ICO will disappear completely in 2020

As we all know, the good days of the 2017 bull market are far away from us. At that time, it seems that anyone can rely on a white paper to raise tens of millions of dollars with their tokens in a round of ICO. But even after a period of bull market, the ICO market seems to be slowly maturing. Its size is no longer as big as it used to be, but things look bright. As Elementus stated in a report published in August 2018: “All indications point to a mature ICO market”.

Unfortunately, after a year, these signs seem to be pointing in the opposite direction.

We analyzed all ICOs listed in the tracking site ICO Watch that ended in 2018 or 2019 (around the end of August). In fact, as a source of its data, the ICO Watch website itself seems to have been closed since we started collecting data at the end of August.

- Explore: How DeFi Improves the Traditional Financial System

- Who is the biggest bitcoin holder: Nakamoto, Winklevoss brothers or "King of encryption" Barry Sylbert?

- Survey: 61 dark net payment status, who is favored outside of Bitcoin

(We have retained the dataset here so that interested readers can verify our work. It is worth pointing out that this dataset, of course, means that this analysis does not include the performance of IEO, IEO in 2019. The regular ICO project is excellent. The data set and analysis also do not include STO.)

Just looking at the number of unedited projects, you can see the massive decline in ICO. Even in the beginning of the bear market in January 2018, the ICO project maintained a fairly constant rate of update, with more than 100 new ICOs per week, but by 2019, the project's traffic had almost zeroed.

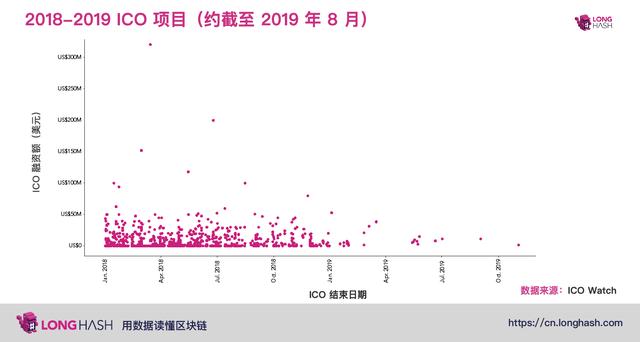

The amount of money that can be won in the ICO market has also decreased. In the chart below, each individual ICO in the dataset is drawn into a corresponding dot based on the ICO end date and the amount of funds raised on the website. In 2018, 14 different projects broke through the $50 million mark, and many of the projects raised more than this amount. By 2019, only one project (Contentos) had successfully crossed this barrier, and in fact the project should be classified to a greater extent in 2018 – its ICO ended on January 3, 2019.

It is worth noting, however, that the data does indicate that the average quality of a few projects that successfully completed ICO in 2019 may be higher than the 2018 ICO project. Although the total amount of financing has shrunk a lot, the median amount of ICO project financing in 2019 is $6.8 million, which is much higher than the median ICO financing of $131,814 in 2018. In addition, although not all ICO projects in the ICO Watch dataset provide data on Telegram fans, the average number of fans in the 2019 ICO project is more than twice that of the 2018 ICO project.

One possible reason for the dramatic decline in the ICO market is that as governments respond to fraud and fanaticism with the initial ICO boom, more stringent regulatory reviews are being implemented globally. In particular, in the face of harsh but lack of clear regulation, the ICO project appears to be withdrawing from the United States.

However, it is difficult to see the development prospects of ICO. Even though the ICO quality that appears on the market today is higher than many of the tokens sold in 2018, there may not be enough tokens for ICO to support it to continue to act as a viable financing model for a longer period of time, especially Now the exchange is increasingly eager to grab any project that can do a decent IEO.

It would not be surprising if the ICO model disappeared completely in 2020.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Not surprising! The Libra Association is considering a “stepped” approach to KYC regulations

- Circle transformation: from Goldman Sachs, Baidu sought after, to give up bitcoin payment and change to stable currency

- Defi Sport Enlightenment Project MakerDAO's ambition and brutal struggle

- Babbitt Entrepreneurship + | Luck and strength blessing, how does Taraxa endorse for the blockchain + IoT?

- When the cryptocurrency market is not good, what kind of trading strategy can you use to make a profit?

- Successful breakthrough in the broader market, platform coins are expected to meet the opportunity

- Vitalik: Ethereum 1.0 will become the subsystem of Ethereum 2.0, PoW will lose its meaning