Overview of the NFTFi ecosystem

NFTFi ecosystem summaryTable of Contents

1.0/ Overview of NFT

1.1/ Background

1.2/ Current Situation

- Derivatives DEX Battle: Kwenta and Level Surpass GMX in Weekly Trading Volume

- Meme Topic Issue 1: May’s Winner

- What happened to the Move2Earn game that was popular in 2022 in 2023?

1.3/ Market Pain Points of NFT

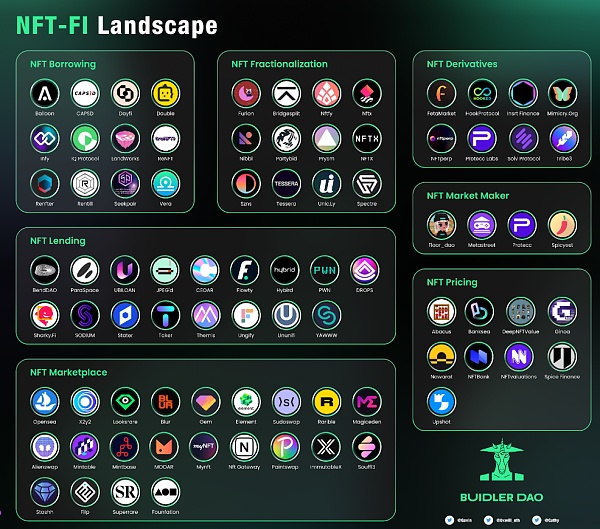

2.0/ Landscape of NFTFi

2.1/ NFT Trading Market

2.2/ NFT Valuation and Pricing

2.3/ NFT Lending

2.4/ NFT Fractionalization

2.5/ NFT Perpetual

3.0/ Conclusion

Overview of NFT

Background

Every cycle of the cryptocurrency world is often accompanied by fresh narratives. 2020 was DeFi Summer, 2021 was NFT Summer. After a year of silence in 2022, NFTFi, which combines NFT and DeFi, gradually emerged in 2023, with various new projects emerging, making NFTFi a promising new narrative.

Current Situation

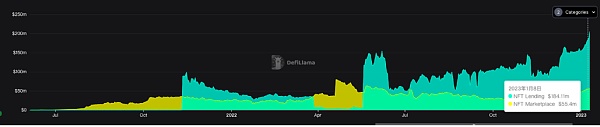

According to data from DefiLlama, since June 2022, the lending volume of NFTFi has been steadily increasing compared to the declining NFT Market, and lending is the most important and product-rich track of NFTFi. This to some extent shows that the NFTFi field has received more attention from funds.

Currently, blue-chip NFTs are the main objects injected with liquidity in the NFTFi track. Based on the market value of blue-chip NFTs, we can estimate the scale of the NFTFi track. According to data from NFTgo, the market values of major blue-chip NFTs calculated according to the ETH price on March 25th are: CryptoPunks is USD 1.421 billion, BAYC is USD 1.318 billion, Otherdeed is USD 632 million, and Azuki is USD 297 million. The total estimated value is approximately USD 5.899 billion.

Market Pain Points of NFT

NFT Liquidity Shortage

Compared to the NFT Summer of 2021, the current NFT trading volume is showing a downward trend year by year. The threshold for NFTs is higher than that of homogeneous tokens. Excluding the situation of Free Mint, the price of NFTs ranges from a few dollars to tens of thousands of dollars, and even the price difference between similar NFTs can reach several times or even tens of times due to factors such as rarity. After most people purchase NFTs, their assets are idle or have low capital efficiency. Holders can only choose to sell valuable NFTs to obtain liquidity to invest in the next NFT or other assets.

Low wealth effect

The investment return of NFTs is still mainly concentrated on buying low and selling high. Some NFT holders with small price fluctuations basically choose to hold the NFTs, which makes valuable cryptocurrencies idle.

Large fluctuations in floor prices

The leading NFT projects have strong monopolies. Due to insufficient market depth or high official control, some small NFT projects often experience large fluctuations in floor prices, and there are many wash trading phenomena. There are a large number of unreal data in the NFT market. Even blue-chip NFTs with high market values are easily manipulated. What about NFTs with small market values and low prices?

Existing NFT liquidity solutions are not flexible enough

Even mature lending projects will only accept some blue-chip NFTs as collateral for security and liquidity reasons. The coverage of NFTs is small, and there are few products that allow users to customize NFT lending solutions.

The NFT sub-market is not yet mature

It is still a long-only market, and speculators can only profit from the increase in the floor price of NFTs. There is no way to respond except for holding and dumping when the market falls, resulting in many NFTs not being zeroed but completely losing liquidity. After the hotspot subsides, no one hangs up and trades.

High royalty costs

The royalty costs of 5-10% and the transaction fees as high as 2.5% in the NFT market make the market with poor liquidity even worse. However, more zero-royalty NFT trading markets have emerged, and the emergence of Blur has finally made Opensea compromise with zero royalties, so the high royalties of NFT trading have now been alleviated.

NFTFi Track Map

NFT Trading Market

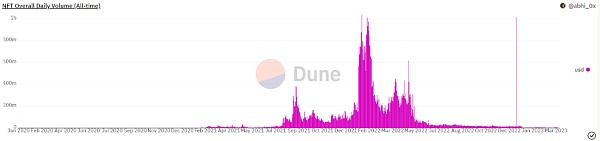

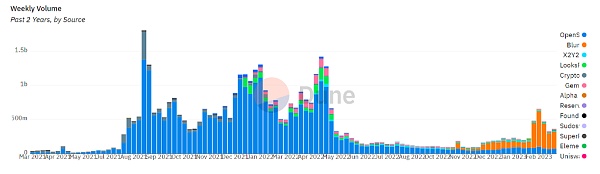

In the broad NFTFi field, the NFT trading market is still the most funded and focused track. The main NFT trading platforms currently include Opensea, LooksRare, X2Y2, aggregators Gem, Blur, Element, and decentralized trading platforms Sudoswap, etc. At the beginning of 2022, the NFT market continued the hot trend of 2021, and the market turnover in January exceeded 5 billion U.S. dollars, a new historical high. Although the overall transaction volume in 2022 has significantly decreased compared with the same period in 2021, some heavyweight events have also occurred in the NFT trading market this year. X2Y2 announced zero royalties, the first NFT trading market that supports AMM Sudoswap, and Blur, which is tailored for professional traders, released airdrop tokens, making the entire NFT trading. The market pattern has undergone earth-shattering changes. Among many NFT markets, the most eye-catching newcomer is the aggregate trading market Blur.

(Source: https://dune.com/abhi_0x/nft-dashboard)

Blur

Introduction

Blur, as a new aggregator trading market, announced on March 29 that it had completed a $11 million seed round of financing, led by Blockingradigm, with participation from eGirl Capital, Keyboard Monkey, and other institutions and angel investors. With a strong background and the expectation of airdropped tokens, it quickly attracted a large number of beta users and established a certain degree of popularity. After distributing airdropped tokens, the bid incentive model triggered a liquidity frenzy in the entire NFT market.

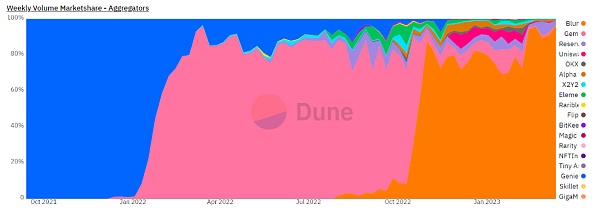

From the chart, we can clearly see the change in market share of mainstream trading markets. Since its official launch in October 2022, Blur has quickly surpassed Gem after only three days of beta testing, rapidly occupying 80% of the entire aggregator trading market trading volume. On November 27, with a trading volume of 5500 ETH, Blur surpassed Opensea’s 5300 ETH and became the undisputed dark horse in the trading market, firmly occupying the dominant position.

(Source: https://dune.com/hildobby/NFTs)

Product Business:

Own NFT market and aggregator

The advantage of the aggregator is that by aggregating prices from multiple platforms, it can select the most advantageous prices and the most abundant orders. Currently, the aggregators on the market support the one-click bulk purchase function, and Blur is no exception. According to Blur, its transaction speed is ten times faster than Gem, which satisfies the needs of most trading scenarios for professional traders. Blur’s unique feature of skipping pending also avoids many scenarios of wasting gas.

In addition to the aggregator, Blur has also launched its own trading market and touted the slogan of “find floor on Blur”. Through loyalty evaluations to incentivize users to place orders on Blur, in S2’s point incentive activity, loyalty is a key factor in measuring point acquisition. If orders are placed on Opensea, loyalty will be directly reduced to 0, stabilizing the number of orders on its own market with such iron-blooded means.

Product Features:

(1) A trading market designed for professional traders

The Blur team emphasizes four advantages of Blur: fast data update, easy user query, investment portfolio advice, and a focus on professional traders. Traditional NFT markets focus too much on a single retail experience. For example, Opensea is more like a supermarket, listing a wide variety of products for users to choose from, while Blur is more like a trading market. When you open Blur, you only see a wealth of data panels. With smooth features such as shopping and skipping pending transactions, which are customized for traders, its slogan “Blur – An NFT Marketplace Made for Professional Traders” quickly spreads in the industry.

(2) 0 fees and custom royalties

a. Blur encourages traders to trade freely and has always been 0 fees.

b. Blur’s royalties allow traders to customize them, but Blur encourages traders to pay royalties to protect the rights of creators. Those who execute high royalties on NFT orders will receive more $BLUR airdrops. Blur defaults to the highest royalty in OpenSea, LooksRare, and X2Y2. When traders list NFT on the Blur market, they can also customize the royalty value. Traders who set royalties above 0.5% will receive more airdrops.

Setting royalties has always been a difficult issue for balancing creators and traders/collectors in the NFT trading market. Traders want to maximize profits, collectors want to support creators, and creators want more royalty income. Since X2Y2 opened the era of 0 royalties, it has sparked a royalty war in major trading markets. Blur cleverly gives traders and collectors the power to set royalties and hopes to encourage traders to respect royalties through their airdrops.

(3) “Blurry” airdrop rules

Blur has held three airdrop events in total.

-

Airdrop 1: Airdrop gift boxes are given to participants who are actively listing and trading on other platforms.

-

Airdrop 2: Airdrop 2, which targets users who actively traded on Blur in November, also includes an evaluation of “loyalty”. The more trades made, the more airdrop gift boxes received, and the higher the loyalty, the higher the rarity of the gift box. Airdrop 2 is much larger than Airdrop 1.

-

Airdrop 3: Airdrop 3 targets traders who list bid orders and listings on Blur. The rewards are divided into bid points and listing points. The general principle of bid point rewards is that the higher the bid order price range, the longer the time, and the higher the project trading volume, the higher the points obtained. The specific weight is not detailed. The listing points are not directly displayed. Because Airdrop 1 and 2 gave users a big surprise, Airdrop 3 attracted a large number of “scalpers” who listed bid orders for speculative purposes, which once increased the liquidity of the entire NFT secondary market.

This vague incentive rule prevents the platform from becoming a “mining game” and also ensures the interests of loyal users who actively use Blur. Traders will become the traders who receive the most tokens and protocol control.

Review:

In retrospect, Blur’s road to success has been carefully designed, with a luxury background and a gift box full of sincerity. With a smooth trading experience and a blurry but reasonable airdrop incentive, it has captured a large number of users. Its purpose, “known to everyone”, is to challenge Opensea’s dominant position, and the actual results are visible. Blur has become the most difficult competitor to Opensea so far.

However, due to the overall market conditions, the NFT market is actually precarious, and the liquidity brought by Blur cannot be sustained, and it needs to wait and see. The competition between Blur and Opensea also proves that NFTFi is still in the early stage of barbaric growth, and the NFT trading market, which is a big cake, is still an unknown number.

NFT Valuation Pricing

NFT pricing is the basis of all NFTFi. We can use blue-chip NFTs as an analogy with real estate in the real world. Real estate can be evaluated based on multiple dimensions such as location, age, surrounding facilities, etc., and the evaluation standards have certain consensus, which constitutes the basis for its speculation. Blue-chip NFTs are the same. Without a reasonable valuation system, it is difficult to promote liquidity. Currently, this track includes Taker, Upshot, Banksea, Abacus, NFTvalations, Blockingwnhouse, Pilgrim, etc.

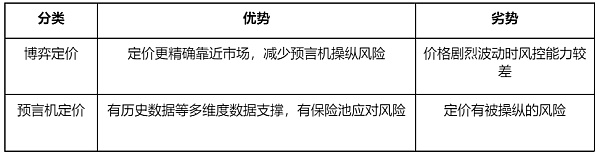

Currently, there are two pricing methods: game pricing and algorithm pricing, which are simply subjective pricing and data objective pricing.

Abacus

Introduction

As for subjective pricing, the most prominent product is Abacus. Abacus uses optimistic PoS to create an NFT valuation method based on a liquidity pool, providing a new solution for NFT valuation. Abacus’s valuation method relies to a large extent on LP’s subjective pricing method, and its advantage is that it can achieve real-time valuation of NFTs, link trading value with real value, and release greater liquidity.

Product Business

(1) Peer Incentive Pricing

Allow all users to submit their own personal evaluations, pledge $ABC as collateral, and derive the final price weighted by group approval. The reward for evaluation is the highest bid, and the reward will be distributed according to the accuracy of the evaluation and the proportion of $ABC pledged. It’s a bit like guessing the stock price to win a bonus.

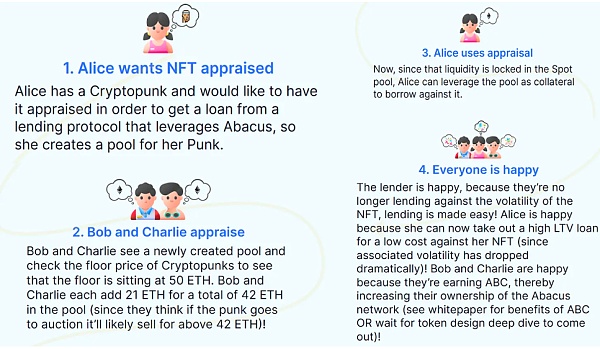

(2) Abacus Spot Pricing

Create a pool around the NFT to be evaluated, which reflects the dynamic price of the NFT. The NFT holder does not need to lose ownership of the NFT during the valuation period, which guarantees its liquidation value for the lender. After the evaluators have made their own evaluations, they lock in ETH as collateral for valuation. All traders participating in the pool’s liquidity will receive epoch credit incentives, which can be exchanged for $ABC in the market. Rewards and pledged amounts are positively correlated with time.

Example: Alice has a CryptoPunk and wants to get more loans through Punk, so she creates a pool and puts her Punk with a market value of 50 ETH into the pool. Evaluators Bob and Charlie added 21 ETH each after evaluating and found that the floor price of Punk was 50 ETH. The pool now has 42 ETH in addition to Punk.

For Alice, she can fully use this pool to borrow more money, and her loan efficiency is improved through the pool.

For evaluators, they can get an increase in Abacus’s native token ABC, and there is a certain probability of getting a certain spread. If Alice’s pool closes and the price of Punk is 50 ETH, which is higher than the price of the pool of 42 ETH, the 8 ETH difference will be evenly distributed to the two evaluators. However, if the floor price of Punk is lower than the price of the pool, the evaluator needs to bear the corresponding loss. The NFT holder Alice profits, and Alice can make profits through band trading. In the end, evaluators and NFT holders use Abacus to constantly play games and reach a balanced price, that is, the auction price.

Product Features

(1) Game Pricing Model

Abacus has created a game pricing model as an intermediary for the price game between evaluators and owners, which can accurately price while improving capital efficiency and greatly improving liquidity. Generally speaking, the more rational the followers of the NFT project are, the more reasonable this pricing model is, which is very suitable for the blue-chip NFT model.

(2) Economic Model

Abacus’ token economy model is somewhat similar to traditional DeFi, but not entirely the same. Abacus’ native token is $ABC, mainly used for participating in reward weight distribution, staking mining, voting, etc., but Abacus incentivizes assessors through EDC points rather than directly using ABC tokens. EDC points are obtained by participating in the assessment process, and the protocol profit generated from this guarantees the support of its token price and is also an important source of its business revenue.

Evaluation

Abacus has found the price essence of NFT. The value discourse power of NFT is still in the hands of traders. For NFTs issued by the project party at the primary market, if traders are not satisfied and do not buy orders, there will only be a result of breaking. The Abacus protocol determines the valuation of NFTs by rational actors who maximize profits. Compared to other capital pools based on floor price pricing, it is more humane, returns to the value of each NFT itself, releases a lot of liquidity, and improves capital efficiency.

However, the gameplay of its token economic model has to some extent increased the participation threshold. Senior NFT traders are naturally excellent assessors. Instead of participating in such a game pricing, it is better to directly participate in secondary market trading. How to reduce their entry threshold or have a better incentive model is the challenge that Abacus will face next.

Banksea

Introduction

In terms of objective data pricing, a more classic project is the oracle Banksea.

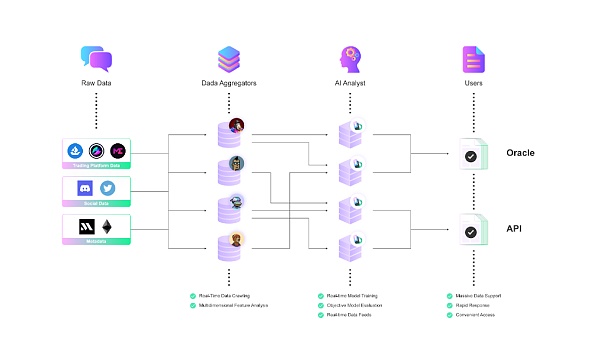

Banksea is a decentralized blockchain infrastructure that uses AI, big data technology to conduct NFT data analysis, NFT valuation, and NFT comprehensive risk assessment. It provides secure, objective, and real-time NFT valuation to on-chain users through the Oracle method.

Banksea consists of data aggregators, AI analysis, and user terminals. The data aggregator collects and processes raw data, and AI generates NFT valuation through the model, and finally provides it to the user terminal in two ways (Oracle-Smart Contract/Banksea API). The AI processing link is their core mechanism. By using time series prediction method to establish a model, the trend is predicted by a certain time series, that is, the current NFT value is estimated by the historical feature data of NFT. After the valuation model is established, the output of the model needs to be evaluated. The AI node uses MAPE (Mean Absolute Percentage Error) and refers to other evaluation indicators to comprehensively evaluate the model effect. Finally, Banksea synchronizes NFT collection values (including market floor prices, AI floor prices, and 24h average transaction prices) and NFT valuations (including standard valuations and valuation ranges) to the contract.

Product Business

(1) Off-chain API Service

To ensure the accuracy of valuation, Banksea NFT Oracle has analyzed a large amount of data in this process. The analysis results are very valuable, so we now provide analysis data through API.

Market Analysis

-

Trading statistics: Statistics on various market trading data, including market value, trading volume, number of holders, etc.

-

Popularity analysis: Analyze the current market heat with social media data and trading statistics results.

Collection Analysis

-

Rarity analysis: Rarity ranking, analysis of the relationship between rarity and transaction price.

-

Trading statistics: Statistics on various transaction data, including market value, trading volume, holding ratio, floor price, creation time, etc.

-

Popularity analysis: Analyze the current market heat with social media data and trading statistics data.

NFT Analysis

-

Static data: Characteristic analysis, rarity distribution.

-

Trading statistics: Statistics on transaction data, including historical transaction price, historical listing price, historical average price, etc.

(2) On-chain data service

-

Collection level

Based on the on-chain transaction and listing records, Banksea NFT Oracle calculates the market floor price, AI floor price, 24-hour average price and other data of NFT collections in real-time and synchronizes these data to the chain. The AI floor price is the minimum value of the AI valuation of all NFTs in a collection to prevent unstable market floor price and short-term manipulation attacks.

-

NFT level

Banksea NFT Oracle comprehensively analyzes the basic data of NFTs, extracts multi-dimensional features, and trains AI models based on time series modeling. The AI model will periodically value a certain NFT, and the platform will perform regression verification based on the real-time transaction price of the NFT, and continuously optimize the model to ensure accuracy. The valuation result includes valuation standards and valuation ranges. The valuation standard refers to the comprehensive evaluation result of the AI model, and the valuation range refers to the valuation boundary of different models.

Banksea currently offers 100 collection-level free feeding services.

Product features

-

Objectivity

AI algorithms generate NFT valuations directly, ensuring fairness, openness, and objectivity of valuations, and are not influenced by subjective consciousness.

-

Safety

Banksea NFT Oracle collects multidimensional data to prevent SPOF (single point of failure). It also applies valuation aggregation algorithms on-chain to avoid false valuations of nodes.

-

Fast speed

Banksea NFT Oracle supports minute-level valuation.

Evaluation

In addition to NFT historical data, Banksea also cites community, social media data, and other indirectly related data to enrich data dimensions. Valuations supported by data are more objective, but their AI algorithms are not public and there are certain risks. I prefer Banksea’s real-time quotes for data analysis.

Compare the advantages and disadvantages of subjective pricing and objective pricing based on data.

NFT lending

NFT lending can be understood as adding DeFi gameplay based on NFT to provide more liquidity and capital returns. NFT lending is a more mature development track among NFT subdivisions, and it is also the most dynamic subdivision track, with new competitors emerging one after another.

Looking at the mainstream lending protocols in the track, there are mainly four borrowing methods:

-

Peer-to-peer (P2P) lending, that is, matching transactions between users for lending. The lender and the borrower match in terms of interest rates, term, NFT collateral type, etc. After the demand is matched, the lending transaction is realized.

-

Peer-to-pool/protocol (P2P) lending, which is a lending model where users and protocol pools reach lending agreements. The lender mortgages NFTs to the protocol pool to quickly obtain loans, and the depositor provides funds to the protocol pool to earn interest income.

-

Mixed lending, which combines the P2P and P2P pool models of the protocol. In this mode, the lender sets a series of parameters such as interest rate, term, loan amount, etc., and requesting a loan on the platform means establishing a separate protocol pool on the platform. Multiple borrowers can deposit funds into the protocol pool to earn interest income.

-

Centralized NFT lending platform, where the borrower mortgages NFTs to the centralized platform, and the platform issues loans after evaluating the collateral.

According to Defillama, there are multiple projects in the NFT lending sector, despite the fact that the floor price drop triggered many BAYC collateral liquidation auctions around November 15, 2022. As the collateral in BendDAO’s auction pool is based on the debt of the borrower, there is a large arbitrage space for NFT Flippers to participate in bidding. BendDAO’s TVL ranking is still in the lead, with TVL far exceeding second place, but the up-and-coming BlockingrasBlockingce has seen rapid TVL growth and is currently ranked second in the lending sector (as shown in Figure 1).

(Source: defillama https://defillama.com/protocols/nft%20lending)

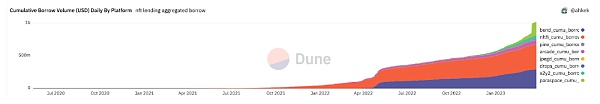

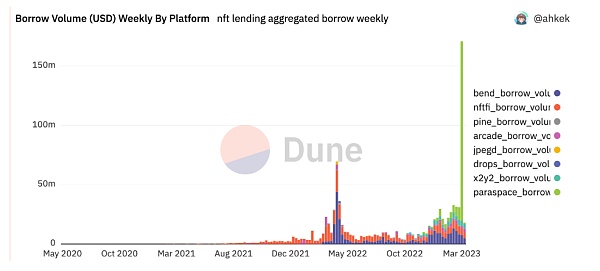

At the same time, it can be seen from the cumulative daily loan amount in Dune Analysis that NFTfi and BendDAO are still the mainstream lending platforms in the market, but since March 2023, BlockingrasBlockingce’s cumulative daily loan amount has shown a significant increase in growth rate. On March 13, BlockingrasBlockingce’s cumulative daily loan amount showed a discontinuous increase (as shown in Figure 2), which may be due to SVB’s announcement of bankruptcy on March 10, which caused a credit crisis in the market. More investors are willing to pledge NFTs to obtain some liquidity in advance, coupled with a series of publicity activities announced by BlockingrasBlockingce on March 12, such as becoming the official designated pledge platform of APE Coin, which has attracted market attention. The loan amount of investors on BlockingrasBlockingce has increased significantly, and in the week of March 13, the weekly loan amount surpassed BendDAO and NFTfi, ranking first in the weekly loan amount (as shown in Figure 3).

(Source: https://dune.com/impossiblefinance/nft-lending-aggregated-dash )

(Source: https://dune.com/impossiblefinance/nft-lending-aggregated-dash)

Therefore, in the NFT lending market, this article will start from the top two TVL-ranked projects to explain the operation mechanism of the NFT lending market and why BlockingrasBlockingce has emerged as a dark horse.

BendDao

Introduction

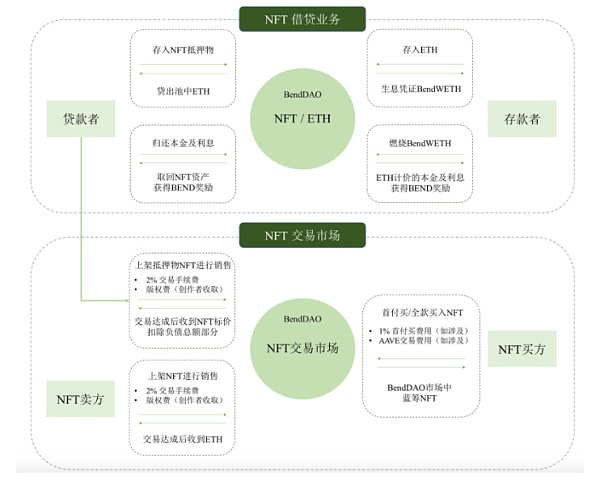

BendDAO mainly provides ETH loans collateralized by blue-chip NFT assets. Other businesses include an embedded trading market on BendDAO, which supports users to place collateralized orders for trading (“order sell”), as well as supporting users to purchase NFTs with a down payment (“down payment buy”). Based on the above businesses, the protocol’s main source of income is the interest rate income generated by collateralized loans, and other income includes trading fee income from the trading market (2% fee rate) and down payment transaction fee income (1% fee rate). Currently, BendDAO’s cumulative number of users has reached 10,016, and the total amount of NFT loans is $256,282,891. The main businesses can be divided into the following categories:

Product Business

The main business can be divided into the following categories:

(1) NFT spot lending

It involves two parties: NFT pledger and liquidity provider. NFT pledger can borrow ETH in the pool by pledging NFT, and liquidity provider can earn interest income. When the price of the pledged NFT falls below the health factor, the liquidation mechanism will be triggered. (As shown in Figure 5)

(2) NFT trading

Sellers can obtain pre-sale liquidity: as a seller of NFT, in most cases, the sale of NFT is not immediate. The seller can choose to pledge NFT and borrow corresponding proportion of ETH to obtain liquidity in advance, and the profit obtained by the seller when NFT is sold is the selling price minus the loan amount (principal + interest).

(3) Down payment for buying

Buyers can pay % down payment and pledge NFT on the BendDAO platform, during which they will enjoy all the benefits of NFT. After the buyer fully repays the principal and interest, the NFT can be unlocked and the buyer can obtain full ownership (as shown in Figure 5).

(Data source: Mint Venture)

(4) APE Coin pledging

At the end of 2022, BendDAO will develop APE Coin pledging business for BAYC community. Some Yuga Labs pledging pools require both NFT and $APE tokens. BendDAO community develops asset pairing business based on this pledging function, so as to solve the problem that some users only have $APE without NFT or only have NFT without $APE. The NFT and $APE in the matching market are combined to maximize the income, and then the income is shared with LP.

It adopts a matching pledging mining scheme, which means that users can participate in pledging even if they only hold part of the assets required by the mining pool. That is to say, users can mine even if they only hold ApeCoin or a certain NFT (BAYC\MAYC\BAKC).

As a way to increase the return for matching NFT and ApeCoin holders, BendDAO will charge 4% of the user’s pledging income as a pairing service fee.

Product Features

(1) NFT + DeFi

The protocol pool concentrates NFT collateral and ETH funds. Loan users pledge blue chip NFT assets they hold, and borrow ETH funds immediately from the protocol according to the NFT floor price, fixed collateral loan ratio LTV, and floating interest rate APR calculated by the protocol. ETH fund borrowers can deposit or withdraw funds at any time according to the floating APR.

(2) Clearing protection mechanism and transaction transparency

For borrowers, during the auction period (48-hour clearing protection period), borrowers (users with pledged NFTs) can still repay loans within 48 hours after the auction starts for the safety of NFT holders. For bidders, when the health factor of the pledged NFT is less than 1, under the Bend auction mechanism, as long as the bid is higher than the floor price, any bidder can obtain ownership of the NFT. In this way, all NFTs will have a price discovery mechanism, making transactions transparent.

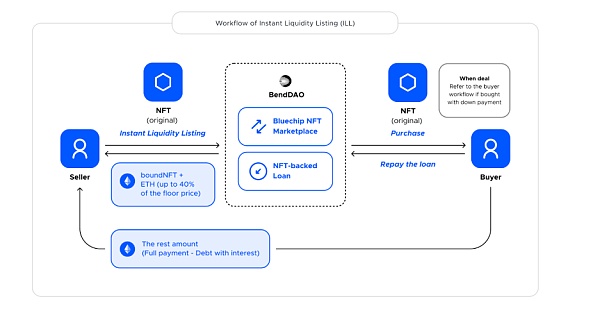

(3) The best blue chip NFT liquidity enhancement solution

By placing collateral orders, NFT holders/sellers can choose to accept instant NFT-supported loans and receive up to 40% of the floor price immediately when placing orders. Users can place collateral on BendDAO at any time. Buyers can buy blue chip NFTs by paying a minimum down payment of 60% based on the actual price, and pay the remaining amount through AAVE’s flash loan. The borrowed amount of the flash loan will be repaid through instant NFT-supported loans on BendDAO. After the down payment, the buyer will automatically become a borrower. Borrowers can also place their pledged NFTs on the order book.

(Data source: Bendao official website)

(4) Borrowers still have ownership of the NFT

When borrowers deposit NFTs into Bend DAO, a boundNFT will be minted as a debt NFT. boundNFT is designed to provide insurance vault functionality, while providing sufficient security and the same digital self-expression. boundNFT has the same metadata and token ID as the original NFT owned by the user, which can still be used for social media PFPs and still enjoy the right to receive airdrops, etc. boundNFT is non-transferable and non-authorizable, so it cannot be stolen.

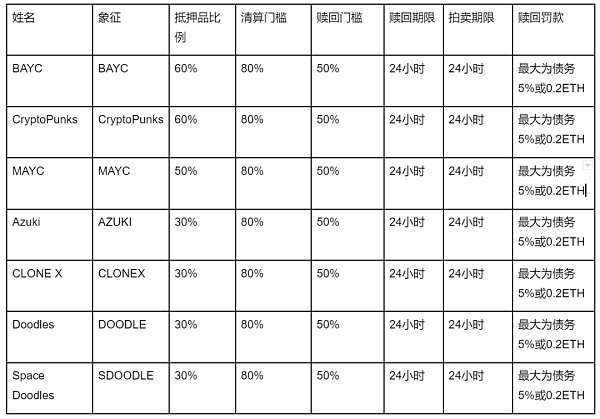

Supported assets and clearing mechanism

(1) NFT collateral ratio

After a community proposal, BendDAO adjusted the redemption deadline and auction deadline on August 30, 2022, and adjusted the NFT collateral ratio on December 18, 2022.

(2) NFT lending interest rate

Loan interest rates will be determined by market supply. When capital is available, low interest rates are used to encourage borrowing. High interest rates are used when capital is scarce to encourage loan repayment and increase deposits.

(3) Liquidation

-

Since the health factor of NFT mortgage loans is less than 1, a 48-hour liquidation protection will be triggered

Health factor = (floor price * liquidation threshold) / outstanding debt

-

If there is no repayment within 48 hours, the auction will last for another 48 hours.

-

Floor price: Original price data is from Opensea and Looksrare. The on-chain calculation time-weighted average price (TWAP) is weighted to ensure a reasonable price.

Evaluation

Advantages:

(1) The project was launched in March 2022. It is a startup point-to-point pool lending method in the NFT lending market. The product logic is simple and easy to understand, eliminating the trouble of setting parameters for users. It is very friendly to basic NFT players. It has accumulated a certain number of users during the NFT Summer and is currently the leading project in NFT lending, with strong user stickiness.

(2) Wide coverage of needs. BendDAO targets the blue-chip NFT market with a relatively large market value proportion and active trading, as well as PFP’s main pricing unit ETH. BendDAO can currently meet the needs of “important” users in the market.

(3) The liquidation mechanism is relatively complete. The loan-to-value ratio of blue-chip NFTs is better than that of peer-to-peer lending protocols such as NFTfi, and there is a 48-hour liquidation protection period.

(4) The decentralized governance of the DAO and team cooperation promote the project together. Staking platform coin $BEND can earn $veBEND to participate in community governance, and the loan-to-value ratio of blue-chip NFTs is continuously optimized under the proposal of the DAO.

Risk factors:

(1) The liquidation mechanism is risky. BendDAO adopts Chainlink’s oracle mechanism, mainly targeting NFT quotes on Opensea and Looksrare to determine NFT prices, and the price of blue-chip NFTs is the main factor determining liquidation. In November 2022, the floor price drop triggered the liquidation auction of many BAYC collateral. Since the liquidation auction starts at the borrower’s debt, there is a large arbitrage space for collateral in the BendDAO auction pool, attracting many NFT Flippers to participate in the bidding. However, due to the price gap between the floor price and the borrower’s debt (such as the large price difference between the Floor Price and Latest Bid of BAYC collateral), Flippers’ arbitrage behavior may further lower the floor price, causing more collateral to be liquidated and magnifying the risk of blue-chip NFT liquidation under the protocol’s liquidation mechanism.

(2) Changes in mortgage ratios are entirely driven by the community. Changes in mortgage ratios often lag behind, and the determination of ratios lacks scientificity. Unlike lending protocols such as Aave and Compound, third-party institutions are not used for risk model evaluation, and there is a lack of evaluation of NFT collateral asset quality.

BlockingrasBlockingce

Introduction

BlockingraSBlockingce is an innovative NFT lending platform based on the Ethereum ecosystem, a point-to-pool NFT lending protocol that allows users to collateralize and borrow NFTs and fungible tokens. Its sister project, Blockingrallel Finance, the largest lending protocol in the Polkadot ecosystem, is also well-known, and its development team is also Blockingra Labs.

In short, BlockingraSBlockingce supports a total of 8 ERC-20 assets, including APE, cAPE, ETH, DAI, WETH, stETH, USDC, and USDT, and innovatively supports 12 sets of UNISWAP V3 LP (specified fee rate) composed of the above ERC20 as collateral. Users can collateralize and borrow bundled assets to improve the problem of low capital efficiency of on-chain assets.

Compared with BendDAO, its model is a cross-margin full-position leverage model, and the development team behind BlockingraSBlockingce, Blockingra Labs, has received $29 million in investment, including star investment institutions such as Polychain Capital, Slow Ventures, Coinbase, and StarkWare, and has great potential in the future.

Product business

(1) Point-to-pool lending

-

Bundled collateral: In addition to supporting users to conduct point-to-pool lending, BlockingrasBlockingce has innovatively proposed a new concept of bundled collateral, which can include interest-bearing assets such as NFT, ERC-20 tokens, and Uniswap V3 LP. Users can bundle NFTs and other interest-bearing assets to obtain higher credit limits and borrow more liquidity assets, further increasing the efficiency of fund use.

-

Cross-margin credit mode: The assets pledged by users are no longer isolated (for example: if a user pledges 5 BAYCs, 5 different health factors will be generated, while BlockingrasBlockingce regards the 5 pledged BAYCs as an asset portfolio and generates a health factor for the asset portfolio). Users can borrow based on the total value of the asset portfolio, maximizing borrowing while ensuring a certain degree of liquidation safety.

(2) APE Coin Staking

The price of APE Coin is closely related to the floor price of Ape NFT, so the liquidation risk is inherently lower than the ETH collateralized borrowing model for NFT mortgages. At the same time, in extreme situations, when the liquidation process is about to start, BlockingraSBlockingce will automatically redeem the Ape NFT that has been pledged, but will deduct the necessary part from its Staking reward to ensure the solvency of APE token lending, and the Ape NFT itself will not really enter the liquidation auction process.

-

One-click Matching: Ape holders can directly pledge Ape NFT to obtain a certain amount of APE Coin and participate in Ape Coin’s liquidity mining. When the liquidation of the pledged Ape NFT begins, BlockingraSBlockingce will automatically redeem the pledged Ape NFT, only deducting the necessary part from its Staking reward to ensure the solvency of APE token lending, and the Ape NFT itself will not really enter the liquidation auction process.

-

Automatic Compound Interest: Currently, BlockingrasBlockingce has developed Staking APE Coin for mining, and the contract can be automatically reinvested, saving operation steps and gas fees.

Product Features

(1) Bundled Mortgage and Full Margin

Allows users to simultaneously collateralize NFTs, ERC-20 Tokens, Uniswap V3 LP positions, or any combination of the three, calculate the maximum amount that can be borrowed according to the platform’s ratio, and generate a credit limit. Users can choose NFT investment combinations with negative correlation to resist liquidation caused by large fluctuations in the price of a single NFT.

(2) Cross-margin Credit System

Allows users to simultaneously collateralize NFTs, ERC-20 Tokens, Uniswap V3 LP positions, or any combination of the three to generate a credit limit. The generated credit limit can be used directly to purchase NFTs from major NFT trading markets in the NFT market embedded in BlockingrasBlockingce, and the loan can be repaid later, improving the efficiency of capital use.

(3) Leveraged NFT Purchasing

In addition to the assets already pledged by the user that can be used to generate points, the NFT to be purchased can also generate new credit points, which can be used to purchase the next NFT. Users need to keep the health factor above 1.

(4) ChainLInk NFT Oracle

BlockingrasBlockingce is the first lending platform to use ChainLink’s NFT oracle as the core of its lending pricing mechanism, making BlockingrasBlockingce’s NFT pricing more accurate than BendDao’s.

(5) Liquidation guarantee

When the health factor falls below 1, the user’s collateral assets will face the risk of liquidation. Users can choose to inject NFTs, ERC-20 Tokens and Uniswap V3 LP positions recognized by the platform into the collateral assets in a timely manner. If the user’s health factor is still below 1, tokens with stronger liquidity, such as ERC-20 Tokens and ETH, will be liquidated first. BlockingrasBlockingce has a unique NFT liquidation mechanism, which uses a hybrid Dutch auction to ensure that NFTs are valued at the maximum price during liquidation.

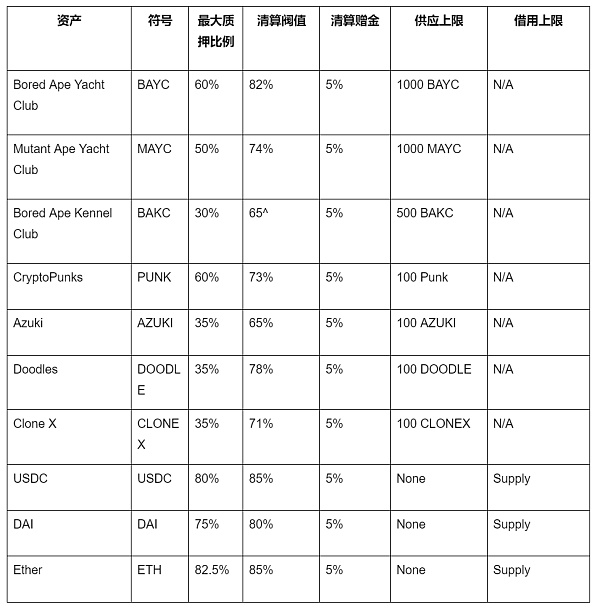

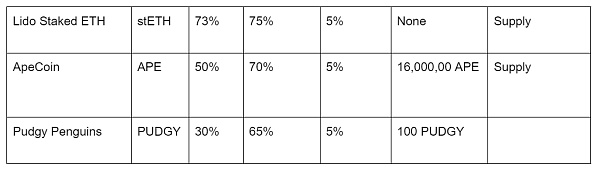

Supported assets and liquidation mechanisms

Currently, there are 9 types of NFTs supported: Bored Ape Yacht Club, Mutant Ape Yacht Club, BoredApeKennelClub, CryptoPunks, Doodles, otherdeed, CloneX, Azuki, MoonBirds, Meebits, PudgyPenguins, and SeWer Blockings.

Supported tokens: APE, cAPE, ETH, DAI, WETH, stETH, USDC, and USDT, a total of 8 ERC-20 assets.

Evaluation

Advantages:

(1) Development team

The development team behind BlockingrasBlockingce is Blockingra Lab, which has developed Parallel Finance, the largest lending protocol in the Polkadot ecosystem. The team has a strong technical background.

(2) Strong endorsement by investors

Polychain Capital, Lightspeed Venture Blockingrtners, Slow Ventures, Coinbase, Blockchain Capital, Blockingntera, gumi cryptos, starkware, continue capital.

(3) Product design

Currently, the product has only been launched for 2 months, and its TVL is already second in the NFT lending field. In addition, BlockingrasBlockingce has made a series of innovations based on BendDao’s spot pool lending, such as a cross-credit system, NFT oracle, hybrid Dutch auction, and automatic reinvestment, which will further stimulate the vitality of NFTs. The product has great potential and is worth paying attention to.

Risks:

(1) NFTs themselves have relatively low liquidity, and the number of users is limited. BendDao, which ranks first in TVL, has less than 1,000 users. It can be predicted that the number of users of BlockingrasBlockingce is less than 1,000.

(2) BlockingrasBlockingce has only been online for three months, and there may be potential risks that have not yet been discovered, but there has already been a breakthrough in existing NFT lending protocols.

(3) Internal team conflicts: The recent exposure of internal conflicts within Blockingrasapce has led to user withdrawals and significant asset loss, making people sigh with regret. A good narrative cannot withstand a team’s bad behavior, and the team should cherish what they have and continue to move forward.

Ubiloan

Introduction

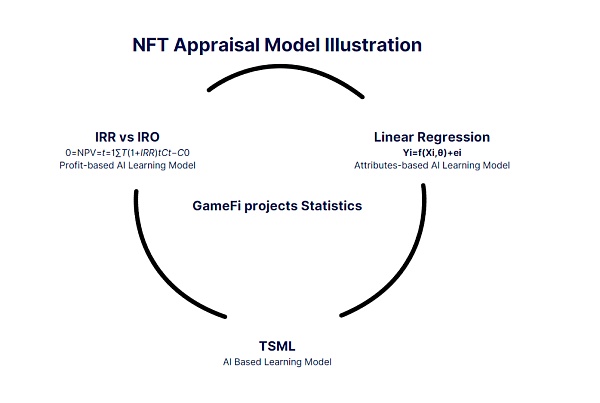

Ubiloan is a decentralized point-to-pool lending protocol that focuses on NFTs in the GameFi track, providing instant loans and liquidity for NFTs in games and metaverses. Ubiloan has a unique NFT valuation framework designed to solve the problems that exist in Web3 games through machine learning and algorithms. Ubiloan’s vision is to connect the metaverse and the physical world. The usefulness of closed-loop systems such as games or metaverses is the future direction of NFTs, enabling the first 100 million gamers or NFT holders to derive economic benefits from their digital assets.

Product Business

Game NFT:

PFP has the largest market share of NFTs, but the application scenarios for pure avatar or art collection NFTs are very limited, and the narrative of the current NFT market PFP has lost its freshness. Blue-chip NFTs (such as BAYC and Azuki) have already planned to develop their own games and ecosystems, laying a solid foundation for the next round of narratives.

Game and metaverse NFTs represent the future of NFTs. In traditional games, players spend more than $100 billion a year on buying character skins, props, or unlocking exclusive content, and these unique and tradable contents are worth being turned into NFTs on the blockchain, thus giving them higher value.

In the future, these assets will no longer be a line of code in a game company’s server, but will be in players’ wallets. NFTs are a necessary factor in realizing the integration of virtual and physical things. Building financial infrastructure for games and metaverses is Ubiloan’s mission. Ubiloan aims to become an NFT bank in the gaming and metaverse fields, starting with the lending business, and continue to provide various digital asset solutions such as “buy now pay later”, “user credit records” and digital asset evaluation.

PFP has the largest market share of NFTs, but pure avatar/art collection NFTs have limited use cases, and the market narrative has lost its freshness. Top blue-chip projects (such as BAYC and Azuki) have already planned to develop their own games/ecosystems, creating the foundation for the next round of market narratives.

Point-to-pool lending:

NFT holders (borrowers) can immediately obtain loans after pledging their NFTs in the Ubiloan protocol. Liquidity providers (lenders) deposit specific cryptocurrencies into the liquidity pool of Ubiloan to earn interest.

Through the Peer-to-Pool model, borrowers and lenders can use Ubiloan automatically and in a decentralized manner without trusting any human being. The loan mode allows borrowers to obtain loans immediately once the protocol agrees to collateral, and automatic allocation without any human intervention. Unlike traditional methods, Ubiloan also supports non-custodial lending and enables a new EIP-5604 to achieve this. The scheme allows borrowers to retain their assets and borrow money from Ubiloan at the same time.

Product Features

(1) Ubiloan has a unique health factor evaluation system, which is the biggest innovation in the lending agreement. It analyzes the background of project teams and investment institutions, and quantitatively analyzes transaction speed, depth, and price difference. Through this evaluation system, it can quantitatively evaluate the risk dimension of NFTs themselves more scientifically, and predict risks more accurately. It can be imagined that when there are systematic risks in some NFTs, Ubiloan can hedge in time based on changes in health factors to avoid causing a “chain liquidation situation.”

(2) Unlike other lending agreements, Ubiloan focuses on NFTs in the GameFi field and bets on the future of the GameFi field. As a leading lending giant, Ubiloan will gain a first-mover advantage.

(3) Ubiloan’s multi-channel liquidation can be settled through auctions, AMMs, and game guilds, with a high level of security.

Evaluation

Ubiloan takes a different path and abandons competition with other platforms in the blue-chip NFT sector to bet on the blue ocean of GameFi NFTs. The recent popularity of game NFTs such as Matr1x also indicates that if it seizes the opportunity of the new narrative in GameFi, Ubiloan is likely to become the BendDAO of the GameFi world. Ubiloan’s health factor evaluation system, multi-channel liquidation, and 48-hour liquidation protection form its three-pronged risk-avoidance strategy, which maximizes the safety of NFT holders.

NFT Fragmentation

Fragmentation of NFTs is not a new topic. The purpose of fragmentation is to significantly reduce the threshold for a single transaction, so that ordinary players in the NFT circle can participate normally. The common fragmentation mechanism in the market is to divide NFTs into a series of homogeneous tokens. The total amount of fragments is first determined by the seller or project party of the NFT. The fragments can be enhanced by borrowing and lending or liquidity pool methods like FT (homogeneous tokens). At the same time, it enhances the price discovery function of the market.

These fragmentation protocols require each fragment to be listed at all times, so that anyone can buy a fragment by matching the price to express their future price predictions. Then, the price of the NFT is the total value of all circulating fragments – investors can buy the entire NFT at any time at that price.

The market size of NFT fragmentation is currently small and the scope of application is narrow, mainly because fragmented NFT objects have high limitations and cannot break away from the dead loop of poor NFT liquidity. At the same time, it increases the risk of recombination, and the liquidity problem needs to attract more users to participate. The implementation of recombination is risky. In order to remove the entire NFT from the vault, all holders must sell their shares, which means that all parts must be recombined. If any part is missing, the NFT cannot be restored.

There are some projects that have received considerable attention in the fragmentation track.

Tessera (formerly Fractional)

Introduction

Fractional is a pure NFT fragmentation protocol built on Ethereum. NFT holders can lock one or more NFTs into a smart contract to create fragmented homogeneous tokens. The number and symbol of tokens are set by the creator. In addition, the creator also needs to set the starting price and buyout price for the locked NFT, allowing other NFT collectors to bid.

Fractional received a $7.9 million seed round investment led by Blockingradigm in 2021; in 2022, Fractional’s Series A raised $20 million, led by Blockingradigm, with Uniswap Labs Ventures, Focus Labs, eGirl Capital, Yunt Capital, and more than 50 individual angel investors following suit.

At the same time as announcing the Series A financing, Fractional announced its name change to Tessera, and announced that it will retain its original fragmentation. Users can still purchase NFT fragments, buyout NFTs, and participate in BlockingrtyBid collective bidding in the front-end, but the new protocol will adopt the concept of Hyperstructures and the NFT fragmentation plan of “RICKS”, which can ensure that fragments always convert back to their underlying NFTs, while avoiding the liquidity and coordination problems of all-or-nothing buyout auctions.

Product Business

(1) Blue-chip NFT fragmentation

Maintain the existing NFT fragmentation service. When the NFT is transferred to the platform’s Vault, an auction will be triggered and minted into a specified number of Raes. Users can purchase fragmented NFTs (Raes) through the first auction or secondary market. If the user wants to buy out the NFT in the vault, they can choose to submit a buyout agreement or choose to give up Raes on the Tessera platform, which will then sell the fragments. Holding Raes will earn users the PFP version of Raes from Tessera for display purposes.

(2) New NFT aggregation service

In the future, Tessera will focus on collaborating with GameFi projects to carry out NFT fragmentation for its GameFi project. Tessera is currently actively deploying the NFT fragmentation platform for GameFi projects. It has supported Blockingrallel (another GameFi project led by Blockingradigm) to combine NFTs on Tessera, and Tessera will extract some of the fees as platform revenue.

Product Features

(1) The fragmentation solution gives NFTs new liquidity, enabling the possibility of owning blue-chip NFTs at a low price.

(2) The NFT fragmentation platform for GameFi projects lowers the entry barrier for players to obtain NFTs at a low price, unlocking more rewards for game levels, further stimulating NFT liquidity and player participation.

Evaluation

Advantages:

(1) Leading project in the fragmentation industry. Launched early, with a wide audience and strong influence, it has top-tier investors as endorsements and actively collaborates with artists to expand the popularity and sales of its NFTs.

(2) Rich business lines. Not limited to the fragmentation of blue-chip NFTs, it has developed NFT combination strategies that support GameFi projects, mutually stimulating NFT transactions, increasing platform recognition and revenue.

Risks:

(1) The fragmented NFTs are limited to blue-chip PFP and well-known GameFi projects, but currently, both NFT and GameFi tracks are in a bear market, with obvious liquidity shortages.

(2) The issue of how blue-chip NFTs will be restored after fragmentation has not been resolved.

(3) Team goal changes: On May 12, 2023, Tessera (formerly Fractional) founder Andy Chorlian tweeted that due to lack of business sense in achieving profit targets (compared to the time and resource costs of expanding there), Tessera and its NFT market “Escher” will end all operations in the next few weeks. The time spent on crypto is always limited, and the narrative is too grand, which may also be another risk point for the project.

Furion

Introduction

Furion is a one-stop NFT liquidity enhancement platform that combines three major solutions: fragmentation + AMM + point-to-pool lending, further stimulating NFT vitality. Furion launched the first phase of the testnet on December 14th. As of the deadline, more than 30,000 addresses participated in the testnet activity.

Product Business

(1) Single asset pool

Unlike conventional fragmented NFTs, users can choose whether to retain NFT ownership. If not, they can use all F-X tokens for lending or other operations, and redeem any NFT in the single asset pool with F-X tokens within a specified period of time for a fixed fee of 100$FUR, which is part of the platform’s income. If NFT ownership is retained, a portion of F-X tokens must be locked in the single pool, with the remaining F-X tokens used for other liquidity operations.

For example, Alice has a DOODLE #7753. Rather than retaining it, she prefers to make better use of it and increase its liquidity. She stores this DOODLE in the Furion Doodle Pool and receives 1000 F-DOODLE tokens. With F-DOODLE, she can sell it through an AMM pool, get other assets, or deposit it for lending. In addition, she can also return 1000 F-DOODLE tokens (plus 100 $FUR) to the Furion Doodle Pool to exchange for any DOODLE #7753 or any other NFT.

(2) Aggregated asset pool: Users can choose to mint FTT tokens by combining same-source F-X tokens (such as F-BAYC, F-MAYC) to form index-like tokens and enjoy the appreciation benefits of the same type of NFT.

(3) AMM: Adopting the automatic market maker system to trade Furion’s F-X tokens, FFT tokens, and FUR tokens.

Product Features

(1) The borrowing and lending asset pool is divided according to risk.

-

Mortgage asset pool: Tokens can be borrowed from collateral assets, cross-layer assets, and isolated assets. Theoretically, the tokens with the lowest risk and the best liquidity will be placed in this pool (such as FX, FFT, ETH, USDC from the blue-chip NFT aggregation pool);

-

Cross-layer asset pool: Tokens can be borrowed from cross-layer assets and isolated assets as collateral;

-

Isolated assets: Tokens can only be borrowed as collateral from isolated assets.

(2) Conduct AMM exchange for FT, FFT, and FUR

Furion Swap also combines every two tokens to form a trading pair, and follows the formula x*y=k for general traders and LP providers. Swap charges a 0.3% transaction fee on trading volume, of which 99% is LP rewards and 1% is platform revenue. In addition, LP providers can use LP for liquidity mining to obtain FUR rewards of the platform token.

(3) ve-token allocation of governance rights

Users can pledge FUR to obtain veFUR and enjoy governance, platform fee income, and increased borrowing and lending utilization rates.

Evaluation

Advantages:

(1) The product line design is rich, introducing FT gameplay to NFT and revitalizing NFT liquidity.

(2) Unlike other fragmented projects, the fragmented NFT objects of Furion are relatively limited, and the NFT participation in fragmentation includes blue-chip NFTs, growth-type NFTs, and Penny NFTs (cross-liquidity, low price).

(3) ve token participation in project governance increases user participation.

Risks:

(1) The project is currently in its early stages, with limited team information and no disclosed financing information.

(2) The nesting of gameplay is more dependent on user participation, and the current NFT fragmentation market capacity is small and needs to wait for the outbreak of NFT to drive the fragmentation market.

Summary

NFT fragmentation can directly reduce user holding costs, but the distribution and recovery of rewards for blue-chip NFT fragmentation and other issues remain major problems. Tessera chooses to provide fragmentation platforms for other projects to expand product uses, while Furion provides more gameplay through fragmentation+AMM+pair pool borrowing and lending combinations. NFT fragmentation is still in its early stages of development and needs more narrative to stimulate liquidity from new perspectives.

NFT perpetual

In traditional finance, the size of the derivative market is always larger than that of the spot market, and the NFT derivative industry currently has few mature products, but it is also the most suitable sub-industry for NFT financial properties. Perpetual contracts mainly allow users to short NFTs and hold NFTs through leverage, but because the entire Web3 derivative project is not mature enough, NFT derivatives are also in the budding stage.

In the perpetual contract field, there are currently few projects, mainly the NFT perpetual contract trading platform nftperp.

nftperp

Introduction

The perpetual contract trading protocol that tracks the NFT series floor price, nftperp, has launched its beta mainnet on Arbitrum One, allowing users to use WETH instead of NFT to long or short blue-chip NFTs, with a maximum leverage of 10 times.

nftperp recently completed a $1.7 million seed round of financing, with participation from Dialectic, Maven 11, Flow Ventures, DCV Capital, Gagra Ventures, AscendEX Ventures, Perridon Ventures, Caballeros Capital, Cogitent Ventures, Nothing Research, Apollo Capital, Tykhe Block Ventures, OP Crypto, among others.

Product Business

The trading adopts a vAMM design, and both parties’ trades have slippage. The protocol dynamically adjusts the virtual pool depth by adjusting the k value to avoid excessive slippage caused by extreme price fluctuations. At the same time, the trader is also the counterparty, and one party’s loss is another party’s profit. All profits and losses are settled in the margin pool; the price feed uses the True Floor Price model, obtains trading data from NFTX, removes high/low-priced transactions based on its own average price algorithm, and calculates the floor price through TWAP.

Product Features

(1) The nftperp trading mechanism uses the virtual automatic market maker (vAMM) model, which does not require real liquidity providers or order books. The trader’s pledged assets are placed in a smart contract Vault, and the trader’s losses and profits are all processed in that Vault.

(2) Provide hedging methods for NFT prices, realize long or short, and the contract supports trading with 5 NFT series including AZUKI/BAYC/MAYC/PUNK/Milady using ETH.

Evaluation

Advantages:

(1) vAMM design instead of zero-slippage opening avoids price manipulation and arbitrage risks similar to GMX design.

(2) Change the long-only situation in the NFT market, meet leveraged trading while realizing long or short.

Risks:

(1) There is a possibility of price manipulation. The NFT market has a small volume, and the spot price is relatively easy to manipulate. When spot price manipulation occurs, the sharp fluctuations in price may cause a large number of liquidation events in the derivatives market, and the protocol’s insurance fund may not be sufficient to repay bad debts, and the protocol may face systemic risks.

(2) Early need for market makers to increase liquidity.

(3) The project is still in its early stages and the True Floor Price Oracle algorithm has not been made public, so there is potential risk.

Conclusion

There are numerous and complex sub-tracks in the NFT field. What is listed in this article is only a part of it. Although the current main focus of NFT is still on marketplaces and aggregators, we cannot deny that NFTFi is a necessary area for NFT development, and NFT lending is one of the least difficult and most closely linked paths to NFT trading, and the NFT lending market has already begun to combine with other DeFi, GameFi tracks, other tokens, etc. We expect NFT lending to be the next gathering place for NFT traffic. At the same time, we will also continue to pay attention to how lending project parties can help users increase passive income and reduce liquidation risk.

In a bull market, traffic is the key, and in a bear market, construction is key. NFTFi projects that can survive the bear market have their own unique advantages, and projects that can achieve development and stable growth in the bear market phase are worth more research and learning. Future NFTFi products will bring more ownership innovations and liquidity creation, and we will also wait and see.

Viewpoint:

-

The development of NFTFi cannot do without more diversified NFTs and large-scale applications. The current PFP-dominated NFT market still has limited imagination space. It is worth looking forward to the GameFi and SocialFi tracks. As the basic infrastructure, NFT will have more diverse application scenarios, and emerging lending protocols like Ubiloan will have more room for development.

-

NFTFi is the “second-tier track” of the NFT industry. Every step from the traditional crypto circle to NFT trading to NFTFi has raised the threshold, resulting in the entire circle being too niche. One of the key issues in solving liquidity is to lower the participation threshold for ordinary players and broaden the channel for users to enter the NFT world from the traditional crypto circle.

-

Long-term projects need team unity and achievable goals. NFTFi has good narratives and novel long-term beliefs, but whether it can achieve long-term development is not only determined by users, but also by the team. The decline of a good narrative is regrettable, and it can only be said that the Summer of NFTFi still needs to wait.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Path to Web3 Identity

- How much does it cost the well-known DeFi protocol MakerDAO per year to maintain the normal operation of its network?

- a16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralization Tools

- Understanding Neon in Six Questions: Scaling Ethereum dApps on Solana

- Hong Kong’s new regulations on virtual assets have been implemented, opening up the golden age of Web3.

- Quick look at Blockingradigm’s Q1 2023 investment landscape

- A16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralized Tools