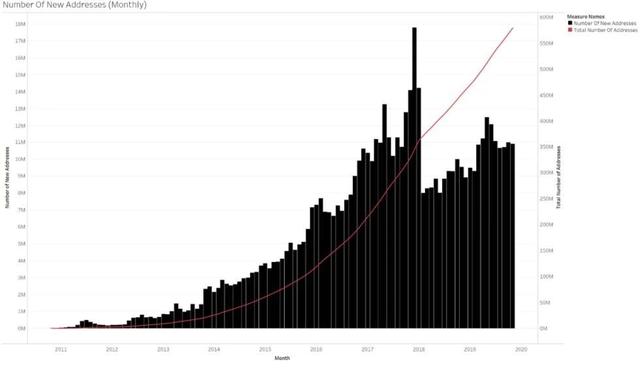

Research: Bitcoin has added more than 124 million addresses since the bull market in 2017

Bitcoin has shown a reference growth indicator that shows a positive attitude towards adoption and potential new users. Both active and new addresses have grown since 2017.

Bitcoin addresses keep growing

After BTC entered the most active bull market in December 2017, as the market expanded, a total of 124 million addresses were created. Decentralized analysis shows that even during the bear market, that is, in mid-2019, the growth of Bitcoin addresses continued, with more than 300,000 new addresses being created every day.

The past 10 years have also shown that "holding" (Hodling) is not just a cultural gene, in fact, it is one of the most prominent models of BTC ownership.

- A week in review | US and Iran situation pushes up crypto market, new EU regulations trigger regulatory storm

- Huo Xuewen, Director of the Beijing Financial Bureau: The first batch of projects in the sandbox will be announced next week

- Huo Xuewen, director of the Beijing Financial Bureau: Blockchain must enter the "supervisory sandbox" test, and the first batch of projects will be announced next week

"In terms of scale, there were only 70,000 addresses holding more than 0 Bitcoin in January 2011. Today, this number has exceeded 28 million, a 400-fold increase in ten years."

Of course, during that time, more than 18 million BTCs were dug out in the market, making more ordinary users available for Bitcoin. However, factors such as the increase in the number of exchanges and the increase in retail sales have driven the growth of Bitcoin addresses.

Not all bitcoin addresses have been mapped out, and the increase may be due to the smaller unit of bitcoin adoption. In addition, there are no restrictions on creating new Bitcoin addresses. You can move BTC and switch wallets to avoid being easily tracked.

Due to dust attacks or other split methods, and then recombining BTC, the address growth also experienced anomalies. But overall, after BTC became mainstream in 2017, both Bitcoin's small wallets and "whale" wallets have grown significantly.

Number of transactions and value transfer near peak

Bitcoin's on-chain activity has also greatly increased. Starting from a few hundred transactions per day in 2011, it has now easily processed more than 300,000 transactions per day. It has peaked in December this year, although the current activity has slowed down.

Compared with non-mainstream cryptocurrencies, the BTC network is still slower and has fewer transactions, but it also has a powerful ability to perform large-scale value transfers. The peak transfer occurred at the beginning of 2018, when the BTC price was close to the peak, and although the transfer fee still exists, the fee is gradually increasing, totaling more than $ 1 billion.

The biggest growth has occurred in the mining ecosystem. With the advent of a new generation of ASIC miners, the ecosystem has expanded many times. Now, with high-capacity machines and established links to hydropower in China, Russia, and the United States, new expansions from mining are also possible.

The original source is bitcoinist, compiled by the Bluemountain Labs team, and the English copyright belongs to the original author. For reprinting in Chinese, please contact the compiler.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- JPMorgan Chase: CME Group launches bitcoin options products tomorrow, bitcoin "peak of interest" is coming again

- Battle for Singapore's Digital Bank License: 21 Ants, Xiaomi, Tencent, Headlines, etc. Who Can Win?

- Viewpoint 丨 Restore the truth of African blockchain, an overview of African blockchain

- The EU Anti-Money Laundering Order No. 5 has officially entered into force. What impact will it have on the crypto field?

- Ethereum 2.0 final specification released! A key step away from going online in 2.0 years

- Former Vice President of the People's Bank of China Suning: The payment cost of adopting digital currency is expected to drop to one tenth of the original

- The Rule of Law Weekend: At least three basic problems must be solved for digital currency to replace banknotes and become the standard of circulation