Meme Topic Issue 1: May’s Winner

Meme Topic Winner: May 1Author: Lisa, LD Capital Research

In May, the meme market was swept up by a thousand-fold wealth effect. As the enthusiasm gradually subsided, three new projects entered the forefront of the meme sector in this round, namely ArbDog AI, Milady Meme Coin and PEPE. Among them, ArbDog AI adopted the distribution mode of specific address airdrop, while Milady Meme Coin and PEPE were directly sent to the liquidity pool. This article will review these three projects.

ArbDog AI

ArbDog AI went online on April 15th, with a total token supply of 210,000,000,000,000,000 (2.1 trillion), 95% of which were distributed free of charge to addresses qualified for ARB token airdrops. The claim period was from April 15th to May 15th, lasting for one month. 5% was used to incentivize users who invited others to claim, with the inviter generating a unique link to invite addresses qualified for the airdrop, while receiving 10% of the total token amount claimed by the invited address as a reward. The 5% reward pool was given out on a first-come, first-served basis.

- What happened to the Move2Earn game that was popular in 2022 in 2023?

- Path to Web3 Identity

- How much does it cost the well-known DeFi protocol MakerDAO per year to maintain the normal operation of its network?

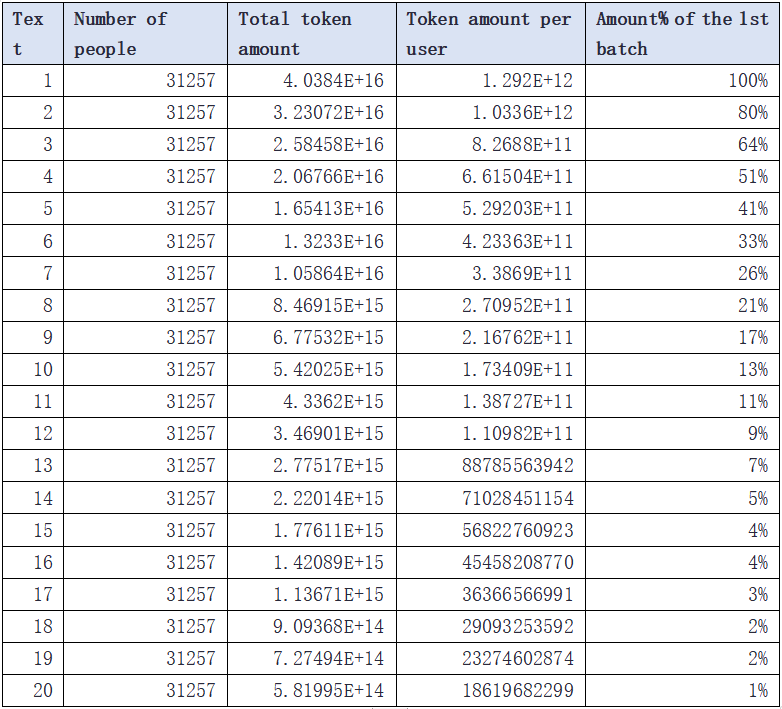

ArbDog AI did not adopt an equal distribution method. Addresses that claimed earlier were able to get more tokens, with the last batch of addresses receiving only 1% of the amount received by the first batch.

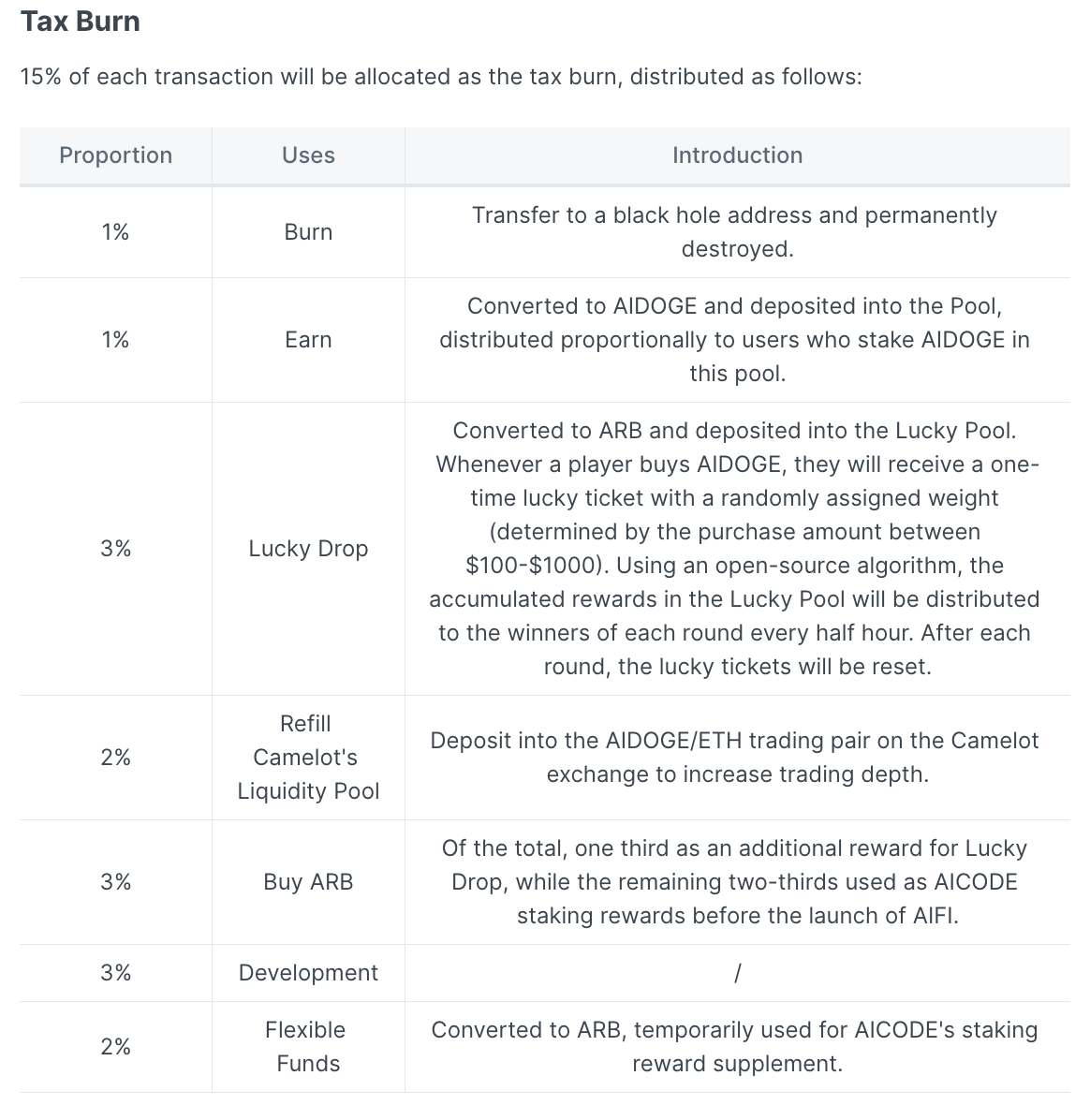

ArbDog AI charges a 15% burning tax on on-chain transactions, with the distribution as follows:

Based on this, AIDOGE can be mined, with a current staking amount of 41,745.6T, accounting for 20% of the total issuance, and an APY of 43%. When users buy AIDOGE worth $100-$1000 on-chain, they will qualify for Lucky Drop and participate in a lottery every half hour.

The project party also issued AICODE tokens, which can be obtained by burning and trading AIDOG in two “mining” formats. Burning Mining format accounts for 60% of the issuance, with a total of 12,600,000 tokens issued; Trading Mining format accounts for 40%, with a total of 8,400,000 tokens issued.

AICODE helps to absorb some of the selling pressure of AIDOGE, and the token price has been declining. The project party passed a proposal to stop the continued issuance of AICODE on May 23, and stopped the release of AICODE mining rewards from May 24. This proposal is favorable for maintaining the price of AICODE, but it also reduces the use cases of AIDOGE.

AIDOGE has been listed on OKX, Gate, and bitget, with a current number of 263,000 coin holding addresses. The highest price of AIDOGE token occurred on May 1st, with a circulating market value of 150 million USD. Since then, the price has dropped, and the current circulating market value is 55 million USD.

PEPE

PEPE Memecoin was launched on April 18, 2023, and within just over two weeks, it entered the top 100 tokens by total market value and was listed on major exchanges including Binance.

According to the official website, PEPE memecoin aims to be the most memorable memecoin, but it explicitly states that PEPE is a meme token with no intrinsic value or expected return. There is no official team or roadmap, and PEPE has no practical use, only for entertainment purposes, and is not affiliated with “PEPE Coin and Matt Furie and his creation Pepe the Frog Meme.”

PEPE has adopted a relatively direct distribution method. The total circulation is 420,690,000,000,000, and 93.1% of tokens are sent to the liquidity pool. 6.9% are stored in an ENS named “pepecexwallet.eth” multisignature wallet for future exchange listing, cross-chain, and LP use. Mechanically, $PEPE represents pure meme class, and its minimalist design maximizes meme culture and emotion.

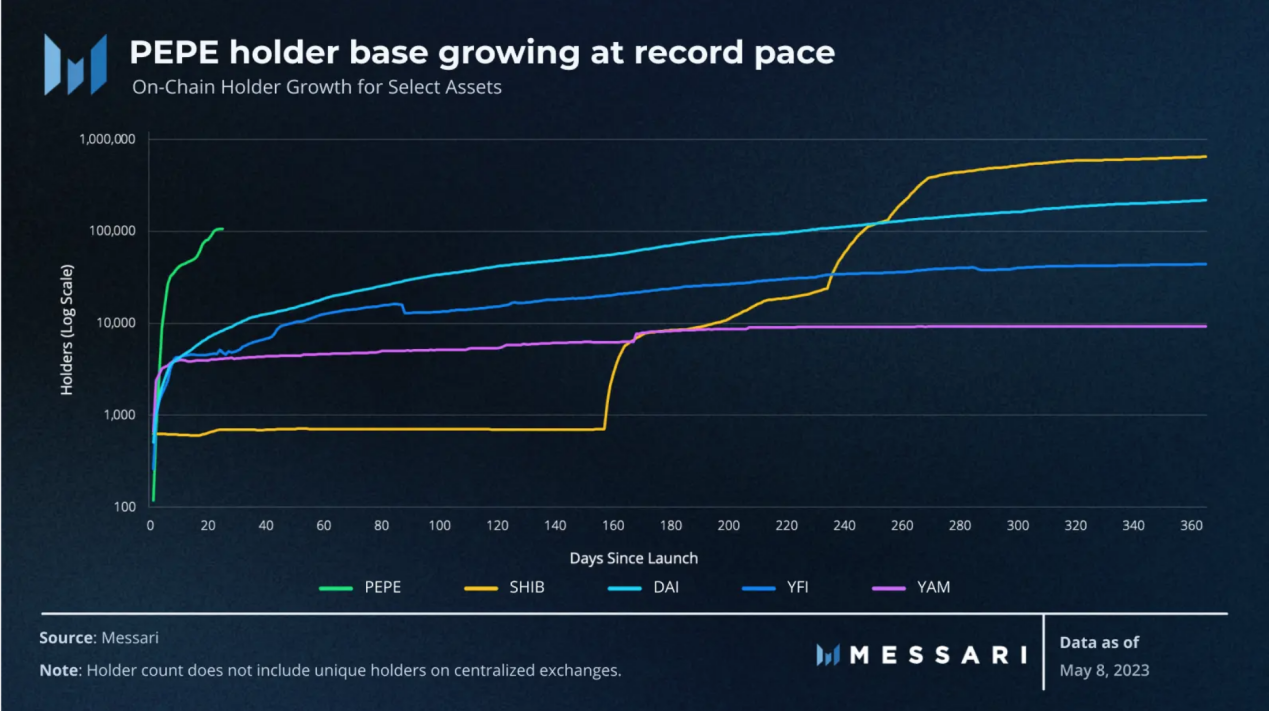

PEPE has pushed the Meme season to its climax and created many wealth myths. Currently, there are 115,000 coin holding addresses. According to statistics from MESSARI, it only took PEPE 22 days to have more than 100,000 holders on the chain, far exceeding the growth rate of other tokens.

Source: Messari

Many early buyers of PEPE hold Milady NFT, which may be the early capital force that pushed up the price of PEPE.

Milady Meme Coin LADYS

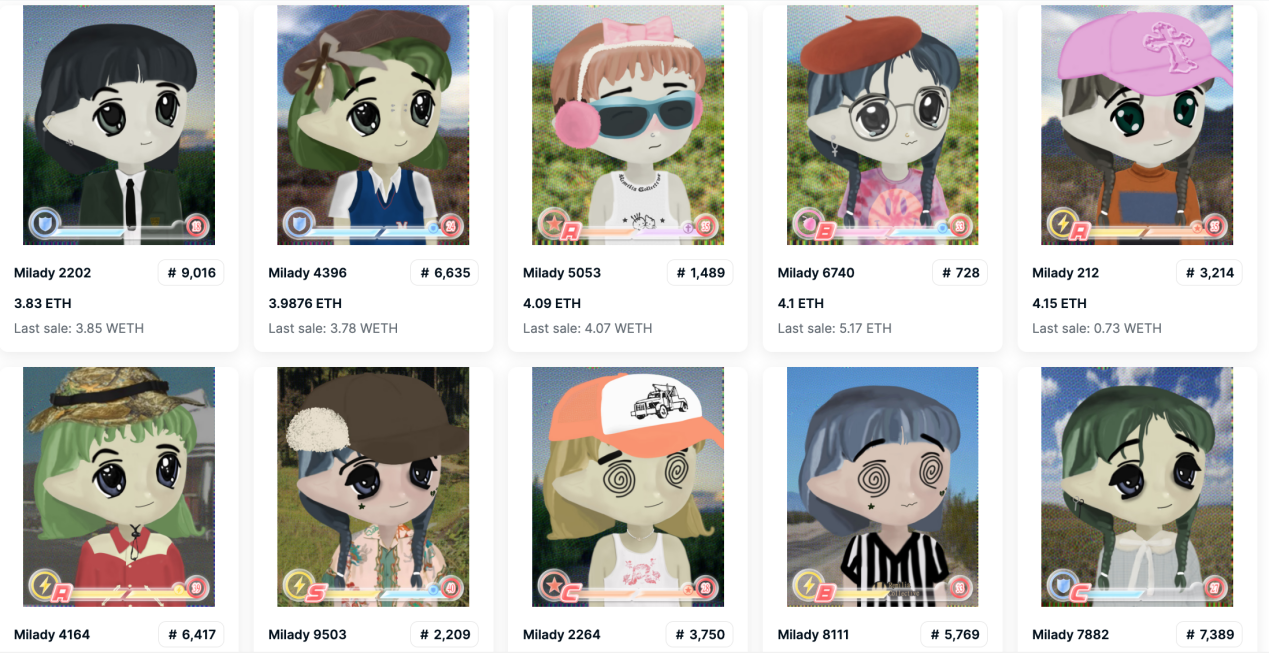

Milady Maker is a collection of 10,000 neochibi aesthetic style PFP (Profile picture) NFTs created in August 2021. The word chibi comes from Japanese and means little dwarf, little devil, and little guy. It is used in anime drawings to refer to the painting style of infantilization and childification, similar to the Q version in Chinese expression.

Source: opensea

The design of Milady Meme Coin is similar to PEPE, with a total issuance of 888,000,888,000,888, of which 94% of the tokens are sent to the liquidity pool, 1% are airdropped to $PEPE and Milady NFT holders, and users can claim them from May 8th to 15th, 2023. 5% is stored in an ENS named “miladymeme.eth” multi-signature wallet for future use in exchanges, cross-chain and LPs.

On May 10th, Musk shared a Milady NFT picture on Twitter, which caused the price of LADYS to soar, with a market capitalization of up to 150 million US dollars.

Except for exchanges, contracts, and addresses on the blacklist, DWF Labs has the largest number of LADYS holdings. According to lookonchain observation, the “0xd4b6” address of DWF Labs transferred 2.2T LADYS Tokens to the exchange on May 11, and the price of LADYS once fell after the transfer.

Summary:

Reviewing the development path of meme coins, it can be found that the rise of a meme project generally requires the following steps:

1.Build a simple and easy-to-spread image or narrative;

2.Fair distribution to a wide range of groups;

3.Community promotion, such as KOL promotion, using exaggerated wealth stories to attract attention, frequent Twitter sBlockingce;

4.Celebrity effect, such as the strongest meme IP Musk;

5.The price rises rapidly, attracting market attention and a wide range of users to enter;

6.After forming a certain scale, go online to centralized exchanges to increase liquidity.

Summary of meme investment ideas:

1. Discovering targets

Pay attention to the tokens that mainly trade on the chain every day;

Track changes in the holdings of smart money addresses.

2. Evaluating targets

Relatively scattered distribution of token holdings;

A certain number of holding addresses and transaction volume, liquidity;

Whether the contract settings are safe;

Whether the team is anonymous;

Is the token economic model design fair and reasonable.

3. Risk control

Diversify investments and keep track of changes in large holding on-chain.

4. Changes in the scope of emotional and social spread

5. Observe the rate of increase in the number of holding addresses and changes in transaction volume

Tracking memes requires the ability to quickly capture information and analyze it, as well as quick reactions and operations, while being able to sell when the buzz is high, highly testing human nature. Memes shorten and intensify the game between people, and the rise of each meme is inseparable from the push of funds. Choosing to participate in the game is also a game with large funds, and it may be on board or left at the bottom of the train. While seeing the myth of wealth generation, it is also necessary to be aware of the high risks.

Looking back at the history, the previous two meme markets both appeared at the end of the overall market trend. After memes generated large trading volumes, BTC experienced a decline. Memes are like a last carnival. While tracking meme alpha, it is necessary to closely and timely pay attention to changes in the overall market trend to protect large positions.

Source: dune

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralization Tools

- Understanding Neon in Six Questions: Scaling Ethereum dApps on Solana

- Hong Kong’s new regulations on virtual assets have been implemented, opening up the golden age of Web3.

- Quick look at Blockingradigm’s Q1 2023 investment landscape

- A16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralized Tools

- Quick overview of the four potential GameFi protocols that may experience explosive growth: Treasure, MapleStory Universe, Questify, and Pixels.

- How has the NFT lending protocol Blend, under Blur, performed in the first month?