Report | Uncovering the currency circle to quantify team operations

Overview Overview

Regardless of the market, the proportion of institutional investors has become a measure of the maturity of an investment market. “De-stocking” will also be a win-win situation for individual investors and institutional investors. The digital money market will also become more rational and more long-term investment value, rather than an irrational market dominated by individual investors. . The investment market is always a professional person to do professional things, only to have a profitable effect.

Market analysis

The standard consensus issued the secondary market market judgment on August 28 and September 6, respectively, which is “the market down expected increase” and “the market will be tested if there is no new funds to enter the market” to indicate the market down risk.

There was a significant drop on August 29 and September 7. Taking BTC as an example, on August 29th, BTC closed down by $730, a decrease of 7.12%; on September 7, BTC closed down by $385, a decrease of 3.56%.

- Bakkt physical bitcoin futures contract is launched soon, trading margin requirements surfaced

- Bitcoin fell below the convergence triangle, and there was no obvious bearish signal in this round of decline.

- In addition to halving expectations and institutional entry, Bitcoin eventually won the world's top five reasons

If the standard consensus secondary market report is issued at the time of short opening, the BTC short-selling price is $10,150 on August 28, and the maximum return is 8.5%; on September 6, the BTC short-selling price is $10,700, although the BTC is still in a downward trend. Within the current range, the maximum revenue is 5.6%. However, the actual BTC price today has no significant change from the August 28 BTC closing price.

Part of the factors that standard consensus analysts make judgments are based on quantitative trading strategies. Taking BTC as an example, there was a significant MACD divergence trend on the hourly lines on August 29 and September 6, indicating a significant increase in the probability of a short-term decline.

MACD top divergence: The high point of the price index is higher than the previous high, while the high point of the MACD indicator is lower than the previous high, which creates a top divergence. It means that the rising kinetic energy is exhausted and the probability of falling is rising.

Quantitative strategies are not omnipotent, time-sensitive and cyclical, and require constant adjustment and follow-up. This requires a long period of empirical judgment and professional analysis. Even if you judge the right direction, you can't judge how much profit will be, because the market is constantly changing every moment, so you make money?

Who is your opponent?

First, the US market

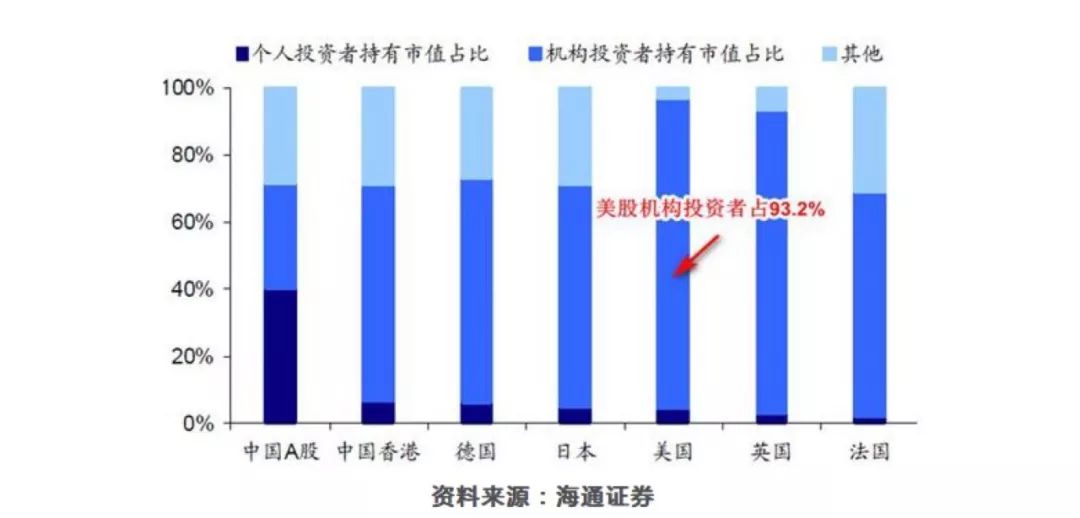

Haitong Securities research report shows that in the middle of 2018, US institutional investors held a market value of 93.2%, and individual investors held less than 6% of market capitalization. As early as 1929, the market share of tradable shares held by retail investors in the US stock market was over 90%.

Market share of various investors in major global stock markets

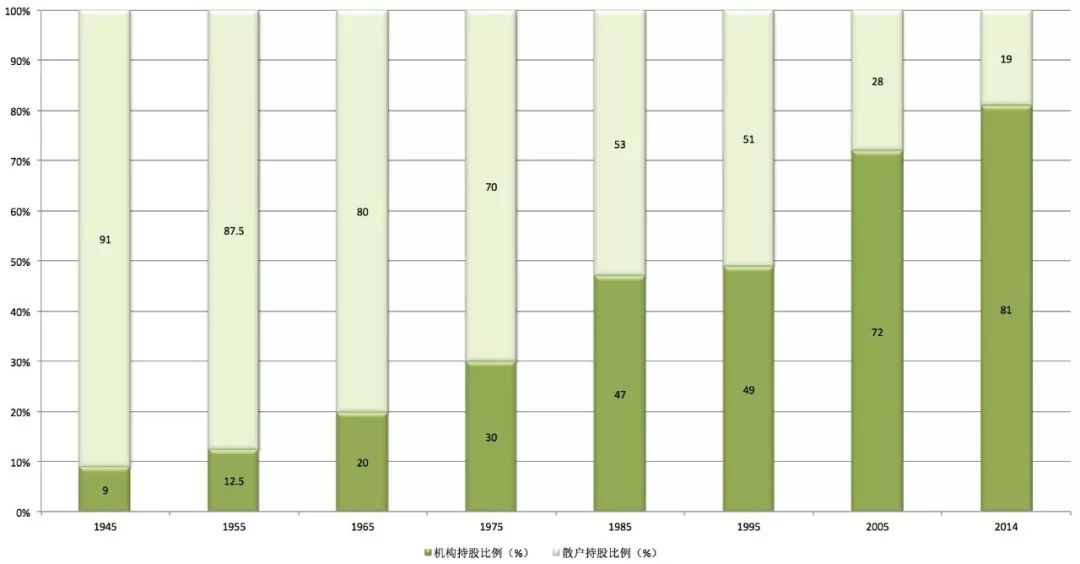

US investor structure changes 1945-2014

In the mid-1970s, the path of US stock retailers became narrower and narrower, and the proportion of institutions continued to be high. In recent years, the trading mechanism has become more complicated. The use of high-frequency trading and quantitative hedging has enabled institutional investors to provide technical support and information. Acquisition, professionalism and other aspects occupy a greater advantage. The investment ability of individual investors in the capital market is weaker and the income is far lower than that of institutional investors.

Second, the Chinese market

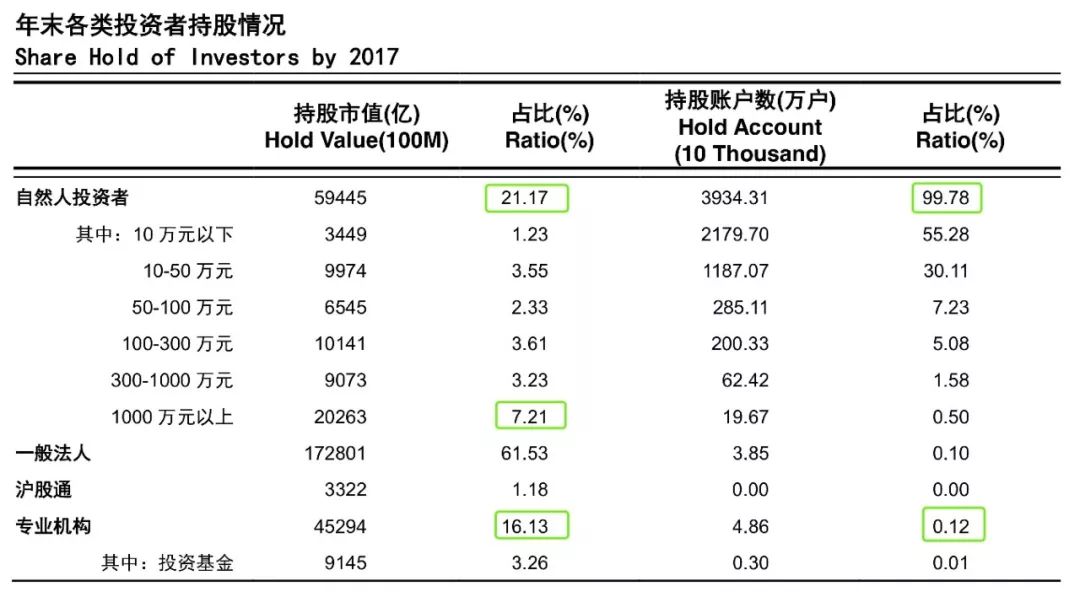

According to the Shanghai Stock Exchange Statistical Yearbook (2018) published by the Shanghai Stock Exchange, as of December 31, 2017, from the number of shareholding accounts, there were 195 million investors in Shanghai stock market, including 194 million natural person investors. More than 99%. Then, from the perspective of the stock market value, natural person investors hold a stock market value of 5.94 trillion yuan, accounting for only 21.17% of the total market value.

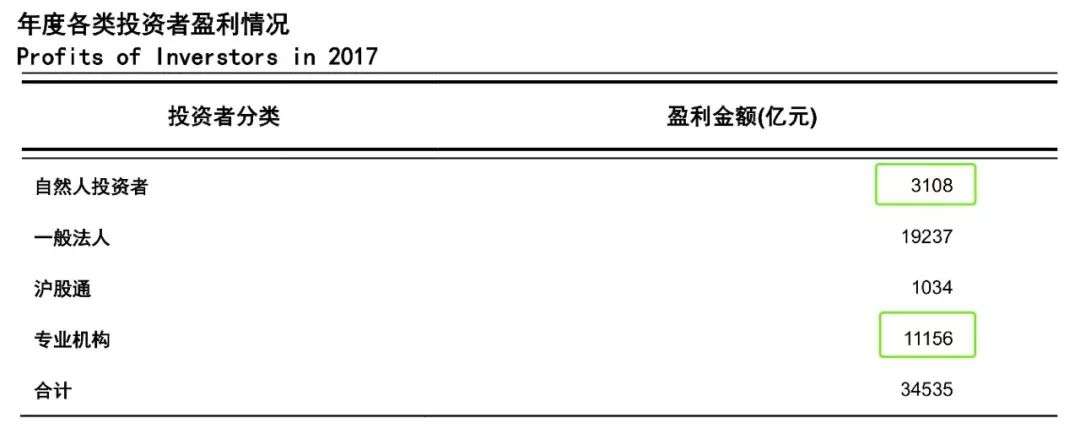

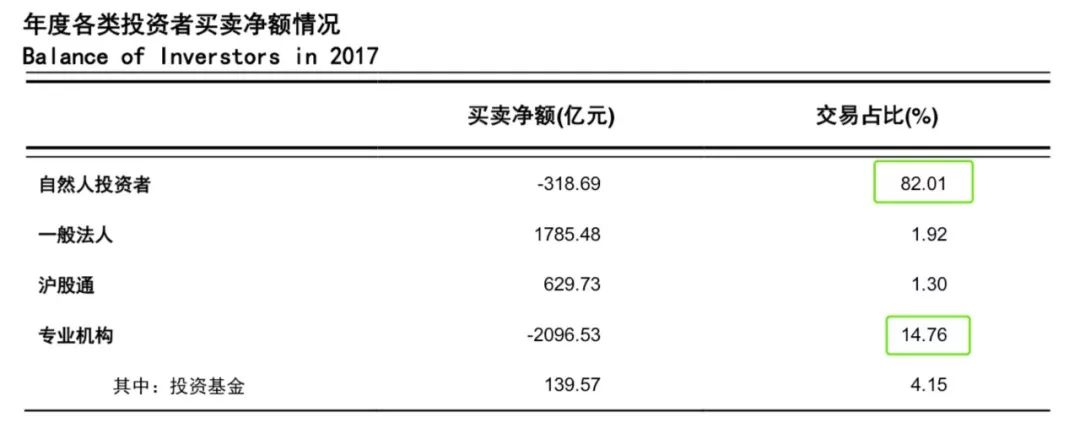

The Yearbook shows that in 2017, individual investors in the Shanghai stock market contributed 82.01% of the transaction volume, while institutions accounted for only 14.76%. Although individual investors contribute more than five times the amount of institutional investors, they are less than 30% of the institutions. Among these individual investors, investors accounted for 7.21% of the total investment of more than 10 million yuan. This part of personal investment has raised the profitability of the overall individual investors to a certain extent.

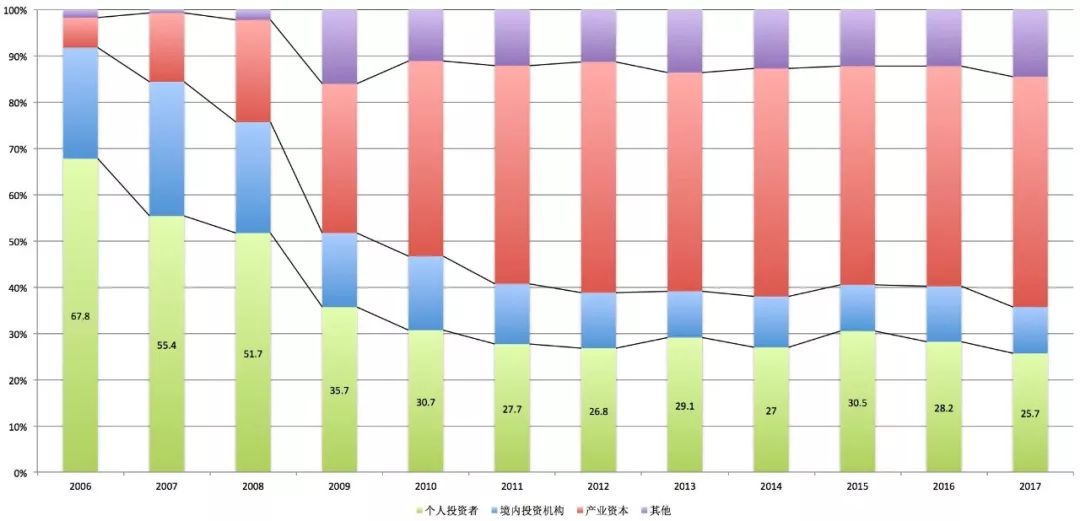

The process of “de-stocking” in China’s stock market is also continuing

Third, the BTC market

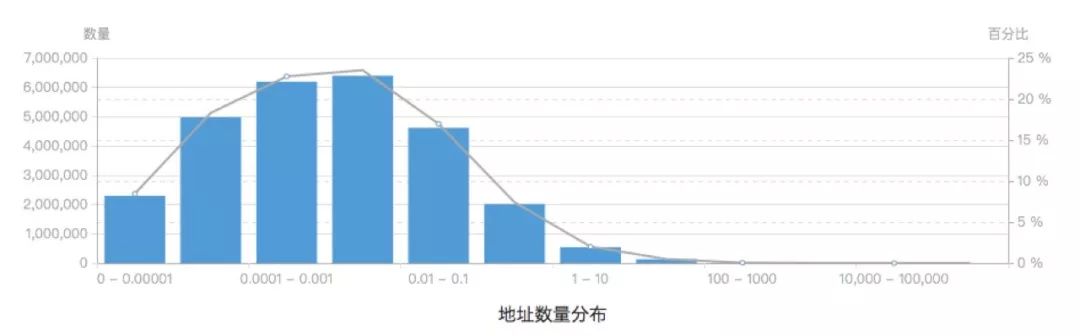

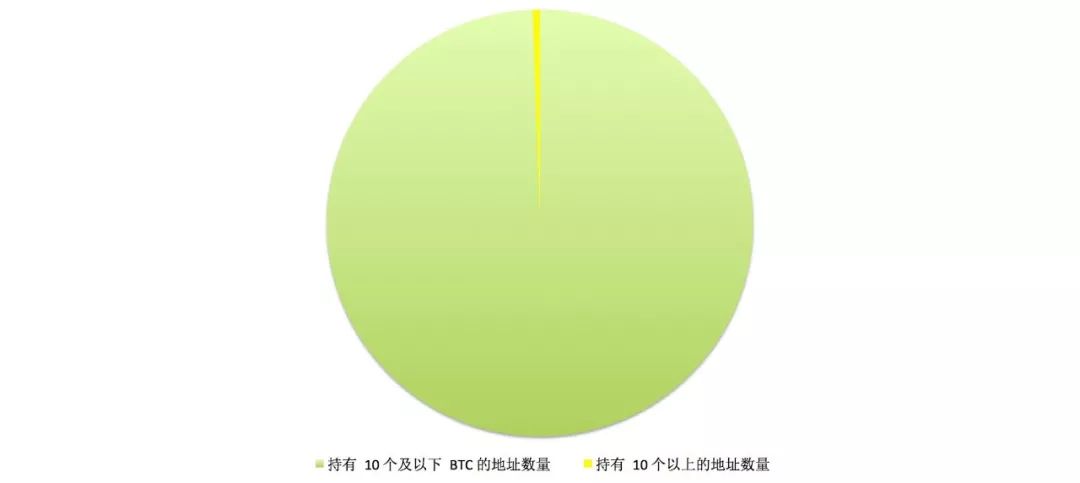

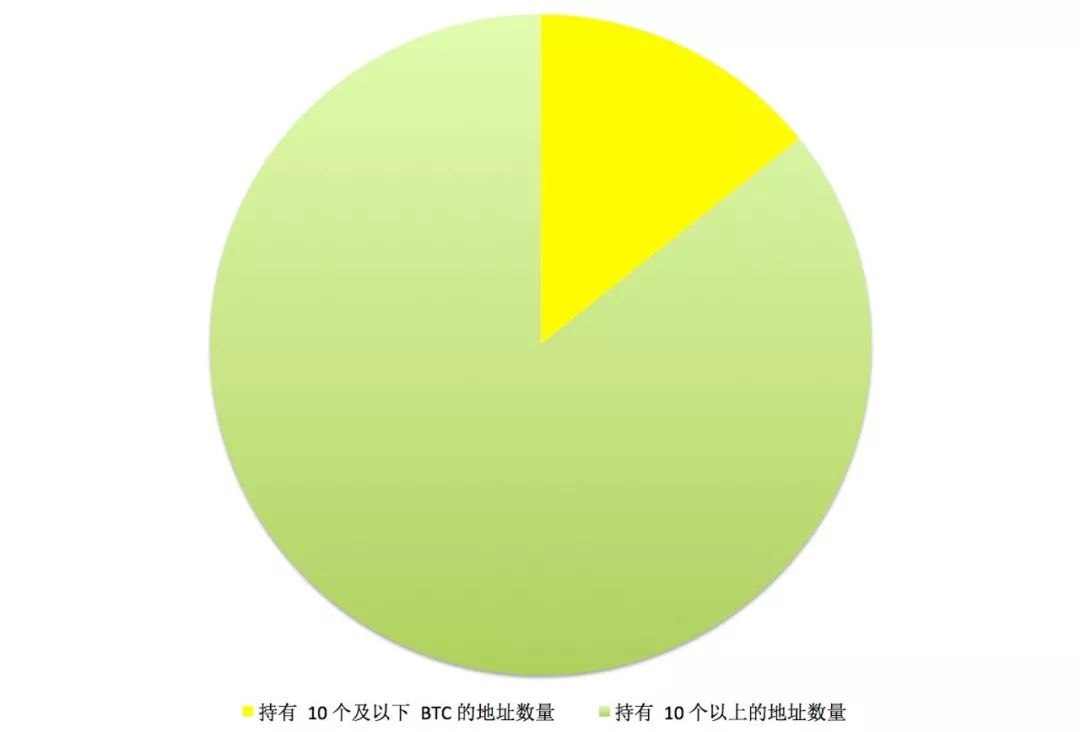

According to the BTC.com data, the number of BTC addresses is 27,198,146, and the number of addresses holding less than 10 BTCs is 27,051,276, accounting for 99.46% of the total.

The total number of BTCs held at 10 and below addresses is 2,563,453.96, accounting for 14.30% of the total BTC, while the number of BTCs holding more than 10 BTC accounts for 85.70% of the total BTC.

The overall state of BTC market investors is the same as that of China's stock market, with more than 99% of individual investors accounting for a relatively low total market capitalization. It is concluded that the income of individual investors in the BTC market is far lower than that of institutional investors, and the BTC market will also enter the process of “de-stocking”.

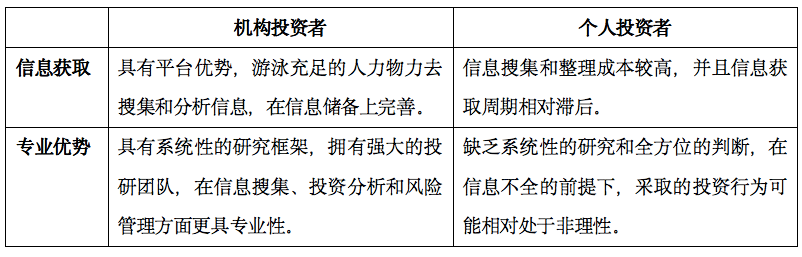

4. Comparison of institutional investors and individual investors

Conclusion

Regardless of the market, the proportion of institutional investors has become a measure of the maturity of an investment market. “De-stocking” will also be a win-win situation for individual investors and institutional investors. The digital money market will also become more rational and more long-term investment value, rather than an irrational market dominated by individual investors. . The investment market is always a professional person to do professional things, only to have a profitable effect.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin and altcoin hoarders can really enjoy the "sleeping" profit?

- Getting started with blockchain | Another "Zhongben Cong"! How can I prove that "I am Sakamoto?"

- Why are you better holding a BTC this year?

- The interest rate cut is superimposed on the trade war. Why is Bitcoin rising hard to become a safe haven?

- Bitcoin computing power has reached 10 billion, a record high

- Bitcoin hits 12,000 US dollars on the station, the reason is actually the main force of 1.7 billion funds

- Bakkt's ambition and dilemma