Exploring the middleware Babylon Chain: Inspired by Eigenlayer, borrowing “Bitcoin security” for other POS chains

Exploring Babylon Chain middleware, borrowing "Bitcoin security" for other POS chains, inspired by Eigenlayer.In the current multi-chain ecosystem, modularity is showcasing its composability in more innovative ways.

A noteworthy narrative is the development of “shared security” and “borrowed security,” with more cases emerging. In all kinds of public chains, the consensus mechanism determines many core factors of the network’s L1 security, scalability, and degree of decentralization. The powerful consensus and security brought by the top public chains are difficult to match by other ecosystems.

Under the structure of modular blockchains, such security can be “borrowed” and reconfigured, which is another major highlight of the public chain ecosystem.

The concept of borrowing security was demonstrated by EigenLayer, which was popular a while back:

- Understanding ZK Cross-Chain Protocol Lagrange in 3 minutes

- Putting AI into NFT: Humans.AI – Let artificial intelligence live on in the Web3 gene pool “Digital Immortality”

- Exploring Web3 Loyalty: Addressing Challenges and Dilemmas After Project Airdrops

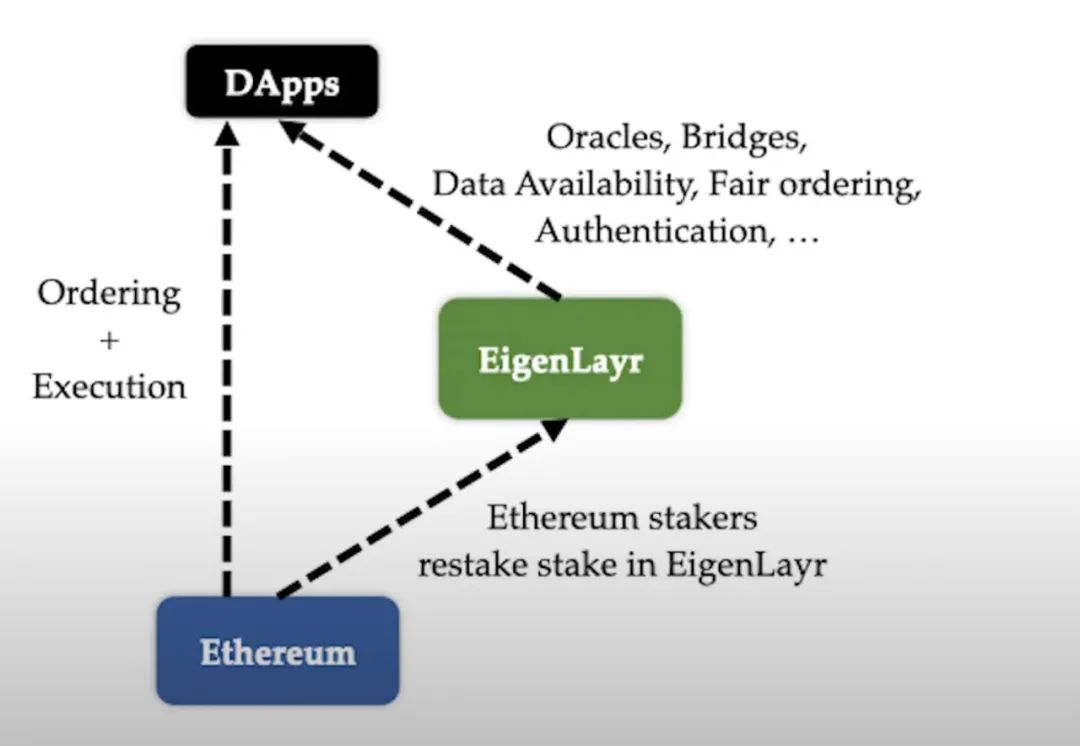

Eigenlayer’s re-staking plan created an optional middle layer that allows users to stake their ETH in a smart contract for secondary staking and become nodes that provide public chain, oracle, bridge, etc. services and receive verification rewards.

This network can be regarded as a voluntary subset of Ethereum validators who have chosen to participate in Re-staking, sharing Ethereum’s security and greatly reducing the cost of verification services.

By “borrowing the ETH consensus layer security” in this way, Ethereum’s security is borrowed downstream to EigenLayer.

From the perspective of modular blockchains and composability, “enhancing one’s own security by leveraging the security of other blockchains” is a direction worth observing and discussing.

If Eigenlayer brings Ethereum’s native security, can this approach be applied to BTC chain? Bitcoin is the most secure blockchain in the world and has the strongest consensus, making it a prime example of using BTC mining power to provide external security.

Babylon Chain has used this approach to enhance the security of existing chains by “borrowing BTC security.” Its idea is essentially to act as middleware and lend Bitcoin’s security to other POS chains.

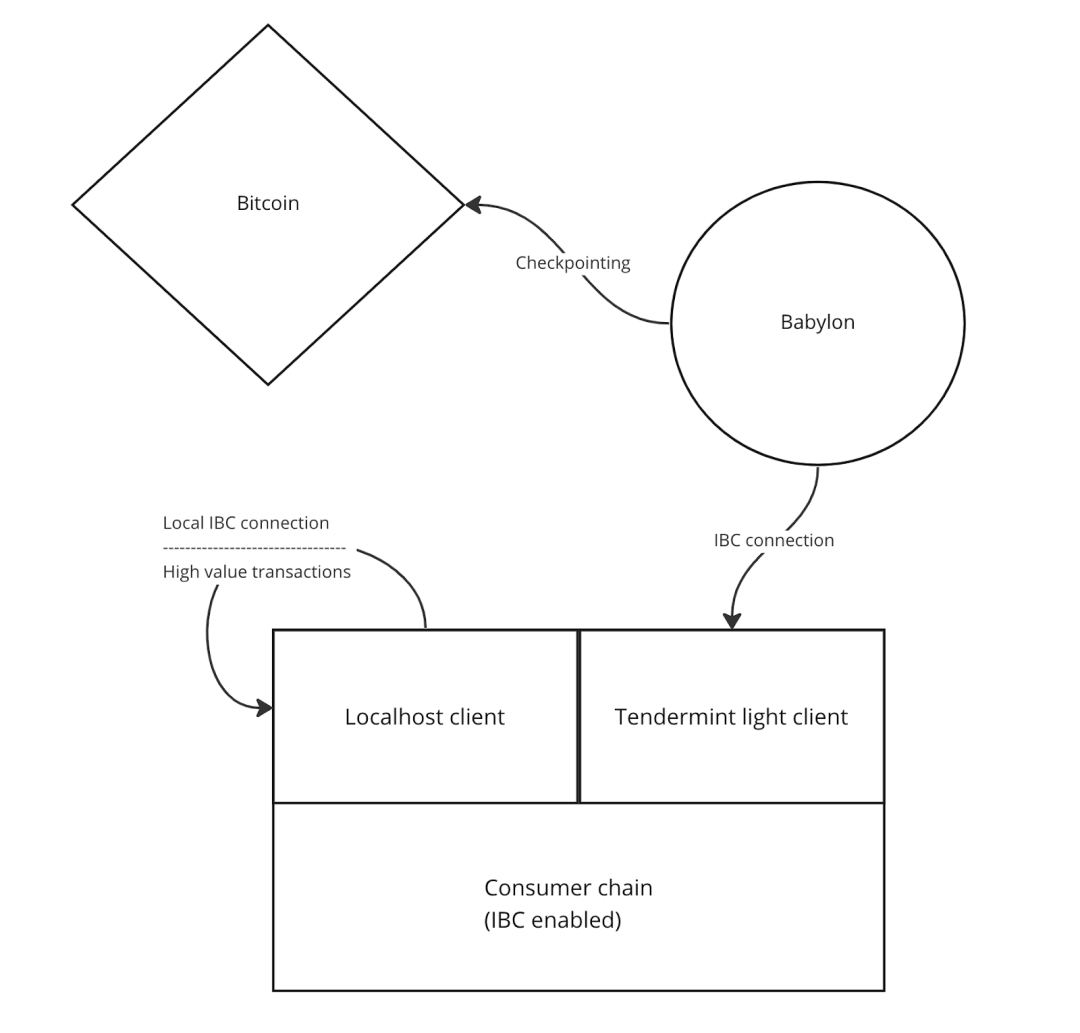

Babylon is a PoW blockchain developed based on Cosmos SDK, and its architecture looks like this:

(*Image source: Babylon white paper)

1) BTC chain as a timestamp service

2) Babylon chain as an intermediary layer

3) Other Cosmos ecosystems, the use or consumption of security services

Babylon is mainly composed of two modules:

1) Babylon chain, connected to the BTC network

2) BE (Babylon-enhancement) module.

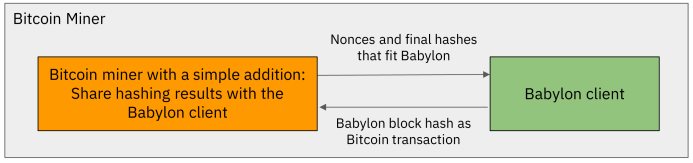

(* Image source: Babylon white paper)

The BE module mainly has the following effects:

2.1) The BE module connects the Babylon oW chain through the Babylon client, and the full node publishes the commitments of protocol-related information to the Babylon PoW chain, checks whether the message is available, and provides timestamps for messages based on the commitments in the Babylon chain, which is made public to PoS nodes.

2.2) It links the Tendermint network module (Cosmos ecosystem), and PoS nodes (including future nodes) can understand the first public time and order of each data, and PoS nodes can use the timestamp of the data in combination with the original PoS protocol consensus logic to solve security conflicts, identify violators, and carry out confiscation, etc.

2.3) The BE module also assists in other rule executions, including monitoring PoS chain information, assisting the consensus engine to verify transactions, and communicating with the governance module (approving community funds, paying Babylon transaction fees), etc.

In short, if this module is viewed as a black box, it inputs “PoS transactions” and outputs the final PoS block containing these transactions.

In this way, Babylon introduces BTC-based security into the Cosmos ecosystem by using Bitcoin PoW as a timestamp and data availability layer:

This mode also solves the problem of Cosmos’ long staking unlock period:

Babylon, as a standalone chain, aggregates the checkpoints (i.e., transaction events that need to be timestamped) of PoS chains to BTC and publishes them on behalf of them, and BTC’s security is used to process transactions.

From another perspective, when the BTC network serves as the timestamp service for PoS chains, the length of time that validation nodes need to stake will be changed. In this case, the 3-week period required by the Cosmos zone can be greatly shortened to hours.

Babylon may bring new narratives for application chains in the Cosmos ecosystem, as well as new ways to extend BTC applications. As BTC has long dominated 60% of the total crypto market value, the market is still expecting BTC to be introduced into other ecosystems in a more trustless manner, and this approach of “borrowing security” may bring more inspiration.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BladeDAO’s Decentralized Vision: Players don’t have to compromise, together build a transparent, fair and safe gaming world.

- Head DEX protocol iZUMi Finance on ZkSync: based on UniSwap V3 improvement, creating a new DL-AMM mechanism

- Weekly Preview | ACDE Conference may determine the scope of Cancun upgrade; Tokens of projects such as Avalanche and RON will be partially unlocked

- Quickly learn about 18 new projects in recent times: DeFi, games, and tools

- Recap of ETHGlobal Lisbon Hackathon: Quick Look at 5 Promising New Projects

- Token issuance of Sui’s ecological project faced setbacks including token unlocking delay and team unlocking, resulting in a difficult start.

- Listing 10 low-market cap LSD-fi projects: