PAData: FCoin potential victims or more than 2000 people, per capita loss or more than 25 BTC

Analyst | Carol Editor | Bi Tongtong

Production | PANews Data Partner | Chain.info

On February 17, the FCoin, which was once the most popular exchange trading model, was thundered. Founder Zhang Jian released the "FCoin Truth" announcement, claiming that the biggest problem FCoin currently faces is the inability of cash reserves to pay users' withdrawals. It is expected that the scale of non-cashing will be between 7000-13000 BTC (valued at approximately 68.6 million-127 million US dollars) .

- The last predictable halving bull market in the currency circle?

- Chengdu chain security: stolen killer whale users may have sustained attacks

- Opinion | Satoshi Nakamoto's idea of multi-client proves correct?

One stone provoked thousands of waves, and the issue of capital security of exchanges once again became the focus of public opinion. In fact, the reason for FCoin's thunderstorm was the universal risk faced by investors when trading on the exchange. On the one hand, supervision is still absent, on the other hand, the books of the exchange are still undisclosed fans, and investors can only "see the flowers in the mist" through limited on-chain data. Therefore, once the issue of capital security occurs, whether the rights and interests of investors can be protected is highly dependent on the goodwill of the exchange.

But this time, FCoin and Zhang Jian failed to give every investor goodwill. Victims in the activist group suffered losses ranging from tens of thousands to ten million yuan. Previously PANews interviewed professional lawyers to advise investors.

What is the scale of the victims of this FCoin thunderstorm? What is the per capita victimization amount? PAData based on Chain.info, a one-stop data service platform focusing on blockchain transactions, performed a predictive analysis on the scale and potential loss of FCoin's address mining data.

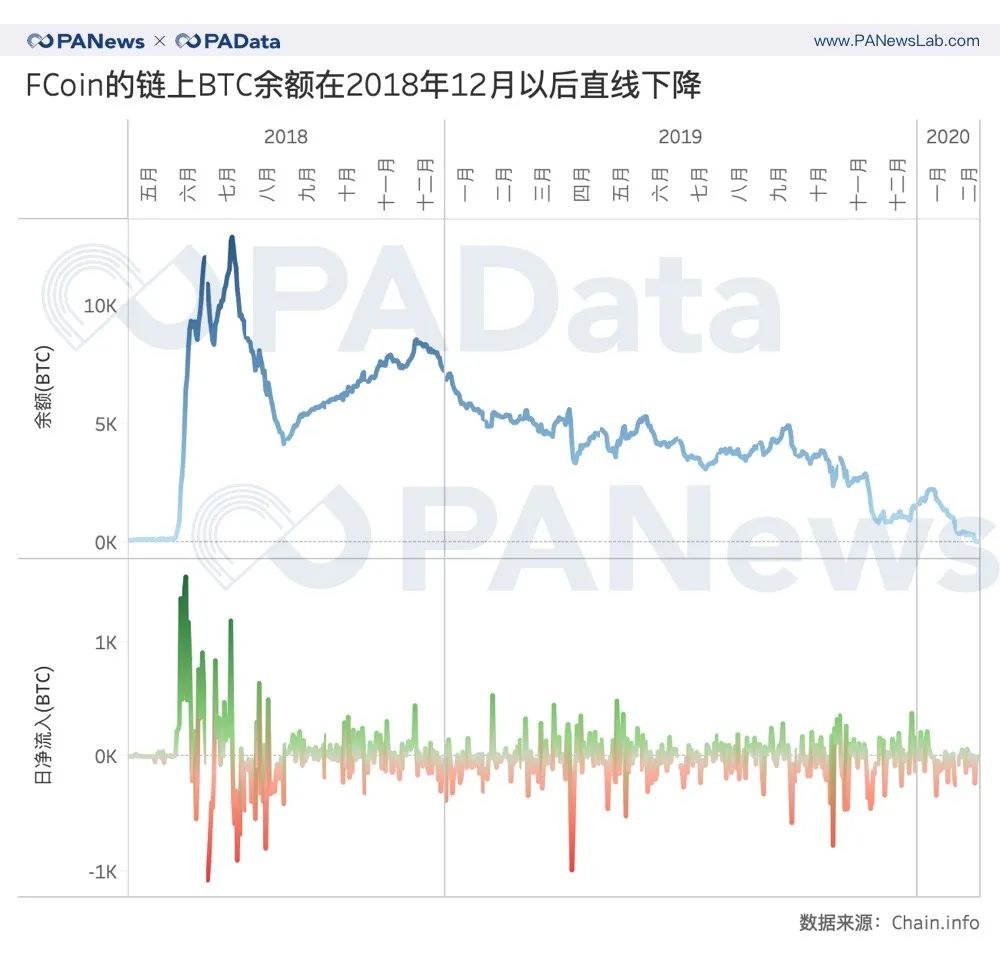

According to Chain.info's statistics on the total historical balance of 21574 deposit addresses, 2 hot wallets, and 1 cold wallet under FCoin's name, on July 20, 2018, the BTC balance on the FCoin chain reached its peak, with a total of 12,900 at that time. BTC.

Throughout FCoin's entire life course, June 18 was a period of rapid development. The balance of BTC on the chain skyrocketed, and it quickly fell after reaching its peak at the end of July. However, from the end of August to the beginning of December, the on-chain balance of FCoin rebounded mildly, reaching a small high on December 9, when there were 8,574 BTC.

However, after the "back to light", it was "slumped". After the beginning of December 18, the BTC balance on FCoin's chain continued to decline. Until February 15, this year, the on-chain balance dropped to 0.153333 BTC, and it never changed.

From the perspective of the daily net inflow of BTC, the median daily net inflow of FCoin (the balance of the day minus the balance of the previous day) is 0.000579, which is equivalent to the "death" declared by FCoin from April 2018 to February 2019 Of the 662 days, the net inflow of 331 days was approximately zero, or even negative. And the number of days with a negative net inflow after December 2018 accounted for 75.57% of the total days with a negative net inflow, which is higher than the 15-month monthly average. A possible inference is that the start of the FCoin operating crisis or December 2018.

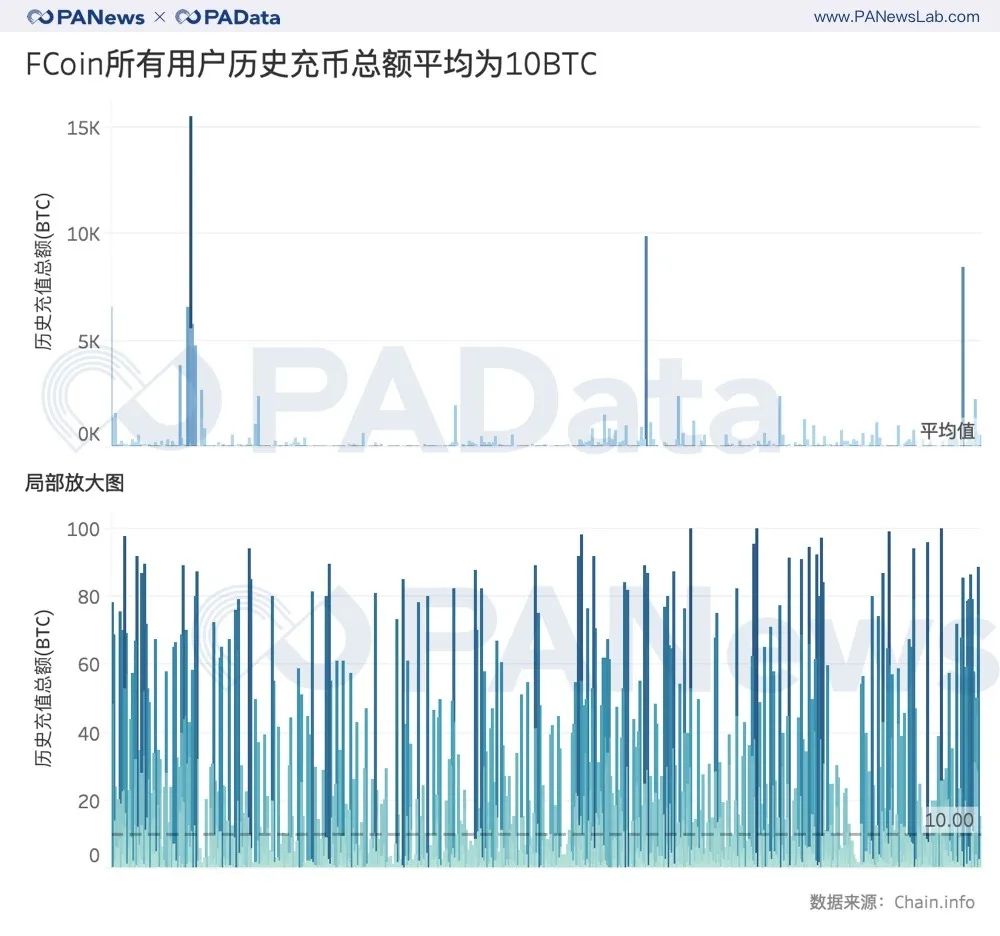

According to the statistics of the historical total recharge amount of 21574 deposit addresses, the average recharge amount of each investor [1] is 10 BTC. Among them, 33 investors recharged more than 1,000 BTC, and the one with the highest recharge amount totaled 15,525 BTC.

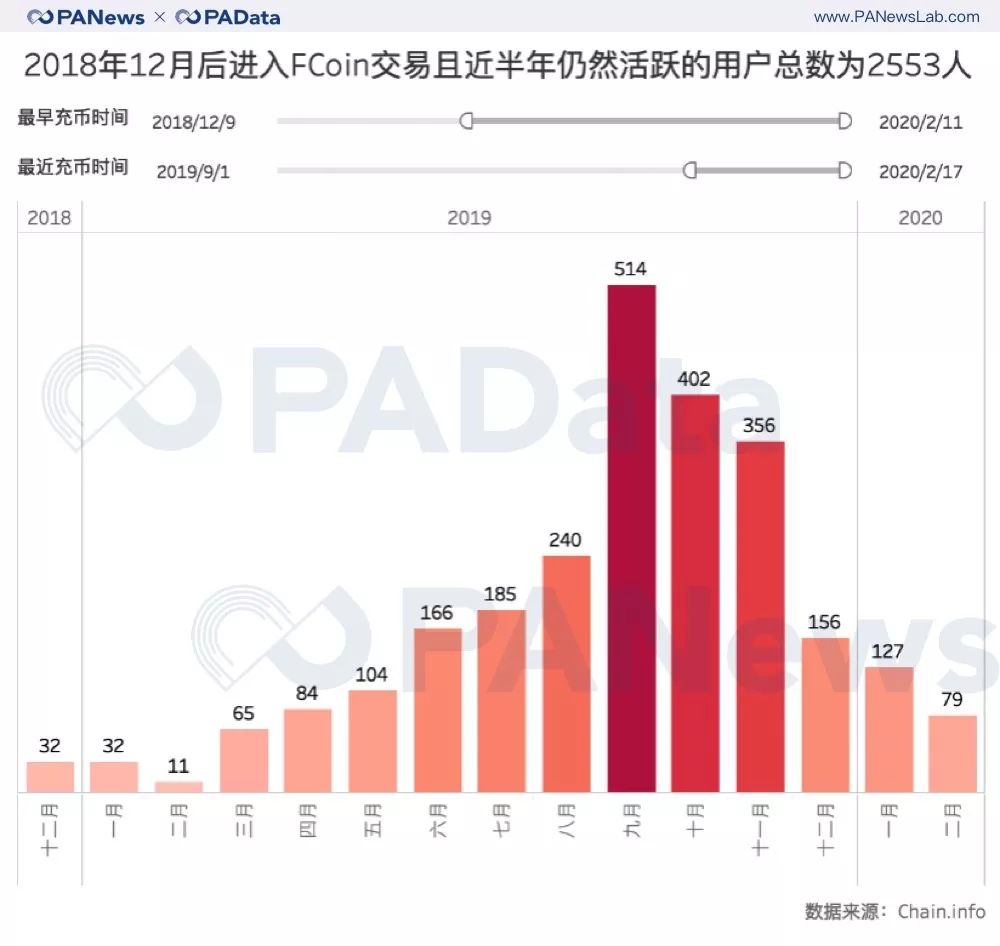

If the first recharge time occurred after December 2018 of the dangerous emergence of FCoin, and the investor who has been active in the last six months (with recharge history) is designated as the potential victim of this FCoin thunderstorm, then The scale is about 2553 people. By 2020, there are still 206 new investors entering FCoin transactions.

From historical data, there were many investors entering from September to November 2019, with a total of 1272 people, accounting for 49.82% of the total number of potential victims. According to a report from the media "Lydao Blockchain" [2], at the time when FCoin restarted mining and stimulated development through FT inflation, FCoin also launched the contract platform FMEX at that time. Platform currency and futures have become the straw when FCoin is "dying and struggling".

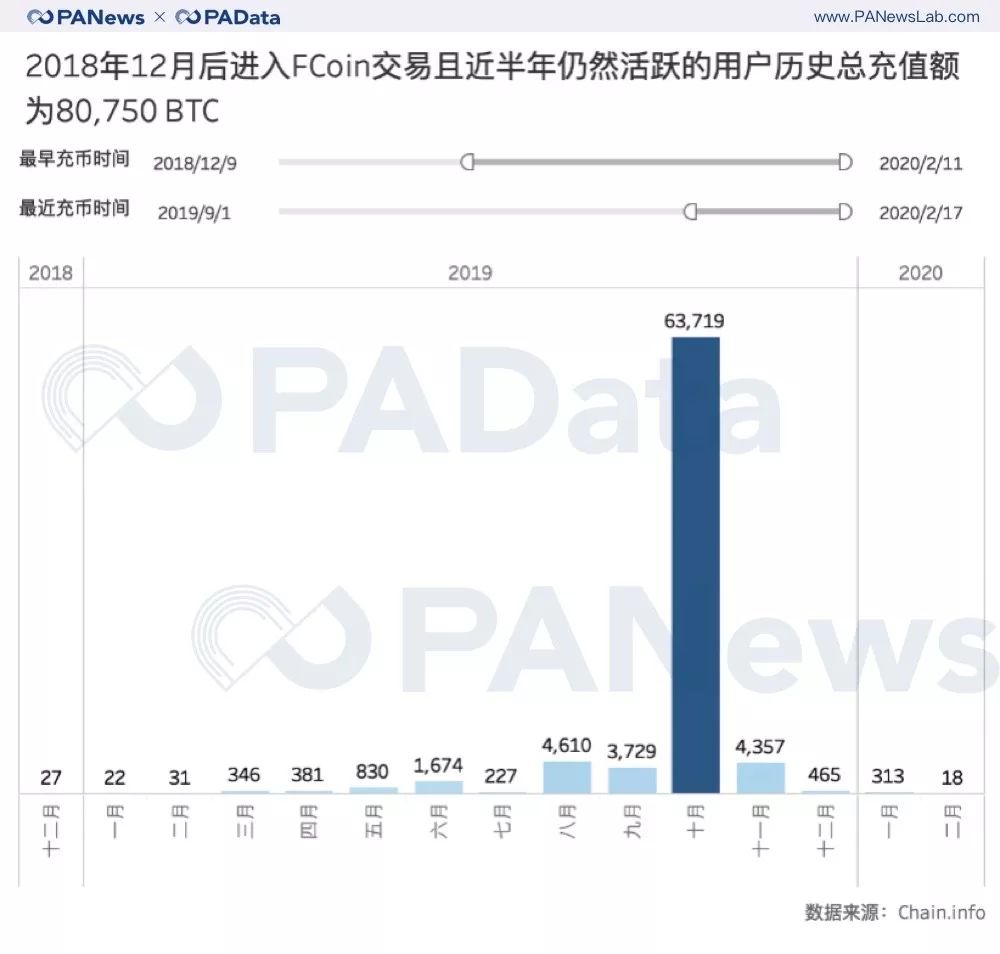

According to the statistics of historical recharge data, these 2553 potential victim investors have recharged 80.75 million BTC, of which in October 2019, approximately 63.72 million BTC were recharged. From January to February this year, there were still 331 BTC deposits into FCoin transactions.

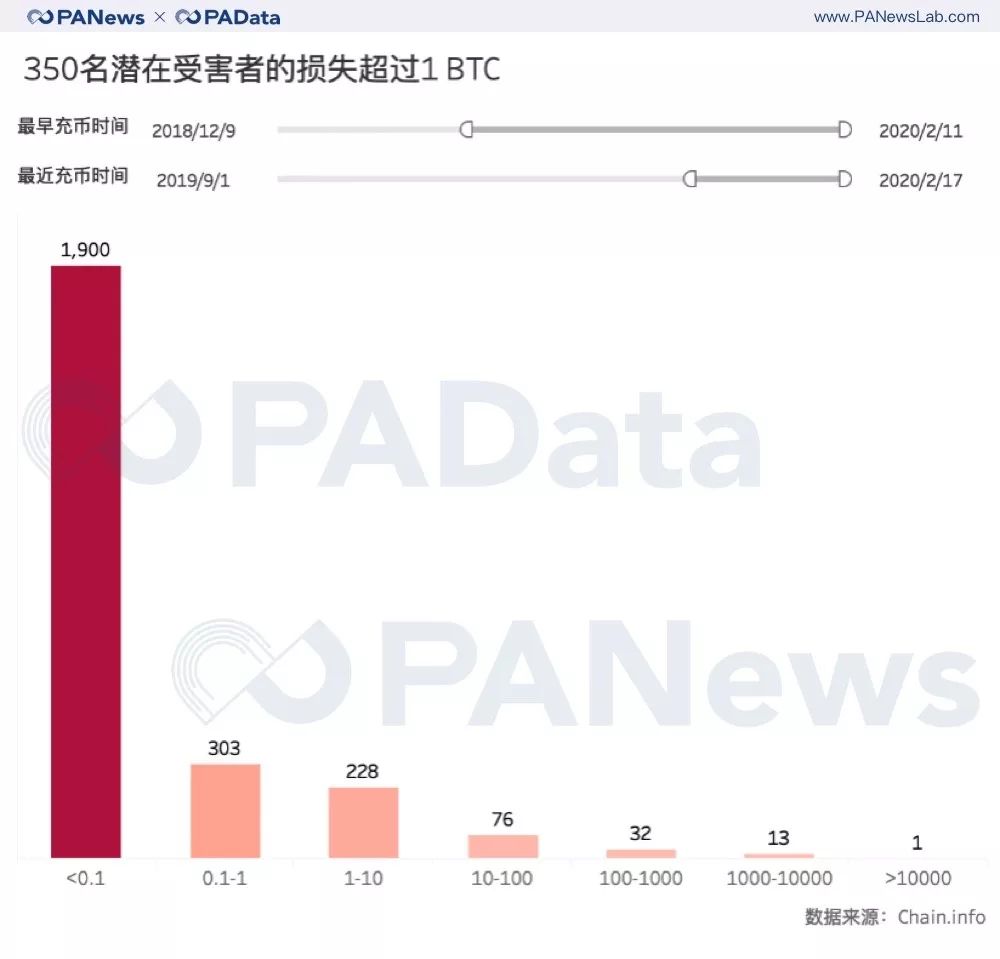

If the historical recharge amount of each investor during this period is grouped and observed, it can be found that the historical recharge amount of 1900 potential victim investors is less than 0.1 BTC, and the historical recharge amount of 350 potential victim investors is greater than 1 BTC.

Among them, 46 people have a potential loss of more than 100 BTC. At the current currency price, 100 BTC is about 6.7 million yuan. The person with the highest potential loss recharges 15,525 BTC. If this extreme value is removed, the potential per capita loss of potential victims is about 25 BTC, which is equivalent to approximately 1.69 million yuan at the current currency price. This value is much higher than the per capita investment amount of FCoin historical investors, which may mean that there are more large households in the designated potential victim range, and the potential losses of large households have increased the average.

However, it must be stated that this is only an estimated analysis of the FCoin thunderstorm event under limited conditions. There may be investors who have entered the FCoin transaction at an early stage and have not yet withdrawn coins. There may also be delineated potential victims. Investors who have withdrawn all or part of their tokens during the period have not been included in the above static analysis. The purpose of the estimation analysis is to provide a reference for understanding the scope and impact of the incident.

Please pay attention to this public account, PAData will further analyze the exchange's on-chain asset reserve and investor protection fund coverage in the next part, and try to explore the operation of the exchange from the valuation analysis of the platform currency, The universal risk is observed.

the data shows:

[1] After the user opens an account on the exchange, the exchange will provide the user with a deposit address. Currently, the deposit addresses provided by mainstream exchanges for users are generally irreplaceable, that is, one user corresponds to one deposit address, unless the exchange is replaced in a large area. For more background information on address mining, please refer to "How are 4 million exchange wallets dug out?" Interview with Li Yi, the technical leader of Chain.info.

[2] The Laidaoblockchain "FCoin myth has fallen. It used to be hundreds of times. Now? "The original link is https://www.sohu.com/a/340563034_100122547

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- CoinGeek Conference 2020 | Satoshi Omoto: You have a misunderstanding about Bitcoin!

- Why did Facebook create the Move language for Libra? Calibra digital executive tells the inside story

- Interpretation | FCoin Shutdown: A Quick Look at the Exchange's Death Stance

- Communication blocked? IRS invites cryptocurrency companies to summit

- Don't wait for the road to wake up: the key points of blockchain project compliance review

- Baidu, Ant, and Tencent on the Forbes Blockchain Top 50: Industry Blockchain Weekly Highlights

- To achieve a 10,000-fold expansion of Bitcoin, what is the new agreement Prism created by MIT and Stanford?