Research | Blockchain technology is expected to restructure the international payment model

Summary

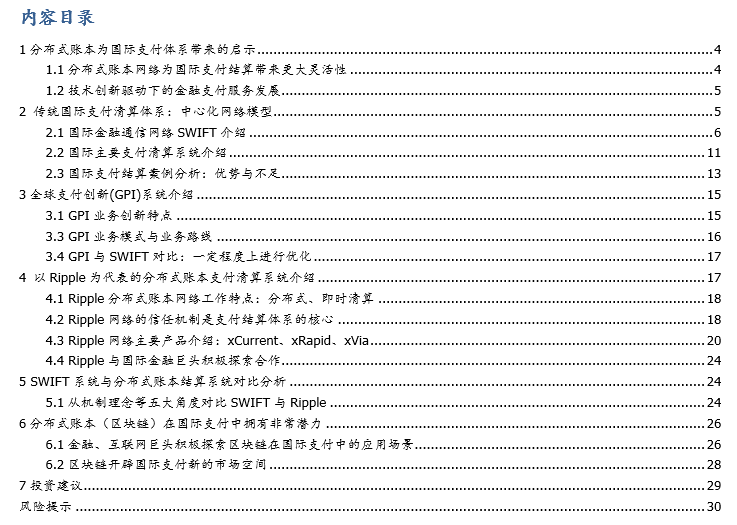

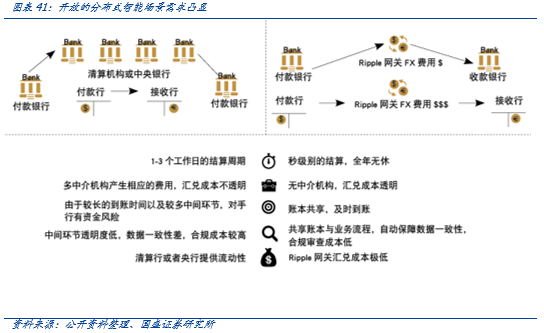

The distributed ledger technology represented by Ripple brings new flexibility and inspiration to international payments. Different from the multi-intermediary participation model of traditional payment systems, distributed ledger technology (DLT) has the characteristics of decentralization (intermediary), mutual trust of nodes, and traceability of data. It brings a lot of flexibility for international payment. The World Economic Forum (WEF) summarizes it into the following six points: simplifying repeated agents in operations, improving the efficiency of supervision and disclosure, changing trust and reducing counterparty risk, shortening the time for clearing and settlement, fast capital flow, transparency, history Trace back to improve safety.

Distributed ledger (blockchain) technology is expected to reconstruct the international payment model. A distributed ledger system (such as xCurrent) represented by Ripple can complete both information transmission and fund settlement. The entire payment process is automatically executed by the system program, and the response speed is fast. The systematic consensus mechanism ensures credit and safety. Ripple and other distributed ledgers (blockchains) have many advantages over traditional international payment and clearing systems. However, due to different regulatory regulations in various countries, the actual international deployment will inevitably face the problem of international regulations and policy coordination. The Ripple network is quite For the alliance between users, the international / market acceptance also needs a certain expansion process. Therefore, the distributed ledger (blockchain) is really used in large-scale cross-border remittances. It also needs to be further optimized and improved in response to regulatory requirements and increase market expansion; at the same time, potential risks at the software and protocol levels, users, and bank Details such as deployment also need to be further polished.

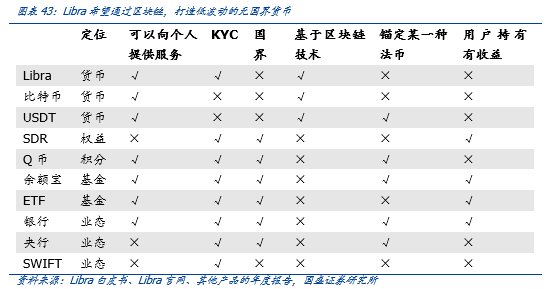

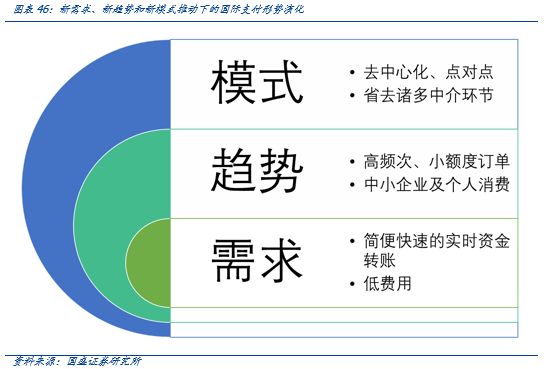

We believe that cross-border trade and cross-border payment are facing the challenges of new trends, new demands and new models, and blockchain is expected to open up new space. In terms of new trends, the point-to-point scenario of high-frequency and small-volume orders is increasingly prominent. With the rapid development of cross-border e-commerce, the number of SMEs participating in cross-border trade is increasing. New consumer demand is driving the growth of personal cross-border consumption. The demand for international payments has risen rapidly; in terms of new demands, users are more and more urgent for simpler and faster real-time fund transfers. The traditional day-to-day capital turnover (the money and goods cycle can be as long as 15 days or even 20 days) cannot effectively meet the cross-border Demand for international trade; in the new model, decentralized peer-to-peer payment will open up new cross-border trade and payment models. With the continuous advancement of globalization, the demand for international payment settlement is no longer limited to large enterprises, and a large number of small and medium-sized enterprises Even individual consumers have a growing demand for peer-to-peer and fast payment experience. The distributed ledger represented by blockchain promotes the development of decentralized and peer-to-peer payment models (thus eliminating many intermediary links) and is expected to become the new international payment model in the future.

- 930 days, witness the blockchain speed of Xiong'an New District

- The Secret History of Bitcoin: Bitcoin and Space Travel

- MOV announces the first list of federal nodes, from open applications to open ecosystem

Investment Advice. We recommend focusing on blockchain service companies on the central bank's digital currency, blockchain supply chain finance, and digital asset main lines.

1. The central bank's digital currency main lines: Sifang Jingchuang, Advanced Datacom, Gao Weida, Changliang Technology (development of bank payment functions), digital authentication, Goer software (digital identity authentication), New World (tool transformation), Feitian integrity (hardware wallet) ); 2. Blockchain + supply chain finance: Easily Shares, Radio and Television Express; 3. Digital asset lines: Donggang shares, Jincai Internet, CANA (CAN.O), Huobi Technology (1611.HK) , Advance Holdings (8395.HK).

Risk warning: Uncertainty in regulatory policies and unsatisfactory development of blockchain infrastructure.

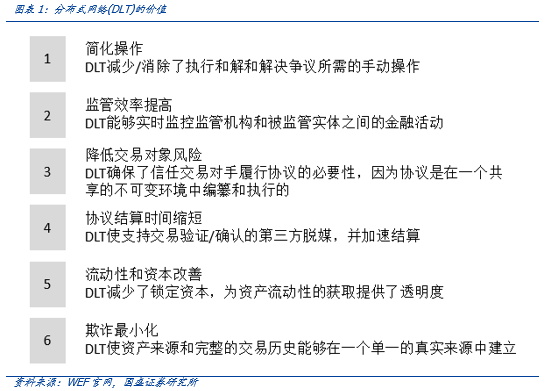

1. The enlightenment of the distributed ledger to the international payment system

1.1 Distributed ledger network brings greater flexibility to international payment settlement

Different from the multi-intermediary participation model of traditional payment systems, distributed ledger technology (DLT) has the characteristics of decentralization (intermediary), mutual trust of nodes, and traceability of data. It brings a lot of flexibility for international payment. The World Economic Forum summarizes the following six points:

1. Repetitive agents in simplified operation;

2. Improve the efficiency of supervision and disclosure;

3. Change trust and reduce counterparty risk;

4. Shorten the time for clearing and settlement;

5. Fast capital flow and improved transparency;

6. History can be traced back to improve safety.

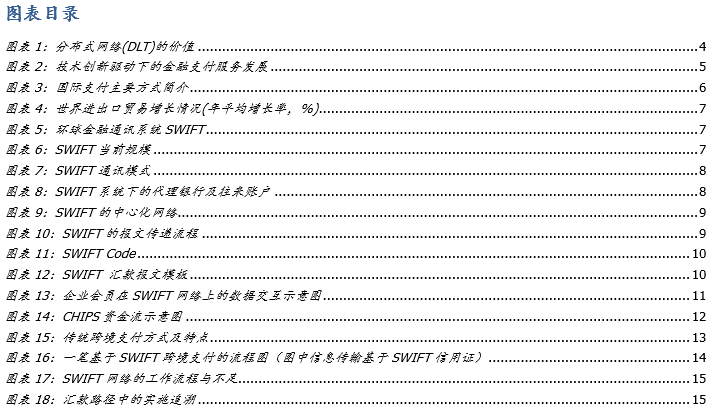

1.2 Development of financial payment services driven by technological innovation

The Ripple (Ripple) network integrates information transmission and fund clearing into a flat distributed ledger network. In the past 50 years, technological innovation has always been the most critical driving force for the development of financial services. Every technological innovation will always set off a new wave of financial services development. SWIFT is a unified information standard established in the 1970s for more efficient information transmission. With the development of distributed ledger technology, Ripple has established a decentralized network ledger protocol to facilitate the flow of funds. Under the impetus of international payment and settlement, the mode of multi-intermediary information transmission + capital settlement has gradually developed towards information transmission and capital flow integration into a set of concise systems-the payment and settlement system is more decentralized and flattened. The basis is that the distributed ledger network has the characteristics of mutual trust between nodes and data traceability.

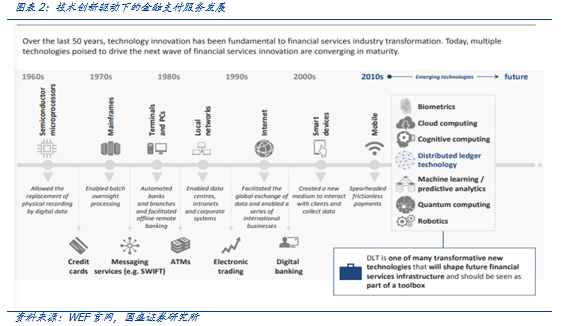

2. Traditional International Payment and Clearing System: Centralized Network Model

The complete international payment includes payment, clearing, settlement and other links, most of which are currently operated in a centralized manner. According to the definition of CPSS (Payment and Settlement System Committee, an international professional organization initiated and established by the Central Bank of the Group of Ten, the secretariat is located in the Bank for International Settlements (BIS)), the payment system includes a series of monetary instruments Process and inter-bank fund transfer system. CPSS defines the clearing system as a series of procedures that enable financial institutions to submit and exchange data and documents related to the transfer of funds or securities. Settlement refers to the process in which the seller transfers securities or other financial instruments to the buyer, and the buyer transfers funds to the seller, which is the final step of the entire transaction. Since the definition and understanding of payment, clearing and settlement in different countries are not consistent, we can loosely divide the international payment system into payment and clearing (settlement) links. Whether it is payment or liquidation, the institution behind it is a centralized operation method.

In the current international payment and settlement system, whether it is the liquidation and settlement of funds in financial institutions or the financial information and communication network, it is a typical centralized working model. In international payment and settlement, SWIFT is the most important financial communication network system in the world. Through this system, all financial institutions that are not in contact with each other can be connected in series on a global scale to exchange information. The system mainly provides communication services, and specifically transmits various information related to currency exchange for its member financial institutions. After receiving such information, the member bank transfers it to the corresponding fund allocation system or clearing system, and then the latter performs various necessary fund transfer processing.

This chapter will introduce the centralized working mode of the financial communication system SWIFT and the payment and clearing system, and take SWIFT wire transfer + letter of credit as an example to analyze the advantages and disadvantages of the centralized working mode in order to do with the subsequent distributed system. Compared.

2.1 Introduction to the International Financial Communication Network SWIFT

2.1.1 The reason, position and purpose of SWIFT establishment

Questions raised: In the 1870s, financial communications of various countries could not adapt to the rapid growth of international payment and settlement.

2.1.2 Working principle of SWIFT mode

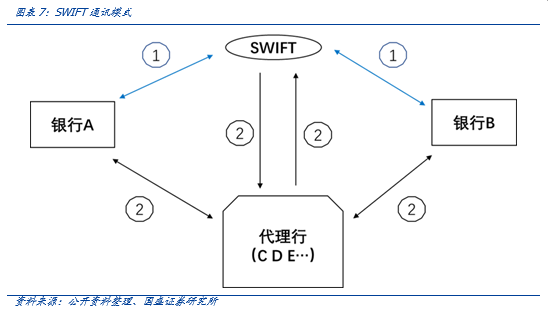

1. The agency bank model of SWIFT's cross-border payment network is a multi-bank model

Only SWIFT member institutions can conduct cross-border payment transactions through the SWIFT network, and in practical applications, it can be simply divided into two cases:

Situation 1: Bank A and bank B have business dealings, then Bank A and Bank B can directly transfer information through SWIFT (as shown in path 1 in the figure).

Case 2: The remittance bank A and the receiving bank B do not have business transactions, so bank A and bank B look for a bank that has business transactions with themselves and is a member of SWIFT to complete cross-border payments. Such a bank is called Acting bank for the remittance bank and the receiving bank from C (as shown in path 2 in the figure).

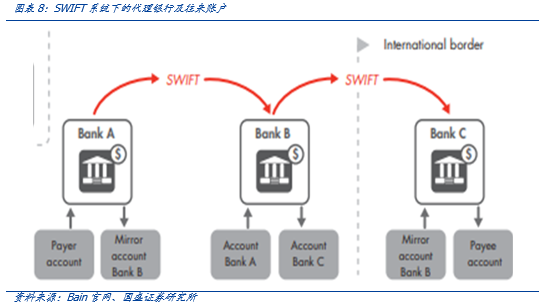

In the simplest case, a transfer by the payer has to go through multiple accounts:

Payer account: the payer's account in Bank A;

Mirror Account Bank B: Bank A's bank account opened with us to record its account in Bank B;

Account Bank A: an account belonging to Bank A opened by Bank A at Bank B;

Account Bank C: an account belonging to Bank A opened by Bank C at Bank B;

Mirror Account Bank B: Bank C's bank account opened with us to record its account with Bank B;

Payee account: The payee's account in Bank C.

In the information transfer of the SWIFT system, due to the agency banking model, the situation of repeated account opening often occurs, which leads to low efficiency and high rates to a certain extent.

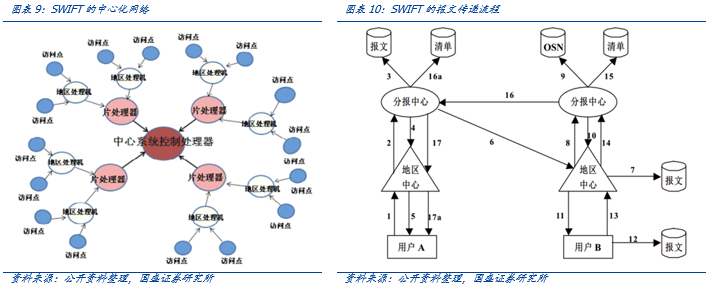

In the SWIFT network, global transaction information is first collected from various access points to regional processors, then uploaded to the chip processor, and finally collected on the control processor of the central system to carry out information transfer transactions and funds in stages and batches. Liquidation and transfer. This is exactly the usual working mode of a centralized network-similar to the hierarchical processing of telecommunications networks. The final processing of information commands must be processed by the central control platform. This working mode is bound to bring greater work pressure to the central platform. The processing pressure is concentrated to the high-level and routing nodes, which brings the bottleneck of information transmission. Therefore, the telecommunications network will enhance the user experience through CDN (Content Distribution Network). However, SWIFT differs from the telecommunications network in that more scenarios under the telecommunications network are that the traffic is downloaded from the Internet content service provider to the user end, and early content distribution can alleviate the transmission bottleneck of the download. The core mode of SWIFT is to solve the problem of user point-to-point information transmission. Under the centralized working mode, there will inevitably be efficiency bottlenecks for gradual and batch processing, which will affect the settlement speed of the banking system. Similarly, the payment system also has a centralized bottleneck Efficiency issues.

1. SWIFT services:

SWIFT operates a world-class financial message network, through which banks and other financial institutions exchange messages with their peers to complete financial transactions. Through this network, SWIFT provides worldwide financial information delivery services, clearing and net payment services, operational information services, software services, certification technical services, customer training and 24-hour technical support. SWIFT's design capability is to transmit 11 million messages per day, and the current transmission of 5 million messages per day. The funds allocated for messages are in trillions of dollars. It relies on more than 240 message standards provided by SWIFT.

2. SWIFT's message language:

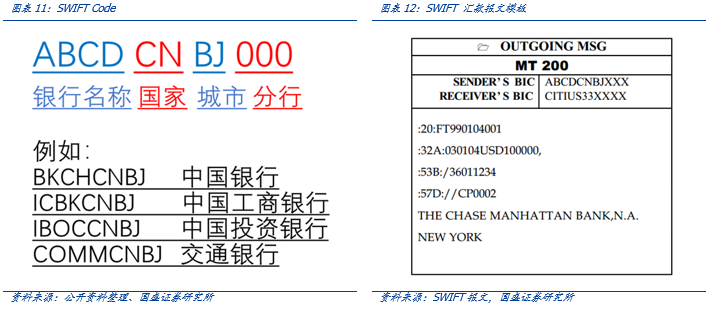

The current SWIFT standard message format has become the standard language for data exchange between international banks, forming a unified account expression. Among them, "SWIFT Code" is used to distinguish the codes of various banks, and the corresponding funds can be accurately transferred to the designated bank by relying on SWIFT Code. (Institutions that join SWIFT will have their own identity code (ie SWIFTCODE, equivalent to the bank's "ID card number"). This code is a string of 8 to 11 digits, which is also known as the Bank Identifier (Bank Identifier Code, BIC).

Take the Industrial and Commercial Bank of China's swift product service for enterprises as an example.

1. SWIFT connection between bank and enterprise. Background: Enterprise A has joined the SWIFT organization and its headquarters is located overseas. Demand: The enterprise hopes to realize the remote monitoring of the accounts in China and the unified management and scheduling of funds within China through the SWIFT network and cooperation with banks. Solution: Corporate headquarters, corporate branches, co-sponsoring banks and co-organizing banks (ICBC) coordinated to jointly establish an enterprise fund management platform, while co-organizing banks provide local cash management services in China. The specific steps are:

1) Branches of Enterprise A open RMB settlement accounts and foreign currency accounts at ICBC local outlets;

2) The enterprise sends a payment instruction to ICBC through the SWIFT FILEACT format, and receives the statement file sent by ICBC through the FILEACT format;

3) Enterprises can arbitrarily choose custom or bank-standard file formats to send and receive instructions.

2. Silver Silver SWIFT connection. Background: Enterprise B is headquartered overseas and has branches all over the world, but the company is not a member of SWIFT, so it needs to seek an international bank cooperation to realize global account monitoring through the SWIFT network. Demand: Enterprise B hopes to send the SWIFT instruction to the co-operating co-organizing bank (ICBC) in China through its co-hosting bank. The co-operating co-organizing bank will complete the external payment or fund transfer of the designated account according to the instruction; The account information sent by the co-sponsoring bank guarantees timely information on account changes.

Solution: Corporate headquarters, corporate branches, co-sponsoring banks and co-sponsoring banks coordinated to jointly establish an enterprise fund management platform, while co-sponsoring banks provide local cash management services in China. The specific steps are:

1) The co-sponsoring bank and co-sponsoring bank signed a cooperation agreement;

2) The branch of Enterprise B opens a RMB settlement account or a foreign currency account at the local co-sponsorship bank and issues an authorization letter;

3) Enterprise B entrusts the co-hosting bank to send instructions to the co-hosting bank through SWIFT;

4) Enterprise B chooses the co-sponsoring bank by itself, and the co-sponsoring bank sends a payment instruction to the co-sponsoring bank through SWIFT FIN. The co-organizing bank automatically receives, sorts and processes instructions. According to the feedback requirements of enterprise account information, the co-organizing bank actively sends the account information report to the co-organizing bank.

SWIFT's service targets are generally large multinational companies that conduct large-scale cross-border payment transactions. The simplest case also involves multiple regions, multiple countries, multiple banks, and multiple accounts.

Taking wire transfer as an example, the bank sends transaction information to the branch or agency bank where the payee is located by telegram or SWIFT. Wire transfer payment needs to provide services through multiple financial institutions such as the remittance bank, central bank, agent bank, and collection bank. Credit endorsement, and each institution has its own accounting system; eventually, the liquidation (settlement) of funds is completed in different countries / regions, and the liquidation is completed by different clearing systems. The wire transfer can be simply understood as the process that SWIFT completes the transfer of financial information, the bank and other institutions complete the transfer, and the clearing system is responsible for the final clearing process. This section mainly introduces the main clearing payment system.

2.2.1 CHIPS USD Cross-border Payment and Clearing System

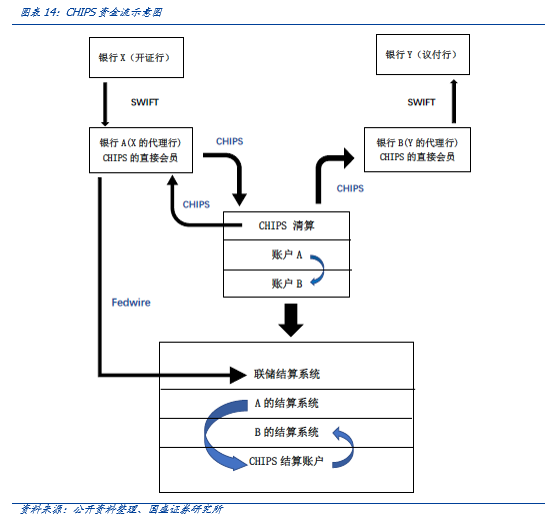

CHIPS (clearing house interbank payment system) is the abbreviation of "New York Clearing House Interbank Payment System". It was established in 1970 and is operated by the New York Clearing House Association (NYCHA). One of the world's largest private payment clearing systems, mainly for clearing cross-border dollar transactions. Although the SWIFT system is an alliance of various national banks, its systems and codes are controlled by the US CHIPS (US dollar large-value clearing system) to provide assistance to the long-arm jurisdiction of the United States.

The payment system in the UK is not directly operated by the central bank, but adopts a corporate business model. However, the main banks open settlement accounts with the Bank of England, and the final settlement is still done by the Bank of England. There are three main cross-bank core payment systems in the UK, namely the new CHAPS large payment system, BACS small payment system, check and credit clearing system. CHAPS was established in London in 1984 to provide the same day pound and euro funds transfer, and is used by 19 settlement banks including the Bank of England and more than 400 sub-member financial institutions. CHAPS is a member of the trade organization APACS and the EU regional settlement system TARGET.

2.2.3 FXYCS yen cross-border payment settlement system

The Foreign Exchange Yen Clearing System (FXYCS) is a large-value payment system built in 1980 to simplify the clearing process of yen payments for cross-border financial transactions. Initially, the operation of the system was based on processing paper documents. In order to adapt to the rapid growth of foreign exchange transactions, the Tokyo Bankers Association (TBA) transformed the system in 1989, automated the system, and entrusted the management authority to the Bank of Japan. Since then, the Japanese yen settlement of foreign exchange transactions has been carried out through the BOJ-NET system of the Bank of Japan. By the end of 2001, there were 244 financial institutions participating in the FXYCS system, including 73 branches of foreign banks in Japan. Among them, 40 are direct participants of the BOJ-NET system, and the remaining 204 are indirect participants. They will join the FXYCS system through direct participants.

2.2.4 TARGET Euro Cross-border Payment and Clearing System

TARGET is a real-time full-value automatic clearing system between Europe and provides real-time full-value clearing services for EU countries. It was established in 1995 and officially launched in 1999. TARGET consists of the RTGS system of 15 countries, the European Central Bank's payment institution EPM and the interconnection system IS, so that payment instructions can be passed from one system to another.

2.2.5 CHIPS RMB cross-border payment system

The Cross-border Interbank Payment System (CIPS) is an independent payment system developed by the People's Bank of China. It aims to further integrate existing RMB cross-border payment settlement channels and resources, improve cross-border clearing efficiency, and meet The development of RMB business in each major time zone needs to improve transaction security and build a fair market competition environment. The system started construction on April 12, 2012 and was officially launched on the morning of October 8, 2015.

2.3 Case analysis of international payment settlement: advantages and disadvantages

The traditional cross-border payment methods commonly used are SWIFT bank wire transfer (combined letter of credit), professional remittance companies, and third-party payment channels / methods (such as Visa, UnionPay, etc.). Various payment methods are aimed at different scenarios and pain points. SWIFT is mainly used for B2B large-value transactions, traditional international trade (generally combined with letters of credit), and individuals with cross-border payment needs. There are many other payment methods for personal remittance scenarios that can be selected by individuals in different countries / regions and different currencies. International trade also has payment methods such as payment D / P and acceptance payment D / A.

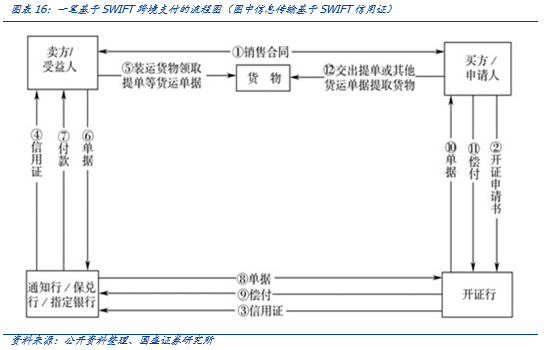

The trade process is as follows:

1. The Chinese export company Y and the US import company X signed a one-million-dollar goods sales contract, in which a commercial documentary credit payment method was clearly adopted.

2. The US import company X, as the applicant for issuance (ie, buyer), applies to a US bank (that is, the issuing bank) within the period specified in the contract or within a period of time after the contract is signed (application for issuance) Issue a letter of credit with Chinese export company Y as the beneficiary.

3. After reviewing the issuing bank, it will open a letter of credit.

4. After receiving the letter of credit, the notifying bank shall confirm the authenticity of the letter of credit, review the terms of the letter of credit, and immediately notify the Chinese export company Y in accordance with the instructions of the issuing bank.

5. Y-certification, delivery, and production of documents by the Chinese export company.

6. The Chinese export company Y submits the original letter of credit and the required documents to the designated bank, and asks them to pay by virtue of the apparently qualified documents.

7. After negotiating bank Y receives the letter of credit and documents from the Chinese exporting company Y, according to the entrustment and instructions of the issuing bank of the letter of credit, the Chinese exporting company is paid one million US dollars (the paying bank can be a designated bank, guarantee Exchange bank, negotiation bank).

8. After negotiating bank Y has paid, you can request the payment from the issuing bank X with the apparently qualified documents.

9. The issuing bank X received the document and, according to the provisions of the "UCP600", within a maximum of 5 bank working days, after reviewing the documents, and confirming that the documents were consistent, the negotiation bank Y was paid a million dollars.

10. After the issuing bank X accepts the documents, it will submit the documents to the issuing applicant according to the pre-established payment agreement.

11. The US importer X pays one million dollars to the issuing bank and pays the redemption in accordance with the pre-established agreement.

12. After the US importer X redeems the documents, he can use the documents to pick up the goods from the transportation department, and arrange for inspection, storage and import declaration.

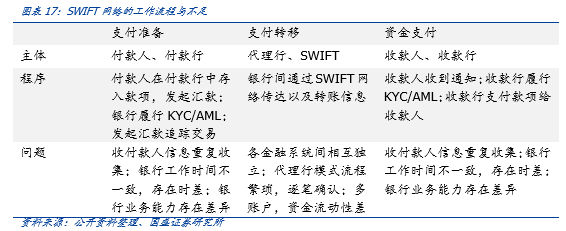

As can be seen from the above case, the transaction process is cumbersome, the payment process is relatively complicated, and multiple intermediaries are required to ensure the security of both money and goods. In essence, the role of these intermediary structures is credit transfer, which is the central mode of the traditional payment and clearing system. decided. On the other hand, the shortcomings of using SWIFT network for international payment are:

1. Technical level: The technical system is relatively complex;

2. Transfer efficiency: the process is complicated and the efficiency is low;

3. Monopolistic institutions: Most of the participating institutions are monopolistic institutions, often becoming a tool for sanctions and long-arm jurisdiction, especially for USD accounts.

3. Introduction of Global Payment Innovation (GPI) System

3.1 Features of GPI business innovation

3.1.1 Cloud tracking database service

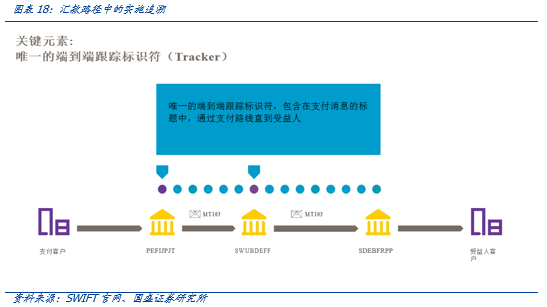

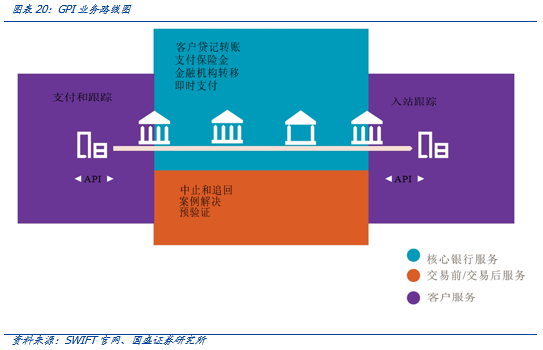

The GPI project provides a service called Tracker that runs in the cloud database. Every bank can access the cloud. Each cross-border remittance can generate a unique tracking reference number for the entire network when it is initiated. Real-time traceability in the remittance path enhances the transparency of international payments. At the same time, the Tracker service visualizes the transaction process, and specific business personnel can be updated in real time through messages or APIs to more intuitively understand the remittance status.

SWIFT created new Service Level Agreement (SLA) regulations, which require participating banks to comply with SLA rules and provide the Observer service to detect the compliance of global banks with their regulations. SLA makes it possible to participate in intelligent collaboration between banks. This service is not only a collaboration platform for banks, but also a constraint. The basis for innovative business development is that all GPI participating banks must ensure compliance with their rules. The Observer monitoring platform subtly transfers the payment and settlement to the central supervision of the competent department to the mode of supervision by the competent department and mutual supervision and collaboration between the participating banks. Each participating bank of the GPI project can see the business quality score and error rate of the Bank and other banks, which is a good promotion for strengthening the bank's self-supervision.

3.1.3 Data list service

SWIFT GPI provides an open data list (The Directory) service that contains the clearing service information of each participating bank, including the bank identification code of each participating bank, whether to accept GPI receipts and payments, currencies that can be received or sent, business deadlines, The channel for accepting remittances, whether it can be used as a transit bank for GPI payments, etc. This service allows the bank to freely choose an efficient remittance path according to the needs of itself or its customers, while also automatically obtaining remittance channels. Banks can use this service to understand the operational capabilities of GPI participating banks, identify the identity of all participating banks on the entire remittance road, and select the best remittance path based on various public indicators before the remittance is initiated. Directory services can further increase the transparency of intermediaries, which is especially important for banks that cross-border transactions across multiple regions or financial markets.

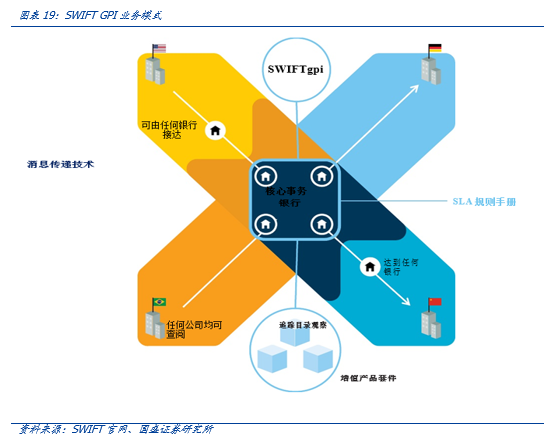

3.3 GPI business model and business route

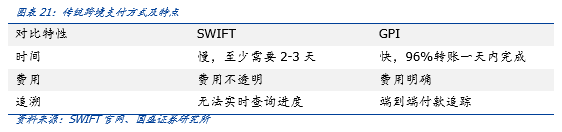

3.4 Comparison of GPI and SWIFT: optimization to a certain extent

Conclusion: On the basis of the original SWIFT message system, GPI added elements such as cloud database, SLA rules, Tracker, etc., and carried out a certain degree of local optimization to achieve the effects of increased remittance speed, transparent remittance process, and traceable remittance progress. User experience improvements. However, it cannot be ignored that GPI is based on the original SWIFT message system and is similar in nature to the traditional international payment and clearing system. As a centralized clearing system, the remittance process still requires the intervention of intermediaries.

4. Introduction of distributed ledger payment and clearing system represented by Ripple

4.1 Working characteristics of Ripple distributed ledger network: distributed, instant clearing

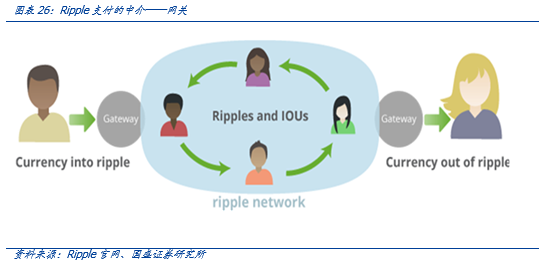

Ripple (Ripple): efficient and open distributed Internet payment protocol. Ripple is an open payment network protocol. Through this payment network, you can transfer any currency, including US dollars, euros, renminbi, yen, or bitcoin. It is simple and fast. The transaction confirmation is completed within a few seconds. The fee is almost zero, there is no so-called cross-border and remote and cross-border payment fees. The early version of the Ripple network was launched in 2004. After OpenCoin took over the Ripple project, it launched a new version in 2013. It introduced a "gateway" and Ripple, turning Ripple into a decentralized, distributed currency covering Internet financial transaction system. Several key principles of Ripple include: ILP protocol: cross-ledger protocol ledger, distributed ledger, and validator.

RippleNet (Ripple Network) is supported by distributed ledger technology and has the characteristics of decentralization, instant clearing, and low cost. The Ripple protocol maintains a distributed ledger common to the entire network. The agreement has a "consensus mechanism" and a "verification mechanism" through which transaction records are added to the general ledger in a timely manner. The Ripple system generates a new ledger instance every few seconds, and the new transaction records generated within these seconds are quickly verified according to the consensus and verification mechanism. Such individual accounts are arranged in chronological order and linked to form the general ledger of the Ripple system. Ripple's "consensus mechanism" allows all nodes in the system to automatically receive updates to general ledger transaction records within a few seconds. This process does not need to go through a central data processing center. This extremely fast processing method is a major breakthrough in the Ripple system. Therefore, Ripple Network has the characteristics of instant liquidation and low cost. In the distributed ledger model, each computer host is a node, and they are all equal. Each node in the system can directly interact without the concept of a central node. At the same time, the transaction information of any two nodes is encrypted to the entire network. All nodes are stored in encrypted blocks and recorded separately in time series, thereby forming a new decentralized mode. Therefore, A sends money to B The transfer process of information flow is the process of transfer and settlement of funds from A to B, and A and B prove their identities through their respective digital signatures, without the need for third-party trust endorsement, and directly realize peer-to-peer electronic cash payment.

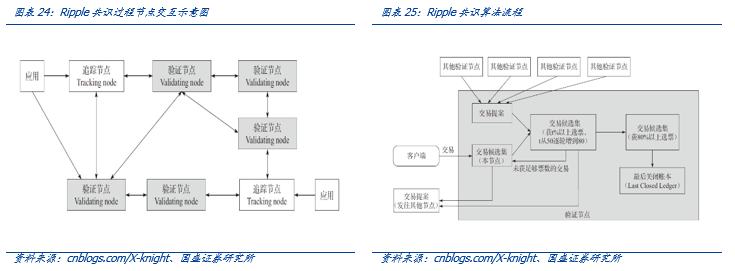

As a decentralized method, it is necessary to find a technical method to replace the credit endorsement of the central institution. The consensus mechanism in the distributed ledger is the core of solving peer-to-peer trust, which is particularly prominent in blockchain projects such as Bitcoin. In Ripple's network, the transaction is initiated by the client (application), and the transaction is broadcast to the entire network through a tracking node or a validating node. The main function of the tracking node is to distribute transaction information and respond to the client's ledger request. In addition to all the functions of the tracking node, the verification node can also add new account instance data to the ledger through a consensus protocol. Ripple consensus reached between verification nodes, each verification node is pre-configured with a list of trusted nodes, called UNL (Unique Node List). The nodes on the list can vote on the conclusion of the transaction.

In Ripple's consensus algorithm, the identities of participating voting nodes are known in advance. Therefore, the efficiency of the algorithm is more efficient than anonymous consensus algorithms such as PoW (the consensus mechanism used by Bitcoin), and the transaction confirmation time only takes a few seconds . This consensus mechanism is very suitable for the participants in the scene to form an alliance in accordance with the established protocol rules for payment and settlement.

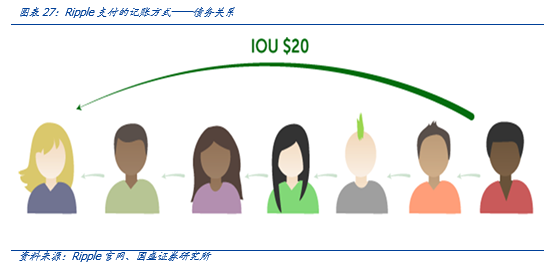

The payer and the payee establish a trust relationship chain through their relationship in the trade payment. Based on the Ripple Ledger Network, the payer and the payee can establish a peer-to-peer payment network that replaces intermediaries such as banks. In this network, individuals can directly borrow from each other, and the effect of payment can be achieved by updating the balance of the loan. Therefore, as long as the system can find the relationship path between the payer and the payee, only need to update the account balance to complete a payment. And all this is based on the functions of mutual trust and data traceability provided by the distributed ledger network.

In response to the current shortage of cross-border payments, Ripple has launched some application products for scenarios: xCurrent, xRapid, and xVia.

Open the basic accounting mode between banks: xCurrent. The product xCurrent (currently selected by most banks) is a solution that provides instant settlement and tracking of cross-border payments between RippleNet members. xCurrent is based on the Interledger Protocol (ILP), which is a protocol used to connect different ledgers or payment networks. This solution is not based on XRP Ledger, and XRP cryptocurrency is not used by default.

1. Messenger (message transmitter) provides peer-to-peer communication between financial institutions in RippleNet and is used to exchange information about risks and compliance, fees, foreign exchange rates, payment details, and estimated time for fund delivery.

2. Validator (validator), which confirms the success or failure of the transaction in a password, can also be used to coordinate the transfer of funds across the ledger system. Financial institutions can run their own validators or rely on third-party validators.

3. The ILP ledger (cross-ledger protocol ledger), the Interledger protocol enables two different billing systems to be freely transmitted to each other through a third-party "connector" or "verifier". The Interledger protocol has been implemented into the existing bank ledger, creating the ILP ledger. The ILP ledger is used as a sub-ledger to track lenders, debits, and liquidity between parties to a transaction. Funds are settled atomically, which means they will either settle immediately or not at all.

4. FX Ticker (FX Ticker), FX Ticker is used to define the exchange rate between the two parties of the transaction. It tracks the current status of each configured ILP ledger.

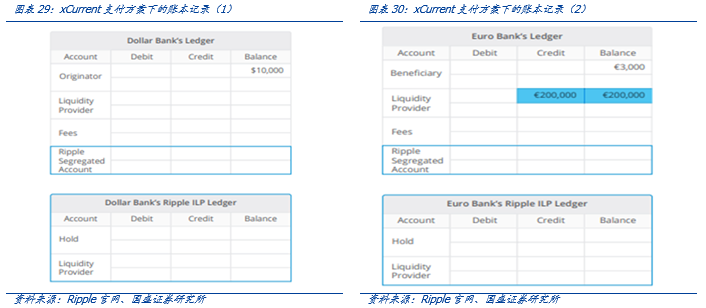

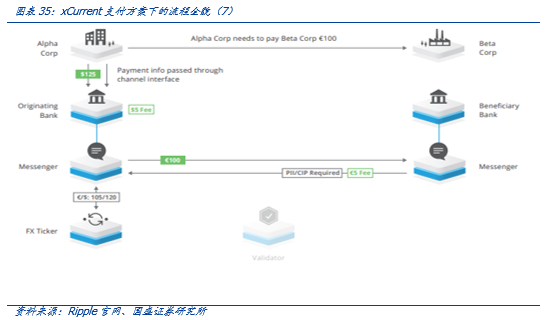

Payment case: Combined with Ripple Segregated Account (Ripple External Independent Account) to explain how to open up the bank's basic bookkeeping model, taking the capital transactions between Alpha and Beta as an example. First, Alpha Company and Beta Company need to open an account in the corresponding bank and have the corresponding currency, and each bank needs to expand a Ripple external independent account, the account balance is associated with the external Ripple ILP, the two are a mapping relationship. The market maker injects sufficient funds into the Ripple plug-in account of the bank where the company opens the account through the local clearing system to support the liquidity expenditures of related transactions. Once there is enough funds in the Ripple plug-in account, the liquidity provider can provide foreign exchange quotation to the US dollar bank through FX tricker (exchange rate quoter) (the quote is automatically selected by Ripple Network among the lowest among the many liquidity providers / Optimal exchange path). Assume that the price provided in this case is EUR / USD = 1.1429.

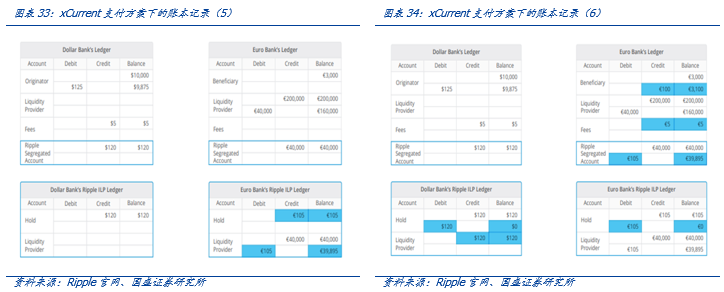

Alpha Company initiates a remittance request to pay 100 Euros to Beta Company through US Dollar Bank. US Dollar Bank connects to Euro Bank through Ripple Messager (Ripple Message Transmitter) and submits relevant remittance information and order information. The Euro bank checks whether it meets the KYC / AML regulatory requirements based on the request submitted by the US dollar bank. After receiving the response from the Euro bank, the US dollar bank obtains the exchange rate quotation of the euro against the US dollar through the FX Tricker (exchange rate quoter) (EUR / USD = 1.1429). At the same time, assuming that the US dollar bank handling fee is 5 US dollars, and the Euro bank handling fee is 5 euros, the payment of 100 euros is completed, and 125 US dollars is required. If Alpha accepts this offer and fee, the payment is initiated. The US dollar bank debited Alpha Corporation-$ 125, received a $ 5 processing fee, and credited the Ripple plug-in account + $ 120, and the ILP account book was also updated. But at this time, $ 120 was not credited to the liquidity provider's account, but in the external account, until the Euro bank provided Validator with proof that the Beta company's external account had sufficient funds. Once the Validator receives the certificate of the external account where the bank funds are deposited on both sides, the consensus will trigger the liquidation of the funds of both parties and automatically record the books on both sides: release the funds of the U.S. bank external account to the liquidity provider account and transfer it at the same time The liquidity provider account funds to the euro bank, 100 euros are credited to the Beta company, 5 euros are charged to the bank account, and the payment is completed.

The main function of Ripple Segregated Account is to reflect the account of the liquidity provider. The actual funds do not need to be moved. Through the conversion of the debt relationship, the system can pass the information processing in just a few minutes to realize the funds. Delivery. Although there are more details of the capital flow and business process in the above steps, through the distributed ledger network, the payment in the same protocol network is completed automatically, the execution time is short, and the payment cost is much lower than the traditional cross-border payment model.

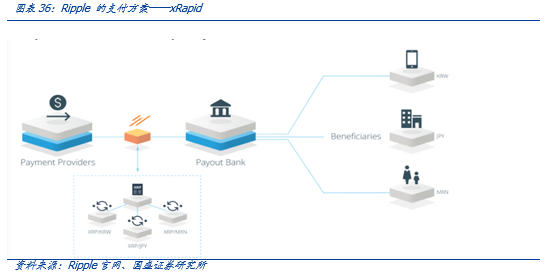

Overall, RippleNet integrates on top of the bank ’s existing infrastructure to supplement and improve the traditional payment system—removing many central institutions and using trust gateways for peer-to-peer payments. xCurrent will achieve low-cost, efficient and real-time payment between financial institutions; xRapid will use borderless currency XRP as an on-demand liquidity pool; xVia will facilitate the integration and communication between RippleNet participants. However, the use of cryptocurrencies XRP, xRapid, and xVia may involve issues such as international regulation and compliance, but xCurrent does not.

4.4 Ripple actively explores cooperation with international financial giants

Low fees, real-time clearing, and high scalability have caused traditional financial institutions and technology companies to attach great importance to Ripple's distributed technologies. International financial / tech giants have cooperated with Ripple and other companies to actively explore possible market potential. According to incomplete statistics, the company has established cooperative relations with more than 300 banks and financial customers in 40 countries / regions, such as Mitsubishi Tokyo UFJ (MUFG), Brazil Bradesco Bank, Standard Chartered Bank, etc. Imperial Bank of Canada, UBS, U.S. Bank of Santander, United Credit Bank of Italy, American Express, etc. have cooperated with Ripple Network for testing.

SWIFT embodies the workflow and mode of traditional centralized institutions: the current SWIFT messaging system does not really involve cross-border flows of funds, but mainly for information transfer, and subsequent reliance on banks to update accounts and clear payment systems such as CHIPS Wait for the system to clear and pay. Such cross-border remittances reflect the working mode and process of traditional centralized institutions: the process is cumbersome, involving many intermediary institutions to enhance credit and ensure safety, and the intermediate fees are large and extended.

The distributed ledger represented by Ripple is expected to reconstruct the international payment model: as a typical decentralized system, the Ripple system (such as xCurrent) can complete both information transmission and fund settlement at the same time. The cross-border remittance process between two banks can be generally divided into the following two stages: first, two (or even multiple) bank accounts exchange information through messengers; then the two banks pass Ripple ’s ILP ledger, The foreign exchange market and validator process the ledger and complete the settlement of funds on the blockchain ledger. The entire process is automatically executed by the system program and the response speed is fast. The systematic consensus mechanism ensures credit and safety. But the premise of all this is that the Ripple system is deployed between the banks, and the enterprise / individual users carry out under the premise of approving the system agreement, which requires a certain social / international acceptance.

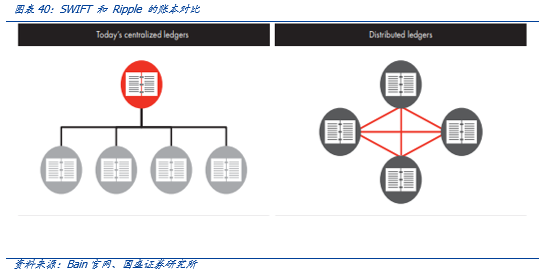

1. System logic: centralized and decentralized consensus mechanism. The SWIFT-based payment network is a centralized payment system. Although the message information is transmitted quickly and freely through the Internet, there are many intermediaries and agents in the fund transfer. This is the current centralized work mode of financial institutions. In order to meet KYC / AML and The inevitable result of security and other requirements. In contrast, the Ripple protocol needs to maintain a general ledger that contains all accounts and all transactions (and therefore all account balances). This general ledger is distributed among all network nodes and is always synchronized. The safe circulation of funds in the Ripple network does not require a central agency to do credit endorsement. Gateway nodes and consensus mechanisms can ensure that users on the network cannot do evil and ensure the safety of the entire network. The Ripple open source protocol allows servers worldwide (banks, currency exchangers, and other gateways that access the protocol) to perform peer-to-peer financial transactions, so it is a distributed network and does not require centralized operation.

2. Transaction cost composition. On the one hand, the cost of the SWIFT system includes various operating costs, and the cost is relatively high, but the cost of the Ripple protocol is extremely low, and only needs to be upgraded based on the existing bank infrastructure, the degree of automation is high, and the cost of payment transfer is very low; On the other hand, the SWIFT system will charge for cross-currency remittances, and the Ripple protocol as a standard protocol, any currency (even virtual currency such as Bitcoin) can be transferred through the Ripple network, currency exchange, based on the consensus mechanism Automated procedures do not need to consider the costs of cross-border, off-site and cross-border payment.

3. Payment settlement speed. Remittances from China to the United States usually take 3-5 working days to arrive via SWIFT; even if it is an in-line transfer of the same bank, remittances from the United States to a domestic account in China will take 24 hours to arrive. The Ripple protocol payment settlement only takes about 5 seconds, which is as fast as sending and receiving emails, so it can be regarded as real-time.

4. Inclusiveness of financial services. The currency applicable to SWIFT is the currency of the member bank of the corresponding clearing system, which is limited by the financial network of the clearing system behind it, and the Ripple protocol is applicable to any currency, and the US dollar, RMB, Euro, and Bitcoin can be used as transaction objects, so it is The scope is more extensive; and as long as you have an Internet connection, you can use the Ripple protocol, so the financial services provided by the Ripple protocol can cover areas where the traditional financial institutions are insufficient.

5. privacy protection. In order to meet KYC / AML requirements, payments based on the SWIFT system are regulatory-friendly, but at the same time, they also bring about strong supervision and other problems brought about by the strong clearing system control country. Jurisdiction brings great assistance. The transactions based on the Ripple protocol can achieve anonymous transactions (as long as you know the address of the other party's Ripple account, you can set up anonymity under the corresponding gateway), but in the scenario of meeting KYC / AML, it is no different from SWIFT.

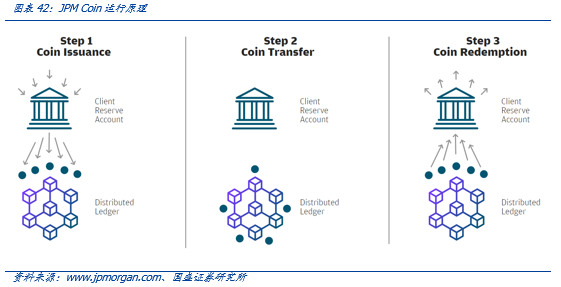

6. Distributed ledger (blockchain) has great potential in international payments

On February 14, 2019, JPMorgan Chase announced on its official website that it became the first U.S. bank to successfully create and test a digital currency (JPM Coin) anchored in fiat currency. Based on blockchain technology, JPM Coin supports instant payment transactions between institutional accounts, which can save costs and improve efficiency, and ultimately benefit users. One JPM Coin can be exchanged for one US dollar, similar to the stable currency already existing in the digital currency market. The early goal of JPM Coin was to provide cross-border payment, securities trading services and replace dollar assets in large corporate customer accounts for large corporate customers. At present, the project is in the testing stage. Only JPMorgan large institutional clients that have undergone regulatory inspections, such as companies, banks and broker-dealers, can use this token. Individuals cannot hold JPM Coin.

International payment has become an important application scenario of JP Morgan. As one of the largest financial services organizations in the United States, JPMorgan Chase became interested in Bitcoin and its underlying technology in early 2015. In the fall of 2016, the company launched an enterprise-level blockchain network based on Ethereum-Quorum Blockchain, JPMorgan Chase has always been at the forefront of the exploration of blockchain digital assets. The JPM Coin to be issued this time is based on the Quorum network, and JPM Coin will enter the testing phase in the next few months. It is estimated that a small number of institutional customers will use JPM Coin to achieve instant settlement of payments between customers. Globally, JP Morgan Chase needs to process more than 6 trillion dollars in settlement and transfer funds every day. Using blockchain and smart contract technology will significantly improve efficiency and speed than traditional methods. In the future, JPM Coin will expand more functions, including the development of asset payment and settlement in other legal currencies other than the US dollar. There is no doubt that JPM Coin has broad application scenarios and market potential in solving international payments and cross-border finance.

The State Administration of Foreign Exchange will actively use the cross-border financial blockchain platform to facilitate small and medium-sized enterprises to carry out trade financing, and blockchain supply chain finance has become a key direction. On March 22 this year, the State Council Office held a press release to respond to the impact of the international epidemic and maintain the stability of the financial market. Xuan Changneng, deputy director of the State Administration of Foreign Exchange, said at the meeting that the Foreign Exchange Administration has always made epidemic prevention and control and support for enterprises to resume work and production as the top priority of their current work. The foreign exchange bureau will actively use cross-border financial blockchain platforms and other technical means to facilitate small and medium-sized enterprises to carry out trade financing. At the end of April 2019, the State Administration of Foreign Exchange's cross-border trade blockchain service platform project launched a low-key pilot. The State Administration of Foreign Exchange is the initiator of the innovative application of the blockchain open registration platform technology of Hangzhou Blockchain Technology Research Institute of China Banknote Credit Card Industry Development Co., Ltd. (hereinafter referred to as China Banknote Blockchain Technology Research Institute). Cross-border trade service platform. The project mainly utilizes the credible technical characteristics of blockchain to solve the problem of cross-border financing difficulties and expensive financing for SMEs, and comprehensively promote the development of cross-border trade finance business.

6.2 Blockchain opens up new market space for international payments

The strong demand for cross-border payments and diverse scenarios will inevitably lead to diverse payment methods and models. According to the statistics of the State Administration of Foreign Exchange, the amount of foreign exchange settlement and sales under bank valet reached US $ 3.46 trillion in 2019, which accounted for more than 60% of the total value of imports and exports in the same year for many consecutive years. A very important payment method. With the rapid development of cross-border e-commerce, the scale of the cross-border payment industry continues to rise. Data shows that in 2018, the transaction volume of China's cross-border payment industry reached 494.4 billion yuan, an increase of 55% year-on-year. Driven by the One Belt One Road policy, e-commerce going overseas will further promote the rapid growth of cross-border payment demand. According to data from Ajsen, cross-border payments processed between banks are between 25 and 30 trillion US dollars each year, and the transaction volume is between 10 and 15 billion.

Seven, investment advice

1. Central bank digital currency DC / EP. With the rapid development of domestic and international payment requirements, digital and online payment methods have gradually become the mainstream. The issuance of DC / EP will further promote the diversification of domestic consumption and international payment methods, and related industry chains are expected to benefit;

2. Blockchain + supply chain finance. Supply chain finance is closely related to physical trade, with a wide range of scenarios and large scale. Blockchain has the characteristics of anti-tampering and traceability of data. It is the key to solving the pain points of mutual trust among nodes in the supply chain. Blockchain + supply chain finance is expected to inspire Market potential, upgrade industry model;

3. Digital assets. Driven by the blockchain, the demand for electronic bills, digital asset storage, and custody will continue to grow, bringing cost reduction and efficiency to the industry.

We recommend focusing on blockchain service companies on the central bank's digital currency, blockchain supply chain finance, and digital asset main lines.

include:

1. The central bank's digital currency main lines: Sifang Jingchuang, Advanced Datacom, Gao Weida, Changliang Technology (development of bank payment functions), digital authentication, Gore software (digital identity authentication), New World (tool transformation), Feitian integrity (hardware wallet) );

2. Blockchain + supply chain finance: Easy to see shares, radio and television express;

3. Digital asset lines: Donggang, Jincai Internet, Jianan Technology (CAN.O); Huobi Technology (1611.HK), Qianjin Holdings (8395.HK).

Blockchain infrastructure development did not meet expectations. Blockchain is the core technology in solving supply chain finance and digital identity. At present, the blockchain infrastructure cannot support high-performance network deployment. The degree of decentralization and security will have a certain constraint on high performance. Blockchain infrastructure exists. The risk of development not reaching expectations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyst: Bitcoin is picking up steadily and may hit a record high in the coming months

- Bitcoin Technology Weekly 丨 Lightning Network usher in a major update, the 0.168 BTC channel limit will disappear

- QKL123 market analysis | BCH computing power switch, BTC computing power soars, what will happen to BSV tomorrow? (0409)

- Depth | How to invest in blockchain infrastructure in a macro cycle?

- Yangchun has arrived in April, and cryptocurrencies continue to rise against the trend?

- Staking this year: have you made money?

- The report shows that the Ethereum DeFi project has grown by nearly 800% over last year