Evolution of the Web3 Community: The Decline of PFP Community and the New Dawn of NFT

Web3 Community Evolution: PFP's Decline and the Rise of NFTsOriginal author: Ally Zach Translated by: DeepTechFlow

Key insights:

-

Initially, PFP NFT projects emphasized community, but over time, many projects have shifted their focus towards financialization, with NFT holders prioritizing financial returns over community participation.

-

Applications focused on decentralized social media, digital identity, and blockchain-based domains have experienced a unique increase in user adoption in the NFT market, increasing nearly tenfold from mid-2021 to early 2022.

-

By prioritizing natural network effects generated through user connections and offering meaningful relationships and opportunities for online identity curation, NFTs have laid the groundwork for success in new consumer applications.

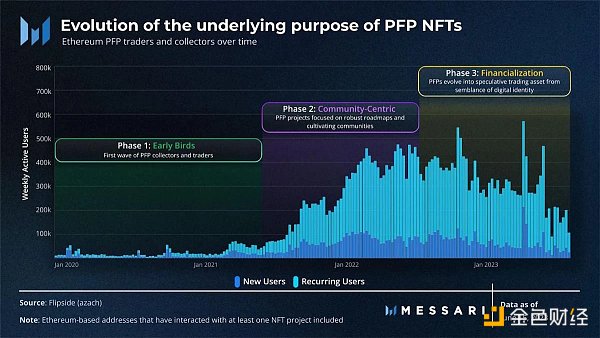

Historically, PFP NFT projects emphasized “community” as a core value proposition. However, over the past year, many prominent NFT projects have increasingly shifted their focus towards financialization, with NFT holders prioritizing financial returns over the emotional value of being a community member.

From a user perspective, the shift from community-driven projects towards financialization may have occurred through two paths. Either the same users changed their values, or new financially motivated users replaced the initial community-driven users. The latter is more likely to occur, as the client profiles of early adopters of community-driven IPs (NFT projects) are significantly different from individuals who simply trade tokens for financial gain. Assuming that community-driven users value early consumer projects more, the question arises: where will these users go once financialization takes hold?

For the most part, these users will migrate to new consumer platforms that prioritize Web3-based community participation. These platforms include decentralized social media, digital identity solutions, and blockchain-based domains. They not only fill the void caused by the changing NFT landscape, but also usher in a new era of comprehensive participation. By studying user behavior across different NFT applications on EVM chains, we can extract valuable insights into user migration and the sub-communities formed in this rapidly evolving industry.

The Decline of the PFP Community

During the early stages of NFT, they were primarily associated with digital art and collectibles. Artists and creators quickly adopted the concept and tokenized their work on blockchain-based platforms, with Ethereum becoming a pioneering force in facilitating NFT transactions.

However, the launch of Bored Ape Yacht Club (BAYC) in early 2021 marked a turning point in the evolution of NFTs. BAYC introduced a community-centric approach by combining unique artwork with membership privileges and a strong social component. Each Bored Ape NFT holder became part of an exclusive club with special events, virtual gatherings, and other benefits. This community-centered model proved to be highly influential and became a catalyst for many subsequent NFT projects adopting similar methods.

BAYC and similar community-driven successes caught the attention of retail investors, leading to a nearly tenfold increase in NFT market adoption rates from mid-2021 to early 2022. Community involvement, commitment to a roadmap, and the potential for sustained value growth attracted many investors to purchase these collectibles.

By the end of 2022, a shift in the narrative occurred with the launch of the Blur trading platform. Blur, along with its ongoing and publicly promoted airdrop program, quickly gained popularity and attracted a large user base. This success paved the way for other markets, including industry giant OpenSea, to either adopt or launch their own professional trading platforms. As a result, this shift also led to a significant decline in creator royalties, as the new era of NFT traders shifted their focus from valuing community and roadmap to trading activity. The focus shifted from NFTs being representatives of digital identity and community to becoming primary speculative assets.

The New Dawn of NFTs

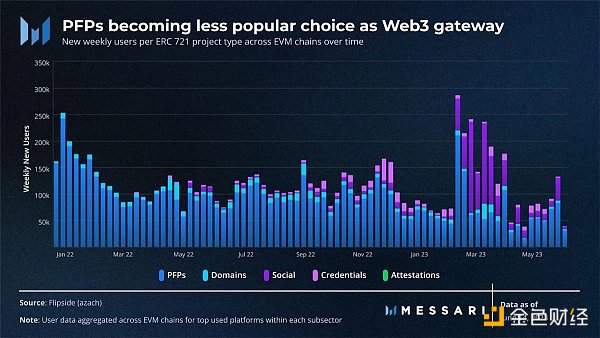

PFP projects, particularly those on Ethereum, were once the primary entry point for newcomers into the Web3 world. However, with the rapid rise of platforms like Blur, this landscape has undergone a major shift, with more focus on catering to traders rather than the core participants that originally drove their growth, such as collectors, creators, and community members. As a result, since January 2022, PFP projects on various EVM chains have experienced a steady decline in attracting new users, with adoption rates dropping by almost 50%.

In the past 18 months, the development of consumer applications on various EVM chains has increased, with a focus on decentralized social media, certificate-based digital identities, and blockchain-based domains. These applications have reactivated Web3 by providing users with meaningful connections, self-expression, and collaborative opportunities. They offer a platform for individuals to plan their online presence, interact with peers, and cultivate a sense of community in a more inclusive way.

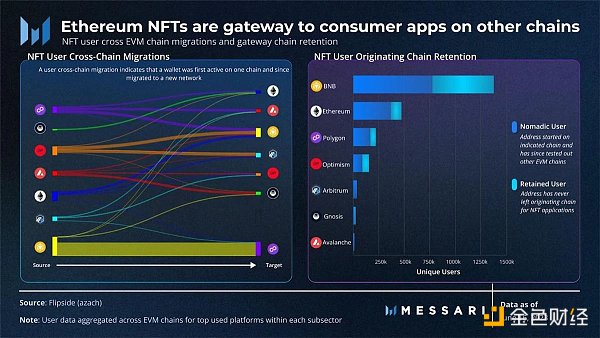

To provide a seamless user experience, consumer applications beyond traditional NFT markets require high throughput and low GAS fees. In response to this need, many of these applications have sought Layer-2 scaling solutions and sidechains. This shift has prompted Ethereum-based PFP traders to explore new paths, with approximately 80% of users exhibiting “nomadic” behavior between different networks.

Nomadic users tend to interact with platforms with similar purposes on different chains. For example, the decentralized social platform CyberConnect on BNB and Lens on Polygon have over 37,000 shared users. Additionally, new era Web3 users have interacted with other new consumer applications without previously participating in PFP.

These emerging consumer applications have not only successfully attracted previous cryptocurrency users, but also new user groups. It is worth noting that ENS, Galxe, Lens, and CyberConnect, among others, allow users to experience their first NFT interaction on their respective chains. This is different from the previous norm where NFT markets were the primary entry point for users.

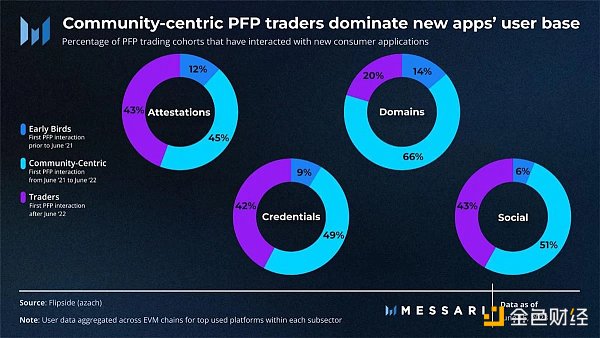

Although the narrative of PFP has changed, users still seek to build online roles. In addition to social media or identity symbols, users have also found new tools and applications to replicate this experience. Notably, compared to early NFT traders or participants in the financialization era, users who interact with PFP in the community-centric era make up the majority of new consumer application users.

Although these emerging consumer applications are still in the early stages, they have successfully attracted specific cryptocurrency users eager to witness the success of these platforms. These applications offer a comprehensive representation of digital identity, which is a crucial aspect in an era where robots and artificial intelligence play an increasingly important role.

These consumer applications have such a strong appeal in their core values that they are able to attract users from different networks. Users are willing to interact with these platforms on multiple chains, emphasizing the importance of improving the interoperability of credentials, domains, and profiles. Supporting the preferences and trends of user groups is becoming increasingly important for achieving seamless interoperability and cultivating cohesive user experiences across different ecosystems.

Looking ahead

Early NFT users were primarily seeking to explore online identities and communities. Initially, PFP projects fulfilled this need, but later shifted focus towards finance. Currently, participating users are primarily involved in decentralized social networks, identity, and credential projects. Looking ahead, it is expected that consumers will continue to seek meaningful connections and unique identities. As consumers strive to fulfill these desires, consumer protocols that facilitate user connections and identities may flourish.

To succeed in competition, protocols should prioritize establishing natural network effects through user connections. One example is Lens, which integrates profile NFTs and follow NFTs into the protocol platform to establish connections between users. This approach integrates network effects of user connections into the protocol itself. In contrast, traditional PFP or standalone identity protocols rely on external platforms to facilitate user connections, resulting in lower network effect values captured within the protocol itself.

The profitability in this case is not limited to low-volume, high-volume markets such as DeFi applications. These new consumer applications provide promising opportunities by leveraging natural network effects and market positioning. They offer valuable experiences and services to community-centered users, fostering participation and potential long-term growth. As the PFP NFT trading market dynamically develops, these applications play a crucial role in providing users with alternative avenues to connect, collaborate, and manage their online identities in a more meaningful and inclusive way.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Amidst the warlord chaos of LSDfi, who will become the “King of Hanzhong”?

- In-depth analysis of the innovation and disruption of Uniswap V4

- Comparing Perp DEX protocol: GMX, Gains, dYdX…

- SatScribe: Game rule changer for rare sat hunting

- Messari: Uniswap V4, the moment for the platform of crypto applications

- Circle restarts buying US treasury bonds as USDC reserve assets

- Messari: Exploring the Evolution of the Web3 Community