Opinion: Why is the DEX of the coin security decentralized?

According to the currency announcement, Binance Chain has been opened today (April 23).

“In the early stage, the currency security club selected nodes from familiar partners.” According to Zhao Changpeng, the founder of the currency, the coin chain will set 11 super nodes.

However, these nodes are all in the hands of the currency security system. The so-called "decentralization" is like a piece of paper. Based on the decentralized exchange Binance DEX launched by the currency chain, it is just wishful thinking and self-deception.

In the field of blockchain, the exchange is the "land of the military." At present, several large exchanges on the market are all centralized, and users have become an industry consensus on their spit.

- Bitcoin 2015-2019 trend comparison, the same as the attack on the annual line, what is the difference?

- Research | Hong Kong is aligning STO compliance

- Blockchain + VR: Consciousness moves through the virtual world, blockchain will prove identity for you

Ever since, the Decentralized Exchange (DEX) has been the story of the “challengers” that have been repeated over the years; of course, the story is a story, and a large number of DEXs have died.

The coin has taken over the storytelling, and the sound is louder and the plot is more beautiful.

It’s just that the good story is no match for the cruelty of reality. The coin-safe DEX has not escaped the law of “pseudo-decentralization”.

This article will peel off the story of the story, restore the truth of a coin and DEX.

"Coin-safe DEX is really not easy to use"

Previously, Zhao Changpeng, the founder of the currency, was not optimistic about DEX. He wrote in the article "Centralization and Decentralization": "The market has already voted with the foot, the centralized exchange is more popular, its trading volume and flow. Sex is much higher than the decentralized exchange."

However, on January 22, 2019, at the Canadian Dollar Summit held in Singapore, the company announced plans for Binance Chain and Binance DEX. A month later, the coin chain and the coin DEX went online to the test network. According to the announcement, the coin security DEX will run on the currency chain.

Many people have lost their expectations after experiencing the currency of DEX. "Registration is quite troublesome. My previous account can't be used anymore. I have to apply again." Zheng Wen, a cryptocurrency trader, said.

Since the coin security DEX is built on the coin chain, the user needs to create a wallet account based on the coin chain before the transaction. This also means that other wallet accounts that users currently have (such as ETH, EOS wallets, etc.) cannot be used, which is very different from traditional decentralized transactions. For example, IDEX, the largest decentralized exchange on Ethereum, can directly import a private key or a hardware wallet for authorized connection without registration.

In addition, during the use of the coin DEX, if there is no operation for a while, the system will lock the wallet. Users need to re-upload the keystore file and enter a password to unlock it, which may cause them to miss the best market. And for mobile devices such as mobile phones, uploading keystore files and entering passwords is obviously more cumbersome than computers. But mobile devices are an indispensable trading terminal. In the user feedback collected by the coin DEX, some people did not adapt the phone to the spit page.

In the course of the transaction, the coin-based DEX currently only supports “limit orders” and does not include “market orders”, which is also inconsistent with the general operating habits.

At the depth of the transaction, more than 50% of the tokens in the coin DEX have no transactions within 24 hours, which means that if the user orders the order, it will not be sold.

“Even if Zhao Changpeng said that the TPS of the coin-based DEX can reach thousands of pens, the depth is the key to the transaction.” Zhu Yun, head of a quantitative fund, explained that “the general problem of decentralized exchanges is insufficient depth, even though the coin-safe DEX has The currency is endorsed, but at present it is not very effective, and the depth is not enough."

In addition to the depth, the currency pair DEX is currently on the line with a big deal. There are very few currencies in the BTC, ETH, and USDT trading areas, and there are more than 50 currencies in the BNB trading area, which means that Binance DEX mainly pushes the BNB trading area. For users, in order to trade other currencies, they must redeem BNB to trade, which is quite troublesome.

In terms of handling fees, the previous decentralized exchanges will charge a 0.1% handling fee to the payer and a 0.2% handling fee to the eater in order to promote liquidity and depth. As for the cost of the transaction, the Gas fee is charged. It is charged according to the network congestion situation. The coin DEX indicates that the same fee is charged as the fuel fee (GAS), but the fee is settled by BNB. The specific charging mechanism and ratio have not yet been announced.

“Coin-Dex is basically a copy of BitShares.” Investor Chen Yuange believes that the coin-based DEX is based on the development of the currency-based public chain, and the model is similar to that of BitShares, and it is not innovative in technology.

BitShares was developed by the founder BM (and later the founder of EOS) in 2014. The combination of orders was not made by smart contracts, but by verification nodes. Later, BM introduced smart contracts in EOS. BitShares is still very low in transaction volume due to the extremely poor user experience.

“Taking the “chain-on-chain + chain-settlement” model, compared with centralized exchanges, the transaction rate is slow and the transaction costs are high, which is its biggest shortcoming. “Chen Yuange believes that the coin-based DEX technology has lagged behind the entire blockchain industry. .

He said: "The actual meaning of the coin security DEX is not large, more is the gimmick."

Coin security DEX is easy to leak private key

For decentralized exchanges, security and ease of use are often not compatible.

“Let us try our best to make wealth more free, and at the same time strive to improve its ease of use and safety.” Although Zhao Changpeng previously said that the currency security DEX will balance security and ease of use.

But at present, in addition to the ease of use is not done well, the bigger problem facing the currency security DEX is that there are hidden dangers in security.

The first risk in security is that the user's private key is easily leaked.

"If the user uses a hardware wallet to link with the currency security link, you will find that your private key has never left your device." Zhao Changpeng said in the February 7th Twitter question and answer that the user's private key is kept by the user. "And we have a lot of other ways to prove that even with other devices or clients, your private key won't leave your device, you will be the only one who owns your private key."

However, the user can keep the private key, does not mean that the private key will not be revealed, and this disclosure is not the user's own responsibility.

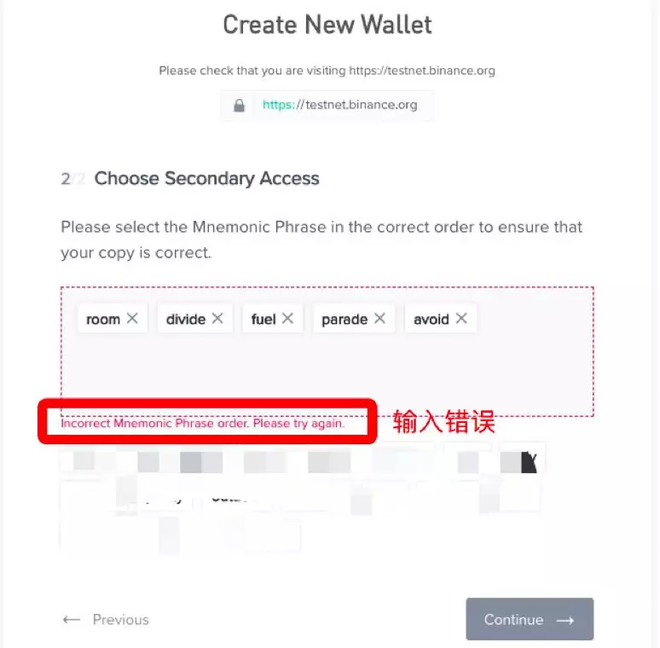

Currently, when a user registers an account, a mnemonic appears to help the user retrieve the private key. However, it is precisely the mnemonic that has a fatal problem.

When a mnemonic is entered, once a mnemonic is entered incorrectly, the system will automatically prompt “Enter Error” (not all mnemonics will be displayed when the mnemonic is submitted). At this point, you can try to change the mnemonic one by one. Until it is correct. And there is no limit to the number of "errors", which means that the attacker can try multiple times to find the private key through the mnemonic.

Binance DEX screenshot

In addition, when re-registering the coin DEX, you must upload the keystore file through the browser to unlock the wallet. This behavior poses a great security risk, and it is easy to be hacked by the phishing website to steal the user account.

TechCrunch, a tech blogger, has written that uploading private key files with a browser is dangerous and vulnerable to cyber attacks. Hardware cold wallets like the Metamask browser plug-in, Ledger, and Trezor are more secure.

However, at present, Binance DEX does not support plugins such as Metamask.

“Coin-safe DEX assets are not safe”

The second risk in security is that user assets may be stolen.

If the private key can also be guaranteed by technical means, but for the most core user assets, the coin security DEX has left a great security risk from the beginning.

Image from chain tower think tank

The first potential factor of asset insecurity is the over-centralization of the currency chain. “The 11 nodes of the coin-based DEX are all in the hands of the coin security.” EOS developer Chen Lei said, “The coin DEX wants to emulate the EOS node campaign, but it has not yet acted, and 11 nodes are also picking themselves out. of."

In the February 7th Q&A, Zhao Changpeng said that the coin chain will have 11 test nodes and refer to the EOS node selection. “In the early days, the currency security club selected nodes from familiar partners, but more nodes will be opened later.”

As for how to choose the details, Zhao Changpeng did not disclose. Since the previous period relied entirely on the currency to choose the node, it is entirely based on credit and brand endorsement. In fact, for the user, there is no absolute guarantee.

"According to the currency security, the reason why the coin security DEX is built on the currency chain is because the ETH and EOS processing speed is relatively slow. But if the number of nodes is reduced, the transparency is sacrificed in exchange for the so-called high TPS, does it really make sense? "For the 11 nodes of the currency security, Chen Lei said that he could not accept and understand.

According to the plan of the currency security, the currency chain will become a public chain in the future, and it can carry out currency and development projects. "To be a public chain, the currency chain must not belong to the currency family first, otherwise it is a private chain." Chen Lei said, "For the user, 11 nodes are 'own people', what do users believe? Is your own assets safe?"

On this issue, Zhao Changpeng also said that the currency has an absolute influence on the choice of the entire network and nodes. His explanation is that at this stage it is still necessary to proceed in a more centralized form, and it is important to maintain a large influence in the early stage.

"Users in the currency of DEX's assets are only shadow assets."

In addition to node centralization, the second problem facing user assets is that there is no smart contract in the currency security chain, and the user assets are actually stored in the currency security account.

“Coin-Dex does not support atomic-level cross-chain functions. The assets that users trade, such as Bitcoin and Ethereum, are actually a mapped shadow asset.” Chen Yuange explained that in fact, the assets are still managed by the currency security, users. I just got the chips that the coins were issued.

In this case, the user can indeed master his or her private key, but the user keeps only some of the chips that the coin is sent to the user. The real assets such as BTC and ETH are still kept by the gateway node of the currency security.

In a perfect decentralized exchange, the funds should be in the user's wallet address or in the trading smart contract, and the user has control over their funds. When the user initiates the transaction, all the processes are carried out on the chain, and the funds do not flow into the exchange, but are delivered directly to the transaction terminal from point to point, and all process chains can be checked and made transparent.

At present, there are still big problems in the security of the currency, which will undoubtedly hurt the immediate interests of the users.

“Do you believe in the currency that is outside the supervision?”

"We are currently applying for a license from South Korea and Japan, and the Korean license is certain to be available." Zhang Zhe, CEO of an exchange, said that they applied for a license because they can only be more promising if they accept supervision.

According to CryptoCompare data, the futures exchange BitMex has a 41% decline in trading volume in January this year, while the regulated Chicago Mercantile Exchange (CME) trading volume has grown against the trend.

From the current global trend, regulation has become the main trend, and only the cryptocurrency exchanges that are regulated can survive and eventually occupy the market.

“The biggest risk point of decentralized exchanges is that they cannot be regulated. If the blockchain wants to enter a wider group, it will inevitably move from the extraterrestrial to the compliance.” Chen Yuange believes that blockchain compliance is not far away. The countries represented by Japan, the United States and South Korea have successively introduced relevant blockchain laws and regulations. At this time, the company launched a decentralized exchange, indicating that it has become farther away from the mainstream group. “How does the currency safety non-compliance path go? Can you go on? This is the biggest test for the future of the currency security.”

“Coin’s only obtained licenses from several small countries including Malta. Is he only active in these small places?” Zhang Zhe said.

Previously, the currency was once criticized by the New York State regulator. According to Bitcoin Bagazine, on September 18, 2018, the Office of the Attorney General of the State of New York issued a survey report on the Virtual Market Integrity Initiative, which criticized several exchanges, including the currency, saying they lacked Appropriate investor protection measures can easily become a tool for large households to manipulate the market. In the investigation and investigation stage, the currency refused to cooperate in the absence of the New York State exhibition industry.

"The reason why Google and Apple have removed the APP at the same time may be related to the investigation in New York State." Chen Yuange believes that "once the New York State criminal investigation, Zhao Changpeng's personal freedom will not be affected. What will the users do in the currency security? "

end

In short, the decentralized coin security DEX and the coin chain are actually a centralized product. The security and ease of use do not seem to have both: security, there is a private key leak. Potential hidden dangers such as theft of assets; ease of use, the registration process is cumbersome, and the transaction depth is not enough.

As the market gradually enters a bear market, the reduction in trading volume of major exchanges has become an indisputable fact, and income has naturally decreased. According to the announcement of the official website of Bin'an, in the past year, Binance completed a total of seven BNB quarterly destructions, but the destruction of the last four times is gradually decreasing:

The fourth destruction of 2,528,767 BNB;

The fifth destruction of 1,643,986 BNB;

The sixth destruction of 1,623,818 BNB;

The seventh destruction of 829,888 BNB.

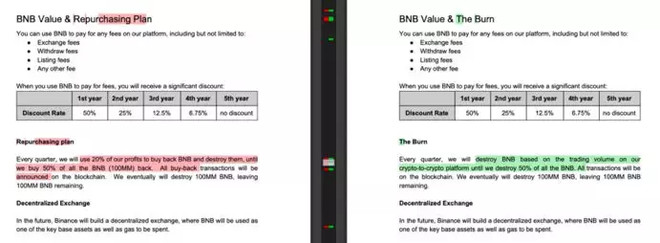

It is worth noting that Coin's recently deleted the terms of the BNB repurchase in the white paper. As shown in the figure below, the currency security white paper was revised to remove the terms of the company's repurchase of BNB with a 20% profit.

Zhao Changpeng said that this was done to clarify that the currency security did not actually repurchase the BNB, but was destroyed. “The use of the word 'repurchase' is not accurate. The income of the currency is originally BNB. If you sell BNB to USDT and then buy back BNB with USDT, it seems that this operation is superfluous. The word was used in the white paper stage because I didn't think clearly. Some local regulators didn't like BNB and profit hooks. We listened to the opinions of relevant departments and removed this part of the description."

Figure: The left version shows the original description (red part) when it was first released in 2017, and the new version is shown on the right.

But it's interesting to update the white paper itself without proper procedures. According to sources, the move may be related to the use of compliance issues related to the securities industry.

Lawyer Stephen Palley said that if the regulator is the reason behind the currency security decision, then the editor (white paper) may not be enough to avoid further problems. “Modifying the wording of the white paper does not necessarily affect the regulator’s analysis of whether something is a security.”

"Why do you want to use your own public chain, use BNB as fuel, and put so many coins in the BNB trading area. The fundamental purpose is to raise the price of the currency." Zhu Yun explained that the money security is to let users hoard. As well as the consumption of BNB, "such a currency security does not require regular repurchase to destroy BNB. After all, the currency security DEX and the currency chain can help them increase the BNB price."

With the release of the currency chain and the currency DEX, the currency platform BNB has soared. According to the data of the official website of the official website, BNB has increased by more than 270% since February 1, and hit a record high of 25.49 US dollars on April 20.

But the bear market is far from over, the exchange income has shrunk dramatically, and how long does the BNB price yank last? Does this have advantages and disadvantages for the entire market?

The story continues to be told, and there are very few people who poke it.

(The interviewed characters in the article are pseudonyms)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Soaring! Looking at the changes in the market value of cryptocurrency in 2013-2019 from the video

- Inflation rate soared to the highest in four years, Brazilian bitcoin trading volume continues to rise

- Exchange + OTC, Venezuelans start buying and selling coins

- How to understand the economic incentives of Ethereum 2.0?

- Using nuclear power to dig bitcoin, Belarus may be the first

- Korean or Korean? Bittrex Dreams New York

- Babbitt column | Cai Weide: The rise of the blockchain industry, this time is true, but is there any regulatory preparation?