You have to look at the status of PoS: hot back, Staking is still worth looking forward to?

The core content of this article

· Companies and investors have invested $4.8 billion in the Staking ecosystem.

· Over the past three months, we have seen a 48% drop in the value of assets involved in pledges, mainly because investors’ funds have fled to Bitcoin and the price of the new Staking token has fallen. These new stakings are still at price. Discovery phase.

- Tongcheng Holdings plans to change its name to Firecoin Technology, and its share price has risen by more than 18%.

- China's first 5G+ blockchain folk technology open source community and 5G chain network engineering task force will be officially launched

- At the 5G Chain Network Industry Innovation Summit, consider the impact of super-smart rise on 5G, artificial intelligence and blockchain

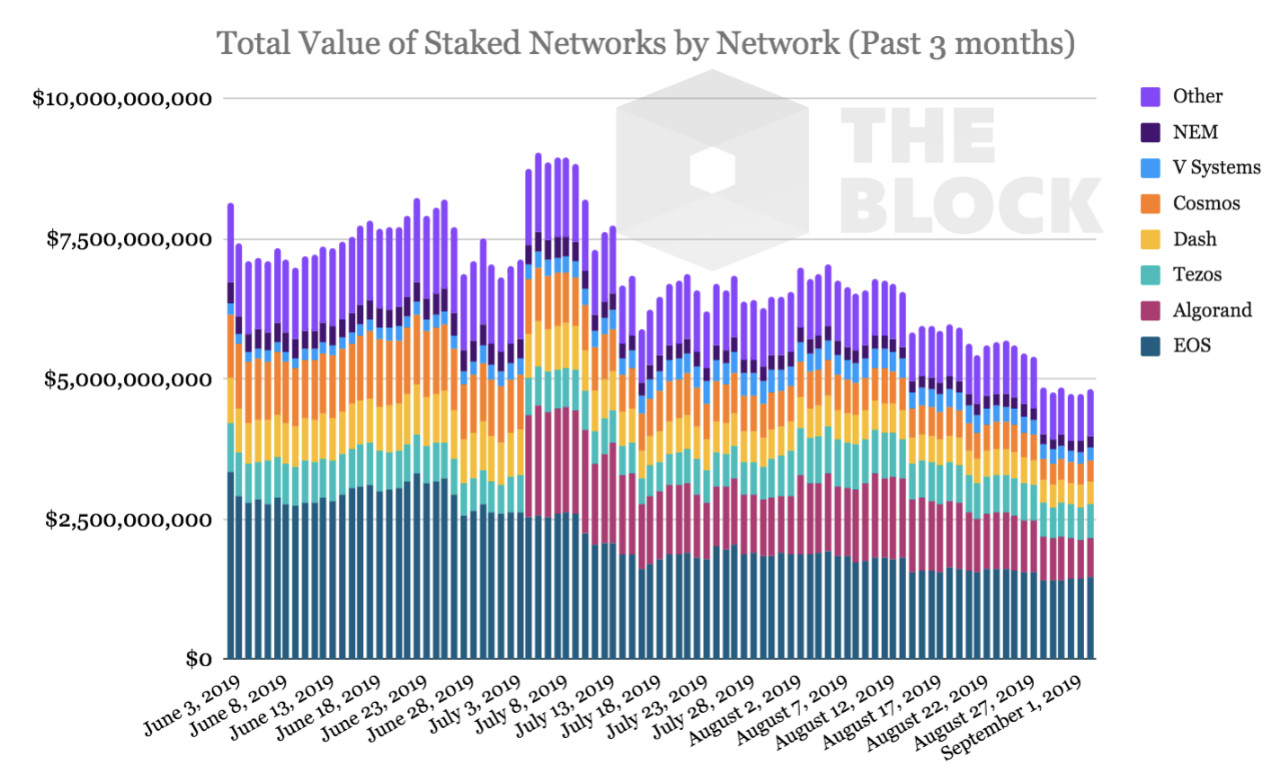

EOS once accounted for 42% of Staking's total value, but as more and more POS networks come online, EOS has now fallen to about 30%.

The blockchain ecosystem is growing rapidly and continues to generate new narratives. In the past year, the Staking agreement has been a hot spot. We have witnessed the highly anticipated Staking agreement, such as Cosmos and Algorand.

In addition to the new Staking agreement, companies and investors have been developing an architecture to support these assets. Coinbase, a San Francisco-based cryptocurrency exchange, provides Staking support for institutional hosting services. Institutional investor Anchorage's cryptocurrency provider raised $40 million on the B side, including Inreessen Horowitz and Visa. Startups in the field of encryption have even emerged, such as Staked, whose entire business model relies on the future of a network that uses Staking as a consensus model.

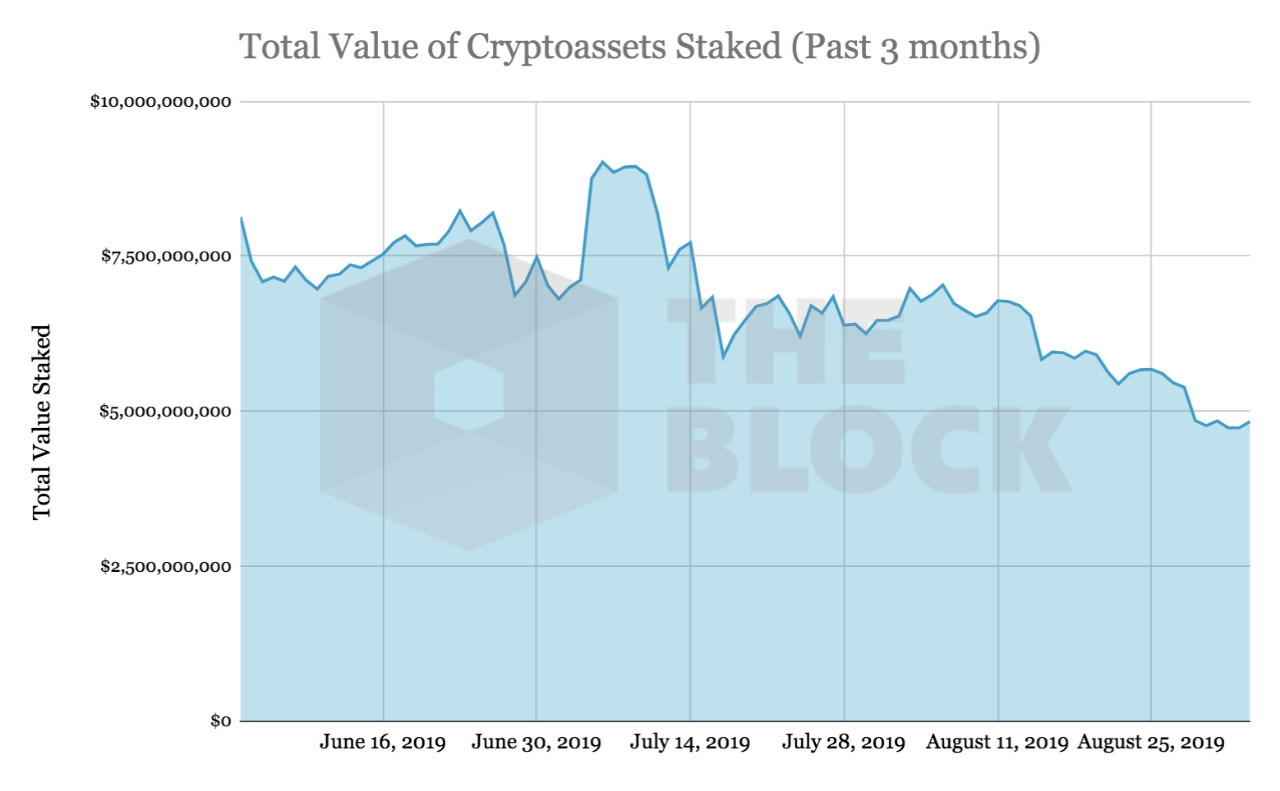

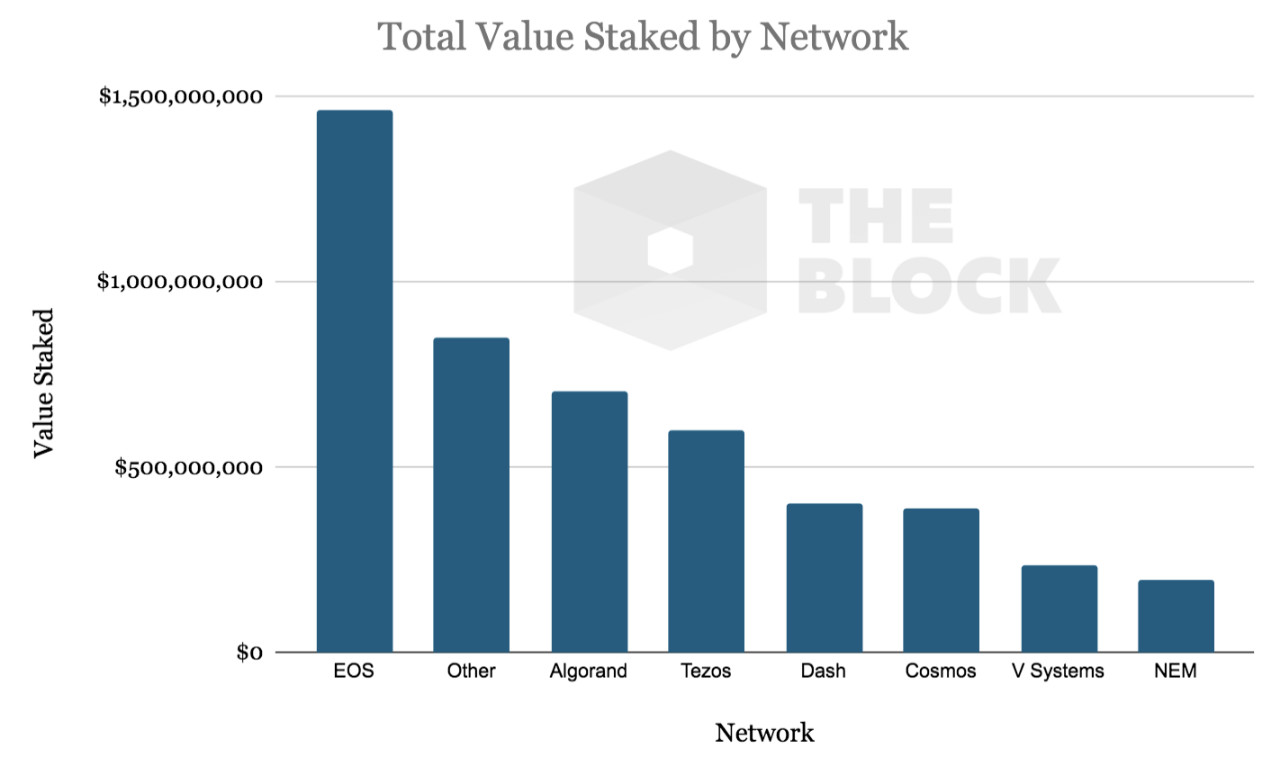

Currently, there are $4,834,977,060 participating in these networks, which use some form of Staking consensus model. Let's take a look at these networks and see how they have evolved over the past few months.

The total value of the crypto assets currently pledged

Source: The Block/StakingRewards

When looking at the total value of assets participating in the Staking network, it must be noted that the total value may be somewhat misleading. Encrypted assets are highly volatile, and their value fluctuates greatly each day, which directly affects these numbers.

In the past three months, the average value of the Staking network was $6,839,724,370, with a median low of $6,839,613,737. From June 3 to September 3, we saw that the total value of Staking assets fell by about 41%. During the same period, the total market value of encrypted assets decreased by only 0.43%. The reasons for this decline include the fact that bitcoin's dominant position has grown to 71%, and new token prices such as Algorand and Cosmos have fallen because they are at the stage of price discovery.

On July 6, the total amount locked into the Staking agreement reached a record high of $9,020,985,344. This coincides with the launch time of the Algorand network. The additional $1,815,385,353 is due to the high price of each token in Algorand's pre-sale.

Focus on the value of the network

Source: The Block/StakingRewards

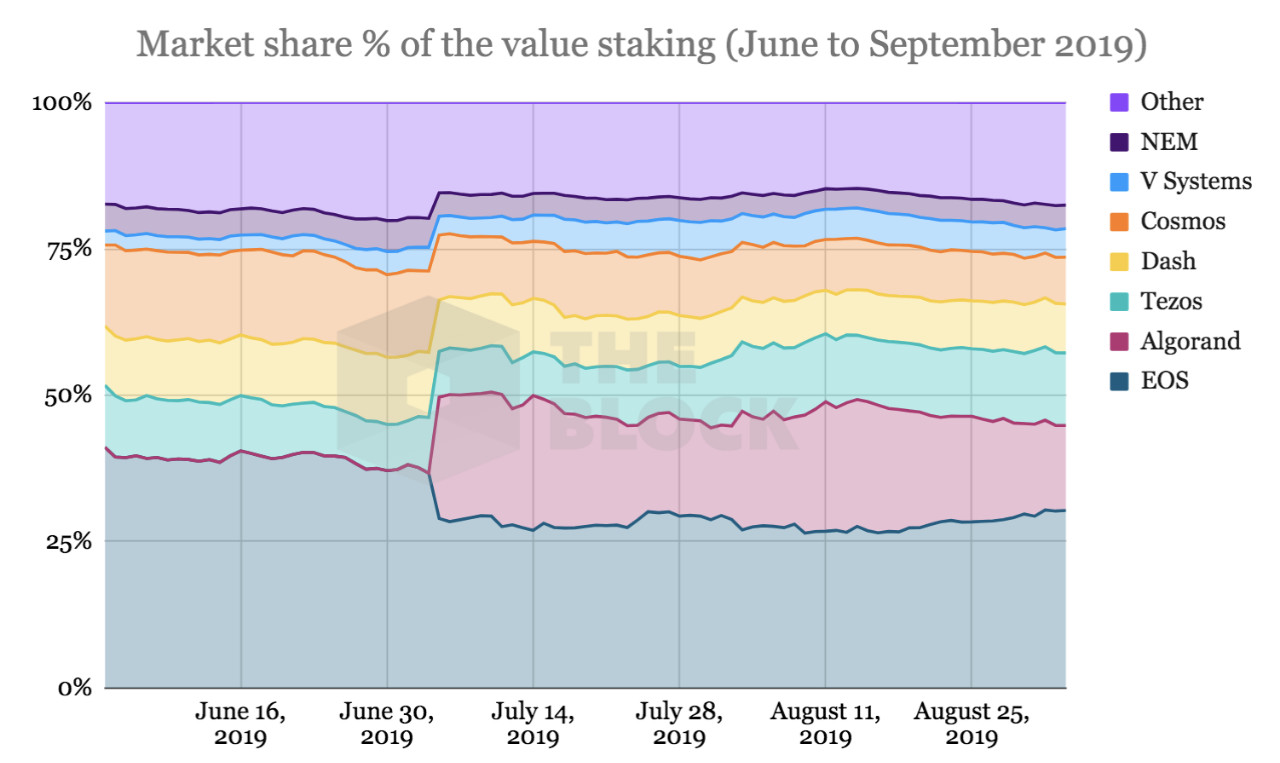

EOS remains the market share leader, accounting for approximately 30% of all current Staking values. Although EOS is still the leader, its market share has fallen from 42% to 30% in the past three months. As more staking agreements go online and other mainstream blockchains such as Ethereum turn into POS governance models, it is foreseeable that EOS's overall market share will continue to decline.

Source: The Block/StakingRewards

In early July, Cosmos accounted for approximately 16% of the entire Staking ecosystem. However, its market share in the staking ecosystem has now decreased by half to around 8%.

Algorand's market share also fell from its peak, with its market share falling from 21.7% to 14.5%. The price drop of new tokens such as Cosmos and Algorand is reasonable because they need more time to find the price.

The current detailed staking value of the network is shown below.

Source: The Block/StakingRewards

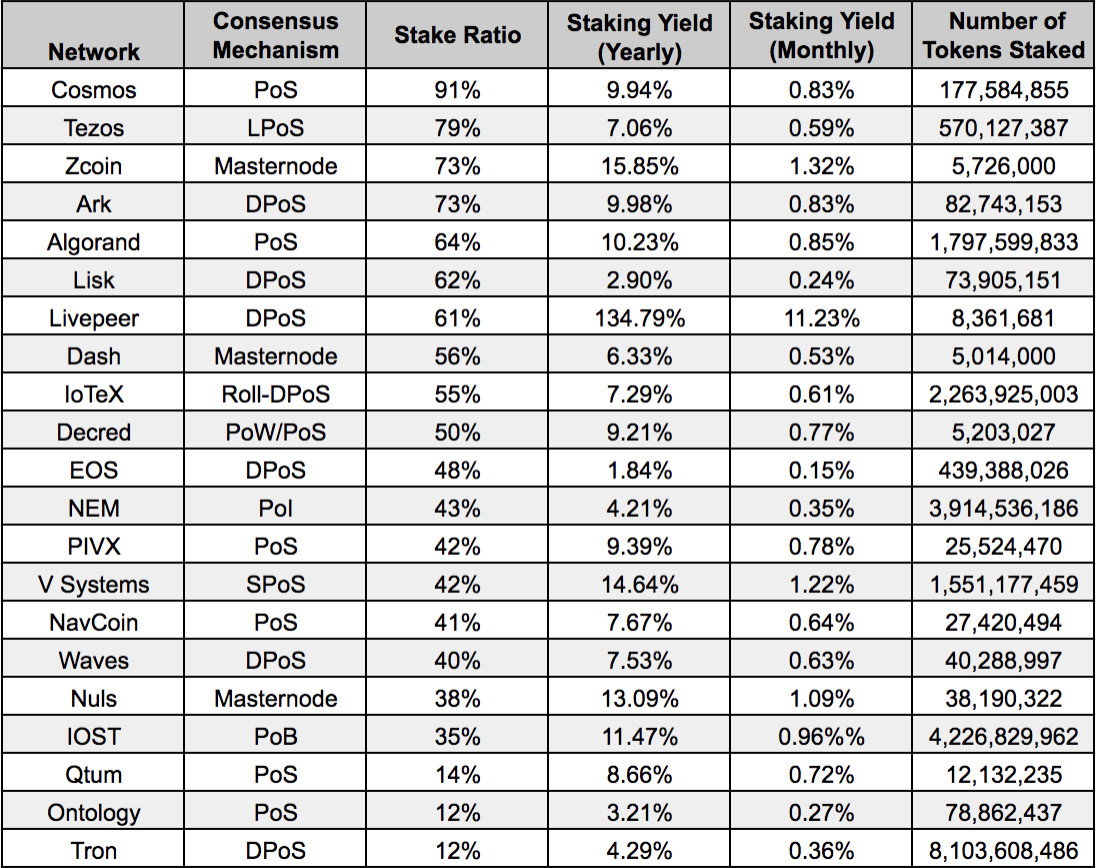

The proportion of each network participating in staking tokens

Source: The Block/StakingRewards

Cosmos is a leader in the proportion of Staking tokens. 91% of its current supply is for staking. Followed by Tezos, 79% of which are actively Staking. The average Staking ratio is much lower, about 38%. As for the yields offered by these tokens, the average of all networks is approximately 13.18%.

in conclusion

Companies and investors continue to focus on the Staking ecosystem, and as of this writing, $4.8 billion has been invested in these networks. In the past three months, we have seen market value decline by about 48%, mainly because investors are turning to investing in bitcoin or the new Staking token is in the early stage of price discovery. EOS's overall market share in the staking network has declined, and with the advent of more networks, this should be expected.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When the insurance industry encounters blockchain

- Blockchain Industry Weekly: Total market capitalization fell 2.11% from last week, 70% of the top 100 projects fell to varying degrees

- Mars Finance "POW'ER 2019 Global Developer Conference" was successfully held in Beijing

- After the cross-chain, where is the next vent of the blockchain?

- IDC Report: Blockchain solution spending will reach $15.9 billion by 2023

- What happened to the blockchain game "Encryption Cat" that used to be a smash hit?

- DEX is in a rush, and the competition with the centralized exchange is bound to win?