If BlackRock’s Bitcoin ETF is approved, which projects will be the winners behind it?

Which projects will benefit if BlackRock's Bitcoin ETF is approved?Author | Hei Mi@Baize Research Institute

If BlackRock’s Bitcoin spot ETF application is approved, it may trigger a new round of cryptocurrency boom, with trillions of dollars in institutional funds pouring into the market, causing a significant rise in the prices of BTC and altcoins.

This article will introduce some projects that may directly benefit from BlackRock’s Bitcoin spot ETF.

Note: This article is for information sharing only. The author has no interest in the mentioned projects and does not endorse any of them. DYOR

- What is the current status of the transition from classical DeFi projects to RWA MakerDAO?

- Introducing the Bitcoin Script Project: Grasping the Pulse of Bitcoin Development Amidst the Noise

- How to Choose the Financing Method and Legal Documents for Web3.0 Blockchain Project Financing?

Why can BlackRock exert such great power?

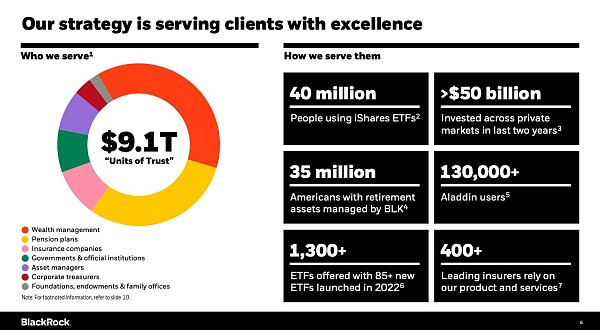

BlackRock is the world’s largest asset management company, currently managing about $9 trillion in assets.

This month, BlackRock’s move to apply for a Bitcoin spot ETF is seen as evidence of “institutional re-entry into the cryptocurrency market”.

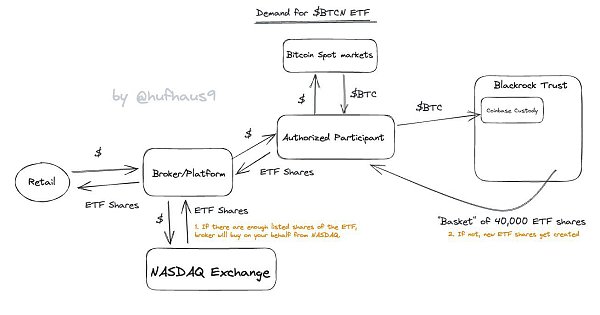

Simply put, if you want to invest in Bitcoin, instead of personally registering with a cryptocurrency exchange, depositing funds to purchase Bitcoin, and paying taxes for each transaction, you can buy BlackRock’s Bitcoin spot ETF, and they will help you do these things. You will receive a receipt to prove your ownership of the ETF, and then track the value and performance of Bitcoin. In addition to using Coinbase’s custody account to manage these Bitcoins, BlackRock cannot use your Bitcoins for any “evil” purposes. They can only provide you with more cost-effective services.

However, what is really interesting is BlackRock’s relationship with the US government and the Federal Reserve.

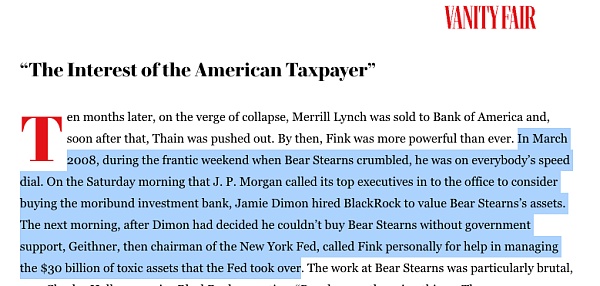

In 2008, when the Federal Reserve wanted someone to manage the troubled assets they took over from Bear Stearns, who did they turn to?

The answer is BlackRock.

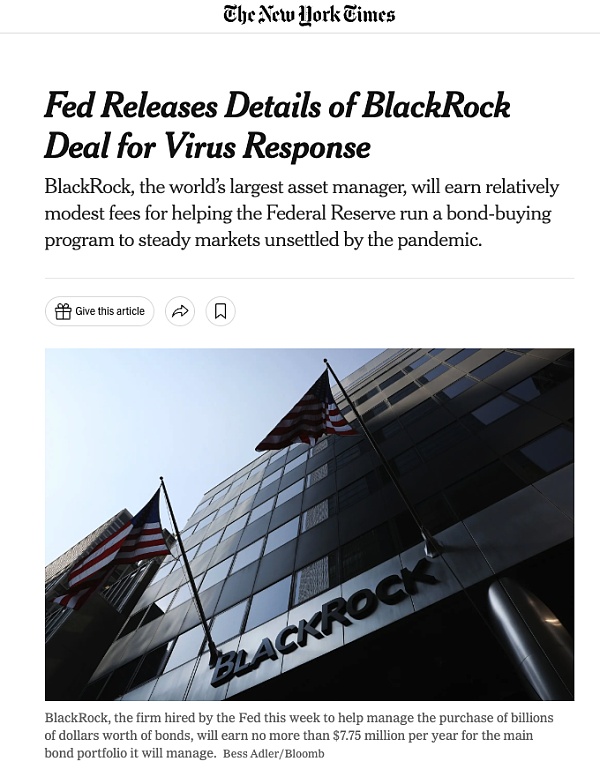

In 2020, when the Federal Reserve wanted to buy some corporate bonds to help support the economy, who did they turn to?

The answer is BlackRock.

In 2023, when the Federal Deposit Insurance Corporation (FDIC) needed someone to help count the assets of Signature and Silicon Valley Banks, who did they turn to?

The answer is BlackRock.

This is why Eric Balchunas, senior ETF analyst at Bloomberg, said that BlackRock’s application for a bitcoin spot ETF is “a big deal” for the entire crypto market.

In addition to entering the crypto market through a bitcoin spot ETF and seizing the flow and fees generated by bitcoin trading, we can also discover from the annual report that BlackRock is interested in tokenizing RWA (real world assets), especially the tokenization of stocks and securities.

Which projects may benefit from this?

1. Bitcoin L2 ecology led by Stacks

Stacks can be said to be the most prosperous Bitcoin L2 network in the current ecosystem.

Similar to the Rollup L2 network that aims to expand Ethereum, Stacks also packages multiple transactions into a batch and submits them to the Bitcoin network for verification, thereby effectively reducing the number of transactions on the Bitcoin network and improving overall performance.

Stacks adopts the consensus mechanism of Proof of Transfer (PoX), and miners need to spend Bitcoin to mine the native token STX, which allows Stacks to borrow the security of the Bitcoin network and allows Bitcoin to be used on dApps in the Stacks ecosystem. (It is worth noting that STX is the first token approved by the US Securities and Exchange Commission in 2019)

With the opening of the Bitcoin NFT protocol Ordinals and the soaring of transaction fees, Stacks has returned to the public’s attention again, and its popularity has continued to rise in the past two months, and the price of STX has risen by more than 4 times in a little over a month.

Therefore, the approval of BlackRock’s bitcoin spot ETF may play a role in promoting STX and the wider Bitcoin L2 ecology.

In addition, Stacks will introduce five important functions in the latest upgrade Nakamoto in Q4 2023, which is expected to be an additional catalyst for the price of STX, including sharing network security with Bitcoin and creating a decentralized Bitcoin-anchored coin SBTC.

2. Projects mentioned by BlackRock: Energy Web

Energy Web is an organization dedicated to accelerating global decarbonization through open-source software and blockchain solutions, focusing on two key challenges: using distributed assets such as solar systems, batteries, electric vehicles, and charging stations to achieve a more efficient and sustainable grid balance, and bringing transparency to the supply chain of emerging green products such as sustainable aviation fuel. The organization has signed deals with several major energy producers and fossil fuel companies, including listed companies such as Shell and Volkswagen.

Its main network, Energy Web Chain, went live in 2019. It is an EVM enterprise-level public chain that uses the Proof of Authority (PoA) consensus mechanism, where blocks and transactions are verified by pre-approved participants (usually partner companies) who act as system managers. However, both enterprises and individual developers can deploy dApps on the network, such as DeFi with energy trading as the theme, and any user can use it. But its native token EWT only serves as the most basic validator reward and Gas token, and has not been given more utility.

This month, the organization announced the launch of a Polkadot parallel chain named Energy Web X, where the simplest way to understand it is that two blockchains share the same token. The idea of Energy Web X is simple – it adds another utility to EWT: anyone can earn token rewards by staking tokens and becoming a trusted node to perform computational work for energy companies. Small token holders can stake tokens with trusted nodes to earn profits.

It is worth noting that when BlackRock launched a Bitcoin private trust last year, it mentioned that Energy Web is helping to improve the transparency of Bitcoin green mining. After the news release, the price of EWT tokens rose by 24%. Therefore, the approval of BlackRock’s Bitcoin spot ETF may have a positive impact on Energy Web, the largest decentralized energy ecosystem, and the adoption by more energy companies may further push up the price of EWT.

3. BlackRock’s interest in the RWA track: Polymesh and Realio Network

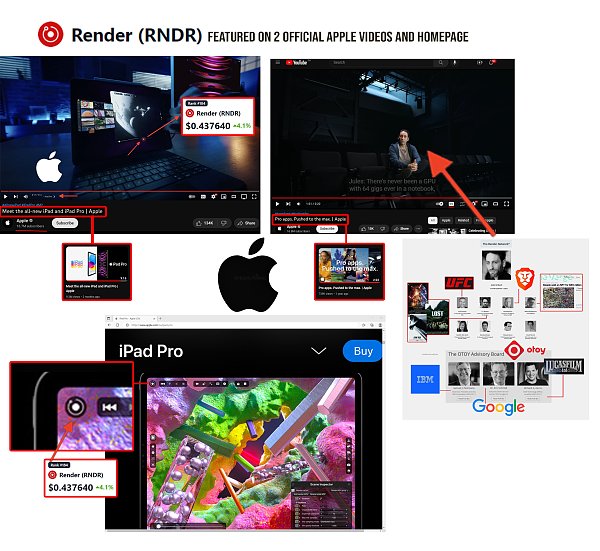

One of the strongest performing tokens this year is its native token RNDR, which has rebounded well in the bear market. This may be due to its parent company OTOY’s partnership with Apple, as Render Network’s logo has appeared multiple times in Apple’s official product promotional videos. Recently, RNDR has adopted a new token economics model called “burn and mint” (BME), making it a highly deflationary token, which could become a catalyst for its future price increases.

As the US SEC filed lawsuits against centralized cryptocurrency exchanges Coinbase and Binance this month, perpetual DEXs are gaining more users. Traders trying to get rid of CEX and KYC are looking for a “new home” in the perpetual DEX race.

The leading project GMX, with a total trading volume of over 133 billion US dollars, is likely to continue to grow as a result.

Risk Warning:

According to the Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation issued by the central bank and other departments, the content of this article is for information sharing only and does not promote or endorse any business and investment behavior. Please strictly abide by local laws and regulations and do not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the development direction of the new NFT project with the Azuki crash and BAYC debut?

- dYdX Chain’s public testnet will officially launch at 01:00 (Beijing time) on July 6th.

- Further observation on the staking track: What other potential projects are there besides EigenLayer?

- Understanding the five core principles and unique features of ZKStack

- Comprehensive Interpretation of the StarkNet Ecosystem: Which Projects are Worth Paying Attention to

- Proto-Danksharding may become the biggest narrative of the year, which projects will benefit?

- 5 noteworthy zkSync ecosystem projects inventory