Where is the next opportunity for NFT? An overview of the current NFTFi subdivisions.

Next NFT opportunity: overview of current NFTFi subdivisions.The rapid development of NFTs began in 2021 and has since experienced multiple market booms, with the most recent being driven by Blur and focusing the community’s attention on NFTFi.

Starting in 2022, the bear market cycle in the cryptocurrency market has led to a cooling of the NFT market. However, due to the development of new public chains and GameFi and SocialFi, the NFT market continues to see significant growth.

As the NFT industry matures, more and more sub-sectors related to NFTs are emerging, with new projects revolving around NFT pricing, liquidity, and fund utilization.

- Inventory of 5 Ethereum ecosystem NFT projects that will “make waves” in June

- LSDFi Summer is coming, quickly understand 6 LSDFi projects worth paying attention to.

- Research Report on Interchain Operation Protocol LayerZero

NFTFi (NFT Finance) essentially combines NFTs with financial properties, making NFTs more diverse and efficient in terms of liquidity and bringing more gameplay opportunities to NFT holders. Existing sub-sectors derived from NFTFi include NFT trading, NFT lending, NFT derivatives, and NFT oracles.

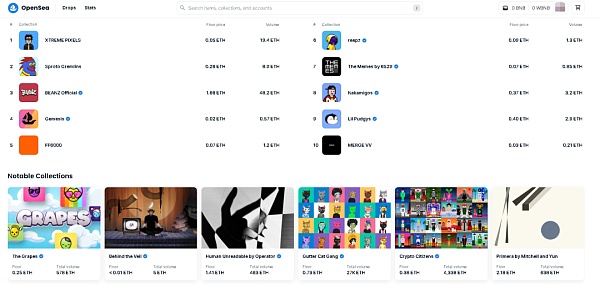

NFT Trading Platforms

Despite the emergence of many up-and-comers such as Blur, Looksrare, and X2Y2, Opensea remains the top NFT trading platform in the public’s consciousness. With its simplicity and good user experience, Opensea has the highest daily trading volume and trading addresses.

Blur is currently Opensea’s biggest competitor, with its main features being lower trading gas fees, real-time data analytics, and a more suitable trading experience for large holders. Unlike Opensea, which targets the general public, Blur is more suitable for professional NFT users. And in terms of trading volume, Blur has already surpassed Opensea.

Sudoswap is a platform that uses the AMM mechanism for NFT trading. Sudoswap allows for the provision of liquidity pools for single-sided NFT and ETH, supporting NFT and ETH pairing transactions. In theory, this approach can make NFT trading more convenient and efficient, while also enhancing trading flexibility.

Competition in the NFT trading platform market has now tended toward two levels: competition in incentive methods for conventional trading platforms and competition in product differentiation. There is currently no consensus on which product will ultimately be universally accepted by the market.

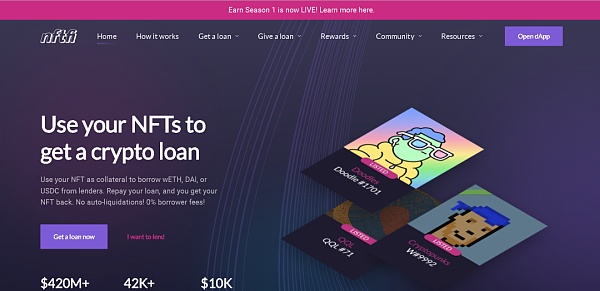

NFT Lending

As with the development of DeFi, lending quickly became another demand in the NFT market after trading.

NFTfi is a platform that provides NFT collateralized loans. It charges a fee of 5% only to the successful loan applicant. NFTfi also supports borrowing and lending long-tail NFT assets such as ENS domain names, Sandbox land, and game NFTs. It also provides services such as NFT debt receipts. In addition, NFTfi supports multiple NFT combination loans and allows users to complete loans privately without displaying loan information publicly.

BendDAO is the first project to launch NFT point-to-pool lending and also the protocol with the most blue-chip NFT collateral. As the creator of the point-to-pool model, BendDAO was highly anticipated before its launch. BendDAO also has project tokens, some of which are used for liquidity incentives.

Currently, there are still many factors that affect the development of NFT lending, such as poor NFT liquidity, unstable value, and easily manipulated prices, resulting in low lending efficiency in the market, which is only suitable for a few blue-chip NFT projects.

NFT Derivatives

NFT derivatives refer to new digital assets derived from NFTs, such as options and futures.

Putty is an Ethereum-based peer-to-peer options market for NFTs and FTs. Users can create call or put options for individual assets or baskets of assets. The user’s position itself is an NFT called OPUT, so it can be transferred between the user’s wallets.

NFTperp is a perpetual contract system designed for NFT floor prices, using the vAMM mechanism and deployed on Arbitrum. NFTperp provides a way to hedge floor prices and index blue-chip NFTs. It allows people to invest in the NFT market when there is a large fluctuation and a high threshold for blue-chip NFTs. NFTperp uses multiple reference data sources in the price-feeding mechanism to reduce the risk of a single data source oracle being manipulated.

The pain points of NFT derivatives are also apparent, mainly including high professional requirements, limited to blue-chip NFTs, and insufficient demand market. According to data, very few users currently use NFT derivative services.

NFTFi’s other segmented tracks include NFT oracles, NFT fragmentation, leasing, crowdfunding, and more. Because GameFi has the P2E mechanism, players can easily calculate the return on investment, so the NFT leasing market is more active.

Summary

The goal of NFTFi is similar to that of DeFi, which is to solve the liquidity problem of NFTs. However, due to the limitations of the characteristics of NFTs themselves and the high dependence of various NFTFi projects on NFT price discovery, the overall development of NFTFi is clearly limited.

Recalling the development process of DeFi, because the AMM mechanism elegantly solved the problem of FT price discovery, it finally ushered in the DeFi summer in 2020. Perhaps now is also the opportunity for NFTFi to find a financialization method that belongs to NFTs through some innovation. The future development of NFTFi still has a lot of imagination space and is worth continued attention.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introducing the important upgrade of MIM: the first Omnistable built on the OFT standard based on LayerZero.

- Which BRC20 projects can I actively participate in?

- First OrdiBots project with a thousand-fold increase? Understand the GBRC721 protocol with this article.

- Explaining the GBRC721 protocol and its ecosystem projects that have been boosted by OrdiBots’ thousand-fold increase

- What are the backgrounds of these 27 projects that received investments from top crypto VCs in April?

- Listing 5 Catalyst Projects / Narrative: Level Finance, Metavault, Lybra Finance…

- Hong Kong’s new crypto policy is about to take effect. Here are 6 crypto projects worth investing in: