"Libra" in the course of history: a 50-year history of man-made currency

Last week, according to a Reuters news agency in Berlin, the Libra basket of currencies accounted for 50% of the US dollar, excluding the yuan.

From the very beginning, Libra gave up regular gameplay and used existing accounting units such as the US dollar, Japanese yen, British pound and Euro to express their monetary value. In other words, Libra's global network will use its own custom Libra currency as the “basic language”.

Now we know what the combination of this basket of currencies might look like:

- No RMB

- 50 U.S. dollars

- 18% Euro

- 14% yen

- 11% pound

- 7% Singapore dollar

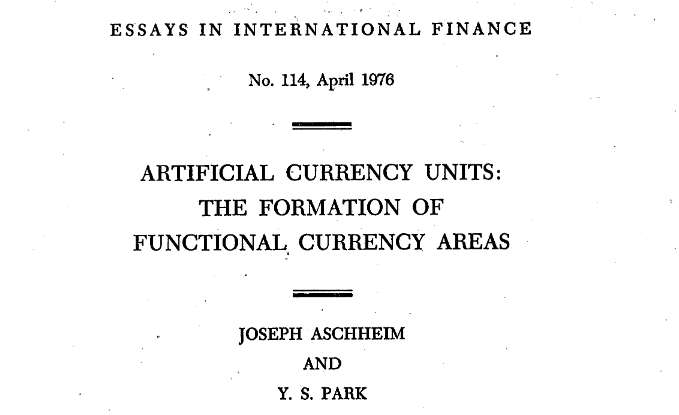

Interestingly, Libra is not the world's first private unit of account. As early as the 1960s and 1970s, several financial institutions had proposed their own custom currency units. I learned this strange and interesting fact from a very readable paper co-authored by two economists, Joseph Aschheim and YS Park.

- Direct access to the Yunqi Conference, a literary view of the ant blockchain ecological summit

- Lambda He Xiaoyang: It is foolish to change the white paper, and the blockchain is advancing in exploration.

- QKL123 market analysis | Bitcoin 200-day moving average shock, the market faces the choice of cattle and bears (0926)

From the paper we can know that the first private man-made currency unit was issued by the Luxembourg Credit Bank , called EUA ("European Bookkeeping Unit"). The EUA was originally designed to anchor 0.88867 grams of pure gold in 1961, and soon the EUA was issued by the Portuguese oil company SACOR. Over the next two decades, the authors said that about 60 bond issuances rely on the EUA as their currency unit.

Between 1968 and 1971, the US Treasury stopped using gold to redeem the dollar. When the Smithsonian Agreement of 1973, a temporary aid that attempted to re-link all currencies back to the dollar, collapsed, the fixed-currency system after World War II came to an end. To help people cope with the sudden currency fluctuations, several new private currency units have joined the EUA of the Luxembourg Credit Bank.

Rothschild International Investment Bank began operating the European currency synthesizer Eurco in 1973. Eurco is made up of nine currencies issued by members of the European Community , including the German mark, the French franc and the Danish krona. According to the authors of the paper, Rothschild International Investment Bank developed Eurco to “evoke investor confidence in long-term bonds,” but as of 1976, Eurcos issued only three bonds.

In 1974, Hambros Bank established the Arab Currency Related Unit (Arcru). Arcru is made up of twelve Arab currencies designed to attract Arab investors with ample oil profits. In the second year, Lyon Credit Bank created a portfolio of ten currencies in Europe and non-Europe, and called it the “International Financial Unit” (IFU). This is a much broader unit of account than Arcru and Eurco . The relative weight of the constituent currencies in the IFU is based on each country's share of international trade.

In 1974, Barclays Bank also officially joined the game of the combined currency. Barclays Bank has issued a currency unit called BcUnit, which consists of five currencies : US Dollar, British Pound, German Mark, French Franc and Swiss Franc. The authors point out that although Arcru, IFU and Eurco are primarily used for bond issuance, B-Unit is designed for international payments.

This made BcUnit directly the predecessor of Libra.

However, looking back today, these private currency units in the list below do not exist. Anyone now want to pay with BcUnit? Certainly not. I think this illustrates the market's demand for such a man-made currency unit . Businesses and consumers don't really like to use them.

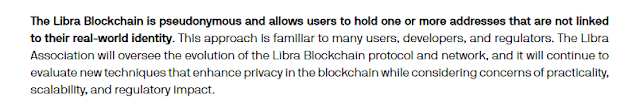

If a private man-made currency unit fails, will the monetary unit made by the government succeed?

Take the International Monetary Fund's (IMF) Special Drawing Rights (SDR) basket as an example: SDR has existed since 1970 and is nearly 50 years old. If you need to use a public man-made unit for international payments, then commercial banks will certainly meet this demand by implementing an SDR-denominated payment system. In fact, the author of the paper speculated this possibility in this 1976 paper.

It is worth reading the excerpt in full:

Again, looking back today, how many other banks will allow you to open an SDR-denominated bank account and make SDR payments? I do not know. Perhaps the IMF's SDR has never been carefully designed, or Barclays Bank is too small to push the adoption of B-Unit – but one more likely scenario is the author's SDR, BcUnit and other private currencies mentioned in the paper. Units are dead ends of the history of money. On this same road, Libra may have made a big mistake.

What is the reason why the artificial currency basket cannot be successful? I have already explored this issue in my first article on Libra. I will repeat my argument below to save you the time you need to go back and read the article.

Let's imagine that in another parallel world, Facebook has introduced a rule: Only after learning Facebook's original private language “Facebook” , users are allowed to join the Facebook platform and chat with other users. The Facebook platform prohibits the use of everything in English, French, Chinese and all other languages.

In this parallel world, all Facebook users can get to know each other because everyone is proficient in the same language – "Facebook." "Understanding" others is a particularly important thing. The problem is that almost no one will be the first user of Facebook. Who wants to work hard to learn a new language? At least I don't want to.

In the real world, the Facebook platform has long opposed the use of methods like "face books." Instead, Facebook supports a wide variety of local languages : Arabic, Chinese, English, Hindi, and more. Of course, one drawback of this approach is that we don't know what Facebook users in other countries are saying, but at least the user is relieved of the obstacles of learning a new language and a new grammar. Thanks to this simple and clear design choice, the Facebook platform has ushered in a thriving development.

Using Libra accounting units is equivalent to forcing users to learn Facebook's new currency. While we all use the same currency unit in Libra's global network, this approach ignores the cost that all of us have to bear when learning a new currency model. From a very young age, we all know how to "speak money." We communicate in local currency units. As a Canadian, the Canadian dollar has always been a means for me to describe prices, remember values, and make cost-effective calculations for people around me . Facebook wants to force all of us to learn a new currency language, a Libra-based currency language – but doing so creates a huge barrier to adopting the currency language itself.

So let me repeat: no matter how subtle the technology of designing "Facebook" (or Libra), artificial language and man-made currency units are dead ends. They are utopian and are not friendly to people. (Well, I might have described this point better in the earliest article, so please continue to check it out.)

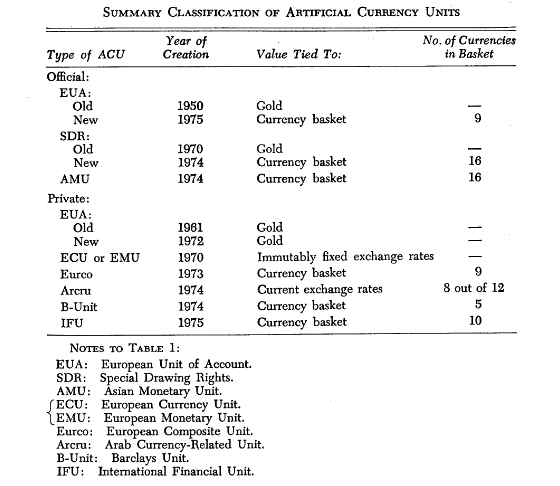

Having said that, I have been slowly warming up Libra for the past few months. Of the millions of blockchain projects that have emerged over the past decade, Libra is similar to the Fedcoin vision I outlined on the 2014 blog. First, Libra's currency will be stable (unlike Bitcoin) thanks to a reliable and powerful issuer; and because it is distributed, the Libra network will be more resilient. Moreover, since Libra is a token, not an account, it should be relatively open for everyone to use. At the same time, David Marcus , the architect behind Libra, understood the financial privacy correctly, and he also made the right voice (of course his intentions are true and hard to say).

I think (I may be wrong), consumers are increasingly looking for more financial privacy. Unfortunately, governments are biased towards the post-9/11 thinking that privacy is a universal threat. Facebook may be one of the only organizations with large financial resources to express consumer demand for more privacy in ways that regulators cannot ignore.

Making Facebook an advocate of financial privacy is likely to be a fragile victory. If Libra (and the financial privacy it promises to bring to mainstream consumers) cannot be widely used due to a fundamental design flaw , it would be too bad, and this flaw will force us all to adopt and "face books." "A similar new currency.

If the correct approach is not a “man-made currency basket,” what should Facebook do? I think most consumers who engage in cross-border transactions want to keep using their national currency, only at the moment of "buy now" or "send immediately" (ie, when the purchase is completed, or when the funds are transferred to a friend) We are willing to leave the cover of our national currency. Let users pre-store some strange foreign currency , whether it is SDR, B-Unit or Libra, this requirement is very difficult to complete.

If it is to maintain user friendliness, Libra needs to design its network to allow tokens denominated in national currencies (US dollars, Chinese yuan, British pounds, Indonesian rupees) to be freely circulated. Then, it also needs to design a cheap, transparent and easy way to make these tokens move from person to person. This is what PayPal does, and what Transferwise, Visa, and MasterCard are doing. None of these platforms created their own currency units and invented a bunch of strange currencies called PayPalios, TransferWise Unit or Visa-oos. These platforms allow users to stay in their home currency systems, ensuring adequate security until the last "send immediately" moment.

So, apart from the criticism of Libra's decision to use a man-made currency unit, what do I think about the form of a basket of combined currencies?

I don't know what process David Marcus and Facebook will use to generate a basket of combined currencies. Potential Libra users may want to know in advance how to update the currency combination in the basket over time. After all, if the user's wealth is to remain on the platform, they will want to know how to prevent Facebook from suddenly rewriting the currency combination and proportion in the basket, and benefiting the network at the expense of the user's wealth.

An important rule everyone wants to know is what kind of economic threshold Libra will use to "filter" or "add" currencies. For example, if the Korean won began to become a popular international currency, when will Libra decide to include the Korean won in the basket? If the decision is included, will Libra issue another currency to make way for the Korean won or keep it?

The current Libra components are absolutely weird, and they didn't disclose what the architects would do to fill the Libra currency basket. For example, I don't know what kind of selection process or rules are in place to determine the Singapore dollar's 7% of the so-called "global currency." Don't get me wrong, I like Singapore very much. However, Singapore does not account for 7% of world trade, does not account for 7% of the world's population, and does not account for 7% of any trade in the world. So, how does the figure of 7% come from? of?

Also, why does the euro account for only 18% of the Libra currency basket, while the US dollar is 50% exclusive? The EU has twice the population of the United States and a much larger share of exports. And, where is the renminbi? For political reasons, choose to give up?

Some people suspect that the small share of the euro and the negative interest rate in Europe may have an impact on network profits. For each Libra that has been issued, the consortium will have to retain Libra's asset reserves. If you reduce the euro portion of a basket of currencies and increase the dollar portion, you can get a bigger profit . After all, this means increasing the entry of high-yield dollar assets and reducing the entry of negative-income European assets. But this is a very scary way to build a currency basket.

Finally, my idea is: If Libra artificially chooses a private currency unit as the basis for its global currency, then it should only use the IMF's SDR basket instead of brewing a strange currency combination.

Think about why the ETFs that track the index are outsourcing all decisions about the index methodology and composition to third parties such as Standard & Poor's, MSCI and FTSE. Because this will make exchange traded funds more credible. The use of SDR will allow Libra to avoid conflicts of interest and exempt political responsibility, while the International Monetary Fund becomes the protagonist in determining the currency basket.

(Finish)

original:

Https://jpkoning.blogspot.com/2019/09/a-fifty-year-history-of-facebooks-libra.html

Author: John Paul Koning

Compilation: Orange Book

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Deng Jianpeng: Gibraltar Blockchain Regulatory Policy and Its Deep Thoughts

- The real story of the turmoil in the repo market, why do bitcoin have better anti-vulnerability?

- Yesterday Bitcoin computing power plummeted 30%? The actual situation is not that simple

- Interview with Babbitt | Expanding the definition of smart contracts, how does Chainlink build the safest predictor?

- Gavin Wood: Cosmos is not enough to trust, not enough to expand

- Ethereum is blocked and falling, and DeFi does not work at all.

- Research|Lawyers' Views: Staking Economy Legal Risk Analysis and Response (I)