Notes | Coingecko Industry Quarterly Report: Defi is unstoppable

真本聪手记: Select 5 cryptocurrencies for the latest quality articles every day. Today's content includes: 1 Coingecko Industry Quarterly Report 2019Q3 2 Dai: Third Quarter Performance Report 3 CIO (Chief Investment Officer) as a cryptocurrency fund feels how 4 polymerization theory Introduction 5 UTIX Analysis of Delphi Capital

Coingecko Industry Quarterly Report

This is Coingecko's quarterly report on the blockchain industry. Coingecko contributes a great industry report every quarter, which is the third quarter of 2019. I remember that in 18 years, the node capital will translate it into a Chinese version. I don't know if they still have this habit (or cooperation). The entire report has 53 pages. I have extracted some important data and opinions from the following:

Market dynamics: In the third quarter, the overall market for cryptocurrency fell by 29%. Among the top five market capitalizations, Litecoin lost the most, falling 39.2%, and Bitcoin fell the least, down 24%.

Bitcoin data Bitcoin computing power rose 92%, reaching an all-time high.

- When will the inflection point of the blockchain industry emerge?

- Talking about how to solve the privacy requirement on the public blockchain

- Love and mourning in the alliance chain (sequel): Performance is not the most decisive factor

Exchange : The Derivatives Exchange is booming in the third quarter with nine new derivatives exchanges. The top three are BitMEX, Bybit and Okex.

Defi: Defi is booming, and the number of Ethereums now locked has reached 2.9 million, with a total value of $500 million. The main application representatives are – MakerDAO (Lending) – Compound (Algorithmic Money Market on Ethereum) – Set Protocol (Simplifying Asset Management) – Synthetix (Decentralized Synthetic Assets) – Fulcrum by bZx Protocol (DeFi margin trading and lending platform)

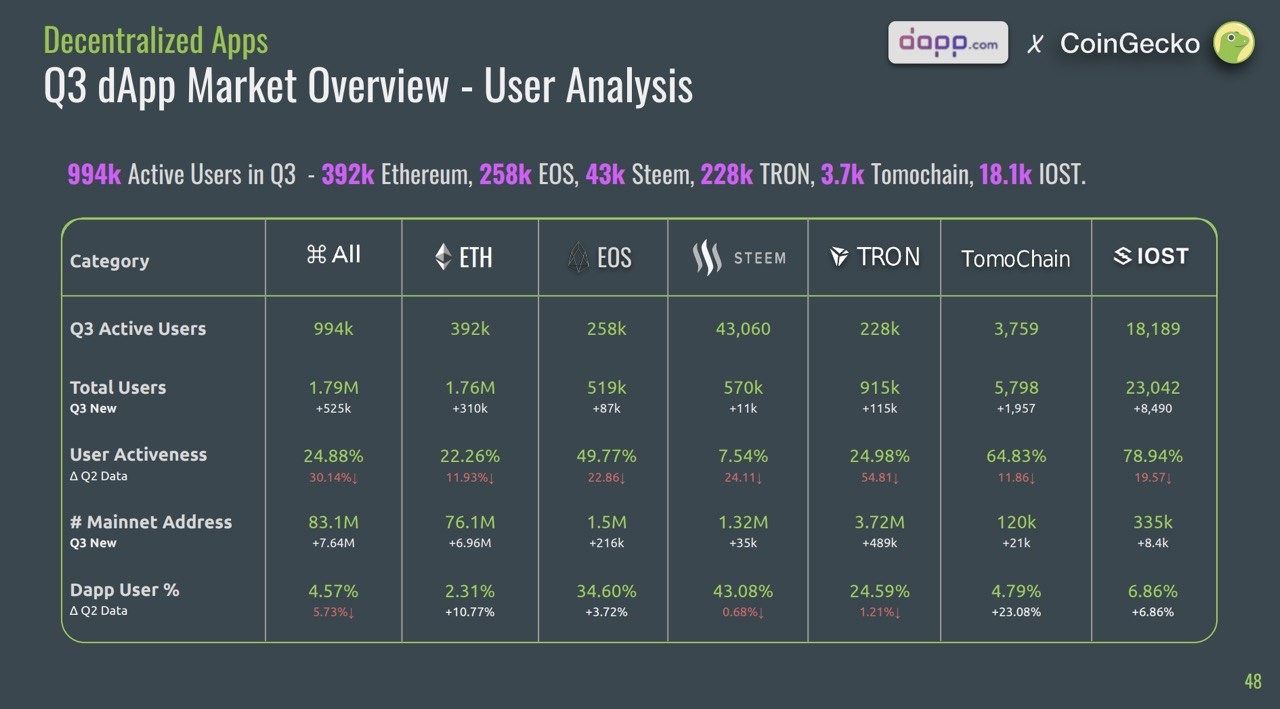

dApp market Ethereum , EOS and wave field are still the top three

Full text link https://assets.coingecko.com/reports/2019-Q3-Report/CoinGecko-2019-Q3-Report.pdf

Dai: Third Quarter Performance Report

This was written by MakerDAO in collaboration with Beneath, a blockchain data analysis platform, which summarizes some of Digital's performance data for Dai in the third quarter. Some of the highlights are as follows:

Dai's active users have increased dramatically Over the past four months, Dai's active users have more than tripled. In September, more than 66,000 active addresses were sent or received by Dai, and the peak in August even reached 100,000. The main reason is that Coinbase held the “Live Dai” campaign in August, and Coinbase brought at least 76,000 new users.

Who holds the circulation rights of Dai? More than half of them directly hold a private user wallet to place Dai, and 20% are on Defi applications. 7% in multi-sign wallets and 6% in exchanges. Compound stores almost 15% of all Dai, which is six times the number in June.

Full text link: https://blog.makerdao.com/dai-in-numbers-momentum-report-q3/

How does the CIO (Chief Investment Officer) as a cryptocurrency fund feel?

Jeff Dorman, a partner at Arca Funds, an encryption asset management company, shared his experience and income as the chief investment officer of the cryptocurrency fund last year.

Building team and strategy cryptocurrency funds are relatively small, and in the traditional world, you won't even try to create funds with assets of less than $150 million. Based on a 1.5% management fee, this is $2.25 million per year for hiring senior talent and ensuring the salaries and infrastructure needed for good operational practices. So, when the median value of the managed assets of the cryptocurrency fund (AUM) is less than $5 million, how do you build a team of the same level?

Operational barriers In terms of cryptocurrency, we estimate the number of new service providers three times a week. Since there are no regulations, no leaders, and no limit to venture capital, the barriers to entry are almost zero. Many service providers have insufficient experience in providing services to asset management customers.

Managing the 24/7 risk cryptocurrency market will never fall asleep. However, contrary to popular belief, I don't think the currency circle needs to be “all-weather”. Instead, strict risk management procedures are required.

Comparing cryptocurrencies with traditional funds Encrypted currencies are both technology and financial products, and both have collective knowledge to create a successful formula. Once these roles and differences are identified, managing cryptocurrencies is equivalent to managing stocks, fixed income, or managed futures funds. Portfolio managers manage risk, analyst analysis, trader transactions, and then the CIO brings together all the risks.

Feel that there are too many things to learn, read and talk about, but it also means that there is no time to do other things. The risk of exhaustion is real. As the chief information officer, the most significant part is knowing that we are in the midst of the next global technological advancement.

Full text link: https://www.coindesk.com/what-its-like-being-cio-of-a-crypto-fund

Introduction to polymerization theory

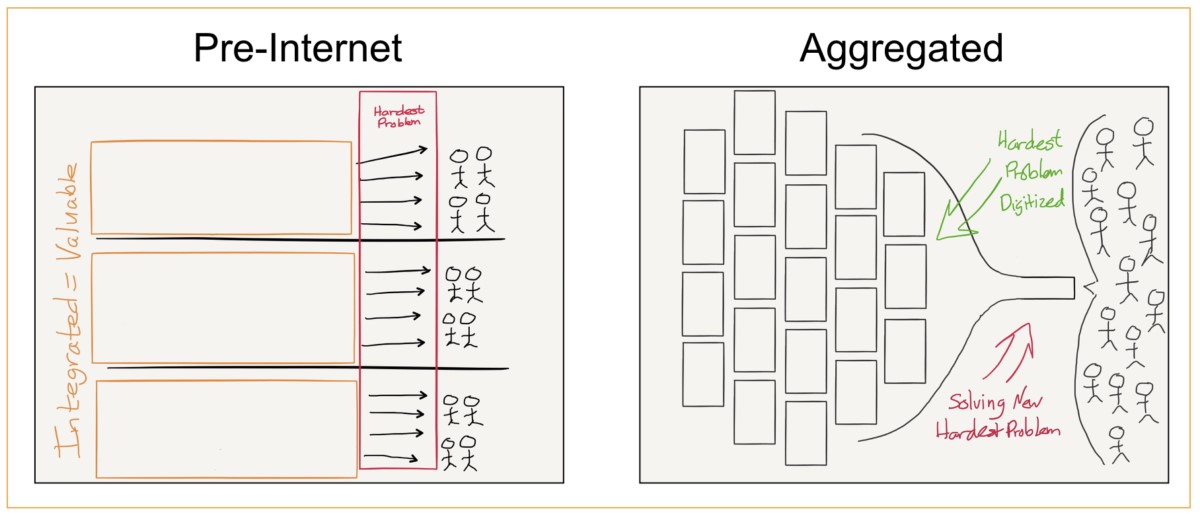

A few days ago I shared an article about the development of the Defi application of Ethereum to the direction of the aggregator. This article is to explain to everyone what is the theory of aggregation. Aggregation theory is the framework developed by Ben Tompson to understand large Internet companies that illustrate how these companies use the Internet to reshape the value chain, gain power and make a profit.

There are usually three types of participants in any given supply chain: suppliers/producers, distributors, and consumers. There are thousands of consumers, and factories, printing presses, trucks, etc. have only a certain number. Therefore, integrating supply and distribution into the company and optimizing these processes will be more profitable. You can't optimize for each customer because the cost of doing so is too high: the marginal cost of providing services to each consumer will be very high. Instead, consumers receive something from the shelves of local stores. This is the prototype of the theory of aggregation.

Ben proposes three key characteristics that an aggregator must have: – a direct relationship with its users – zero marginal cost of servicing new users – a demand-driven multilateral network with reduced acquisition costs

Aggregation theory explains how these companies are becoming so powerful and how they differ from the pre-Internet companies. Crucially, they are controlling the needs of end users and commercializing their suppliers. In addition, they have greater interest and bargaining power in protecting data usage. Today, venture capital is primarily deployed in B2B start-ups because it is almost impossible to compete with aggregators in attracting consumers.

Aggregators have a strong winner-take-all effect. All the examples I have listed will not only serve all consumers/users, but they will also become better services as more consumers/users they serve – they can all be on Earth Consumers/users provide services. First, this is why consumer technology companies are highly valued in both public and private markets.

Full text link: https://medium.com/@hagaetc/an-introduction-to-aggregation-theory-7cea63cc0e20

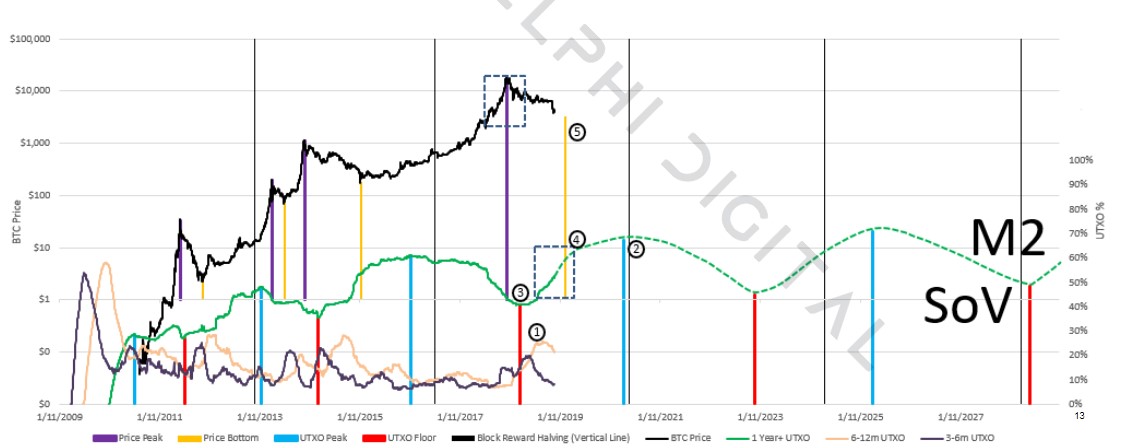

UTMO analysis of Delphi Capital

This is in addition to Delphi Capital's short-term prospects in the “Bitcoin Status”. They further analyze to determine when selling pressure may be weakened, thus predicting the upcoming market cycle. Below, you can find the basic principles and support we provide throughout the package.

Each transaction creates a new utxo, and the age of utxo indicates that it was originally included in the block. In layman's terms, utxo age means that Bitcoin was last moved. By analyzing the UTXO age distribution of Bitcoin, we can gain insight into the buying and selling patterns of past market cycles, as well as our current situation and our possible future developments.

The main points of analysis: – The age distribution of utxo and the relationship between this distribution and time and price have always been consistent. – Lost bitcoin may account for a large portion of the holder for 5 years + and the sales pressure from long-term holders (mainly holders holding 3-5 years) is almost exhausted. – We see the beginning of another accumulation process for long-term holders, similar to the accumulation process at the end of 2014. – Using the time at the bottom of the previous price associated with different bitcoin accumulation points, we were able to use our current utxo dynamics to reinforce our forecast of the approximate date at the bottom of the price (sometime in the first quarter of 2019)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The market “falls” endlessly, can the recent major changes in EOS reverse the overall situation?

- Introduction to Asymmetric Encryption: Vernacular Analysis of Private Keys, Public Keys, RSA

- Love and mourning of the alliance chain: development is difficult, where is the source?

- Visit: What is behind the brush of the digital currency exchange?

- Interview with famous economist W. Brian Arthur: historic changes are taking place, blockchain will enter everyday life

- Viewpoint | Say goodbye to traffic and funds, is there still value in digital currency?

- How blockchain technology can improve the lives of 22 hospitals