License Chain vs. Public Chain: The "Best Rule" for Local and Global Digital Securities

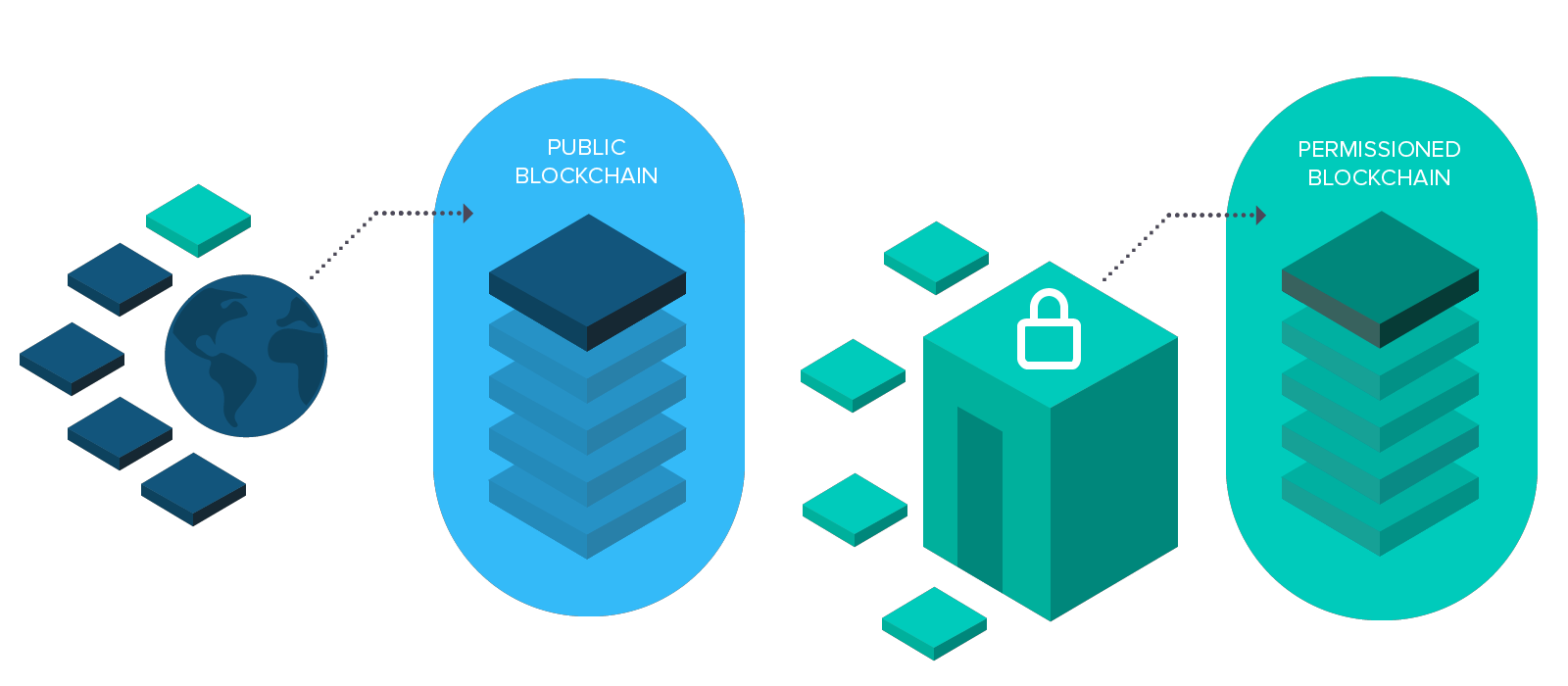

With the development of digital securities, there is such a trend worthy of attention: digital securities are trying to go in two different directions, the public chain and the license chain. In the past few months, many startups are embarking on a digital securities platform based on the licensing chain. These solutions are designed to enable banks and institutional investors to successfully apply digital securities to build infrastructure while reducing the risk of public ownership. While the positioning of the digital securities licensing chain may seem clear in the short term, in order to keep this trend going, we should consider some technical perspectives that are relevant.

The application of the licensing chain to digital securities clearly meets the requirements of large institutional investors to participate in the digital securities ecosystem. For large financial institutions, the risk of public chain has now surpassed the benefits of universalization and has created obstacles to adopting this new type of financial instrument. The licensing chain seems to eliminate the risk of a public-chain operating environment that allows organizations to better utilize digital securities, but this positioning becomes more ambiguous given the possible future developments in the digital securities ecosystem.

The dilemma between local optimal solution and global optimal solution

- Ethereum's smart contracts exceed 200,000, ranking the dominant position in the Defi ecosystem

- Technical Perspectives | Information Value and Identity System in the Blockchain World

- South Korea: Seoul City will launch S-coin and launch the first blockchain administrative service in November

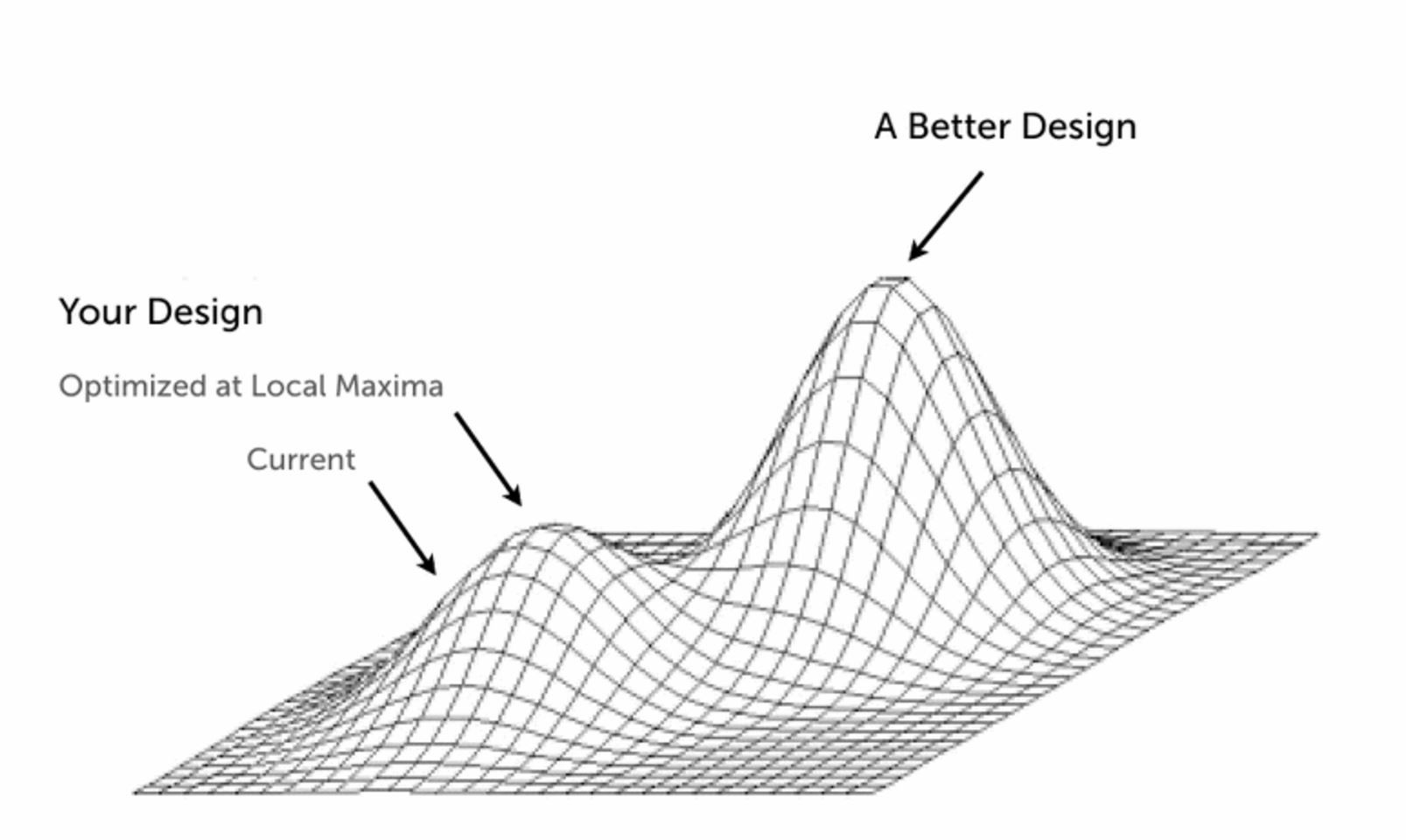

In the modeling of optimization algorithms, there are often two solutions: local optimal solutions and global optimal solutions. The local optimal solution is the solution of a problem within a certain range or region, but the final result is not necessarily optimal; the global optimal solution must satisfy the final result. However, the friction between the local optimal solution and the global optimal solution is difficult to see at the outset because we are used to breaking down large problems into a series of small problems when dealing with problems.

When it comes to the technology market, a short-term optimal solution is not the same as a long-term optimal solution. If you can't develop a solution with a long-term perspective, then it is difficult to assess short-term progress. In the field of digital securities, the licensing chain can be seen as a partial problem, although the licensing chain addresses the concerns of large organizations in the adoption of digital securities, but in the long run, this may be counterproductive. The biggest challenge in the digital securities industry is to create an efficient operating environment for large institutions and investors, while others may be just partial challenges.

Advantages and Disadvantages of Digital Securities License Chain Model

Whether it is a public or licensed chain model, this issue can spark the most heated debate in the digital securities community, where we will see some ideas worth considering.

Some of the ideas that support the use of the licensing chain for digital securities include:

Privacy: The lack of privacy models in the public chain is a major challenge in the application of digital securities. The license chain provides native privacy features and can be hosted within the customer network.

• Scalability: Even though digital securities currently do not have any relevant transaction volume, early adopters still believe that Ethereum's scalability is a major challenge. The license chain provides a scalable and network growth model that can be adapted to the needs of specific customers.

At the same time, the licensing chain model has also created challenges for early adopters of digital securities.

• Tradeability: The license chain model will limit digital securities to a small number of large institutional investors, limiting the potential tradability of these assets.

Fragmentation: Imagine a financial ecosystem in which assets are issued on heterogeneous and incompatible blockchains, and the licensing chain architecture will increase the fragmentation of the digital securities ecosystem by an order of magnitude.

Interoperability with exchanges: Digital stock exchanges are at a very early stage, and they will become extremely important components of the ecosystem in order to achieve the liquidity and tradability of digital securities. The license chain model assumes that liquidity will be limited to a small number of investors. In order to better implement digital securities trading, the license chain architecture will require integration work, which undoubtedly adds complexity to it.

Limited Programmability: The digital securities licensing chain model does not focus on the programmability of cryptographic securities, and programmability is the biggest advantage of the entire digital securities ecosystem, which may be the main limitation of the licensing chain.

Building a licensed digital securities network

There is a fact that is being ignored by many companies. In a limited ecosystem, the organic growth of the network is very difficult. Even companies with unlimited resources like IBM are working hard to build a large alliance network for the Hyperledger solution. Building a strong blockchain network requires a combination of factors, including a significant number of participants, the right incentives, a scalable consensus model, and the enthusiasm of participants to promote ecosystem growth. Without these elements, any blockchain network is nothing more than a beautified ledger.

For digital securities, small networks mean limited network effects, which offset many of the benefits of digital securities from the outset. In addition, the lack of network effects directly limits the adoption of relevant protocols, making the network vulnerable to a variety of attacks.

To balance the advantages and disadvantages of the digital securities licensing chain, the challenges and difficulties are not small. We already know the limitations of the public chain and also the risks of the purely licensed blockchain model. If you think from a longer-term perspective, there are several cut-in angles worth exploring.

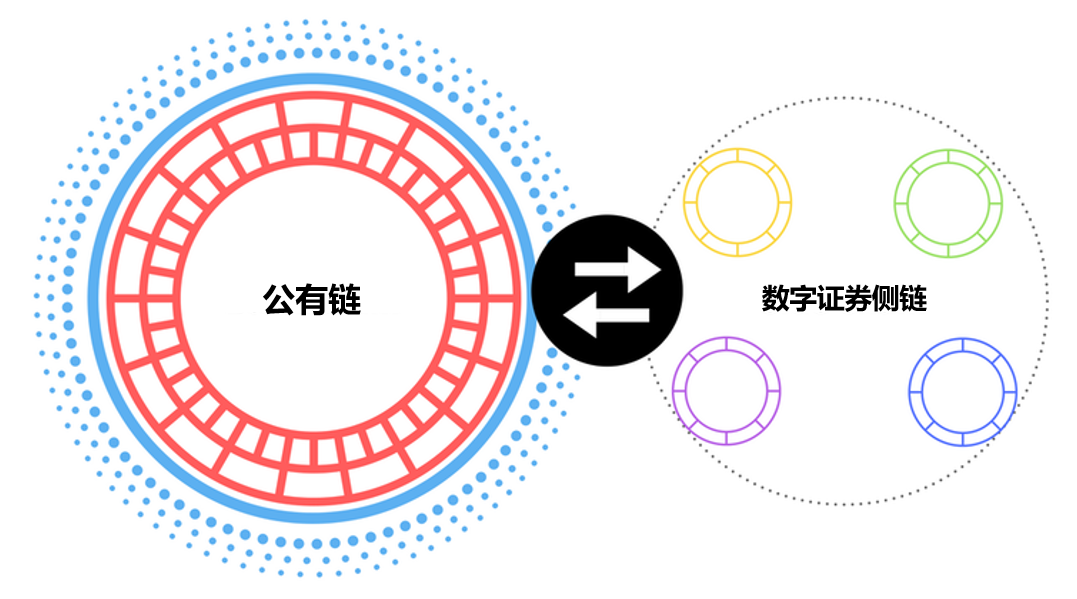

1. Licensed digital securities side chain and public chain

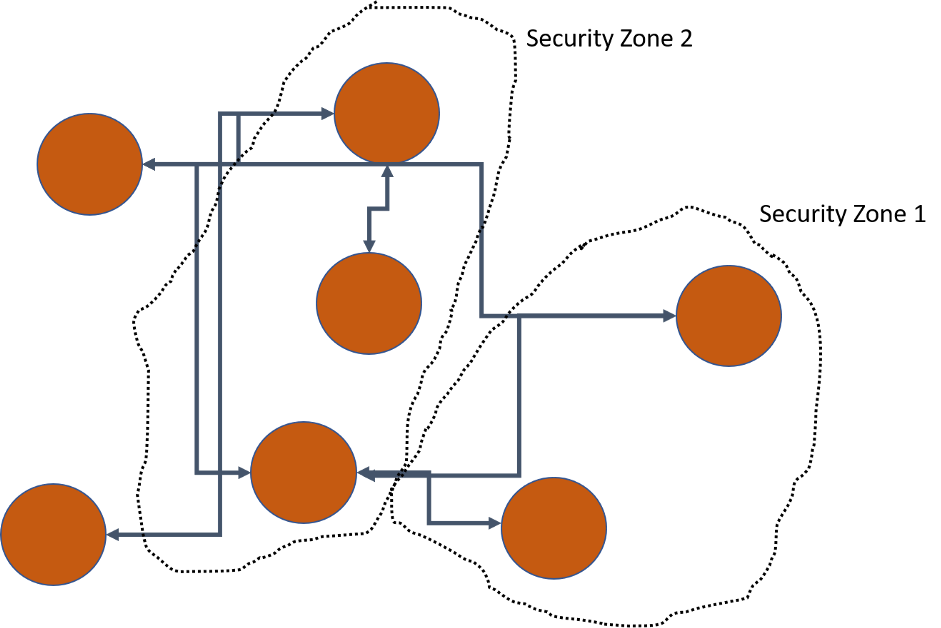

To achieve a certain degree of balance between the public and digital chains of digital securities, a digital security side chain with associated attributes can be used to connect to the public chain. In this architecture, organizations can still enjoy the scalability and privacy advantages of the licensing chain, while relying on the public chain to expand access to investors and support interoperability of exchanges and other agreements.

2. Digital securities network with built-in privacy attributes

Unlike the sidechains, we can also consider a single digital securities network where large financial institutions act as verifiers and compliance performers, but investors can also participate. In this model, privacy is enforced as a primary attribute, and access to different parts of the network is only for specific participants. To achieve this goal, a new digital securities blockchain network is needed, which is also a hot topic in the digital securities community.

In the near future, the licensing chain is likely to become a relevant element of the digital securities ecosystem, and many start-ups and large financial institutions have already conducted research and practice in this field. While short-term benefits are obvious, the development of digital securities may challenge these models, and achieving a model that works well in the licensing and public-chain architectures is one of the major challenges of today's digital securities ecosystem.

Source: Encrypted Financial Lab

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Samsung Dapp Store now offers 17 encryption apps for wallet, gaming and entertainment apps

- Interesting blockchain experiment: Why is the gold coin depreciated 6.6 times?

- Dry goods | comprehensive overview decentralized predictor

- Digital Money Hosting Alliance White Paper

- Getting started with blockchain | What is the difference between spot leveraged trading and futures contracts? Risk geometry?

- US Treasury Secretary: Libra is involved in “national security” and may be abused by terrorists

- VC such a hot blockchain | Interpretation of the first half of the financing report