Blockchain Industry Development Monthly Report: Blockchain Financing Market Meets Cold Again in February, Fiat Digital Currency Track Is Hot

Foreword

In order to better understand the development status of the global blockchain industry in February 2020, Zero One Think Tank and the Digital Asset Research Institute will jointly invest in and invest in blockchain, mainstream crypto digital currency market, policy orientation, domestic industry development trends and global news. Dimension, striving to "decrypt" the latest trend of the blockchain industry.

Industry Overview at February

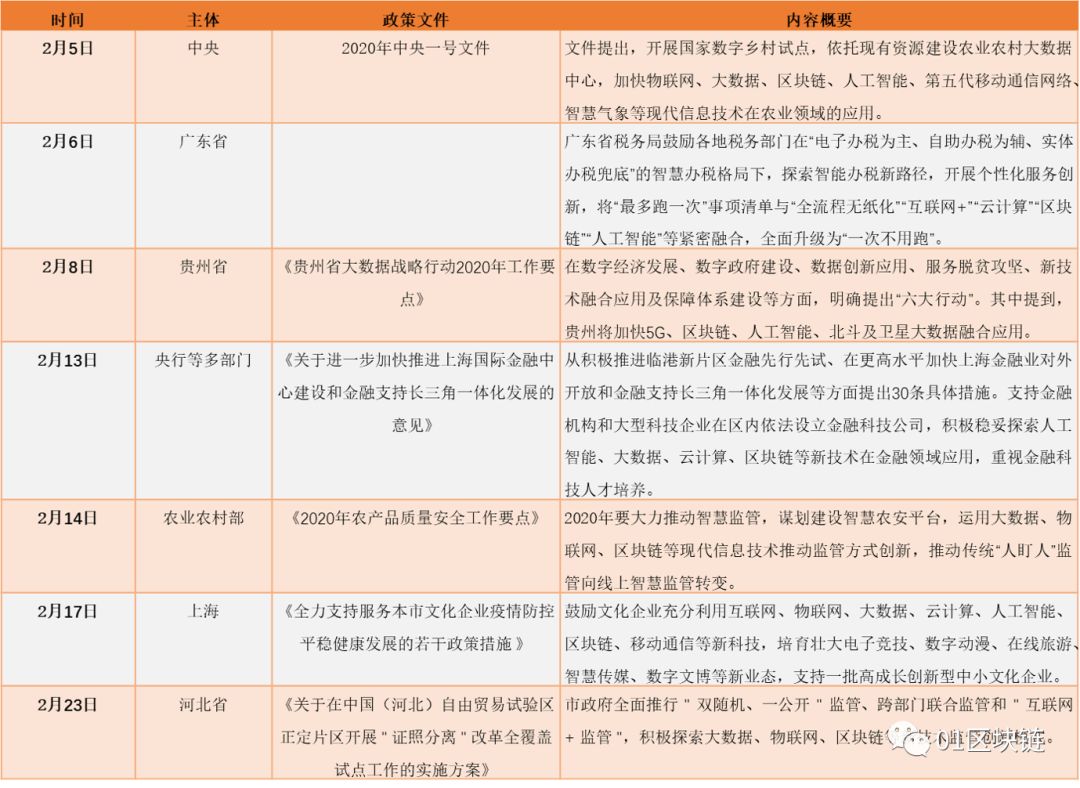

- In 2020, the Central Document No. 1 proposed to accelerate the application of blockchain and other technologies in the agricultural field;

- Shanghai Customs strengthened the research on the innovation of the customs system for new technologies such as blockchain;

- Since the launch of the Central Bank's gold trading blockchain platform, its cumulative business volume has exceeded RMB 90 billion;

- Beijing's blockchain-based supply chain debt and debt platform has been officially launched;

- Forbes released a list of the top 50 blockchains, and Baidu, Ant Financial, and Tencent were on the list;

- Huobi China will soon launch a blockchain BaaS platform to create an industry application ecological cluster;

- China Mutual Fund Association guides the launch of donation and certificate public welfare platform, with blockchain technology blessing;

- Donghua Software undertook the information system of Vulcan Mountain Hospital and established a health file and health data sharing platform based on blockchain.

- Australia launches national blockchain strategy;

- Spain approves fintech sandbox plan to allow crypto-related companies to use controlled test platforms;

- Brazilian central bank will launch instant payment system to deal with cryptocurrencies;

- KLM uses R3 blockchain technology for financial processing;

- British blockchain company Agriledger creates a blockchain system for Haitian farmers to increase their income.

- In February 2020, a total of 27 financing events occurred in the global blockchain industry, with financing of USD 154 million;

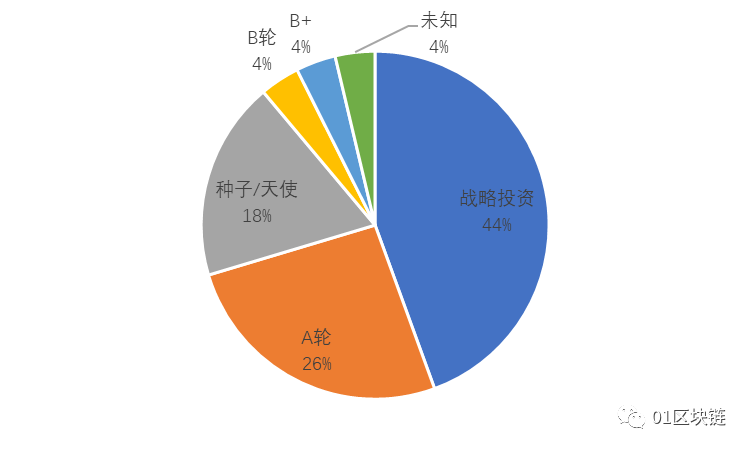

- Round A and strategic investment were the mainstays, and another 6 M & A events occurred;

- The amount of financing in February was relatively concentrated in the millions and tens of millions, and no large-scale financing of more than 100 million yuan occurred;

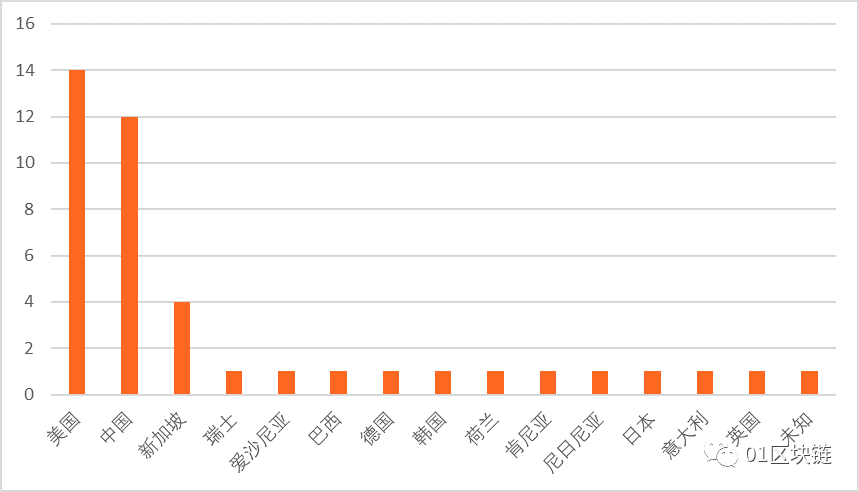

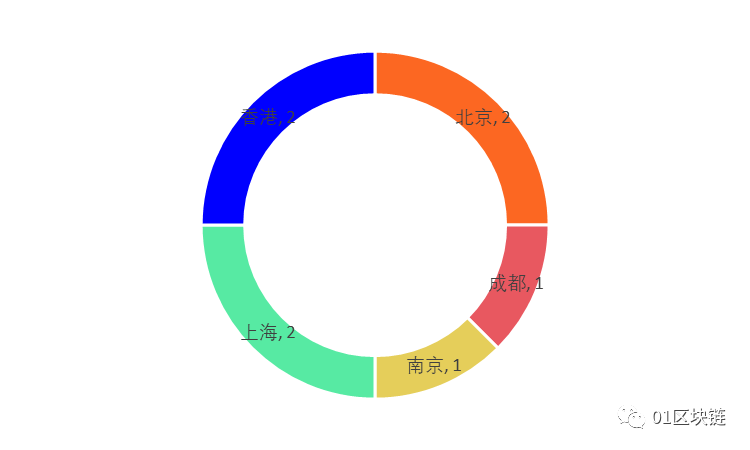

- U.S. blockchain financing activities are the most active, and domestic financing is dominated by North Shanghai Port;

- The popularity of digital asset-related scenarios continues, and the overall performance of the industrial blockchain is not good;

- The overall amount of blockchain financing in February was low. The highest amount of financing in a single month was the $ 30 million investment obtained by the US cryptocurrency loan company BlockFi.

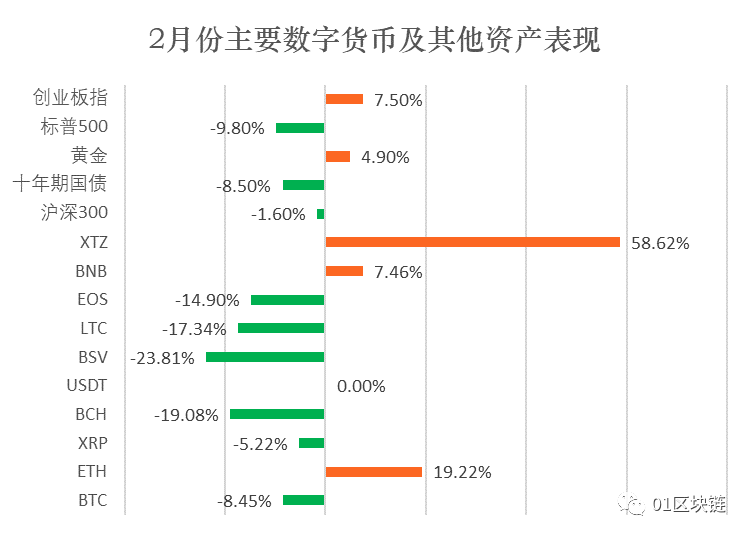

- Bitcoin price fell by 8.45% and is currently quoted at $ 8657;

- Ethereum rose sharply in February with a rise of 19.22% and is currently quoted at $ 221.9;

-

XTZ has the largest increase, rising 58.62% in one month, ranking among the top ten in market value; BSV has the largest decrease, falling 23.81% in a single month.

Investment and financing situation

- Observation | OKEx triggers "destruction war", why is absolute deflation worth learning in the currency circle?

- Industry Blockchain Weekly 丨 Baidu's financial report mentions blockchain again

- Research | How Does Blockchain Technology Promote the Transformation of Charities?

In terms of mergers and acquisitions, a total of 6 related events occurred in the blockchain field in February. Among them, Singapore-based fintech group Uniweb recently completed a comprehensive acquisition of Jubi.com (China) and has submitted an application for a digital currency trading license in Singapore.

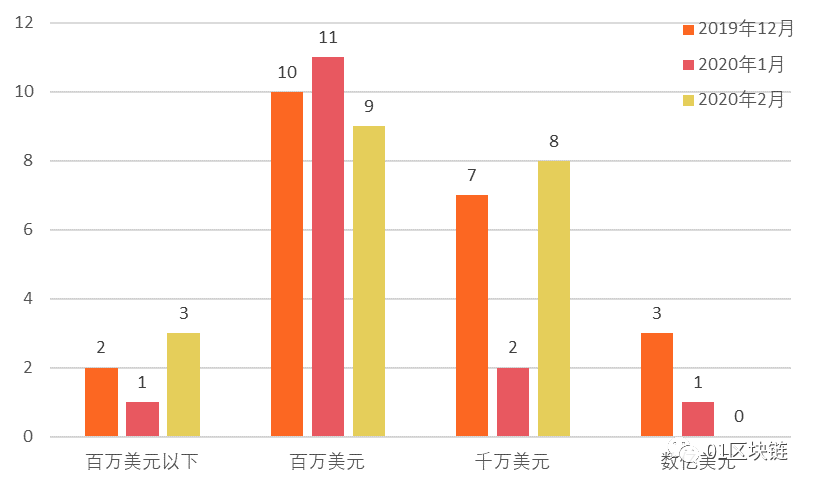

Compared with the previous two months, the amount of blockchain financing distributed in February was basically stable in terms of millions of dollars, and the number of tens of millions of dollars rebounded after a trough in January, which was basically the same as in December 2019, but 100 million Large-scale financing of more than RMB 100 million fell monthly, and no large-scale financing of more than RMB 100 million occurred in February.

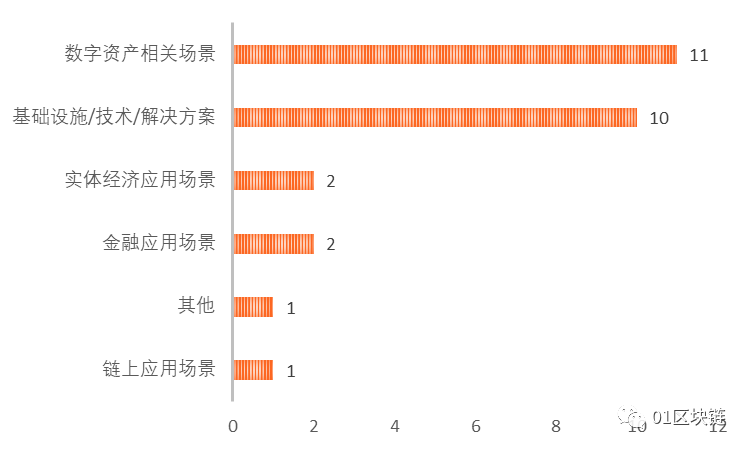

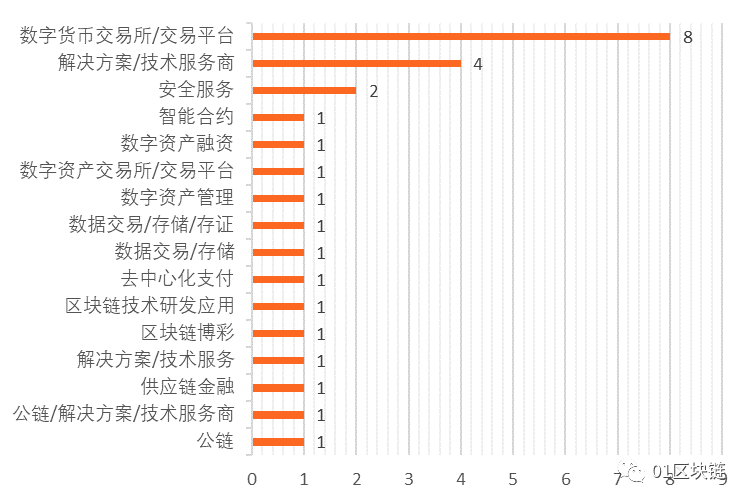

From a broad perspective, digital asset-related categories (including exchanges / trading platforms, digital currency wallets, digital asset management, etc.) and blockchain infrastructure technology / solutions are the most popular tracks in the capital market in February. 21 related track companies received financing, accounting for 77.78%. The physical application scenario and financial application scenario actively guided by domestic policies performed poorly last month, with two financing incidents each.

It can be seen that the most active areas of the blockchain industry are still related to digital currency / digital assets and the underlying technology of the blockchain. The blockchain application layer is in the early stages of development and its overall performance in the capital market is poor.

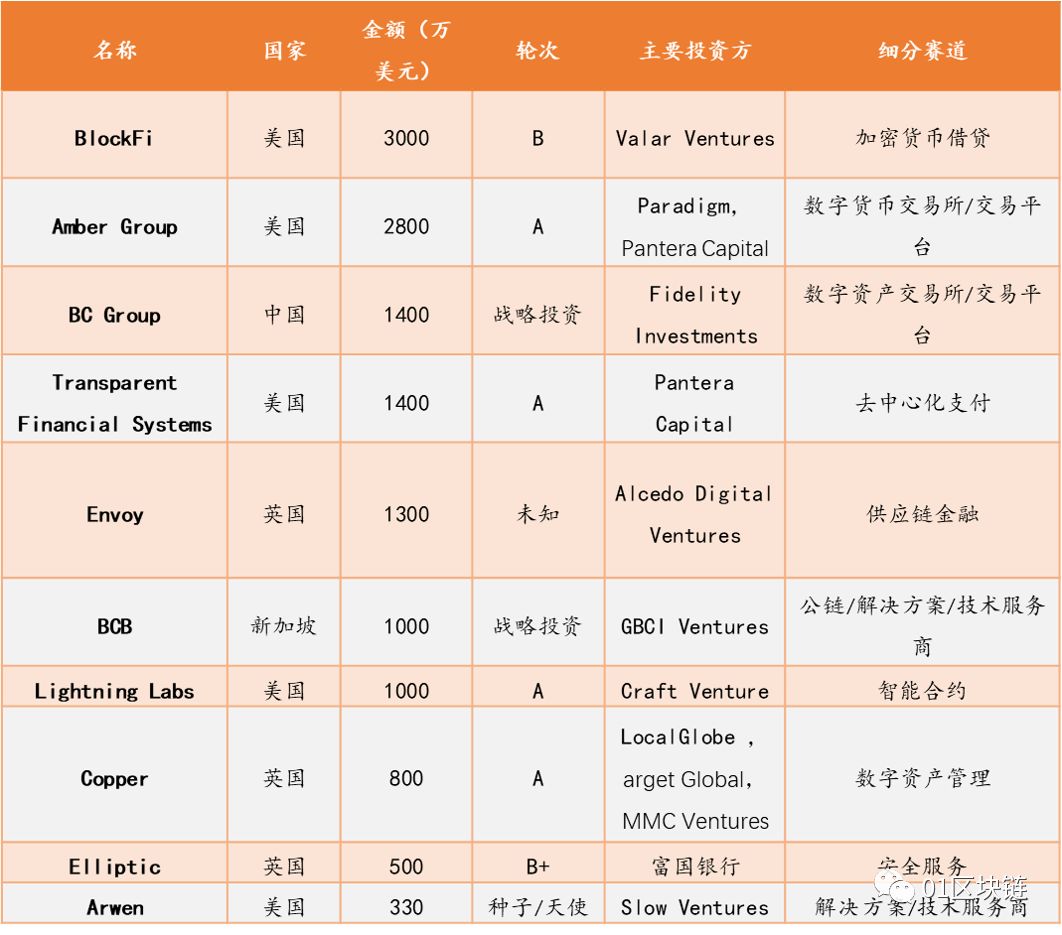

1. The Top10 list was basically ranked by the British and American, among which 5 items in the United States were selected and 3 items in the United Kingdom were selected;

2. Hong Kong Cryptocurrency Exchange OSL operator BC Group received 14 million strategic investments and became the only Chinese project selected in the Top 10 list of blockchain financing in February

3. The overall amount of blockchain financing in February was relatively low. The highest amount of financing in a single month was the US $ 30 million investment obtained by the American cryptocurrency loan company BlockFi;

4. Among the TOP10 projects, there are 5 projects related to digital assets, 2 projects related to the underlying technology / solution of the blockchain, and 1 project for each of the remaining smart contracts, security services, and supply chain financial scenarios. The overall scenario distribution in the blockchain field in February was similar.

Digital currency market market in February

Industry News

The Central Bank's trading gold blockchain platform has run a number of businesses including supply chain receivables multi-level financing, cross-border financing, international trade account supervision, and external payment tax filing forms. For more than a year since the platform went online, the number of connected banks and businesses has continued to increase. Data show that as of mid-January 2020, there were 44 banks and 485 outlets participating in the promotion and application, and 1898 companies that had business operations, achieving more than 30,000 business on-chain transactions and more than 8,000 business transactions. The cumulative business volume exceeded 90 billion yuan.

[Beijing's blockchain-based supply chain debt and debt platform has been officially launched]

Beijing's blockchain-based supply chain debt and debt platform has been officially launched. The platform uses the Beijing Xiaowei Financial Services Platform, a subsidiary of Beijing Financial Holdings Group, as the unified entrance. Through the underlying technology of the blockchain, the government and the state-owned enterprise procurement contract receivables are confirmed, and various financial resources such as financing guarantees and asset management are aggregated. Provide SMEs with comprehensive supply chain financial services quickly. The main functions of the platform include: providing proof of account confirmation based on blockchain technology, and supporting online management of the confirmation process; supporting small and medium-sized enterprises to initiate financing needs online after obtaining the confirmation of the authorization, and launching the "confirmation of rights" "Loan" products; support banks to review financing applications, credit management and loan management.

[Forbes releases list of the top 50 blockchains, and Baidu, Ant Financial, and Tencent are on the list]

Forbes released a list of the top 50 blockchains on Wednesday. Organizations entering the top 50 need revenue or valuations of more than $ 1 billion. The list includes many industry giants from finance and technology, such as JP Morgan Chase, Citibank, HSBC, ING Group, Amazon, Google, Microsoft, BMW, General Electric, Honeywell, IBM, Intercontinental Exchange, Nasdaq, LV, Mastercard, Samsung, Wal-Mart, etc., Chinese technology giants Baidu, Ant Financial and Tencent are on the list. Other Chinese companies include China Construction Bank and Foxconn.

[Huobi China is about to launch a blockchain BaaS platform to create an industry application ecological cluster]

Huobi China announced that it will launch a self-developed blockchain BaaS platform, which will be used as a carrier to create a blockchain industry application ecological cluster.

[Donghua Software undertakes the information system of Vulcan Mountain Hospital and establishes a health file and health data sharing platform based on blockchain]

Donghua Software received a notice from the information system of Vulcan Mountain Hospital. The workload of 2 to 3 months was completed in 9 days. The information management system of Vulcan Mountain Hospital was delivered as scheduled on February 3. Guo Haozhe, senior vice president of Donghua Software, said that it is worth noting that there is a lack of data comparison between patients with the same symptoms between hospitals, and horizontal information sharing has not been achieved. In terms of patient treatment, information sharing also has serious shortcomings, and information sharing must be temporarily established. system. To this end, Donghua Software has established a health file and health data sharing platform based on blockchain technology. By using blockchain technology, one party can report and multiple parties can respond quickly, so as to gain time for epidemic prevention and control.

[China Mutual Fund Association guides the launch of donation certificate public welfare platform, blockchain technology blessing]

According to the Beijing News on February 28, the reporter learned from the China Internet Finance Association that, in response to the problems of information asymmetry, opacity, and lack of credibility in the donation of epidemic prevention materials, the China Internet Finance Association has initiated the guidance recently. Information Science and Technology of Peking University The Institute's Blockchain Research Center and Boya Zhengchain (Beijing) Technology Co., Ltd. have developed and constructed a public welfare platform for donating and depositing medical supplies for "Boya Medical Chain" and "epidemic" medical supplies.

Australia launched a national strategy for blockchain technology, focusing on the opportunities this technology brings to industries ranging from finance to wine. The Minister of Industry, Science and Technology said that the five-year blockchain roadmap will support the relevant work of regulators, start-ups and researchers, and said that the value of the industry will reach A $ 259.4 billion.

[Spain approves fintech sandbox plan to allow crypto-related companies to use controlled test platforms]

The Spanish government has approved a fintech sandbox program that will allow blockchain and cryptocurrency-related companies to use a controlled test platform before putting their products on the market. The sandbox may open sometime this year and will be overseen jointly by the Ministry of Finance, the Bank of Spain and two financial regulators. The government started the sandbox review as early as 2017 and initially hoped to open the test platform in October last year.

[The Brazilian central bank will launch an instant payment system to deal with cryptocurrencies]

The Brazilian central bank will launch a new payment system, PIX, which will provide 24/7 payment services via mobile applications, Internet banking and ATMs within 10 seconds. The central bank's governor, Roberto Campos Neto, said at the launch of the system that the PIX was developed to address new digital payment methods such as cryptocurrencies.

[KLM Royal Dutch Airlines uses R3 blockchain technology for financial processing]

According to Cointelegraph on February 28, KLM Royal Dutch Airlines is applying blockchain technology to facilitate the intercompany settlement process with its subsidiaries. KLM has partnered with Dutch software startup Unchain.io to explore the potential benefits of blockchain technology for its business and internal processes. After close cooperation, Unchain provided KLM with a strategic financing application based on blockchain technology. The technology was developed by R3, a major global enterprise software company. The solution aims to simplify KLM's accounting process and settlement by implementing R3's Corda.

[British blockchain company Agriledger creates blockchain system for Haitian farmers to increase their income]

According to Springwise, British blockchain startup Agriledger has created a blockchain system for Haitian farmers to help farmers earn better income and provide consumers with reliable and transparent data about the origin of their products.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- deal! Germany officially classifies digital assets as financial instruments and does not have monetary legal status

- Tokenized securities say it's easy, but CBDC is in trouble? What does the latest BIS report say

- February security incident inventory: 12 incidents lost a total of 48.23 million US dollars, bZx was attacked by hackers

- Dry Goods | Read the Taproot / Schnorr Upgrade for Bitcoin

- DeFi guardian: DeFi insurance agreement

- DeFi weekly selection 丨 Lightning attack or new normal, should I buy insurance for DeFi?

- Web3 Foundation announces funding for Second State blockchain company, introduces Ethereum virtual machine to Boca ecosystem