Opinion: Why is the price of Bitcoin not important?

Translator's Note: The author of the article puts forward an interesting point of view, which rejects the traditional idea of treating bitcoin as “simple currency” and compares the current bitcoin with the initial e-mail. The author believes that the current exchange business model The essential problem of Bitcoin is not solved correctly. They are using models of 20th century stocks, commodities and currency exchanges and stacking them on Bitcoin.

“Actually, in essence, Bitcoin is an agreement and not a currency. ”

The author's idea may not be rigorous, but it is only at the stage of envisioning. However, this interesting point of view has undoubtedly found a breakthrough for Bitcoin to get rid of “simple money”. Also as a form of payment, how bitcoin can get rid of "speculative" attracting investors, how to move from alternative currency to surpassing currency, this new idea provides people with an imaginative space for the future development of Bitcoin.

——

- ConsenSys latest report: 2019 Stabilization currency status

- Bitcoin Mining In-depth Survey: Chinese mining machine dealers dominate, mining in the first half of the year is called profiteering

- Video | Babbitt "8 Questions" 2 minutes mixed, 40 industry big brothers together with the box, inciting people!

Bitcoin is a very new technology, although the concept it brings has been around for a decade. It solves the double expense problem, which means that you can use digital credentials instead of currency and make sure that no one can use it unless you hold it. This is an unprecedented paradigm shift, the meaning of which has not yet been fully understood, and the tools to make the most of this new idea are not yet available.

This new technology requires some new thinking to develop the business built on it. Just as e-mail pioneers haven't correctly understood the services they sell over the years, bitcoin needs and new thinking will emerge to make the most of its potential and become ubiquitous.

Original Hotmail interface (Hotmail is one of the Internet free email providers)

Hotmail uses familiar technology (browser, email) to create better ways to access and send email. However, the idea of using an email client like Outlook Express has been replaced by a web interface and "cloud" email, which offers many advantages over dedicated clients that store mail in local storage.

Bitcoin, which will change the way you transfer money, it needs to be understood as its own terminology, not just an online currency form. Bitcoin is considered a currency, just as ridiculous as e-mail is another form of mailing . One not only replaces the other, but also profoundly changes the way people send and consume information. It is not a simple replacement or one-dimensional improvement of existing ideas or services.

As I explained before, bitcoin is not money. Bitcoin is a protocol. If you treat it this way, with the right assumptions, you can start putting Bitcoin in a suitable context and let you make reasonable suggestions about the potential profitable services based on Bitcoin.

Every part of Bitcoin is text. It is always text and is text at all times. This is a fact, and as a text, it is protected by the freedom of speech provisions of the Constitution of the Civilized State, which guarantee irrevocable rights.

If Bitcoin is a deal, not a currency, then establishing a currency exchange that mimics real-world currency, stocks, and commodity exchanges is not the only way to find its price. You won't discover the value of an email service by establishing an email exchange, and the same applies to Bitcoin.

According to this idea, when you enter an email on your Gmail account, you are entering your "letter". You press the send button, it goes through your ISP, through the internet, into your recipient's ISP and it is output to your recipient's machine.

The same is true for Bitcoin, where you enter money on one end and then send the bitcoin to your recipients without the need for an intermediary to process the transfer. Once Bitcoin has completed the task of transferring your value globally to its recipients, it needs to be “read out”, that is, become a currency, just like your letter is shown to it in an email. The same as the recipient.

In an email scenario, once a transfer occurs and the email you receive passes it to you, it has no use other than as a record (accounting) of the sent information, and you archive the information . Bitcoin does these accounting work for you on the blockchain. The good service built on top of it will store the extended transaction details for you locally, but as a recipient of bitcoin, you need a service or commodity, and Not bitcoin itself.

The true essence of Bitcoin is as an instant payment method (although not money) anywhere in the world. This is not an investment. It doesn't make sense to hold it and hope it will become valuable, just like holding an email or PDF file and hoping it will become valuable.

Of course, you can hold Bitcoin and watch its value rise, and its value will rise now, but with the transition to the all-bitcoin economy, you need to have the courage to withstand the volatility of buying and selling. Also keep in mind that if their models are open and exposed to the market, companies that need to store Bitcoin need to pay attention to their value. The "closed-loop bitcoin" model can control everything without worrying about the price of the exchange. They can use a few bitcoins to move all the business of the French currency indefinitely.

Although you can't double them, and each one is unique, Bitcoin doesn't have the intrinsic value of books or anything. They can't appreciate the value. The "wrong" idea about Bitcoin has spread because it behaves like money because it can't be reused. The misunderstanding of the true nature of Bitcoin masks the dual nature of bitcoin digitization and non-double consumption.

They start with candy and eventually become chewing gum. What are they before you chew them? Candy or chewing gum?

Bitcoin is digital and has all the qualities of information, making information no longer scarce. It is situated in a new place, swaying between the goods of the material world and the world of infinitely rich digital information , and belongs only to the digital world, but has the characteristics of both. That's why it is widely "misunderstood" and why a new approach is needed to design a business around it.

All of this explains to some extent why the price of bitcoin purchased on an exchange is not important to consumers.

If the cost of buying a bitcoin drops to 1 cent, this does not change the amount at the other end of the transfer. As long as you convert Bitcoin into goods or currency immediately, no matter how much you pay at the beginning of the transaction, the other end of Bitcoin will show the same value.

Think like this. Let us assume that you want to send a long text file to another person. You can send it as is, or compress it with zip. The compressed document file can be 87% smaller than the original file. When we convert this idea into bitcoin, the compression ratio is the price of Bitcoin on the exchange. If a bitcoin is $100 and you want to buy something from an Indian at $100, you need to buy 1 bitcoin to send $100 to India. If the price of Bitcoin is 1 cent, then you need 10,000 bitcoins to remit 100 dollars to India. They are expressed as compression ratios of 1:1 and 10000:1, respectively.

The same $100 value is sent to India, whether you use 10,000 or 1 bitcoin. The price of Bitcoin has nothing to do with the value being transmitted, just as the zip file doesn't care what it is. Bitcoin and zip are a powerful stupid protocol. As long as the value of Bitcoin is not zero, it will have the same utility, as if the value is very "high."

With all of this in mind, it's clear that new services are needed to facilitate the fast, frictionless conversion of Bitcoin to operate in a way that is essential to its nature.

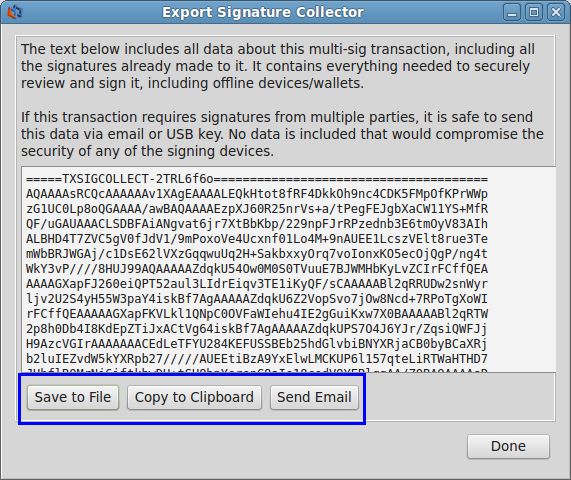

The current exchange business model does not correctly address the nature of Bitcoin. They are using models of 20th century stocks, commodities and currency exchanges and stacking them on Bitcoin. Interacting with these exchanges is not straightforward, and for the average user, this is a daunting prospect. In some cases, you must wait 7 days before receiving a transfer of legal tender from the Bitcoin account. Although this is not the fault of the exchange, it poses a very real obstacle to the nature of Bitcoin and its full value.

Imagine: You will receive an email from all over the world and notify you of this fact by displaying the subject line in your browser. Then, you apply to the ISP to send this email to you, you must wait 7 days until it reaches your physical mailbox.

The idea itself is completely ridiculous, however, this is exactly what Bitcoin is doing, for no technical reasons.

Obviously, we need to rethink the services that have developed around Bitcoin and what the true nature of Bitcoin is. Rethinking service is a normal part of entrepreneurship . We should expect that with continuous iterations and constant changes, business models will fail and early entrants will be abandoned.

With all this in mind, it is irrational to use a business model that is not suitable for this new software to pay attention to the price of Bitcoin on the exchange; it is like putting a can of methane that can breathe in an oxygen-filled mine. Let humans breathe oxygen as a detector. Even if there is no problem with the air, the birds will die; the miners will rush away and leave the exposed gold deposits, thinking that they will all be destroyed, but in fact everything is fine.

Day traders who speculate on Bitcoin at home can cause bitcoin price fluctuations. This is an artificial signal that has nothing to do with the demand for Bitcoin and is not related to the circulation of Bitcoin as an economic tool to promote business.

Bitcoin, and the ideas behind it, will always exist. Like Hotmail, as the number of downloading and using clients increases, it will eventually reach a critical mass and then spread exponentially on the Internet. When this happens, the right business model will naturally appear, just as they will become obvious, just like Hotmail, Gmail, Facebook, mobile phones and instant messaging seem to be second nature.

In the future, I think few people will speculate on the value of Bitcoin, because even if it is possible or even profitable, providing easy-to-use bitcoin services and taking advantage of Bitcoin will make More money.

One thing is certain, speed will be at the heart of any future Bitcoin business model. Startups that provide instant gratification on both sides of the transaction will be successful. Even if the fluctuations in bitcoin prices will certainly stabilize, but because Bitcoin itself has no use, any company based on Bitcoin will urgently need to recover funds or goods immediately.

The needs of the Bitcoin business pose many challenges in terms of performance, security and new thinking. These challenges will bring new practices and software.

Finally, when there is no legal currency, the chaotic transition zone between French and Bitcoin is abolished, then everything will be denominated in bitcoin, without any fluctuations, because no one uses anything other than Bitcoin to buy or sell.

It's like a reagent that reaches equilibrium, you can shake it, stir it, the reaction is over, and the rest is inert. Bitcoin can now expand and contract rapidly over a wide range, compared to the world's legal currency, because it is small. It can expand to a high price that is unimaginable for many people and then shrink again. As it gets bigger and accumulates more quality (in French dollars), these fluctuations will become smaller and smaller. After all this, Bitcoin is still exactly the same, and its users will release the number as a signal to react.

Author: Beautyon

Compile: Sharing Finance Neo

Source: Sharing Finance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin breaks through 10,000, and the bull market really depends on halving support?

- R3 enters into strategic partnership with Dubai Financial Technology to build the next generation financial architecture for Islamic capital markets

- Blockchain security | APT attacks against a blockchain digital cryptocurrency trading platform

- The multiple contradictions are concentrated and the reasons for the low XRP currency price are down?

- 78% of the cottage currency hit a three-month low, is it worth investing?

- QKL123 market analysis | Bitcoin rapid downturn, the altcoin transaction against the new low (0829)

- Institutions sought after, Angel Wheel financing 20 million, what is the advantage of NewStar (net red chain) that changes the underlying accounting logic of the online red industry?