Opinion | Why can't ETH maintain a currency premium in the long run?

The Ethereum project has been criticized for a long time, and opinions mainly come from Bitcoin fans, covering its design, their execution, and their failure to actually fulfill their ICO commitments. The Ethereum Foundation is currently experimenting with a bottomless engineering challenge: rebuilding a brand new blockchain, and then integrating the new and old chains together when both are running. This is not an easy task, and it increasingly highlights the deep-rooted issues in the original design of Ethereum and the long-term uncertainty that future investors will experience.

At the same time, Ethereum Ecology has also discovered a new direction: decentralized financial applications. The reason why this direction can be developed also depends on the developer activities on Ethereum (this point has also been positioned as the "moat" of Ethereum). The idea behind the decentralized financial movement is "to create an open and never-stop financial system", and to establish ETH as a reserve currency for the entire ecology.

In this article, I will list some reasons to prove that even with this movement, ETH is unlikely to have a satisfactory currency premium. The reason that is particularly important is that ETH has always stood on the opposite side of cryptocurrencies such as Bitcoin, which has a cap on supply and additional currency issuance at a predetermined liquidity depth. My core point revolves around the following four topics:

- Uncertainty in monetary policy and (at least people think) centralized governance

- Secondary System Syndrome (high expectations generated by the original system distorted the design of subsequent systems) and long-term project direction confusion

- Rely on application layer to achieve value accumulation

- Underestimated the nature of the "tortoise and rabbit race" of Bitcoin development

Monetary policy and governance

The core design of Bitcoin's monetary policy is a pre-determined money supply curve hard-coded in the genesis block and a hard cap of 21 million money supply. Bitcoin's monetary policy has only been changed once, that is, when the BIP-42 soft fork, BIP-42 removed the abnormal and undefined behavior of Satoshi Nakamoto in C ++ code to support the development of alternative clients.

- Bakkt options trading volume low, Wall Street remains silent amid bitcoin rally

- alert! Highly respected DeFi is threatening Ethereum security

- Crypto asset management in the second half, the path to the break of the active ETF

This monetary policy is now also protected by a robust social contract (consensus). If you rashly change Bitcoin's monetary policy, it will inevitably destroy the basic value of the entire project and lead to fork protests. Most Bitcoin fans support: Don't change this supply curve; if there is a slight change in this supply curve, it is not Bitcoin.

In the 11-year history of Bitcoin, this unchanged supply curve has provided investors with relative certainty and allowed Bitcoin to successfully capture the high value. Bitcoin's design has given people confidence in fighting future unexpected inflation.

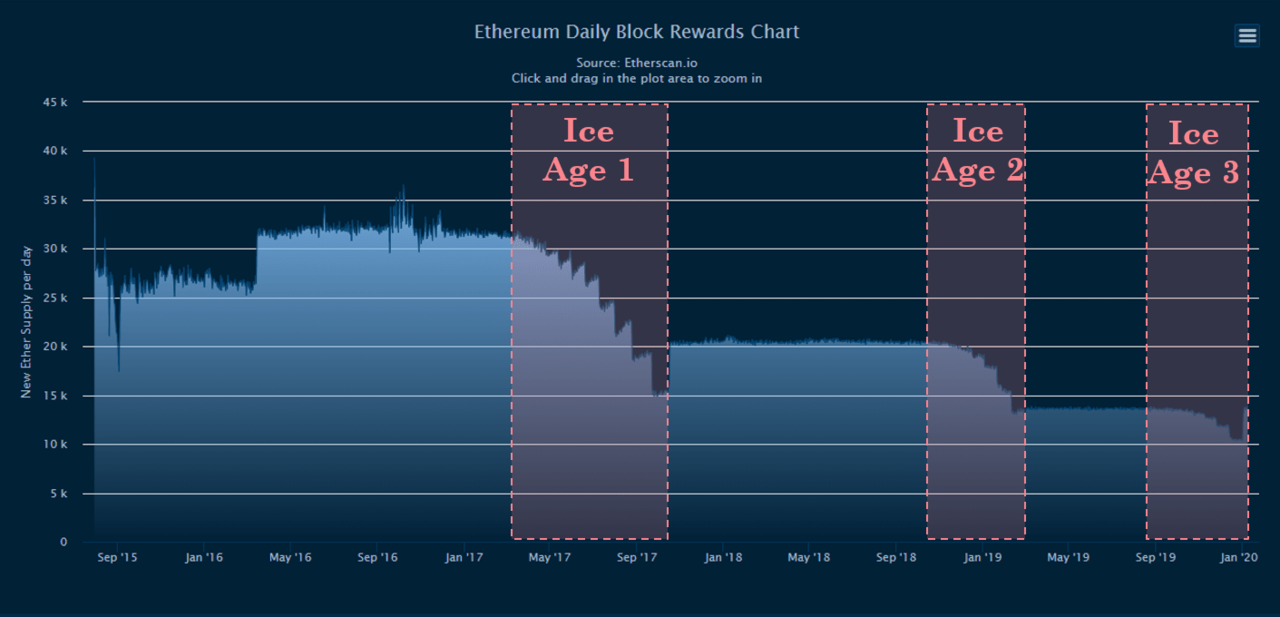

In contrast to Ethereum, the 2014 ICO was launched when everyone knew that the project would move to Proof-of-Stake at some stage in the future. In order to push developers towards this goal, an "Ice Age" design is also specifically inserted into the agreement, which will intentionally lengthen the block time by regularly increasing the difficulty of PoW block generation. Its original intention is to provide PoW miners with negative incentives to mine on the PoW chain, making the PoS migration process easier.

But in Ethereum history, the ice age has been postponed three times through a hard fork method (changing the consensus rules). Three times because the implementation of PoS has not been able to meet the deployment needs; the first two delays have also reduced the rate of ETH issuance.

Volatile monetary policy

Ethereum advocates often point out that the continued decline in block rewards (that is, currency issuance) is also a symbol of the ETH currency's robustness, which can also increase its scarcity. However, there is a difference here that must be discerned in detail: the asset issuance rate (its robustness) is not the same as the anti-forgery property (its soundness).

Although the ETH issuance rate has been declining, the choice of inflation rate is the product of developer intervention, not determined by deterministic and reliable hard coding.

So there is only one main point of my criticism here: let a small group of people have the authority to determine the inflation rate of an asset to be a global currency. How can this be done? Over time, it will become an abuse of power.

Until now, people are not sure how the future inflation rate and money supply of ETH will change. Even if the development of Ethereum 2.0 is successful, the question remains: Who has the authority to decide what is called "success" at the minimum feasible increase rate? Those who have this authority will constantly adjust the pledge rate to achieve this subjective and arbitrary goal. It is also impossible to leave it to the algorithm, because people will find this model vulnerable, and then some people will once again change the inflation rate at the protocol level.

This process never ends, as attack methods evolve. Therefore, we can only think that ETH's monetary policy is incomplete and changeable, because its social contract gives the authority of monetary policy to a small number of people.

Centralization of nodes and validators

Bitcoin has also had controversial moments, the most famous one being the debate over the activation of SegWit (segregated witness data). User Activated Soft Fork (UASF) defeated the ambition of miners to abduct the Bitcoin blockchain through social consensus; after the user node is upgraded, it will automatically disregard the rewards issued by those blocks that do not meet the agreement .

In order to make this kind of checks and balances take effect, Bitcoin's node software has been designed to be as lightweight as possible to ensure that users can easily obtain the software, and that poor hardware can also run nodes.

Ethereum has always required more specialized and powerful hardware to run nodes. This is generally due to the transaction size and stronger demand for block space due to Turing Completeness.

Although the optimization of node hardware has continued, synchronization time and hardware requirements have continued to increase. Assuming that Ethereum really faces global users, the centralization of this node is contrary to it: now only those who can afford solid-state drives and can frequently upgrade software can participate. It is very likely that the operators of the nodes will be centralized around core Ethereum developers (such as the Ethereum Foundation and Consensys), exchange operators, on-chain banks, and a small number of pledged service providers.

Ethereum 2.0 will actually speed up this process, because ordinary users do not have the technical ability to operate nodes, so they will choose the exchange and pledge service provider for convenience.

As the centralization of nodes becomes more and more obvious, the ability of users to signal and initiate UASF-type defense measures will become weaker.

This in turn highlights the relationship between accelerated centralization of governance power and core developers, who, on the one hand, hold a large amount of ETH to participate in PoS verification, and can also influence the direction of monetary policy experiments.

Currency experiment

The latest currency policy experiment that is currently being discussed is EIP-1559. This EIP will introduce an ETH destruction mechanism, so it will completely change the mechanism and incentive mode of blockchain operation.

Ultimately, this destruction mechanism will bring great benefits to current ETH holders, but will harm future holders and users. Assuming that the Ethereum network will continue to grow, this policy will increase the user's dollar-denominated Gas fees (that is, Gas fees will swell). Pledgers are largely unaffected because they can benefit from both non-inflationary block rewards (that is, transaction fees) and the tax measures introduced by the ETH burning mechanism.

The author believes that this kind of monetary policy experiment was created by those who can make the most profit from it, and it specially caters to the "research opinions" of developers who believe that the current gas fee mechanism is insufficient to make ETH accumulate value.

This is very similar to the current central bank policy and its Cantilon effect.

(Translator's Note: The Cantilon effect, a wealth redistribution effect caused by the incremental injection of additional currency into the economy, because the devaluation of the currency value does not occur at one time, but gradually. Someone can always get the devalued Currency and use it first.)

We can only assert that Ethereum's monetary policy is more floating and more influenced by people than by code. This uncertainty reflects its inadequate monetary policy (easy to be artificially forged) and raises doubts about centralized governance. This undoubtedly prevents ETH from generating a currency premium, and it seems that it can only go from bad to worse.

Secondary system syndrome

The initial promise of the Ethereum project was to extend the capabilities of Bitcoin by introducing Turing-complete scripts. The intention of this design is to create a global computing network, a "world computer". This was originally a great design goal, and it is also a very suitable goal for Ethereum to pursue. It provides a verification code mechanism (CAPTCHA) for the Internet of a transaction.

The price of this design decision is naturally the increasing complexity of the protocol, more attack surfaces (or hacking behaviors) due to software bugs, and the inevitable bloated volume of the blockchain. The design direction of Ethereum has also changed several times due to changes in market demand. From the world's computers, non-stop dApps, to token issuers, the story of Ethereum has also been changing, and now it has become an open financial application.

It is worth noting that the original Ethereum design explicitly ruled out ETH as a currency. But that has changed, and the documentation for the Ethereum.org website and the project has changed.

This is an innovation, and it means they have learned a lesson; but this shift in design trajectory also reflects the long-term appeal of Bitcoin design (single currency use case). During the exploration of Ethereum, Bitcoin has been enriching its currency attributes, such as uniqueness (characteristics), liquidity, network effects, and characteristics of financial products, and finally established a good reputation and market adaptability.

Ethereum is a great example of the Secondary System Syndrome. They decided that such a simple technology as Bitcoin could not achieve its design goals, and iteratively iterated towards a more complex and "more promising" project; in the end, they fell into an endless loop of research, discovering new problems, and postponing the issuance scheme. .

(Translator's Note: "Secondary System Syndrome" is a concept put forward by software engineer Frederick P. Brooks, which means that the completion of a small and beautiful system has caused people to have high expectations for the product, which in turn creates overdesign, Overly complex system and eventually fails)

Building Ethereum 2.0 from 0 is the latest solution, but this once again paints a thrilling future for ETH holders. The new blockchain will eventually clear the Lindy effect already established on the existing chain with one click. There is reason to predict that the result is nothing more than more research and more newly discovered problems.

(Translator's Note: "Lindy Effect", a concept proposed by Nassim Nicholas Taleb in Anti-Vulnerability, refers to something that does not die out naturally, and its remaining life expectancy will be proportional to the time that has existed, the longer it has existed , The longer it will survive.)

Furthermore, the Ethereum 2.0 beacon chain is also very similar to Bitcoin, that is, it only deals with consensus and global status, and applications and data are pushed to the shards (like Bitcoin's second-tier network, etc.).

Rely on application layer to achieve value accumulation

Although the achievements of the open financial ecosystem in technology and engineering are compelling, for ETH, relying on third-party protocols to achieve value accumulation still faces the risk of linear increase. Recently, many high-profile applications that claim to be “unable to shut down”, “do n’t engage in depository”, and “decentralized” have been proven to both shut down and manage user assets, and are centralized:

- MakerDAO has a zero-latency shutdown mechanism and will host user funds

- Compound was found to host user funds and has a backdoor and shutdown mechanism for developers

- 0x There is a bug in the V2 upgrade. After being found, the developer urgently shut down the agreement.

These cases break the story of open finance's “never stop” and make the latter seem so dishonest, because the so-called “decentralized” products can actually control user assets and have a back door. Although security measures are necessary in the early stages of research and development, this sounds too much like a secondary system syndrome. Always research, and your development timeline will always be "almost good".

There is no such thing as a "secure backdoor" in cryptography. Developers can get in, attackers can get in.

Relying on a centralized oracle

The core of the "DeFi" ecosystem is MakerDAO, whose system is regulated using MKR governance tokens. Some people say that without Maker and its DAI / SAI, half of DeFi's reliance will depend on centralized, entry-level stablecoins, such as USDT and USDC. But in fact, most Maker's ETH / USD price predictors, which are used by DeFi, are also controlled by the center.

This problem is difficult to solve in a trustless manner.

In fact, the author does not think that a trustless oracle can be realized within a period of time, and the author should emphasize that research in this area has been done for decades. All the price information transmission mechanisms on the chain (including Uniswap) are vulnerable to liquidity attacks, and the amount of funds required for defense (most optimistically) will not be available for decades.

Therefore, the trustless oracle, as the core component of DeFi, will remain centralized for the next few decades.

In the foreseeable future, attacks on these centralized oracles will be the basic risk faced by investors. It's inappropriate to use the "House of Cards" to describe DeFi: these centralized oracles are used as components of other combinable protocols; the reliability of the entire building originally depended on the weakest pillar, but the user is here It is not clear where the real risk comes from.

This appears to be a systemic risk that has not yet been mitigated.

Dependence on MakerDAO

A major criticism of MKR is that its tokens are concentrated in a group of known, KYC-based venture capital and the team itself. There is also every reason to believe that MKR is a quasi-equity token and will be defined as financial securities in most jurisdictions.

In fact, a recent proposal by MakerDAO proposed to reduce the interest rate of this "decentralized" bank to 4%, but 94% of the votes in favor were cast by an entity. This shows the indifference of bearers, poor incentives for participation, and strong influence from a small group of large households.

Now, given the relationship between the entire open financial ecosystem and heavy reliance on Maker's centralized oracle, we have to ask: What if Maker and its holders are being watched by regulators, governments, or hackers? In most developed countries, a bank license is required to issue debt unsupervised; regulators will first focus on this project, just as they accused of illegal token issuance during the ICO bubble.

Supervisors shut down Maker for only a moment, and grassroots copies will spring again. But how much will ETH holders pay at this time? This long-term threat, and the variety of uncertainties that can cause economic losses, make ETH unattractive.

If MakerDAO's oracle is hacked, not only its mortgage debt position will be closed, but all dependent protocols will be liquidated by the attacker using the cheap ETH obtained from the closed position.

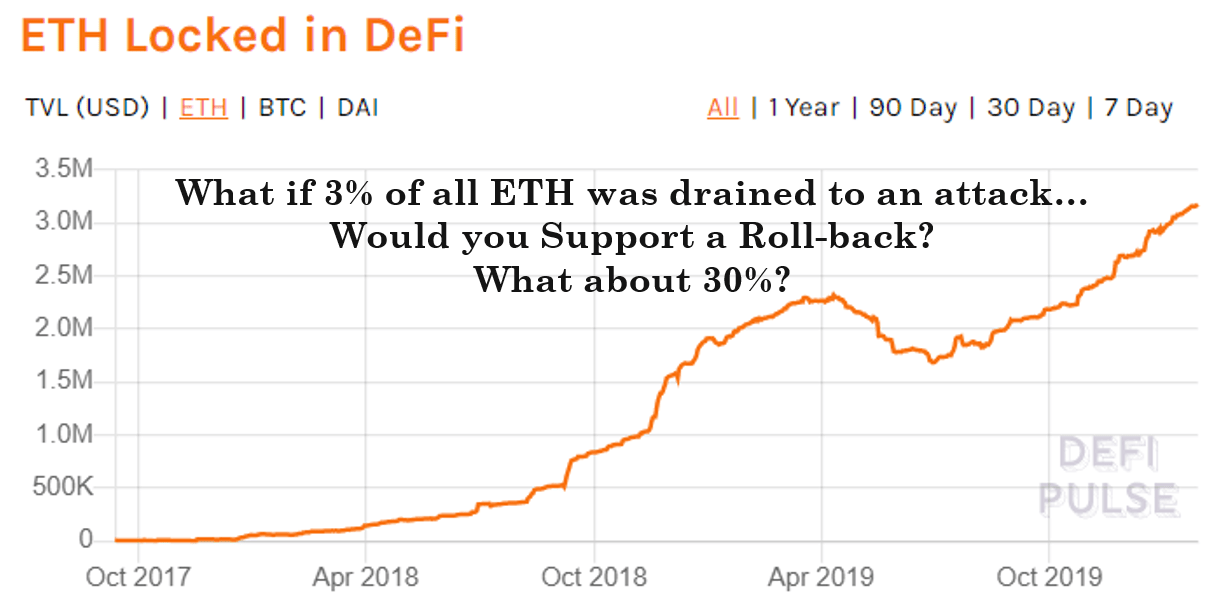

If a hacker steals 3% of the total supply of ETH from DeFi users, will it be rolled back again? 3% won't. What about 30%? The attacker is the biggest verifier of PoS in seconds!

This is not sensational, and the results are really hard to say.

Assuming the value position of “driving open finance with ETH” is disillusioned, it is entirely conceivable that the value accumulated under this disguise will also disappear. Ethereum advocates claim that smart contracts that are native to the protocol can be copied and rebuilt by third parties. This is all right, but the author's point is: new story-> new bubble-> provoked supervision / hacked / unable to achieve promises-> bankruptcy investors have the patience to swallow-> no one to accumulate value accumulation propositions … How many rounds will the cycle take before ETH can really develop a currency premium.

Turtle Rabbit Race

To sum up, Ethereum suffers from the following (combined):

- Relatively centralized governance model, imperfect monetary policy and no signs of improvement

- The latest EIP-1559 experiment seems to go against the needs of all users, only those who are now holding ETH. EIP-1559 will make ETH an unfair system, making the transaction on the chain more costly

- Compared with Bitcoin, the attack surface is an order of magnitude larger because of the complexity of the protocol itself, Turing completeness, developer backdoors, and a centralized oracle.

- The project's vision, direction, and experimental features have been changing; now it is looking for ways to approach the "sound currency" narrative of Bitcoin.

- ETH relies too much on (possibly shut down) third-party applications to accumulate value. But because there is no upper limit on supply and monetary policy is erratic, they have to rely on them.

- A single or all pool of ETH funds (including DeFi applications) may become a malicious PoS verifier, or may be hacked and become a malicious verifier

- The end result of the secondary system syndrome: the desire to completely rebuild the underlying blockchain. But integrating one chain into another is a bottomless pit, and it takes years to complete.

The author finally wants to say that Ethereum cannot obtain and maintain a satisfactory currency premium for a simple reason.

Because investors are not sure exactly what they are buying. Systematic, uneliminated risks are part of this social contract, and there is no tangible evidence that things will change.

An alert investor, aware of the scale, history, and depth of the uncertainty, is unwilling to take out real money to support ETH, which is beyond reproach.

In my opinion, the initial vision of World Computer is the story that is best suited for this project, and this is an achievable goal, as long as everyone does not change towards Qin Muchu. The problem is that compared to Bitcoin's "world currency", the market that "world computer" can satisfy is smaller, so the story slowly turned to "ETH is Money".

The thing I want readers to think about is how far Bitcoin has gone on the road to electronic, sound, and unchangeable currency, and how much ethereum has done is useless. It is generally not understood how effective the role of Lightning Network, sidechains, and any number of high-level solutions is in strengthening Bitcoin as a global reserve asset.

The author expects that if Bitcoin can gain the status of a global currency, most users will not make transactions on the chain, because the handling fee will be expensive. Ordinary users will only use the layered high-level technology stack completely, and the ultimate settlement function will become the primary function of the base layer.

Intuitively, it is feasible to develop an extremely secure and unchangeable foundation layer that only deals with the settlement of transactions. More complex, less secure, and less consensus-required layers should fit into layers above the underlying technology stack.

In fact, Ethereum 2.0 also wants to achieve this goal, only providing transaction determinism and settlement functions, without loading data. The 2.0 shard is also simply a solution to duplicate the second, third, and even higher layers of Bitcoin. However, liquidity, reputation, and security premiums are all bitcoin-dominated and will continue to dominate.

Author Checkmate is a full-time engineer and amateur on-chain activity analyst for Bitcoin and Decred.

(Finish)

Vitalik's response on Reddit

I really heard this view at both ends for three days: It is really very important to have a ceiling of 21 million, and Ethereum should also accept this model, otherwise don't want to become a value storage tool. However, when I asked people in the Ethereum community how important this really was (the most public one was at the "controversial issues" roundtable at Sydney's EDCON 2019), the response was generally, "Um, it's not that important."

Ethereum's supporters seem to be largely pragmatists, and don't think it's important to make their public statements tough. When the crisis rolled out , I found (I was surprised) that the ideology of Bitcoin theology now feels that the chain reorganization that lasts for several days is not a violation of "immutability".

And there is also a good reason, let us not have to make a public commitment to never withdraw from the fixed issuance model, you listen. Obviously, there is an inevitable trade-off between the level of stable issuance and the level of secure issuance. You have to pay the miners to protect the blockchain (the validator in PoS). The security is roughly proportional to the number of miners you attract, and how much you pay them. The payment to the miner / verifier is equal to the additional volume and transaction fees. Therefore, if the issuance rate drops to zero, then the security depends only on the transaction fee, which is a very unstable fund. So, if you want security, you have to admit that if transaction fees are low for a period of time, security will be a problem.

Ethereum's stability is not worse than Bitcoin. On the contrary, Ethereum chose stable security instead of stable issuance rate. Considering that the 0.5% increase and decrease of the issuance rate has such a small impact on everyone's wealth, obviously Ethereum's choice is the right one.

(Translator's note: Vitalik has many more responses, including that the combustion mechanism is not unfair and does not affect the stability of monetary policy; the narrative of general technology will increase without transferring; Ethereum 2.0 does not Like Bitcoin layered system; etc.)

Original link: https://bankless.substack.com/p/why-eth-wont-sustain-a-monetary-premium Author: Checkmate translation & proofreading: A sword & Zeng Mi

This article was translated and republished by the original author with permission from EthFans.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory 201 DeFi systems on Ethereum

- Analysis | Forecasting Bitcoin mining cost price after halving with hashrate trend

- January data shows: cryptocurrency derivatives market still dominated by "unregulated participants"

- After the epidemic is overcome, it may have a profound impact on the development of the blockchain.

- Stoppages, losses, suffering … Having not halved, but the mine disaster is coming?

- MakerDAO-backed PoolTogether raises $ 1.05 million, with ConsenSys participating

- QKL123 Blockchain List | The market value of the project rebounded sharply, and the trading platform was significantly active (2020.01)