Analysis: Six Sources of Excess Return of Crypto Assets

Source: intotheblock

Translation: First Class (First.VIP)

- Startup Proof of Impact completes Series A financing, led by asset management company Franklin Templeton Group

- Inventory: major thefts of crypto exchanges in 2019

- The Filecoin testnet based on IPFS has been launched, and a new round of opportunities is coming?

Editor's note: Previously, Michael J. Mauboussin, an analyst and well-known author of Blue Mountain Asset Management, introduced traditional capital in the paper "Who is on the other side?" There are four basic sources of different Alpha values (that is, excess returns on assets) in the market. On this basis, Jesus Rodriguez, author of this article and chief technology officer of intotheblock, will explore new sources of excess returns in the cryptocurrency market.

Efficient markets and excess returns

The alpha return of assets in financial markets is the excess return, which can be understood as the difference between a single asset and the average return of a market index. The concept of Alpha originated from the researchers' belief that most financial markets are more efficient-the returns of some market indexes can accurately reflect the performance of an asset class. Of course, this is also reflected in the cryptocurrency market. And researchers want to use Alpha returns to measure some of the "ineffectiveness" of the capital market can have as much impact.

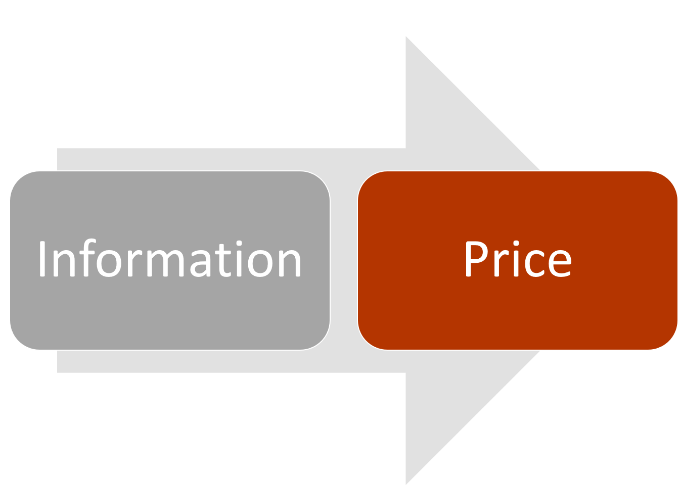

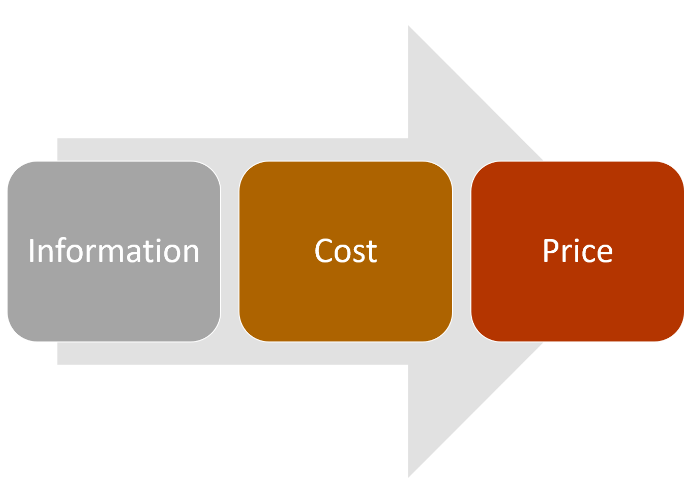

The concept of efficiency comes from physics, explaining the relationship between the amount of energy consumed to produce a result and the result itself. In financial markets, efficiency refers to the relationship between information and asset prices. In modern finance, the introduction of the efficient market hypothesis (EMH) is a major milestone that has been mentioned repeatedly. It was proposed by the Nobel laureate in economics, Eugene Fama, in a doctoral dissertation in 1962. The efficient market hypothesis holds that the stock's trading price in an efficient capital market reflects all relevant information, and the stock will always be traded at its fair value. Therefore, the stock price can never be higher or lower than its fair price, and investors cannot buy or sell stock at a discount or premium. Therefore, it is impossible for a stock to "outperform" the market. Since its introduction, the EMH theory has been mixed, and has become one of the most controversial theories in the financial field.

If a capital market is really effective, how to have an Alpha? Professor Michael J. Mauboussin makes a very convincing argument that it is related to information-related costs. We can see that the assumption of efficient market theory ignores the cost of information acquisition and the cost of transaction operations based on this information. But this is rare in financial markets. The cost of obtaining and implementing information brings inefficiencies, and you can start with these related costs to consider earning excess benefits.

Traditional sources of excess returns

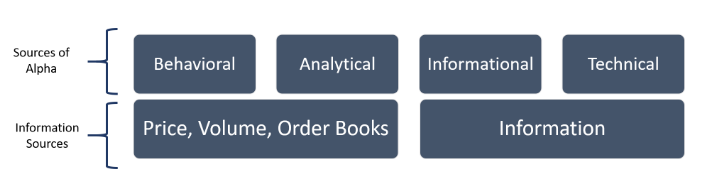

Professor Michael J. Mauboussin pointed out in the thesis that from the perspective of information acquisition and implementation costs, there are four basic sources of excess returns (Alpha):

1) Behavioral effectiveness: When an investor or a group of investors acts in a way that causes price and value to diverge, invalid behavior occurs (first-class position note: Another basic assumption of the efficient market hypothesis is the "rational person assumption ", That is, investors in the market will make optimal decisions on information, and any" irrational "operation by investors may allow others to take advantage of it;)

2) Information effectiveness: When some market participants have different information from other market participants and can use this asymmetry to make profitable transactions, information inefficiencies will occur (first-class position: for example In a weak and efficient market, some investors can obtain inside information so that most market participants can operate to earn excess income before obtaining this information);

3) Validity of analysis: When all participants obtain the same or very similar information, but some investors can perform better analysis than others, such as mathematical modeling, it is possible to make more accurate judgments Thereby earning excess income;

4) Technical reasons: When some market participants have to buy or sell certain assets due to reasons unrelated to the basic value, such as laws, regulations or internal policies, the price and value of assets may deviate.

The four sources of excess returns provide a good summary of the dynamics of efficient capital markets, but do they apply to the cryptocurrency space? After all, the crypto market is not efficient.

New sources of excess returns for crypto assets

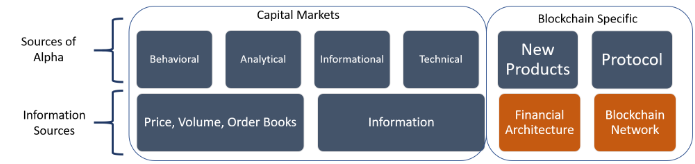

In the context of the crypto market , the four sources in Professor Mauboussin's theory are undoubtedly emphasized (applicable), but they cannot fully take advantage of the inefficient state of the crypto market. The author believes that the crypto market has also spawned two new sources of excess revenue: Alpha products generated by new product or underlying protocol behavior.

1) New things: The factors of new products are related to the financial structure of the crypto market, and also to the possible impact of the current new product launch in the inefficient crypto market. In traditional capital markets, a new IPO or a new bond issue rarely disrupts the behavior of the entire market. Except for very few examples, such as the failure of Facebook's IPO, which has triggered investors' bearish sentiment on technology stocks for several months, this situation is extremely rare, because the efficiency of the entire traditional capital market can often make up for any anomalies in a long time. The opposite phenomenon occurs in the crypto market. In the current crypto market, the introduction of new things, such as the advent of crypto derivatives, or the entry of a large institutional investor, or the introduction of new concepts, can bring amazing excess returns to an asset or class of assets .

2) Low-level protocol behavior: The network on the blockchain behind related crypto assets is often based on different protocols. These agreements can also generate related excess returns. For example, Bitcoin's upcoming halving event-an event that the Bitcoin network has been anticipating will affect the price of the entire cryptocurrency market and effectively push the entire market. Although this information is well known and readily available, there are costs associated with implementing effective strategies to use this information, and not everyone can use it effectively. In addition, when the underlying agreement stipulates that a certain point in time will be used to burn coins to affect the circulation, etc., a similar effect will also occur.

Many factors in the crypto market are very unique and generate excess returns in unique ways. The four sources of the traditional capital market plus the two new sources proposed by the author have analyzed the excessive returns of the crypto market. But as the market develops, these theories may change.

Reprinted please retain copyright information, thanks for reading.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin also needs DeFi application, startups launch Bitcoin version of MakerDAO

- PwC Kris Kersey: Autonomous network formed by the integration of AI, Internet of Things, and blockchain is a promising future

- Lightning Network ushers in "the most significant technological progress" in 2019, and multi-path payment is about to go online, solving the problem of large payments

- Galaxy Digital and XBTO participate, Bakkt Bitcoin options contract completes first block trade

- Babbitt Original | Starting domestic alliance chain, this is the best era for blockchain to help Chinese manufacturing

- + Government | Government is doing these things with blockchain

- Observation | The story of the application layer is difficult to continue. How does the public chain live through 2020?