How much does Tether make?

Text | Qin Xiaofeng

Produced | Odaily Planet Daily (ID: o-daily)

Tether has recently been fired by class action. As a “publicity” in the circle, Tether is often criticized for the opacity of the USDT issue and the anchoring assets behind it. However, through some public information and chain data, the Odaily Planet Daily has found some interesting details and data to share with readers. .

Addition process

Addition process

- Report Extract | CICC Research: Blockchain has entered the 3.0 era

- Getting started with blockchain | How many people hold or use cryptocurrencies?

- Babbitt column | Tencent blockchains are strong, what is the opportunity for the public chain?

Tether's issuance is divided into two parts: Authorized and Issue.

In general, Tether will first issue a certain amount of USDT in the chain, which will be monitored by various media; then USDT will be put into the foundation account and transparently publicized on its official website “Authorized but not issued” Cast but not distributed). According to the official statement, the USDT has not entered the market at this time, and only the USDT that actually received the remittance will flow into the market.

Users who have passed Tether KYC verification can submit an application to transfer money to Tether with a personal business threshold of $100,000. For institutional users, if the volume is large, you need to contact Tether in advance to allow it to issue the corresponding USDT.

" Tether received the payment immediately after it was received (USDT). " Ren DongBit founder Zhao Dong told the Odaily Planet Daily that after the "Authorized but not issued" was used up, a batch would be issued.

Zhao Dong added that Tether currently does not provide services to the United States, Canada and terrorist countries.

When the user wants to redeem the US dollar, he only needs to send the USDT to the specified address. These USDTs will be remitted to the Tether Foundation account and become part of the “Authorized but not issued”.

Zhao Dong said that in general "Authorized but not issued" pool will reserve tens of millions of dollars in USDT. Once the Foundation believes that the quantity exceeds the limit, Tether destroys and destroys the excess USDT.

Additional USDT flow

Additional USDT flow

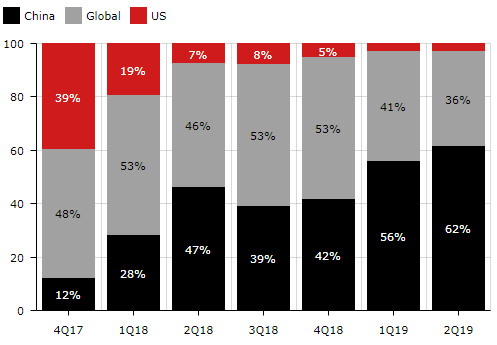

According to the DIAR research report, most of the additional USDTs flowed to the China Exchange.

In the second quarter of 2019, this figure increased to 62%; at the same time, the US exchange's demand for USDT fell from nearly 40% in the fourth quarter of 2017 to less than 5%; to the second quarter, 2019 The USDT trade volume of the China Exchange exceeded US$10 billion in the year, and the US only traded US$450 million in USDT.

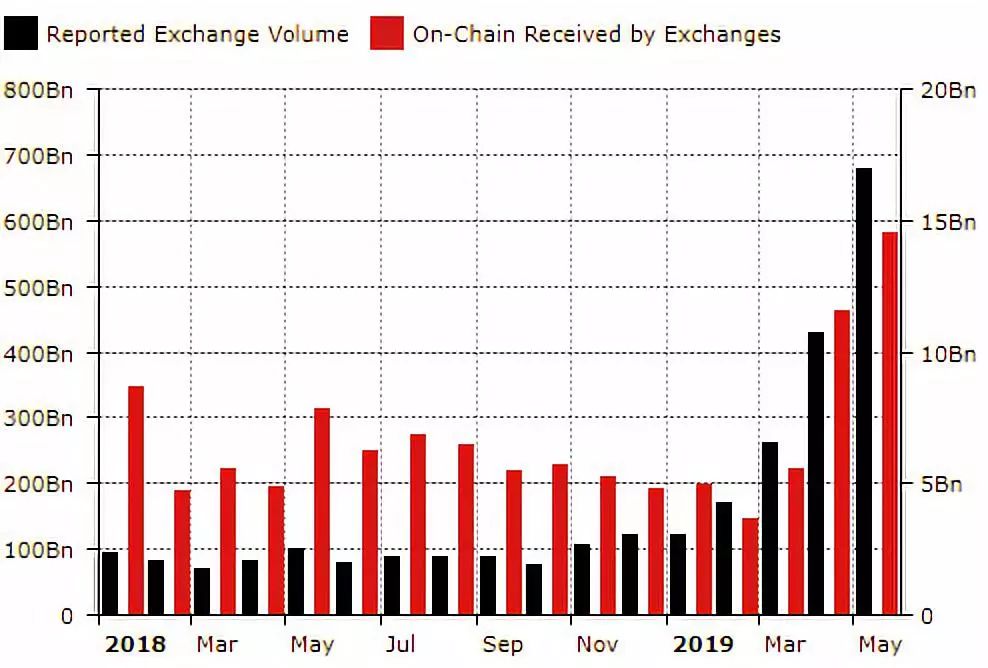

(USDT chain transfer amount & exchange report volume)

(USDT chain transfer amount & exchange report volume)

In addition, since 2019, the trading volume of USDT has been in line with the exchange volume reported by the exchange, that is, the global cryptocurrency trading volume has indeed increased rapidly in 2019.

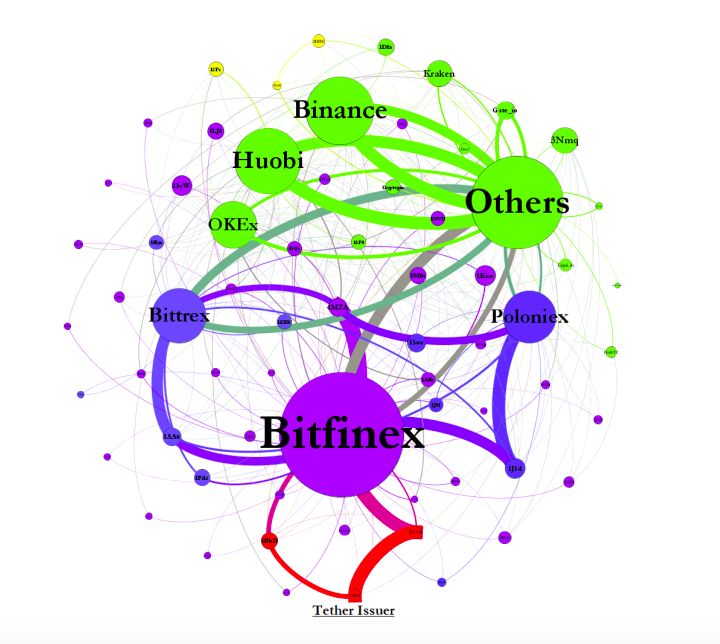

Research by Professor John Griffin, a well-known expert on fraud on Wall Street, also pointed out that among the exchanges that Tether eventually flows to, OKEx, Firecoin, Coin, Bitfinex, Poloniex, Bittrex and other exchanges are the most important.

(Odaily Planet Daily Note: The study is available from March 2017 to March 2018.)

(Report on Tether flow chart)

(Report on Tether flow chart)

The pictures in the report show that the first stop for Tether flow is often Bitfinex. This is related to the early use of USDT. At the beginning, USDT only traded on Bitfinex, and more and more exchanges were supported later.

Zhao Dong also explained that the early USDT was mainly to support the dollar trading service on Bitfinex; now the scope of USDT has expanded, and the biggest flow of Tether has changed.

The Odaily Planet Daily found that this was the case. On the Tether Rich List, the top ranked addresses are currently occupied by exchanges such as Binance, Huobi, and Okex.

Tether's positive and negative premium

Tether's positive and negative premium

For a long time, many investors like to use the positive and negative premium of USDT as the weather vane of the transaction.

A positive premium for USDT means that its price exceeds $1, and a negative premium means that its price is less than $1.

The root cause is actually the buying and selling behavior. If the market buys a large amount of USDT for a period of time, it will result in a positive premium for the price, and a large sale will result in a negative premium.

Therefore, when many people see a positive premium in the USDT, they will think that the off-exchange funds are starting to enter the market to buy the USDT, and they are optimistic that the cryptocurrency will rise accordingly, thus doing more. This is actually based on certain reasons.

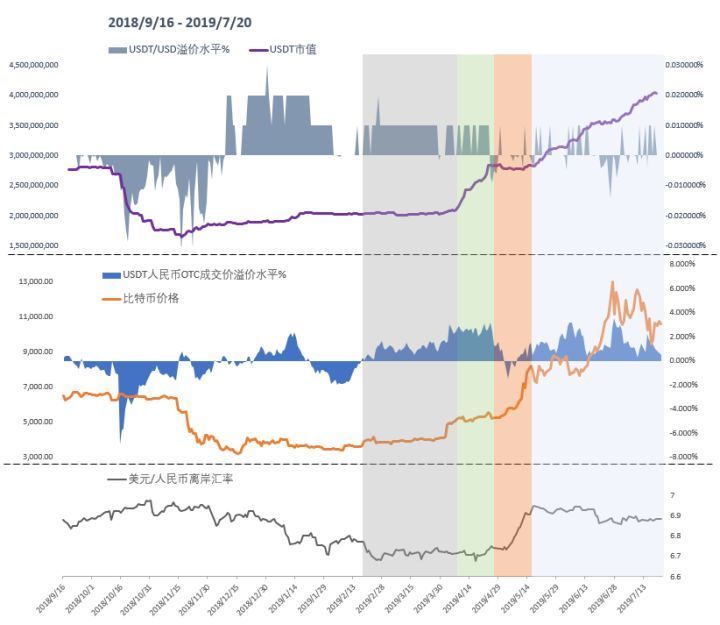

Top: USDT/USD Exchange Rate & USDT Market Value (Gray/Blue) on Kranken Exchange – Coinmarketcap

Top: USDT/USD Exchange Rate & USDT Market Value (Gray/Blue) on Kranken Exchange – Coinmarketcap

According to the block rhythm BlockBeats reported that from the second half of February to the beginning of April (gray shaded area), the USDT premium level rose from 1% to 3%, mainly due to several wave rises after Bitcoin bottomed out at $3,500. Arouse the demand for a large number of hopes to bottom out. After entering April, the USDT premium level of domestic OTC transactions rose again with the increase in bitcoin prices, indicating a huge demand for USDT in the Chinese market.

However, the USDT positive premium does not always mean that the cryptocurrency will rise. As can be seen from the above chart, after July of this year, although the USDT still has a positive premium, the BTC price has gradually declined. This is mainly because more investors have exchanged assets such as BTC for USDT for safe haven, which has pushed up the USDT price.

The CoinMarketCap data shows that the USDT is at a negative premium for a fraction of the time.

Some investors told the Odaily Planet Daily that every time the USDT has a negative premium, it can be arbitrage.

In October 2018, Tether suffered a crisis of confidence, when USDT plunged 10% to as low as $0.869. The investor had bought a USDT of millions of dollars, and finally the USDT price recovered to around US$1 and the profit was hundreds of thousands of yuan.

“The USDT negative premium will cause Tether to take back the USDT and destroy it (control the currency price).” Zhao Dong said that in the October 2018 crisis, Tether finally destroyed 500 million own USDTs to stabilize the currency price. .

Tether total profit of $80 million

Tether total profit of $80 million

In May of this year, Tether and the Bitfinex parent company announced a total revenue of more than $410 million in 2018. How many of these belong to Tether?

Zhao Dong explained that the $410 million is all Bitfinex's profit and does not include Tether.

How much does Tether earn? It seems to be a mystery?

According to the official, Tether has two ways to make money:

- 1:1 dollar deposit interest in the bank;

- The user will charge a 5% handling fee.

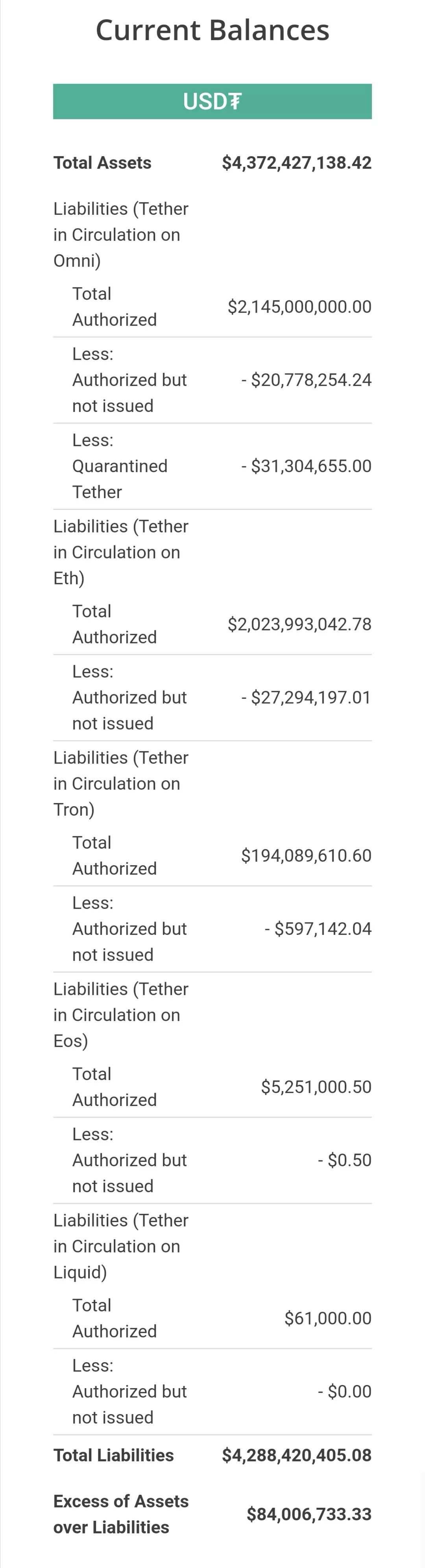

The Odaily Planet Daily found that although there is no explicit list of profits in Tether's official website, there is an item called "Excess of Assets over Liabilities" (exceeding debt assets), which can be understood to have a profit of about $84 million since its inception. In other words, Tether's profit size is not even comparable to a quarter of the 2018 profits of the three exchanges.

Tether embraces Ethereum

Tether embraces Ethereum

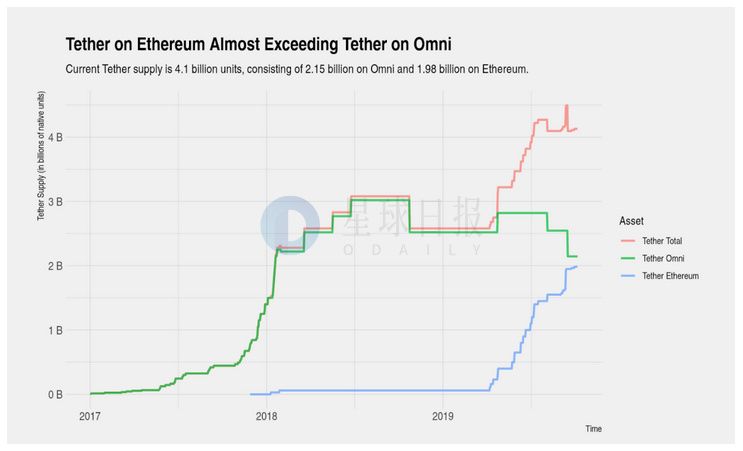

For several months, Tether has been shifting the focus of USDT's issuance from OMNI (Bitcoin Network) to ERC20 (Ethereum Network). In September, Tether issued a formal transfer announcement, which means that ERC20-USDT officially replaced OMNI-USDT.

Among them, on September 12, Tether migrated 300 million USDTs from Omni to the ERC20 agreement.

According to Coinmetrics data, Omni still has the upper hand. In the 4.1 billion USDT supply, the supply of Omni network is 2.15 billion, while the supply of Ethereum network is 1.96 billion. The number of Tethers issued in other blockchains is very high. less.

Unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Huawei has disclosed four blockchain related patents this month.

- US legislators consider enacting a bill to classify stable currency as securities

- Zuckerberg: Libra does not intend to replace sovereign currency and will expand US financial leadership

- PayPal can not escape the blockchain "true incense law"

- Libra "soft" with the G7

- Sudden! V God turns on the AMA answer mode to see what kind of "difficulty" he has encountered.

- Bitcoin vs. US Dollar: Who has value support?