Viewing the Status Quo of Blockchain from "Byzantine Compassion" and the original sin of Nakamoto

Author: village two old

"Byzantine Compassion" is the work of Mr. Liu Yukun, which is included in the "Twelve Tomorrows" science fiction series. He was highly recommended by Mr. Liu Cixin, the author of "Three-body".

The blockchain industry often refers to the words “byzantine generals” and “byzantine fault tolerance.” This science fiction novel, called Byzantine Compassion, is a hint of the book's blockchain and digital currency.

- The witness said: I participated in the Wuzhen Conference last year, why did you want to come this year?

- Interview with BitMax.io Cao Jing: Compliance, Localization and Traffic Integration, Exchange Status and Future

- Blockstream CEO Adam Back: Bitcoin sidechain may destroy competitive coins

In the novel, the protagonist created a website called sympathy net. The token on the website is a sympathy coin. At that time, some countries and regions were in war. International relief organizations participated in this website in order to provide humanitarianism, so that all rescue funds can pass digital currency. The way is sent to the people who need help, which is easier to pass than the legal currency or materials.

So how do people know who needs help? The answer is that the local situation is horribly sent to the website and posted on the website. The bigger the traffic, the more worthy of sympathy. The form mentioned in the book is basically the vibrato of the future version. The video of virtual reality is taken out by VR, and it is transmitted to the website to open its own address. Anyone who sees this video feels that you deserve help, and then sympathizes with the coin. Give you.

There is a mechanism hidden in it. You need to take a token to vote for the video publisher who feels that you need help. If you vote for one person and most of the community bets on another person, then your digital currency will be It will be reduced accordingly, and the number of people who have invested will increase, and some will be given to the people who need the most help. This is a mechanism to prevent cheating, in case someone posts their own video and then scams the participant's token.

What is the final outcome? It’s completely gone.

The sympathy network finally became a tragic conference, and the sympathy coin finally became a betting game.

The work is about a charity. The protagonist of the novel is also quite mainstream and correct. He wants to help the people in the war. Let the token pass through the fire line to the refugees. This is a good intention, but why is it? Not good?

1. The subject matter is difficult to quantify , such as "sympathy".

2. Institutions have advantages over individuals in many competitions, causing people who really need help to make a sound . His video has no time and effort to polish the post processing. Publishing VR videos online to win sympathy coins is the basic logic for sympathetic network operations. In the competitive market, professional organizations such as large national teams are always the main force, that is, like the current vibrato, there is a lot of network red behind the team;

3. The consensus of the community is difficult to establish . Even the “project party” of the operating website has its own thoughts. In the novel, when someone proposed to the board of directors, they already thought about building the website into the world's largest charity platform to do commercial fundraising. If the novel was written down, the sympathy coin would have to be hard. Forked.

4. The betting mechanism turns this charity website into a gambling game with a lot of gambling.

The inventor of the sympathy coin in the novel appeared, and its role is probably like the "Nakamoto Satoshi" in the real world. She generally does not speak in the community, just like Nakamoto. However, there is a detail. Once she thought that she would vote for A, and the majority of the community voted for B. Then her currency was 10% less. The digital currency was reduced. She didn’t care, but under this betting mechanism. Personal judgment, such as obeying public judgment, everyone needs to judge "who most people think is the worst", so such a website becomes a bet.

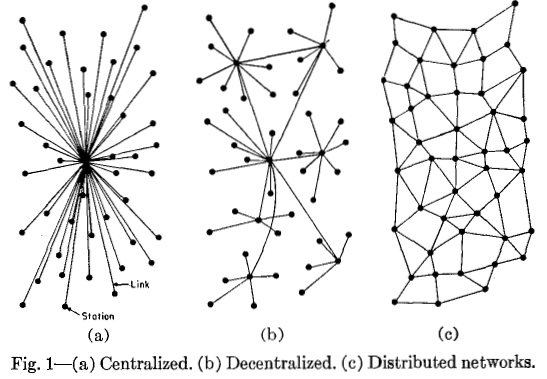

The content of the book is very short, basically finished in an hour or two, but what is the blockchain in the book? Centralized: The founders and holders are more centralized, and the participants are also centralized. And without realizing any ideals or practicing values, the founders of sympathy did not see the results they wanted.

The current blockchain situation is actually much better than the novel. If the founder of the sympathy coin in the novel is to help others, the reality may be darker than the novel .

Some big Internet companies claim to be the target of killing the intermediary. However, in one sentence, the complete version is: killing the intermediary and then becoming the largest intermediary. Isn’t the blockchain industry digital currency system so different? Only the vision of Bitcoin is more ambitious, and it is possible to classify large organizations as intermediaries.

Bitcoin centralization is very serious. From mining machine production to mine owners, Bitcoin mining is central. So, what about the distribution of bitcoin? Still the same.

More than 100,000 bitcoins in the hands of the Chinese should be no less than ten (self-judgment), more than 10,000, and the distribution of bitcoin whales in the world is basically the same. These coins were bought in the early days and were not sold. They were auctioned off from the Silk Road, and there were big miners, the founders of the early mines. What’s more interesting was the participants who participated in the fund game a few years ago. The organization has Bitcoin in its hands and does not want to return the French currency. Finally, it gives the participants Bitcoin (the amount is quite large), because Bitcoin is not worth the money at that time, and the institutional liar said, "It will be very valuable in the future."

Bitcoin whales don't show up very much. Except for some well-known big coffee makers, it is impossible to accurately count who these whales are and how many coins they have. Ironically, Bitcoin is already the most decentralized of the tens of thousands of digital currencies.

Having said that, whether centralization means bad or not, Rockefeller monopolized the oil industry and offered gasoline to the public more cheaply than ever before; the chip giant monopolized the price of the chip to a decentralized organization. To the point where it is not, the term “monopoly” is only a neutral word in economics, and there is no embarrassment. Many economists are against the “anti-monopoly law”.

The contribution of Nakamoto Satoshi is familiar, decentralized, and guides the technology of the blockchain to contribute to the world.

Is there any original sin in Nakamoto? Perhaps there is also, the first application of a technology is to directly target the currency, the benchmark financial system. The development of the blockchain industry is unhealthy. Just like a child with a fast-developing capital, the person grows very fast. However, there is not much stuff in his mind, and it is more like a large meat grinder walking in the human world.

Most of the time, the issuance of digital currency can't help traditional enterprises or those who do things, because "fake the truth is true and false", investors can not see whether it is a real project or a fake project, if the "Byzantine sympathy" novel The reality of metaphor, the propaganda effect of the team doing the work is not as good as the fake team, the latter often looks more professional, more promising and more attractive.

So what about the so-called investors? Will large investment institutions be more professional?

Yes, it will be more professional, but as long as the laws and regulations allow, capital is more focused on the money-making effect than retail investors. In the face of a space shuttle project and a leek harvester project, the capital side will be more inclined to the latter, because capital is the most chasing interest, which is very reasonable . The price of the currency does not rise. What is a good project? Focusing on technology is a waste of time. Focusing on model and community building is the investment king.

Therefore, the accumulation of technical research on blockchain is more in large enterprises such as IBM and Alibaba , rather than in innovative small teams. This is not in the way of thinking about the edge of the Internet. However, the money-making effect is better than the Internet. To be fast, financial logic makes it happen. This is not the original sin of Nakamoto, and it is still to be commented on by future generations.

Perhaps the real opportunities and changes are bred , the road to financing is flatter, it is more convenient to have money to do things, but it takes some time to believe that it takes some time to do these things. This article is just a kind of thinking about a scenario that is seen in the novel Byzantine Compassion. If you have other interpretations, welcome to communicate and discuss. However, the development of the industry requires many people's awakening and struggle. Dialogue, discussion and thinking are not useful in the short term, but the brain is clearer and there is no harm in making money.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Economic Ecology at the Edge: Digital Money Payment Breakthrough

- Opera browser: 350 million users can now use Bitcoin to pay directly in the browser

- Tencent Blockchain White Paper: Blockchain startups increase by 250%, global patent growth has slowed

- Bitcoin: an experiment in the form of a new currency

- Head of FinCEN, USA: Anyone must abide by the Anti-Money Laundering Act (AML), and the stable currency is no exception.

- Full deployment of cryptocurrency regulatory rules in 2020? The FATF will begin a one-year review

- Wuzhen News | BKEX founder Ji Jiaming confirmed attending the World Blockchain Conference, he will bring the heavy news of BKEX