10 million bitcoins are "sleeping"! Is it better to have more money laundering parties?

Considering that the total number of Bitcoins in circulation is more than 18 million, this means that nearly 60% of Bitcoins have remained dormant for more than a year.

In other words, only 40% of bitcoin participated in the change of bitcoin price throughout 2019. And the remaining bitcoin holders, no matter how the market fluctuates, they remain intact and all become the most solid bitcoin "Hodler".

Note: Hodler refers to those who have held Bitcoin for a long time and will not sell it.

1. Why is there more and more Bitcoin Hodler?

Aside from passive conditions such as wallet and private key loss, more and more people are actively joining the Hodler family. Why are Hodler growing? Let's look at a real "tragedy" first.

In the "Bitcoin" post bar, there is an old old post from 2014, called "just started 480 thousand 100 bitcoins, record my day of speculation" . At a price of 4,800 yuan, the landlord secretly took 480,000 yuan to buy a house and started with 100 bitcoins.

In less than three months, the price of bitcoin dropped by 50%. What's not bad is that the landlord stole the money to buy the house and speculated that his wife and his family found the family mess.

The landlord was under tremendous pressure waiting to return to the book. During the numerous quarrels, even the mother-in-law called out to sell coins in the middle of the night.

After staying there for a month, Bitcoin has really risen back to its original value. The landlord burst out of good intentions, and spent 10,000 yuan on the spot to charge friends.

However, in the next two years, Bitcoin entered a two-year long bear market, rising a bit, falling more, and so on. Finally, one day in 2016, the landlord finally couldn't handle it, losing 180,000 cutting meat Leaving the field, never appeared in the post again.

This post is still there today, and many people feel sorry for "480,000 brothers". If he takes another one or two years, he will be a multi-millionaire.

No one wants to fall in the darkness before dawn like "480,000 brothers", which is why Hodler is getting more and more.

In reality, the trend of Bitcoin also tells you over and over again: as long as you hold it, sooner or later you will be "rich."

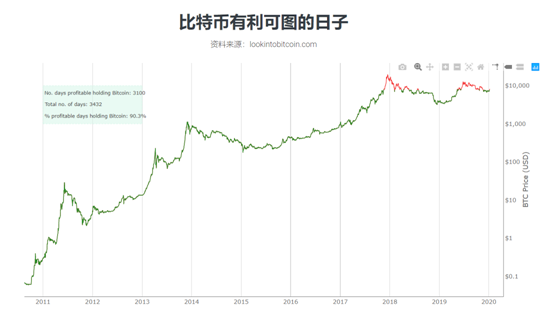

Lookintobitcoin website shows that 90.3% of the days, Bitcoin is profitable. Except for the end of 2017 and mid-2019, no matter what time you enter, as long as you can Hodl to this day, regardless of how much you make, at least you will not lose money.

Well-known Wall Street analyst Thomas Lee also made a statistic: "In the past few years, if we removed the 10 trading days that Bitcoin performed best, the annual revenue of Bitcoin would be -25%."

That is to say, "down" is the normal state of Bitcoin, and the days of "big rise" are pathetic. At this time, buying and holding has instead become an effortless trading strategy that will not lose money in the long run.

Can Hodl affect the market?

The wider the Hodl group, the stronger the consensus is. Will the strength of the consensus affect the market?

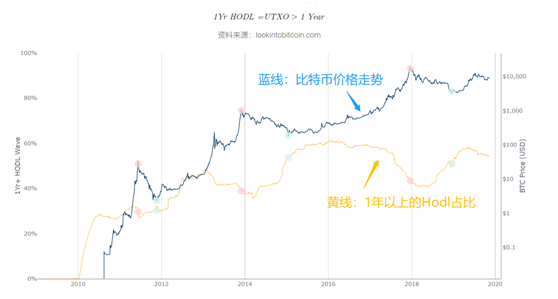

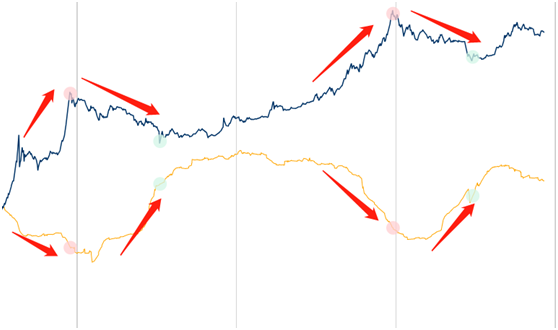

Some people have compared "the price trend of bitcoin" with "the proportion of bitcoin that has not been moved for more than one year":

It can be seen that in most cases, the two are negatively correlated. Whenever the market starts to fall, the number of Hodl gradually increases; whenever the number of Hodl continues to decrease, the market will also peak.

(Red dots represent price peaks, green dots represent price bottoms)

It is precisely because the change in Hodl's proportion is highly matched with the high and low points of the market cycle. Many people like to use this model to judge the market cycle.

Back to the beginning of the article, the percentage of bitcoin that has been dormant for more than a year has reached a new height, so you can boldly guess what cycle the market is in today?

3. Is it better to have more Hodler?

Hodler can't be everyone. When 480,000 brothers left the market after losing money for two years, in the face of the endless market, when everyone around them sang empty, and under the pressure of various countries' policies, they reaffirmed their confidence. Will shake. There are only a few people who can have such perseverance and a strong heart.

Even when Hodler is not simple, the return data tells us that Hodl's strategy is very useful, so there are many voices in the market that have begun to call on everyone to join the coin hoarding party, such as Jiu Shen's "Bitcoin Hoarding", Li Xiaolai's scheduled investment class, they have all passed The "hoarding" action has received many tangible returns.

But we can't help but think of a question: the more Hodler, the better for Bitcoin?

From the price of the currency, yes. The logic is simple: There is a supply-demand relationship in the Bitcoin market. When demand exceeds supply, prices naturally rise. Hodl is artificially reducing the supply, which can make the price of Bitcoin more likely to rise to a certain extent.

But from the perspective of Bitcoin's implementation?

One year ago, the creator of the word "Hodl" was interviewed by Coindesk and, unexpectedly, he told the media:

"The word Hodl has been abused, and the situation is not what he originally meant-Bitcoin is intended to be spent, and the current BTC is gradually losing its original value proposition."

When everyone tends to be a person who doesn't move, this pair of Bitcoin's original goals-to be a peer-to-peer electronic cash system- really didn't help directly.

However, when we think about it from another perspective, people who insist on Hodl believe that the price of BTC will become higher and higher. When such a "price consensus" is getting stronger, it is difficult to say that this is not a bit good for Bitcoin.

Therefore, although Hodl cannot directly change the development of Bitcoin, we cannot say that it is completely useless.

Whether it is coin hoarding or speculation, they are all played in the financial market. It is natural for people to profit, and they cannot be judged with simple words of right and wrong.

So the question comes, would you choose to be a Hodler?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research: Bitcoin has added more than 124 million addresses since the bull market in 2017

- A week in review | US and Iran situation pushes up crypto market, new EU regulations trigger regulatory storm

- Huo Xuewen, Director of the Beijing Financial Bureau: The first batch of projects in the sandbox will be announced next week

- Huo Xuewen, director of the Beijing Financial Bureau: Blockchain must enter the "supervisory sandbox" test, and the first batch of projects will be announced next week

- JPMorgan Chase: CME Group launches bitcoin options products tomorrow, bitcoin "peak of interest" is coming again

- Battle for Singapore's Digital Bank License: 21 Ants, Xiaomi, Tencent, Headlines, etc. Who Can Win?

- Viewpoint 丨 Restore the truth of African blockchain, an overview of African blockchain