Is DApp a fake requirement? DeFi is the real use case for Ethereum to live

Those who are concerned about cryptocurrencies will definitely notice a word DeFi that has appeared frequently.

DeFi, the open finance, the most representative of which is the decentralized lending platform MakerDAO and its stable currency Dai.

However, Dai is just the tip of the iceberg in this growing open financial ecosystem.

Although the expansion of Ethereum is difficult, another new force built on Ethereum is beginning to take shape. From lending agreements, bond passes, cryptocurrency derivatives to decentralized exchanges, we are seeing the emergence of DeFi ecology. It has gradually evolved into an unstoppable new force.

- Libra's regulatory game: multi-party "gunfire" storm regulation will come

- What does the “finality” of the blockchain mean?

- Dialogue with the Minerals Club Yu Yang: The Rules, Opportunities and Trap of Bitcoin Mining

Reconstructing traditional finance

DeFi, the decentralized finance, is also known as open finance.

It is defined as “an ecosystem of decentralized applications built on unlicensed blockchains, point-to-point protocols, and decentralized networks, primarily to facilitate lending practices or financial transactions.”

The so-called decentralized finance is actually relative to the traditional centralized finance.

In the traditional financial system, banks play an important role in the mechanism of currency liquidity acting on the economy.

In this ecosystem, including central banks, commercial banks and investment banks.

The highest level is the central bank, which creates and issues sovereign currency and controls the money supply through a series of economic regulation policies including adjustment of deposit reserve ratio and liquidity regulation to effectively control inflation.

The next level is a commercial bank that generates credit expansion by pooling citizens' deposits and then lending them in the form of secondary reserves.

Then there is the investment bank, which issues various assets in the form of IPOs and corporate bonds, and makes a second investment in the bank savings of citizens.

In essence, banks monopolize cheap funds.

And DeFi is an open financial ecosystem. It is no longer restricted by the control of traditional banking networks and physical boundaries. Values flow here in new ways. With open financial infrastructure, we can design new capital flows. system.

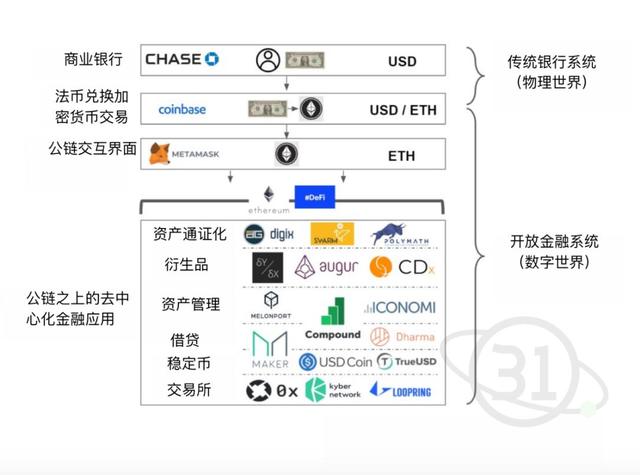

In the DeFi ecosystem, cryptocurrencies are generated in two ways.

One is the native cryptocurrency, which does not require the mortgage or endorsement of real assets, but is generated directly by consuming real-world energy sources, such as Bitcoin and Ethereum, which are generated by mining and produce corresponding values.

The other is to exchange directly from the exchange . In the process, the trader converts the legal currency into an encrypted token, such as a stable currency such as Bitcoin or USDC. In the process, the cryptocurrency exchange acts as a bridge between the legal currency and the digital currency.

The next level is the native digital financial services built on the public infrastructure.

In this open ecology that has escaped the constraints of commercial banks and distribution networks, liquidity has gathered in different ways, dissolving the comparative advantages that commercial banks have accumulated for a long time: monopolizing cheap funds and deposits.

By fundamentally redefining “financial services”, the way banks operate will change dramatically, and as a result, we will enter a new world of free value.

For example, with an interface like the Metamask browser, people can move from the Internet world to the world of cryptocurrencies. From here on, consumers can begin to access financial services directly, without the need for third-party trust brokers, such as banks.

Ethereum DeFi Eco-Flower

Compared to the Bitcoin protocol that does not support Turing's completeness, the Ethereum with intelligent contract function is Turing-complete. In addition, only Ethereum can carry the most valuable assets and liquidity. Therefore, we see that the ether Fang Gong Chain became the first choice for developers of early DeFi projects.

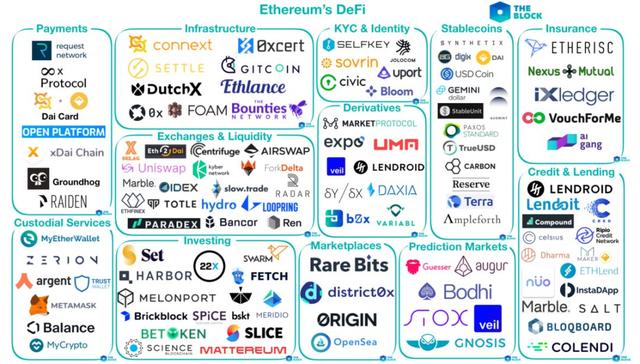

In the DeFi ecosystem of the Ethereum, there are currently hundreds of DeFi projects based on Ethereum. Among the ecological maps listed by The Block, DeFi has expanded to KYC identity, exchange and liquidity, lending markets, derivatives, stable currencies, payments, infrastructure, forecasting markets, insurance, investment management, wallets and hosting. Multiple typical use cases and projects within.

▲ Whether it is an exchange, a derivative, a loan, or a forecasting market, almost all real-world financial services can find a corresponding decentralized version on Ethereum.

Decentralized finance is now an economic system worth up to $430 million.

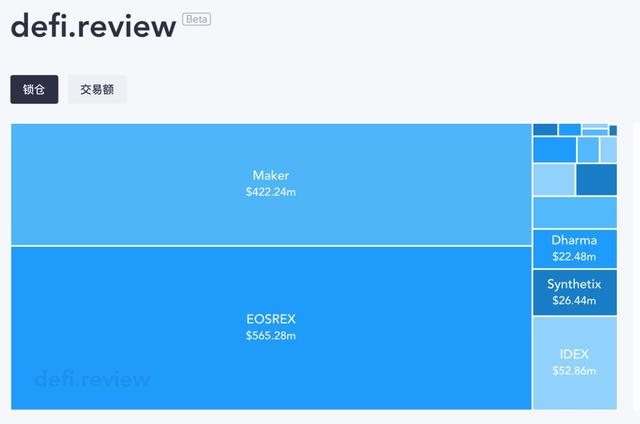

It is worth noting that Ethereum has always been the leader in the DeFi ecosystem. Maker, Compound, and Dharma each occupy the top three in the DeFi volume.

Defi.pulse data shows that Maker, as the largest component of DeFi on Ethereum, dominates the entire DeFi ecosystem by nearly 76.7%, and its CDP mortgage smart contract locks in ETH worth about $6.42 billion. It accounts for 1.5% of the total Ethereum.

The second and third names belong to Compound and Dharma in the category of lending agreements. The former Compound is a “commercial bank” that does not need a pool of funds to automatically adjust interest rates according to supply and demand. The latter Dharma is a decentralized P2P “loaning agreement”. ".

However, it is worth noting that the above defi.pulse data does not include the DeFi application in the EOS platform.

In fact, the DeFi ecosystem, which was dominated by Ethereum, has been broken by the later EOS.

Recently, the DeFi project on EOS has sprung up, and EOSREX in the EOS platform took MakerDAO to the second in just over 20 days.

Data from defi.review shows that EOSREX locks 5.6 billion US dollars, accounting for 49.21%, ranking first; Maker locks 422 million, accounting for 37%, ranking second.

However, most of the current DeFi innovations are still concentrated on the Ethereum platform, with only a few running on other public chains such as Bitcoin or EOS.

Whether it is ICO or DeFi, it is essentially the accumulation of traffic through the wealth effect, and making money is the internal driving force for the development of the cryptocurrency market.

As long as there is a wealth effect, the market will not die.

In addition to the arbitrage of DeFi, the core of DeFi has a very important role in enabling the holder to obtain liquidity without losing ownership of the encrypted assets.

Therefore, in the chilling winter, DeFi development is still unaffected, and even in the 2018 bear market, the entire digital currency market value has shrunk significantly, the DeFi lock position has increased by 112%.

As a result, we found that Ethereum's DeFi ecosystem clearly has more tenacious vitality and sustainable development capabilities compared to the short-lived 1CO model.

Ethereum, which was launched with “financing tools”, could not become a world computer because of the progress of the expansion plan. However, with the rise of DeFi, the goal of Ethereum has become clearer and clearer, and Ethereum hopes to become a “global settlement layer”. .

At the end of April, 2019, the new version of the Ethereum official website, Ethereum officially revised the positioning of Ethereum, with particular emphasis on the vision of Ethereum in the decentralized financial direction:

Ethereum is a global, open source platform designed for decentralized applications. At Ethereum, you can write code that controls the value of the code, which is executed programmatically and accessible from anywhere in the world.

The advantage of DeFi – open

One of the main advantages of DeFi compared to traditional financial systems is openness. Specifically, opening has the following meanings:

1, no entry barriers, everyone can participate

As long as you have cryptocurrencies and Internet links, anyone in the world can access and interact with this open financial system without having to gain access, including creating accounts, transferring funds, and contracting interactions.

According to World Bank data, there are about 2 billion people in the world who do not have bank accounts, most of which are in developing countries and regions in Africa, the Middle East and parts of Asia. The reason is that the per capita income in these areas is too low and the market is not big enough, which has made banks and financial institutions reluctant to enter these markets.

However, this does not mean that there is no need for financial services in these areas. In these areas without financial infrastructure, it is very difficult and costly to open an account. Therefore, open finance without an access mechanism can be fully The world's 2 billion no bank accounts are seamlessly connected, and global assets are freely flowing at an unprecedented rate with a more dispersed and granular structure. Undoubtedly, DeFi, which promotes financial inclusion, will be released. Great potential.

2, interoperability and combinable, modular use

Combingability means that open source protocols are compatible with each other and can be combined and called with each other. Developers can combine and call different protocols at will, so that they can be combined into higher-order applications like Lego.

An obvious benefit is that developers don't need to rebuild their wheels, for example, without having to re-develop the underlying modules, which greatly increases development efficiency.

Another benefit is that you can share and inherit the security and trust of the upper layer of the protocol, and for the financial industry, security and trust are the most critical components.

This means that trusts that have already been proven by the market can be combined, trusts are superimposed on each other, and blessing is leveraged. DeFi enables trust to be expanded without permission, trust, and scale, thereby maximizing efficiency.

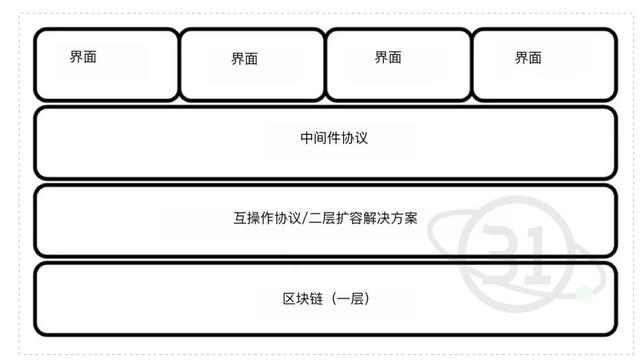

A typical example is the rise of middleware.

What is middleware?

Placeholder co-founder Chris Burniske is defined as "the middleware protocol for cryptocurrency" is a developer-oriented protocol that provides services in addition to the underlying blockchain consensus and core functionality. As a value-added glue between the underlying blockchain and the end users of DApps, the middleware protocol will make DApps creation easier and faster. ”

Intermediate layer protocol for bonding the underlying blockchain protocol and the DApp interaction interface

Augur is a typical predictive market middleware agreement in which people can pledge tokens to bet on the outcome of future events, but this platform has been criticized for its poor experience.

Veil, a predictive application built on top of this protocol, improves the user experience of Augur, while at the same time inheriting the user's trust in Augur.

Thanks to a long market test, it can be said that Augur's safety and reliability are guaranteed, so it will be safer than re-manufacturing a new system.

As Kyle Samani said, the key innovations in open finance are through the modularization of the fundamentals of finance and the commodification of trust through this modularity.

Placeholder, which specializes in middleware investment, once wrote an article to publish its investment secret “The middle layer is the most beautiful, why don’t we buy Ethereum?”, because if ETH appreciates, then the quality assets based on Ethereum (middleware) will often follow Appreciation, however, middleware is not affected by the downside risk of the Layer 1 smart contract blockchain, as interoperability agreements capture value from Ethereum.

3. Openness means financial transparency

Since the traditional financial system is opaque, it can be said that banks and financial institutions perform "black-box" operations on user assets. Users need to believe that institutions do not do evil, and are essentially subjective trust. In fact, many of the financial risks and violent incidents that occurred were actually caused by opaque violations.

In open finance, the code on the blockchain platform is open source and transparent. All transactions and operations are recorded on public distributed ledgers, cannot be tampered with, and can be viewed at any time. This is a machine-based and algorithm-based objective. trust.

There is no need to entrust a third-party agency to escrow funds or confirm transactions, it can also reduce the risk of the counterparty, while saving transaction costs.

Problems and bottlenecks

Although DeFi is the most promising development direction, there are still many problems with DeFi.

First of all, there are more than one hundred DeFi projects in Ethereum, and there are more than one hundred DeFi projects. However, compared with traditional finance, DeFi is extremely small, and its scale is not worth mentioning.

According to defi.review data, DeFi daily transactions total less than 1.4 billion US dollars, compared to the centralized exchange trading volume is also very weak.

This is mainly because DeFi is mainly focused on Ethereum, and a few are running on other public chains such as Bitcoin or EOS, which means that most of the focus is on people who hold Ethereum, resulting in no incremental funds.

In addition, the DeFi model is single and 90% of the business is focused on the lending scene.

DApp Total's data shows that the total value of locks on DeFi, 83.14% from Maker, 8.46% from Compound, and 3.2% from Dharma. That is to say, although there are thousands of projects in the DeFi ecosystem, the head effect is obvious, and it is basically occupied by the three head loan business applications, occupying more than 90% of DeFi market.

But Pan Chao believes: "This is normal, because the core of finance is borrowing, but at the same time we also see more financial derivatives. For example, margin trading, binary options, etc."

On the one hand, the supply side of thousands of applications has sprung up, and the other side of the coin is the demanding end of the abnormally cold, the users are scarce, and the core needs are unknown.

Compared with traditional financial products, DeFi is more difficult to use, and has higher requirements for users. As a result, users are scarce, it is difficult to attract new users, and no new funds are entering the market, which still remains at the stage of the stock market game. It is also the biggest “drag bottle” for DeFi to move forward.

Not only that, for the decentralized lending platform, due to the lack of credit system, users often need excessive mortgage, which leads to low utilization of assets, which greatly weakens the enthusiasm of users and asset liquidity.

Taking MakerDao as an example, in order to maintain the stability and security of the system, the user must mortgage Ethereum to generate the stable currency Dai with a 150% excess mortgage rate. That is to say, Dai who has obtained 1000 US dollars must pledge 1,500 US dollars in Ethereum. At present, MakerDao's entire network mortgage rate has reached 478%, although such a high pledge rate can ensure the security and stability of the system, but it will greatly weaken the utilization of funds.

So where is the fate of DeFi going in the future? Is it a substitute for traditional finance, is it traditional income, or is it parallel to traditional financial coexistence?

What is certain is that DeFi will coexist for a long time as a supplement to traditional finance. DeFi will not replace traditional markets, nor will it be accepted by traditional finance, but will provide people with a new option.

Substituting the traditional centralized financial system, the open finance represented by DeFi will be mainly for small-scale, complex demand, small-scale financial needs that do not require credit endorsement.

Openness means equality, everyone can participate and liberate.

An open system often contributes to the formation and rapid development of ecology, and can bring the power that is incomparable to the centralization organization.

It is precisely because of the openness that Wikipedia, which everyone can participate in, has come to the fore, surpassing Microsoft's old digital encyclopedia Encarta.

The open Internet liberates the acquisition and exchange of human information, and then, the open financial system will include billions of people excluded from the existing financial system. In a globally open market, these assets are arbitrary. Free trading and efficient flow of granularity will unleash unlimited potential.

It has been predicted that in the next two decades, the traditional financial system will be replaced by open finance and will generate trillions of dollars of new assets.

Compared to traditional financial services institutions, DeFi does have many advantages, such as financial inclusiveness, high transparency, low transaction costs, and so on. However, 31QU believes that open finance will not replace traditional finance, but will become a powerful complement to traditional finance. The two worlds of traditional finance and open finance will coexist for a long time.

The traditional centralized financial system mainly serves large-scale assets with high degree of standardization. The low-standardization, complex requirements, and small-scale financial needs that do not require endorsement of the central body are what DeFi is good at.

The founder of Ethereum V God once said that the financial sector is one of the first areas where blockchain technology first landed. However, the open finance that is still in its infancy is limited by low liquidity, technology and application, and the demand is not clear. Bottlenecks such as user experience and cognitive thresholds, the future application path still has a long way to go.

Text: 31QU Xiaoping

Source: 31QU

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- TS Run Road Funds Defence Action: Graphic Tracking Asset Transfer Money Laundering (2)

- If Bitcoin can achieve all the plans, is it necessary for most of the competition coins to exist?

- Kraken CEO: The rise in the currency price is due to real market demand and has nothing to do with Tether

- [Chainge] Technology Salon: "Parallel Cross-Chain Practice – IBC Cross-Chain Communication Protocol and iService Cross-Chain Service" IRISnet Harriet

- Winklevoss brothers take another shot: cryptocurrency exchange Gemini to apply for a broker self-employed license

- Is the Ethereum Foundation intending to hold the thighs of the Middle East royal family, is it a "moon landing plan" or a pie?

- Research Report | Currency Form: From Physical Currency to Password Currency