How will the issuance of the US dollar stablecoin PYUSD by LianGuaiyLianGuail impact the cryptocurrency industry?

What impact will the launch of PYUSD, a US dollar stablecoin by LianGuaiyLianGuail, have on the crypto industry?Author: Samuel McCulloch, Flywheel DeFi; Translator: LianGuaixiaozou

On the morning of August 7, 2023, payment giant LianGuaiyLianGuail announced the launch of its stablecoin LianGuaiyLianGuail USD (PYUSD). The stablecoin will be used to connect LianGuaiyLianGuail’s existing user base of 431 million and ultimately demonstrate their commitment to the blockchain world without reservation.

1. What is PYUSD?

LianGuaiyLianGuail’s PYUSD is the first stablecoin issued by a large “non-crypto” company. This represents a significant shift in corporate attitudes towards stablecoins and a future that is expected to be accepted by policies.

- Dialogue with Linea Product Manager How does Linea, backed by ConsenSys, achieve progressive decentralization?

- Interpreting the stablecoin PYUSD issued by LianGuaiyLianGuail which trends are worth paying attention to?

- Impact of Curve Finance Vulnerability on MEV Approximately 6000 ETH Earned

LianGuaiyLianGuail’s stablecoin PYUSD is fully backed by USD deposits, such as short-term US Treasury bills, and equivalent assets. PYUSD is managed by LianGuaixos Trust Company and can be exchanged for USD at a 1:1 ratio through the LianGuaiyLianGuail or Venmo applications.

According to LianGuaiyLianGuail’s press release:

LianGuaiyLianGuail customers who purchase LianGuaiyLianGuail USD will be able to:

Transfer LianGuaiyLianGuail USD between LianGuaiyLianGuail and compatible external wallets.

Make face-to-face payments using PYUSD.

Use LianGuaiyLianGuail USD to purchase funds by selecting it at checkout.

Exchange between any LianGuaiyLianGuail-supported cryptocurrency and LianGuaiyLianGuail USD.

2. Why will the issuance of PYUSD drive cryptocurrency adoption?

Until now, the only way to obtain payment stablecoins was through crypto companies like Tether, Coinbase, or Gemini. Now, with LianGuaiyLianGuail entering the market, millions of people have access to one of the world’s most widely used payment platforms, serving as a gateway to enter the crypto world.

Austin Campbell, former portfolio manager at LianGuaixos and partner at Zero Knowledge Consulting, said on Leviathan News, “One of the most underdeveloped parts of the crypto ecosystem is real on-ramps and off-ramps. From that perspective, overtaking LianGuaiyLianGuail is challenging. In fact, I think the most significant innovation is adding a native stablecoin on the LianGuaiyLianGuail platform.”

Campbell further stated that he had been preparing for this product for two and a half years before its release. Rumors about the development of LianGuaiyLianGuail’s stablecoin surfaced as early as 2021 when Jose Fernandez da Ponte, VP and GM of Blockchain, Crypto, and Digital Currencies at LianGuaiyLianGuail, told the media, “It’s too early right now.” With more rumors appearing in various media outlets, it further confirmed LianGuaiyLianGuail’s plans. However, in February of this year, the payment company announced that the stablecoin project had been put on hold during LianGuaixos’ investigation by the New York Department of Financial Services. Six months later, the company apparently felt that the regulatory environment had stabilized enough to launch their stablecoin.

LianGuaiyLianGuail has chosen LianGuaixos to manage and issue their stablecoin, which means that the stablecoin will be fully reserved, with separate funds and transparent monthly reports. In addition, their stablecoin will be monitored by on-chain analysis companies such as Chainalysis and TRM to monitor illegal usage. LianGuaiyLianGuail will be able to freeze funds related to criminal activities.

LianGuaixos has drawn the anger of regulatory authorities due to its relationship with Binance, with a long list of alleged violations leading to the New York Department of Financial Services (NYDFS) ordering a halt to BUSD mining, and the U.S. Securities and Exchange Commission issuing a Wells Notice. The NYDFS stated that the order was “the result of several unresolved issues relating to LianGuaixos’ relationship with Binance.”

In a statement, LianGuaixos stated, “Starting from February 21, LianGuaixos will cease issuing new BUSD tokens in close coordination with the New York Department of Financial Services.” LianGuaixos added that it will “terminate its partnership with Binance regarding BUSD stablecoin.”

“The market has changed, and our relationship with Binance no longer aligns with our current strategic focus,” said Charles Cascarilla, CEO of LianGuaixos.

The relationship between Binance and LianGuaixos allows them to mint BUSD directly from their exchange and port it to any blockchain of their choice.

The NYDFS stated, “We have not authorized Binance-Peg BUSD on any blockchain, and Binance-Peg BUSD is not issued by LianGuaixos.”

Since LianGuaiyLianGuail is partnering with LianGuaixos, it must indicate that the investigation has ended and this beleaguered issuer can now operate freely after undergoing rigorous regulatory scrutiny.

3. LianGuaiyLianGuail vs Meta

Although this is a recent development, people’s reactions to it are clearly different from the failed Diem stablecoin developed by Meta. When the social media company first announced its intention to enter the crypto market in 2021, it faced fierce criticism from politicians, economists, and activists from both parties.

At that time, Facebook was still plagued by the Cambridge Analytica scandal, which was a turning point in the 2020 election. The company had not yet recovered its image, so the reaction to the Diem news was intense.

Senator Elizabeth Warren expressed the strongest opposition to Facebook’s plan to launch a cryptocurrency and digital wallet. In addition, she and Senators Brian Schatz (Democratic) and Sherrod Brown (Democratic) wrote in a letter, “Facebook is once again aggressively pushing its digital currency plans and has launched a pilot of a payment infrastructure network, but these plans are not compatible with the actual financial regulatory environment—not only for Diem, but for stablecoins in general.”

Campbell believes that Facebook faces a dual problem.

Firstly, unlike Libra, Diem is a completely new business line for the company. Facebook is a social network used by over 2 billion people worldwide. It also owns the brands WhatsApp and Instagram. If it adds payment services, Facebook will completely transform into a huge quasi-bank that can rapidly provide services to all users overnight. Legislators and regulators are concerned that Facebook will further abuse its already considerable power by leveraging the user data it has collected.

This social media giant not only has access to data such as your friend list, likes, posts, direct messages, and location information, but the addition of Diem could also give every Facebook user unprecedented financial privileges. For a company that has suffered significant damage to its image due to scandals, Diem is just too big a step.

The second issue with Diem is that the protocol is not just a dollar-pegged stablecoin, but envisions a currency similar to an SDR supported by multiple foreign currencies such as the Euro, Yen, Australian Dollar, and Swiss Franc. Economists are astonished by this proposal. In their view, the global use of a basket of currencies would weaken the ability of central banks in various countries to implement domestic monetary transmission. If their citizens can easily obtain stablecoins with suppressed volatility anywhere in the world, which poor fool would buy their worthless bonds?

Diem has been unable to escape the regulatory hell, while Libra is shining brightly.

4. Interest rates dominate everything around us

By 2023, every major fintech company will become a quasi-bank, with a significant portion of their revenue coming from net interest income. Coinbase, Robinhood, and many other companies have made huge profits from rising interest rates.

The prospect of adding stablecoins to their products is enticing because such a design is similar to zero-interest, interest-free bonds. Stablecoin issuers issue tokens but can retain all the income obtained from short-term treasury bills. In a completely rational world, in an unconstrained competitive market, no one would hold stablecoins or cash for this reason. What benefit is there in holding an asset that does not generate interest income? The simple answer is, none.

But we live in a world with significant regulatory barriers, sanctions, foreign exchange restrictions, domestic capital controls, and securities laws. For some people, simply being able to access US dollars is enough. Until recently, in the field of cryptocurrencies, the demand for leverage far exceeded the demand for yields on government bonds. A new pattern emerged as short-term interest rates reached over 5% with no sign of cooling down.

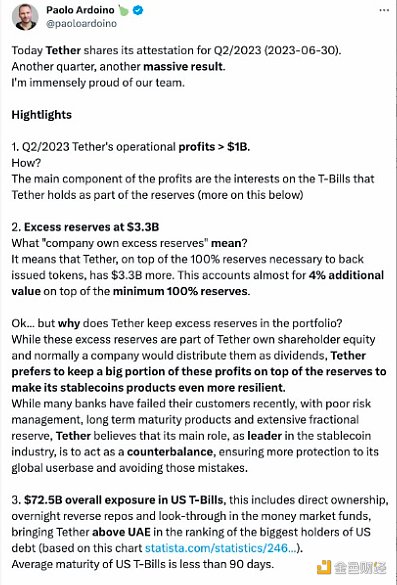

Now let’s look at Tether…

Tether is expected to achieve $4 billion in net interest income this year. This is more than Blackrock’s expected earnings this year. All of this is for the issuance of dollar-denominated bonds. It’s clear that every fintech company + bank should issue its own stablecoin, which is “free” money for them.

In theory, LianGuaiyLianGuail should be able to win in competition with Tether or even Circle, thanks to its larger user base and wider global market presence. In our interview with Campbell, he believes that the market capitalization of PYUSD could rise to $500 billion in 5-10 years. At this scale, LianGuaiyLianGuail will become one of the largest holders of US government bonds globally, with annual interest income exceeding $25 billion.

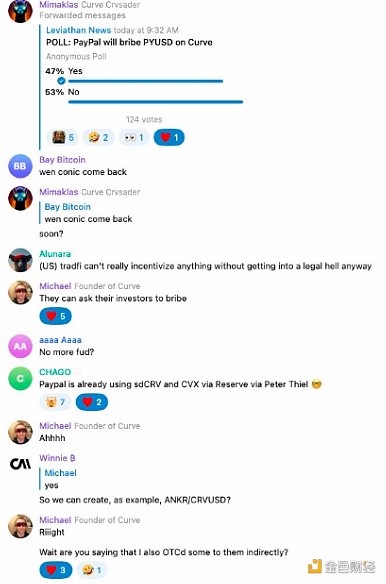

5. Will LianGuaiyLianGuail join the Curve battle?

The short answer is no. The more detailed answer depends on jurisdiction.

In the United States and Europe, there are strict limitations or complete prohibitions on returning interest income to the public. If LianGuaiyLianGuail starts bribing their liquidity pools from Michael by trading CRV over-the-counter, then Gary G will personally knock on LianGuaiyLianGuail’s door. In impoverished European countries, new issuers of stablecoins under MiCA (Electronic Money Token or EMT) will be prohibited from distributing interest to “lower the risk of electronic money tokens being used as a store of value”. When the government’s minting tax is no longer a functional channel, the relevant economics will collapse. We discussed this issue in a recent podcast with Omid Malekan, and the government is not ready to make government bonds the true payment instrument in this world.

Outside of these two continents, the fiercely competitive market will drive policy attraction for new companies in the Middle East and Asia, which only focus on delivering interest to investors. We have already seen this with Zunami Dollar (USZ), a stablecoin based in Japan that directly deposits its net interest income into the Votium pool to enhance Curve’s liquidity. Campbell believes that LianGuaiyLianGuail can establish branches in one of these regions. They are “quite globalized”, but they are not required to set up branches outside of the United States.

If Michael’s vision is realized, Curve will become the primary market for foreign exchange trading. PYUSD is just one of thousands of international stablecoins in the market. Traders will need liquidity, and liquidity on Curve requires bribery. If PYUSD really achieves scalability, it would not be surprising for LianGuaiyLianGuail’s subsidiaries outside of the United States to join the Curve battle.

6. Threat to banks

The current form of payment stablecoins poses a threat to the inherent leverage lending model of the banking industry. After the collapse of Silicon Valley Bank, depositors were forced to reevaluate the business models supporting their deposits. If companies like LianGuaiyLianGuail offer stablecoins that can be used for DeFi, what reason is there for funds to exist in banks other than the insurance from the Federal Deposit Insurance Corporation (FDIC) and a series of regulatory provisions?

When I convert my dollars to PYUSD, I can check the exact amount of all investments and holdings that support my stablecoin on a monthly basis. LianGuaiyLianGuail only holds cash and short-term Treasury bills. They do not have long-term bond exposure that led to the collapse of Silicon Valley Bank.

“If I want to use a debit card, I would also like to engage in real estate commercial loans. People usually don’t think of it this way, but when you deposit money in a bank, they do. They lend the money out.”

The U.S. Securities and Exchange Commission (SEC) and Elizabeth Warren are doing everything they can to hinder the growth of banks, and JPMorgan Chase will be the last institution to receive regulatory approval to issue stablecoins. As more and more small depositors transfer their deposits from banks to DeFi, bank deposits are facing threats.

If financial technology companies are allowed to operate in the current manner, structural reforms will be imminent. Campbell said, “Overall, if this model continues, I want to be clear that I think banks will face survival issues, i.e., what is our financing model? What is the actual price of borrowing? How should we build it? Because as we discovered in 2008, we may be too inclined to lend at all costs, which may be because we want to force all deposits into the system and then lend out in a risky way, regardless of whether people are willing to do so.”

7. The Stablecoin Season is Coming

LianGuaiyLianGuail’s entry into the market is just the beginning. According to reports, more major payment and credit companies such as Visa, Mastercard, and Square are exploring the inclusion of stablecoins in their product lines. The announcement of PYUSD’s release will give the green light to competitors’ issuances and accelerate development time. LianGuaiyLianGuail was the first to launch this service, but its competitors will closely monitor the market and Washington’s reaction.

If there is no significant opposition, LianGuaiyLianGuail’s stablecoin will also grow, and they will quickly enter the market, marking a new monetary system. Congress has not yet passed a unified stablecoin bill, and this moment may be the catalyst to force Washington to end the long-awaited stalemate on the stablecoin bill. Once a clear regulatory system is established, the “spring of a thousand stablecoins” will begin, unlocking the capital efficiency of the off-chain world while a large amount of liquidity flows to the on-chain.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Milestone Moment, Quick Look at LianGuaiyLianGuail USD Stablecoin

- U merchant selling USDT (Tether) got into trouble and was arrested. How to prepare for a criminal defense?

- The ‘Endgame’ of Protocol Consensus Proof of Governance (PoG)

- Explaining Stargate The first cross-chain bridge launched by LayerZero to solve the trilemma of bridging difficulties.

- The hype of room-temperature superconductor triggers the meme token craze of LK-99 Is it innovation or ‘cutting-edge’?

- How far away is Web3 from 90% of ordinary people?

- Analyzing the major update designed by Arbitrum Unpermissioned verification using BOLD