Opinion | ETH is the best currency model in the world I have ever seen

Recently, POV Crypto host and RealT chief operating officer David Houman wrote a column about how Ethereum created the "new value Internet," which cleverly combined some fragmentation concepts. Together, I put forward the idea that "ETH is the best currency model in the world I have ever seen."

If you can give yourself some time, this article is worth reading.

Written by: David Houman, Chief Operating Officer, RealT, POV Crypto Host

- Want to join the blockchain industry? This developer's authoritative guide is worth reading

- Explaining what is a "zero knowledge proof" with Halloween candy may be a very popular explanation of cryptography…

- Ant Financial Service Jiang Guofei's latest speech: Within one year, there will be a batch of thousands of live applications in the blockchain.

Redefining the meaning of ETH as an asset

Economic "three-phase point", bandwidth reserved without permission

This article will explore the role of the Ethereum's native token ETH in the Ethereum blockchain. Using the data from the Ethereum economy for the last two years, I proposed a new definition to understand ETH, which should be: the bandwidth prepared by Ethereum for “no license”.

This article will be summarized in two parts:

- Ethereum is the foundation for building an alternative Internet-based financial system that is fully open and trustless, while the new financial system requires a native currency to operate. In this new situation, financial applications need to operate in an untrusted mortgage, and the only true untrusted asset in Ethereum is ETH.

- This demand has led to the result that ETH has become a “three-phase point” asset that triples its economy and meets all the requirements of the new economy. Therefore, I think ETH is the best currency model in the world.

In the analysis of ETH and Ethereum, we made two assumptions:

- Ethereum 2.0 already supports ETH token mortgages✅

- Ethereum's improvement proposal EIP-1559 has been implemented and ETH✅ will be destroyed in the transaction.

Definition of Ethereum

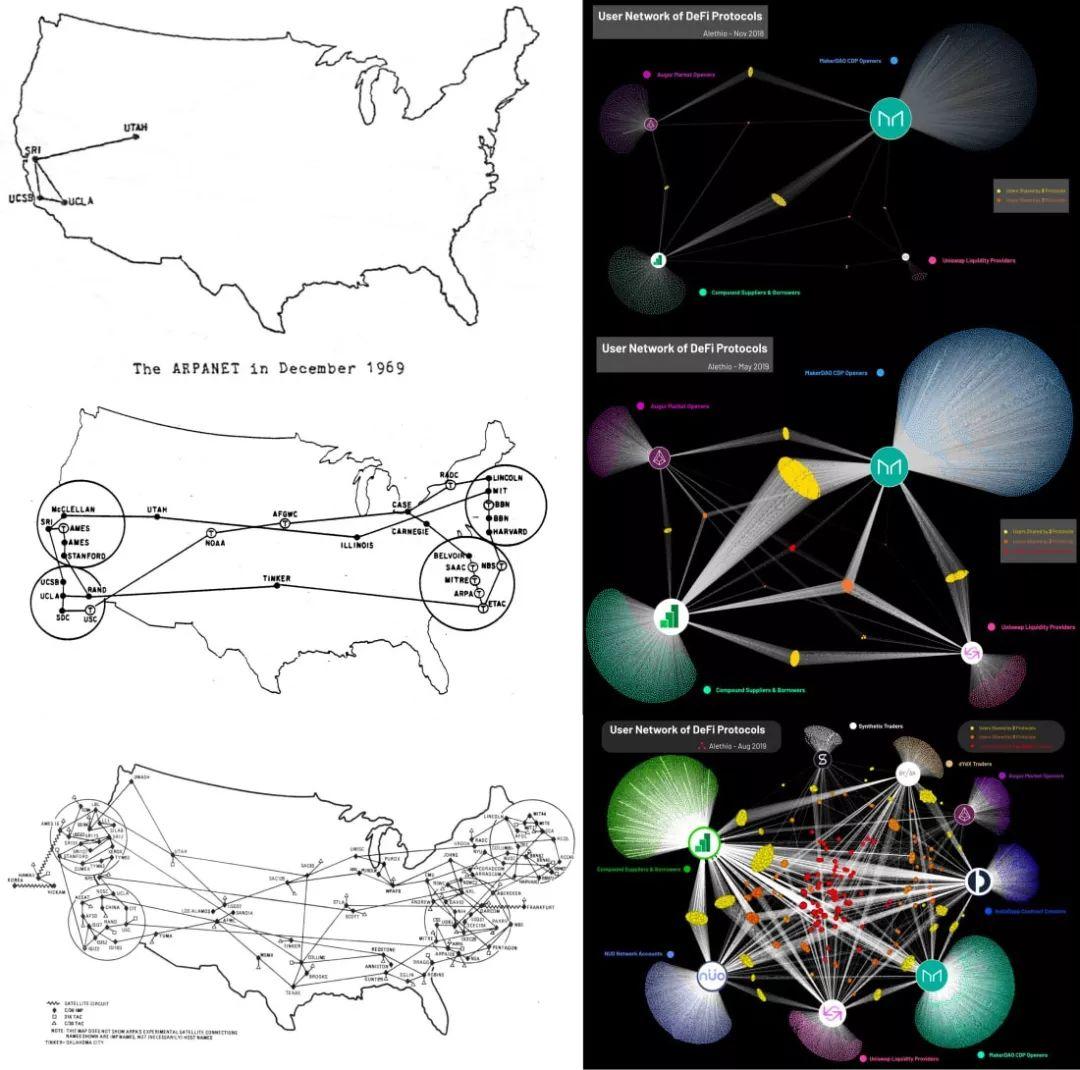

Before we define ETH, we need to define Ethereum first. ETH will be defined by how Ethereum is used. Defining Ethereum is actually very difficult. Trying to define Ethereum feels like defining the Internet in the 1980s, because no one really knows what will happen in the future. The coolest part of open source technology is the ability to gradually discover its use cases as the community continues to build, and technology applications will continue to evolve.

Application defines the internet

If you ask Google how to define the Internet, you may get the following answers:

- a global computer network;

- Provide a variety of information and communication facilities;

- Composed of interconnected networks;

- Use standardized communication protocols.

Personally, I think the above definition is actually not very helpful. Although there is no problem from a technical point of view, this is actually defined for the definition of technology. If you want to ask "How is the Internet?" or "How does the Internet affect humans?", we will look at what people are doing 99% of the time on the Internet, and therefore think of the following answer:

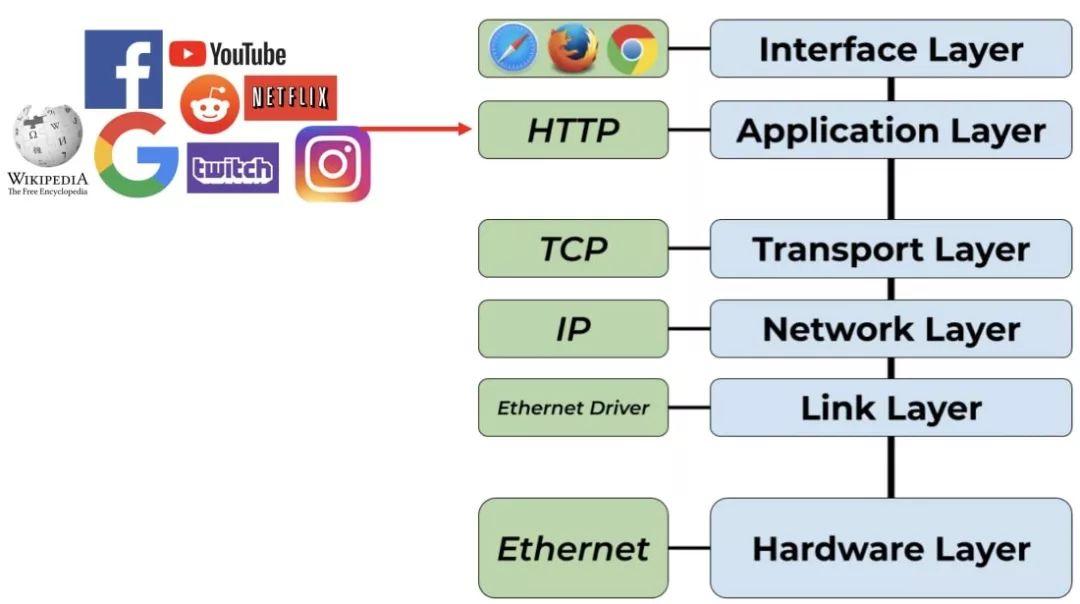

The Internet can be seen as a "diuerent" technology stack, the most important of which is the application. If there is no Internet without an application, we can enjoy a meaningful life. In fact, it benefits from the application layer of the Internet. It is the application layer that defines the Internet. All of the applications below have achieved this goal. Means, and the purpose of the application layer is to provide products and services to people.

Missing layer: value

The innovation behind the Internet is making data more affordable, usable, and unlimited. This innovation has brought rich and cheap information to the world, and humans have become better.

However, affordable, usable, and infinitely replicable data is contrary to the nature of money and value. By definition, money and value are expensive, inaccessible, and difficult to obtain.

When Bitcoin solved the "double-spend" problem of the Internet, it also brought a scarcity to the Internet. For the first time in history, when you send something on the Internet, you will find that you can't keep it anymore. But Bitcoin, when you send Bitcoin, will find that it does not affect other aspects of the Internet. The Bitcoin protocol only provides scarcity for Bitcoin, nothing else.

This is actually where Ethereum wants to come in: Ethereum is a platform for providing digital scarcity for any digital asset. In fact, Ethereum not only provides the power of digital scarcity to its own native tokens, but also the scarcity of any asset on its platform. The "tokenization" and ERC-20 standards are digital "stainless" "printers". Based on this concept, Ethereum has become the most unpredictable asset settlement layer on the Internet.

Due to the license-free and open nature of Ethereum, any asset can enter Ethereum and use Ethereum to manage its digital scarcity and settlement between parties.

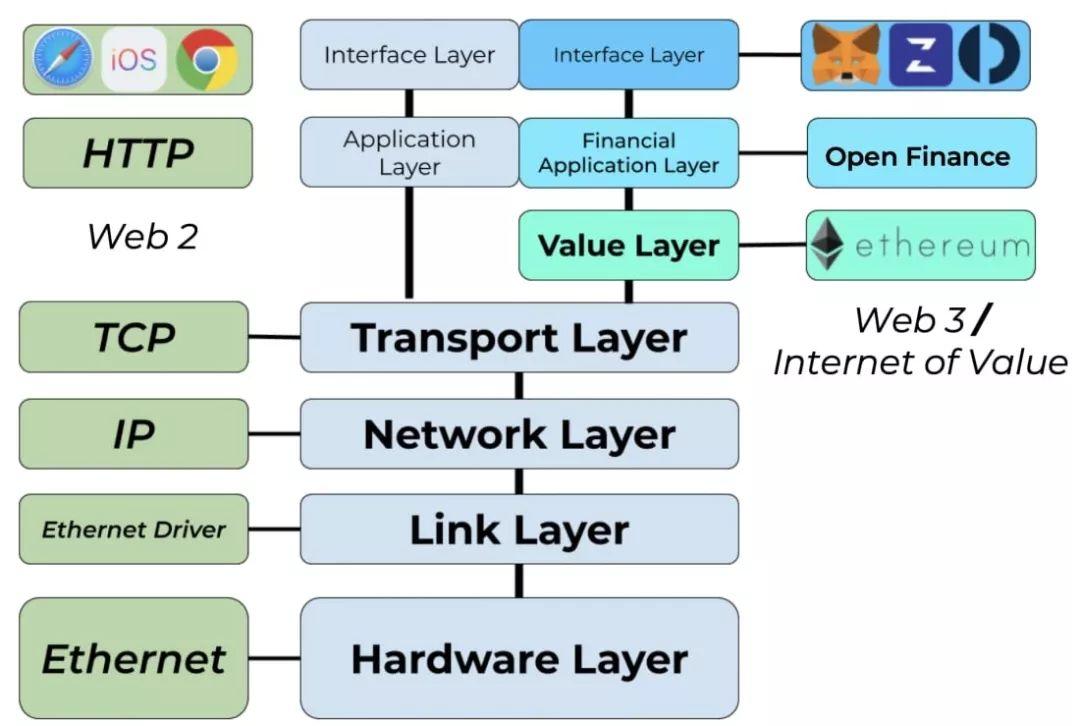

Ethereum became a "new layer" of the Internet and used its underlying communication protocol to create a new network that defines how to manage digital value. In other words, Ethereum is the value layer of the Internet.

If you visit Ethereum.org, you will find the following definition for Ethereum:

- Ethereum is a global open source platform for decentralized applications;

- At Ethereum, you can write code to control the value of your numbers, run it programmatically, and access it anywhere in the world.

The application on the Internet defines what the Internet is. Similarly, the application on Ethereum will also define what Ethereum is.

Ethereum's application layer

The place where Ethereum brought change was that it established a new application layer on the Internet. Web 2 Internet is a centralized database and centralized data Internet. Large applications on Web 2 include Facebook, Google, Amazon and other products.

Ethereum offers another option, a new layer, a layer of value that allows new applications to deliver greater value.

Currently, the Web 2 Internet is saturated and dominated by giants, while Web 3 provides potential value applications, although this potential has not been understood by too many people.

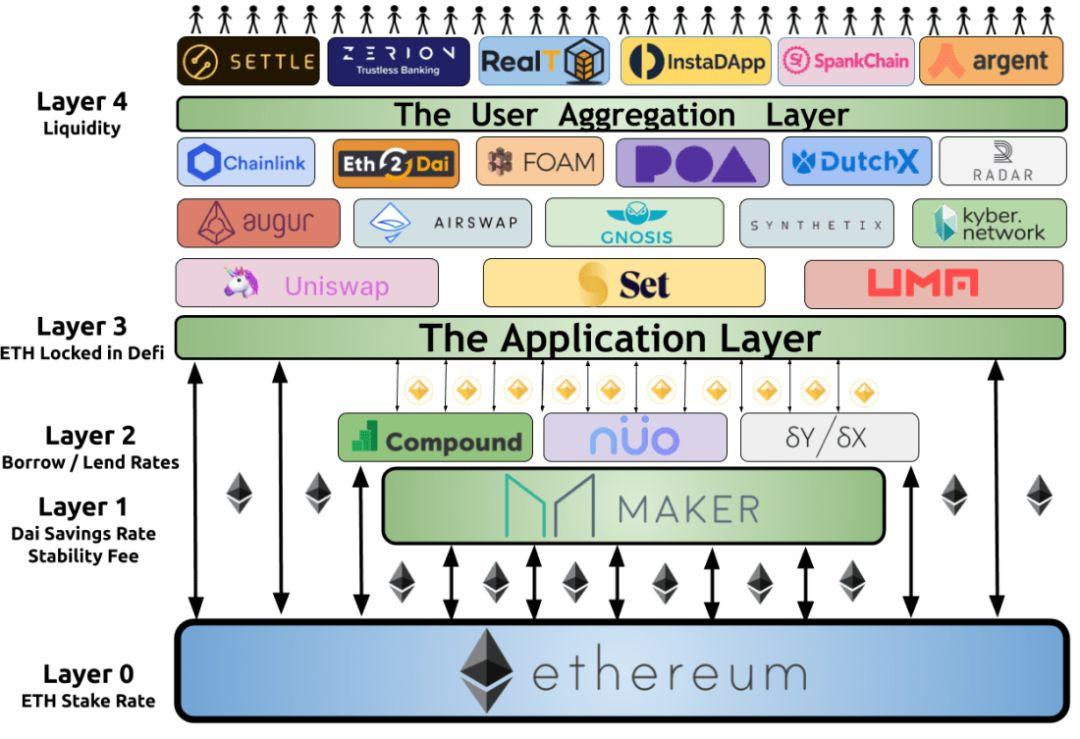

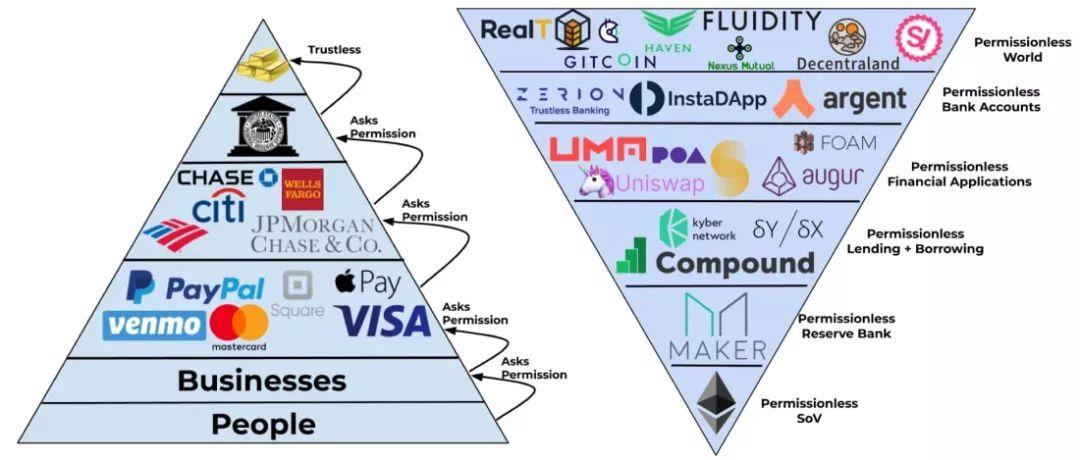

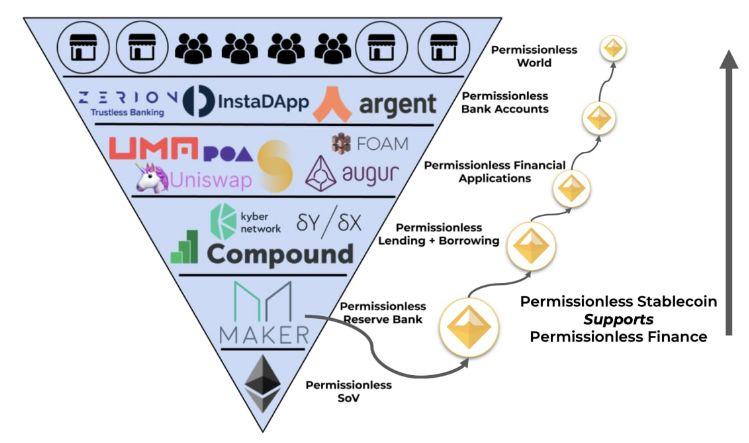

At present, the dominant application area in Ethereum is mainly financial applications. Under the leadership of MakerDAO, the stable currency DAI built a license-free financial stability, while the Ethereum's license-free financial network was exploding. Ethereum's open finance has locked it into a global value settlement platform. The Open Financial Movement began in 2018 and has now evolved into the core purpose of Ethereum: a network for license-free financial applications and services.

The open financial structure of Ethereum is produced in parallel in its value Internet. Each application can be combined with other applications to generate endless replacement transactions between each application.

However, Ethereum is not flat, because the financial system is layered in nature, and Ethereum is no exception.

However, with the underlying blockchain, applications on Ethereum achieve tiering by mapping to traditional financial systems.

Currency is the foundation of every financial system , no matter when. Gold is a great license-free value storage currency, but the problem is that gold is “heavy”, tangible and easily captured. So far, 90% of the world's gold supply has been taken away by the central bank, but at the same time, the financial products and services of these central banks are almost all based on legal tender. Since gold is available, every financial layer under the Fed must obtain a license from the previous level because the Fed is “top” and controls the currency.

This actually shows that at the bottom of the new financial alternative system, the license-free and programmable value storage currency is promising . Gold is license-free, as is Bitcoin, but if the systems that leverage the value of these assets are not free of reliability, then over time they will use these assets and build an authorization system to rent through such systems. Profit.

"stitched" together

Read here, if you agree with my description of Ethereum, then here is my definition of Ethereum:

- Ethereum is the value of the Internet;

- Ethereum is the global settlement layer of the Internet's native digital assets;

- Ethereum is a license-free financial application platform that collectively supports the license-free economy.

Define ETH

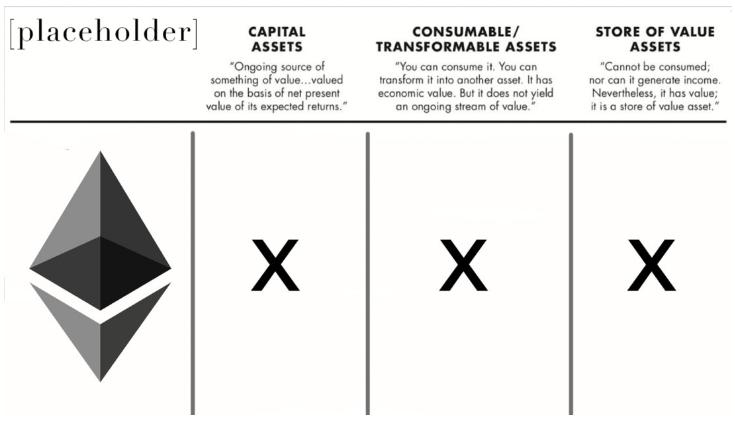

As an asset, ETH has always been difficult to define. Turing's complete blockchain (Ethereum) has the greatest flexibility, meaning that Ethereum can really do anything, and it is a bit wrong to define ETH with other asset class categories.

In order to define ETH as an asset, we first need to understand what an asset class is.

Define asset class

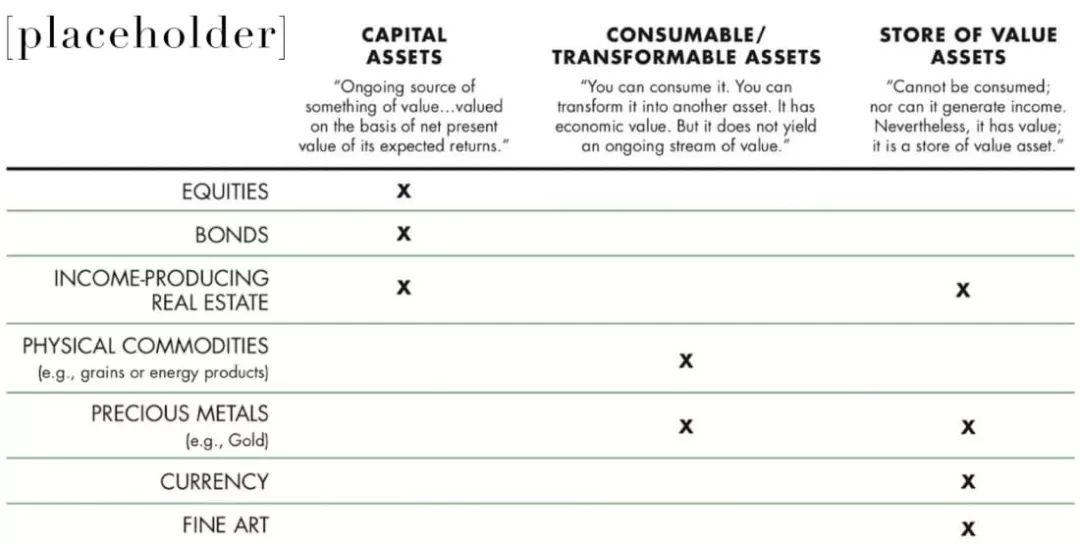

Chris Burniske, a cryptocurrency analyst, mentioned in his blog post a paper published by Robert Greer in 1997, "What is an asset class?" (What is an Asset Class Anyways?), which proposes three asset classes:

1. Capital assets

- Productive assets;

- Create value/money/cash flow that produces a continuous source of value;

- An asset that brings cash flow to the owner in some way.

For example, stocks, bonds, and rentable real estate.

2. Convertible / expendable assets

- Can consume / burn it – only one-time use;

- You can convert it to another asset;

- Consumption can generate economic benefits.

The most typical examples of such assets include gold, oil, commodities (wheat, etc.), or energy, and this type of asset is often used in the industrial sector to produce some economically beneficial outcome. You can imagine a common electronic product, but if it is gold-plated, the price will increase dramatically; in the same way, the oil in the car is considered a convertible/expendable asset.

3. Value storage assets

- Unable to consume;

- Value persists in time/space;

- Scarcity.

Typical examples of such assets include gold, currency, real estate, art or bitcoin.

This is the simplest asset class, but perhaps the most important . These types of assets must be scarce and difficult to generate/repeating/replicating. Globally, such assets should be generally expected/expected, and they also benefit from assets that are trusted to perceive value.

When we talk about "currency premium," we are actually discussing value storage assets.

At this point, you may have discovered that certain assets belong to more than one category. For example, real estate, it is a good value storage asset, but sometimes you can rent a house to generate cash flow.

Similarly, gold is an important industrial product component due to its electronic wire number and anti-decay capability, but it is also the most valuable asset-preserving asset in history.

At least so far, this is the case.

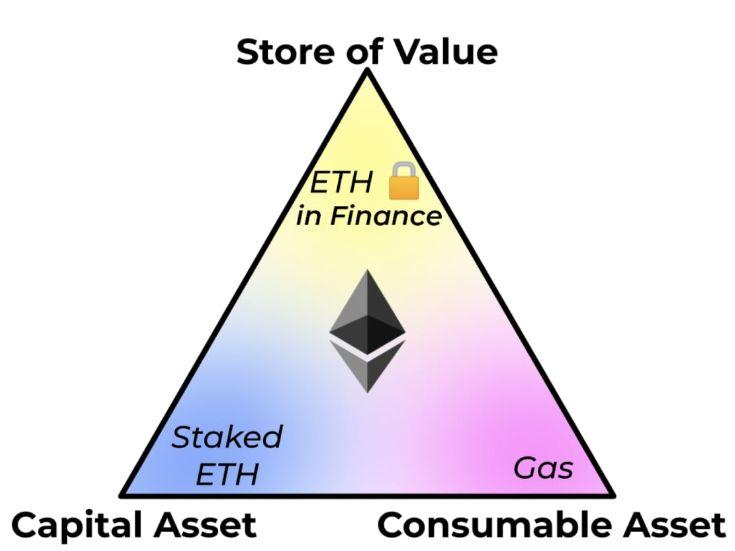

ETH: Covers three asset classes

The ETH attribute covers the above three asset classes. Depending on the situation, ETH can operate as any of these three asset classes, or even as three asset classes at the same time!

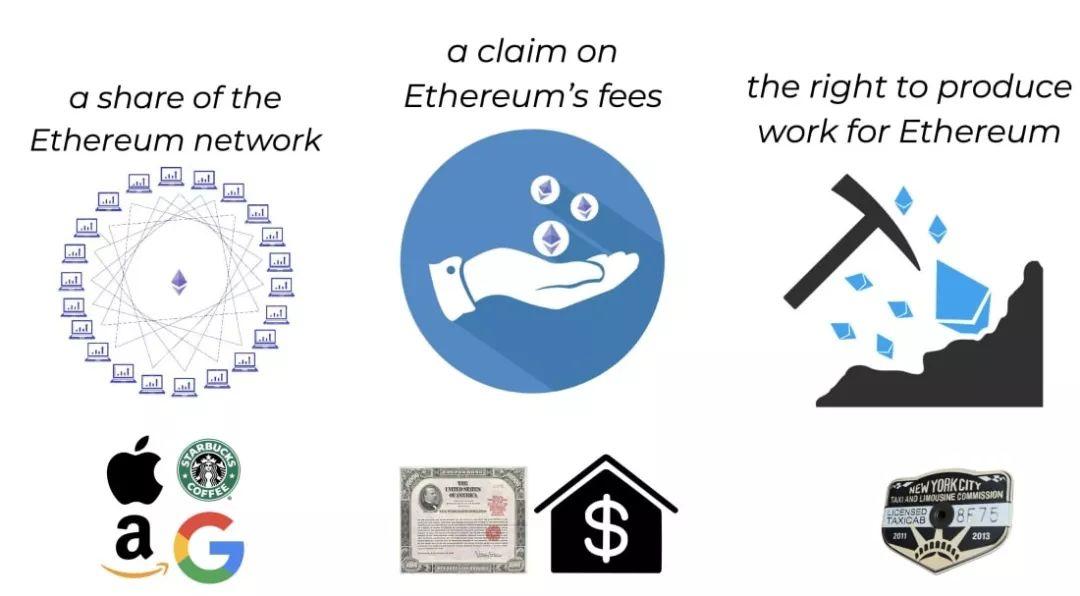

ETH is a capital asset

In the form of capital assets, ETH is:

- a share in the Ethereum network;

- Representative or claim of the Ethereum gas fee;

- The right to produce for Ethereum.

a share in the Ethereum network

The Ethereum Network is a decentralized organization that uses Ethereum Networks to produce products and services for its value Internet to expand its network, develop users and gain more value. Now, Ethereum has created a number of excellent products and services (such as MakerDAO, Compound, dYdX, Augur), and has the largest number of customers. Ethereum customers can find applications on the platform, and these people are also users of the application.

Representative or claim of the Ethereum gas fee

In order to keep the network running, Ethereum needs to pay its "workers". These "workers" exist in the form of verifiers. The verifier is Ethereum to ensure that all users act in accordance with Ethereum's terms of service (Ethereum's services) Terms: Please follow the Ethereum virtual machine rules; do not repeat spending). The "worker" labor will be rewarded, but it can also be used as a "wall" to protect Ethereum. The "wall height" is highly correlated with the total cost of the network. This height is also the price of attacking the Ethereum.

The right to produce for Ethereum

With ETH, you have the power to work and collect fees from Ethereum. ETH is also a mechanism to ensure consistency between the Ethereum network and its staff. All “workers” must have ETH to work for Ethereum. If you want to be an employee of the Ethereum network or pay for related services, you must have ETH and be consistent with the network.

These are all part of ETH's capital assets. At the time of the mortgage, ETH becomes the production asset of its owner. When the ETH owner mortgages it, it can bring more ETH to the mortgage. The way is very effective in Ethereum.

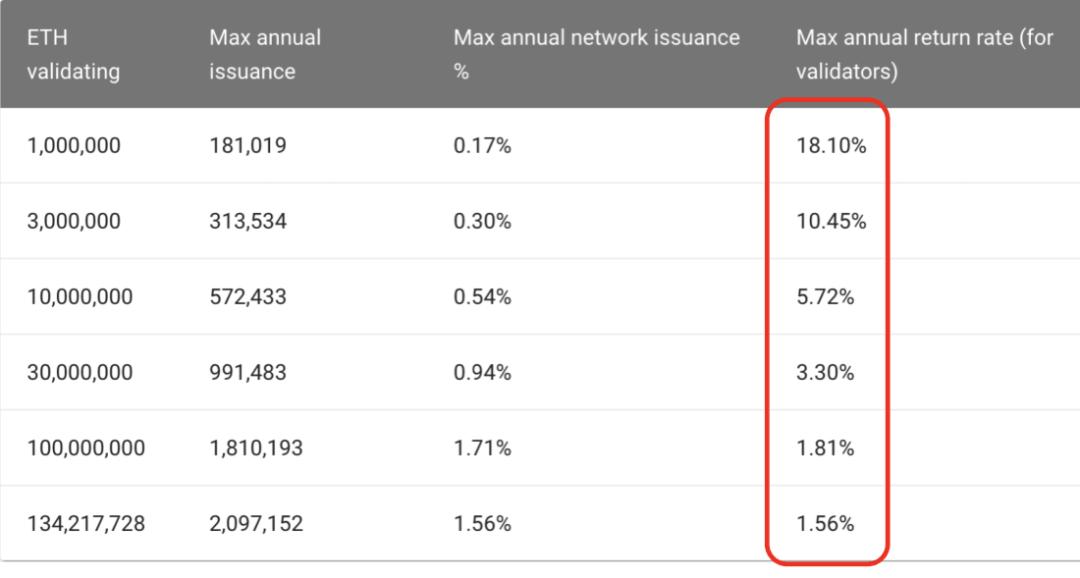

The current ETH 2.0 specification release schedule has not yet been finalized, but the smaller the number of ETH stakeholders, the higher the salary they receive, which is to motivate more Ethereum users to work or provide security for Ethereum. . When more ETH positions are mortgaged with their own ETH, Etherfang will pay less for each mortgagor because the overall security of the network itself has increased.

The chart below can look at the rate of return of ETH as a capital asset. This is the "return rate" generated based on the different staking quantities of ETH. If 10 million ETHs participate in staking, the ETH's pledge will receive a 5.7% annual return.

However, this is not the only way ETH's pledge party can make a profit. The above rate of return applies to the newly issued ETH, and they will also receive a portion of the gas fee paid to the network.

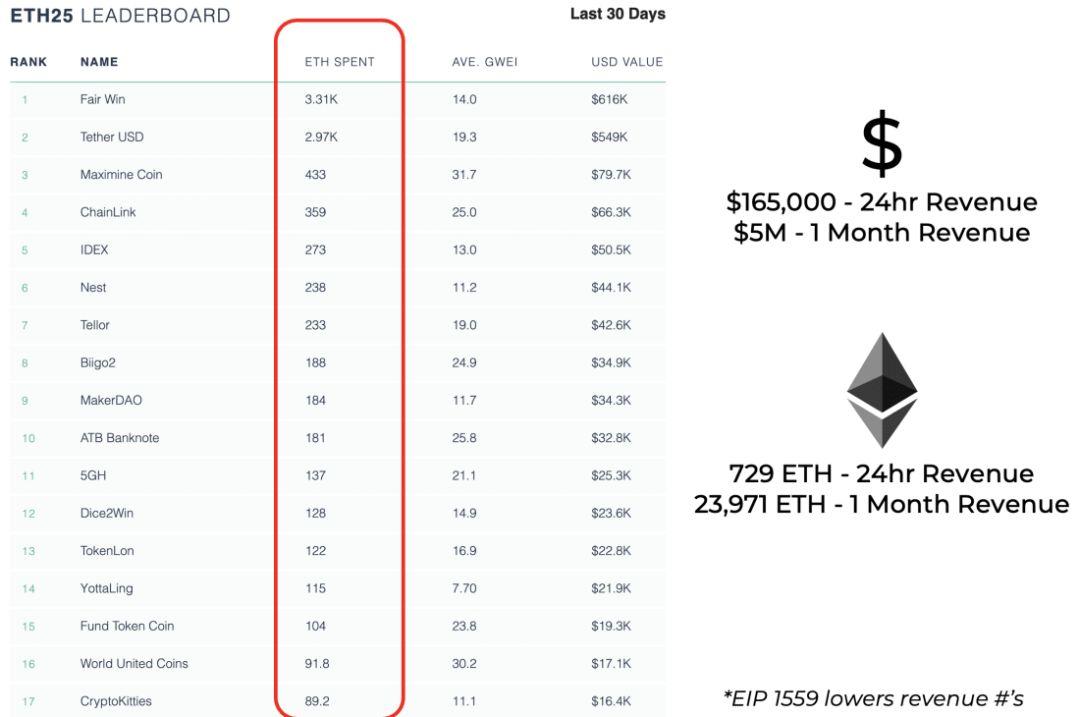

The following picture shows the “customer” who paid the highest gas fee at the Ethereum (September 18). (After the conversion of Ethereum to PoS), these gas charges, together with the new ETH issued on the basis of the online distribution, will be the reward for the Ethereum "workers".

ETH is a convertible/expendable asset

There are many forms of convertible/expendable assets. The most typical of this type of asset is not its specific asset itself, but an asset that produces energy.

Energy is a consumable asset, and we all convert energy into something of the world. Energy is raw ore, it can be turned into a skyscraper or a steel in a car; energy is an elevator that can bring people to their offices; energy allows us to trade and conduct business on a computer/phone; energy is a cargo ship The power behind it creates global trade; energy is the heat in our ovens, turning raw food into edible meals.

Imagine if we were in a world without energy…

Energy makes our world work. Without energy, we will not be able to turn useless things into useful things. We will judge the value based on people's demand for energy, such as what makes oil have global value, why electric cars will become a hot topic, and why batteries are so expensive.

Energy is the economic foundation that powers the world economy.

ETH is the economic foundation of the Internet

The original definition of ETH is "the ether of Ethereum", which is a good illustration of this. Consumption of ETH is the cost of turning the "economic wheel" inside Ethereum. Every time any activity is completed, ETH is consumed, such as:

- Transfer of assets to generate loans;

- Exchange

- Perform purchases;

- Start DAO.

The above activities will consume ETH.

ETH is a value storage asset

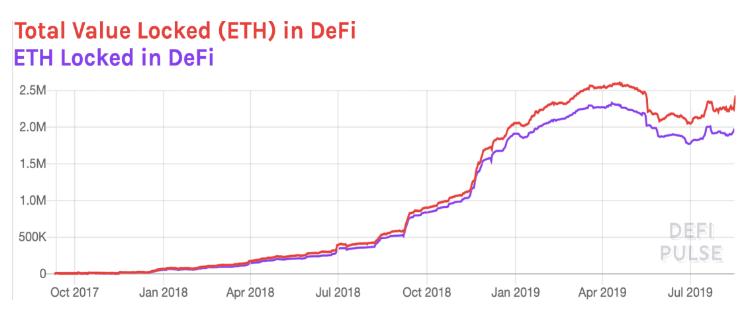

If you are concerned about the "ETH locked in DeFi" metric, then you should know that ETH can be used as a value storage asset. Being “locked in” means that ETH will be used as a collateral for something and will not be “locked in” if it cannot be promised to support the value of an Ethereum agreement/contract/asset.

As an unlicensed global asset, Ethereum is also a tool for establishing license-free financial organizations in Ethereum. We refer to these license-free financial organizations as “DApps” and call the economic network they created. "DeFi" or "open finance".

If ETH is not license-free, or if the “open finance” applications on Ethereum are running on licensed collateral, then they will not be true license-free systems (such as centralized stabilization coins or tokenized gold). ). At this point, we have to trust the chain assets issued by the centralization agencies, which are legal and will be redeemable.

Fortunately, Ethereum is exempt from licensing. Therefore, if we use ETH for collateral in decentralized finance or open finance, the above problems will not arise. (Note: Actually we have already done this)

Ethereum's first decentralized application: MakerDAO

MakerDAO is critical to the development of ETF's open finance, just as stability is critical to finance. Without the stability reference of ETH, many financial applications in Ethereum may not work well. Platforms such as Compound, DyDx, or Set require a stable currency for their applications to function properly.

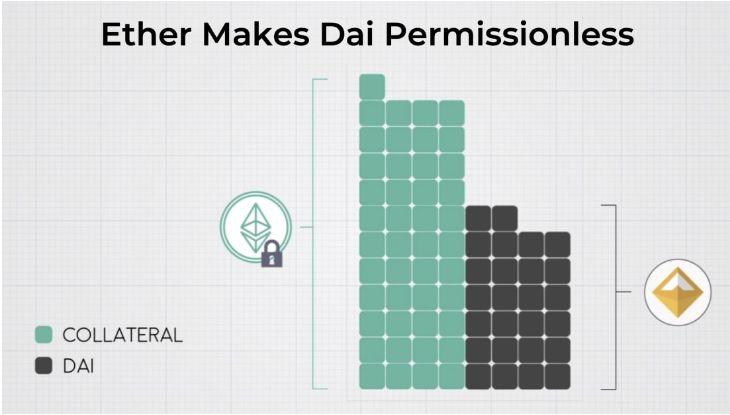

There are a lot of stable coins on Ethereum, but only one is perfect. DAI is the only original stable currency in Ethereum, and its birth is also achieved through the ETH, the only untrusted asset in Ethereum.

DAI realizes its value through ETH's “value storage” function and realizes its license-free function through its over-collateralization.

Unlicensed stability provides support for untrusted finance

It is really important to have a license-free stable currency.

In addition to providing a stable financial base, if you want to be exempt from the financial structure on this basis, then you need to make the stable financial base free of licenses.

If DeFi is all running on the USDC, then we need to trust the Circle to manage its funds. DAI is the only stable currency that can be removed from the user's wallet by the central authority. That's why developing financial applications can be guaranteed when building applications with DAI: If DAI is running in their application, no central authority can remove it from the application.

New currency for the new economy

New currency for the new economy

All of this is based on ETH, and ETH is now acting as a license-free, programmable value storage asset.

Compound

Compound.Finance is a lending application of Ethereum. It is a financial raw means and a key component of the Ethereum financial system.

Compound is an application that brings together lenders and borrowers and matches the needs and supply of the parties at variable interest rates. It generates DAI Borrow Rate and DAI Supply Rate, or the cost of borrowing DAI and DAI loan interest, which can be viewed at LoanScan.io.

Compound does not require trust through collateral.

Mortgage is one reason why Compound is a royalty-free platform. The borrower must over-collateralize the loan in order to assure the lender that there is always money in the “bank” for them to extract, in other words: no trust.

The vast majority of collateral in Compound is ETH, and borrowers need to lock ETH as a collateral for their loans. In this case, ETH is used as a value storage asset, which the market believes will retain its value over time and can be used as collateral for unlicensed loans. This license-free collateral is the reason for powering Compound lenders because the Compound application ensures over-collateralization and automatic liquidation of the borrower's collateral. The lender does not have to trust the borrower: Compound removes the trust in the two-party equation of lending.

Compund does this by two things:

- Use ETH as a value store;

- With the programmability of ETH, detrusting lending/loaning is realized.

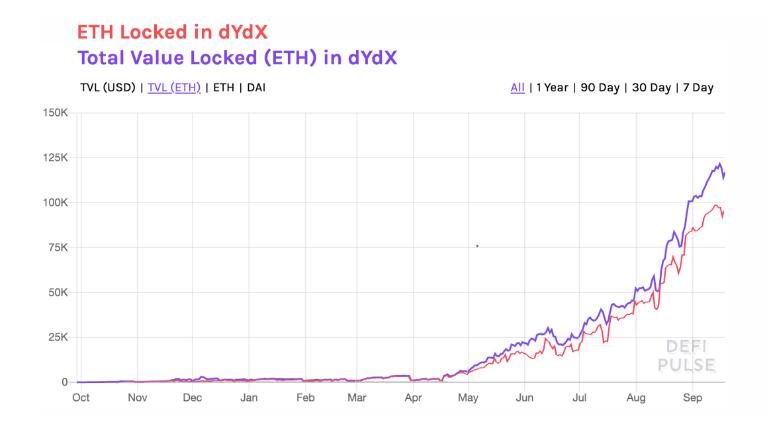

dYdX

dYdX is a platform that provides margin trading and lending, runs smart contracts on Ethereum, and users can trade without an intermediary.

dYdX provides services to users by requiring a "value store" collateral to trade or borrow a deposit. In theory, collateral can be anything, and dYdX supports USDC as collateral. However, as shown in the following figure, most of the collateral on the dYdX platform is ETH.

ETH is the primary "value store" collateral used on the dYdX platform. The combination of dYdX's smart contract and license-free value storage programmable assets (such as ETH) makes dYdX a royalty-free and trusted financial application.

You will see that 94% of dYdX internal requirements are ETH or DAI. It should be noted that DAI is just a token representing the mortgage ETH.

Value Storage ETH makes dYdX unlicensed and trusted.

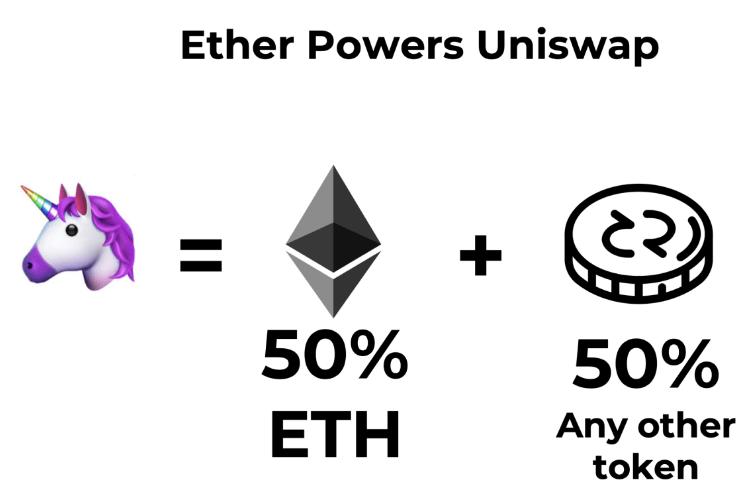

Uniswap

The same pattern applies to Uniswap.Exchange, and Uniswap.Exchange operates two mortgage pools for all token transactions.

In the first version of Uniswap, all tokens can be traded with the “value store” ETH, which acts as a value store, making it the best collateral for all token pairs;

In the second version of Uniswap (probably at the end of 2019), Uniswap will support any token transaction pair, and the most commonly used collateral is expected to be DAI (the stable currency form of ETH).

ETH is a value store for open financial services.

Ten years after the birth of the blockchain, it seems that only one use case has been discovered: value management across the Internet.

For financial institutions that have just entered the market, open finance is a new landscape with fertility. In the field of open finance, the institution is a self-governing contract that does not require human manipulation. Not only that, but what we can see from DeFi so far is that they use ETH as the underlying value storage asset for their applications.

All are ETH!

While people want more assets to join open finance and act as collateral (centralized stable currencies, gold in treasury, securities and treasury bills, etc.) , ETH and DAI remain the most used collateral in open financial applications. Open financial applications using ETH and DAI retain a completely "no license" feature, if open financial applications use other "trusted assets" in the chain (chain note: note, not "trust-free assets" such as ETH), Then they can only be a hybrid open financial application.

These hybrid open financial applications are not as cool as ETH and DAI, which are completely trust-free and completely license-free.

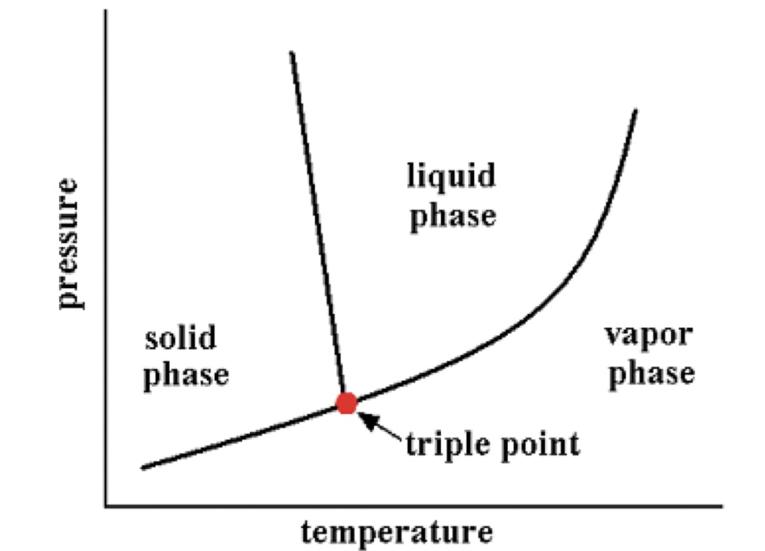

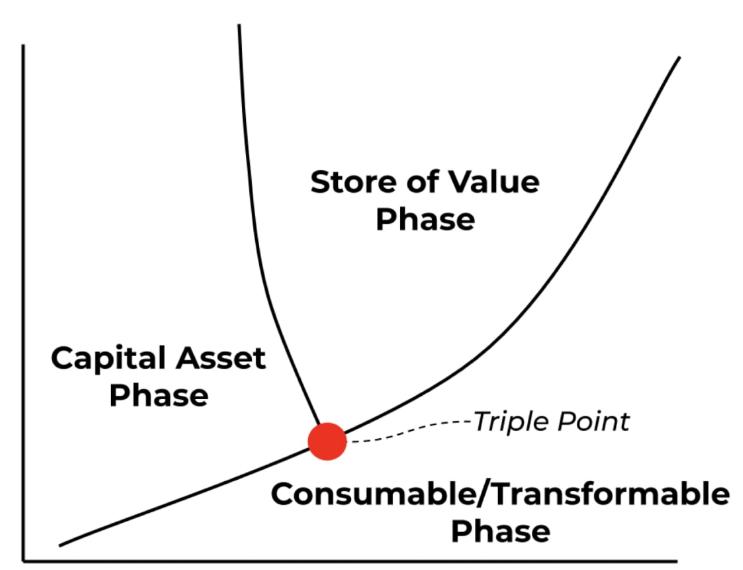

ETH: three-phase point assets

Depending on the situation, ETH will "play" any of the three main asset superclasses.

- Mortgage ETH = Capital Assets

- Consumable ETH = consumable / transferable assets

- ETH = Value Store ETH locked in DeFi

As far as I know, ETH is the first asset to go beyond these three asset classes, which is great for ETH. The definition of money is actually very flexible. When you need money, it will become what you need, as well as ETH. ETH will decide what value it will be based on the actual situation in order to fit all three major asset frameworks.

The story doesn't stop there. The " three-phase point " is actually a thermodynamic concept, which refers to a temperature and pressure value that allows three phases (gas phase, liquid phase, solid phase) of a substance to coexist in thermodynamics. For example, the triple point of water occurs at 0.01 ° C (273.16 K) and 610.75 Pa; while the triple point of mercury occurs at −38.8344 ° C and 0.2 MPa.

The state of matter states are usually different, with solid, liquid or gaseous states, respectively.

However, if the situation happens to be balanced, you can have these three states coexist.

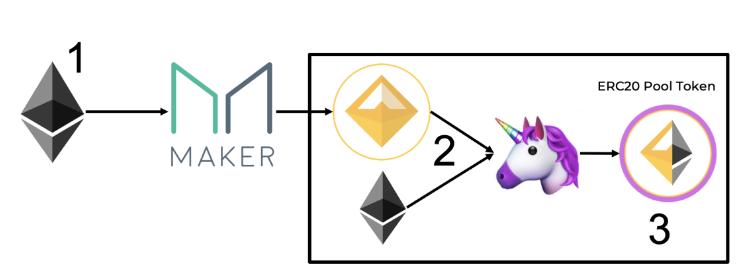

IDEO CoLab investor, Dan Elitzer, founder of the MIT Bitcoin Club, wrote a book called SuperFluid Collateral in Open Finance, which illustrates this.

Ultra-liquidity mortgage in open finance

What happens when collateral becomes liquid?

Dan Elitzer's article explains the liquidity of collateral within the open financial applications of Ethereum. This is what Dan is talking about:

- ETH is used as a value store inside MakerDAO to produce DAI;

- ETH and DAI are used to mortgage in Uniswap…

- ….Generate Uniswap pool sharing tokens (how to read this link).

- The value of this new ERC20 token is 1 ETH and 1 DAI, both of which are stored in the original value of Ethereum;

- Use the new value store tokens inside Compound as a loan collateral.

The main point that Dan Elitzer puts forward in his article is that ETH is locked inside Uniswap and generates a new token that represents its value, and then relocks the new token inside the Compound. ETH mortgaged within Uniswap can also be used as a collateral for Compound.

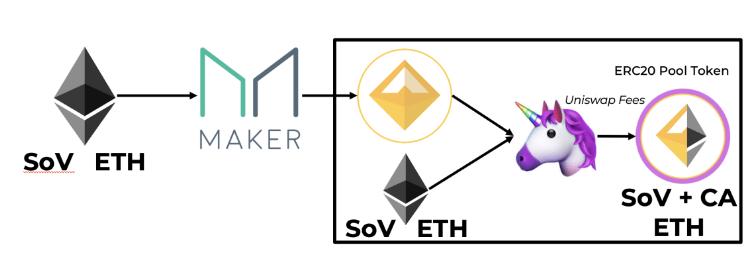

Let us summarize this situation into the asset definition given above:

- The value store ETH is placed in the Maker to produce the DAI;

- The value store DAI+ETH is placed in Uniswap to produce the Uniswap Pool Share Token;

- Uniswap Pool Share Token is a value storage asset and a capital asset. The Uniswap Pool Share Token is collateralized by the assets that support it, but at the same time, when the assets that support it are traded, the Uniswap Pool Share Token will also charge a fee, and Uniswap will charge a 0.3% fee, which means the generation of the Uniswap Pool Share Token The value of the currency will increase as it will be charged from Uniswap.

Therefore, Uniswap Pool Share Tokens is a value storage asset and a capital asset.

let's continue.

This brand new token, the value storage asset and the capital asset, was deposited into Compound as a loan collateral, and now it acts as a value storage asset to support the loan.

So, although the Uniswap Pool Share Token is a value storage asset and capital asset, it exists as a value storage asset in (ETH+DAI), but when it supports the Compound loan, it plays [[value storage + capital] The role of the asset]*value store].

In theory, this can also be used as a loan tool in Compound, not as a borrowing tool. If you replace step 4 with a new step, you will find:

4. In Compound, allow your Uniswap Pool Share Token to be borrowed, and then you can get interest from the borrower on the Uniswap Pool Share Tokens.

At this point, we now have a "value store and capital" asset that can be borrowed and charged, so it becomes a [[value store + capital] * capital] asset.

The whole process needs to pass eight transactions, and every time Ethereum has economic activities, it will consume ETH. When ETH is converted into a capital + value storage asset, ETH will be used as the economic basis of Ethereum.

In other words, ETH is a value storage/capital hybrid asset, and ETH is also used to pay for the conversion of ETH to a Compound loan collateralized by the Uniswap Pool Share Token.

ETH acts as the orange of the "three-phase point" asset because it has the ability to become three super-class assets at the same time.

Why is this important?

ETH is the first asset in history to be able to operate as a superclass of three assets at the same time. Why does this all seem to be very organized? What does this mean at the same time?

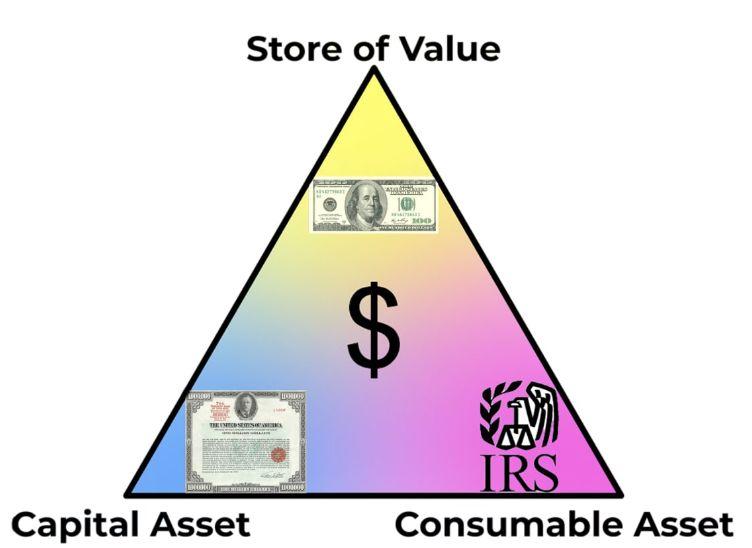

This model ensures the security of the US economy

The ternary combination of capital assets/value storage assets/expendable assets is the three main components that ensure good economic performance. Through the tandem of these three, the necessary driving force to support a healthy and strong economy has emerged.

Value Storage – US Dollar Capital Assets – US Treasury Debt Expendable Assets – Taxation

Money is an important value storage asset. The currencies of each country want to be able to ensure that wealth does not depreciate over time (of course, they can actually do better with money, maybe it will be better). Money is a trust tool for the exchange of time and space and the value of transactions. The dollar is also the most successful currency in history and dominates the value storage assets of the world economy.

US Treasury bonds are the foundation of the US bond market. The US bond market is probably one of the world's largest economic powers because it allows the market to reflect whether it trusts the government's ability to pay its debts or not. The bond market yield is a basic risk-free rate that provides the US government with value storage assets (US dollars) and promises to return you dollars with a certain percentage of additional interest. At this time, the US government uses this value to protect the US economy.

Taxation is the way the US government repays debt and finances new businesses. The US Internal Revenue Service levies taxes on economic activity and supports the US real economy. The (partial) tax collected is owned by the holder of the US Treasury, and the tax is also a mechanism used to pay interest on the holder of the national debt. In theory, the US government also pays Treasury holders through US dollar inflation, reducing the ability of the US dollar to be a value storage asset.

ETH and Ethereum follow the same pattern

Ethereum uses the same economic structure as the United States. Everything is centered on ETH, and Ethereum is an economic system.

Value Storage – ETH Capital Assets Locked in DeFi – Mortgaged ETH Consumer Assets – Gas

ETH is used as a value storage asset to support open source economic applications.

ETH is a mortgage for Ethereum to ensure financial security and access to risk-free interest.

ETH is used to pay for gas charges (using Ethereum fees), just like paying taxes for network security.

All together

The core of Ethereum is actually used as the infrastructure needed to generate a new economy. This time, the financial services in this economy have the following characteristics:

1, completely run by the code *; 2, to trust / license-free; 3, are on the Internet.

Now that we have this new economy, we also need new funds to make this economic model work. If we want to keep the Ethereum economy trustworthy and license-free, we need a currency that is trustworthy and license-free.

The only trusted and license-free asset in Ethereum is ETH.

ETH's role in Ethereum

ETH is the bandwidth that is provided for license-free.

The need for and use of ETH within Ethereum is actually to make it stable to the license-free currency within financial applications.

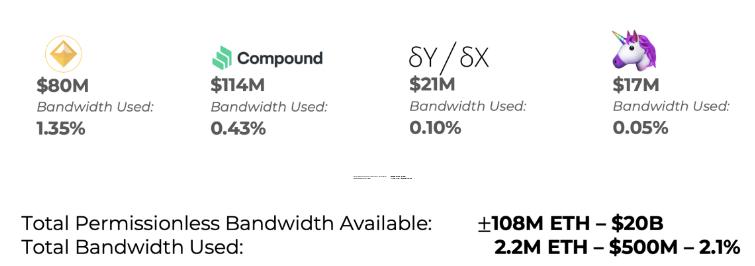

The ETH in Ethereum is limited, which means that when ETH is locked inside an application, the application will consume a portion of the total ETH. In order to get ETH, the applications need to compete with each other. They also use a part of ETH in Ethereum, which is what we call "the ETH locked in DeFi".

" Bandwidth " actually means "ETH locked in DeFi" or "How many ETHs does this application need to meet the needs of its users?"

At this stage, Ethereum's bandwidth usage is very low, and there is a lot of room for applications to grow and give people the opportunity to get more ETH.

- If you want more DAIs to appear, you need to lock more ETHs to create "more" license-free, so each DAI needs to be collateralized by its 1.5 times value ETH.

- If all of the loan demand for Compound increases, then Compound needs more ETH mortgages to support the loan, which is the same as dYdX.

- If the number and mobility of Uniswap increases, it also needs more ETH or DAI to augment these flow pools.

All of this requires a portion of the ETH to be taken from the total ETH, representing the bandwidth of the ETH as an unlicensed currency.

Growing bandwidth

ETH has enough bandwidth to meet the current Ethereum state. At the time of this writing, the market value of ETH is about $20 billion, and the total value of ETH locked in open finance is about $600 million. In other words, to meet the needs of current users, the current bandwidth is actually sufficient.

However, as an economy, Ethereum has many shortcomings, if we want Ethereum to become:

- The global financial platform of the Internet;

- Value internet

- The global clearing layer for all digital assets.

If we want to get exemption/trust, then we need to expand the number of ETHs further.

In Ethereum, trusted finance and authorized assets are very popular, and their roles and functions in Ethereum are the same. But if you want to make a real difference, then all financial applications need to be license-free, and use a completely license-free currency to support operations, and everything else can be compromised.

At present, there are about 1.7 trillion US dollars in circulation. If we want Ethereum to meet this demand, ETH prices must rise 85 times.

Stocks in the stock market have a size of about $73 trillion. If we want to generate the same size of license-free equivalents on Ethereum, they need to mortgage ETH, which will require an ETH price increase of 3,650 times. Similarly, the global money supply will increase accordingly.

If we want a world that is free of licenses, then in this world, people will pass on a value through a platform of trust, then the value of ETH needs to be further expanded to meet this demand. Now, ETH and Ethereum only meet the needs of a few devotees. Of course, the value of Ethereum is now enough to meet the needs of these people.

However, if we want to get Ethereum to get the next 1 million or 1 billion users, we must increase the price of ETH in order to support the economic activities required for license-free/trusted financial applications.

So how does ETH expand?

We need to increase the price of ETH so that we can provide more funding for more financial platforms, but how can we do that?

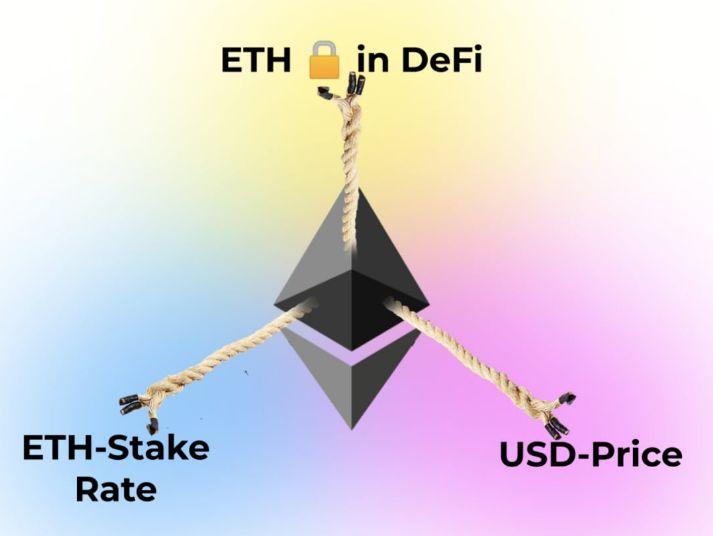

Three "taw wars"

According to my understanding, there are three modes for ETH to appreciate, which is also the basic value proposition of ETH.

- Open finance attracts ETH . Open financial applications provide products and services that need to lock in ETH. Mortgage provides support for de-trust, while ETH provides support for DeFi. The DeFi application will create valuable services for ETH holders and will also convince ETH holders to lock ETHs into their applications to access services and products. MakerDAO, Compound, dYdX, Uniswap….. The more useful applications, the more reasons you need to lock ETH.

- ETH-Stake Rate . Another way to lock ETH in DeFi is to staking ETH. The ETH mortgage rate provides the ETH holder with a “no risk ratio.” If you believe that the return from staking ETH is higher than the return on locking it in DeFi, the ETH pledge rate is the motivation for your investment. The ETH locked in DeFi and the ETH that performs staking will continue to "oppose" ETH. It is worth noting that the more ETH is locked in DeFi, the better the ETH pledge rate will be. If DeFi produces a great product, then more ETHs will be transferred to DeFi, and those who still choose staking ETH will get more rewards.

- The price in dollars . Both the ETH pledge rate and open finance have driven prices in US dollars. If DeFi is competing for ETH, the ETH pledge is also competing for ETH, which in turn leads to a significant reduction in the number of ETHs that can be purchased. For the above two forces, the dollar will have the same equal-and-opposite problem, and the only mechanism is to raise the price, so the dollar value of ETH actually represents the cumulative power generated by the ETH pledge rate and the DeFi product trade-off.

This mechanism is really great, because as open finance becomes more and more useful, ETH prices will rise to meet demand. The greater the demand for ETH in open finance, the better the ETH equity rate. All in all, both forces have driven the price of ETH to increase ETH bandwidth in open finance and support the security mechanisms of an open financial economy.

As long as DeFi continues to generate more financial applications on this basis, the dollar may not have a chance.

Source: Chain News ChainNews

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ant blockchain releases the latest cross-chain product ODATS, and the cross-chain communication infrastructure is ready to go

- Introduction | Vision · System Registry of the World Computer

- Libra leader David Marcus: Why do we want to establish a new currency agreement?

- In addition to physical delivery futures, what are the ambitions of Bakkt?

- Germany releases blockchain strategy, focusing on digitalization of securities

- After reading the Ethereum 2.0 progress update (September 2019)

- Supply Chain + Blockchain: How does the blockchain set off a global supply chain revolution?