Is DAI’s 8% excess risk-free rate a Ponzi scheme?

Is DAI's 8% risk-free rate a Ponzi scheme?Author: Bocai Bocai

Just recently, MakerDAO officially adjusted the deposit interest rate of DAI in its lending protocol SLianGuairk Protocol to 8%. This is the “risk-free interest rate” of stablecoin that is higher than the current US bond yield. It makes people wonder whether there is a Ponzi scheme behind this high return.

Where does this 8% “risk-free” return come from? Is there a Ponzi scheme behind it? Is this return sustainable? Why did MakerDAO do this?

RWA has been a hot topic in the industry recently, and MakerDAO has become a highly regarded project in the RWA concept due to the introduction of a large number of RWA assets. This article by Bocai provides a detailed analysis of the logic behind MakerDAO’s introduction of a large number of RWA assets: Buying $1.2 billion of US bonds! What does MakerDAO’s ambitious introduction of RWA real assets mean?

- How will the issuance of the US dollar stablecoin PYUSD by LianGuaiyLianGuail impact the cryptocurrency industry?

- Dialogue with Linea Product Manager How does Linea, backed by ConsenSys, achieve progressive decentralization?

- Interpreting the stablecoin PYUSD issued by LianGuaiyLianGuail which trends are worth paying attention to?

In simple terms, the purpose of introducing RWA assets by MakerDAO is to diversify the assets supported by external credit and utilize the long-term additional income brought by US bonds to stabilize the exchange rate of DAI, increase the flexibility of issuance, and reduce the dependence of DAI on USDC by incorporating US bonds into the balance sheet, thereby reducing single-point risks.

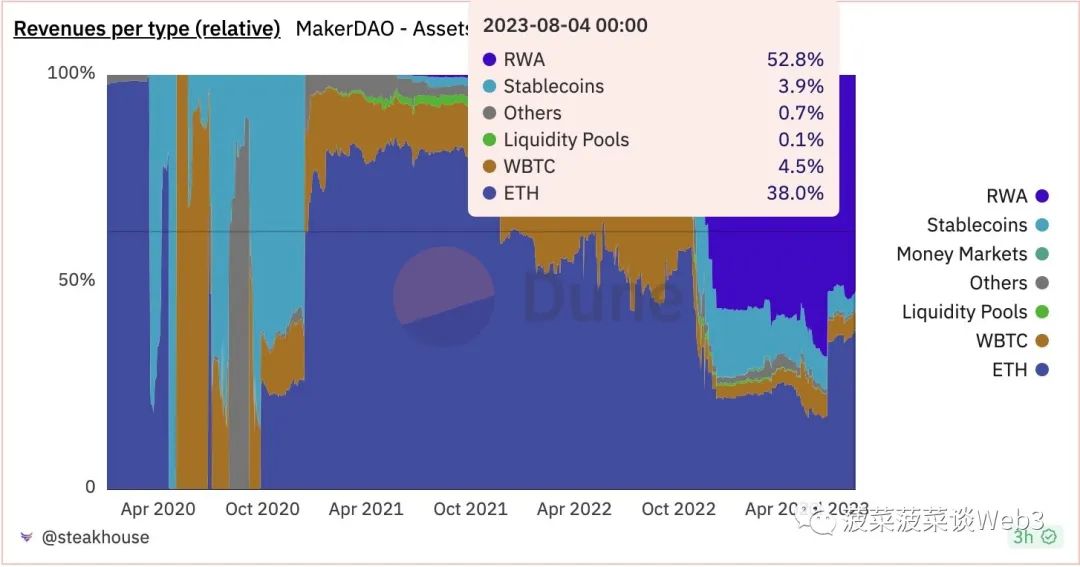

The introduction of a large number of RWA assets has also brought a considerable amount of additional income to MakerDAO. We can see from Dune that the proportion of RWA assets has exceeded half of the MakerDAO protocol’s balance sheet.

Data source: https://dune.com/SebVentures/maker—accounting_1

A large amount of interest-bearing RWA assets has brought more income to MakerDAO. We can see that currently, more than half of MakerDAO’s income comes from interest-bearing assets of RWA, most of which are US bonds with an interest rate of around 5%. However, these profits ultimately go to MakerDAO’s pocket rather than DAI holders.

Data source: https://dune.com/SebVentures/maker—accounting_1

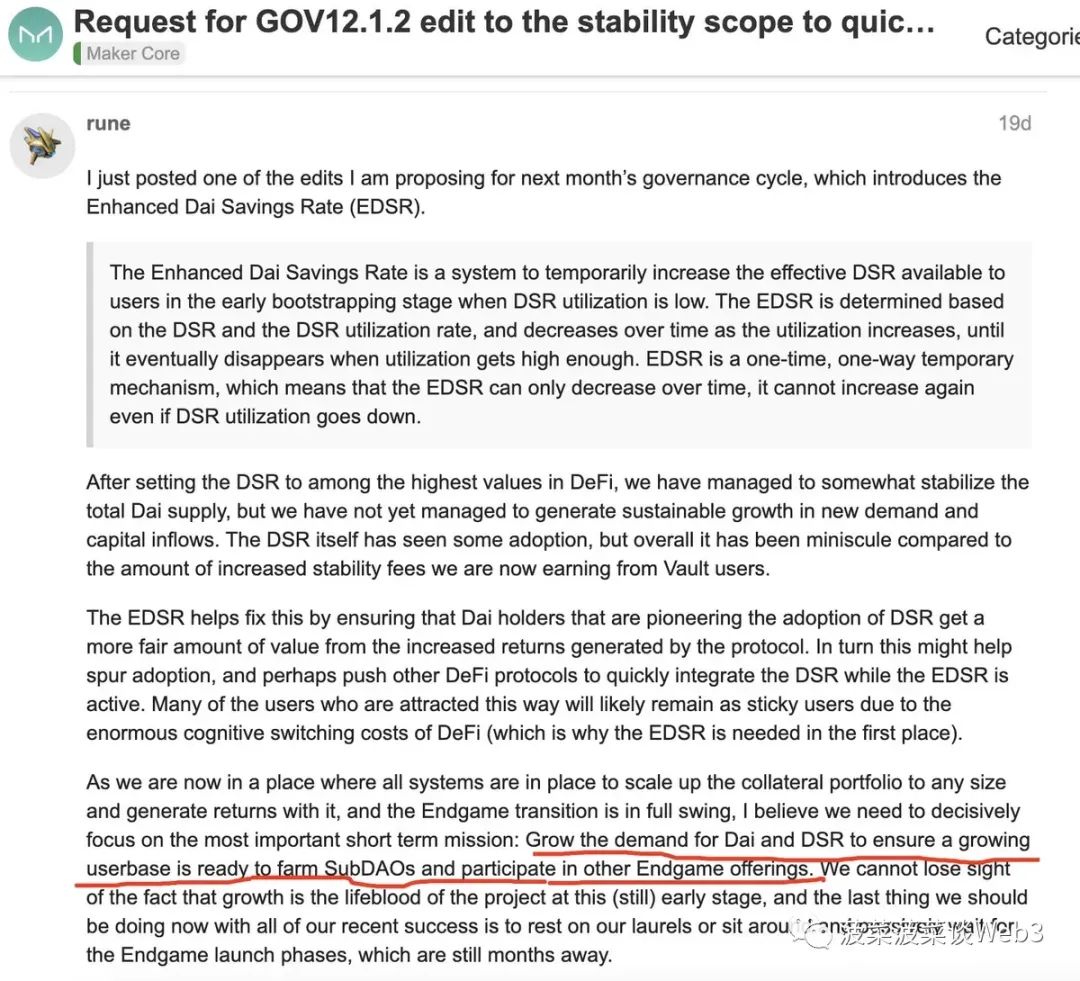

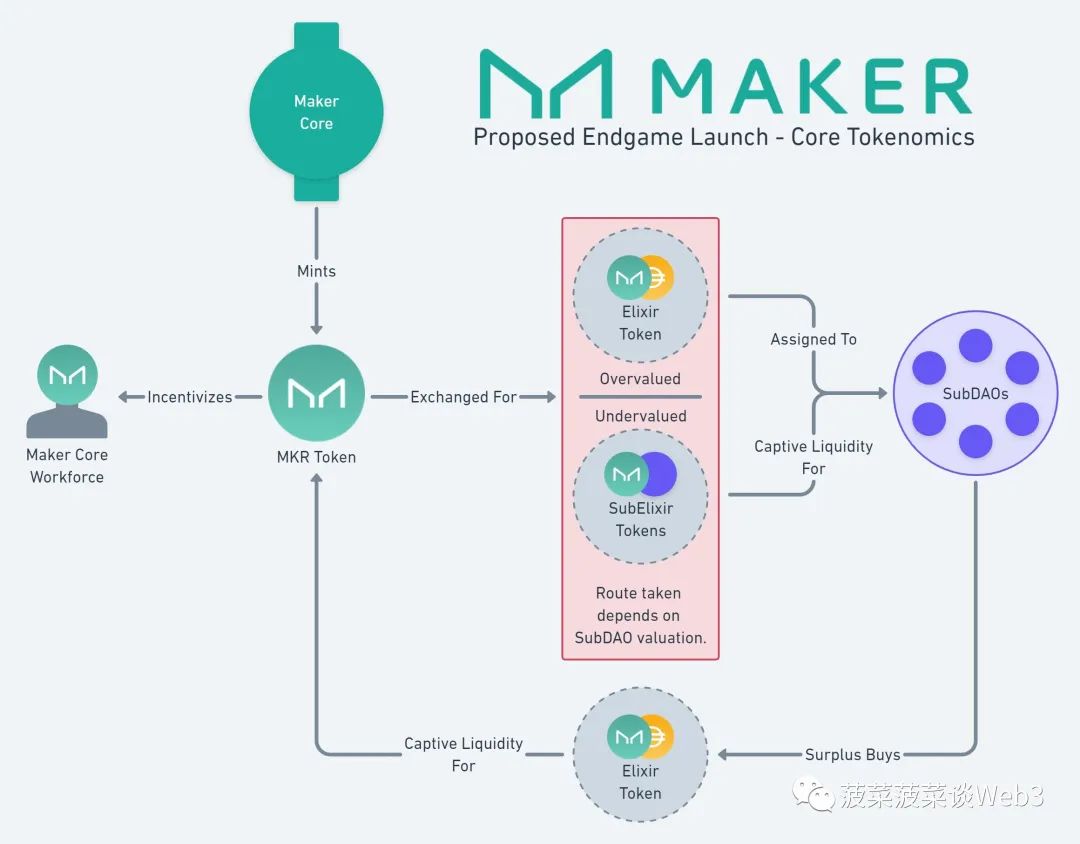

So the source of the 8% return is very clear. The MakerDAO protocol earns a lot of profits from interest-bearing RWA assets and uses these profits to pay 8% interest. But why do they do this? According to MakerDAO founder Rune, the purpose of setting the interest rate to 8% is to increase the demand for DAI and DSR, to ensure a growing user base participating in SubDAO and other parts of the Endgame.

Source: https://forum.makerdao.com/t/request-for-gov12-1-2-edit-to-the-stability-scope-to-quickly-implement-enhanced-dsr/21405/3

In simple terms, it is about increasing the demand for DAI, more DAI = more collateral = more money to purchase RWA interest-bearing assets = more returns. On the other hand, it is also about advancing the progress of the Endgame plan, which is a vision of MakerDAO for achieving complete decentralization.

So, is this 8% yield sustainable?

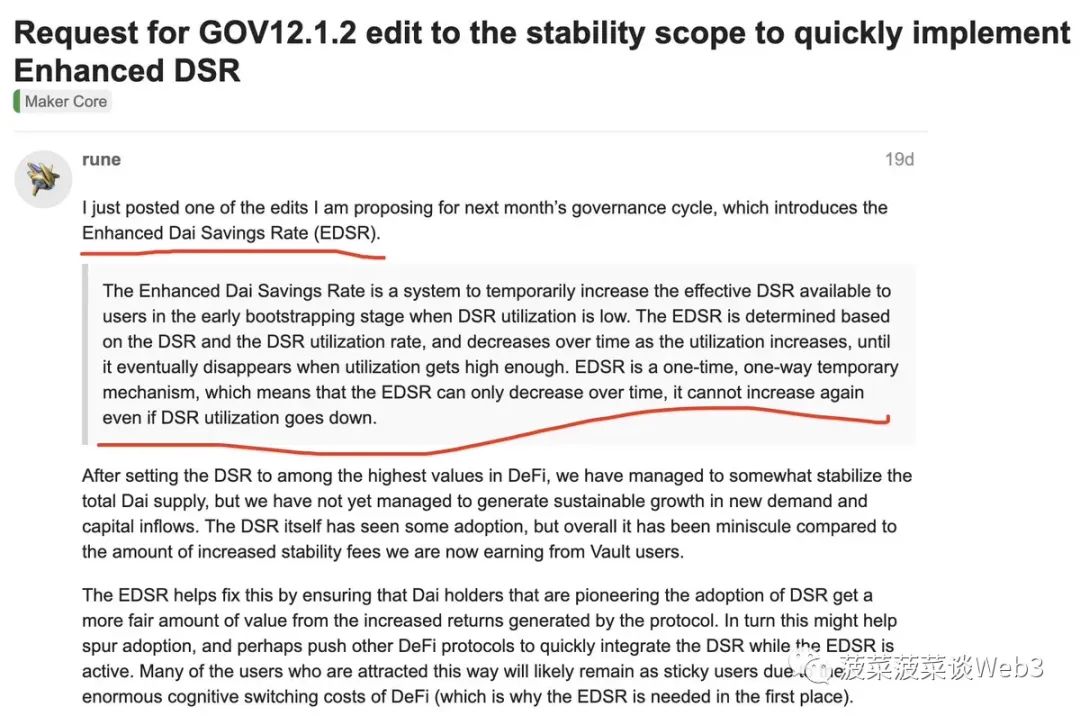

First of all, the answer is no, because this 8% interest rate is actually a one-time “promotion”. We can see from the discussion about increasing the DSR interest rate that Rune mentioned the introduction of a new mechanism: Enhanced Dai Savings Rate (EDSR), which is a temporary mechanism used to temporarily increase the effective DSR available to users during the early stages of low DSR utilization.

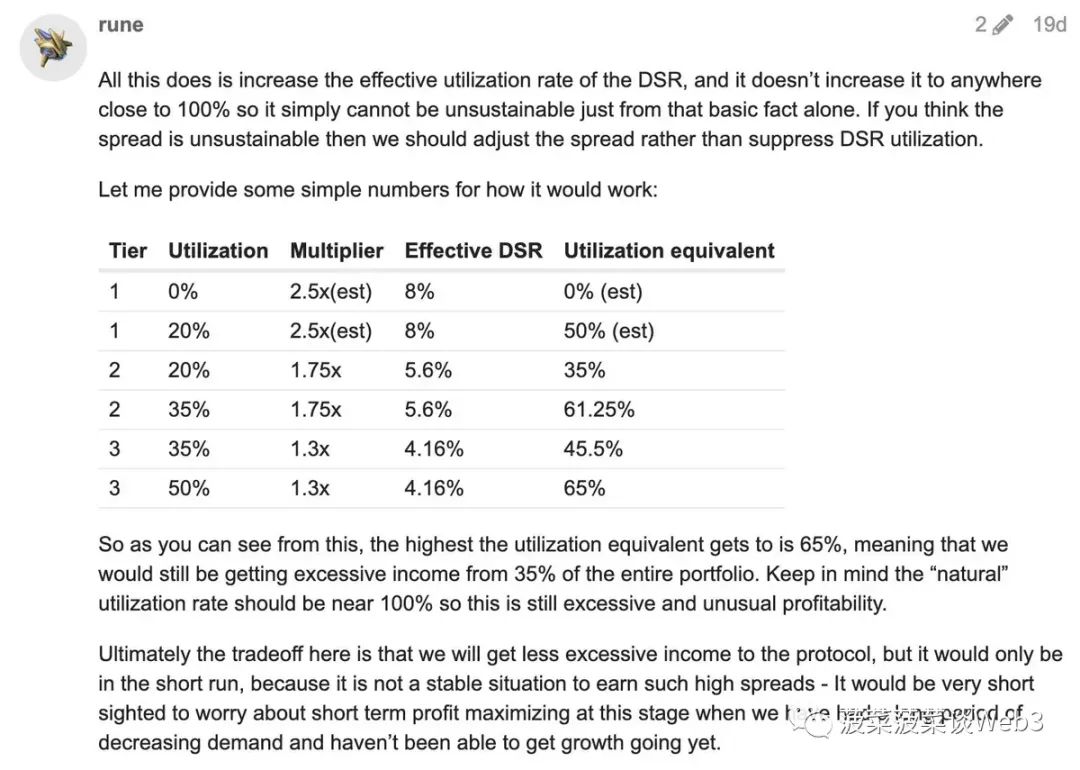

In plain language, it means that there are not many people earning interest in the early DSR, so a one-time high interest rate is introduced to attract users. EDSR is determined based on DSR and DSR utilization rate, and gradually decreases as the utilization rate increases, until it disappears when the utilization rate is high enough. EDSR is a one-time, one-way temporary mechanism, which means that EDSR can only decrease over time and cannot be increased again even if the DSR utilization rate decreases.

In other words, this 8% interest rate is a one-way one-time “promotion”. When the amount of DAI deposited in DSR reaches a certain threshold, this interest rate will decrease one-way and cannot be increased again. According to Rune, when the utilization rate of DSR reaches 50%, this extra interest rate will disappear, and MakerDAO will never lose. In plain language, MakerDAO is distributing some of its protocol revenue to DAI holders.

In summary, MakerDAO spent a lot of money to buy a lot of RWA and made a lot of money, then raised the interest rate to 8% and distributed part of the profit to DAI holders to increase the demand and users of DAI. Once more people start earning interest, this interest rate will decrease until it returns to a normal level.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Impact of Curve Finance Vulnerability on MEV Approximately 6000 ETH Earned

- Milestone Moment, Quick Look at LianGuaiyLianGuail USD Stablecoin

- U merchant selling USDT (Tether) got into trouble and was arrested. How to prepare for a criminal defense?

- The ‘Endgame’ of Protocol Consensus Proof of Governance (PoG)

- Explaining Stargate The first cross-chain bridge launched by LayerZero to solve the trilemma of bridging difficulties.

- The hype of room-temperature superconductor triggers the meme token craze of LK-99 Is it innovation or ‘cutting-edge’?

- How far away is Web3 from 90% of ordinary people?