How to start a blockchain fairly or unfairly?

Written by: Nic Carter, Founder of Coin Metrics, a cryptocurrency data provider

Compile: Zhan Juan

School Translator: Huang Peijian

Source: Chain News

- NFT-the cornerstone of encrypted digital assets

- CPPCC member Jing Xiandong: Promote Zhejiang Digital Government Affairs Upgrade with Blockchain

- The main body of Bitmain's two official micro account registrations has been transferred, and some of the shares in Fujian Zhanhua have been frozen into the rights and interests of Baozhanke Group?

Disclaimer: Whether personally or professionally, I am currently or in the future not interested in launching a new cryptocurrency. This article is primarily intended to be a thought experiment, not an endorsement of any particular project. I do not recommend or condone the creation of any new base layer cryptocurrency.

Foreword

The role of ASICs in Proof of Work systems has been controversial.

In the maturity stage, ASIC enhanced the security of the network (by forcing miners to bet on the success of a protocol for a long time), but in the transition stage, the first hardware manufacturer to build an ASIC could almost monopolize the minting of new coins. This could lead to an informal coinage tax-coining money at a cost below market price. Protocols that frequently fork also face this risk; developers have the ability to decide which PoW function the chain will turn to so they can monetize their influence on the protocol. This could be a form of covert corruption that undermines PoW's well-known "fairness."

GPU-based blockchains also have a bad quality, that is, "nehash-able" mining, which can also be attacked by renting commercialized hardware for a short period of time. Because the use of these hardware can be redirected and rentable, people who mine GPU coins do not need to be tied to it for a long time.

Annotation: ASCI is the abbreviation of Application-Specific Integrated Circuit, which is Application Specific Integrated Circuit. Compared with common CPU, GPU and other general-purpose chips, the computing power and efficiency of ASIC chips are directly customized according to the needs of specific algorithms, so ASIC chips can achieve small size, low power consumption, high reliability, and confidentiality. Strong, high computing performance, high computing efficiency and other advantages.

These questions fill my head. In 2018, I started to think about how an ASIC-type startup would work. Not because I am interested in participating in a project, but because I find it interesting to think about the trade-offs in it. This tweet represents what I thought at the time:

@nic__carter: In the future (<12 months), sooner or later, we will see that a development team announces a PoW-type fair-start project, and the team will launch an ASIC chip for the PoW algorithm mining of this project . Until the genesis block, details of the algorithm will not be announced.

About a month later, Obelisk (a subsidiary of Nebulous) announced a plan to provide some kind of business service, called Launchpad, which facilitates PoW-type startups using specially customized ASICs.

I put my tweet above in this article to prove that I have thought about these ideas for a long time, and this article is not written to provide "ethical support" for any particular PoW-type startup. Most of this manuscript has been written long ago, but I did not take it out, because I thought that the PoW-type startup has basically been paralyzed, and people will not be very interested in it.

In fact, my prediction of time was wrong-within 12 months after I tweeted that, as far as I know, there was no such PoW-type launcher. However, I noticed that several teams are currently considering similar launches. Therefore, I think my thoughts on this issue may be valuable. This is not for the benefit of a particular team, but because this thinking can provide us with an interesting background to evaluate some of the key issues of social scalability and security of these network projects, whether it is Bitcoin Or other PoW chains.

If anyone plans to launch a new public blockchain, I firmly believe that PoW without pre-mining is the best way to achieve it. There are many reasons, which I will introduce below.

But I find GPU-style booting increasingly difficult and risky. I can't stop anyone from starting a certain chain. But I think that a careful analysis of the trade-offs can encourage teams to do things more responsibly, or at least explore other parts of the project design.

Finally, my thoughts on how to launch a new universal blockchain may disturb some people. If that's the case, I recommend closing this article altogether.

In addition, although I think that Bitcoin may be sufficient for non-national currencies, I also do not want to permanently rule out the possibility of other PoW-type blockchains. I don't see any need for another chain now, but I can hardly convince myself that Bitcoin will be the first and last viable blockchain in history.

I am not afraid of competition. I think Bitcoin has its unique advantages. The smaller PoW-type startup will not compete with Bitcoin, nor will it harm it in any way. I think it is entirely possible that we will launch another PoW chain at some point, so it is necessary to think about how to launch it.

I want to make it clear: I'm not endorsing any particular launch or a certain coin, or that is my attitude towards any new PoW-type launch. In fact, I generally discourage anyone from starting a new blockchain project. They are often useless things or ghost towns. But I do not rule out that a new blockchain may appear sometime in the future.

Introduction

The launch of new cryptocurrencies suffers from a strange paradox: they usually require a single authoritative entity to lead development, manage the startup process, and coordinate development work during an important period of the initial phase. Generally speaking, if you want to create a unique agreement, you usually need to invest a lot of up-front investment in research and development. All of these characteristics require the organization and financial commitment of a single entity.

However, the support of a corporate entity (or a more subtle model, let us assume that there is no organization pulling in a model) is obviously the key to centralization. This means that if the protocol grows too large or too disruptive, opponents can find obvious points of attack; in general, those who are hostile to the network will also have enough power to intervene in it. In addition, these administrative entities often choose not only to control most of the money supply, but also have real power in decision-making, trademarks and veto power over future development.

Engels once believed that "the demise of the state" was the end result of socialist utopia, and similarly, the so-called "decentralization road" in the currency agreement was closer to fantasy than reality.

To truly renounce power as promised, the founders of these projects must persevere in poverty and eventually get out of the way. So people sometimes say that Satoshi Nakamoto's second best opinion after creating Bitcoin is to leave the project. Unfortunately, since then, few cryptocurrency founders have followed in their footsteps. They prefer ill-gotten wealth and are keen to join the Davos Forum with central bank governors.

Over the years, people have tried many types of protocol financing models: bitcointalk pre-mining, more complex ICOs, founder rewards, secretly pre-mining and date-changing white papers, instant mining, merge forks. Purists believe that, in addition to the PoW-type fair start (ensure that there is no coinage, not even developers), no other way is sufficient to give the founding team the legitimacy to create a global agreement.

Their idea makes sense: if a significant portion of the world's people turn to a neutral cryptocurrency agreement, future buyers of the currency will simply not accept a situation where the founders of the global currency give themselves free 20% or more. This is an unlikely scenario. A coinage tax-more generally, a feeling of apparent unfairness or deception-can be extremely unpleasant. It is this, not a small technical disadvantage that will make most sexy, high-throughput, VC-supported base layer protocols go to the end. This is not a startup project: they are currencies, and competitiveness is built on credibility, neutrality, institutional stability, and fairness. Private equity projects are indeed centralized and unfair, but you don't need Uber's stock to buy your daily bread. For something as important as money, fairness is crucial. And a very unfair start will be an ugly squall, which will linger and poison the integrity of the entire project.

The unique appeal of the PoW-type launch is not just that the distributed advantages brought by ordinary people to home mining (although this is a powerful and underestimated feature). The most important feature of the PoW-type fair launch is that it ensures that it is impossible to obtain coins at below market prices. You can buy coins on the market, or you can mine with electricity; but no one has the right to trade internally.

Let's take a look at another way to start: the development team pre-mines an ERC20 token, and then sells it slowly in the market for a few years. This looks the same as PoW. But this is not the case, because this team can get all the tokens for 0 yuan. If the development team used the funds they received for tokens and burned them, it would be similar to PoW.

Of course, "fair launch" has its inherent disadvantages, namely that it faces challenges in commercializing the network, especially in its early stages. If developers work with idealistic or altruistic sentiments, then no problem. This is the case with Bitcoin. As the Bitcoin network became more and more systemically important, patrons finally appeared.

Today, a group of wealthy and diverse patrons fund dozens of core developers who allow the Bitcoin blockchain to run smoothly while also working for long-term infrastructure. This may be the most ideal model; but the advantage of Bitcoin is that it is the first and most important project and does not need to deal with venture capitalists.

Today, any new cryptocurrency has to work hard to find its own special place. Obtaining enough traction to secure the sponsorship or donation that depends on it is a difficult task. In terms of early research and development, it is almost impossible to raise capital without selling the future rights of the agreement tokens in some way.

Many people will cite Grin's case: Grin strives to achieve a PoW-type fair startup with GPU as the goal. This decision is actually a bit outdated and it is difficult for the Grin team to make money. Very few donations have been received so far. For many, this is a cautionary tale.

Of course, some people will be proud to laugh at the weaknesses of the fair launch mode. Their intentions have not been made clear, but they want to directly advocate their own predatory launch mode. Only those teams and projects without pre-digging are eligible to speak. Although Grin's financing has been difficult so far, the possibility of it becoming an important currency asset will not be stranded by some issues, including securities law issues, such as the risk of the founder being arrested, such as the community being harvested by VC And lose charm. (If anyone doesn't believe what I said, you can read about the fundraising platform for crypto funds focused on token strategies. The shorter term "time to get liquidity"-meaning "we plan to exit the Currency positions because we want to ensure risk-free returns and sell these assets as quickly as possible. ")

During this period of 2014-2018, ICO was largely a disastrous financial tool. I rarely saw a project that made me feel that it was being released in a responsible manner. Once these projects are no longer open to the public, they lose their only advantage: extensive, license-free distribution (note that this is an inherent feature of PoW). There are many problems with ICOs, especially those that immediately chose the authoritative model of proof of stake (PoS) (rather than wisely choosing PoW as the project guide as Ethereum). These problems include the following:

- Insiders can participate in their own crowdfunding, and secretly get a arbitrarily set share for free (because they actually control the funds in the crowdfunding stage).

- Some buyers can get tokens at an arbitrarily low price, because these coins are not created in an expensive way through PoW, but are generated out of thin air. Therefore, the private placement round prior to the public offering usually consisted of pure mintage.

- Tokens eventually became a pot of mixed food, mixed with an informal investment contract, and arcade tokens to unlock network resources. This allowed speculation to crowd out uses and contributed to a host of chaotic value accumulation theories.

- The sale of tokens to the public (or indirectly through Telegram) is, in most jurisdictions, very similar to an investment contract. This generally leaves issuers bound by securities law, whether they like it or not.

- If the issuer keeps most of the supply of tokens, they will tend to maintain their authority in the network, especially when the Proof-of-Stake (PoS) model is selected. This makes it difficult for authoritative decentralization to go because publishers often refuse to give up their share of the network.

- Early supporters of the project can get a disproportionate supply of tokens almost free of charge. If the network follows the PoS model, these people will maintain this advantage permanently and at no cost. This forms a powerful force that makes the distribution of tokens difficult to sustain because equity holders are not under pressure to sell tokens. In contrast, under the PoW model, miners must constantly spend and invest to maintain a certain percentage of network power. In a PoS system, the cost of maintaining stake is actually the cost of running a server.

My core point is that the main challenge in managing a new currency-based commodity is not technical. Of course, your blockchain must have compelling technical characteristics, but the ultimate difficulty is to cross the wall of disregard. In the initial stage, no one cares about your system. In the mature period, you need the attention of tens or even hundreds of millions of people. If you provide a large portion of the token supply to early investors at a discounted price, and give them strong anti-dilution rights (at the same time hope / expect that in the future people will use your network as working capital and tolerate a certain degree of Dilution, which is actually subsidizing the early buyers who passively bet), you will likely create a system that is obviously unfair, in which the winner is already long-term by the wayward history Decide.

In my opinion, attracting people to join such a network is almost impossible. Why join your chain? Why not have a fair start and have each owner work for their own tokens, instead of allocating chips based on distance from the founding team?

However, ICO, pre-mining, and founder coin tax type tokens have a key advantage: they can subsidize people who work on the agreement even before they are issued. It is naive to imagine that not all cryptocurrency protocols that will exist in 2019 have been launched. Some people may say that funding the agreement before it is launched is not a good model? So, can people design some form of currency startup that both avoids the worst part and adopts the good parts? I think it can.

Let's first review three popular models:

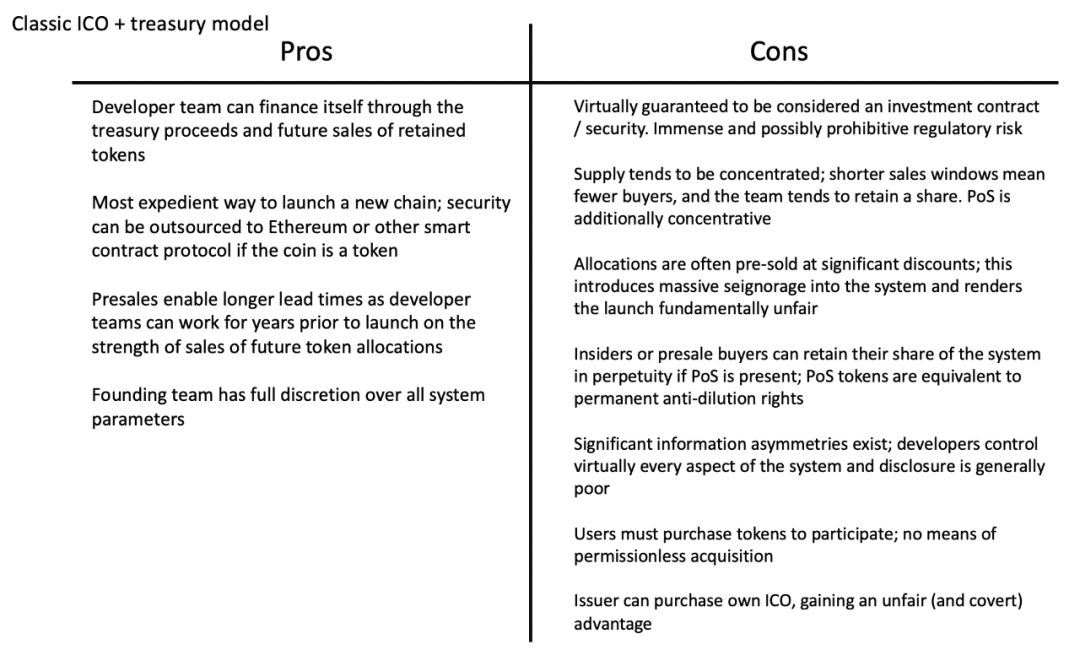

Classic ICO + treasury model

Lee:

- The developer team can finance themselves through the proceeds of the treasury and future sales of retained tokens;

- The most convenient way to start a new chain; if tokens are issued, security can be outsourced to Ethereum or other smart contract protocols;

- Pre-sale makes delivery time longer, and the development team can have several years of preparation work before the project is released because it can sell future token shares;

- The founding team has full authority over all parameters of the system.

Cons:

- Almost destined to be considered an investment contract / security. Significant and potentially prohibitive regulatory risks;

- Supply tends to be concentrated; shorter sales windows mean fewer buyers, and teams tend to retain their share. The PoS model also tends to be centralized;

- Pre-sale shares usually have a large price discount; this introduces a large amount of coin tax to the system, making the issue fundamentally unfair;

- As long as PoS exists, insiders or pre-sale buyers can permanently retain their share in the system; PoS tokens are equivalent to a permanent anti-dilution right;

- Significant information asymmetry exists; developers control almost every aspect of the system, and information disclosure is often poor;

- Users must purchase tokens to participate; there is no license-free acquisition method;

- Issuers can buy their own ICOs to gain an unfair (hidden) advantage.

It can be seen that this model obviously does more harm than good. In the United States, the right to sell a cryptocurrency, especially to the public, is unpopular in the eyes of securities regulators. Is not recommended. In addition, giving early supporters or large shareholders permanent anti-dilution rights with low exercise costs will stifle the distribution of tokens and limit their reach. Thanks to the transparency provided by the blockchain, we have good data in this regard to prove it. (I hope someone writes a serious article comparing the distribution of ownership of PoS chains and PoW chains. If you are an interested researcher, please contact us! I already have the data.)

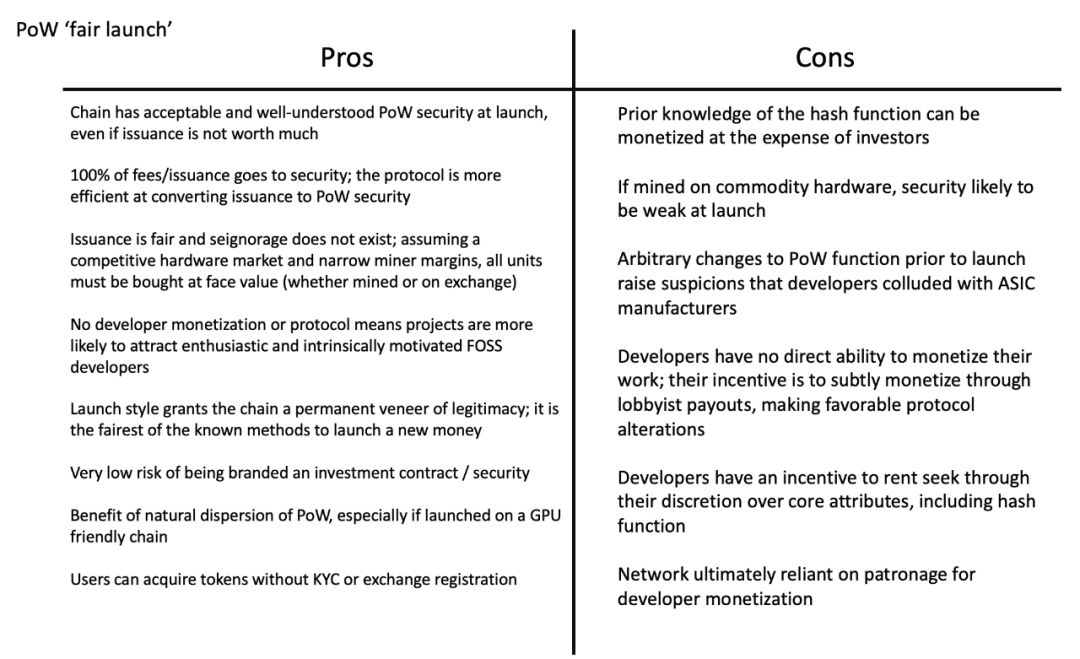

PoW type "fair launch"

Lee:

- Even if the issuance is not high, the chain has acceptable and fully understood PoW security at the time of issuance;

- 100% of fees / issues translate into security; this protocol is more efficient in terms of the security of converting releases into PoW

- Issuance is fair and there is no coin tax; assuming that the hardware market is highly competitive and miners have low profit margins, all coins must be purchased at face value (whether mining or on an exchange)

- There is no way for the developer or the agreement to make money, which means that the project is more likely to attract enthusiastic and intrinsically motivated free / open source software developers;

- This startup style gives the blockchain permanent legitimacy; it is the most fair one known among the various methods of issuing a new currency;

- Very low risk of being labeled as investment contract / security;

- Possesses the benefits of natural distribution of PoW, especially those that are GPU-friendly at the initial stage;

- Users can acquire the token without KYC compliance or exchange registration.

Cons:

- Preliminaries on hash functions, investors need to pay for themselves;

- If mining is done on commodity hardware, its security will be poor when the project starts;

- Switching to a PoW function before the project is started will make people suspect that the developers are colluding with some ASIC manufacturers;

- Developers have no direct channel to profit from their work; they can only make money through lobbyists' expenses, such as making preferential agreement modifications;

- Developers are motivated to rent-seek through their choice of core attributes (including hash functions);

- The network ultimately depends on how developers are funded.

This is the classic model. Bitcoin, Litecoin, Monero, and Grin are all this model. This model is reasonable, but it is difficult to get support in the initial stage, and it will depend on community fundraising or continuous funding in the future. As long as you can push it, it is very effective and difficult to kill-but it requires a lot of community building to gain traction. Over time, this model has become increasingly unfeasible, especially as financial equity models continue to grow.

I think that almost all GPU-based startups today may run into the risk of inner ghosts. These people have mastered the algorithm for secretly creating a certain type of ASIC chip in advance.

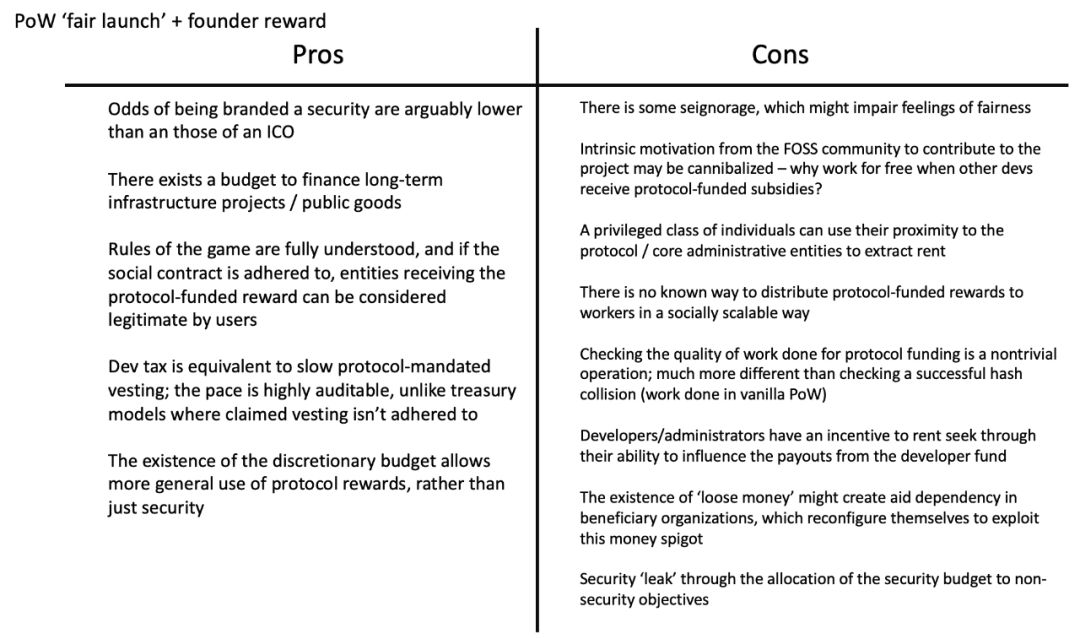

PoW “ Fair Startup '' + Founder Reward

Lee:

- The probability of being marked as a security should be lower than that of an ICO type coin;

- A budget exists to finance long-term infrastructure projects / public goods;

- The rules of the game are fully understood. If the social contract is strictly adhered to, users can think that certain entities have the right to receive rewards funded by the agreement;

- The development tax is equivalent to the slow cash flow authorized by the agreement; the cash flow steps are highly auditable, unlike the capital pool model, the cash flow plan claimed externally has not been strictly followed;

- There is a discretionary budget that allows agreement rewards to be used for more general purposes than just security.

Cons:

- There are some coinage taxes, which may hurt the sense of fairness;

- The enthusiasm of the free / open source software community for contributing to this project may be eroded-why should other developers work for free when other developers can receive subsidized funding for the agreement?

- Some privileged people can use their near-water platforms with the agreement / core management entity to seek rent;

- There is currently no known way to distribute rewards funded by agreements to workers in a socially scalable way;

- It is not trivial to perform a quality check on the work supported by the agreement funds; compared to checking a successful hash collision (the work to be done in an ordinary PoW), the workload is quite different;

- Developers / managers have an incentive to seek rent by influencing the direction in which developer funds are used;

- The existence of "loose funds" may cause beneficiary organizations to rely on aid, and they will restructure themselves to take advantage of this money valve;

- By allocating a safety budget to non-safety objectives, safety “leaks” can result.

This hybrid model was first pioneered by Zcash. It is essentially equivalent to a pre-mining model with a redemption plan. Compared with pure pre-mining, it can better allocate incentives, because it will take several years for these allocations to be lifted. In any case, this solution has its own problems: As far as Zcash is concerned, the agreement has a controversial issue, namely whether managers should get additional funds derived from the agreement. Once the coinage valve is opened, it is difficult to close.

Having said that, you may ask why I don't directly advocate the most common PoW-type fair startup. From this perspective, it is obviously better. But it is not completely without problems. I think that there should be a realistic attitude to GPU-based PoW startup. Let's look at a few recent case studies.

Why GPU-style fair boot may be tomorrow

As someone who closely follows Grin's launch, I must admit that it feels nostalgic, as if it was the last attempt from a previous era. Watching the whole process, I felt a kind of Proust-like pain. It's as if I dipped the Madeleine cake in tea and traveled back to the glory days of the 2012-2014 PoW launch.

The rumor that "VC-backed special purpose companies have $ 100 million" is indeed exaggerated, but there must be something wrong with the way it is launched. Initially, developers wanted to stay on the ASIC-resistant road forever, but eventually chose a practical phased development path from GPU to ASIC. They envisioned a slow transition to an ASIC-dominated network, but hoped that the initial stage would take The GPU way that is being mined by the wider crowd. I could still use GPU mining for a while, but some miners now report to me that ASICs—or at least more efficient hardware (FPGAs) —have started to take a significant share of the hash power A little bit ahead of schedule.

This is not a real failure, but it does show that the concept of anti-ASIC mining has inherently huge difficulties.

Some people anticipate that PoW will change, or are lobbying developers to get the results they want, and these people get huge benefits from the Grin model. Grin developers do have a somewhat ambiguous attitude towards the eventual shift to the PoW model (this is generally a fairly grueling discussion process), and this ambiguity has sparked a lot of anger and lobbying. In general, it would be much more efficient if resources were not used to lobby developers to support a better hash function. In the end, developers put a lot of effort into making this chain resistant to ASIC mining in the initial stages, but they have no control over the future. They didn't choose ASIC right away because they naively thought that GPU mining would dominate in the early stages of Grin (a distributed, non-enterprise team is actually quite difficult to coordinate this model) . But ASIC (or at least FPGA) mining finally appeared.

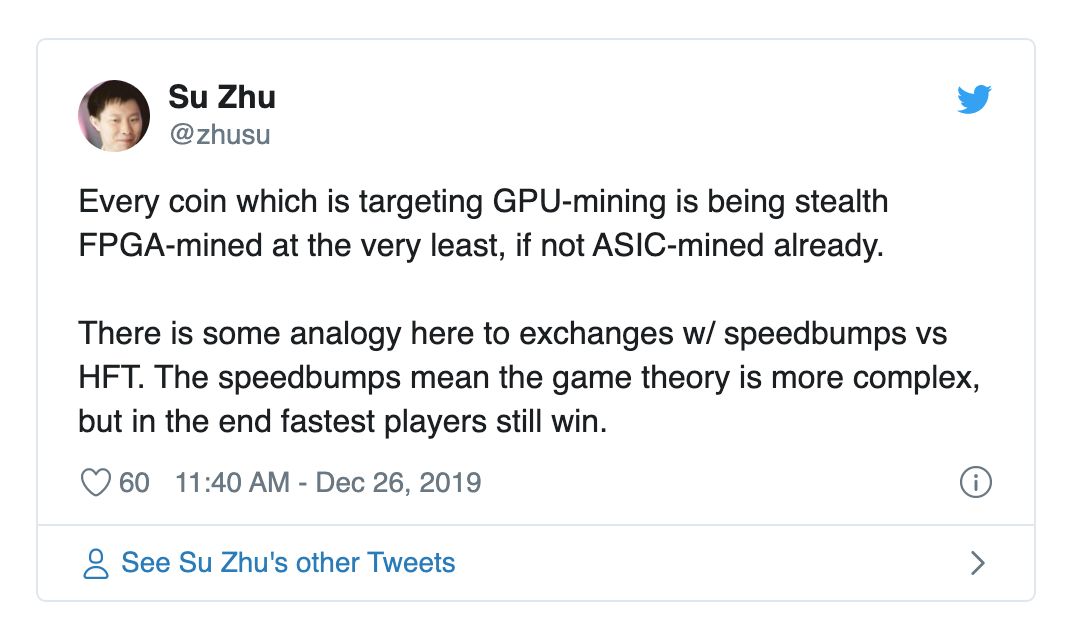

Most ASIC-resistant mining chains face the same difficulties. These projects actually create a lot of bonuses for teams that create FPGA or ASIC chips, and they fly under the radar, hoping they won't be found. Su Zhu has a good point:

You would naively think that the future team would learn from it, bite the bullet, and release the ASIC chip from the beginning.

A proposal

After chatting so much, I will share my thoughts. Let's re-list what we want to optimize:

- We want to limit the minting tax; that is, we want almost all participants to get tokens at market prices with a few exceptions;

- We want the distribution period to be as long as possible;

- If becoming an early supporter of the network does bring advantages, then that advantage should be temporary and will fade away over time;

- The cost of retaining a position of authority in the system should be high; it should not be costless to be able to exert influence forever;

- As an early supporter of the network, you should not be granted permanent anti-dilution rights;

- We want the system to work under existing U.S. securities laws: we want to separate investment contracts from assets issued under agreements;

- We want the network to be secure from the start (from the perspective of cryptoeconomics);

- We hope the founding team can reasonably remove their power and authority in the network;

- We want to cultivate a sense of fairness and minimize the information asymmetry when the network is launched.

I believe that there is a model that has never been tried and that basically has all of the above characteristics:

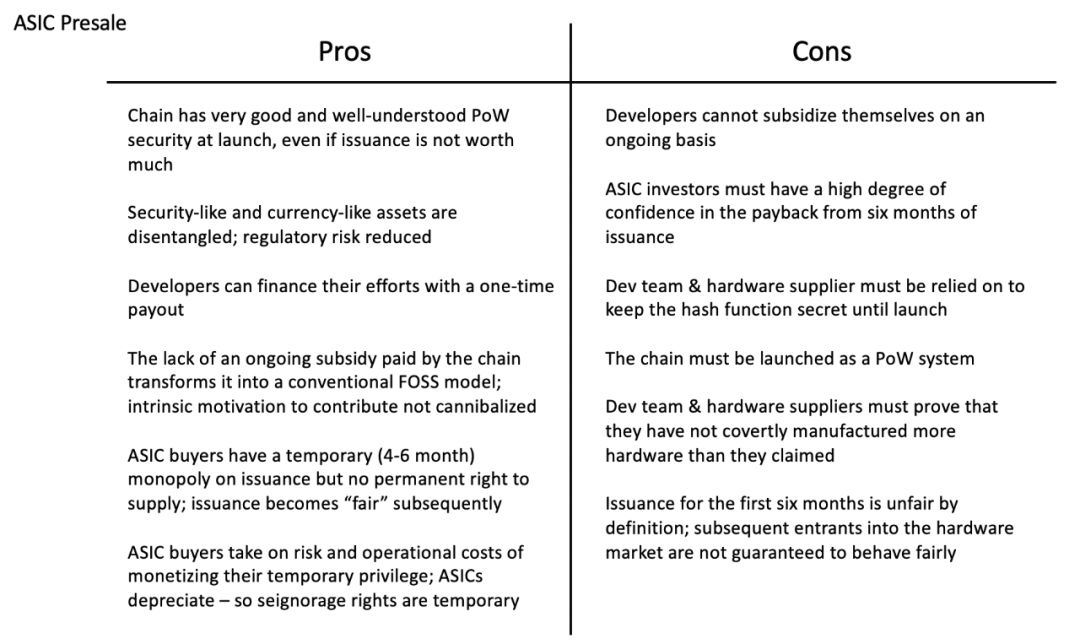

ASIC pre-sale mode

The basic idea is:

- Some developers create a new cryptocurrency protocol;

- To raise funds, they are not selling rights for tokens, but rights for physical ASICs;

- Together with their trusted supply chain partners, they started manufacturing these ASIC chips before the project started;

- These ASICs are sold to investors, or better yet, to a community of users who want to explicitly support the network early in its launch. It may be in the form of some kind of securities, but I have not done legal analysis, (I'm not sure about this). These sales are recorded as the revenue of the issuing company

- These ASICs support a specific hash function (no other blockchain can deploy this function);

- Developers keep this hash function secret until the project starts;

- At the start of the project, the hash function was made public, and a race was started between ASIC manufacturers to create a second-generation ASIC;

- Within 4-6 months, with the production of new generation ASIC, the first generation ASIC will be eliminated, and the monopoly enjoyed by early supporters in ASIC supply will be broken;

- Over time, the advantages enjoyed by early miners gradually disappeared;

- The developer promises to never change this PoW function in the future;

- Developers hold little / or no tokens and can withdraw from the project if necessary, or adopt a Red-Hat / commercial open source method to manage the chain without retaining any items not explicitly stated in the agreement Power.

Let's consider the pros and cons of the ASIC pre-sale model.

Lee:

- Even if the circulation is not high, the chain has a good and well-understood PoW security at startup;

- Securities assets and currency assets are separated; regulatory risks are reduced;

- Developers can use one-time payments to fund their work;

- Due to the lack of continuous subsidies provided by the chain, the project will transform into a traditional free / open source software model, and the intrinsic motivation is contribution, not predatory;

- The ASIC buyer had a temporary (4-6 months) monopoly at the time of release, but was unable to permanently control the supply right; the issue of coins became "fair";

- ASIC buyers bear the risk and operating costs of monetizing their temporary privileges; ASIC chips will depreciate, so coinage tax rights are temporary.

Cons:

- Developers are unable to receive subsidies on a continuous basis;

- Investors in ASIC chips must have a high degree of confidence in the return 6 months after its release;

- Must rely on development teams and hardware vendors to keep secrets of hash functions before release;

- The chain must be started as a PoW system;

- Development teams and hardware vendors must demonstrate that they have not secretly produced more hardware than claimed;

- Issuing work for the first 6 months does not meet the definition of fairness, and latecomers entering the hardware market cannot guarantee fair behavior.

I think the main advantages of the ASIC-based pre-sale model are as follows:

You get ASIC-level security at the start

This is a huge advantage compared to GPU-style PoW fair boot. As we learn more and more about PoW's security model, it is clear that other networks are not secure except the largest GPU mining network. Ethereum is an exception because it accounts for a large percentage of global GPU mining, and these GPUs are not sold or leased to other networks. In addition to the structural difficulty of obtaining sufficient hash power, it also means that successfully attacking Ethereum will cause the value of global GPUs to decline, which is a powerful inhibitor for any attacker. Except for Ethereum, most GPU mining tokens face the risk of being attacked by renting hardware. We have seen many such examples. If you think that dedicated hardware helps improve security, then you will prefer the ASIC mode. This approach provides unbreakable security from the start.

Elements similar to investment contracts are completely separated from actual tokens

In the ICO mode, you have to set aside some tokens for pre-sale. If this part of the token is understood as an investment contract or security, it may damage the overall supply of tokens and affect their ability to circulate on the exchange. In order to circumvent this, there is a view that the investment contract should only cover the right to obtain tokens in the future, and the token itself is not the subject of the investment contract. Based on this theory, some people believe that ETH in the pre-sale phase can be understood as the subject of an investment contract, but the ETH units that have not been issued when the Ethereum blockchain is delivered are not securities themselves. I really don't agree with this difference-at least I find it annoying. Isn't it simpler to separate the two directly?

Under the ASIC type pre-sale model, the investment contract and the token itself can be clearly distinguished. If there is something like securities, it is ASICs sold to investors (however, as mentioned earlier, it is entirely possible that this is not a security at all, because the end user must actually operate them to power the chip mining machine, and not Satisfies the "third-party effort" in Howey's test and is not considered a security).

In my opinion, the nature of the actual tokens themselves is very clear, as they are issued in a traditional fair start-up method according to the agreement of the chain. I think we have a lot of evidence that fair launch tokens are not interpreted as securities by the SEC. This provides a truly convenient guarantee for potential users that the transaction of the asset will not be suddenly restricted to the trading venue of the security token. This is one of the biggest advantages of this mode.

Translation note: In 1946, the U.S. Supreme Court established the "howey test" in SEC v. WJ Howey Co to determine whether a transaction constitutes an "investment contract" and thus a "security." The Howey test contains four elements: (1) capital investment; (2) investing in a common cause; (3) expecting to obtain profit; (4) not directly participating in the business, relying solely on the efforts of the promoter or a third party.

You get a PoW-type distribution, and developers get limited financing

So far, the distribution advantages of PoW have not been well written, but I have a strong intuition: they will make the money supply better distributed. Compared with the ordinary PoW-type startup, developers can obtain the R & D and management costs required for a new chain startup in this mode. Moreover, they did not violate securities laws. perfect!

You get an arbitrarily long distribution cycle

Many people have noticed that, as far as the generation mechanism of new currencies is concerned, the randomness of time existing in distribution introduces an arbitrariness, which will limit the spread of coins. In other words, the short issuance time (some ICOs take only a few minutes to end) makes the supply highly concentrated. The longer-term issuance gives everyone a chance to get a certain amount of tokens. The ICO process of EOS lasted for one year, and there was a similar intuition behind it. This idea is quite smart. Of funds were reinvested in this ICO).

If you think about it, you will find that EOS 'year-long token sale is a bit similar to PoW-type startup (the only difference is that the coins obtained by crowdfunding have not been burned). The PoW model gives you a long license-free distribution phase, although diminishing block rewards mean that there will be much more early supply. The issuance of Bitcoin will last for more than 100 years, but more than 80% of Bitcoin has been mined.

Comparing a PoW-type launch with an ordinary ICO, it is clear that there is no license-free access right in a newly launched ICO. Tezos has overcome this transformation. It does not perform KYC in the crowdfunding stage, and then forces users to perform KYC, so as to unblock Tezzies in the hands of users. I thought that all subsequent ICOs would follow up.

The PoW model is different. You get coins from a protocol. Although ASIC vendors may require KYC, overall, mining requires far fewer licenses than ICO or crowdfunding. In addition, electricity is obviously easier to obtain than capital markets globally, so PoW looks very attractive. An agreement to exchange and distribute tokens with electricity over a long period of time is an extremely effective way to issue an asset to the global public. So far, no one else has come up with a better way.

The rules of this game are clear

One of the biggest problems with today's PoW chains is ambiguity, especially regarding changing hash functions. As long as there is ambiguity, there will be debates, lobbying, and the possibility for developers to take advantage of their privileged position in the system. This usually has catastrophic consequences, reducing its social scalability and the credibility of the system.

If one finds a small group of people abusing their closeness to the agreement to make money, the reputation of the system will be damaged. One option is to set a PoW function and promise to never change (this is essentially the path Bitcoin chooses, so Bitcoin will never change its PoW route unless some disaster occurs). This is also the demand of our model, no debate, no lobbying, no secret plunder.

The initial advantages gradually disappeared over time, which provided the system with a natural token distribution process

Unlike PoS tokens sold in pre-sale, the initial power balance of an ASIC-style system will change dramatically over time. Initially, a selected group of people had near monopoly power in supply, but this was only a temporary and limited advantage. With the emergence of new-generation ASIC chips, even the depreciation over time, they will Eroding this initial advantage. I want to emphasize that I think this is a good feature. Granting too much power to early stakeholders in the network-coupled with the ability to retain this power permanently and at no cost-is actually a degraded property that will greatly inhibit the spread of holder bases . Therefore, the existence of PoW is very valuable. It makes miners have to continuously sell newly mined coins, which reduces their privilege to be close to the agreement. The staking mode does not have this feature. In the ASIC-style boot mode, there will initially be a few privileged individuals, but their advantages will quickly diminish.

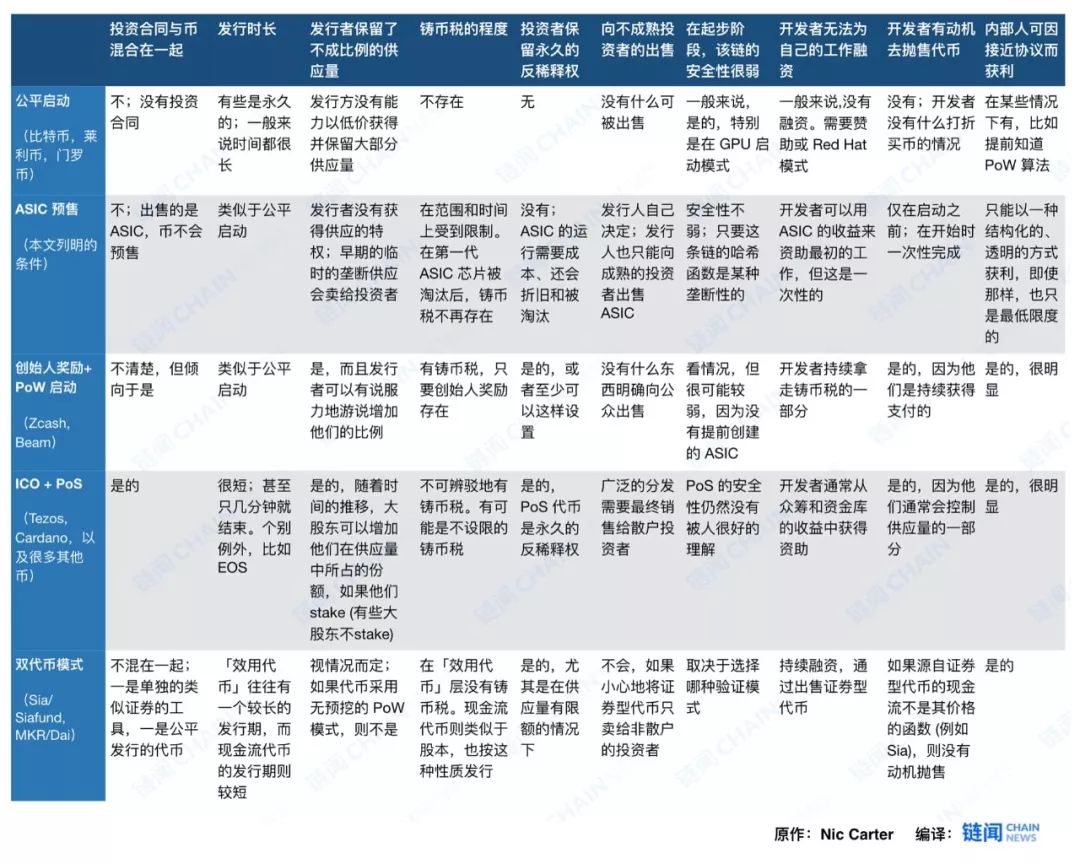

Let's put all the problems into a big table and compare how each startup mode will deal with various defects.

Although I think this is a new and interesting startup mode that is both interesting and attractive, it is certain that there are some questions that need to be answered, especially since we have never seen anyone operate this mode. Here are some of my questions:

- Is it possible to get enough profit from ASIC to become a profitable business?

- What should the shape of the supply curve look like to enable future users to accept this temporary monopoly on supply?

- How can ASIC buyers be confident that no one secretly creates excess ASICs?

- Is a one-time financing sufficient to guide the cause of building an open source agreement?

- Is the limited coinage tax persuasive in terms of creating a monetary asset?

- Is ASIC itself an investment contract / security? Or is their nature clear?

- Is it possible to establish an ASIC supply chain and the supply chain will not be controlled unilaterally by one or two entities for its hardware production?

What do you think about this? Is it worth trying or is it just a waste of time? I would love to hear your thoughts. I think that the startup method is usually written too little, so no matter whether this model is feasible, I hope this article can cause some discussion.

opposing view

Let me answer some of my objections below.

If you apply this model to bitcoin, 6 months of mining is equivalent to 1.3 million bitcoins, which accounts for too much of the total supply

You can freely adjust the shape of the supply curve to allow the monopolist to allocate a certain percentage of the supply in the first 4-6 months. You can design a curve so that they get 0.1% or 99.5% of the supply. I think that issuers may set their initial supply target at around 5-10%, but this is a complete guess.

Why do you think the first ASICs will maintain the advantage for 4-6 months? Why can't they exist forever and give ASIC buyers a permanent advantage?

If the final project agreement is indeed more important (in terms of its market value), then the ASIC manufacturer must step in and make a specific ASIC chip for it. In conversations with ASIC manufacturers, I know that it takes about 4 months to make a useful ASIC for a new cryptocurrency algorithm (experts are welcome to provide comments in this regard). In this case, the competitiveness of FPGA is not enough, because there is a special ASIC at the beginning stage, which means that competitive hardware faces a relatively high threshold. Either way, my point is still true-I expect that the first miners will encounter competitors at the latest within 6 months.

The ASIC in this example is not actually a security

To be precise, this is not an objection. But I still want to answer. I confess I don't know the answer. To reciprocate, you must combine ASICs with your own labor (and electricity) so that their value does not all come from the efforts of a third party. I am only vaguely guessing that ASIC may resemble an investment contract. I am not a lawyer. This is also not legal advice. In any case, if they are not securities, then this model is even better. Remember, what we have to do is not to violate securities laws.

The issuer gives the ASIC manufacturer full power. They can make additional ASICs and get confused in the process

This is definitely a risk, so ASIC manufacturers must be contractually bound or trusted by the distribution team. It is indeed possible that they will secretly make more ASICs. There are ways to mitigate this situation. I didn't think too far in this regard, I think the team can establish a protocol similar to Google's authenticator, which stipulates that the ciphertext they provide to the miners must be included in the output of coinbase in the first few months to ensure that Mined blocks are created only by those specified ASICs. I think there will be smart people who come up with better ways to ensure this, that only this licensed ASIC community can mine during their temporary monopoly period.

We don't need more blockchains, stop helping people find ways to issue new cryptocurrencies

I basically agree, but I will not stop exploring these issues because you do not like new coins to appear. Maybe we will find a reason to create another blockchain at some point. Who knows?

This launch is actually quite unfair, as you suggest creating a pre-mining project

By definition, this is not pre-mining. There is no "mining in advance". (I admit that there is no point in nitpicking by definition). This model is actually where publishers use their information advantage to make money. They know which hash function will be used and sell this information so that buyers can build hardware with built-in targets. Whoever sells ASIC can mine. They did gain a temporary monopoly. You can think of it as a taxi license that expires after six months. This is obviously unfair. But after observing the launch of Grin, the controversy of ProgPoW, and the multiple "anti-ASIC" hard forks of Monero and Vertcoin, I realized that developers are easily affected by lobbying related to PoW. I would prefer the hash function to be constant forever, so that the rules of the game are fixed and the return on lobbying is zero.

Therefore, in this case, we have a transparent unfair model, rather than a model that people naively think is fair, but may be hidden and unfair. The latter will be disastrous. Imagine this situation: an ASIC-resistant blockchain is forked into a new PoW chain, and it was later discovered that developers have already customized hardware for it, while others are still mining with GPUs. This is exploiting and exploiting communities and undermining trust. This is entirely possible in the framework of ASIC-resistant coins. And I think that really will happen at some point. The model I propose is that there is a temporary limited inequity that will dissipate over time and become fairly fair afterwards.

Developers should not make money, they should do these things selflessly, otherwise you will eat away their internal motivation

I very much agree! I think one of the most reactionary consequences of the funding and rewards provided by the agreement is that free / open source software developers have lost their incentive to contribute to the agreement, and all work is left to those who directly receive funding from the agreement. Remunerated professionals. This essentially turns a free / open source software project into an enterprise project, throwing away all the advantages of using the free / open source software model from the beginning.

And the mode setting I proposed makes the opportunities for making money very limited. Developers sell ASICs at a price that the market can tolerate, and this is their only opportunity to directly monetize the access rights of the agreement. Thereafter, they can consider adopting the Red Hat / COSS / Blockstream model, that is, using their protocol-related expertise to make money. Of course, this model also allows the original publisher / developer to exit smoothly without harming the project. The situation is different because they have no permanent authority in the network, and those networks where the issuing team retains a large number of PoS tokens.

In this setting, developers do not make enough money

In my opinion, if a monetized agreement allows its developers to over-profit, it is very dangerous. Beyond a certain threshold, the system will allow people to extract rents rather than provide calculation services based on commodity prices. If developers abuse their authority in the system-including extracting more than the minimum required value (most likely 0)-then it will destroy the credibility of the system, and users may leave the system and move to claim fewer systems. I generally think that if a project does not have any profit model funded by agreement, that is the most preferred. But if a little profit is really needed, then the condition that I can tolerate it is that it is temporary, limited, and does not give developers a permanent right to the system. And this model meets these conditions.

The cost of launching this way is too high for issuers to raise enough funds for themselves

This criticism is quite reasonable. Developers must actually create and sell hardware, not create and sell some kind of token for free. ASICs are usually expensive. I think the price will be different for different types, but a decent run should cost millions of dollars. As a result, issuers will need to be priced sufficiently high to make their income a profit. The "pricing" effect of issuance is an interesting question.

If the ASIC is expected to have a monopoly mining capability in the first 6 months, and a total of 10% of the money supply is issued during this period, the value of the fully diluted supply is approximately 10% of the amount paid by the buyer for the ASIC Times. This laid the foundation for the valuation needed for the project, which was to enable the issuer to make a profit in this way. Let's say it costs $ 5 million to run 1,000 ASIC miners (probably more-I don't know much about hardware). Developers need to raise a significant amount of funds to fund R & D, such as raising another $ 5 million. As a result, they need to sell ASICs (or $ 10,000 each) for a total of $ 10 million. Suppose they decide to issue 10% of the money supply in the first 6 months, and they think that ASIC can carry it during this time. This means that in order for the issuer to obtain sufficient profits, the market value of the blockchain must reach a total of $ 100 million (at the ASIC sale stage).

Why start in such a complicated way? Why not simply make an ICO and keep a pool of funds for long-term incentive allocation?

First, ICOs seem to violate securities laws in almost any jurisdiction around the world. In 2020, many issuers may find that "offshore" operations may not be enough. This article is an alternative suggestion for a PoW-type "fair" launch, and I think the idea has improved in every way. It is not an alternative to ICO. I believe that today (and in fact any time after the July 2017 SEC DAO report), from an regulatory perspective, ICOs are basically not feasible. In addition, I think that the launch method of ICO will face a difficult time in creating a durable currency.

This is still a hypothesis, but I strongly believe that the most important characteristic of a new monetary system is the widespread distribution of its ownership. Its initial Gini coefficient is 1, and the goal is to reach a reasonable distribution over time. I don't mean complete equality of results-this kind of thing is impossible, not even how it works. In 2019, let every adult be equally empowered to get a part of a new monetary system? What about future humans? What about unborn children? Even if it were possible, a global UBI (universal basic wage) would still be affected by a huge time contingency-in favor of the people of today.

The airdrop effect does not seem to be very good. Stellar's plan to distribute their tokens as widely as possible failed. What you get for free is often not valued by the recipient. Not surprisingly. Proof-of-work may be a higher-level system. The miner must do the job he wants. They must invest time and energy in mining. This distribution method is indeed underestimated. If Ethereum is successful, it is largely because it can be mined for more than 5 years with ordinary GPUs. In my opinion, delaying the switch to PoS (which I discussed above, which would curb the distribution of tokens) is a desirable thing. As mentioned before, this is just my intuition. But I think the distribution advantage of PoW is seriously underestimated. Those currency agreements held by a few people will face a Sisyphus-like dilemma on how to convince users to use this token to store value.

ASIC manufacturing is a centralized industry, and the pattern of foundries and political relations determine who is the winner. Your model will make ASIC makers the king of this system

It is true that the ASIC manufacturing of cryptocurrencies is currently quite an oligopoly. If you want to know how this industry works from an American ASIC manufacturer, check out David Vorick's article. Interestingly, ASIC-style startups actually deprive large manufacturers like Bitmain and restore them to the token issuer. A GPU-based fair start is actually just an arms race between large ASIC manufacturers. Whoever can make the fastest ASIC is the winner. Once they become winners, they lobbied the team violently (see the ProgPoW debate on Ethereum).

But in the model I proposed, the team worked with the ASIC manufacturer of their choice to create the ASIC for startup, and then the ASIC manufacturer had the opportunity to make hardware customized for the chain. It is clear that early mining revenues do not accumulate in the hands of large ASIC manufacturers. If it does, it will also be owned by community members who buy ASICs from publishers. Overall, this is a significant improvement. I would add that almost every anti-ASIC chain goes through an awkward transition, and they will eventually yield and accept ASICs. If you choose to preach how to resist ASIC, then coordinate a series of hard forks, and finally accept the inevitability of ASIC, then this process is actually creating a lot of ambiguity, which may and indeed is used by ASIC manufacturers . I prefer games with clear rules from day one.

Finally, it is possible to create some kind of ASIC that is not subject to special supply chains like the SHA-256 ASIC. The king of bitcoin ASIC chips is foundries, which provide privileges to large ASIC manufacturers who can advance expenses and compete to allocate a larger share. There are alternative technologies, such as optical Proof of Work, which are working to instill a fairer ASIC manufacturing process. I did not independently verify these things, and seeing that this is possible. If this is the case, then this ASIC will be easier to mass-produce, with a variety of settings.

Any amount of mintage is unreasonable

I'm not entirely sure that there is a so-called coinage tax in this model. Because it is entirely possible for ASIC buyers to lose money, such as actually paying $ 1.10 for every $ 1 they eventually mine. At least that's not to ensure a mintage tax. ASIC buyers take a degree of risk. That is, if the model works well, ASIC buyers will mine coins at a cost below the market price-if this is not possible, they will not participate. So this is a potential coinage tax. If you think that even the slightest mintage tax will permanently destroy the credibility of the project, then this model is not your dish. However, if you, like me, think that a small amount of mintage tax can be very useful, even if it will undermine credibility, you may find this model attractive.

Why are you wasting your time thinking about these things? We already have Bitcoin and we don't need any new chains

I have the right to think and write anything that I find interesting.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyze the correlation of Bitcoin with gold and crude oil: Is Bitcoin a commodity, currency or a safe-haven asset?

- 10 million bitcoins are "sleeping"! Is it better to have more money laundering parties?

- 2019 Spot Exchange Research Report: The total global trading volume is $ 13.8 trillion, BTC accounts for 48.29%

- The central bank's digital currency DCEP is about to be piloted. What can it bring us?

- Research shows: 39 “giant whales” account for 11.1% of existing Bitcoin

- Research: Bitcoin has added more than 124 million addresses since the bull market in 2017

- A week in review | US and Iran situation pushes up crypto market, new EU regulations trigger regulatory storm