Jia Nan Zhi Zhi will be listed in the US, what is the composition of the “blockchain first stock”?

Author: in this stupid thirty-one

Source: Deep Chain Deepchain

Jia Nan Zhi Zhi will soon become the "first block of the blockchain listing."

- Deloitte uses zero-knowledge proof technology to improve the privacy attributes of its blockchain platform

- Infinite War in the World of Cryptographic Currency, ASIC and Anti-ASIC

- Calibra leader David Marcus: Libra's anti-money laundering standards will outperform other payment networks

On October 29th, a photo of Jianan Zhizhi’s executives on Nasdaq went away. At one time, the public opinion was stunned. They thought that Jianan Zhizhi had successfully landed in the US stock market, even though it was discovered through deep-chain financial exploration. For Jianan Zhizhi executives to visit Nasdaq in August, it has not yet officially listed.

According to US stock sources, it is almost a foregone conclusion.

Just the day before, Jia Nan Yu Zhi officially submitted a prospectus to Nasdaq. Credit Suisse, Citibank, Huaxing Capital Holdings and CMB International jointly guarantee. With the stock code CAN listed on NASDAQ, it plans to raise US$400 million, which is a significant reduction from the 1 billion fundraising amount that was previously promoted by IPOs in Hong Kong.

The company, which was established in 2013, has not been aware of it for six years. As the upcoming "block stock first stock", Jia Nan Zhi Zhi in the end, why can it be successfully listed?

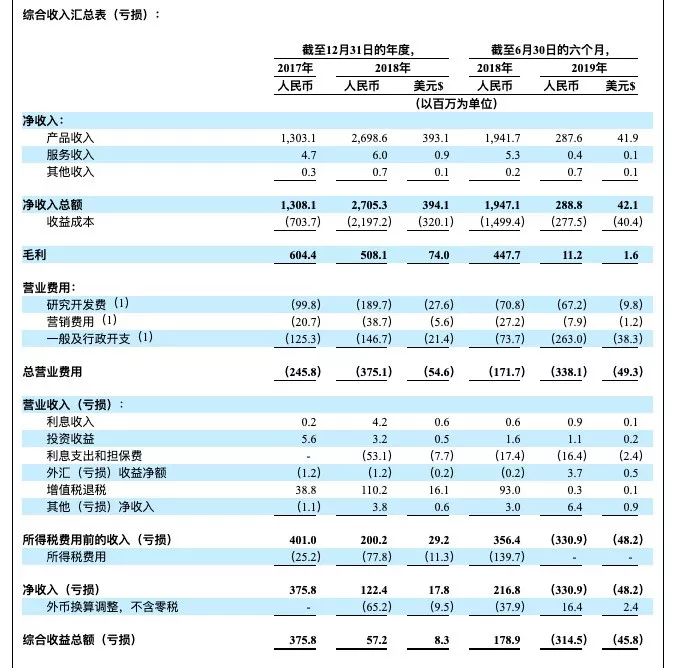

According to the prospectus, Jianan Zhizhi's net income in 2018 was 394 million US dollars (about 2.705 billion yuan), and net profit was 8.3 million US dollars (about 58.66 million yuan).

In the first half of the year ended June 30, 2018, Jianan’s net income was 1.947 billion yuan and net profit was 217 million yuan.

However, in the first six months ended June 30, 2019, Jianan Zhizhi's net income was only 42.1 million US dollars (about 288 million yuan), and the net loss was 45.8 million US dollars (about 331 million yuan).

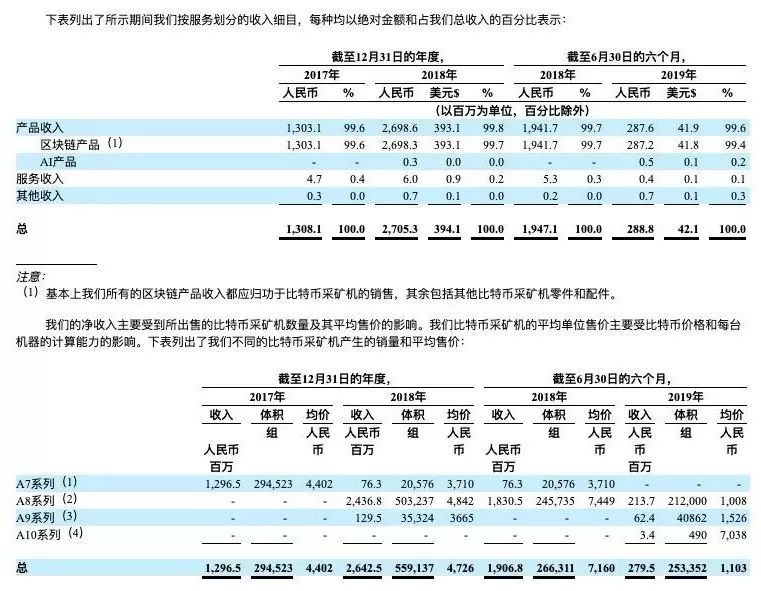

However, it can be clearly seen that the revenue of blockchain products is 99.6% in 2017 and 99.7% in 2018. It can be said that the growth rate is slow.

In the first half of 2019, the revenue of Jianan Minzhi Mining Machinery was 287 million yuan, the vast majority of which came from the A8 series.

However, it is worth noting that Jianan Zhizhi AI products only earned 500,000 yuan in the first half of 2019. As a comparison, the income of AI products in the second half of 2018 was 300,000 yuan. Prior to this, Jia Nan Zhizhi's AI products have never had income.

Compared with last year's achievements, Jianan Zhizhi's financial report this year is slightly "dismal." Despite the influence of the market environment, the mining company's financial report this year is not satisfactory. However, for Jia Nan Zhi Zhi, on the one hand, his own AI business did not produce a satisfactory answer, on the other hand, the newly rising mining company Shenma mining machine is closely following.

For Jianan Zhizhi, although the successful listing is indeed a major positive news, in the future development process, it still cannot be taken lightly.

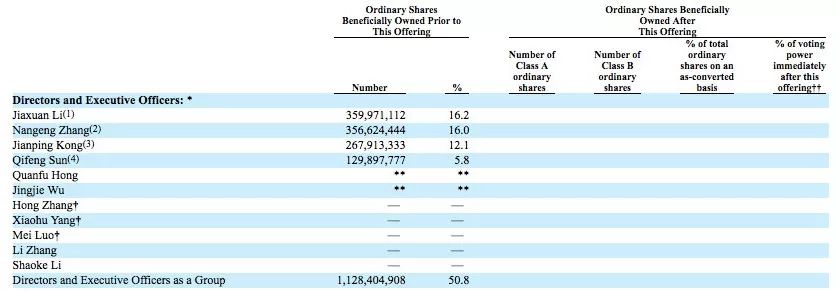

According to the prospectus information, Jianan has a total of 11 management personnel. Chief Financial Officer Li Jiaxuan holds 16.2% of the company's shares. Founder Zhang Nanyu holds 16% of the company's shares. Hengtongyun (838316) executive Kong Jianping holds 12.1% of the company. Sun Qifeng holds a 5.8% stake in the company.

According to reports, in April 2015, Kong Jianping passed the core investment, Sun Qifeng invested in Jia Nan Zhi Zhi through Peter Tiel, and the former major shareholder Liu Xiangfu held 10.2% of the shares through Urkanall Ltd., compared with the previous offer. The 17.6% disclosed in the book has dropped sharply and is no longer the largest shareholder of Jianan Zhizhi.

In addition, the shareholding entities include five companies and individuals including Ouroboros Ltd and Flueqel Ltd.

Compared with the over-concentration of Bitcoin shares, Jianan’s share allocation appears to be relatively “balanced”.

However, it is worth noting that Liu Xiangfu, who was one of the actual controllers of Jianan Zhizhi, also had the most shareholdings in the management position earlier this year. The specific reason is that Liu Xiangfu and the company's overall strategic development are divided. .

Despite this, in comparison with the fascinating "Palace of the Palace" in the Bitumn, Jia Nan Zhizhi is much more understated in the process of dealing with contradictions.

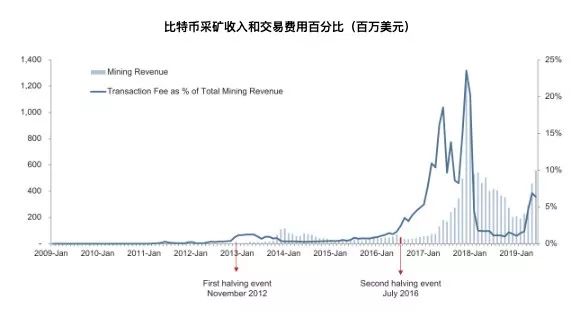

According to the prospectus, Jia Nan Zhizhi listed the bitcoin price as the first risk factor.

"Our results of operations have been and are expected to continue to be negatively impacted by sharp Bitcoin price decreases."

"We derive a significant portion of our revenues from our Bitcoin mining machines. If the market for Bitcoin mining machines ceases to exist or diminishes significantly, our business and results of operations would be materially harmed. (A large percentage of our profits are from Obtained in the sale of Bitcoin mining machines, if the Bitcoin mining machine market ceases to exist or decrease in the future, our business will be seriously damaged)"

It can also be seen from the change in profits that bitcoin prices hold the fate of major mining machine manufacturers, and the symbiotic properties are obvious. Due to the need for power consumption, the cost of mining is also affected by the dry and wet periods of hydropower.

According to previous reports, Jianan Zhizhi's profits in 2015 and 2016 were 1.511 million yuan and 52.544 million yuan respectively. It can be seen that the price trend of Bitcoin has a great influence on Jianan's business.

In addition to bitcoin prices, the mining machine market is near saturation, growth is slow, and mining is difficult. Less and less bitcoin that has not been dug in the mining pool will eventually lead to a decline in future mining machine sales. These problems also need to be carefully considered by Jia Nan.

In addition, in terms of AI applications, Jianan is worried that it will not be successful from the AI market, or it will cause income, growth prospects and financial situation to be affected.

In terms of regulatory policies, Jianan Zhizhi faces regulatory risks related to mining, holding, using and transferring cryptocurrencies.

Changes in bitcoin algorithms and mining mechanisms, increased mining difficulty, high R&D investment and aggressiveness from competitors all pose new risks.

Since January 2013, Jia Nan Zhizhi Chairman and CEO Zhang Nanyu and his team invented and delivered the first Bitcoin mining machines using ASIC technology, Jia Nan has always paid special attention to the development of chip technology.

Therefore, the accumulation of long-term experience has accumulated a great advantage in the technology of Jia Nan.

Therefore, since June 2015, Jia Nan has completed 7 kinds of tapes for 28nm, 16nm and 7nm ASICs with a success rate of 100%. In addition, Jia Nan Zhizhi has produced 130 million chips in the two and a half years of 2017, 2018 and June 30, 2019.

Not only that, but Jia Nan’s achievements in the research of ASIC technology are not small.

Jia Nan Zhi Zhi believes that ASIC edge AI chips will be favored in the future and occupy a larger market share. Its market share will soar from 21.3% in 2018 to 40.9% in 2023.

In September 2018, Jianan Zhizhi released the first generation AI chip K210. By June 30, 2019, Jianan Zhizhi had delivered more than 26,000 K210 chips and supporting facilities to the market.

Up to now, Jianan Zhizhi's K210 edge chip has been used in the Internet of Things, such as smart home, smart driving, and medical and education industries.

However, some insiders said that they are not optimistic about the transformation of Jia Nan Zhi Zhi.

The ASIC chip used in the mining machine is a customized chip for a specific field. The chip structure is relatively simple, and the computing power and calculation efficiency are directly customized according to the needs of specific algorithms. The AI chip requires massive calculation, high flexibility and high efficiency. Data interaction efficiency, etc.

In addition, the production of the chip is divided into front-end design and back-end design. Jianan Zhizhi is currently limited to the front-end design and development of the chip, and then finds TSMC OEM production, and can not independently complete the mass production of the chip.

5 “ Financing continues, valuation is over 20 billion yuan ”

According to the prospectus, in 2018, Jia Nan Zhi Zhi signed a number of short-term loan agreements with a number of banks, totaling RMB 500 million.

In April 2018, Jianan Zhizhi signed a financing agreement with China Merchants Bank Co., Ltd. Hong Kong Branch and China Merchants International Finance Co., Ltd., amounting to approximately HK$930 million.

After two rounds of financing, in the "2018 Second Quarter Hurun Greater China Unicorn Index", Jia Nan Zhizhi's valuation reached 20 billion yuan.

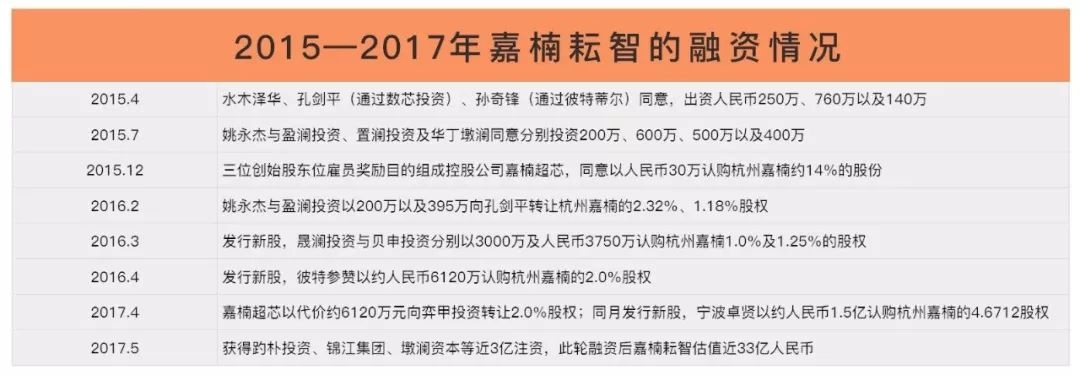

As early as 1 year ago, Jia Nan Zhi Zhi received nearly 300 million yuan in financing from Ping Pu Investment, Jin Jiang Group and Yan Capital. At that time, the valuation was close to 3.3 billion yuan.

Through the large investment in chips, mining machines and other aspects, although Jia Nan has a distance from the Bitumn in the field of mining machines, it still has good results.

At present, the bitcoin mining machine sold by Jianan Zhizhi has occupied 21.9% of the total sales of the mined machine in the global market, which is a significant increase from the 15.3% in the same period last year.

However, Jianan Zhizhi’s market share in the shipment of Bitcoin mining machines was 23.3%, which is still far from the market share of Bitcoin’s 64.5%.

On the chip side, in September 2018, Jia Nan was recognized as the first commercial edge computing artificial intelligence chip company in the industry to provide a neural network accelerator based on the Risc-V architecture and self-developed.

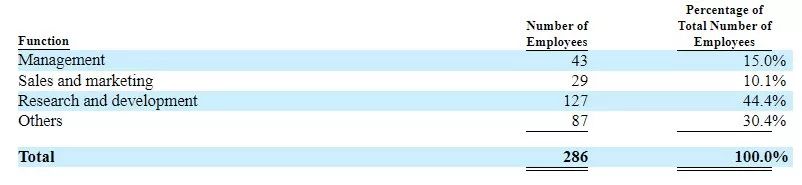

In terms of personnel composition, up to now, Jia Nan has all 286 staff members, of which 127 are responsible for research and development, accounting for 44.4%.

6 " Why can Jia Nan Zhi Zhi be listed in the US? "

A week before Jia Nan’s announcement of the prospectus, Bit China had secretly submitted a listing application to the SEC, and the sponsor was Deutsche Bank. In addition, as early as June this year, Yibang International also reported the news that it will go public in the United States.

Why did the three giants of the mining industry in the Hong Kong Stock Exchange have gathered in the US stock market?

Wall Street has always been the capital of Internet companies, compared to the listing of A shares and Hong Kong stocks, listed in the United States, the threshold is lower.

Because the United States adopts a registration and filing system, as long as the information is submitted in accordance with the requirements of the SEC, the application for filing can be listed without any human factors.

Legal transparency, flexible securities regulations, and loose listing system are the characteristics of the US capital market. Even if companies are not profitable, they can enter the US capital market to raise funds through the issuance of stocks or bonds.

Secondly, in June 2017, in order to activate the US IPO market, under the leadership of the current Securities and Exchange Commission Chairman Jay Clayton appointed by Trump, the policy of secretly submitting an IPO application file. It has been relaxed to all companies that are ready to go public.

This also means that all companies preparing to go public in the US can choose to submit an initial public offering application file.

The benefits of secretly submitting the first prospectus are:

According to informed sources on Wall Street, Jia Nan Zhizhi secretly submitted a prospectus to the SEC a few months ago, and passed several rounds of questions and answers from the SEC, after which the prospectus was published.

In the end, Jia Nan’s business is relatively “simple” and has not been associated with too much cryptocurrency. It has always been a legal currency system. The financial system is relatively simple and more easily recognized by the traditional capital market.

Founded in 2013 and listed in 2019, Jia Nan Zhizhi, who was born in the cryptocurrency market, seems to be making a positive result. But for a company, a company that represents the cryptocurrency and blockchain industries, listing is only the first step. The next road is still very long.

Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Russia: The aluminum plant is going to mine, is it going to win 20% of the global bitcoin production?

- Harvard Business Review: Blockchain fires, but you may know a little about it

- BCH is on the rise as expected, the market is still in a state of consolidation

- Analysis: Why can Bitcoin submit a listing application secretly?

- Tiandao has a good reincarnation, who the SEC has spared: What impact does the SEC’s regulatory punches have on the encryption market?

- BCH's "time bomb"? The commentary believes that "halving BCH" is a disaster for them.

- What is the difference between the central bank digital currency DCEP and Alipay, WeChat and Bitcoin?