Origin Protocol: Dual-token model, a new player in the DeFi track

Origin Protocol: New DeFi player with dual-token model.Mechanism

OUSD and OETH are two derivative tokens of the Origin Protocol, and their biggest feature is to provide holders with the highest possible income while maintaining a 1:1 anchor with the original token. Among them, OUSD is supported by USDT, USDC, and DAI at a 1:1 ratio, so the price of 1 unit of OUSD is always close to 1 US dollar. Similarly, OETH is supported by ETH and liquidity collateral derivatives (such as stETH, rETH, and sfrxETH) at a 1:1 ratio, so the price of 1 unit of OETH is always close to 1 unit of ETH.

Attributes

OUSD:

▪️ 1OUSD = 1 USD

▪️ Supported by other stablecoins (USDT, USDC, and DAI) at a 1:1 ratio

- Why does Vitalik believe that zk-SNARK technology will be as important as blockchain in the next 10 years?

- Understanding SAFT and Web3 Token Financing from the Perspective of Three-Generation Token Models

- Relation Protocol announces its native token REL economic model

▪️ Generate income by deploying underlying assets to diversified DeFi protocols

▪️ Elastic supply, continuously distribute additional OUSD to holders

▪️ 100% on-chain open source, no permission required

OETH:

▪️ 1OETH = 1 ETH

▪️ Supported by ETH and liquidity collateral derivatives at a 1:1 ratio

▪️ OETH earns higher returns than rETH, stETH, or sfrxETH

▪️ No need to pledge or claim rewards

▪️ OETH earns income by providing DeFi liquidity and holding blue-chip liquidity collateral derivatives

Purchase and Sale

Origin Protocol users can upgrade existing stablecoins to OUSD through app.ousd.com, or convert ETH or LSD to OETH through app.oeth.com. After the upgrade, the user’s OUSD and OETH will accumulate yield immediately and automatically. When users make transactions, Origin DApps will consider slippage and gas fees, and intelligently provide users with the most appropriate price. This means that DApps will encourage users to buy OUSD or OETH that are already in circulation, rather than mint new tokens from the treasury. DApps will deploy holders’ capital to a diversified set of income strategies, which can diversify risks and rebalance over time to achieve strong returns.

Users can exchange their OUSD or OETH for the underlying collateral at any time. As with purchasing, the Origin DApp will consider slippage, gas fees, and the treasury’s exit fee, and intelligently provide users with the most appropriate price. This means that DApps usually help users sell their OUSD or OETH on AMMs, rather than redeeming them from the treasury and incurring the protocol’s exit fee.

When users redeem OUSD through the vault, the vault charges a 0.25% exit fee to the user. This fee is distributed as extra income to the other participants in the vault (i.e. other OUSD or OETH holders). The fee is a security function that makes it difficult for attackers to exploit lagging oracles and prevent them from stealing stablecoins from the vault in the event of mispriced underlying assets. The presence of an exit fee also serves to incentivize long-term holders rather than short-term speculators. After redemption, the vault will return tokens in proportion to the user’s current holdings. This lack of user choice design can protect the vault when supported stablecoins lose their peg.

OUSD

Price Stabilization Mechanism

Revenue Strategy

AAVE and Compound

Borrowers on AAVE and Compound offer different types of collateral, such as ETH, BTC, and other tokens to borrow assets. AAVE and Compound require borrowers to over-collateralize, and if a borrower’s leverage exceeds a certain threshold, the protocol will sell their collateral. For example, users posting ETH as collateral on AAVE can borrow at most 82.5% of their position. If they borrow USDC worth 85% of their ETH, their collateral will be sold. Using this mechanism, OUSD lends stablecoins on the platform to earn revenue and distributes it to OUSD holders. The revenue comes from interest and fees generated by stablecoin pools on Aave and Compound.

Curve (CRV) and Convex (CVX)

Liquidity providers on Curve allow traders to swap assets for a fee, such as exchanging DAI, USDC, or USDT. Curve also rewards liquidity providers with CRV tokens. Convex is a yield optimizer for Curve that prioritizes obtaining CRV tokens. Liquidity providers can stake their Curve position on Convex to receive enhanced rewards and CVX tokens. In return, Convex receives a certain percentage of CRV token rewards. OUSD acts as a liquidity provider for DAI, USDC, USDT, and OUSD, charging transaction fees and selling CRV token rewards for more stablecoins. Users earn token rewards and fees through the above protocols.

OETH

Revenue Strategy

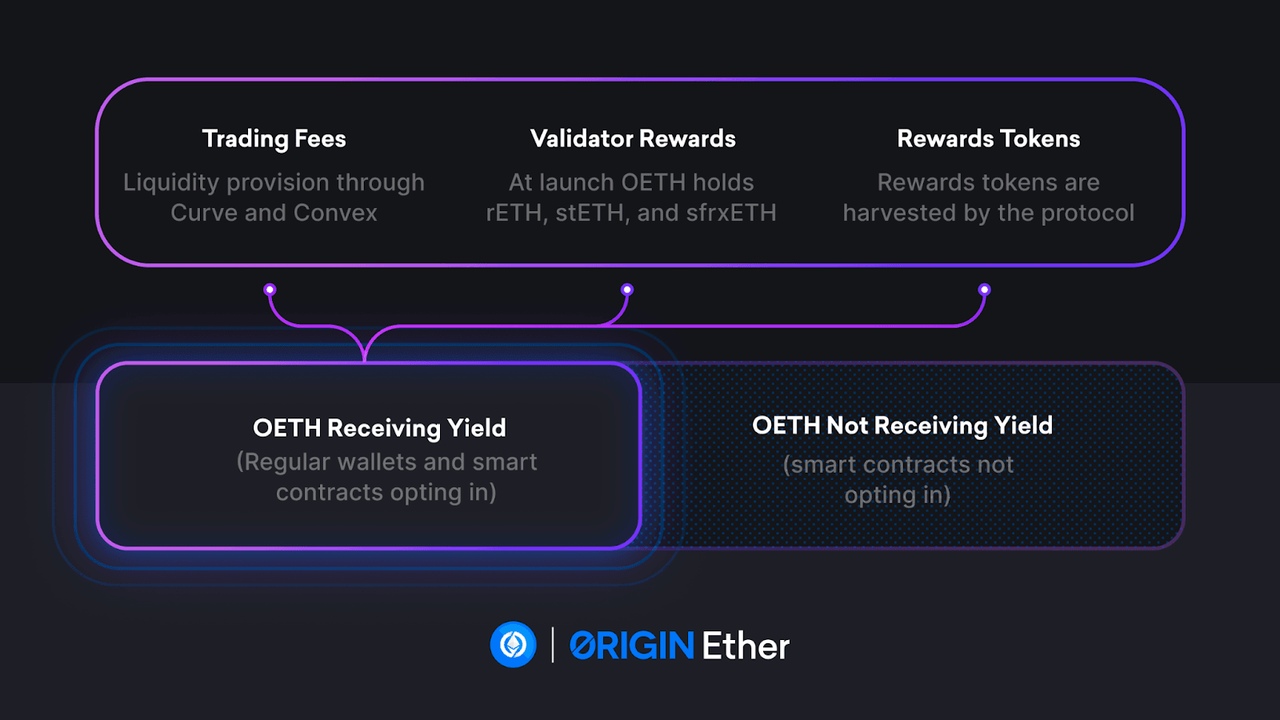

OETH generates yield in a similar way to OUSD, by earning yield from collateral from various sources. By default, OETH held by the smart contract does not earn yield, with the yield from these tokens being rerouted to the wallets of regular holders. The main difference between OETH and OUSD is that OETH also earns yield from liquidity staking tokens (LST).

- Validator rewards

- Trading fees

- Reward tokens

Origin Ether increases its ETH balance through staking rewards by holding stETH and staking frxETH. OETH also benefits from the appreciation of Rocket Pool ETH (rETH), which also gains value from validator rewards. By holding a basket of liquidity staking tokens, Origin Ether optimizes validator rewards while providing users with diversified liquidity staking entry points.

Origin Ether earns additional yield from its Convex AMO strategy. OETH collateral is used to provide liquidity for OETH-ETH pools on Curve and Convex, allowing holders to earn higher yields from transaction fees on these liquidity pools. Finally, OETH earns yield from accumulated reward tokens, starting with CRV and CVX.

Tokenomics

The initial circulating supply of OGV token is 1 billion OGV, with an initial total supply of 4 billion OGV that will be fully distributed after four years.

OGV tokens are divided into initial allocations:

- 25% airdropped to OGN holders

- 1.25% pre-launch liquidity mining campaign

- 25% future liquidity mining incentives

- 10% USD holders

- 10% current open-source contributors

- 10% future open-source contributors

- 18.75% DAO reserve

The majority of tokens are distributed to parties not controlled by Origin, effectively preventing Origin or its entities from controlling voting rights.

Origin Protocol did not participate in any private or public fundraising activities for OGV. The token was launched to the community in July 2022, with the majority of tokens to be distributed to OUSD holders, OETH holders, and liquidity providers in the coming years.

Vote-Escrow OGV (veOGV)

OGV holders can receive veOGV through the OETH staking protocol, while veOGV holders earn protocol income and control the token rewards earned by the Origin Ether protocol. The OETH protocol takes a 20% performance fee from profits earned through OETH. This fee is used to acquire CVX tokens, which are effectively reinvested into the Origin Ether AMO strategy and the OETH deployment pool’s earnings by passing through to the CVX and CRV reward amounts of the OETH-ETH curve pool. This greatly increases the earnings for the Origin Ether AMO strategy and the OETH deployment pool’s funding pool.

According to decentralized governance, veOGV holders can independently choose to change the percentage of protocol fees, directly value them to OGV stakers, or acquire new tokens for the Origin Ether protocol. Protocol income can also be used to repurchase OGV and distribute them to veOGV holders.

The number of OGV coins received by OGV stakers who stake veOGV depends on the amount of OGV staked and the time the staking token is held.

Team Information

Origin Ether was created by Origin Protocol Labs and is managed by the existing OGV staker community. Origin was founded by Josh Fraser and Matthew Liu, and later joined by BlockingyBlockingl co-founders, executives from Coinbase, Lyft, Dropbox, and Google, and many top engineers from web2 startups, working together to build the Origin Protocol.

Origin’s main investor is the world’s oldest cryptocurrency fund, Blockingntera Capital. Other notable investors include Foundation Capital, Blocktower, Blockchain.com, KBW Ventures, SBlockingrtan Capital, PreAngel Fund, Hashed, Kenetic Capital, FBG, QCP Capital, and Smart Contract JaBlockingn. Notable angel investors include YouTube co-founder Steve Chen, Reddit co-founder Alexis Ohanian, Y Combinator partner Garry Tan, and Akamai co-founder Randall Kaplan.

Summary

As a newcomer to the LSDFi track, the Origin Protocol is using multiple revenue strategies to enhance earnings, adding another powerful contender to the already fierce competition for liquidity between xETH tokens. However, if we think carefully, in the LSD War, the real winner may never be on the battlefield.

Disclaimer: This article is for research reference only and does not constitute any investment advice or recommendation. The project mechanism described in this article represents only the author’s personal opinion and is not related to the author or this platform. Blockchain and cryptocurrency investment involves high market risks, policy risks, technical risks, and other uncertainties. The price of tokens in the secondary market fluctuates dramatically, and investors should make investment decisions with caution and independently assume investment risks. The author of this article or this platform is not responsible for any losses incurred by investors due to the use of the information provided in this article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- With the rise of the APP Chains, what is its past life, present life and future?

- The ATOM 2.0 white paper is about to be released, can the value capture capability of Cosmos be improved?

- Technical Guide | Teach you how to build a commercial DAO without a bank

- LikeCoin wait 21 days to cancel the delegation? Talk about Cosmos's proof of bound equity BPoS

- Bitcoin Technology Weekly: Statechain, Schnorr signature and BIP322

- Technical Guide | IPFS Relationship Genealogy, Technical Framework and Working Principle

- Technical Primer | GHAST Rule Upgrade (Part 1)