Re-examine the investment value of hard currency bitcoin in the era of negative interest rates

Everyone is talking about negative interest rates . Yes, we are not far from the world of negative interest rates. Rick Rieder, chief investment officer of BlackRock, the world's largest asset manager, asked an official blog last week: What is the end of monetary easing? The capital market and the whole society will move toward an era where there is no historical experience to refer to; under negative interest rates, there is no "hard currency" at all.

We can't help but ask, in the era of negative interest rates, is Bitcoin enough "hard"? It’s better to forget about the currency. We must trust the bank to keep and electronically transfer our deposits, but they borrow a lot of money with little reserve and generate a credit bubble.

—— Nakamoto Satoshi becomes the main axis of my life. I am often immersed in the cryptocurrency market and its bull market cycle. I am shocked that I have been stuck for too long. I forgot the fact that I don’t have any Bitcoin. Experienced a truly complete global economic cycle.

- Thailand's state-owned natural gas group PTT and non-profit organization to build blockchain renewable energy platform

- Bakkt three-step test, why are bitcoin ETFs all the way?

- Cycle observation | New cycle? Four possibilities for Bitcoin's future

Bitcoin was officially born in 2009 and has been around for ten years. 2009 was a special year. The biggest financial crisis after World War II – the US subprime mortgage crisis has just passed; it also coincides with the economic bottoming out, the longest bull market in the history of US stocks – the beginning of 3,453 days.

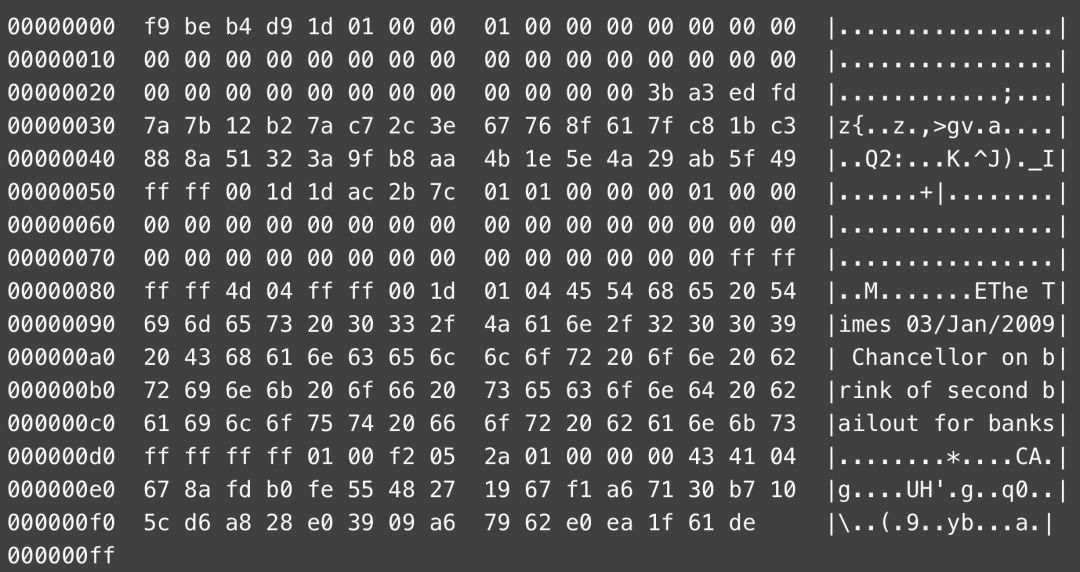

"On January 3, 2009, the Chancellor of the Exchequer is on the verge of implementing the second round of bank emergency assistance."

This sentence has been recorded forever in the Bitcoin creation block.

A report published by BitMEX , " Bitcoin Economics: The Potentiality of Credit Expansion and Money Makes Bitcoin," writes: Banks can create new loans and expand economic credits almost at random, causing inflation. The credit cycle is generally considered to be the core driver of the modern economy. Ray Dalio , founder of Bridge Water Fund, also believes that the credit cycle is the main reason for the fluctuation of economic growth. The theory is also very popular in the Bitcoin community, known as the " Austrian business cycle theory" .

If you jump out of the time span of the currency circle, it can be said that the golden age of bitcoin from the origin to the barbaric growth is just in the relatively prosperous economic cycle in which the global economy bottomed out, and it is also based on the central bank of the modern banking system to raise interest rates. Against the background of the main axis to avoid inflation and overheating.

The fish are trapped in a place with water shortages. The test we face with Bitcoin will not only be trapped in the so-called "coin circle", but everything has not yet been experienced, and the test that will surely be experienced in the future is in the context of the entire global economic cycle.

The era of negative interest rates: things we have not experienced with Bitcoin

In most economic models, there is only one way to stimulate economic development, namely, adjusting interest rates. Under such an economic model, if we continue to give economic impetus, we will enter the era of negative interest rates sooner or later.

The Fed announced a rate cut of 25 basis points on August 1 this year, and lowered the federal funds rate target range to 2.00% to 2.25%, which is the first time in 10 years since the US cut interest rates. In Denmark, the bank's interest rate setting method also appeared upside down. On the one hand, the country's third-largest bank, Jutland Bank, decided to impose a negative interest rate of 0.6% on large deposit accounts, and on the other hand, launched the world's first negative interest rate housing loan.

In the context of central banks turning "doves", global negative interest rate government bonds accounted for more than historical highs. According to Wind Info data, as of the end of August, there were about 18 trillion US dollars of negative interest rate bonds in the world, which is twice the number at the beginning of the year. The fundamental reason is that the central bank has further introduced monetary easing policy in anticipation of the global economic downturn. Concerns about the global trade environment and economic downturn dominated the market, and political issues such as trade wars have further aggravated market panic.

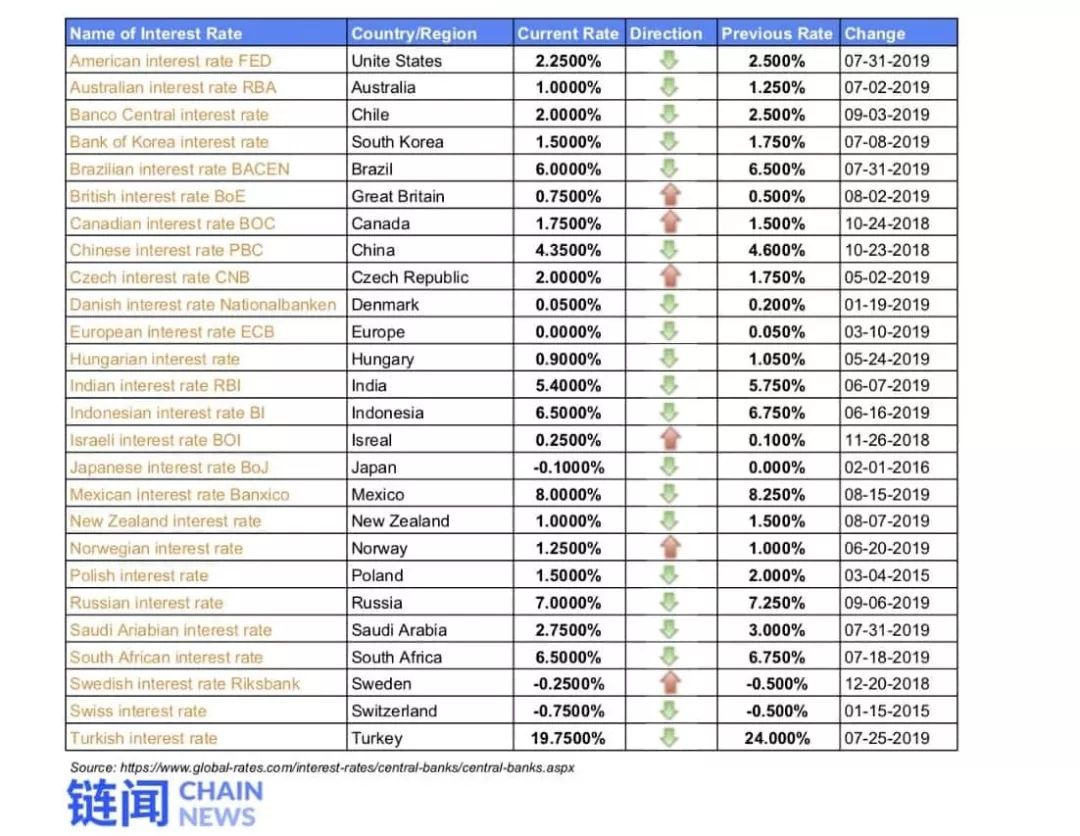

According to Global-rates.com data, as of July 2019, among the 26 countries or economies in the world, 20 countries or economies have a downward trend in interest rates, and the economy with zero interest rate is the EU, with negative interest rates. There are 3 countries, including Japan, Sweden, and Switzerland.

What does negative interest mean?

One of the biggest concerns of governments around the world since 2008 is deflation . In the case of a negative inflation rate, but the real interest rate is still greater than zero, the real interest rate rise will result in gross domestic product (GDP). ) Reduced and vicious cycles of further reductions in deflation expectations.

To put it simply, negative interest rates mean that commercial banks' deposits at the central bank also have to lose money, that is, they do not encourage commercial banks to deposit excessive excess reserves in the central bank, but encourage commercial banks to lend as much as possible. Negative interest rate policy is often considered a monetary easing policy to deal with economic deflation.

Economist William White has said that in most economic models, there is only one way to stimulate economic development, namely, adjusting interest rates . Under such an economic model, if we continue to give economic impetus, we will enter the era of negative interest rates sooner or later.

At present, the global economic situation is still unknown, and the negative interest rate policy also has a certain degree of political obstacles in its implementation. We can only say that in the context of the deflationary risks of the global economy, we need to pay attention to the problem of low interest rates, as well as the issues discussed in this article. Based on the assumption that the world is about to enter the "negative interest rate era", the macroeconomic environment has an impact on the asset class that has never existed before, that is, the cryptocurrency represented by Bitcoin.

Negative interest rates meet Bitcoin at first: seemingly not good

The first thing to show is that some investors, including myself, believe that Bitcoin is “digital gold” and will often compare Bitcoin with gold and highlight their value in dealing with inflation.

Historical experience tells us that bitcoin is sought after in Venezuela, where inflation is the most serious, or in Turkey and Argentina, where interest rates are high and currency crises have recently exploded. There are different levels of premium.

Venezuela's shortage of goods is inflationary, source: Mario Tama/Getty Images

Deflation is the opposite of inflation. In theory, the deflationary era has reduced the need for investors to hedge inflation. According to this logic, in the era of deflation, investors holding dollars and other legal currencies do not have to worry about inflation in their base currency, which may increase the allocation of cash assets and reduce the holding of assets such as gold or bitcoin. The price of the currency will decrease.

But is this really the case?

In reality, we cannot judge the final impact of monetary policy on prices by a single factor. In particular, bitcoin, as an asset class that never appears, does not only have the need to hedge inflation, but some investors also Think of it as an emerging hedge asset to hedge against the downside of traditional global finance.

From the perspective of hedging inflation risks, as an asset allocation logic, it will definitely have some impact on the asset allocation ideas of institutional investors and large fund managers. The entry of traditional financial institutions will indirectly affect Bitcoin. The price has risen and fallen.

Double-edged sword under negative interest rate: "opportunism" prevails

Negative interest rates bring two extremes: On the one hand, more and more negative yield bonds will fall into the "lower for longer" quagmire, with lower yields and longer maturities; on the other hand, negative interest rate expectations will lead to high returns. High-risk junk debt performance will be particularly dazzling.

Junk Bond, also known as inferior bonds, high-yield bonds, is a bond with a low credit rating. Jam bonds are issued by small and medium-sized enterprises with low commercial credit capacity, emerging companies, and companies with bad debts. High, you need to attract investors by increasing the rate of return.

Junk Bond is an unexpectedly eye- catching asset, source: barrons.com

Andrew Wilmont, senior investment manager at Pictet, said that under negative interest rates, the market will continue to seek high yields and junk bonds will become "new hunting grounds for speculators."

The cryptocurrency we are familiar with in the early days attracted and scared countless investors because of its exaggerated high yield and high volatility. In terms of Bitcoin, the current price of Bitcoin has risen 150 times compared to the July 2013 price ($65) , which is also a double of the December 17 price ($20,000) .

From the perspective of short-term price fluctuations, speculators or short-term investors can also consider cryptocurrencies such as Bitcoin as high-risk, high-return asset classes. At the time of negative interest rates, speculativeism prevails. Whether or not there is a high-yield expected property is still crucial, attracting profit-seeking investment groups in every era.

Stabilizing the currency

Gold or bitcoin will not be the only potential beneficiary in the economic downturn, and the stable currency anchoring the US dollar or a basket of legal tender will also be greatly attracted by the public in the context of future economic downturns and instability of the Securities and Futures Commission. force.

As we mentioned earlier, negative interest rates mean that commercial banks’ deposits at the central bank are also losing money. The central bank implements negative interest rates. The most unfortunate is often commercial banks. On the one hand, there is no interest on the central bank's reserves. On the other hand, banks have to pay positive interest rates on the people's savings. Sherti Vadera, chairman of Santander's Bank of England, once said that it is difficult for banks to pass negative interest rates to retail customers.

In theory, assuming that the central bank implements a negative interest rate policy, residents and households will increase their debts and consumption, because people's savings in the bank can get lower interest, and the interest to pay for bank borrowing is lower. Consumption growth will stimulate economic growth. .

So can this inference be realized in reality?

Charles Goodhart, a professor at the London School of Economics, expressed doubts about this inference, saying that the European Central Bank is supposed to announce a cut in the benchmark interest rate to minus 10% tomorrow. The first reaction of many people is definitely: Are the decision makers of these central banks crazy? Due to the huge uncertainty brought about by negative interest rates, people will not increase consumption, but will increase savings and reduce consumption.

According to the Wall Street Journal, Germany has been trying to implement a negative interest rate policy in recent years. After years of falling deposit rates, depositors have begun to move away from the traditional way of depositing bank deposits. Many people now find a safer place to deposit cash, that is, safe deposit boxes. .

Uwe Wiese, 82, a 82-year-old pensioner in Germany, said that if he deposits money in a safe, he will not be charged by the bank and intends to deposit his pension in a safe. Burg-Waechter KG, the largest safe manufacturer in Germany, said that in the first half of 2016, sales of safes increased by 25% year-on-year.

Managing Director, Ha mburger Stahltresor GmbH

Economists never imagined that negative interest rates have increased the demand for safes.

In addition to the safe, is there a tool that can both preserve value and satisfy people's sense of security in their hands?

The answer is simple: stabilize the currency . Stabilizing coins can satisfy the public's need for value preservation, and it can also satisfy the public's sense of security in keeping their money in their hands.

In the future, stable coins will play an increasingly important role in connecting the legal currency market and the encryption economy. If the real economic winter comes, people gradually realize the role of stable coins. In the context of the ever-decreasing technical threshold, the demand for stable coins remains It will be exaggerated, and we expect that some of the premium stable coins are likely to maintain a positive premium for a long time.

In addition to stabilizing the currency, but another heavy market factor – the central bank digital currency , in fact, is essentially a digital stable currency based on national credit issuance.

Meguro, the deputy governor of the Bank of Japan, believes that the central bank's digital currency (CBDC) will not receive widespread support. The premise of the widespread adoption of the central bank's digital currency is the decline in cash. He added that if the digital currency still has negative interest rates, people will still choose cash to reduce expenses, thus limiting the adoption rate of the central bank's digital currency.

Although the development of the central bank's digital currency will take more time to achieve, and may reduce the demand for ordinary stable currency in the development process, we believe that the issuance of central bank digital currency will play a significant positive role in the acceptance of cryptocurrency by the public.

Bitcoin has opportunities in emerging markets

In theory, deflation is generally accompanied by a recession, and insufficient demand leads to falling prices. Under this circumstance, the company's profit declines or even loses money. The company can't afford wages, employees are laid off, and it has accumulated a certain amount of bankrupt banks to form bad debts, and even systemic risks may occur.

Historical experience tells us that when the economy begins to decline, Western developed countries can indeed implement appropriate monetary easing policies to stimulate economic demand, to change the cycle, or to achieve a soft landing of the economy in the transition of the global economic cycle.

But the most vulnerable are still emerging economies with relatively weak economies. When the era of negative interest rates really comes, the first to be affected and long-term affected are the emerging economies, such as Thailand, which broke out in 1997 when the Asian economic crisis began. The currency crisis in Venezuela, Turkey and Argentina, which has been affected by the international situation, has escalated.

The long-term stagnation theory proposed by Lawrence H. Summers in 2013 points out that in some cases, Keynesianism is ineffective, and insufficient demand will result in an approximation of permanent damage.

When emerging countries or economies are unable to control their own destiny in the international situation, some central banks have chosen to print banknotes properly in the country to support domestic demand. At the same time, people began to choose safe havens for cash, such as buying dollars and euros in large quantities. But what often happens is that when the Argentine currency crisis began to escalate in September, Argentine nationals were restricted from buying dollars. The government stipulated that only $10,000 per month was allowed. The excess requires special permission.

The Central Bank of Argentina restricted nationals from making dollar purchases in order to restore confidence in the plunge in the Argentine peso.

So is there a currency that can be purchased anywhere in the world? Although there are certain technical thresholds, Bitcoin is likely to be limited by the nature of the purchase, and is likely to be affected by the development of emerging economies that are affected by the economic downturn.

"paradigm shift" worth pondering

"Paradigm shift" refers to a shift from a fundamental assumption in basic theory.

Going back to the article that led to our question, Rick Rieder , chief investment officer at BlackRock , wrote at the end of "What is the end of monetary easing":

Everything that people now have in various legal currencies, including stocks, real estate, and even hard currency such as gold, will depreciate together in the event of a depreciation of the local currency (especially the central bank cut interest rates to negative interest rates), with no exceptions.

The logic behind the negative interest rate is essentially the expectation of the economic downturn and the long-term decline in the market.

Before the advent of the financial crisis in the past, because the information was only in the hands of a small number of people, ordinary people could only be aware of it and passively beaten. What is different from the past era is that although we can't predict where the future will go, will the negative interest rate era really come, but we can clearly know that some people have perceived and thought about potential changes, and those top investors are far superior to ordinary people. Thinking and anticipating, we are also at your fingertips.

Perhaps the report of the Paradigm Shift, written by Ray Dalio, founder of Bridge Water Fund, has given the answer:

In the future, from the re-inflation of central bank-led priming at the beginning of this century, to the transition to an unsustainable huge debt and increasing geopolitical tensions, the investment portfolio can increase gold, as well as other “depreciation in the currency, domestic And good assets can be demonstrated when international conflicts continue."

Ray Dalio, the billionaire investor and founder of Bridge Water Fund (Source: bravenewcoin.com)

Based on the thinking of these smartest investors, I will analyze and predict Bitcoin in the future negative interest rate era, and finally return from rationality to sensibility: I think Bitcoin only produces ten years, but it contains human beings. A good vision for the future of the financial world, I want to end with a poem by Du Fu:

Er Cao is out of the name and does not cost the rivers and rivers.

reference:

BitMEX: Bitcoin Economics – Credit expansion and money characteristics create the possibility of Bitcoin

Https://blog.bitmex.com/en-us-bitcoin-economics-credit-expansion-and-the-characteristics-of-money-part-2/

Rick Rieder: The monetary policy endgame

Https://www.blackrockblog.com/2019/09/05/monetary-policy-endgame/

Ray Dalio: Paradigm Shifts

Https://www.linkedin.com/pulse/paradigm-shifts-ray-dalio/

Wu Zhijian: What does negative interest rate mean?

Https://zhuanlan.zhihu.com/p/22657662

Kevin Virgil: Bitcoin in a Deflationary Age

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research | Data Compliance, Reptile Technology Interprets Legal Issues

- Swiss FINMA issued a guide to the stable currency, proposing Libra to obtain the necessary conditions for payment of the license

- Close the back door of the transaction, Zcash is the biggest defect or is solved due to this program

- What kind of consensus algorithm do we need?

- Liang Xinjun: In the next fifteen years, blockchain restructures social production relations

- Encrypted synthetic assets DIY era is coming, UMA brings DeFi new explosion point?

- It’s better to chase the wind than to create the wind – to pay tribute to the participants in the Ant Blockchain Innovation Competition