Industry Watch | Where is the future of blockchain, the opportunities and challenges of the US Securities Regulatory Commission's STO opening

Welcome attention: Digit Insight, we will continue to export high-quality industry research reports.

On July 11, the US Securities and Exchange Commission (SEC) approved Blockchain, a blockchain company, to sell $28 million worth of tokens under Reg A+ rules. This is the first token issue approved in the history of the SEC, marking the SEC opening up a new channel for the future financing of US companies, with a huge demonstration effect.

The US SEC has issued a policy green light on the Blockstack project's open token fundraising. Does it mean that the US government's STO policy is about to open a large-scale implementation? Based on Digit Insight, this paper summarizes the US government's “attitude” change in blockchain project financing, the update of regulatory policies, and a comprehensive analysis of the possibilities of future STO development.

The full text of more than 3,800 words will be developed from the following aspects:

- QKL123 market analysis | "slow cooking" market will continue (0827)

- Viewpoint | What is the ultimate ideal for blockchain economic system design and blockchain technology?

- I left the project side and went to the exchange.

1. Backtracking: STO birth history inventory

2. Dismantling: STO full industrial chain dismantling

3. Outlook: STO brings opportunity analysis

4. Summary: The Challenge and Future of STO

5. Ending: Current Status of US STO Policy

1

Backtracking: STO birth history inventory

What is STO?

STO is called "Security Token Offering", which is a securities-type issuance. Its goal is to issue a public certificate of tokens under a legal and regulatory regulatory framework. The issuance of securities tokens allows the holder to own certain interests of the company and is legally regulated by the US Securities and Exchange Commission (SEC), as well as through KYC (customer survey), AML (anti-money laundering), and qualified investor review.

Passing the history of economic development

The practice of blockchain in the financial sector, namely the development of the pass-through economy, has gone through three phases:

1. The birth of Bitcoin, the 1.0 era of blockchain, Bitcoin uses the two technical foundations of distributed network and encryption technology to make global currency creation and distribution become a reality, and open up global finance driven by blockchain technology. practice.

2. The birth of Ethereum, the blockchain 2.0 era, the introduction of the new concept of “smart contract” makes it possible for Ethereum to help other digital currencies to issue digital currency. The time cost of new digital currency issuance The cost of technology has been greatly reduced, which has led to the 2017 digital currency boom.

3. The rise of ICO and STO, namely the blockchain 3.0 era, the combination of blockchain technology, digital currency and traditional finance, securities and financing, the tokenization of asset securities is on the rise, and governments and traditional financial forces have also stepped in.

STO's compliance path

The popularity of STO goes back to 1CO. This kind of use of ETH smart contract to raise funds to attract a large number of growth funds and blockchain projects to enter the market, but the project is mixed, fraudulent coins, air coins flooding the market, so the regulator began to take a series of actions, currently multi-government ICO has been ordered to ban ICO-type financing activities.

To a certain extent, STO is formed by the US Securities and Exchange Commission (SEC) after deciding to include it in the securities regulation after seeing the new species produced by the blockchain in Token. In essence, there is no STO without supervision.

The STO regulation issued from the United States has gradually led to the follow-up of many countries and regions around the world, allowing the market to gradually realize that supervision is not a disaster, but to give legal status and to grow and develop in a bright future.

Figure 1: Regulatory requirements for national STOs (Source: Online, Digit Insight)

2

Dismantling: STO full industrial chain dismantling

STO Industry Chain Outlook

There are more institutions in each of the segments in the STO market. These segments can be broadly divided into ST distribution platforms, marketing platforms, trading platforms and asset escrow companies.

Distribution platform: Polymath, Harbor and Securitize are now available. In terms of marketing platforms, there are Indigogo, Republic and Coinlist.

Trading platform: There are TZero, Open Finance Network and the emerging ATS trading platform.

Asset Custody Companies: Traditional asset escrow companies such as Fidelity are also beginning to offer managed services for encrypted digital assets.

In addition to these platforms that provide services in the segmentation area, there are companies that offer a package of solutions such as Templum and Sharepost. The participation of these financial institutions will make the STO market more efficient.

Among them, there are dozens of secondary trading platforms for ST worldwide worldwide, and they are growing. We divide these trading platforms into three categories: the new STO (ST) exchange; the original digital currency exchange transformation / upgrade / incubation; traditional stock exchange derivative / compatibility.

Figure 2. STO Exchange (Source: Chain, Digit Insight)

Note: ATS is an alternative trading system, which is a securities trading license issued by the US SEC. An exchange holding an ATS license can legally trade ST.

3

Outlook: STO brings opportunity analysis

Historical opportunities brought about by the development of STO

Blockstack, as the first STO approved by the SEC to be approved by Reg A+, has a huge demonstration effect, especially the ICO legalization path. The legalization path of ICO is significant, which is equivalent to the legal and public participation of ICO, which will be encrypted. The money market brings huge incremental funds. The SEC's behavior indicates that it hopes that new financial technologies will bring more efficient tools to the market, and with the deepening of the research on digital currency by regulators, the future supervision is expected to be more refined and more certain, and the accelerated development of the digital currency trading market. More specific.

STO gives the name of the financing

IPO is a relatively common fundraising method, but its threshold is high. At the same time, the long operating cycle of IPO is not suitable for enterprises with more urgent fund-raising needs and thinner foundations.

As a way of fundraising along with the blockchain wave, ICO has lowered the threshold for fundraising and simplified the fundraising process. However, due to insufficient compliance, the risk is extremely high, and most countries including China have The strong regulatory attitude adopted by ICO.

STO is to innovate against the shortcomings of the previous ICO form, and introduces supervision from both the project side and the investor. Strict access standards have been set up from the perspective of the project side to avoid the creation of the vast majority of “air coins”; from the perspective of investors, it is necessary to be “qualified investors” to participate in STO investments. It can be seen that the better the development of STO, the more likely it is to create a new ecology for the blockchain market and bring new prosperity.

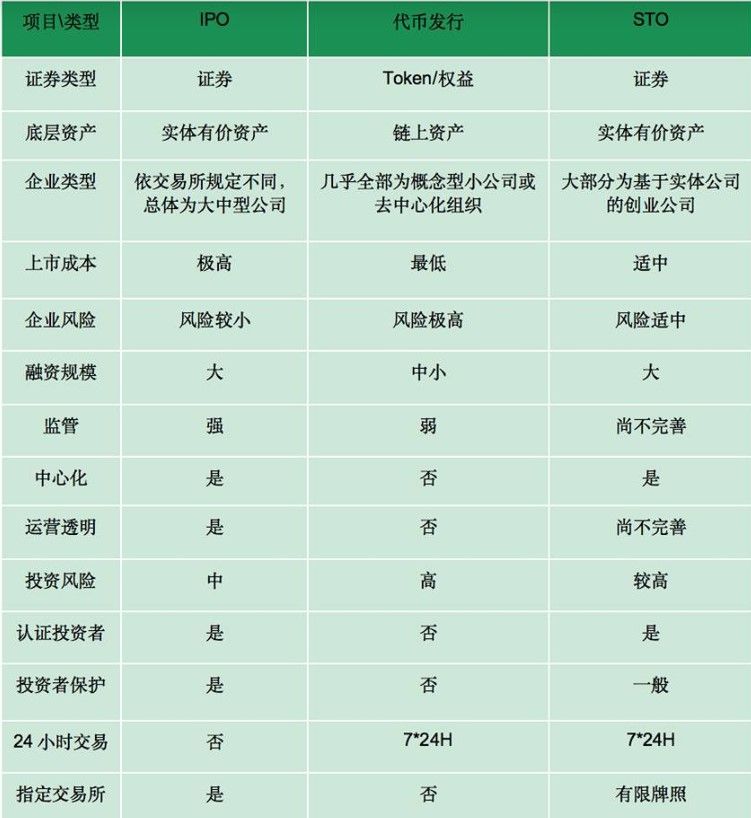

Figure 3. Comparison of several financing methods (Source: Online, Digit Insight)

STO stimulates the development of the certificate

Based on the distributed accounting mechanism adopted by the bottom of the blockchain, STO can provide a more concise investment process and reduce transaction costs. It conforms to the current regulatory mechanism and will not encounter the negative impact of strong supervision. STO is generated in the blockchain field, but its influence is by no means limited to the blockchain field. As STO becomes a new investment tool, there will be some important changes in the market.

(1) Advantages of the STO financing model:

● For the first time for global investors, you can trade 7*24 hours, and the market depth is wider;

● Programmable, fast settlement, and the supervision cost of the regulatory department is relatively lower;

● Asset interoperability, there is more room for financial innovation imagination;

● Fragmented transactions support larger transactions;

● Compliance with regulations, lower cost than operating IPO;

● Investment threshold is lower than traditional

(2) STO has greatly expanded the way of investment in the pass:

STO plus stable currency will turn Token into a more mainstream investment. Because there are stable coins, the price of Token will not change with the huge fluctuations of Ethereum or Bitcoin, and mainstream investors and corporate investors will come in. With STO, the investment pool of mainstream investment and investment institutions has more legitimate digital asset investment varieties and increased investment exit channels.

At present, the world's 70 trillion US dollars of stock assets, 100 trillion US dollars of bond assets, 230 trillion US dollars of real estate assets, in line with the Securities Law and regulatory agencies required securities pass has great potential for development, if there are 10 The transfer of % of financial assets to STO is a big market.

First, for investors, STO can reduce fraudulent projects because of supervision. In addition, investors can own part of the company's ownership (such as shares or other forms of ownership), and can also access more asset classes (such as art or real estate), and investment liquidity is better (more liquidity).

Secondly, for the project side, STO is simpler, faster and cheaper than traditional financing schemes such as IPOs; it can reach global investors if it meets local legal requirements.

Once again, the emergence of STO will accelerate the flow of global assets. Since financial markets belong to areas of strong supervision by various countries, financial sovereignty largely determines political sovereignty. Therefore, countries have strictly established barriers to entry for foreign investors. However, through the securities pass on the blockchain, STO is able to conduct more convenient global investment and financing, and it is convenient for qualified investors from all over the world to invest in securities certificates in other regions.

4

Summary: The Challenge and Future of STO

Regulatory rules still need to be improved:

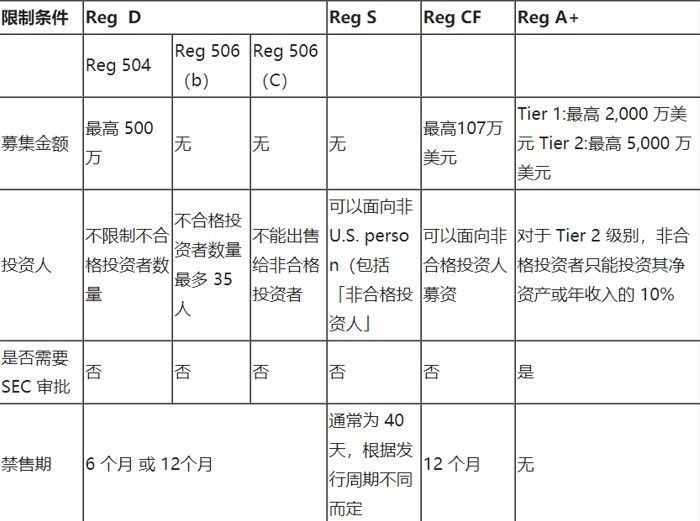

(1) STO follows a private placement bill that requires fundraising within the scope of these regulations, and these regulations limit the scope of investors and the holding time of equity. According to Reg D, investors can transfer this equity to other qualified investors after obtaining the equity for one year, which has great restrictions on holding time and circulation objects.

(2) The infrastructure of STO is not perfect. The expected STO should be able to carry, confirm and trade legally and compliantly across jurisdictions. However, the existing infrastructure does not support the complete process of completing STO. For example, STO exchanges are operated by licenses, making the choice of space small; and global regulatory policies are not compatible.

(3) The STO method is used for fund raising, and the cost is not low. STO compliance will involve an increase in costs, such as attorney fees, audit fees, fees for issuers and advisory bodies, and expenses incurred for disclosure obligations after completion of the issue. The current cost of fundraising using the STO approach is typically between $1 million and $2 million.

Chinese government attitude

Regulatory risk is the biggest uncertainty of STO, especially in countries such as China, which is very cautious and has a strong regulatory tradition. On December 4, 2018, the Beijing Internet Finance Industry Association issued the "Risk Tips on Preventing the Implementation of Criminal Activities in the Name of STO". According to the requirements of the documents, STO is essentially suspected of issuing tokens and is an illegal financial activity.

A few days ago, the director of the Beijing Municipal Bureau of Local Financial Supervision said in the speech of the "2018 Global Wealth Management Forum" "When will the relevant departments approve you to do STO, you will do it again." Shortly after the announcement of the Beijing Municipal Financial Bureau, Zhu Youping, deputy director of the China Information Network Management Center, also made relevant statements. In addition to endorsing the speech of the Beijing Financial Bureau, he also emphasized that “STO training and academics” Activities are not illegal, which means that exploration and research are necessary before the STO really falls.

5

End: Current status of US STO policy

Like all new things, fragile vitality always undergoes painful tempering.

Although STO still has some problems and dilemmas in its practical application, such as the lack of a stronger trading environment and supporting infrastructure, STO's tremendous changes in accelerating global asset liquidity are worthy of recognition. It may be the future financial investment. A trend, we expect it to open the door to the digital currency asset management industry.

US version STO

The world is currently preparing for STO, and the United States is the forerunner. The flexible, adaptable framework of the US legal, regulatory, and institutional systems makes STO, an emerging financing method, more likely to sprout and grow in the United States. Small-scale fund-raising exemptions such as Reg D and Reg S opened the door to fundraising for STO, and ATS licenses paved the way for secondary market transactions. These have enabled STO to be strongly supported in the primary and secondary markets.

According to the US Federal Securities Act, there are only two ways to comply with the issuance or sale of any securities:

1. Registering securities at the SEC;

2, to meet the relevant regulations to obtain exemptions; the relevant regulations of the exemption currently have four relevant regulations: Reg D, Reg S, Reg CF, Reg A+.

If you do not apply for an exemption, the company will meet the criteria for securities registration. Although the Reg A+ exemption has higher requirements for corporate qualifications, information disclosure and filing costs than other exemptions, it allows companies to raise up to $50 million in financing through publicity, which is equivalent to a small IPO. .

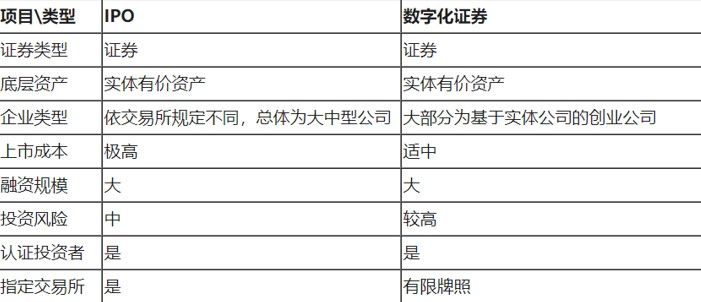

Figure 4: Comparison of STO and IPO (Source: Online, Digit Insight)

Figure 5: Comparison of different regulations (Source: Online, Digit Insight)

[Disclaimer]

The digital currency market is highly risky, so readers should be vigilant and must comply with laws and regulations. The information in this report is derived from publicly available information, and this report makes no guarantees as to the accuracy or completeness of such information. The content and opinions in the report are for reference only and do not constitute investment advice for anyone.

The information, opinions and speculations contained in this report only reflect the judgment of the researchers at the time of writing the report. In the future, based on industry changes and the updating of data information, there is a possibility of updating opinions and judgments. Please pay attention to the readers.

Welcome attention: Digit Insight, we will continue to export high-quality industry research reports.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Blockchain Project Governance, Rules and Influence

- "The Eye of the Government" Chainalysis: Most Bitcoin mixed currency transactions are legal transactions

- The so-called "Defi", how much do you go to the center?

- Programmer Xiao Ge told: What is the experience of all the wages only bitcoin?

- Babbitt column | Shenzhen digital currency mobile payment pilot zone prequel

- Ethereum was “occupied” by USDT, with network utilization of 90%

- BTC 徘徊 "万" word area long and short into the tug of war