Why are you better holding a BTC this year?

I had to write other content, but I just saw the news that the Argentine peso had plummeted again. I felt it necessary to talk about it again: Why do you want to hold a BTC this year?

Let me talk about the news of Argentina first.

On Monday, a general election for Argentina, Argentina, staged a stock, debt, and three kills.

In the stock market, the main index of Argentina's Merval index fell more than 38% in intraday trading;

- The interest rate cut is superimposed on the trade war. Why is Bitcoin rising hard to become a safe haven?

- Bitcoin computing power has reached 10 billion, a record high

- Bitcoin hits 12,000 US dollars on the station, the reason is actually the main force of 1.7 billion funds

In the bond market, the price of Argentina’s 100-year “century bond” fell 27%; the interbank lending rate soared and credit default swaps soared;

In the foreign exchange market, the Argentine peso plunged nearly 37% against the US dollar, setting a record low of 62 pesos.

Currently, the Argentine peso is stable at 52:1 against the US dollar, but a day ago, the exchange ratio was 42:1.

In other words, the Argentine people woke up and personal assets hit a 20% discount.

The cause of the peso's plunge was the primaries of the Argentine presidential election. The current president's primal vote was largely unsuccessful, and the candidate Fernandez was far ahead of the current president's 15% vote, which means that Markley is likely to be at 10 No longer re-elected after the month.

The market is worried that after Fernandez, represented by populism, is the new president, the pro-market and pro-business policies that Marki has previously introduced will be destroyed. On the other hand, the Argentine government budget may re-expand, and the $57 billion loan agreement (economic aid) that Mark and the IMF reached last year will be affected.

Then why are investors so worried about Mark's defeat, but Marx has such a big drop in the vote rate.

The reason is that in the past few years, in order to reduce the inflation rate, the government has been adopting a austerity policy. The people need to shrink and eat to support the national economic recovery, which has been rebounded by public opinion.

Friends who often read financial news may know that Argentina not only has football and tango, but also a high-income country in its glory. However, due to various reasons such as political infighting, Argentina has experienced a weak economy and an increase in unemployment over the past two decades. The inflation rate is also getting higher and higher. It is also the first country in the world to default on foreign debts. It even needs the assistance of the IMF and is checked and balanced by others.

The turmoil in Argentina’s political situation is simply to give the fastest-moving financial market a low-buy and high-selling opportunity.

But there are several reasons for Argentina’s defeat:

1. The peso has fixed the US dollar exchange rate (1:1) for a long time, and the foreign exchange system lacks flexibility and is subject to the US dollar;

2. The foreign exchange reserve is too low, which is not enough to stabilize the exchange rate, and the US dollar debt is too high;

3. The domestic currency continued to collapse and continued to depreciate, and the inflation rate was at most 57%;

In the end, Argentina lost in its own sovereign currency, and the real back pot should be the mechanism of traditional currency.

Last year’s “desperate rate hike” incident just showed that the Argentine people began to question their own currency and economic policies. In addition to Argentina, the same disease is accompanied by emerging countries such as Iran and Turkey in 2018. Their monetary sovereignty is vulnerable to the strength of the US dollar. The public can only rely on BTC to defend their wealth.

The most worrying thing is that this phenomenon may happen more frequently.

You may say that we will not have the situation like Argentina, because we have a strict foreign exchange control system, which can prevent large-scale foreign exchange from fleeing; we are the world's first foreign exchange reserve and the third largest gold reserve, which can effectively balance the RMB exchange rate. . In addition, we are the second largest economy in the world. Although GDP growth has slowed down, it is still three times that of the United States.

But you may underestimate the severity of the downturn in the global economy.

Trade friction is only an event, and the weakness of the global economy is the big environment behind it. After the US announced a rate cut, the RMB exchange rate showed a corresponding adjustment.

But since then, countries such as New Zealand, India and Thailand that rely on exports to China have also announced interest rate cuts in response to the depreciation of the yuan. In addition to these emerging countries, there have been more than 20 countries that have started to cut interest rates. They may be affected by the US dollar or affected by China, but in the final analysis, there are hidden dangers in their own economies, and they should not be affected by the game of big countries. But under the trend of economic globalization, our economy will also be more affected by cross-border capital flows.

In addition, the US economy has also had problems. The recently announced US 10-year Treasury yield is now almost below the 3-month US Treasury yield, close to the “reverse yield curve”.

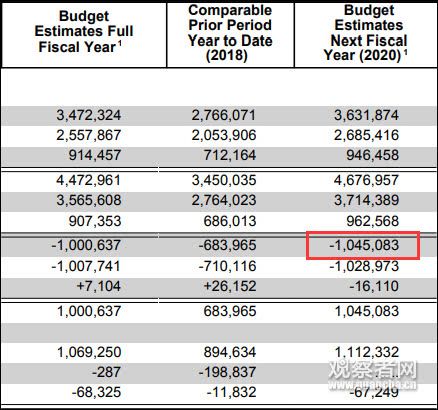

On the 12th, the US government announced that the fiscal deficit rate continued to rise. The US Treasury Department expects that the US government's accumulated deficit will soar to 10.45.83 billion in this fiscal year, and the US government deficit level will reach the highest level in seven years.

Former US Treasury Secretary Lawrence Summers warned in an interview with CNN News on the 11th that as international trade tensions continue to intensify, the US economy is at its greatest risk since the global financial crisis 10 years ago. The past few rounds of the Great Depression were caused by the United States.

The uncertainty of trade friction between China and the United States has intensified, bringing more uncertainties to the international market. Although this is in line with the law of Thucydides and the only way for the rise of China's great powers, trade friction has not gone out of control. But the other side is the sign that the global economy has Financial Crisis.

What we need to worry about is whether our personal wealth will be trapped. If the United States has set off a currency war like the 1930s and the global economy continues to slump, do we need a better safe haven and value-preserving tools.

History has not left, it is only repeated.

In the 1930s, people worried that currency depreciation, Financial Crisis or war would destroy their personal wealth, and gold became the only safe haven for the rich.

But today, we have the Internet, blockchain technology, facing gold or silver that is difficult to store, not to consume, difficult to carry, and inconvenient to divide. It is scarce, durable, convenient, interchangeable, separable, and Verification, BTC with 20 million audiences, born in the financial crisis, borderless, and long cuts is actually worth considering.

Also in the past decade, blockchain technology has made BTC better, cheaper, and more useful. BTC ATMs are also available in many countries, and many products are subject to BTC payments, which gold cannot do.

Perhaps you will say that BTC is not stable enough, the technical threshold is too high, and the existence time is too short to replace gold. However, in the past 100 years, the international gold price has only risen in 20 years, and the remaining 80 years are falling.

If you want wealth to appreciate or preserve, BTC is still a good choice. I even think that not only this year, we should even turn some assets into BTC "holders".

In May 2020, BTC will welcome its third production cut.

Several reductions in the return to history:

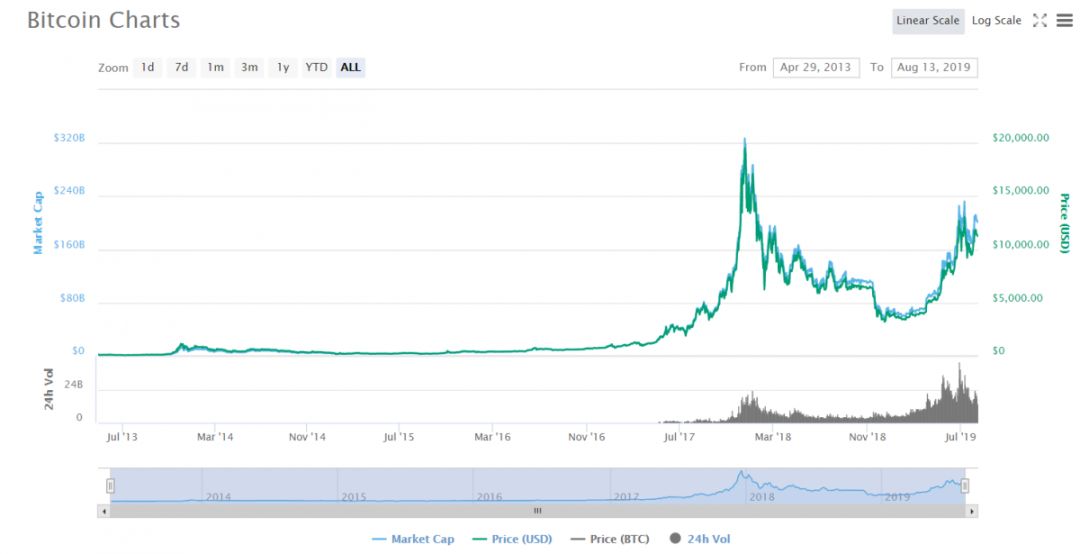

In 2012, the first reduction in production, the block reward for the first time halved, for the 25BTC and then in 2013 BTC ushered in its first round of bull market.

In 2016, BTC cut production for the second time, halving to 12.5BTC, and then at the end of 2017, BTC ushered in its second round of bull market.

In May 2020, BTC will welcome its third production cut, and the Bitcoin block reward will be reduced to only 6.25 BTC.

In the past few rounds of production cuts, BTC will always fall and then rise, then enter the acceleration channel and hit a record high.

The best time to own a BTC is 2009, followed by this year.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bakkt's ambition and dilemma

- Blockchain Weekly | One analysis is fiercer than the tiger, ups and downs look at Trump

- The myth of millionaires and bitcoins: some people buy for buy, or just want to show off

- The Federal Reserve announced that the hawks cut interest rates, the three major US stock indexes plummeted across the board, and the cryptocurrency responded smoothly.

- BlackRock CEO: We don't need Libra, we need technology

- According to the report, Fidelity Digital Asset Services has applied for a trust license to the New York Financial Services Authority.

- Iran will promote the legalization of the encryption mining business