Jia Nan’s four wars IPO, but the time left for it’s transformation is running out.

Text: Mutual Chain Pulse · Liangshan Huarong

Source: Interchain Pulse

Following the failure of China's A-share, NEEQ and Hong Kong stocks, Jianan Zhizhi, the world's second-largest bitcoin mining machine manufacturer, once again sprinted to US stocks.

According to Coindesk, Jia Nan Zhizhi submitted an initial public offering statement (hereinafter referred to as the “Prospectus”) to the US Securities and Exchange Commission (SEC) on October 28. The prospectus shows that the company plans to list on the Nasdaq with the stock symbol CAN and set aside $400 million in funding. It is not yet possible to determine the final fundraising amount, valuation and price per share.

- Why is the hash public key not resistant to quantum computing threats?

- Inside the ICBC internal digital wallet: China leads the currency trend for 3000 years

- Jianan Zhizhi prospectus full interpretation: 99% of revenue comes from mining machines and related sales, future growth bets on AI chips

The highlights disclosed by Jianan Zhizhi in the prospectus include the use of dual-equity structure of A and B common stocks and comprehensive financial and business data. However, the inter-chain pulse also noticed that Jianan’s potential risks to the growth of the main business caused by the difficulty of bitcoin mining and the conversion of the public chain mining mechanism from PoW to PoS have not been mentioned. .

Not only that, but Jianan Zhizhi is also hoping for new business growth points in the artificial intelligence field where the track is crowded and the profitability is generally low. Once its ASIC is not able to become the mainstream solution for AI technology and applications, the artificial intelligence business If the expansion does not meet expectations, Jianan Zhizhi may face the risk of “performance change”.

The decline in revenue, the growth of the main industry encountered "ceiling"

In the Jianan Zhizhi prospectus, its main business has already faced the risk of falling revenue and even losing money.

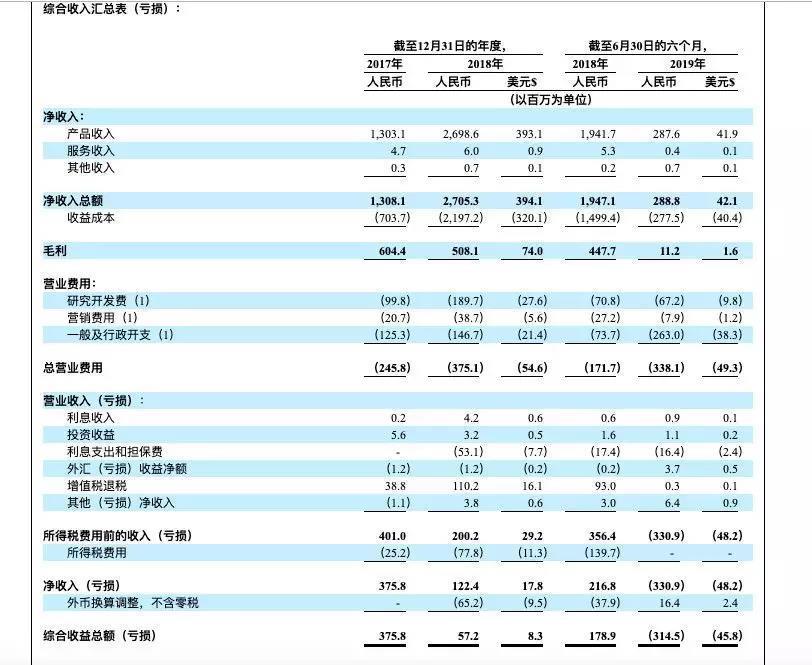

According to the prospectus, from 2017 to 2018, the total revenue of Jianan Zhizhi increased from 1.381 billion yuan to 2.705 billion yuan, but in the same period, its net profit fell by 67.4%, from 375.8 million yuan to 122.4 million yuan. In the six months ended June 30, 2019, the total revenue of Jianan Zhizhi was only 288.8 million yuan, down 85.2% year-on-year.

Not only that, in the six months ended June 30, 2019, Jianan Zhizhi's net loss was 330.9 million yuan, and the adjusted net loss was 109.9 million yuan.

(2017-2019, the first half of the year, Jia Nan Zhizhi performance sources: Jia Nan Zhizhi prospectus)

In the prospectus, Jia Nanzhi explained the reason for the decrease in income: Bitcoin prices will directly affect the market demand and price of Bitcoin mining machines. “The fall in bitcoin prices in 2018 also led customers who purchased our bitcoin mining products by credit to be less willing to pay.”

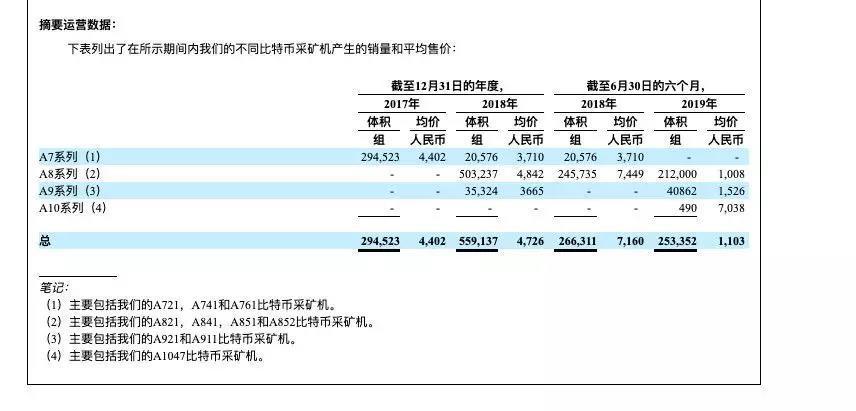

(The sales volume of Jianan Minzhi mining machine in the first half of 2017-2019: Jianan Yuzhi prospectus)

The uncertainty of currency price fluctuations has always been the “life gate” of the entire mining industry, especially for mining machine manufacturers whose main business relies excessively on the sale of mining machines.

Jia Nan Zhizhi even pointed out in the prospectus, "In 2017, 2018 and the six months ended June 30, 2019, sales of our bitcoin mining machines and other bitcoin mining machine parts and accessories. They account for 99.6%, 99.7% and 99.4% of our revenue, respectively. If the Bitcoin mining machine market no longer exists or is significantly reduced, our Bitcoin mining machine will suffer significant sales losses, order cancellations or customer churn."

In fact, as the balance of bitcoin mining is only 3 million, the difficulty of mining is increasing and the cost of mining is rising. The threshold for bitcoin mining is also rising, and Jianan’s mining machine sales business is growing. Very limited.

According to ZB's innovative think tank statistics, the difficulty of bitcoin mining has increased by 19.4% in the past September. Since December 2018, the computing power and mining difficulty of the Bitcoin network have been increasing in one direction. These values have risen during the year. More than doubled, it is expected that the difficulty of bitcoin mining will continue to increase until halved in May 2020.

Although the current mining giants including Jia Nan Zhi Zhi have successively launched low-power large-capacity mining machines, the high price of large-scale mining machines has discouraged a large number of retail investors in the case of weak bitcoin price recovery. .

On the other hand, due to the PoW mining mechanism and the entire mining industry behind it, the defects and disputes have been proved. The public chain represented by Ethereum has set off a wave of PoW to PoS. In the long run, PoW Mechanism mining is facing a trend of being eliminated. This will inevitably bring greater risks to the development of Jianan Zhizhi's main business.

Not only that, the recent development of the blockchain industry at the national level is mainly aimed at the alliance chain level. For Jianan Zhizhi, which is closer to the currency circle, it is difficult to bring policy benefits.

Betting artificial intelligence is not clear

In order to get rid of the lack of growth in mining machine sales and the risk of the main business being too single, Jia Nan Zhi Zhi will be betting on the transformation of artificial intelligence.

In May 2019, the founder of Jianan Zhizhi, Zhang Nanxuan, once called the export number. It is planned to realize the ratio of the company's mining machine and AI business income to 1:1 in three years. In 2019, the company's AI business income is expected to reach tens of millions of yuan. .

However, Jianan Zhizhi’s prospectus shows that as of June 30, 2019, its artificial intelligence products revenue in the first half of this year was only 500,000 yuan, and artificial intelligence revenue accounted for only 0.2%.

Judging from the actual income situation, Zhang Nanxuan seems to be too optimistic about the progress of Jianan's artificial intelligence business.

Assume that in the next three years, Jianan Zhizhi's mining machine and AI business revenue will reach 1:1. According to the conservative calculation of its 2018 mining machine sales revenue, then its target of artificial intelligence business revenue will reach 2.643 billion yuan three years later. This performance income is enough to squeeze into the ranks of artificial intelligence unicorns, because currently one of the best in China's contempt for technology, its annual revenue last year was only 1.427 billion yuan.

Jia Nan Zhizhi also pointed out in the prospectus that the company's current AI products are mainly focused on the edge AI chip field, but the future growth of AI business revenue depends largely on whether we can successfully expand our business in the artificial intelligence market and play Enter the new application market.

In fact, the track in the field of artificial intelligence chips is already very crowded. Whether it is technologists such as Qualcomm, Intel, NVIDIA, Google, Huawei, or Chinese unicorn companies such as Cambrian, Shangtang Technology, and Vision Technology, The AI chips have been launched one after another, and these giants and unicorns have their first-mover advantage in applications such as security, Internet of Things, and voice recognition.

For Jia Nan Zhi Zhi, from the bitcoin mining machine manufacturing lane change to the AI chip field, there is no obvious advantage of the dimension reduction attack. The only clear benefit is that you may get a higher valuation before you land in the secondary market.

In addition, Jia Nan Zhizhi also pointed out in the prospectus that "because ASIC may not develop into a mainstream solution for AI technology and applications, we may not be able to take advantage of the growth of our ASIC technology and application market. If the artificial intelligence market does not As we have expected so far, and we are unable to penetrate the new application market, our future revenues and profits may be significantly and adversely affected."

This also means that once the artificial intelligence business is not up to expectations, Jianan will face the risk of “performance change”.

Therefore, Jianan Zhizhi hopes that the growth of its main business in the future will be based on the transformation of artificial intelligence. However, in view of the fact that Jianan Zhizhi has invested a lot of funds and technical teams in the field of artificial intelligence chips, we still hope that it can successfully transform and succeed.

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- David Marcus: Libra's anti-money laundering standard is higher than other payment networks

- Bloomberg: The $5 billion encryption loan market is just a credit bubble that is about to burst?

- Vitalik: On the two-way bridging of eth1 and eth2

- Which block is the first benefit to the blockchain?

- What are the points worth noting in the Jianan Zhizhi prospectus?

- Why is the blockchain that has been blushing overnight a representative of "an important breakthrough" and "a new round of information technology"?

- You know the blockchain, now it’s time to understand the DCEP central bank digital currency.