Derivatives DEX Battle: Kwenta and Level Surpass GMX in Weekly Trading Volume

Kwenta and Level surpass GMX in weekly derivatives DEX trading volume.

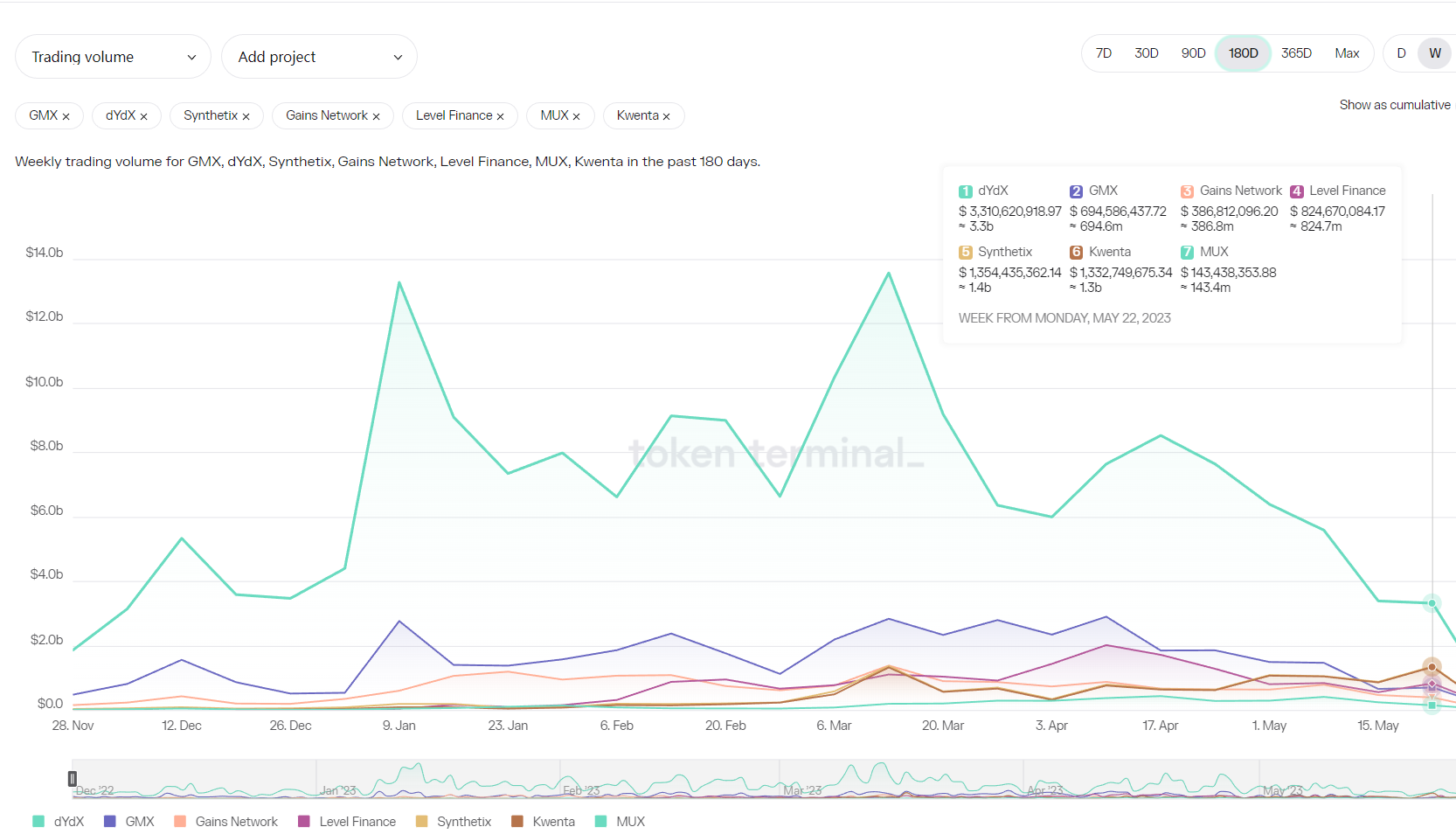

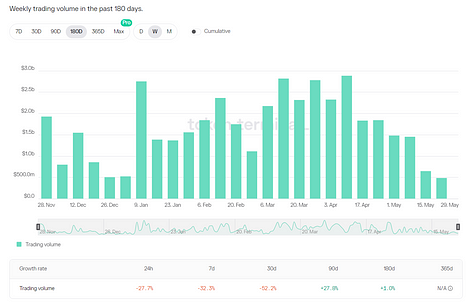

Currently, the competition in the derivatives DEX track is fierce, and the overall market trading volume is declining, while new protocols are still being launched. In a shrinking market, traders are more sensitive to various incentive measures and yields, which further stimulates the competition of derivative DEX for users.

Since late March, the overall trading volume of derivative DEX has been on a downward trend. Among the 6 major derivative DEX protocols, 5 have shown a trend of declining trading volume, while only Kwenta has shown an upward trend.

Kwenta is a perp frontend built on Synthetix and contributes to over 95% of Synthetix’s trading volume growth and revenue growth. Synthetix is a liquidity provision protocol with over $400 million TVL, providing liquidity pools for frontends such as Kwenta.

- Meme Topic Issue 1: May’s Winner

- What happened to the Move2Earn game that was popular in 2022 in 2023?

- Path to Web3 Identity

Figure: Weekly trading volume of major derivative DEX

Source: tokenterminal

- The relevant data in this article mainly comes from tokenterminal. Due to different statistical caliber, there may be differences in statistics between different data platforms.

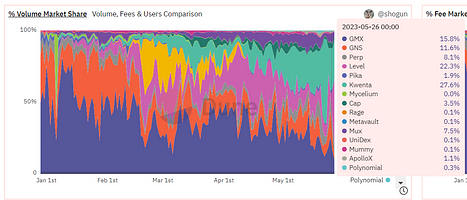

DYDX, which operates on the order book model, still accounts for nearly half of the trading volume of the entire market. However, in the fund pool model derivative DEX, GMX has been challenged by Kwenta and Level. This week, the trading volume of Kwenta and Level surpassed GMX.

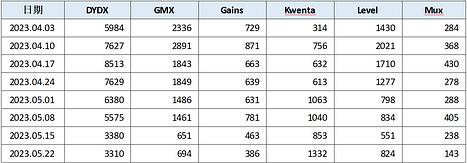

Table: Weekly trading volume of major derivative DEX since April (unit: million)

Source: tokenterminal

Figure: Distribution of market share of fund pool model derivative DEX

Source: Dune Analytics

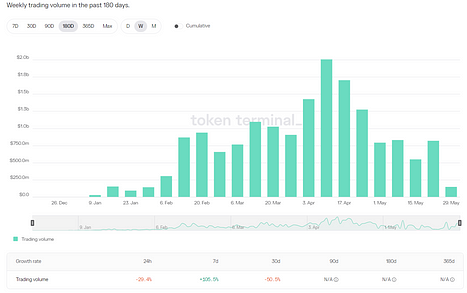

The trading volume peak of GMX appeared in mid-April, and has shown a continuous downward trend since then. The current trading volume level is equivalent to the end of 2022.

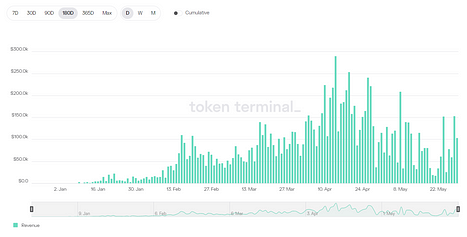

Figure: Weekly trading volume change of GMX

Source: tokenterminal

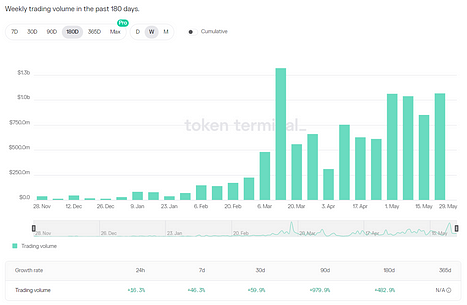

Kwenta is a DEX that started operating at the end of 2022. In mid-February, trading incentive activities began, and trading volume increased significantly. In late April, OP tokens were adopted as incentives, and trading volume increased in May.

Figure: Kwenta Weekly Trading Volume Change

Source: tokenterminal

The trading volume peak of Level also appeared in mid-April, with a weekly trading volume of $2 billion. After that, it declined. However, there was a rebound in the week of May 22.

Figure: Level Weekly Trading Volume Change

Source: tokenterminal

Reasons for the increase in trading volume: more incentives, lower costs

The counter-trend growth of Kwenta’s trading volume may be mainly due to two aspects: one is that the intensity of Kwenta’s trading incentives is relatively large, in addition to the token incentives of the protocol itself, from April 26, a weekly reward of 130,000 OP tokens was provided; from May 10th to August 30th, a weekly reward of 330,000 OP tokens was provided, with a market value of approximately $500,000.

The second reason is that Kwenta’s trading fees are relatively low compared to GMX, with current trading fees ranging from 0.02% to 0.06%, which are charged differently according to taker and maker. GMX’s trading fee is 0.1%, and it charges borrowing fees based on positions. For real users, the entry cost of Kwenta is lower after deducting users who completely brush the volume.

Figure: Kwenta Trading Incentive Rules

Source: mirror.xyz/kwenta.eth

LEVEL has also taken trading incentive measures. Users can receive 1 LEVEL Loyalty token (lyLVL) for every $1 of transaction fee paid. A total of 10,000 LVLs are distributed every day, and they are distributed according to the proportion of lyLVL held by users on the entire platform. The validity period of the claim is 24 hours.

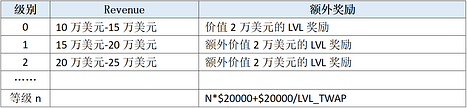

In addition to the above basic reward measures, there is also a Ladder reward mechanism. When the platform’s daily Revenue income exceeds a certain threshold, an additional incentive of LVL tokens will be added. This reward will accumulate and be distributed after one week.

Note: Level n = (Revenue-$100,000)/$50,000

Source: LD Capital

Ladder rewards are given to the top 20 traders on the weekly leaderboard. The trader’s ranking is determined by the number of points they have earned from trading on the protocol during the current week. Points are earned based on the trader’s contribution to the protocol’s trading fees, multiplied by (1+boost) to increase points. The boost factor is determined by the total amount of LVL tokens that the trader has staked on the platform. For every 1000 LVL staked, the boost factor increases by 1%.

In the past six months, there have been 46 days with revenue greater than $100,000, accounting for 25% of all days. Of these, there were 19 days with revenue greater than $150,000, 8 days with revenue greater than $200,000, and 2 days with revenue greater than $250,000.

Figure: Level daily revenue

Source: tokenterminal

Additionally, DYDX’s order book model has maintained high trading incentives since its launch. Although the incentive token has undergone two reductions, it still offers approximately 1.58 million DYDX tokens per epoch, worth around $3 million at market prices, with daily incentives reaching $100,000. This is a relatively high incentive level for current derivatives DEX models.

It is necessary to consider the impact of trading incentive measures on protocol token selling pressure and sustainability.

In Kwenta’s incentive measures, the OP ecological token incentives account for the majority, while the protocol token incentives are gradually decreasing, resulting in smaller selling pressure. In addition, Kwenta’s trading incentives are obtained on a weekly basis, with a lock-up period, and a portion of the tokens must be destroyed if they are unlocked early. However, the OP incentive is currently only valid until August 30th, and without any extension measures, trading volume may experience significant declines.

In Level’s incentive measures, only protocol tokens are used, which are received daily without any lock-up period, resulting in greater selling pressure. Additionally, its ladder incentive measures focus on increasing trading volume, offering high incentives to the top 20 users, far exceeding those for regular users. This can also lead to a highly concentrated trading volume problem.

DYDX has been under continuous observation in the market due to its large token incentives and many token unlocks, waiting for the launch of its DYDX chain and modifications to its token mechanism.

Real Trading Volume Analysis

Given the existence of trading incentives, it is necessary to analyze trading volume to understand the general situation of real trading. A brief statistical analysis was conducted on the number of users, trading volume, concentration, and position size of several fund pool derivative DEXs.

Table: Analysis of the Quality of Trading Volume of Fund Pool Derivative DEX

Source: LD Capital

GMX’s user count is 4-5 times higher than other projects, and its position size is much larger than other projects, 3 times that of Kwenta and 5 times that of Gains Network.

The average user trading volume of Kwenta and Level is significantly higher than that of other projects without incentives.

Kwenta’s 30-day average user trading volume is about 1.6 million, 4 times that of GMX. The top five trading volumes account for 33.35%, indicating relatively low concentration. The number of users has reached 2,986, ranking first in the second tier. The position size fluctuates between 40m-60m.

The 30-day average user trading volume of Level has reached 5.76 million, 15 times that of GMX. The trading volume is highly concentrated, with the top five traders accounting for nearly 75%. The position size is only 2.6m, and the number of users is less than 600. It can be seen that the platform has a higher proportion of brushing and interaction.

Overall, GMX is still the leader in the race, with significant advantages in user count and position size. Kwenta has more real users, and trading volume is relatively dispersed. Its incentives may retain users by providing better liquidity depth, lower fees, etc. Level has a higher proportion of brushing users and higher inflation.

Recent Development Plans

GMX

According to information obtained from the community, the GMX project team believes that the decline in trading volume and yield is mainly due to the overall market decline.

The recent focus of GMX’s work is to launch its V2 version. Its V2 test version was released on May 17th and users can participate in the testing. The main modifications include:

GLP will transition from the current comprehensive pool to a single pool for each currency pair. Through isolation, high-risk assets can be added.

There are two types of assets, one type that requires support from native assets such as BTC and ETH for trading pairs, and another type that is entirely supported by USDC for synthetic asset trading pairs. Traders can choose liquidity from different pools.

With multiple pools, the difficulty for LP participants will increase, requiring analysis of the usage and changes in yield rates of each pool to determine which pool to participate in.

Added funding rates and price impact factors to balance the changes of both long and short positions.

Kwenta

Kwenta’s development is closely related to Synthetix. Both are part of the same ecosystem, with Synthtix providing good liquidity services and Kwenta providing frontend services and acquiring users.

On May 25, Synthetix founder Kain Warwick proposed some ideas for the future development of Synthetix, including:

Using SNX for transaction incentives, with plans to allocate 5 to 10 million SNX to the incentive plan.

Considering increasing passive SNX staking to increase participation and pool size. Previously, Synthetix used an active staking model, where the staker had to perform better than the entire staking pool to achieve a better yield rate, or needed to use hedging tools to hedge risks. Now, passive staking pools have been added to maintain the basic yield rate, which is relatively simple and convenient for users to participate.

Subsidizing frontend fees. The income of frontend operators basically belongs to SNX stakers, and in the long run, there is insufficient incentive for frontend operators. For example, all of Kwenta’s protocol income is distributed to SNX stakers. It is suggested to allocate a certain proportion (such as 10 million SNX) of SNX from the treasury to subsidize frontend fees. Representing the frontend for staking will generate 3-5% of basic fee income.

These plans consider the relationship between users, funds, and products. If implemented, they will have a significant incentive effect on projects built on Synthetix.

Level

Level added new cross-chains through community voting in May and moved to Arbitrum. Currently, liquidity pools for LVL tokens have been deployed on Arbitrum and can be traded. The frontend trading business is expected to be launched in mid-June. Based on the large number of active users and funds on Arbitrum, this migration may bring new users and funds to participate.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How much does it cost the well-known DeFi protocol MakerDAO per year to maintain the normal operation of its network?

- a16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralization Tools

- Understanding Neon in Six Questions: Scaling Ethereum dApps on Solana

- Hong Kong’s new regulations on virtual assets have been implemented, opening up the golden age of Web3.

- Quick look at Blockingradigm’s Q1 2023 investment landscape

- A16z: Decoding the Key Elements of Decentralization in Web3 Protocols, Driving Decentralized Tools

- Quick overview of the four potential GameFi protocols that may experience explosive growth: Treasure, MapleStory Universe, Questify, and Pixels.