Listing 10 low-market cap LSD-fi projects:

10 low-market cap projects in the LSD-fi category:Author: Nikyous, Cryptocurrency KOL

Translated by: Felix, BlockingNews

Narratives about LSD and LSD-Fi are heating up again. However, if you only focus on top tokens such as LDO, RPL, FXS, etc., it may be difficult to earn high returns. Therefore, savvy investors always seek undervalued projects. This article introduces 10 LSD-Fi projects with potential. (BlockingNews note: This article aims to provide market information and does not represent investment or usage opinions.)

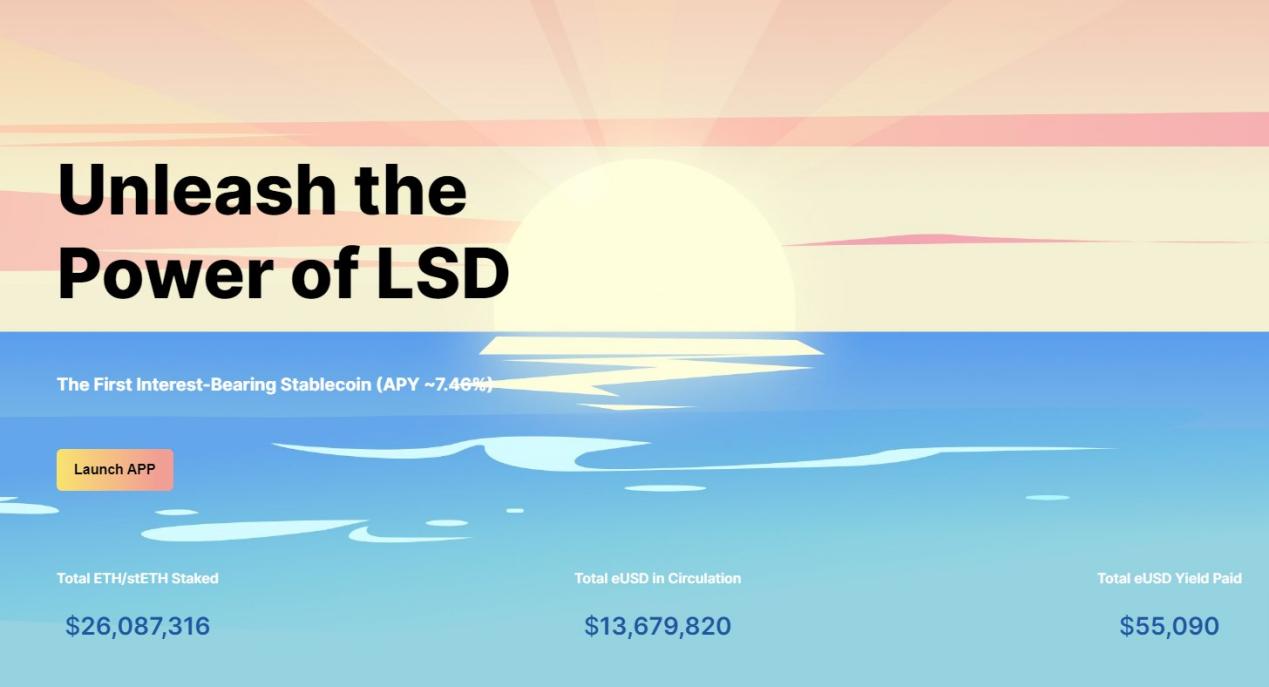

1. Lybra Finance

Lybra mints interest-bearing stablecoin eUSD by collateralizing stETH, capturing Ethereum staking rewards with stablecoin eUSD

- The absurdity in the Meme season: me, Ben.eth, sending money

- NFT as a wallet: What innovations will the new standard ERC-6551 bring to NFTs?

- Where’s the next opportunity? A review of the potential projects that will issue tokens on the Sui blockchain.

Features:

- Supported by LSD

- 1:1 peg

- 0 minting/borrowing fee

- Approximately 8% basic interest rate

TVL: $24.2 million

Market cap: $4.3 million

Approximately 144,000 stETH deposits

Related reading: LSD-Fi innovation continues, inventory of 4 types of early projects worth paying attention to

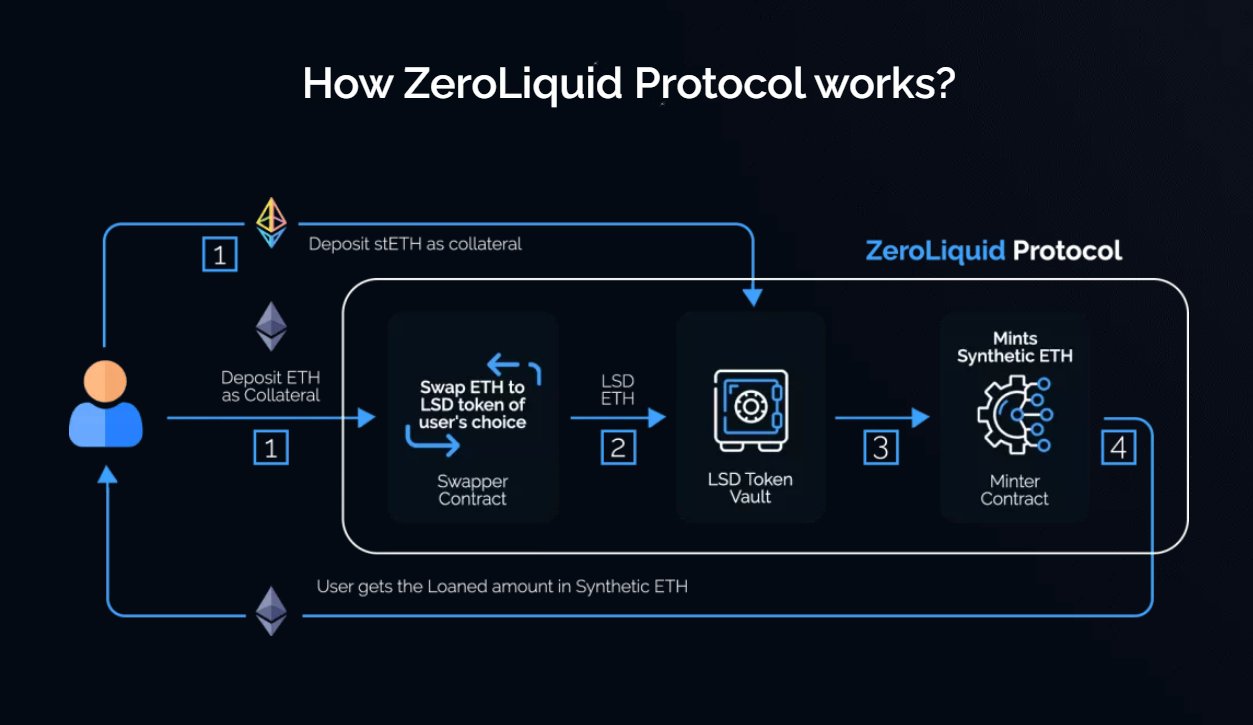

2. Zero Liquid

Zero Liquid (token ZERO) uses the income generated by users depositing collateral to automatically repay debts.

Features:

- Zero interest

- No liquidation risk

Mechanism:

- Deposit LSD tokens such as stETH

- Use it as collateral for loans

- When LSD tokens generate income, repay the loan

Related reading: What expectations can the Ethereum Shapella upgrade bring us?

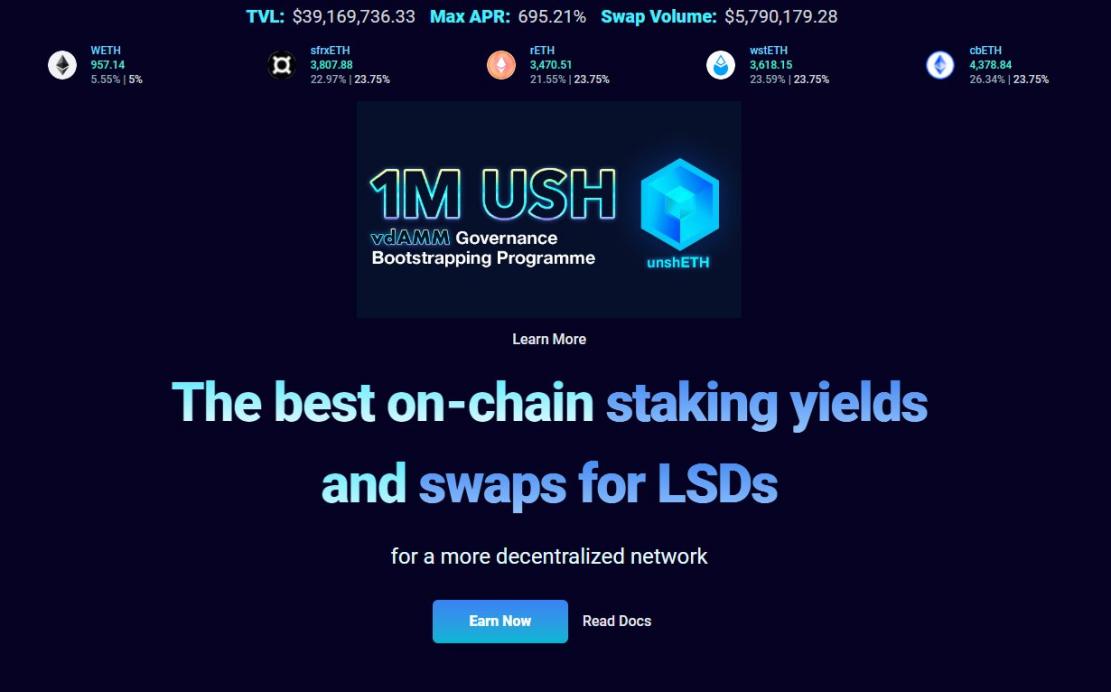

3. unshETH

One of the goals of unshETH (token USH) is to incentivize decentralization. Simply put:

unshETH provides higher returns for smaller validators. Stakers receive higher returns, and ETH becomes more decentralized. Think of it as a yield aggregator that prioritizes decentralized returns.

Related reading: Analysis of the new project unshETH: an LSD protocol that uses incentive mechanisms to optimize validator decentralization

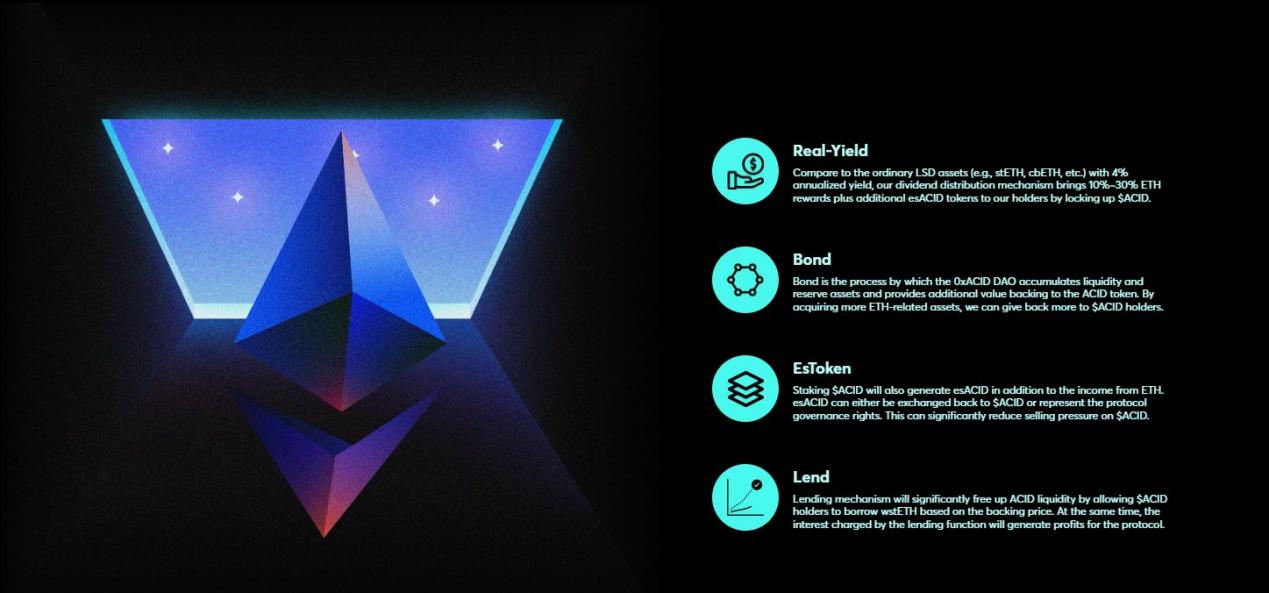

4. 0xAcid

0xAcid (token: ACID) aims to optimize LSD revenue, such as:

- stETH

- rETH

- frxETH

0xAcid provides higher returns than traditional LSD assets, which typically only have a 4-5% annual interest rate. ACID holds LSD assets and earns income from ETH nodes.

Related reading: Analyzing the LSDfi protocol’s 0xAcid revenue mechanism: is 90% APR the real return?

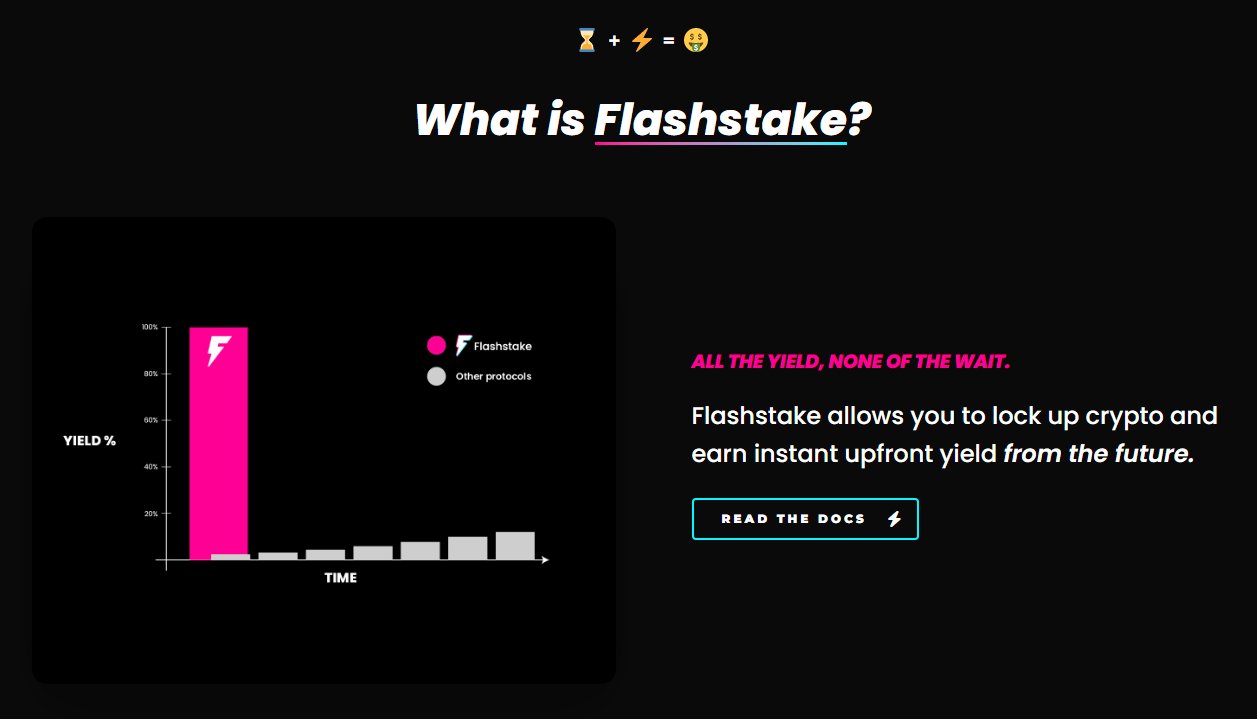

5. Flashstake

Flashstake (token: FLASH) can earn instant early returns. To get a 4-5% collateral return on ETH, you usually have to wait a year. FLASH allows you to lock in your principal and receive returns immediately and in advance.

Currently supported:

- stETH

- sUSD

- GLP

- rETH (coming soon)

Related reading: One article to understand Flashstake: bill interest discount product, LSD capital amplifier

6. Agility

Agility (token: AGI) is:

- an aUSD trading platform

- an LSD liquidity allocation platform

The Agility Protocol aims to help LSD projects improve initial liquidity: LSD/ETH. There are different strategy treasuries for different revenue strategies.

Related reading: LSDFi Summer and representative project Agility interpretation

7. LSDx Finance

LSDx Finance (token: LSD) currently offers two products:

- ETHx: a basket of LSD, which can be switched quickly

- UM: a stablecoin supported by sovereign bonds based on ETH collateral returns

LSDx Finance is the ultra-liquidity protocol for all LSD.

Related reading: An article on the ultra-liquidity protocol LSDx Finance

8. SharedStake

SharedStake (token SGT) is a decentralized staking solution that allows users to stake ETH and earn additional rewards outside of their staking rewards.

If they hold their NFTs, they are the first to offer an increase in APR for LSD.

- TVL: $29 million

- Market cap: $2 million

Related reading: LSD competition heats up, a quick look at 9 potential protocols

9. Blockingrallax Finance

Blockingrallax Finance (token PLX) is a liquidity layer infrastructure that supports DeFi, DAO, and protocols.

There are 4 main components:

- Orbital: Yield optimizer (Orbital optimizes the yield generation process by pooling all deposited assets and collectively investing them in their respective LPs. LP participants earn higher fees compared to individual staking.)

- Andromeda: Multivariate yield

- Supernova: Powers LSDfi (An LSD strategy consisting of multiple strategies in the insurance vault. Think of it as an index approach to a basket of strategies, each with customizable investment portfolio allocation percentages.)

- Black Hole – Liquidity market

Related reading: Detailed explanation of 5 strategies that generate excess returns in the LSDFi War

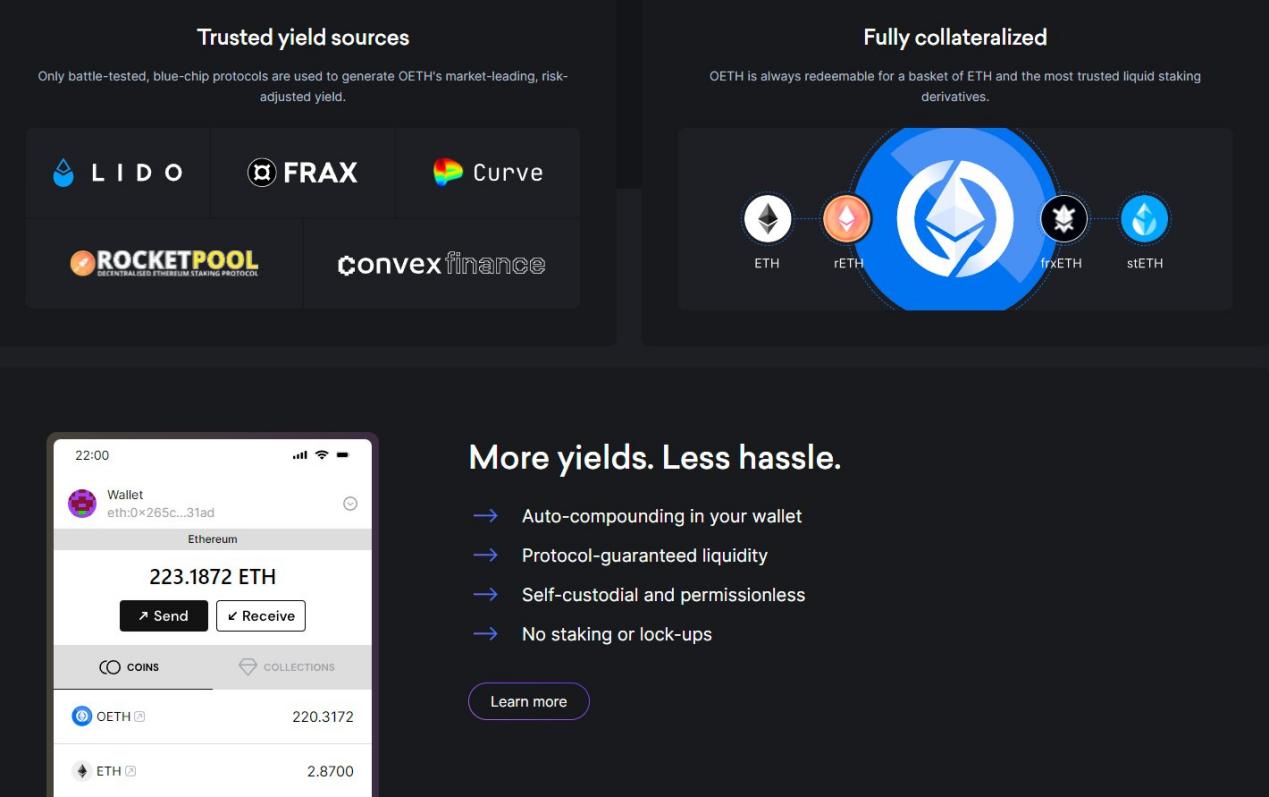

10. Origin DeFi

New LSD project. Origin DeFi has launched a revenue-generating stablecoin, OUSD. Additionally, they have just launched a revenue aggregator, OETH. Supports:

- LDO

- FRAX

- RPL

- CRV

- CVX

Related reading: Data interpretation of Ethereum staking track.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of Bitcoin DeFi ecosystem projects

- Project Research | Aptos In-Depth Study Report on MOVE’s New Public Chain

- MEV vs. Flashbots: A Story of Natural Rivals and the Delicate Balance of Building DeFi Systems

- From Wealth Effect to Organic Growth: Revealing the Secrets to the Success of High-Quality Cryptocurrency Projects

- HyperCycle: An innovative blockchain architecture for AI algorithm data

- Project Research | Canvas: Focused on DeFi, Layer2 Protocol Based on StareWare ZK Rollups

- Neutron: A new cross-chain DeFi blockchain on Cosmos