Full Name Exploring the Path of Future On-chain Identity Layer Construction

Exploring On-chain Identity Layer Construction

Author: Spike @ Contributor of PermaDAO

Reviewed by: Lemon @ Contributor of PermaDAO

TL;DR (Summary)

- The operation process of the on-chain identity layer consists of four stages: offline identity on-chain, on-chain identity components, on-chain reputation system, and on-chain generic identity;

- In the current practice of identity construction, it can be divided into the following product forms: wallets, social media, domain names, and abstract accounts;

- The identity layer can be applied to various offline scenarios: UBI, RWA, government identity systems, and encrypted taxation.

When Musk started the acquisition of Twitter, most Web3 users were hoping that he could “chainify” Twitter. However, from the current situation, Twitter is more like a super app similar to WeChat, where you can complete all your daily activities on WeChat.

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

On the one hand, the X (Twitter) platform is applying for qualifications related to cryptocurrencies, but on the other hand, Musk is developing audio and video calling functions, and explicitly stating that X platform will not launch its own coin. In the recent preheating of his autobiography, Musk mentioned the close relationship between him and Dogecoin. However, as a global mainstream social platform, it is difficult to imagine that Twitter will immediately become a We3 social platform.

We hope Musk will transform Twitter with decentralized means, but it seems that cryptocurrencies are being transformed into part of a centralized platform.

The good news is that another mainstream social product, Telegram, is steadily advancing its decentralized path. Recently, the popular TG Bots have been frequently mentioned. From a technical perspective, this type of bot is not “advanced,” but it allows ordinary people, especially those who have never been exposed to concepts such as DeFi and wallets, to interact with on-chain protocols.

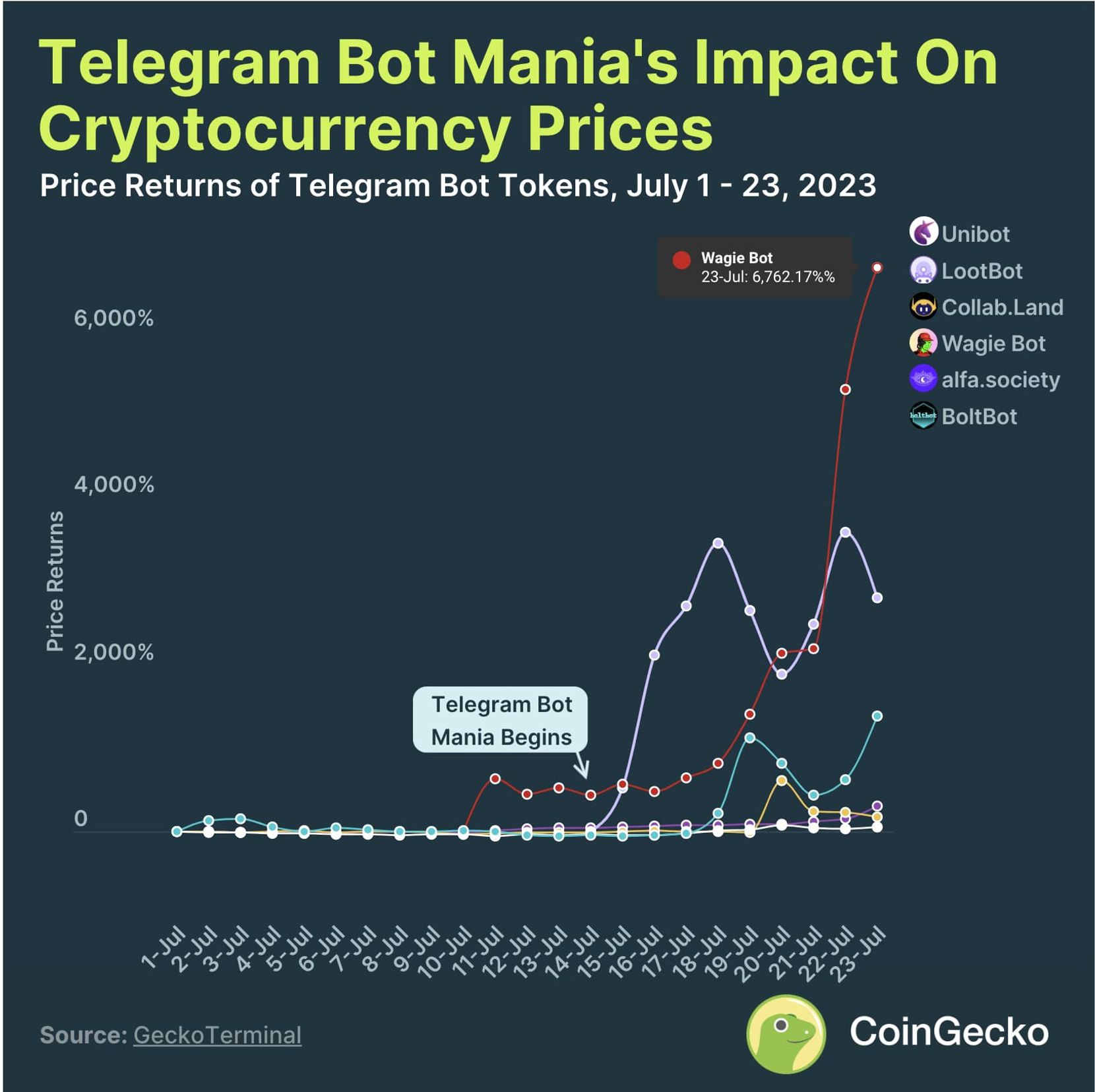

In July, represented by Unibot, a round of mobilization of trading bots was launched. Overall, the most important functions of the current bots can be summarized as follows:

- Swap

- MEV protection

- Copy trading strategies

- Aggregated trading

Their most important significance lies in completing the mobile evolution of DeFi. Before the emergence of bots, most DeFi protocols were extremely unfriendly to mobile devices and only supported web-based interactions.

Image description: TG Bots, image source: CoinGecko

From this perspective, the next step for DeFi products is to adapt to traditional users. Currently, the number of DeFi users, taking the 1inch mobile app as an example, is approximately in the millions. Even if it is multiplied by ten, it is still only in the tens of millions.

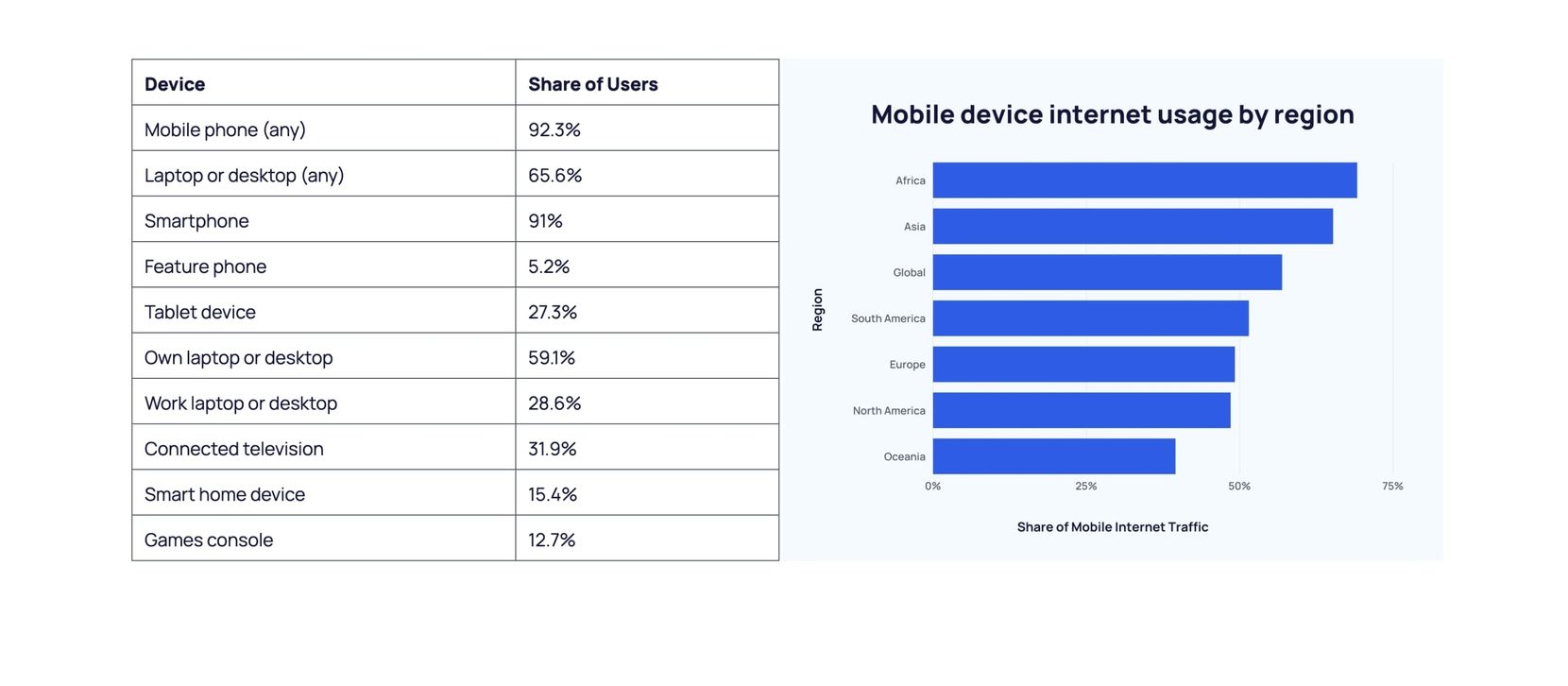

Currently, mobile devices account for the vast majority of Internet access devices. In many third-world countries, people may not have computers, but they generally have smartphones. The penetration rate of smartphones has reached 91%. This trend is similar to when China skipped the era of credit cards and directly entered the era of mobile payments. It is very likely that third-world countries will also skip the banking system and directly enter the era of encrypted payments.

Web3 social has the significance of not only revolutionizing the current social system, but more importantly, it will package Web3-related practices into more user-friendly products to compete with existing Web2 social products, fundamentally solving the dual dilemma of Web2 platforms infringing privacy and Web3 lacking users.

Therefore, after the hype of Friend Tech, we need to reconsider the construction of the on-chain identity layer. This is not entirely equivalent to the so-called Web3 social concept. The difference between the two lies in the fact that social is only an extension of the identity layer, and identity is the source of all self-subjective cognition and connection relationships.

Another point is the difference with Decentralized Identity (DID). Essentially, from an architectural perspective, the on-chain identity layer believes that the current blockchain has not considered embedding the identity system into the entire blockchain too much, but only has this concept and has dispersed it into various types of products. This will be explained in detail below.

In a broader sense, social needs to build an indispensable identity system in order to withstand repeated shocks, accumulate a sufficient user base, and complete the positive cycle of user-product, breaking out of the negative feedback system of mining-making-money-losing.

The Quartet of On-Chain Identity: Where Does It Come From

For a successful technological paradigm, the ability to deliver products must take priority over marketing, because most users cannot be continuously fooled. Products that only have economic incentives will also be unsustainable as personnel continue to enter. However, if users have actual needs for the product, the flywheel effect of the number of users will start to roll.

A typical example is the previously popular Worldcoin, which aims to put people’s real-world identities on the chain through “proof of personhood”, thus building an independent user group separate from existing Web2 giants and local governments. There are three points worth noting:

- Proof of personhood requires real-person verification, and the core is recognizing people without authentication, because many governments in the wide third world cannot build an official identity system for their citizens;

- Web2 social giants or financial institutions have a psychological exclusion towards third world people. Under marginal utility, a large number of non-consumer populations cannot provide them with profits, and the profit-seeking nature of companies will cause Web2 products to ignore their needs, thereby causing them to be further away from the global economic cycle;

- When personal identity is put on the chain, the flow of information transcends national borders, which fundamentally challenges the political system structure based on nation-states. This is the essential reason why Worldcoin frequently faces regulatory scrutiny.

However, it is worth noting that not all political entities or economic entities reject this. For example, some island countries are open to this. Palau’s RNS.ID is the best example, which is issued by the national entity and can be practically used.

However, whether it is the company (Worldcoin) or the national entity (Palau), the commonality between the two is that the identity layer cannot exist independently of the off-chain entities or processes and must be tied to Web2. The identity, whether off-chain or on-chain, serves as an entry point or link.

In summary, there are two foundations for the argument on the on-chain identity layer. First, the current on-chain identity has reached a bottom line that must be addressed, otherwise there will be a lack of feedback from real users, and any product will eventually become a counterfeit. Second, the combination with off-chain entities is not a “betrayal” of decentralization spirit. Ethereum’s PoS mechanism and Layer 2 practices, as well as RWA products or “intent” concepts, all use third-party or off-chain computing to improve on-chain efficiency.

In the Arweave ecosystem, the general payment protocol everLianGuaiy and DEX Permaswap have been in practice for several years, using the SCP (storage-based consensus paradigm) theory of “off-chain computing and off-chain storage,” which has unlimited storage capacity. Perhaps decentralization should be understood as a decentralized collaborative model that relies not only on the blockchain.

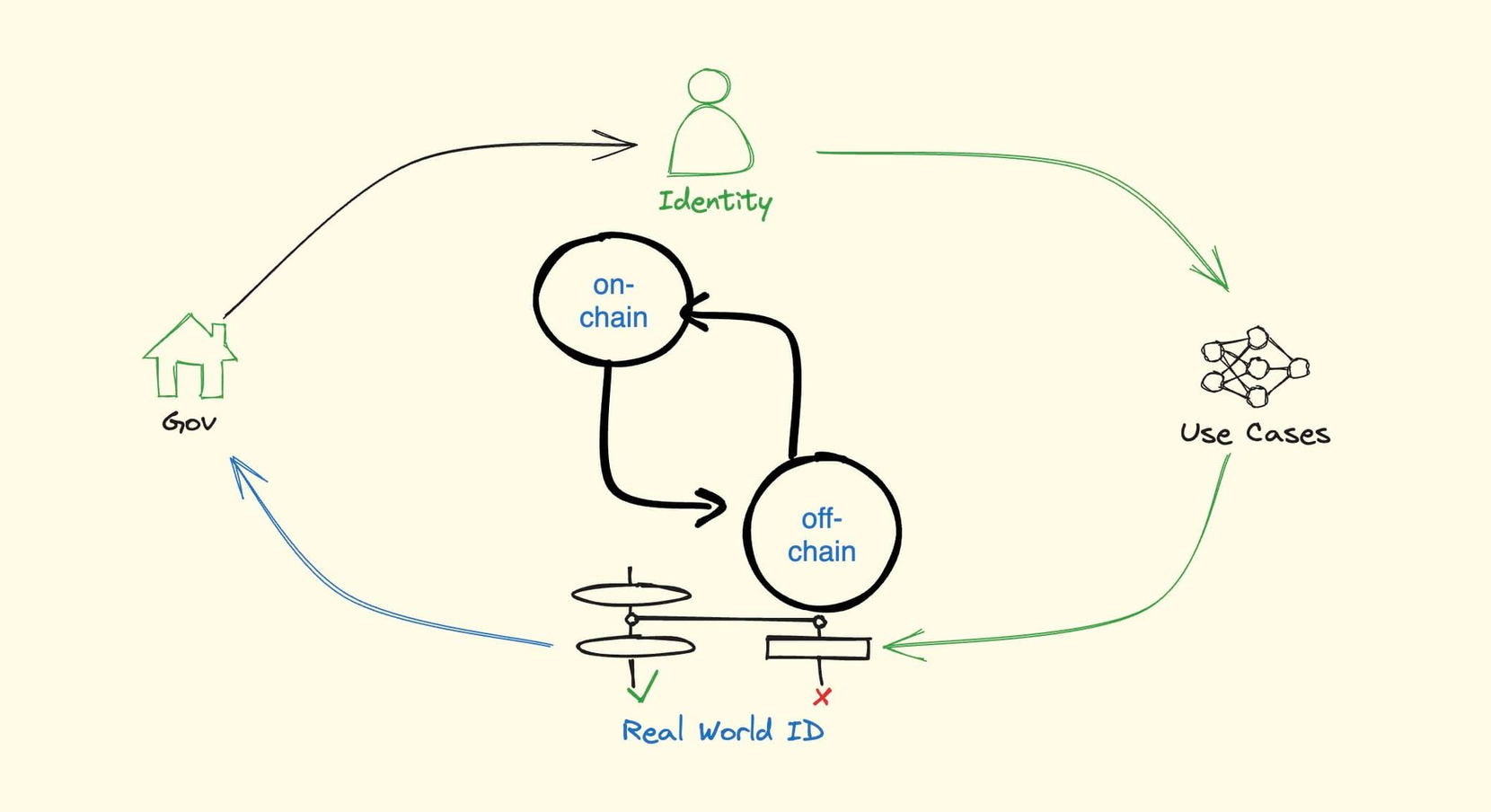

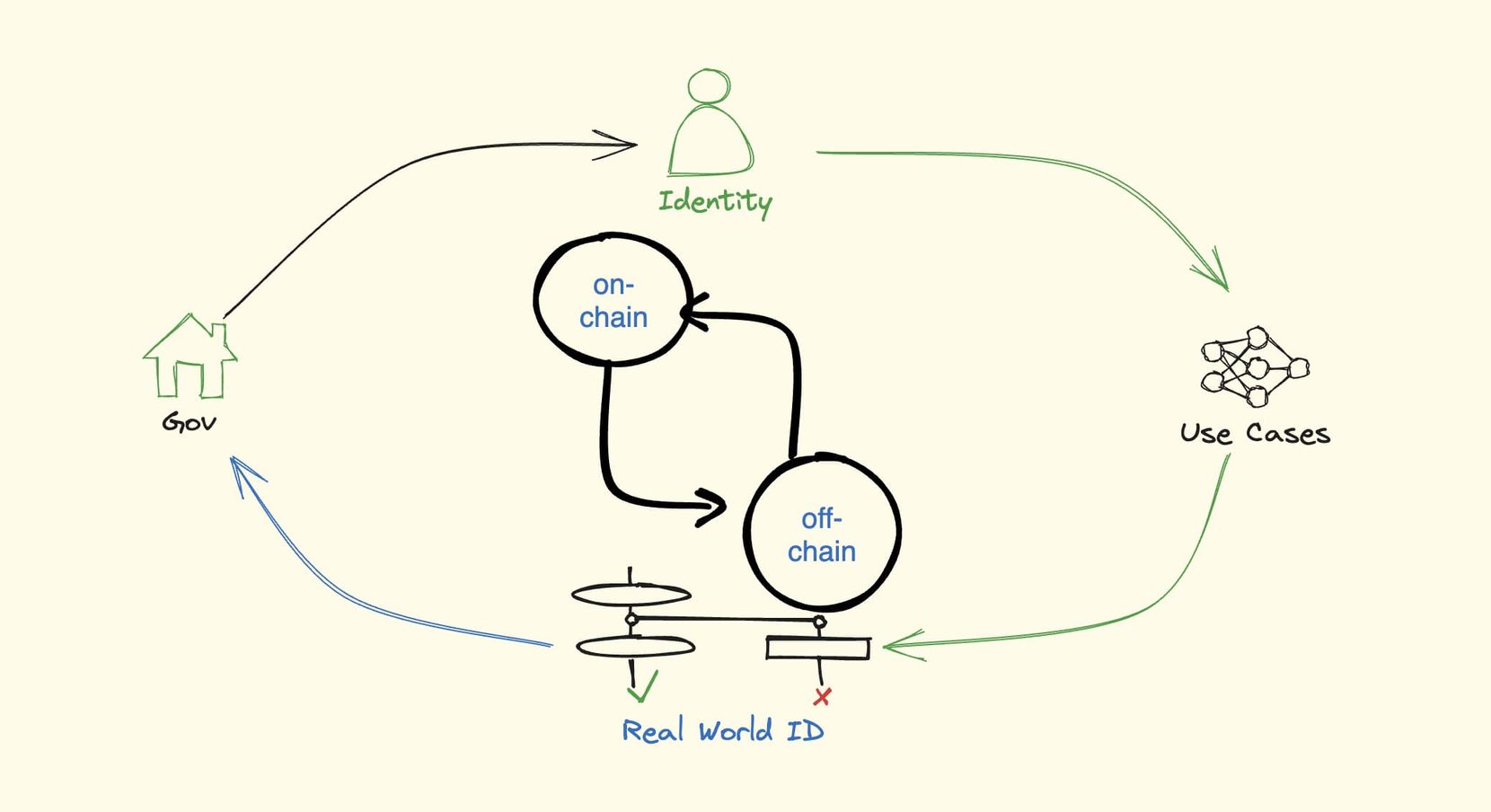

With this in mind, we can briefly summarize the operating mode of the on-chain identity layer:

- Offline identity on-chain: Governments, enterprises, and NGOs (DAOs) are three types of entities that can actually handle identity information. In large countries, this responsibility is borne by the government, while in areas with poor information infrastructure or low administrative capacity, it can be undertaken by enterprises or non-governmental organizations.

- On-chain identity components: Such as using DeFi, NFT products, or even fiat currency deposits and withdrawals, to integrate more deeply with existing financial infrastructure.

- On-chain reputation system: Here, it is necessary to distinguish from the existing concept. In the past, the on-chain reputation system tracked and rated based on on-chain addresses, but the reputation system of the on-chain identity layer can be directly bound to real-person identities, with legal effectiveness, and privacy issues can be addressed through privacy computing methods such as ZK.

- Generalization of on-chain identity: Similar to the Ant Credit Score mechanism, when people have enough behavioral information on the blockchain, it can be used as an off-chain identity proof and can be further transmitted to the blockchain to form a closed loop.

Image Description: Operation process of the identity layer. Image source: Arweave SCP Ventures

The Web3 Social Curse: The Quixotic History of Failure

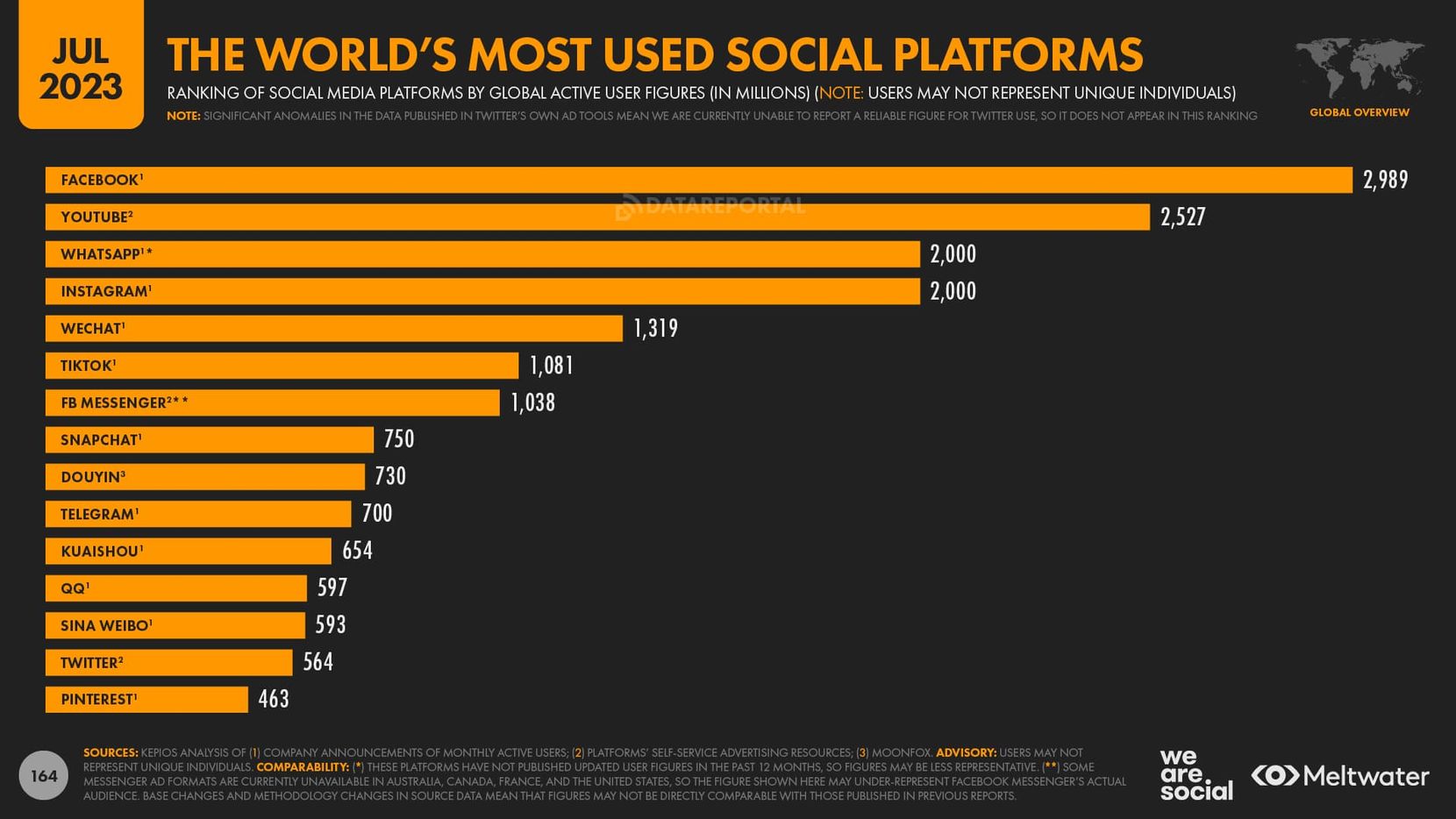

Before considering who can sound the first horn of mass adoption, whether it’s TG Bot or Musk’s X, it is necessary to acknowledge the current situation. The current Web3 social products are extremely niche globally. In the statistics for 2023, not only did web3 social products not enter the top 15 in terms of user numbers, even the combined user numbers of TG and X platforms, which are relatively friendly to cryptocurrencies (1.2 billion), are still smaller than the volume of the fifth-ranked WeChat.

Image description: Number of users of mainstream social applications Image source: https://datareportal.com/social-media-users

Furthermore, there are currently many practitioners who start from existing social platforms and guide mainstream users to enter the world of blockchain. However, there are very few who can achieve long-term user retention.

Take Friend Tech as an example. Similar to Damus, they both use X platform as a source of traffic and attract users to their own platform through some form of economic incentives, hoping to retain users through DeFi and other products.

The biggest problem with these types of products is that they are an extension of existing products, similar to mini-programs on WeChat or Layer 2 on Ethereum. They do not cause effective impact on existing platforms, but rather enhance the user experience of the original products.

The advantage is that the users of these products have already been screened by the original platforms and have even undergone KYC and other authentication methods, to some extent avoiding the problem of user identity authenticity. It can be understood as solving the problem of offline identity on-chain. However, their weak user experience can only attract native Web3 users who are interested in “earning rewards”, and cannot reach the attention and retention of mainstream users.

From Clubhouse, to Damus, and to the current round of Friend Tech, we can see that products that attract Web3 users through X (Twitter) cannot truly grow and become strong. After a brief period of popularity, they fall into permanent silence, or even have their product features absorbed by X itself.

For example, Twitter SLianGuaice. X supports displaying cryptocurrency donation addresses and X shares revenue with creators. This is the transformation advantage of the first-mover platform. Users have already developed habits and dependencies on existing platforms, while new platforms only have certain unique features, and migration costs are always a problem.

In this repeated cycle of battles, X’s Web3 characteristics become more and more obvious, but fundamentally, it is still a traditional corporate model that considers advertising revenue, and will not distribute profits to users through tokens.

In this regard, are Web3 social products still powerless at the current stage? At least TG Bot provides another possibility.

Using TG’s robot development components has already proven to be effective. Specifically, a Bot is an embedded automation tool in Telegram. For example, the official built-in Wallet is a Bot. Users do not need complex registration, KYC, and other processes, and it supports one-click deposits and withdrawals and simple trading functions. TG Bot can also execute complex commands, such as accessing Uniswap and other DEX, to improve transaction speed and interact on the blockchain.

Furthermore, Discord has become a standard for Web3 projects’ communities. However, Discord itself became popular as a management tool for gaming communities. One can imagine a scenario where Discord discusses currencies and TG Bot executes transactions, thereby achieving a seamless transaction experience across the entire process.

Furthermore, providing cryptocurrency functionality to Web2 users and connecting the two is the community, with Bot being the form that simplifies the experience.

Credibility comes from behavior, identity system

The current on-chain identity layer is not classified uniformly, which means there is no module called the identity system. It could be a wallet, login manager, or social media account. In other words, it is fragmented and lacks a traditional and unified classification system such as ID cards or driver’s licenses.

As mentioned earlier, we believe that the problem with on-chain credibility systems is not the wrong approach, but the inability to link addresses to real people. However, the recent situation has changed. For example, the Sell feature built into Metamask requires users to provide banking information during transactions. Combined with the module for fiat deposits, it establishes a complete identity circulation system of depositing, trading, and withdrawing.

Regulation may not need to involve the on-chain process and only needs to focus on deposits and withdrawals. Decentralization belongs to the blockchain, while centralization belongs to the government. They complement each other and do not interfere with each other.

We can briefly discuss the various forms of on-chain identity systems and summarize which patterns are more likely to succeed based on practice:

- Wallets

- Social media

- Domain names

- Abstract accounts

Using Metamask as an example again, wallets are one of the most successful products in native encryption, becoming the most important traffic carrier after exchanges. From a purist perspective, wallets replace addresses and have a slight sense of centralization. However, interacting directly with the public chain every time an address is used requires a high level of difficulty that most non-technical users cannot participate in. Wallets are a natural choice for products.

In the wallet market, WalletConnect is a more fundamental meta-wallet protocol. It does not provide wallet login or address management services itself but facilitates the use of its services by any wallet. From the perspective of project developers, supporting Metamask and WalletConnect can meet the needs of most users. From the user’s perspective, wallet protocols give them the freedom to configure their wallets.

However, it is important to note that wallets still generally have management or development teams. For example, Metamask can block IP addresses. A completely free market still does not exist. But overall, wallets are an effective starting point for organizing on-chain address behavior data.

However, from the perspective of user habits, wallets are more similar to “Alipay.” People only use them when they have financial needs. Such products naturally have lower user stickiness compared to social media. The biggest problem with current Web3 social media is the lack of time-consuming applications like TikTok or Xiaohongshu (Little Red Book).

Specifically, social media can be divided into four categories:

- Used by the Web3 community, such as X platform (a mix of Web2 and Web3 users), Lens, and other native Web3 social protocols;

- Exploiting benefits from Web2, as discussed earlier with Damus and Friend Tech;

- Small to almost non-existent market share, the most typical being the Nostr protocol and products. In reality, it has a small but stable user base. However, the problem is similar to Web3 social products, with a very small market share;

- Always looking towards the future, such as the Twitter founder’s BlueSky project.

Here’s a brief supplement on the current situation of social protocols like Lens. They use Arweave and Bundlr as data solutions, with transaction fees of less than 0.0003 USD per transaction. They have already completed nearly 700,000 transactions, proving the usability of Web3 social products.

However, the issue is the lack of sufficient usability. Most of them are decentralized versions of existing web products. For example, LensFrens is basically a decentralized version of Twitter. But the question of why one would use Lens instead of Twitter remains unresolved.

On the other hand, certain products, such as domain names, were initially developed in the Web3 field to simplify the difficulty of remembering addresses. But over time, people have discovered that they are more effective as identity identifiers. Binding them to on-chain addresses not only allows others to identify them, but also satisfies the emotional needs of self-fulfillment.

ENS and other products are undoubtedly some of the most successful forms of Web3 products. They, along with DEX and wallets, have become the standard trio for any public blockchain. However, their problems are also very prominent. The use cases for domain names are limited to Web3, and in traditional products like X platform, they can only be displayed as text and have no other functions besides presentation.

Lastly, there are abstract accounts. Essentially, abstract accounts are smart contract versions of the existing account system. But when combined with traditional login systems such as email and phone numbers, it can be seen that their effect is very similar to that of TG Bot. They solve the problem of how traditional users “get online” without the need to remember complex concepts such as private keys and addresses. They only need to register and log in with a single click, just like with traditional web products.

Take EverID developed by everVision as an example. It supports the FIDO standard, allowing users to use features like facial recognition and iCloud Keychain to eliminate the need for password management. It also supports multiple hardware devices to split private keys and maintain security.

Vitalik Buterin, co-founder of Ethereum, is a fervent advocate of abstract accounts. We expect that more real users will be generated on Ethereum first. For example, directly logging into Ethereum with a phone number may not be an impossible task in the future.

Entering Thousands of Households, Identity Goes Off-Chain

The identity layer is not limited to on-chain usage, which seems to be a consensus in the industry. However, there is no industry consensus on how to introduce off-chain elements. Here, we are only imagining possible use cases to spark discussion.

In terms of the current distribution of global internet users, smartphones are the absolute dominators. They have almost achieved coverage across all demographics and scenarios. More importantly, in underdeveloped regions such as Asia, Africa, and Latin America, due to economic limitations, smartphones are almost the only devices through which they can access the internet.

For example, in underdeveloped regions, the operation of Universal Basic Income (UBI) relies on assistance from developed economies. However, accurately identifying workloads and ensuring traceability of fund flows has always been a problem. On-chain identity layers may be able to solve such issues. For instance, after Worldcoin verification, the account is bound to a real person’s address, and sampling comparisons can be conducted.

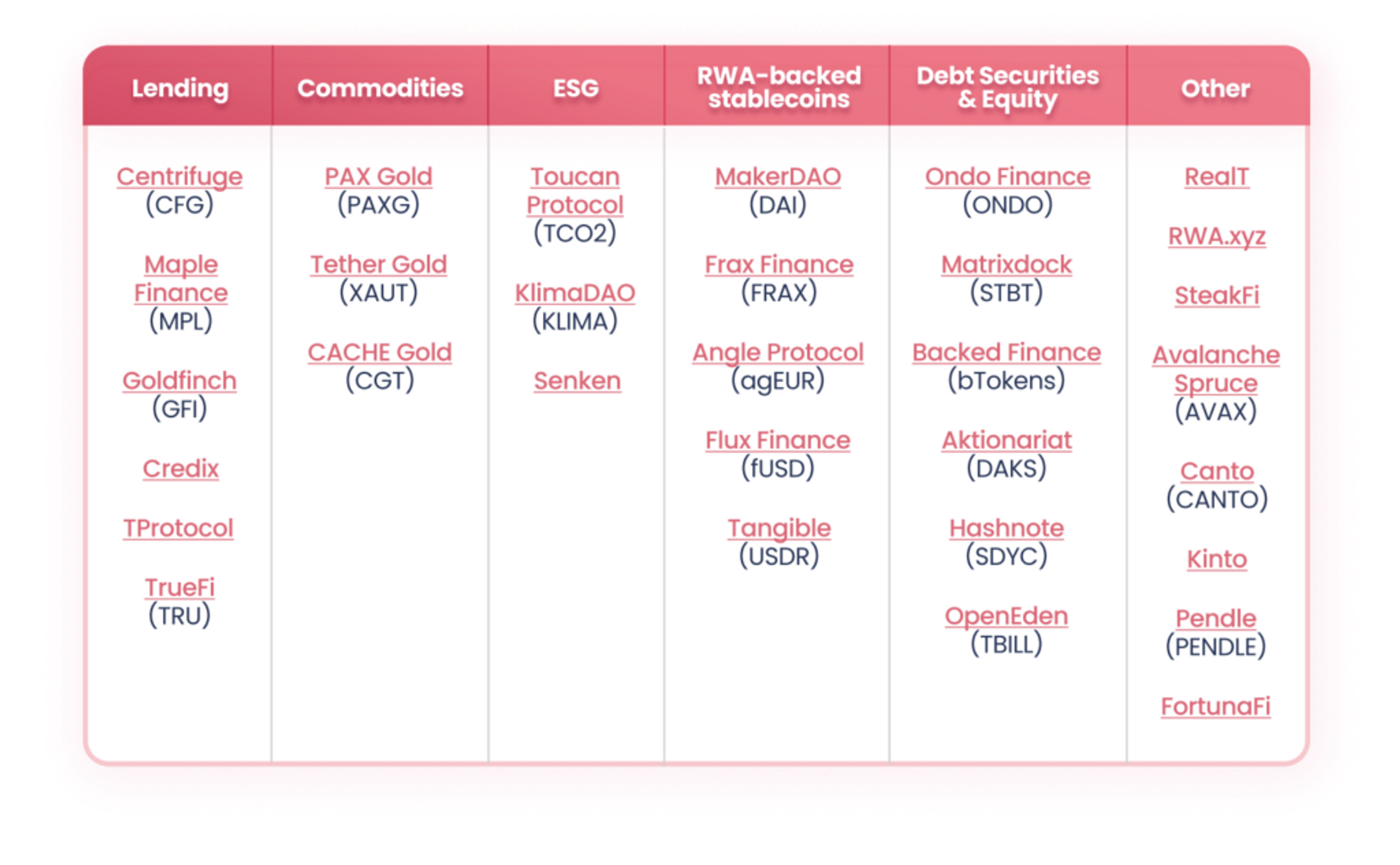

Secondly, there is also potential for collaboration between identity layers and RWAs. In the current RWA practice, it is necessary to perform KYC on users to ensure the authenticity of participation. Otherwise, there is a high risk of legal disputes when it comes to products such as bonds and real estate, which in turn affects operational efficiency.

According to RedStone’s RWA report, the current RWA market is dominated by the US dollar, gold, and bonds, while the market potential for real estate and knowledge products is yet to be explored. The key lies in property rights division and pricing mechanisms. Starting from the on-chain identity layer, it is possible to promote the on-chain claiming of RWA assets and monetize on-chain profits.

Image description: RWA project classification image source: Redstone blog

In addition, if the data accumulated by the on-chain identity layer is sufficient, it can even be integrated into existing government identity systems or be part of the data source. In the real world, assets certification provided by financial institutions such as visas and banks is an important source of personal financial proof, and the combination of the on-chain identity layer and on-chain financial data also has such potential.

Although there is still a long way to go for the practicality of the on-chain identity layer, in the current practice, people generally assume that off-chain data is more authoritative, while on-chain behavior lacks authority. However, with the recommendation of related practices in encrypted taxation, the official identity system will sooner or later incorporate the on-chain identity into the government system.

In the current encrypted taxation system, cryptocurrencies are mostly considered as taxable income, and most of them can only be processed through centralized exchanges because wallets and other platforms do not support user identity verification. However, if the construction of the identity layer is successful, DEX or wallets can also handle declaration and taxation, which will promote the legitimacy of decentralized systems.

Conclusion

The construction of the on-chain identity layer cannot be completed overnight, but a simple social paradigm is not enough to cover its full significance. At least in the process of expanding cryptocurrency to more users, the identity layer is an indispensable step.

Whether it is Worldcoin’s biometric verification or the practice of Web3 wallets, they have already formed a user base of tens of millions. In the next step, expanding to hundreds of millions or billions of users, abstract accounts have special meaning.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why should MakerDAO choose Cosmos instead of Solana?

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation