Understand the difference between token financing and equity financing

Author: Huangbing Jie, distributed capital

As the token market gradually cools down, market liquidity decreases, and token financing becomes difficult. In order to survive the cold winter, more and more blockchain projects have embarked on the path of traditional equity financing.

But for many blockchain practitioners, equity financing may be relatively new. Especially for many community-based projects, the team has rich experience in token financing, but no equity financing experience, which makes them a little helpless or even suffer a big loss in the process of equity financing.

So, what are the differences between token financing and equity financing? We have combined many years of experience in equity financing and token financing, and summarized the following points, hoping to help teams with equity financing needs:

- Analysis: Ethereum, the largest "air coin" in the industry?

- Digital Dollar Foundation: America Needs Real "Digital Dollars"

- Will the USDT market cap exceed Bitcoin? Stablecoin has become a strategic highland of blockchain

I. Financing Amount

For early blockchain projects (early refers to products that have not been launched or the market has not been verified, most blockchain projects fall into this category), the financing amount through equity financing is expected to be less than the financing amount through token financing.

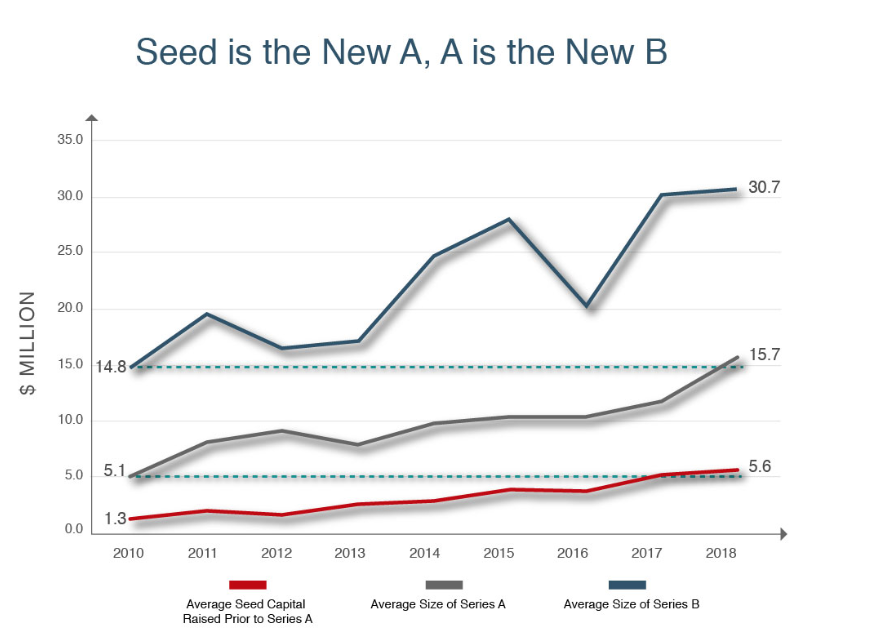

(Source: Wing)

The above is the average value of equity financing in recent years. It can be seen from the figure that although the financing amount of equity financing is also increasing year by year, the average financing amount of the seed round in 18 years is only $ 5.6 million. According to the report of PWC, the average financing amount of the first token issuance in the same year was as high as 25.5 million US dollars, which is about 5 times the financing amount of the equity seed round! Only slightly lower than the financing amount of traditional equity B round financing. Of course, according to Cruchbase, there are also some super-large seed round projects in equity financing. These projects are called "Supergiants". The financing amount of these supergiants can be as high as 10-20 million US dollars, but through the first pass The EOS ratio of $ 4.1 billion was released, and these "super giants" can at best be regarded as the super giants of the villain country.

So in general, project teams that are accustomed to token financing, if your products and market are still in their infancy, generally need to reduce their expectations of financing when seeking equity financing.

However, a low initial financing does not mean that the total amount of financing through equity financing is also low. The fundamental reason is that equity investment comes round after round. General projects need to go through seed rounds, A rounds, B rounds, C rounds … Each round will inject new funds, and at the same time each round has its approximate index and investment amount range. This is done to protect investors, and at the same time to give the project party sufficient pressure and motivation. If the project develops well, the final amount of equity financing will not be lower than the token financing.

Therefore, when seeking equity investment, it is not necessary to stick to the original financing amount expectations, so as not to miss precious financing opportunities because the expectations of the two parties are too large. Generally speaking, the financing amount should be able to meet the team's operation and growth plan for about 2 years. Therefore, when the team puts forward the expected financing amount, they can prepare a plan for the use of funds and the expected goals to support the expected financing amount.

Second, the transfer ratio

Relative to token financing, when doing equity financing, the proportion of equity transferred can be "generous." The reason to be generous to equity investors is not because equity investors are more expensive, but because equity can be diluted, and tokens cannot! The proportion of equity investors will gradually decrease in subsequent financing, with more capital and investors joining; and subsequent investors in token financing will not affect the proportion of existing investors.

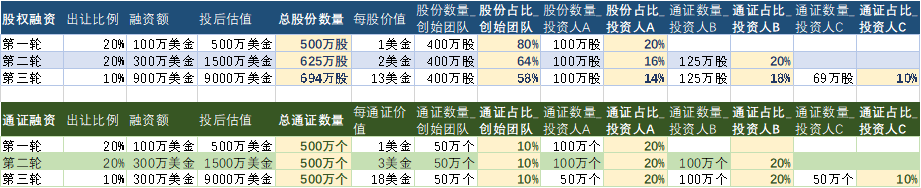

The following will use an example to show the dilution effect of equity financing more intuitively for everyone.

Suppose the same company is in two parallel worlds: in one parallel world, this company chooses equity financing; in the other parallel world, this company chooses token financing. We know that token financing needs to formulate a token distribution scheme in advance. This company chose to refer to Bancor's scheme. This is a typical scheme of a blockchain project. The specific scheme is as follows:

The company currently has three rounds of financing:

The first round: the founding team sold 20% of the shares / tokens to investor A at a valuation of 5 million US dollars in exchange for 1 million US dollars of investment

Second round: The founding team transfers 20% of the shares / tokens to investor B at a valuation of 15 million U.S. dollars in exchange for 3 million U.S. dollars in investment

Third round: The founding team transferred 10% of the shares / tokens to investor C at a valuation of 90 million US dollars in exchange for 9 million US dollars of investment

The following table will show you the changes that equity financing and token financing will bring to the project equity / token structure after three financings:

From the above table we can observe several points:

1. If token financing is used, the proportion of the founding team is determined in advance and is not affected by subsequent financing; and if equity financing is used, the team's equity proportion is gradually reduced and released.

2. After accepting the new investment, the shares of the original equity investor will be diluted with the founder's shares. If the valuation increases more slowly, the dilution rate will be faster; the proportion of token investors will not be subject to subsequent financing. Impact. Therefore, the initial transfer ratio of token financing is more “valuable”.

3. The key reason for the dilution of equity is that the total number of shares will increase with subsequent financing; however, in token financing, the total amount of tokens is not affected by subsequent financing.

4. In theory, equity financing can be carried on indefinitely according to financing needs, so equity investors may theoretically be infinitely diluted. For token financing, in principle, if the team has used all available tokens for financing, the team will have no more tokens to use for financing.

In general, equity financing brings more flexibility to the team's subsequent financing, and due to the dilution effect, the final proportion of equity investors will be lower than its initial proportion. It is worth noting that in the above example, after three rounds of financing, although the team literally sold 50% (20% + 20% + 10%) of the shares, it eventually owned 58% of the shares. The difference between 58% and 50% comes from the diluted part of the original equity investor.

Therefore, compared with token investors, equity investors generally require a higher transfer ratio. How high is that reasonable? According to YC research, in general, it is reasonable that the proportion of round A is around 20%. If the founder can guarantee that the funds are sufficient, he only needs to transfer 10%. Of course, this is very good, but if the market does not allow it, there is no need to be persistent, leading to the loss of valuable development time. In addition, the team should try to avoid more than 25% of the A round release, which may cause disadvantages for the team in subsequent financing. If the team plans to melt the seed round before the A round, the distribution ratio between the seed round and the A round can be flexibly allocated. Generally, the transfer rate of the seed round is 10-15%, but the total transfer rate of the seed round and the A round needs to be as much as possible. Less than 30%.

Another point to mention is that once the financing amount and the transfer ratio are available, a valuation can be launched (valuation = financing amount / transfer ratio). This inverted valuation has important reference significance. Many project owners think that investors just want the cheaper the better the project, but this is not entirely the case , because if the project valuation is too low, it may cause two situations: 1. The financing amount is too low, which makes it impossible to achieve the growth plan; 2. The equity transfer ratio is too high, which causes problems with subsequent control. Both of these situations are very detrimental to the success of the project, and investors are not willing to see it. On the other hand, many project parties also believe that higher valuations are more beneficial to project parties, but this is not the case. In equity financing, there is a very scary thing for the project party, called: Downround (discount valuation)! That is, the next round of project valuation is lower than the previous round, which will not only make the existing Investors are extremely unhappy (because they will be greatly diluted), and it is easy to cause new investors to doubt the project's prospects, eventually leading to the death of "new father ignores, old father does not love". Therefore, when it comes to equity financing, especially in the early days, it is not necessary to blindly pursue high valuations. As a result, the company has become a big doll with a high mortality rate. Therefore, both the investor and the project owner, reasonable valuation is very important. The valuation derived from the financing amount and the transfer ratio can be the starting point for determining a reasonable valuation.

3. Financing documents

Pre-investment documents

Pre-investment documents refer to the documents that the investor will ask the project team before determining the investment. It is best for the team to start preparing these documents once a financing plan is in place. For token projects, the most important pre-investment document is the white paper, which is not repeated here. For equity projects, there are several general pre-investment documents:

1. Project introduction : The project introduction can be understood as a paragraph introduction (or Elevator Pitch). The project profile is prepared to facilitate the project team and FA to forward the project information in WeChat or email. The focus of the project brief is short and important highlights are in place.

2. Project summary : The project summary can be understood as One-pager, which is to summarize several key sections of the project (market, product, technology, business model, operation, team, etc.), and summarize them in an A4 with the highlights as the destination. On paper. When the investor says, "Is there any materials you can send to see", you can package the project summary and Deck and send it to him / her. Because it takes far less time to browse the project summary than to view the Deck, even if some investors do not have time to look at the Deck, he / she may glance at the project summary. Therefore, attaching a project summary can increase the probability that the project will be noticed by investors. It is also recommended that when using WeChat to send the project summary, it is recommended to save the project summary as a picture.

3. Deck : Deck is the highlight of the pre-investment document. Sometimes it is also called a business plan. Relative to the project summary, Deck needs to show the project more comprehensively in each section (market, product, technology, business model, operation, team, etc.). Generally use PPT to do it. Deck can be used for circulation between investors, and can also be used as a support for the team to introduce the project to the investors after the project team meets the investors.

4. Financial forecasting models : accurate financial budgeting models are not required (and accurate forecasting models are not possible), but some key values need to be in mind and there are sufficient reasons to support them, such as turnover, operating growth rate, Various costs, etc. When making financial forecasting models, it can also help the team sort out the key issue of "financing amount" mentioned above.

5. Demo : Not required, but if there are, points will generally be added.

6. Due diligence materials : Due diligence materials are materials that are required from the team after the investor contacts the team and is interested in the team. Generally speaking, due diligence materials are more detailed and richer than the above materials. A detailed list of due diligence materials will be issued by the investor. Generally speaking, due diligence materials will include basic materials such as company registration certificate, shareholding structure table, key contracts, and labor contracts for key positions.

Judging from the documents mentioned above by investors, you may have noticed that relatively speaking, token investors value technology more, while equity investors consider commercial feasibility more.

Delivery documents

The delivery document for token financing is usually SAFT (Simple Agreement for Future Tokens). Equity can be a bit more complicated. Here are some common equity delivery documents:

1. Term Sheet (also known as TS). Although TS is listed here as the delivery document, it does not actually have legal effect. Even so, TS is a very important delivery document because the investor and founder team can negotiate key terms during the TS phase. The following clauses will be finally written into the formal investment agreement , and the investment agreement will only take effect when the two parties sign the formal investment agreement. To some extent, the function of TS is similar to the "admission notice" in the job search process. It is a gentleman agreement. Although it has no legal effect, in general, investors who have signed TS have indicated their willingness to invest.

In addition, since it comes to terms negotiation, here by the way, the important financing terms in token investment include lock-up period, release ratio and discount, etc. In equity financing, although the ultimate purpose is to protect the exit, but due to equity The process from the seed round to the IPO is long and the liquidity before the IPO is poor, so the specific mechanism for protecting the exit is different. Generally speaking, equity investors will pay more attention to Liquidation Preference and dilution protection. In addition, compared with token investors, equity investors are generally closer to the project and have a longer accompany time. Therefore, some equity investors, especially those who account for a relatively large amount of equity, attach great importance to those Terms related to the company's operations, such as director seats, Protective Provisions and Drag Along.

2. A formal investment document, which is an investment agreement with legal effect. Formal investment agreements vary according to the financing instruments (financing instruments include: convertible bonds, preferred shares, convertible preferred shares, ordinary shares, etc.) and investment rights. The full set of equity and preferred stock investment agreements is more complicated, and it is recommended to find a lawyer. If the team does not have a too high budget for attorney fees, you can also consider Convertible Notes and Simple Agreements for Future Equity (SAFE, YC SAFE template link). For blockchain projects, our most recommended legal document is SAFE-TO (Simple Agreements for Future Equity with Token Option) . As the name suggests, this is the SAFE with additional ownership of the token . This kind of document allows investors to acquire the same proportion of tokens as they purchase equity. Theoretically, both the token and the equity represent a part of the value of the company, so investors will inevitably worry that the project team will turn their left and right hands through the token and equity. For example, the team will use the profits that belong to the equity investor for token repurchase. . SAFE-TO is essentially a bundled sale of equity and tokens. This method is reasonable, and it can also eliminate investor concerns and make project financing smooth.

Key points summary

1. Project teams that are accustomed to token financing generally need to reduce their expectations of financing when they seek equity financing in the early stages, so as to avoid losing valuable financing opportunities due to the large difference between the expectations of both parties. Generally speaking, the amount of financing needs to be able to meet the team's operation and growth plan for about 2 years.

2. Compared with token investors, equity investors generally require a higher transfer ratio because equity will be diluted and tokens will not. Generally speaking, the transfer rate of the seed round + A round is reasonable under 30%.

3. For the project party, the higher the valuation, the better. Reasonability is the most important. Valuation derived from the required financing amount and transfer ratio is an important valuation reference.

4. Compared with token investors, equity investors focus more on the evaluation of commercial feasibility, so they can be inclined when preparing financing materials. For delivery documents, it is recommended to give priority to SAFE-TO (Simple Agreements for Future Equity with Token Option).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain and agency risk: we just need to trust the code

- Ethereum core developer: MPT hex tree will be replaced

- BKS officially logs in LBANK! Airdrop candy show!

- KPMG 2019 Global Fintech Pulse Report: Blockchain is still a key investment area, large companies and governments have already acted

- The annual salary is as high as that of Goldman Sachs. The screen launches a battle to grab people. The first blockchain cloud recruitment will ignite "Golden Three Silver Four"

- Hunan Province announces 16 key projects for blockchain industry development

- Depth | Business opportunities brought by ABCDI in the era of digital new infrastructure