NFT-the cornerstone of encrypted digital assets

Introduction: It has been nearly 2 years since the popularity of cryptokitties at the end of 2017. It has brought the ERC721 agreement and also made people see the magic of NFT. This article will comprehensively interpret the value points, application scenarios and technical aspects of NFT, and conduct a comparative analysis of mainstream NFT asset standards.

What is N FT ?

The full name of NFT is non-fungible Token, and the Chinese name is non-fungible token. Our common tokens (such as BTC, ETH, etc.) are all homogeneous, there is no difference between each BTC (like two 100 yuan RMB), and they can be exchanged and divided. The important feature of NFT is that each NFT has a unique and unique identification, which is not interchangeable. The smallest unit is 1 and is indivisible.

In obsessed cats, each cat corresponds to an NFT on the chain, has a unique id and gene, and more importantly, has independent value . The secondary market for obsessed cats is very active. The most expensive cat sold 750,000 RMB, which also proves that the value of NFT as a virtual item has been recognized by the market.

The obsession with cat games is revolutionary for the proposal and practice of NFT-not only can the value be carried through cryptocurrencies, but also a new and unique way to carry it.

- CPPCC member Jing Xiandong: Promote Zhejiang Digital Government Affairs Upgrade with Blockchain

- The main body of Bitmain's two official micro account registrations has been transferred, and some of the shares in Fujian Zhanhua have been frozen into the rights and interests of Baozhanke Group?

- Analyze the correlation of Bitcoin with gold and crude oil: Is Bitcoin a commodity, currency or a safe-haven asset?

The value of N FT

We know that money is essentially a general equivalent and a carrier of value consensus. In modern society, personal wealth is no longer measured by the amount of money held, but rather by the assets in its name. These assets include, but are not limited to, houses, cars, stock bonds and other items with a certain market value. For the average individual in modern society, the value carried by assets is often much greater than the value of the cash they hold.

However, real-world assets often have the following two flaws:

1. Most of the physical assets have poor liquidity;

2. The cost of anti-counterfeiting is high, and some heavy assets need centralized confirmation. For example, the real right of a real estate needs to be registered with the Housing Authority; it is difficult to prove that you own it before you see it;

In the blockchain world, we have cryptocurrencies to represent assets with monetary attributes. Naturally, we also need a value medium for representing non-monetary assets, so NFT came into being. Thanks to the decentralization, immutability, and cryptographic power confirmation of the blockchain, NFT solves a series of problems of assets in real society:

1. Better liquidity, allowing efficient and atomic transactions;

2. Cryptography confirms rights and cannot forge assets.

In addition, NFT also achieves characteristics that cryptocurrencies cannot, such as characterizing negative assets (liabilities), proof of identity or equity, virtual props, etc. N FT fills the gap in crypto assets, allowing us to bring assets with independent value into the category of the crypto economy and obtain the protection of the blockchain.

However, when empowering the real economy, we also found that the current problem of NFT: the problem of value mapping of physical assets , in simple terms, "value on the chain"-how to convince participants that this NFT represents its owner How is the promised asset proven? Who endorses it? We believe that, since most of the current physical assets are a centralized asset, before the NFT has reached consensus, its value chain has to rely on the endorsement of the central institution. For example, if the property is to be chained in the form of NFT, then under the current system, we still need the Housing Authority to endorse the value of this NFT.

But we also need to point out that N FT is a data protocol, which is carried by the chain, circulated on the chain, and the encryption is confirmed. The business it applies to does not necessarily need to be decentralized.

Application scenarios of N FT

NFT can characterize the digital asset itself, and it can also be used to characterize certain special-purpose vouchers (real estate certificates, passports, tickets, coupons, etc.), so its use scenarios are extremely extensive. Below I will mainly introduce the application of NFT in the field of games and collectibles.

game props

The generalized game props contain all relevant assets owned by the players in the game. These assets have one thing in common: players must acquire them through gameplay or purchase them through money.

Game props are a form of data that is well-suited for characterization using NFT. On the one hand, game props are produced on the chain, and the use of the chain provides value support by the game scene, avoiding the centralized link of "value on the chain" ; on the other hand, most of the game equipment and characters are unique And can flow freely, which is consistent with the characteristics of NFT. In addition, NFT game props can also be used to confirm and reuse cross-scene, cross-service, and even cross-game, making the game assets themselves no longer limited to an isolated island, but may become a truly universal hard currency in the ecosystem.

Crypto Cat team's new character NFT

Crypto Cat team's new character NFT

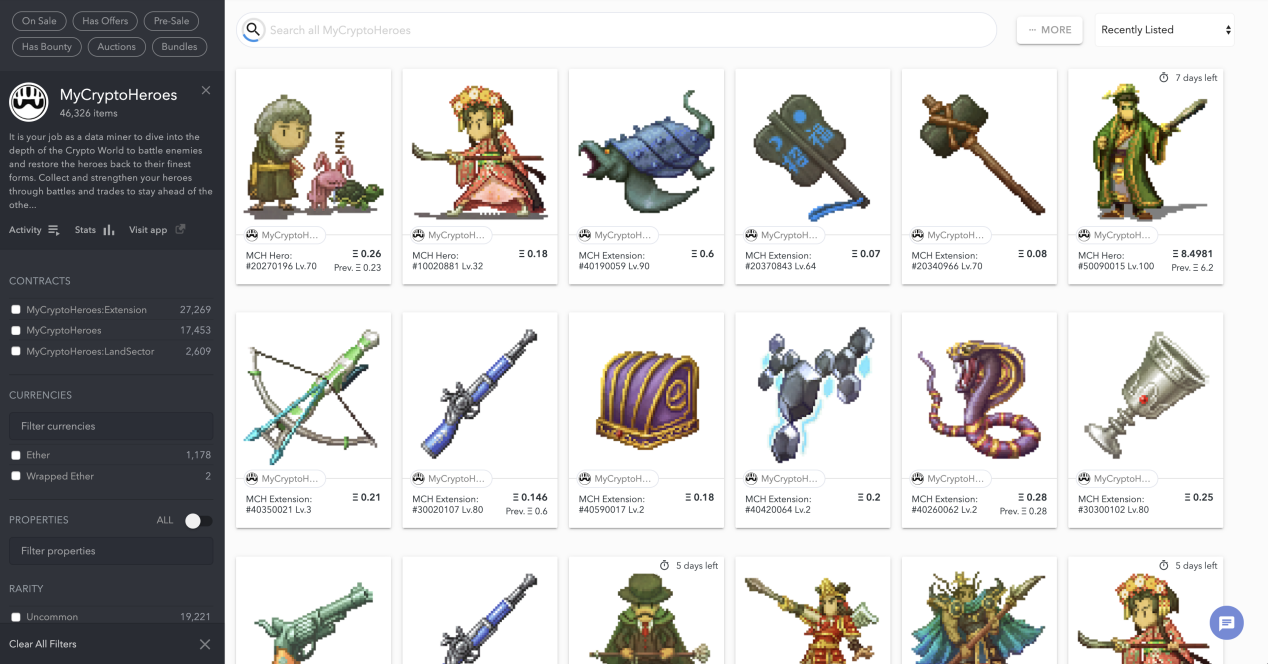

OpenSea, as the largest NFT trading market, has access to NFT trading of more than 100 products, most of which are freely circulating game props and hero characters. Thanks to the characteristics of the blockchain and smart contracts, the trading of game props no longer requires online payment in-game delivery as in the past 5173 platform. With N FT , instant intermediary payment and delivery can be achieved , greatly improving the liquidity of virtual items and the user experience of item transactions.

MyCryptoHeros' NFT Game Props and Heroes

Collection

NFT can be used to characterize the ownership of some collectibles.

Collectibles have two characteristics: unique and unforgeable. In a centralized online world, it is difficult for us to use a digital medium to properly represent such assets. NFT makes up for this gap. For example, in the field of art, we can save the ownership of artistic assets such as paintings and sculptures on the blockchain in the form of NTF, and deposit the entities in some trusted central institutions (such as museums, vaults, etc.) to achieve Perform operations such as authorization, transaction, authentication, and circulation without contacting the physical object. We can even securitize artwork into a more liquid investment product

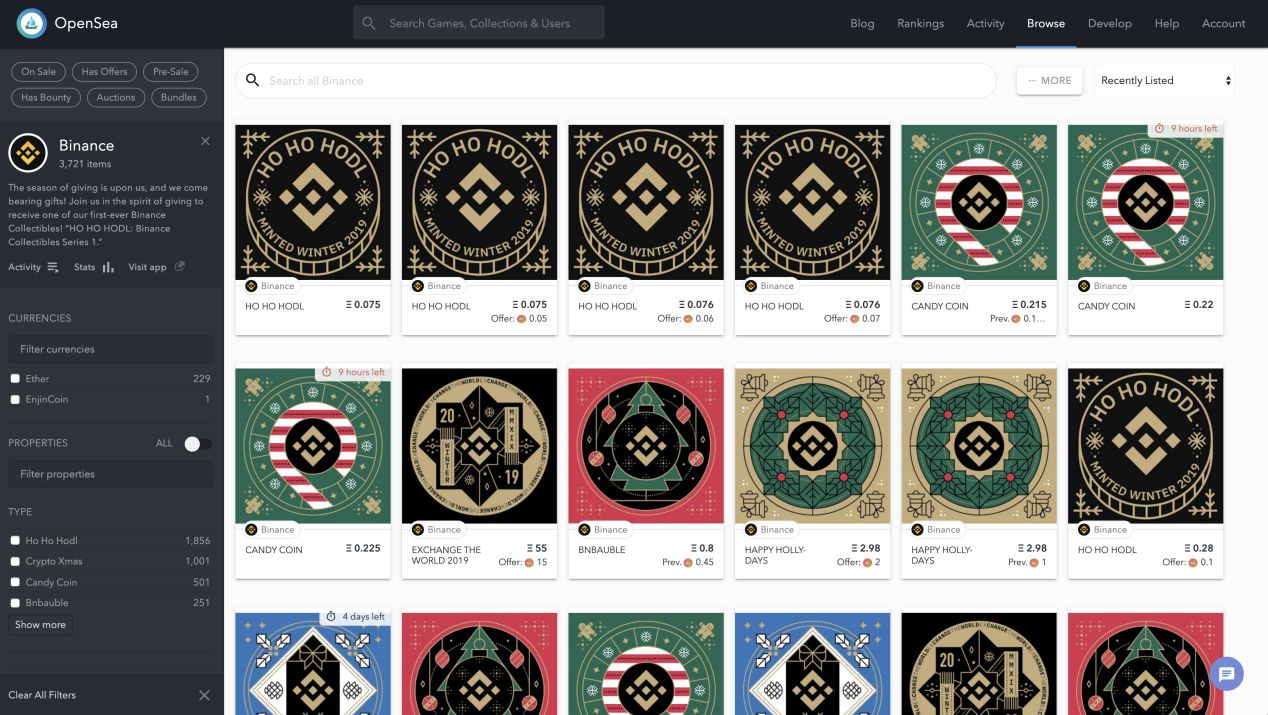

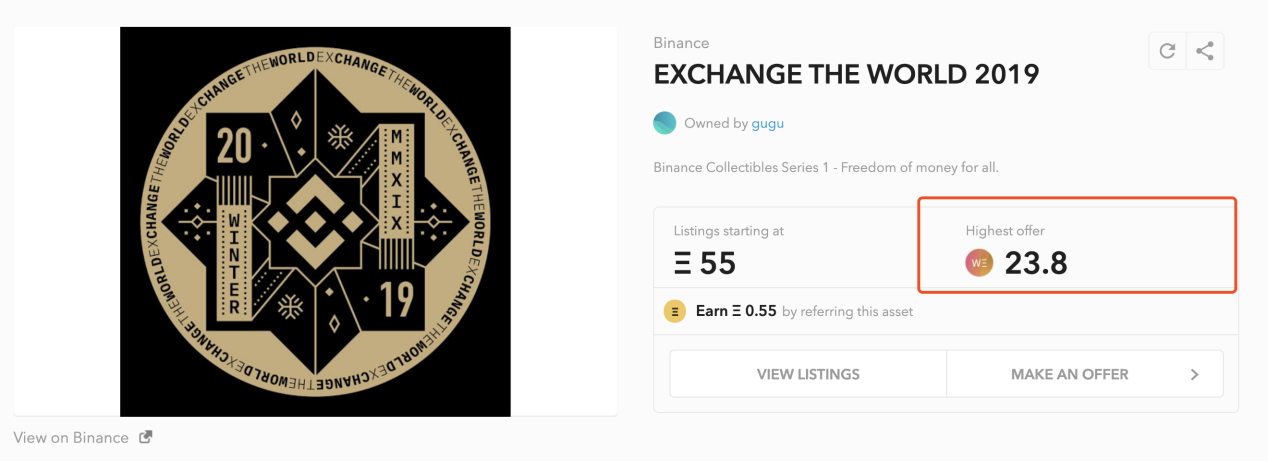

In December 19, Binance issued a series of limited-collection NFTs based on the ERC1155 agreement, and it was also the first batch of NFTs in the industry to carry brand value. The following figure is part of the price of this type of NFT in the OpenSea trading market at the time of writing. The cheapest is around 0.075 ETH (about 73 RMB), and the most expensive transaction price is as high as 23.8 ETH (about 22,900 RMB). It can be seen that the value support of NFT as a collectible can be derived from brand premium and its own scarcity, and has been highly recognized by the market.

Opensea China Binance NFT Market

Opensea China Binance NFT Market

Highest recently traded NFT

Highest recently traded NFT

N FT 's mainstream protocol standards

E RC721

The ERC721 protocol was born from cryptokitties. It is the earliest NFT protocol recognized by the Ethereum community and the most widely used standard at present. It defines four key metadata of NFT: ID ( Global ID ), NAME (Name), SYMBOL (Symbol), U RI ( Uniform Resource Identifier ) , these have also become the meta of various NFT protocols that appeared later Data foundation. The ERC721 protocol interface is similar to ERC20, which can realize the issuance, trading, and authorization of NFT, which basically meets the needs of blockchain business.

However, a fatal flaw in the ERC721 protocol is restricting its popularity- a contract can only issue one type of N FT assets . In addition, Solidity also does not have a good solution to easily manage the assets of different contracts in a unified manner, which makes ERC721 difficult to handle complex game scenarios (a game may have thousands of prop types).

E RC1155

ERC1155 is an NFT asset agreement proposed by Enjin for game scenarios. It differs from ERC721 mainly in the following three points:

1. Any kind of N FT assets can be issued in the same contract , and multiple types of assets can be packaged for trading. This greatly saves the user's fees when conducting asset transactions, and optimizes the experience.

2. The id split scheme can simultaneously characterize FT (Fungible Token, such as BTC, ETH) and NFT. This is more useful in game scenarios, such as characterizing some stackable consumables (blood medicine, blue medicine, etc.), which are themselves homogeneous.

3. Removed the NAME and SYMBOL fields in the metadata, leaving only the ID and URI. This reduces the description capability of ERC1155 itself, and transfers the power to describe the assets to the upper layer . Dapp can customize the parsing logic of URI fields as required. For game scenarios, it is worthwhile to trade convenience and scalability by sacrificing decentralization, which enables developers to reuse NFT props for different business scenarios.

From the design point of view, ERC1155 places more emphasis on the lightweight and interoperability of NFT. In Enjin 's implementation of E RC1155 , the entire id field is used directly to characterize the type of FT, and the specific meaning of id is left to the higher level of analysis.

EOSIO.NFT

EOSIO.NFT is the NFT asset standard on the EOSIO blockchain.It comes from the community team and is also a widely used standard. EOSIO.NFT retains the four major metadata fields of NFT: id, name, uri, symbol, and can issue any kind and any number of NFT assets in a contract. It is a very common NFT asset standard. However, its shortcomings are that the data used is redundant, and NFT cannot be transferred in batches in a single contract call.

OASIS.ASSET

OASIS.ASSET is part of THE OASIS protocol, which is a set of cross-game and cross-contract N FT asset transfer protocols suitable for games developed by DegameLabs . We have learned from the experience of the above three NFT asset agreements and formulated a new general asset agreement. Developers can use OASIS.ASSET to issue any kind and number of FT and NFT.

The assets issued by OASIS.ASSET have only three metadata: UUID, URI and SYMBOL. URI carries the important task of analyzing the meaning of NFT assets. We have designed a set of concise, game-oriented URI formats that can maximize and enrich the relevant information describing NFT assets (this is optional, we are also studying the use of the PPK & ODIN protocol to design the URI format). OASIS.ASSET, like ERC1155, transfers more specific NFT asset description capabilities to the upper layers, but it provides richer meta-information for the upper layers, ensuring scalability while having self-describing capabilities. This part of the design document can be found on Github .

When O ASIS.ASSET is used with O ASIS.WORLD and O ASIS.MAIN , it can realize the transfer of N FT assets across contracts. Authenticity, security and location tracking . This is different from the common method of asset reuse in the past (that is, calling the same contract)-in the THE OASIS protocol, developers can customize, deploy their own contracts, customize mapping logic, and freely choose to receive or transfer What kind of asset. This not only eliminates the risk of centralization of the contract itself (Bugs, hacking), but also more flexibly adapts to the development needs of different businesses.

The OASIS protocol has now been developed and has been adapted to the Ethereum and EOSIO blockchains. We will open source when appropriate and free for community use.

The future of N FT

DegameLabs has always believed that the encrypted digital economy is composed of NFT and FT-FT is flowing blood, and NFT is the cornerstone of toughness.

How to use NFT correctly? We believe that the concept of layering should be followed: at the bottom of the data, N FT should be immutable -once issued, the rights must always be confirmed to ensure the security of the asset itself; at the application layer, the description logic for N FT is mainly formulated That is, how to correctly identify N FT . This set of identification logic can be centralized, which is understandable, because it constitutes different application scenarios of the same NFT, which is what is called "asset reuse".

It is believed that with the continuous deepening of the concept of data as assets, more and more digital assets will be presented in the form of NFT, and we will eventually usher in a world of milky silky digital economy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 10 million bitcoins are "sleeping"! Is it better to have more money laundering parties?

- 2019 Spot Exchange Research Report: The total global trading volume is $ 13.8 trillion, BTC accounts for 48.29%

- The central bank's digital currency DCEP is about to be piloted. What can it bring us?

- Research shows: 39 “giant whales” account for 11.1% of existing Bitcoin

- Research: Bitcoin has added more than 124 million addresses since the bull market in 2017

- A week in review | US and Iran situation pushes up crypto market, new EU regulations trigger regulatory storm

- Huo Xuewen, Director of the Beijing Financial Bureau: The first batch of projects in the sandbox will be announced next week