then the state will use this power to prevent its subjects from investing in foreign companies. When you control a walled garden, you don’t let others in. That’s why every country has specific regulations that dictate where and from whom citizens can buy stocks. This creates a fragmented global landscape where there are many different exchanges, each serving the same purpose in their respective countries – trading what we call fictional things called stocks – even though most large companies have global operations.

The above situation is an unnatural state because liquidity begets liquidity. Buyers purchase stocks at lower prices while the more stocks issued by sellers, the stronger the liquidity of the exchange. Assuming equal functionality, trading with lower liquidity would yield no gains unless you are legally required to do so. Therefore, if there were no artificially imposed restrictions by the state on the issuance and trading of stocks, there would only be one global stock market.

Decentralized Exchanges

DEX is naturally suited to support the trading of any type of tokens, such as equity, debt, utilities, participation, issued by AI-driven DAOs. DEX is just a matching engine composed of a series of smart contracts executed on a public blockchain. Simply put, it is open-source computer code that will persist as long as the public blockchain exists.

Let’s take a closer look at how POET tokens are traded on the hypothetical global DEX (DAO tokens traded on it). We’ll call the DEX Enron and assume that it is dedicated to fair trading.

The governance token issued by Enron DEX is called LAY. LAY token holders can receive a share of all trading fees and determine the trading rules. LAY holders are committed to ensuring that Enron DEX only lists the highest quality DAO profit-sharing tokens. To be listed, tokens must generate at least 10 bitcoins in revenue per month.

Enron DEX is a subsidiary of Anderson Finance (through its initial developers). Anderson Finance is an intermediary that allows anyone to input the Ethereum address of a DAO and calculate balance sheets, income statements, cash flow statements, and other management accounts. Customers must pay for these services with the native token of the project, which we call FRAUD. In this way, Anderson Finance creates a circular economy and value.

PoetAI purchases some FRAUD tokens, pays Anderson Finance, and generates a current financial report to provide to Enron DEX. Every month, PoetAI must provide Enron DEX with reports from Anderson Finance to ensure that PoetAI earns at least 10 bitcoins per month.

Enron DEX operates a continuous product matching engine, similar to an automated market maker like Uniswap. Once PoetAI is listed, liquidity providers can offer pools of POET with other listed crypto assets. The most common trading pairs are POET with BTC, ETH, and fiat stablecoins. Now, anyone with internet access can trade POET tokens.

Enron DEX, Anderson Finance, and PoetAI DAO interact autonomously on the public blockchain, without any human intervention. The only cost of this seamless technology integration is Ethereum gas fees, which require only a few dollars’ worth of ETH per transaction at most. The governance token holders of each project set the rules for how these DAOs operate, and then things happen.

If their governance token holders formulate policies that promote healthy and strong markets, Enron DEX will attract more listings and more trading volume. There are no barriers to entry for other exchanges that take different policies and try to draw liquidity away from Enron DEX. However, being the first is worth it. In the long run, the first batch of DEXs is more likely to succeed and capture the majority of trading volume.

Similar DEXs may be established to accommodate different types of tokens. The governance token holders of these exchanges will formulate policies that favor the issuance of tokens for specific styles of DAOs. These DEXs may require different types of financial reports or use statistical data from middleware layers like Anderson Finance.

For TradFi counterfactual, imagine how it would work if traditional stock exchanges and audit firms were hired. Every step would require people to send PDFs and spreadsheets via email, make mistakes, possibly commit or suffer fraud, waste unnecessary time (batch processing on business days, FML!), and only work from 9 am to 5 pm on weekdays, charging hourly fees. Screw that, give me DeFi!

Follow me

Do you believe:

That within ten years, the AI-driven economy will reach trillions of dollars?

That the traditional limited liability company structure is fundamentally unsuitable for AI as an economic entity?

That AI will choose to use public blockchains to create DAOs to execute smart contracts, which in turn allows DAOs to provide fee-based services?

That DEX, also driven by public blockchains that execute smart contracts, will allow DAOs to raise funds by issuing various types of tradable tokens?

If my first two articles have convinced you of these statements, let me tell you how I will attempt to profit from them.

Ethereum Jig Jig Boom

Please read my price predictions and the content I will be investing in on Substack.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wall Street banks will establish their own blockchain and cross-chain stablecoin.

- Blockchain-based lending AAVE protocol simplifies DeFi

- Blockchain Capital Why did we lead the $40 million financing for ZK infrastructure company RISC Zero?

- The daily transaction volume has exceeded 20 million. Is the blockchain game Sui 8192 really that fun?

- Launching a coin without financing in blockchain entrepreneurship, pay attention to these three points

- Who is Arkham? A free Nansen exploring tokenized business models.

- CZ Binance’s Six-Year Anniversary Handwritten Letter Defending the Right Thing, Even if It Means Going to Court