LianGuaiWeb3.0 Daily | Huobi renamed as HTX

LianGuaiWeb3.0 Daily | Huobi rebranded as HTXDeFi Data

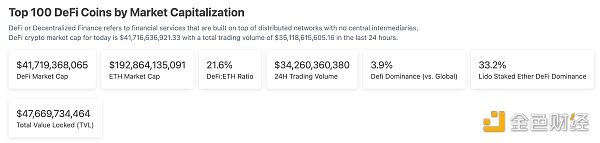

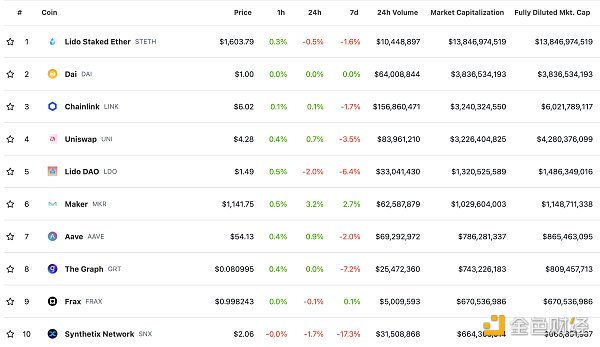

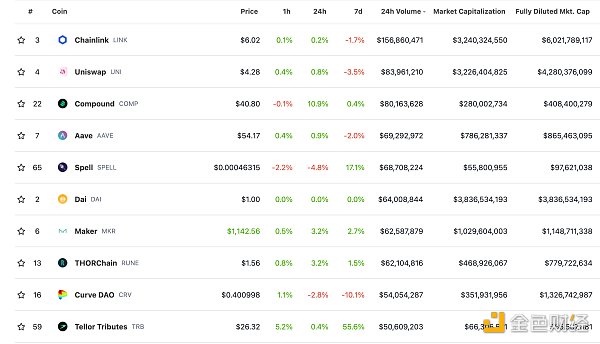

1. Total Market Cap of DeFi Tokens: $41.719 billion

- LianGuai Morning News | Coinbase’s platform delists 38 non-dollar trading pairs

- Gov2 Polkadot’s Next Generation Decentralized Governance

- BitMEX Founder Arthur Hayes’ Token2049 Speech Fiat Debt and AI-Driven Next Bull Market (with PPT)

Data source: Coingecko

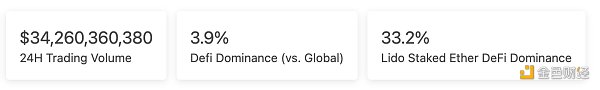

2. 24-hour Trading Volume on Decentralized Exchanges: $3.426 billion

Data source: Coingecko

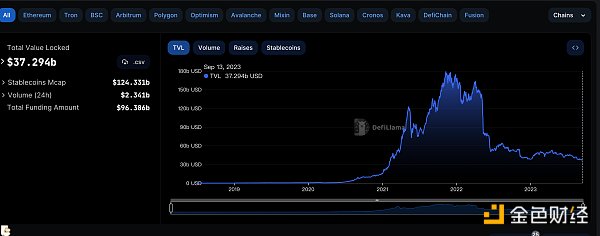

3. Locked Assets in DeFi: $37.294 billion

Data source: Defillama

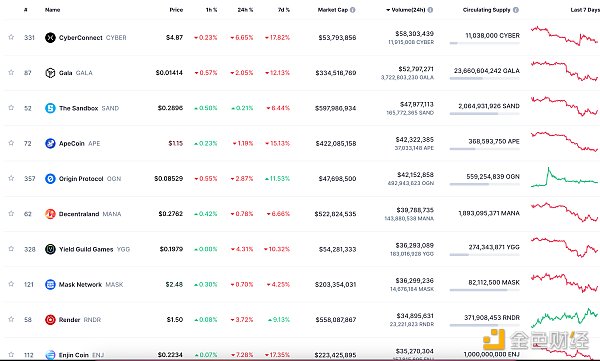

NFT Data

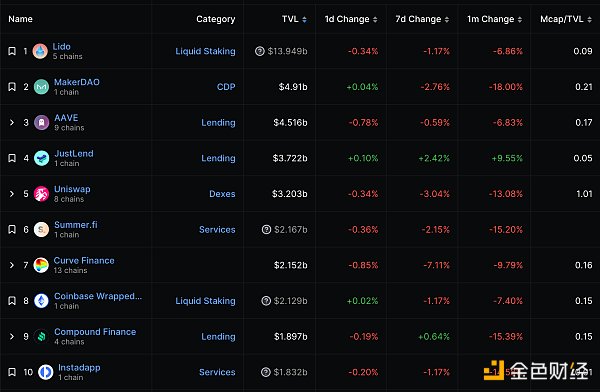

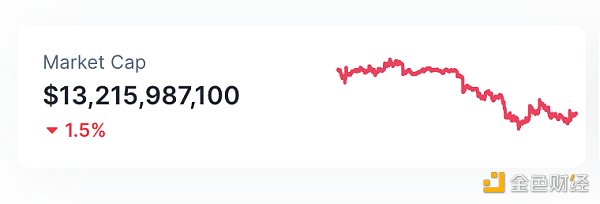

1. Total Market Cap of NFTs: $13.215 billion

Data source: Coinmarketcap

2. 24-hour NFT Trading Volume: $950 million

Data source: Coinmarketcap

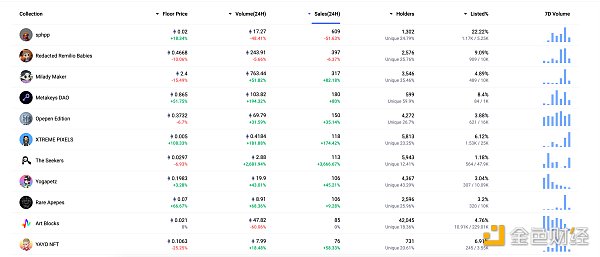

3. Top 10 NFTs Sold in the Last 24 Hours

Data source: NFTGO

Headline

Huobi Renamed as HTX

On September 13th, at the Token2049 conference in Singapore, Huobi was renamed as HTX. According to LianGuai, Huobi’s official X (previously Twitter) account has also been renamed as HTX.

The “H” represents Huobi, the “T” represents TRON, and the “X” represents the exchange business. Huobi HTX has accumulated 44 million registered users, 9 million trading users, and a total trading volume of 31 trillion USDT. The platform’s highest historical assets reached 50 billion USDT, and the highest monthly active trading population reached 3 million.

NFT/Digital Collectibles Highlights

1. Animoca Brands’ subsidiary GAMEE launches Arc8 game partner NFT series “Beasties” and has started minting

According to official news from Animoca Brands, its subsidiary GAMEE has announced the launch of the Arc8 game partner NFT series “Beasties”. Players can already mint for free in the Arc8 app, and upgrading the NFT can unlock in-game benefits. In addition, GAMEE allows “Beasties” NFT holders to mine an in-game token called “Luck” and have the opportunity to participate in special events. It is currently unclear whether the “Luck” token supports in-game payments. As previously reported, Arc8 received an investment of approximately $1.5 million from Binance Labs in 2022, and the current daily active independent wallet count is approximately 10,000.

DeFi Hotspots

1. opBNB Mainnet Officially Launched

On September 13th, opBNB Mainnet was officially launched. In the future, it will focus on enhancing the network’s resilience and decentralization through Proof Enhancement, Account Abstraction, BNB Greenfield’s data availability, interoperability with BNB Greenfield, and decentralized sorters.

2. Astar Collaborates with Polygon Labs to Launch Astar zkEVM, an Ethereum Layer2 Network

On September 13th, Astar Network, the smart contract platform in the Polkadot ecosystem, collaborated with Polygon Labs to launch Astar zkEVM, an Ethereum Layer2 network. Astar aims to expand its cross-chain capabilities with the introduction of Astar zkEVM and become a gateway connecting the Ethereum and Polkadot ecosystems.

3. “The Network State” Author: Decentralized Network States are Possible, Preferable, and Profitable

According to on-site reports by LianGuai, Balaji Srinivasan, the author of “The Network State,” stated at the Token 2049 event on September 13th that establishing a decentralized network state is possible, preferable, and profitable. He mentioned that the conditions for the birth of a network state have already been met, with businesses forming interconnected networks globally, and community identity being the core of today’s society. With tech giants like NVIDIA and Tesla joining the crypto wave and El Salvador adopting Bitcoin as legal tender, the birth of a network state may happen in the near future, although the timing is uncertain. In a network state, digital citizenship will be realized, and gaining diplomatic recognition will have social and political impacts on the network state. Traditional nations and social media giants generate significant GDP and market value through large populations or users and high ARPU, while future network states can rival traditional nations and social media giants in scale through Saas (Society-as-a-Service).

4. Clave Founder: Emerging Markets Lack Institutional Funding in DeFi and Crypto-related Solutions

According to LianGuai’s report, CrossRegional LianGuairtners and Clave founder LianGuaiblo Pizzimbono stated at the Permissionless conference held in Austin, Texas, on Tuesday that emerging markets currently lack institutional funding in DeFi and crypto-related solutions. One way to alleviate the waning interest of investors in emerging markets is to expand the use of stablecoins and central bank digital currencies. CBDCs have more complexity compared to various crypto assets. Pizzimbono attributed this to asset quality, governance, the feasibility of collateral, and scalability. Pizzimbono also mentioned that good assets, good credit characteristics, low default rates, and effective bankruptcy laws are another gateway for institutional investors to enter emerging markets. Scalability is also important for institutions because they won’t see real returns unless their investment exceeds $100 million.

5. Compound Founder: Institutions Will Not Engage in DeFi

According to LianGuai’s report at the Permissionless conference in Austin, Texas, Compound founder Robert Leshner commented on DeFi, saying, “I have a strong opinion on this, institutions will not come.” Leshner is currently the CEO of Superstate, a blockchain financial company. He believes that TradFi institutions want to use DeFi technology without purchasing the tokens that the ecosystem relies on. In his view, traditional financial companies joining DeFi would require tokenizing traditional financial assets and giving up native crypto assets. Leshner stated, “This is the massive divide that will define DeFi for the next decade.”

Game Hotspots

1. Apple iPhone 15 Pro to Support Ray Tracing, Ubisoft and Capcom Games

LianGuai reports that Apple released its iPhone 15 series new phones on Tuesday, which are equipped with new chips and a series of promised upgrades, such as ray tracing. The company claims that this will make video games run smoother on the device. Additionally, according to the announcement, games such as Capcom’s “Resident Evil Village” and “Resident Evil 4 Remake” will also be compatible with the new iPhone 15 Pro model.

In the announcement, Fabrice Navrez, Ubisoft Mobile Executive Producer, stated that the A17 Pro chip enables Ubisoft to provide gamers with higher resolutions, more dynamic lighting, and more environmental visual effects. Ubisoft’s “Tom Clancy’s The Division: Revival” and “Assassin’s Creed: Phantom” will be released on iPhone 15 Pro in 2024.

Disclaimer: As a blockchain news platform, LianGuai’s published article content is for information reference only and should not be considered as actual investment advice. Please establish the correct investment concept and be sure to enhance risk awareness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Full Text of Arthur Hayes’ Token2049 Speech in Singapore The Next Bull Market Will Start in Early 2024

- Opportunities and Limitations of Stablecoins Supported by LSD

- NEAR user count and transaction volume skyrocket, potentially influenced by the token reward program of KaiKai, the chain upgrade.

- a16z Dialogues with Solana Co-founders People Should Try to Create Greater Ideas Instead of Replicating Existing Ones

- Arthur Hayes Post Even if my judgment on the Federal Reserve is wrong, I still believe that cryptocurrencies will rise significantly.

- NEAR’s number of users and transaction volume skyrocketed, possibly influenced by the token reward program of KaiKai, a chain upgrade.

- LianGuaiWeb3.0 Daily | LianGuai Launches Cryptocurrency to USD Exchange Service