Opinion: Will the traditional currency circle “sit and wait” before the regular army arrives?

Summary

VanEck Securities and SolidX Management provide Bitcoin ETF services to institutional clients. According to the Wall Street Journal, although the US Securities and Exchange Commission (SEC) has not formally approved the proposed Bitcoin exchange-traded fund (bitcoin ETF), VanEck Securities and SolidX Management intend to opt for an unusual route this week. Regulatory, they will use SEC exemptions to provide Bitcoin ETF services to institutional clients such as hedge funds and banks, without opening up to retail investors. It is reported that such products allow private securities to be traded between "qualified institutional buyers" for a short period of time and do not need to be registered with the US Securities and Exchange Commission. The bitcoin trust VanEck SolidX Bitcoin Trust, which sells two companies to hedge funds and other institutions, will be traded on the SEC-regulated alternative trading system OTC Link ATS. According to a report on the Chinese version of the China Daily on September 4, central bank officials revealed that the central bank's digital currency has begun a “closed-loop test” that will simulate certain payment plans and involve some commercial and non-government agencies.

On the other hand, the traditional currency circle, since the last round of the Ethereum and ICO brought the bull market, but entered a quiet period, good and good. Ethereum will be ushered in the activation of the Itanbu upgrade test network on October 2nd. Whether the Ethereum upgrade can return to its former glory, the industry's confidence is not sufficient. The latest statistics released by ICO research firm Inwara show that the ICO alternative – securities-based token issuance (STO) has almost disappeared. The data shows that the total amount of industry financing in August was $207 million, and STO only accounted for 0.28% of the total, ie 579,600. In the US dollar, the largest source of financing is still venture capital, accounting for 51.73% of the financing amount. No matter whether it is the underlying public chain or the opening of financing channels, the currency circle has not found a clear direction.

As traditional financial institutions continue to enter the cryptocurrency industry, the Chinese central bank's digital currency, Facebook's Libra's accelerated launch, seems to leave little time for the traditional currency. As a rising grassroots group, the currency circle will not sit still before the arrival of the regular army, embrace supervision, compete for the market, or the only way for the currency circle.

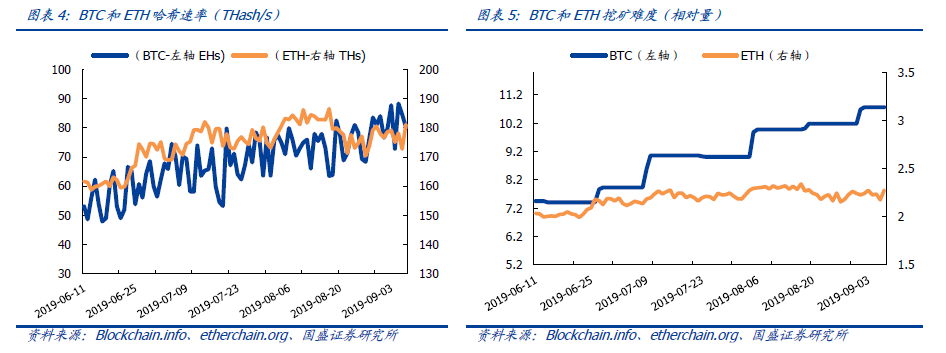

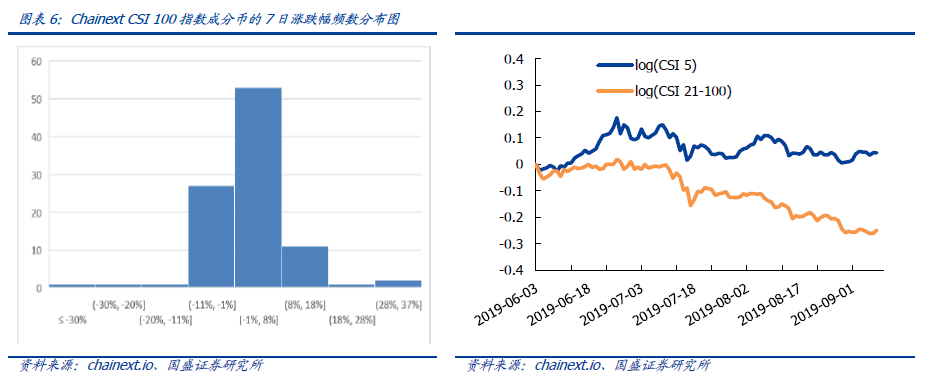

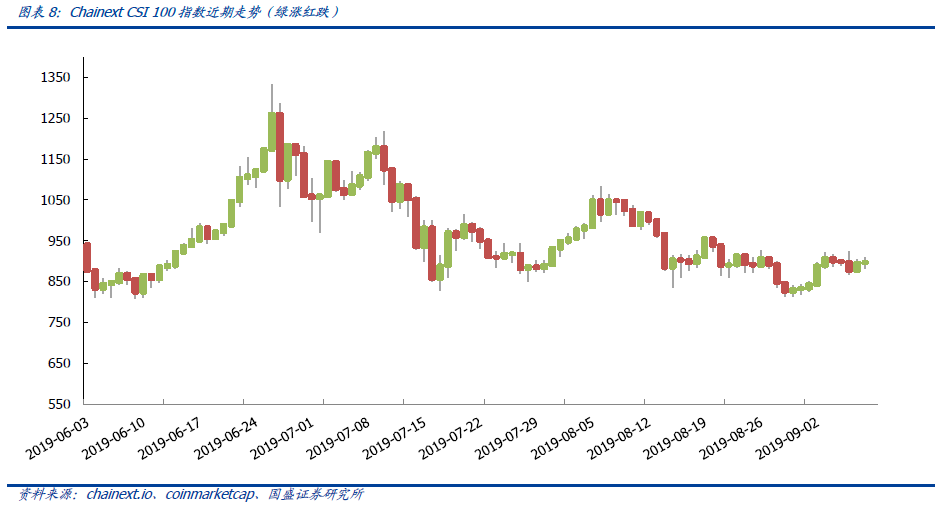

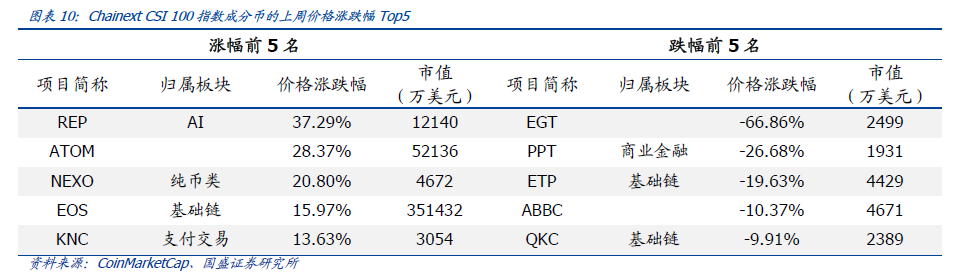

Last week's market review: Chainext CSI 100 rose 6.4%, and the AI class in the subdivision sector performed best. From the perspective of subdivision, pure currency and AI performed better than Chainext CSI 100 average, 7.35%, 27.63%, payment transaction, Internet of Things & traceability, entertainment social, commercial finance, basic enhancement, basic chain, storage & Computational sector performance was inferior to Chainext CSI 100 average, 3.13%, -3.65%, 1.42%, 3.26%, 6.24%, 1.00%.

- You have to look at the status of PoS: hot back, Staking is still worth looking forward to?

- Babbitt column | "Does one chain alone" feasible?

- Tongcheng Holdings plans to change its name to Firecoin Technology, and its share price has risen by more than 18%.

Risk warning: regulatory policy uncertainty, project technology progress and application landings are not as expected, and cryptocurrency-related risk events occur.

1. Hotspot tracking: Will the traditional currency circle “sit and wait” before the regular army comes?

VanEck Securities and SolidX Management provide Bitcoin ETF services to institutional clients. According to the Wall Street Journal, although the US Securities and Exchange Commission (SEC) has not formally approved the proposed Bitcoin exchange-traded fund (bitcoin ETF), VanEck Securities and SolidX Management intend to opt for an unusual route this week. Regulatory, they will use SEC exemptions to provide Bitcoin ETF services to institutional clients such as hedge funds and banks, without opening up to retail investors. It is reported that such products allow private securities to be traded between "qualified institutional buyers" for a short period of time and do not need to be registered with the US Securities and Exchange Commission. The bitcoin trust VanEck SolidX Bitcoin Trust, which sells two companies to hedge funds and other institutions, will be traded on the SEC-regulated alternative trading system OTC Link ATS. The above-mentioned trusts that VanEck and SolidX applied for in June last year were the most likely to be approved by the outside world. The Bitcoin ETF was repeatedly postponed by the SEC and was last postponed until October 18 this year. Therefore, the ETF is not yet available for retail investors. The VanEck and SolidX offerings take advantage of the SEC's exemption Rule 144A, which allows institutions to issue securities exemption requirements for issuance, but can only be sold to “qualified institutional buyers” such as hedge funds, brokers and banks. Even so, according to the statements of the two organizations, VanEck SolidX Bitcoin Trust has become "the first institutional quality clearing product that provides bitcoin exposure and implements standard ETF creation and redemption processes." Ed Lopez, head of ETF products at VanEck, told CoinDesk that VanEck SolidX Bitcoin Trust is not really a ETF, it is not listed on a national exchange, but is traded over-the-counter through broker-deal, its creation and Redemption is similar to ETF.

According to a report on the Chinese version of the China Daily on September 4, central bank officials revealed that the central bank's digital currency has begun a “closed-loop test” that will simulate certain payment plans and involve some commercial and non-government agencies.

On the other hand, the traditional currency circle, since the last round of the Ethereum and ICO brought the bull market, but entered a quiet period, good and good . Ethereum will be ushered in the activation of the Itanbu upgrade test network on October 2nd. Whether the Ethereum upgrade can return to its former glory, the industry's confidence is not sufficient. The latest statistics released by ICO research firm Inwara show that the ICO alternative – securities-based token issuance (STO) has almost disappeared. The data shows that the total amount of industry financing in August was $207 million, and STO only accounted for 0.28% of the total, ie 579,600. In the US dollar, the largest source of financing is still venture capital, accounting for 51.73% of the financing amount. No matter whether it is the underlying public chain or the opening of financing channels, the currency circle has not found a clear direction.

As traditional financial institutions continue to enter the cryptocurrency industry, the Chinese central bank's digital currency, Facebook's Libra's accelerated launch, seems to leave little time for the traditional currency. As a rising grassroots group, the currency circle will not sit still before the arrival of the regular army, embrace supervision, compete for the market, or the only way for the currency circle.

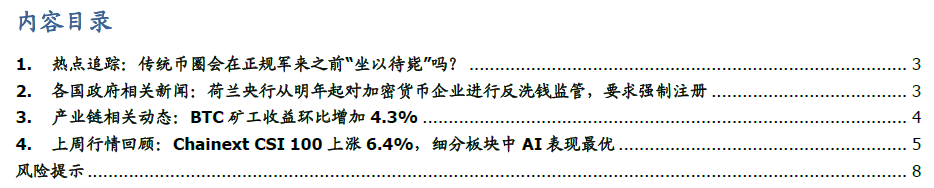

2. Relevant news from various governments: The Dutch central bank will conduct anti-money laundering supervision on cryptocurrency enterprises from next year, requiring mandatory registration

Ministry of Industry and Information Technology: Encourage enterprises, research institutions and other entities to actively participate in key technology research and verification of blockchain. Recently, the Ministry of Industry and Information Technology issued the "Guidelines for the Development of Industrial Big Data (Draft for Comment)", and proposed to promote the application of 5G, NB-IoT and other technologies in industrial scenarios, promote the deployment of IPv6 scale, and upgrade and upgrade the internal and external networks of industrial enterprises. Stimulate the vitality of the industrial big data market.

3. Industry chain related dynamics: BTC miners' revenue increased by 4.3% from the previous month

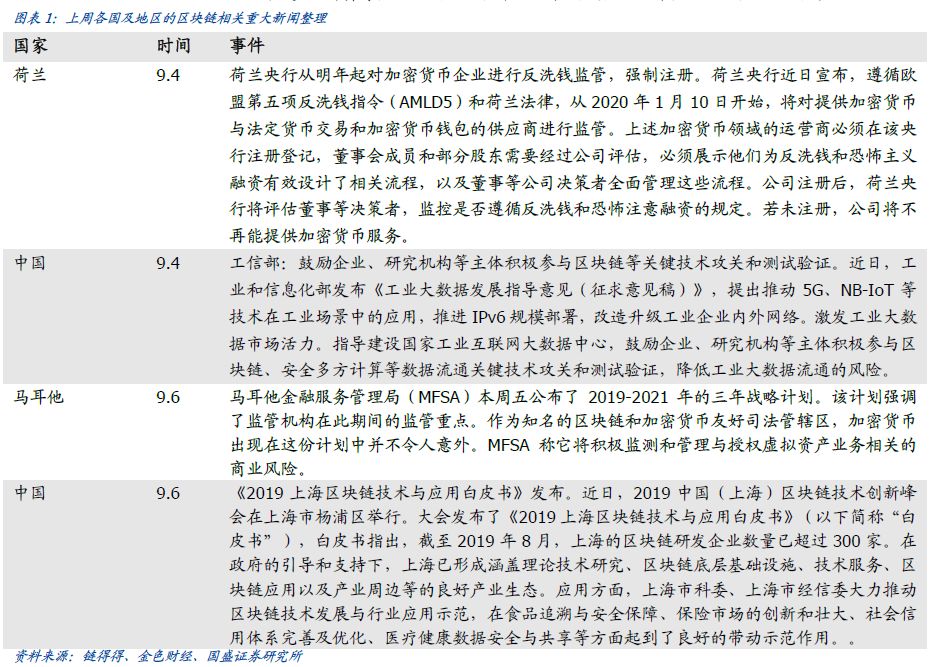

Last week, BTC added 2.34 million new transactions, an increase of 1.2% from the previous month; ETH added 5.13 million new transactions, an increase of 2.3% from the previous month.

Last week, the average daily income of BTC miners was $19.99 million, an increase of 4.3% from the previous month; the average daily income of ETH miners was $2.48 million, a decrease of 1.4% from the previous month.

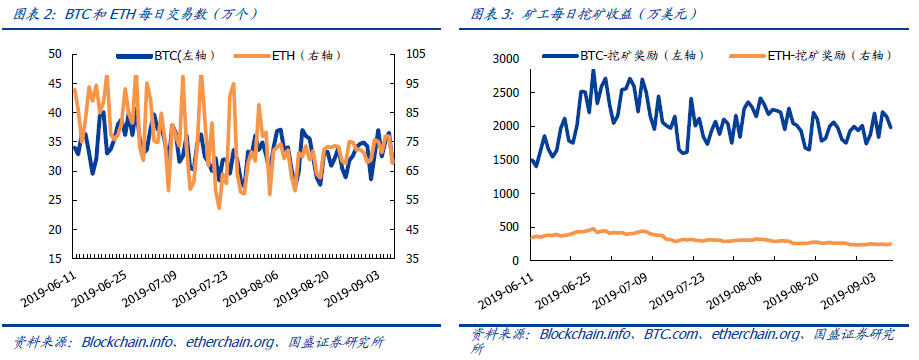

Last week, the average daily computing power of BTC reached 81.5EH/s, an increase of 5.4% from the previous month; the average daily computing power of the ETH network reached 177.4TH/s, an increase of 0.4% from the previous month.

Last week, the difficulty of mining the BTC in the whole network was 10.77T, an increase of 5.7% from the previous month; the next difficulty adjustment date was on September 14, the expected difficulty value was 11.63T, and the difficulty increased by 7.99%; the average mining difficulty of the ETH whole network last week was 2.24T, an increase of 1.2% from the previous month.

4. Last week's market review: Chainext CSI 100 rose 6.4%, and AI performed best in the segment.

From the perspective of subdivision, pure currency and AI performed better than Chainext CSI 100 average, 7.35%, 27.63%, payment transaction, Internet of Things & traceability, entertainment social, commercial finance, basic enhancement, basic chain, storage & Computational sector performance was inferior to Chainext CSI 100 average, 3.13%, -3.65%, 1.42%, 3.26%, 6.24%, 1.00%.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- China's first 5G+ blockchain folk technology open source community and 5G chain network engineering task force will be officially launched

- At the 5G Chain Network Industry Innovation Summit, consider the impact of super-smart rise on 5G, artificial intelligence and blockchain

- When the insurance industry encounters blockchain

- Blockchain Industry Weekly: Total market capitalization fell 2.11% from last week, 70% of the top 100 projects fell to varying degrees

- Mars Finance "POW'ER 2019 Global Developer Conference" was successfully held in Beijing

- After the cross-chain, where is the next vent of the blockchain?

- IDC Report: Blockchain solution spending will reach $15.9 billion by 2023