Ray Dalio's latest 4D Long Article: Quietly Changing World Patterns and Macro Cycles

Translator: Yuan Yuxin and Liu Jiapei

Source: Yuyuan Yuxin

The founder and chief investment officer of Bridgewater Fund, Ray Dalio, uses Bridgewater Fund's excellent performance, decades of deep insights into the global macro market, and two books, Principles and Debt Crisis, to explain personal life The principle of work, one that explains the operation law of an economy from a macro perspective, has won the favor of the market and readers.

Yesterday, he published the latest series of research on "Changing World Order" on LinkedIn. This time, he transcended the laws of operation of individuals and economies. He tried to study the past 500 years by including China, the United States, the United Kingdom, and six other countries. And other forms of the rise and decline of major global economic forces to explain that we are in a special period in the context of a 50-100 year long cycle, that is, the changing world pattern and the alternation of power, and the upcoming economic, geopolitical and values Shocks and huge changes.

- Comparison of overseas blockchain epidemic prevention with China: limited use cases, lack of government presence

- Popular science | Is distributed, decentralized, multi-centralized the same thing?

- Linked US stocks fell again, BTC pullback sentiment strengthened

In this regard, Su Yuan Yuxin translated the first time and presented it to everyone.

1. Economic growth dilemma : High levels of indebtedness + low interest rates in global economies will greatly limit the ability of major central banks to stimulate economic growth;

2. Internal conflicts: The huge gap between rich and poor and the corresponding political differences within each country have brought about deteriorating internal social and political conflicts;

3. External conflicts: As a continuously developing and rising world power, China is challenging the United States, which appears to be overwhelmed after excessive expansion. In the process, many geopolitical and trade conflicts have arisen.

Looking back at history, the period we are going through now is the period with the highest similarity between 1930-1945; we all know what happened during that period, and this is also very important for me to worry very much about what will happen next the reason.

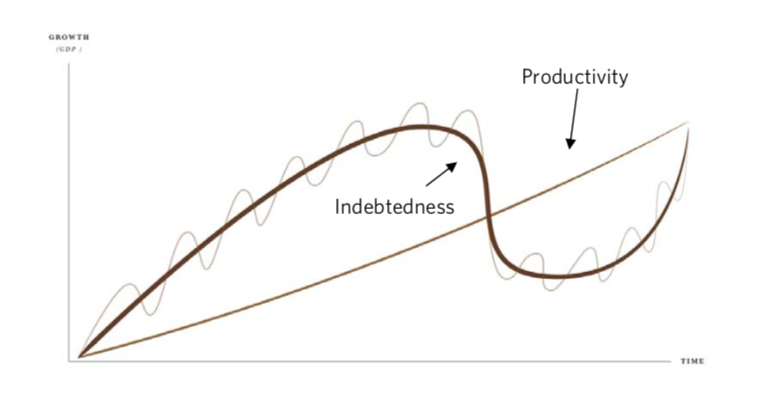

In the course of studying history, I saw the coincidence and intersection of two typical cycles, one long and one short, which are "transitional" cycles of about 10-20 years, and the following 50-100 years. Economic and political cycle. These economic and political cycles are composed of two elements:

1. The period of prosperity and prosperity: people with power live together in harmony and go hand in hand, and pursue the creation of wealth in a suitable and sustainable way;

2. A period of painful downward turbulence: Conflicts between various parties in the struggle for power and wealth create conflict, disrupting the harmonious development of the economy and the continuous improvement of productivity, and sometimes even leading to war and social unrest.

These shock periods are usually like a blizzard. Even if they cause a lot of damage and pain, they will solve the products caused by many weaknesses and excessive indulgence, such as excessive debt; and in the end will put market fundamentals Bring back to a more rational level. This will naturally produce a process of adapting to painful changes, which will eventually make us stronger and more flexible as a whole, although in the end there will be new and different world orders and new world forces that we are not familiar with.

How all this will happen, the answer can only come from studying and studying similar historical cases-for example, during the period 1930-1945, there were also the rise and decline of the British Empire and the Dutch dynasty, and the rise and fall of different dynasties in China. Wait. From these studies, we can dig up the understanding of the two questions “what are we going through now” and “what may happen next”. This is the purpose of a series of studies that I will publish next.

When I wrote this article, COVID-19 was raging as a global pandemic. This is also a major event that I have never experienced in my life, but repeated many times in history, which also promotes I keep learning and studying history to really understand what is happening now.

The first "big surprise" that the market gave me was in 1971, when I was 22 years old and worked as a bookkeeper in the New York Stock Exchange. On the evening of Sunday, August 15, 1971, President Nixon announced that the US dollar would depart from the gold standard system and no longer promised that the US dollar and each ounce of gold could be fixedly exchanged. The dollar plummeted. As I listened, I realized that the U.S. government had just defaulted on their promises, and the concept of "money" that we are familiar with might be completely over. I was screaming inwardly. When I went to work on Monday, I was thinking that the stock market could fall sharply, and there would be chaos in the trading floor. When I entered the trading floor, it was indeed a mess, but this was not caused by the stock market crash. The performance of the stock market was the opposite, and the overall surge was 4%. I'm stuck all over.

Then think about it, of course, because I have never experienced currency devaluation before, so I made a wrong prediction. In the next few days, I drilled into various historical documents and found that many cases of similar currency depreciation have similar effects on the stock market. After further research, I understand the principle behind this, and this valuable experience will help me to survive the market volatility and crisis again and again in the near future. But this is not the end of the story. I also experienced several painful "big surprises" before I truly faced the reality: I need to truly understand all the important economic and market events that have occurred in major global countries in the past 100 years. Events (big economic and market moves).

In other words, if there have been some major events in the past (such as the Great Depression of the 1930s), I ca n’t say with certainty that “this will not happen to me”, so I must study the mechanism of its occurrence and make corresponding actions. ready. Through my research, I found that many specific events of similar nature (such as various economic depressions) have repeatedly occurred in history. Like doctors studying different cases of many specific types of diseases, by studying them, I can learn more about the mechanism of their occurrence. The way I work is to study as many important cases of [specific events] as possible, and then in the process abstract a typical event, which I call an archetype.

Typical examples help me understand the causality that drives these events. Then I compare the relationship between a specific event and a typical paradigm to understand what is behind the difference. This process helped me deepen my understanding of causality, so that I could create a decision mechanism in the form of "if … then." (If / then) statements, that is, if X happens, then I bet Y. Then, I observed the actual events, and compared and measured them with the prototype template and corresponding expected values that we previously designed. At Bridgewater, my colleagues and I performed the above process in a very systematic and structured way. If things go smoothly, we will continue to bet on what usually happens next. If things go wrong, we will try to understand the reasons and gradually correct them.

My method is not a research methodology created for academic research; it is a very practical set of principles, and I rely on strictly implementing this set of principles to do my job well. As a global macro investor, my job requires me to have a deeper understanding of the workings of the economy and market changes than my competitors. During my years of playing with the market and trying to summarize a set of principles, I gradually learned:

1. The ability of investors to predict and respond to the future depends on their understanding of the causality behind changes in things

2. To understand causality, investors should study the past changes and performance of these things

For decades, Bridgewater's track record can measure the usefulness of this approach.

Looking at events in this way helps to shift my perspective away from the noisy event noise, and allows me to observe changes in the law over time from a perspective beyond this event. In this way, the more I know about the interconnected events themselves, the more I can discover their interactions. For example, how economic cycles interact with political cycles, and how they interact over longer time frames. I also learned that when I pay attention to the details, I don't see the big picture; when I pay attention to the big picture, I don't see the big picture. However, in order to understand these patterns and the causality behind them, I need to look at them from a higher level, a broader perspective and a more basic level, and look at the details in more detail, and examine the interrelationships between the most important market forces . In my opinion, it seems that most things develop upwards with the cycle (improved over time), like an opener up:

I believe that the reason why people often miss important "evolutionary moments" in life is that each of us can only experience a small part of the macro cycle and what happens now. In a way, we are just as busy as ants in moving bread crumbs in short lives, instead of global laws and macro cycles, the important and interrelated things that drive them, our position in the cycle, A broader view of what might happen.

From this perspective, I have already believed that only a limited number of individuals will continue to follow a limited path, causing them to encounter a limited number of situations and eventually produce a limited number of stories / events; these events will follow As time goes on, it repeats itself.

In this iterative process, the only thing that has changed is the identity / background of these individuals and the technology they use.

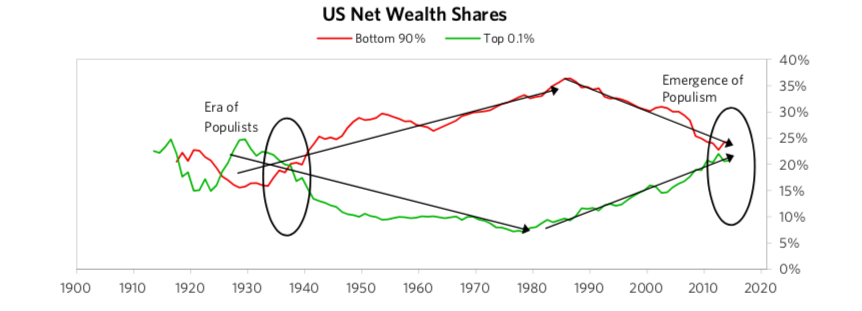

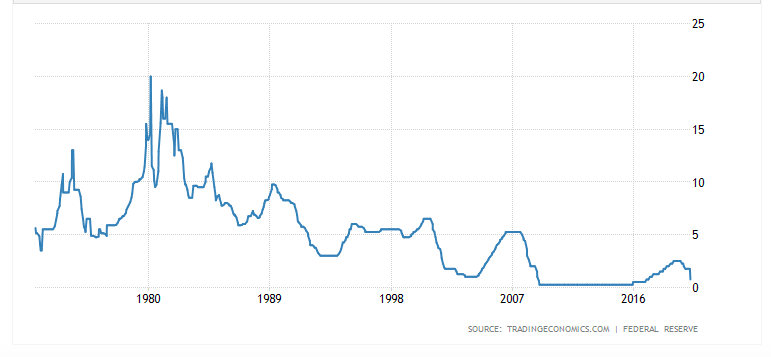

Studying the various currency and credit cycles that existed in human history made me aware of the existence of the [long-term debt cycle] (usually lasting about 50 to 100 years). This led me to analyze and understand what is happening now in a completely different way than in the past. For example, before interest rates reached 0%, the Federal Reserve issued a large number of banknotes, and purchased financial assets in response to the global financial crisis of 2008-09, I studied similar events and market trends that occurred in the 1930s. This allows our funds to weather market fluctuations and make profits. From that research, I also saw how the actions of these central banks have pushed up the prices of financial assets and revitalized economic performance. As a result, the gap between the rich and the poor has widened, leading to the populist and Various social conflicts. We are now seeing in the market the power to play the same role in the post-2009 period.

The report can be obtained by clicking the link at the end of the report, entitled: "Productivity and Structural Reform: Why Countries Succeed and Fail, and What Should Be Done So Failing Countries Succeed." [3]

Soon after Trump's election in 2016, as populism became more apparent in developed countries, I began to study the history of populism. For me, this highlights the wealth gap and the differences in values behind the profound social and political conflicts that are very similar to the differences in wealth and values during the Great Depression of the 1930s. In the course of my research, I also discovered why reformist (left) populists and conservative (right) populists tend to prefer nationalism, militarism, protectionism, and confrontationism, as well as this approach Terrible results in the end. I saw how strong the conflict between economic / political reforms and conservative claims can become, and the strong negative impact of such conflicts on the economy, markets, wealth, and power. This gave me a better understanding of what was happening in the past and now.

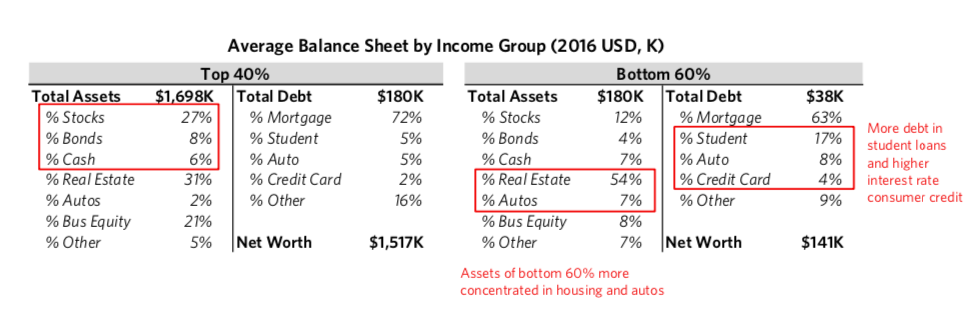

By conducting these studies and observing what is happening around me, I find that Americans are experiencing huge gaps in economic conditions; these gaps are often covered by smoke bombs of [economic average]. Therefore, I divided the economic level into five equal parts. By looking at the top 20% of the population, all the way down to the bottom 20%, and then studying the situation of these groups separately. This led to two studies.

The United States is now approaching similar levels [4]

"Our Biggest Economic, Social, and Political Issue: The Two Economies—The Top 40% and the Bottom 60%" [5]

"Why and How Capitalism Needs to Be Reformed" [6]

At the same time, through my investment and research in other countries over the years, I have seen tremendous changes in the global economy and geopolitics, especially in China. In the past 35 years, I have been traveling to China to do field research and surveys. I have been fortunate to have met some senior Chinese policy makers. This helped me get a closer look at China's great achievements and its capabilities and historical perspective. These outstanding capabilities and foresight have made China an effective competitor to the United States in production, trade, technology, geopolitics, and world capital markets.

By the way, you can read these studies for free at www.economicprinciples.org.

The reason I write these things is because I need to research and understand the important events that are happening. These events have never happened in my life, but have happened repeatedly many times in the course of history. These important events are caused by changes in the three major forces and the problems they cause.

THE LONG-TERM MONEY AND DEBT CYCLE

- Naturally, I wonder why anyone would want to hold a bond with a negative interest rate (purchase $ 100 and pay $ 98), and to what extent can the interest rate be lower in the case of a negative interest rate?

- I also want to know what will happen if the economy and markets cannot be depressed?

- When the next economic downturn is inevitable and we are facing negative interest rates, how will the central banks play their due role in stimulating the economy?

- Will the central bank issue more currency, causing its value to fall?

- What happens if the settlement currency used for debt depreciates at such a low interest rate?

- These questions led me to further ask myself, what measures will the central bank take if investors flee bonds that are settled in the world's common reserve currencies (that is, the US dollar, euro, and yen)? This is a problem that central banks must take seriously, considering that the currency used to repay bonds has depreciated while the bonds paying interest have been at negative interest rates.

Adding a little background, reserve currency is the world's recognized trading and savings currency. Countries that can print the world ’s major currencies (now the United States) enjoy privileges and are in a very strong position. Debts denominated in world reserve currencies (that is, debts denominated in U.S. dollars) are to achieve the smooth operation of the world's capital markets and stable economic development. The most basic elements of a goal. In the past history, basically all the status of the "world reserve currency" was inevitably ended; and for countries that enjoy this special privilege (printing the "world reserve currency"), this end is often Can lead to very bad endings. Therefore, I also began to doubt and think about whether, when and why the dollar will decline and end in the process of becoming the world's leading reserve currency, and how this will change the current world pattern and economic situation.

THE DOMESTIC WEALTH AND POWER CYCLE

In addition to the inefficiency of these traditional tools (cutting interest rates), printing additional banknotes and buying financial assets (now called “quantitative easing”) has also widened the gap between the rich and the poor, as buying financial assets will drive up the prices of these assets, It is often the rich, not the poor, who can buy financial assets.

THE INTERNATIONAL WEALTH AND POWER CYCLE

The simultaneous appearance of these three forces aroused my curiosity. In my research, I began to focus on similar periods in which three forces appeared simultaneously, such as the period 1930-45 and many similar historical periods.

For a detailed example:

- Serious debt and economic crises occurred in both the years 1929-32 and 2008-09. In both eras, the interest rate reached 0%, which greatly restricted the ability of the central bank to stimulate the economy by reducing interest rates. Therefore, both central banks printed a large amount of currency to purchase financial assets. This behavior eventually led to the financial crisis, and the gap between the rich and the poor was extremely widened due to rising asset prices.

- In these two periods, the huge wealth and income gap led to a high degree of political polarization , in the form of a larger populism. And the struggle between leftist radical populists led by [socialists] and rightist radical populists led by [capitalists]. As emerging powers, such as Germany and Japan in the 1930s, increasingly challenge existing world powers, these internal conflicts will slowly heat up and sprout.

- Finally, as today, the fusion of these three forces means that it is impossible to understand any of them without understanding the overlapping effects of any of them.

In order to understand what these three forces themselves and the fusion of the three might mean, I looked at the rise and fall of all the major empires and their currencies over the past 500 years , with the three most closely watched: the United States and now The most important US dollar, the most important British Empire and British pound before, and the older Dutch Empire and Dutch Guilder. I also looked at six very important but relatively less dominant empires: Germany, France, Russia, Japan, China, and India. Of these six countries, I paid the most attention to China and reviewed its history 600 years ago because:

1. China used to have a very important position in the entire history of mankind, and its status is still very important, and it may become even more important in the future;

2. Its rich history provides many examples of the rise and fall of the dynasty, which can help me better understand the natural laws and the driving forces behind them.

After studying these cases, I found that a larger narrative emerged, the most important of which were technological innovation and natural disasters, which played an important role in promoting the rise and fall of these empires. By examining the cases of different empires and different periods, I find that the important empire cycle usually lasts about 150-250 years, and in this cycle, huge economic, debt and political cycles last about 50-100 years. By studying the impact of these changes, we can abstract an [typical example] of an average level, and then we can study how they work in different ways based on this, and the reasons for change. It inspired me a lot. But the challenge I face is to find a way to communicate so that everyone can understand.

I have more questions than answers, and I know that I am delving into some areas that I have tried to make sense of in my lifetime. Therefore, I actively and humbly absorbed the knowledge of some outstanding scholars and practitioners, each of whom has an in-depth understanding of some aspects of this difficult problem, although no one has the comprehensive understanding and talents I need to fully answer All my questions. To understand all the causality behind these cycles, I combined the following three:

- Historians (they specialize in different parts of complex history)

- Decision makers (both practical and historical)

- Statistics (extracted by reading our ancient and contemporary clerks and archives by our brilliant research team)

Although I have learned a lot that I can make full use of, I realize that in order to be confident about my future development and prospects (enough to invest in the future), all I know at present is only a small part of what I should know. However, I also know from experience that if I wait until I learn enough to be satisfied with my knowledge, I will never be able to use or communicate what I have learned.

Therefore, readers are requested to understand that this research is based on a top-down and big-picture perspective, providing you with my past research results and uncertainty about the future. Very low-confidence outlook for the future. You should take the conclusion here as [theory] rather than [fact]. Also keep in mind that despite so many assumptions and prudent perspectives, I still make very, very many mistakes, which is why I put the most emphasis on asset diversification in my investments. Therefore, whenever I present my ideas to you, as I did in this research, please realize that I am doing my best to communicate my ideas openly to you.

You can evaluate the value and right of my research and use this knowledge to do things that interest you.

Part 1 summarizes everything I learned in my research on the rise and fall of the empire in a very simplified archetype, which I derived after studying specific individual cases. To make the most important concepts easy to understand, I will write them in vernacular, advocating clarity rather than precision. Some of my words are generally accurate, but not always. (I will also highlight key phrases in bold so you can read them and skip the rest to get a quick idea)

First, I abstracted my findings into indexes of the total strength of different empires, thereby summarizing how the powers of different empires rose and fell, and changed; this index consists of eight indicators representing different types of strength. Then I explained these different types of strengths so that you understand how they change, and finally I discussed what I think it means for the future.

Part 2 introduces all individual cases in more depth, using the same index to indicate the replacement and strength changes of all major empires in the past 500 years. Displaying information in this way can make you understand the changing principles behind these ups and downs when you read Part 1. Then choose whether to enter Part 2 and see these interesting cases in a separate and contrasted way. In addition, you can take the data and case studies from Part 2 and go to the rebate control to analyze the templates explained in Part 1. My suggestion is to look at both parts, because these world powers analyzed in Part 2 and their grand narrative behind their evolution over the past 500 years are very exciting.

This story presents a sequential picture of the evolution of world order through the following events:

The rise and fall of the Dutch Empire, followed by the rise and decline of the British Empire, followed by the rapid development and early decline of the United States, and finally the rise of China in China. It also compares the three world powers with the historical prosperity and decline of Germany, France, Russia, Japan, China, and India.

As you will see in each analysis, although not exactly the same, they all roughly follow a certain pattern and cycle. In addition, I hope that you will take the time train like me and discover the story of the rise and fall of the ancient Chinese dynasty from 600 AD to today and be fascinated by it. By studying the history of the dynasty, I learned the similarities between the rise and fall of the Chinese dynasty and the rest of the world (most of them), and also helped me understand the differences (this is what makes China different from the West the reason). This also gave me a deeper understanding of the views of Chinese policy makers (leaders), who have carefully studied these dynasties, learned lessons, summarized experiences, and created new methods and capabilities.

Frankly, I don't really know how to understand what is happening now and what is going to happen next without studying all the history of the past. But before introducing these fascinating individual cases, let's take a closer look at the archetypical case we mentioned above.

(To be continued)

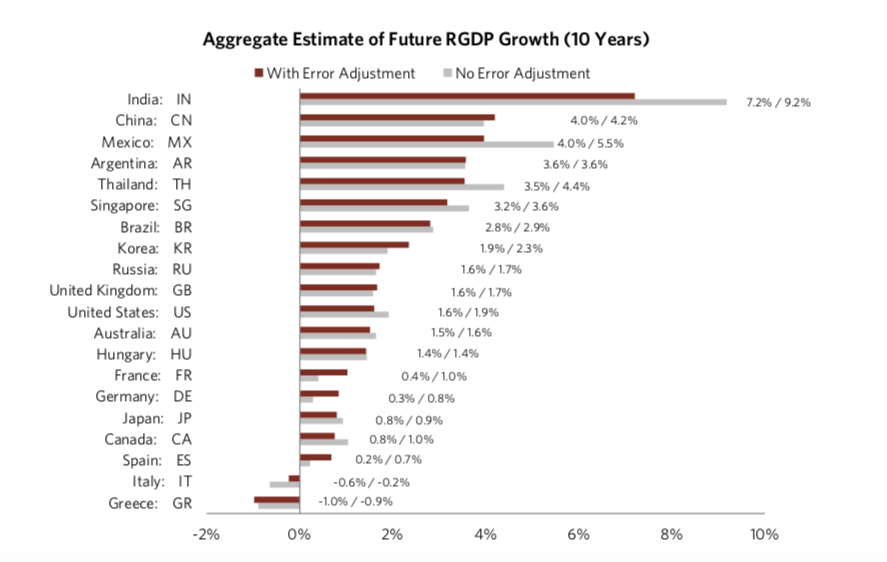

[2] Bridgewater Fund's forecast of 10-year economic growth rates of various countries

source: https://economicprinciples.org/downloads/ray_dalio__how_the_economic_machine_works__leveragings_and_deleveragings.pdf

[3] Productivity and Structural Reform: Why Countries Succeed and Fail, and What Should Be Done So Failing Countries Succeed.

https://economicprinciples.org/downloads/ray_dalio__how_the_economic_machine_works__leveragings_and_deleveragings.pdf

[4] source: https://www.bridgewater.com/resources/bwam102317.pdf

[5] "Our Biggest Economic, Social, and Political Issue: The Two Economies—The Top 40% and the Bottom 60%" https://www.bridgewater.com/resources/bwam102317.pdf

[6] "Why and How Capitalism Needs to Be Reformed"

https://www.economicprinciples.org/Why-and-How-Capitalism-Needs-To-Be-Reformed/

[8] source: https://www.bridgewater.com/resources/bwam102317.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understand the difference between token financing and equity financing

- Analysis: Ethereum, the largest "air coin" in the industry?

- Digital Dollar Foundation: America Needs Real "Digital Dollars"

- Will the USDT market cap exceed Bitcoin? Stablecoin has become a strategic highland of blockchain

- Blockchain and agency risk: we just need to trust the code

- Ethereum core developer: MPT hex tree will be replaced

- BKS officially logs in LBANK! Airdrop candy show!