Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

Changes in demand, yield, and products in the ETH Staking market after the Shanghai upgrade.Rising Demand for ETH Staking After Withdrawal Wave

Since December 2020, ETH staking has been possible on the Ethereum beacon chain, but it wasn’t until the Shanghai upgrade last month that staking withdrawals were enabled. After the Shanghai upgrade, market demand for ETH staking significantly increased, as Ethereum validators were able to withdraw their staked ETH.

Currently, ETH holders can participate in staking by setting up network validators or using staking service providers such as LSD, earning 4-6% ETH-denominated returns annually. In the eyes of most investors, opening up ETH staking withdrawals has increased fund flexibility, eliminating concerns of funds being locked up for a long period of time and significantly reducing staking risks.

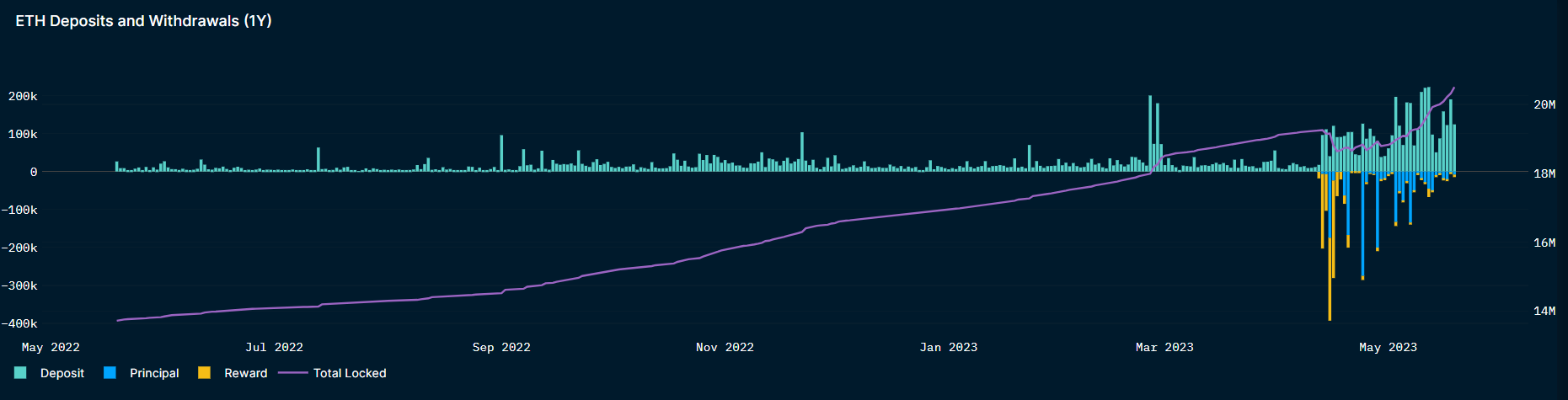

Looking at the trend chart of ETH staking deposits and withdrawals, the withdrawal wave is gradually subsiding after the Shanghai upgrade, with staking deposits now significantly exceeding withdrawals.

- How to search and join some popular events, using Bitcoin Pizza Day as an example?

- Exclusive Interview with Arbitrum Founder: One Whiteboard, Three “Zhuge Liangs”, Creating the King of Billions in Layer2

- The RWA vision is promising, but it requires a joint effort from the encrypted market, traditional finance, and regulation.

According to data from Wenmerge.com on May 20th, there are 62,932 “potential validators” waiting in the staking queue. If one wants to queue up to stake ETH on the Ethereum network, they will have to wait for 34 days and 2 hours. There are currently only six validators waiting to withdraw their staked ETH, and they are almost not required to queue up.

According to OKLink data, at the time of the Shanghai upgrade (April 12th), the number of ETH staked was about 18.01 million, while on May 18th, the number of ETH staked reached 18.41 million. After undergoing several waves of withdrawals, the number of ETH staked has increased by 400,000.

Given that the total supply of ETH is about 120 million, this means that the current staking participation rate on Ethereum is 15.47%, up from 15.1% before the Shanghai upgrade.

Potential Dual “Deflationary” Trends for ETH

Compared with other PoS blockchains such as Cardano, Solana, Avalanche, and Cosmos, which can flexibly withdraw staked assets (with staking participation rates within the range of 60-70%), there is still a lot of room for ETH’s staking rate to increase. Allen, the founder of Ebunker, predicted that Ethereum’s future staking rate will be around 40%. Of course, since only slightly over 50,000 ETH are allowed to be withdrawn from staking contracts per day, ETH staking withdrawals are not completely flexible (in fact, they may need to queue up depending on the situation), so it may not be possible to achieve the high staking participation rates of the aforementioned PoS blockchains.

Based on the current situation, the staking participation rate of ETH will continue to rise gradually over time, and the amount of ETH that is not staked will gradually decrease, which will provide the first support for the ETH price.

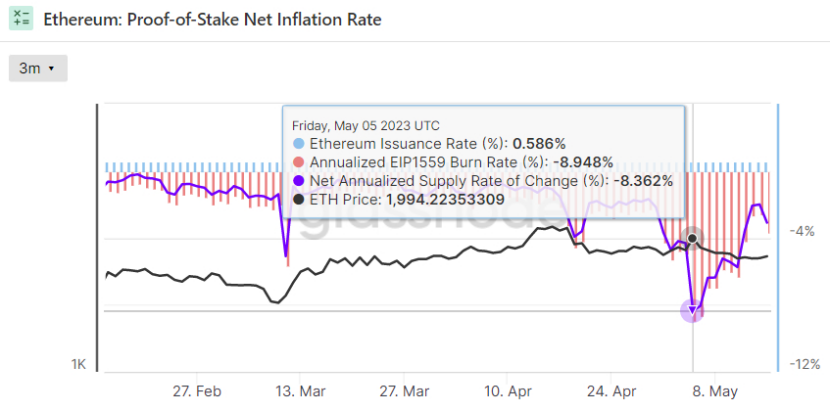

In addition, since Ethereum completed the merger, the total supply of ETH has decreased by 248,000, and the annual inflation rate is -0.31%. The total supply of ETH is decreasing, which is the second price support.

In early May, the increase in transaction fees caused by meme-related network congestion has led to a surge in the burning rate of ETH, and the annual inflation rate of ETH in the short term once reached -8.3%.

LSD obtains more liquidity

The value of liquidity capital unlocked by Shanghai Upgrade exceeds 35 billion U.S. dollars, which has a significant impact on the liquidity staking derivatives (LSD) market and significantly increases market liquidity. Before unlocking, the main risk of holding LSD (such as stETH or rETH) was the fluctuation of the LSD/ETH exchange rate, but now this situation no longer exists.

The fluctuation of the LSD/ETH exchange rate is largely due to the fact that the staked ETH is locked, and investors can only withdraw the staked ETH at a certain discount exchange rate when they urgently need funds. After the upgrade, ETH can be withdrawn from the staking contract, so LSD can be closer to the ETH price. Correspondingly, the risk of impermanent loss in DeFi has also been reduced, and users have more opportunities to use LSD and ETH to provide liquidity for AMM.

Taking Lido Staked ETH as an example, as stETH of the Lido protocol gains liquidity, it has become the most important liquidity LSD. Thanks to the snowball effect, Lido Staked ETH quickly gained most of the market share of staked ETH. In the longer term, similar situations may play a more widespread role in the entire asset class.

Compressed Yield & More Products

According to Delphi Digital’s prediction, the staking rate of ETH will double in the next 12 months. Based on the recent 5% staking annualized yield, it is very cost-effective for ETH stakers. However, as more and more users participate in staking to earn rewards, staking yield will be compressed. It is expected that the future ETH staking yield will gradually decrease to 3%, and stakers will also look for alternative solutions to increase their yield.

Case One: OETH of Origin Protocol

OETH was created in response to the latest developments in Ethereum and LSD. OETH hopes to provide an alternative to LSD and earn profits from staking rewards, transaction fees, and token rewards. Specifically, OETH’s sources of income include ETH staking interest + DeFi strategy profit and other token rewards (Compound, Aave, Curve, Convex, etc.).

First of all, by holding LSD, OETH can obtain a basic yield from validator rewards; secondly, by providing DeFi liquidity, it can also obtain more yield; finally, because ETH in DeFi earns transaction fees and token rewards, OETH holders will also receive additional income.

The rebase mechanism allows holders to receive rewards without paying gas fees or staking their tokens. The end result is a significantly higher APY on ETH, without any hassle associated with staking. The characteristics of the Origin Protocol make it one of the simplest ways to earn ETH yield, with a yield exceeding that of traditional LSD protocols.

To increase efficiency, users can mint OETH on oeth.com or exchange ETH for OETH on the Curve platform.

In terms of security, OETH has been audited by OpenZeppelin, which is also responsible for security audits of Coinbase, Aave, and The Ethereum Foundation, among others.

Case Two: EigenLayer and Shared Staking

Eigenlayer is a new ecosystem for shared security that allows developers to leverage staked ETH to provide shared security. In return, stakers can receive auxiliary yield from other networks, providing more selectivity and higher yields for ETH stakers. Although Eigenlayer is still in its early stages, it offers new opportunities for ETH yield.

In short, EigenLayer aims to enable ETH stakers to perform more validation work, such as oracle feeders, cross-chain bridge intermediaries, validators of certain chains, etc., with a deposit (i.e., 32 ETH), so as to enable ETH stakers to obtain more income.

Summary

Since the launch of the Shanghai upgrade, the market has been highly concerned about the trend of Ethereum prices, but what should really be paid attention to is the progress of LSD and its surrounding infrastructure. Currently, there is a trend that is quite obvious: as the participation rate of ETH staking increases, the staking rewards will inevitably be averaged and correspondingly reduced until a dynamic balance is reached. Currently, the field is still in a very early stage, in the dividend period of Staking, so participating in Staking as soon as possible, getting in line as soon as possible, and mining the current high APR is the best choice for ETH holders.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Financing Weekly Report | 24 public financing events; Bitcoin financial services provider River completes $35 million Series B financing, led by Kingsway Capital.

- Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million