Staking this year: have you made money?

Text: Boo

Source: Honeycomb Finance

Editor's Note: This article has been deleted without changing the author's original intention.

It's been a year since Staking set off a new wave of "everyone's mining", and those who are optimistic about it will call it "the first year of development of Staking." At that time, ATOM, ALGO, VSYS and other PoS star projects appeared overseas. In the domestic background public chain, Qtum and IOST also followed up the Staking economy in the ecology.

- The report shows that the Ethereum DeFi project has grown by nearly 800% over last year

- New “anti-epidemic” tactics: WHO, IBM, Oracle, and Microsoft build an open data blockchain project

- Blockchain payment company Sila completes $ 7.7 million seed round of financing to welcome the next generation of global financial system innovation

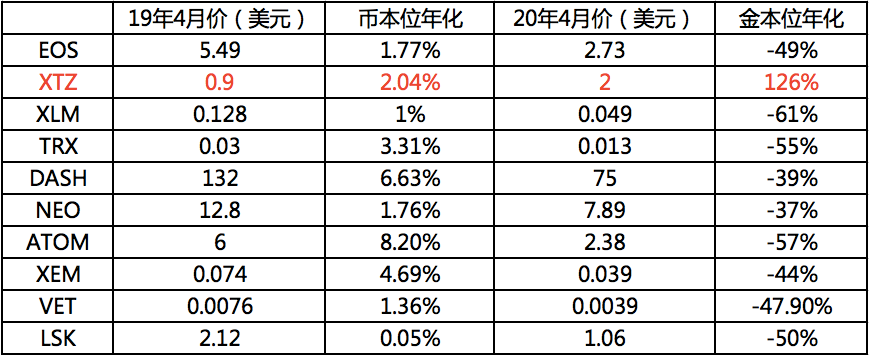

A year later, do people who participate in Staking make money? Honeycomb Finance has counted the top ten projects in the Staking ecosystem by market value. Based on the expected annualized currency income and the currency price performance one year ago, it roughly estimates the gold standard returns of these projects in the past year.

The data table shows that among the top 10 Staking projects in terms of market value, only XTZ has achieved profit on the gold standard, and the remaining projects have a loss ratio between 40% and 60%. It is difficult for ordinary investors to make money.

Node operators who regard service fees as their main source of income do not seem to be worried about the negative impact of falling currency prices. Several staking node service providers said to Honeycomb Finance that they have operated the node for one year and are generally profitable.

The Staking economy's unsatisfactory performance directly led TwoBitIdiot, the founder of crypto research company Messari, to rate this model as "stupid." He believes that staking not only dilutes the value of tokens, but the high pledge rate will also greatly increase the possibility of conspirators colluding to disrupt the normal governance vote on the chain.

Participants may need to rethink the risks and problems of the Staking ecosystem.

In terms of the gold standard, nine losses in ten projects

On April 7th, the veteran digital asset exchange Bitfinex announced the launch of the Staking service, the first phase to support EOS, Cosmos (ATOM) and other mainstream projects such as currency deposit and interest-bearing services. Coincidentally, Binance, BitMax and other trading platforms have also recently launched their own Staking sections.

However, this once popular area has not attracted much market enthusiasm. On social media, there are large discussions about the staking model and earnings related to August and September last year. The decline in popularity may be related to the market performance of the Staking project in the past year.

In the second half of last year, Staking had set off a new wave of "everyone's mining". In 2019, it was called "the first year of development of Staking" by those who are optimistic about it. At that time, PoS star projects such as ATOM, ALGO, and VSYS appeared overseas. In the public chain with domestic background, Qtum and IOST also promoted the staking economy in the ecology, providing investors with the function of "storage and mining".

The concept of Staking is derived from the term Stake in Proof of Stake (PoS), which refers to the behavior that an institution or individual participates in activities such as voting and verifying blocks in PoS tokens to obtain revenue based on ownership. A simple understanding is similar to "digging coins with coins".

According to the statistics of the Staking Rewards website, as of April 8, a total of more than 90 digital assets have been opened for Staking, with a total market value of 11.3 billion U.S. dollars, of which pledged tokens totaled 7.6 billion U.S. dollars, and the pledge rate was 67%. The average annual currency standard The profit from chemical conversion is about 14.89%.

The market value of tens of billions of dollars does indeed reflect the market size and demand of Staking. According to Staking Rewards data, on April 9, 2019, the total market value of Staking's entire network was 15 billion US dollars, while the total amount of network pledge tokens at that time was 4.1 billion US dollars, and the pledge rate was only 27%.

According to the market value ranking, EOS currently occupies the top spot with 3.76 billion US dollars, followed by XTZ, XLM, TRX and so on. So, did investors who followed suit last year make money?

In this regard, Honeycomb Finance has counted the top ten projects in the current market value of the Staking ecosystem, and combined with the expected annualized currency income of the above assets and the currency price of one year ago, roughly estimated the gold standard returns of these projects in the past year . From the data point of view, among the 10 projects, only XTZ achieved profit in the gold standard, and the remaining projects had a loss ratio between 40% and 60%.

Of the 10 projects, only XTZ achieved profitability on the gold standard

The data shows that in the case of continued bearish currency prices, the increase in the amount of currency brought by currency-based wealth management is far from enough to offset the capital losses caused by the decline in currency prices in the process of holding the currency.

At the same time, if the currency price rises during staking to earn coins, investors can enjoy a win-win situation between the currency standard and the gold standard. But in the past year, among the top ten Staking projects by market value, only one project has experienced a win-win situation. 90% of Staking projects have suffered serious losses in terms of the gold standard. If they do not choose to withdraw, they can only hold the currency to rise.

Scale effect leads to node profit and retail loss

Gold standard wealth management has performed poorly in the past year, but the staking pledge rate is on the rise, from 27% a year ago to 67% today. This means that more than half of the tokens in the projects that provide Staking services have flowed into their respective pledge pools.

This raises an important question. Since the currency performance of most Staking projects in the past year has not been good, why did the pledge rate of Staking rise instead?

"Because for long-term token holders, participating in Staking can get token dividends, rather than keeping the coins all the time." A digital asset wallet staff told Honeycomb Finance, "At present, the Staking industry has begun to take shape. Capital organizations, exchanges, mining pools, wallets and other industry organizations have actively deployed. However, from the data point of view, wallets and exchanges are still Token gathering places, so exchanges and wallets that provide Staking services often have natural advantages. "

Among the nodes of a large number of PoS projects emerging in 2019, exchanges and wallet service providers also account for the majority. Among them, mainstream exchanges such as OKEx and Huobi have opened doors to welcome customers, providing platform users with a more convenient entrance for staking. Some trading platforms such as KuCoin, Gate.io, etc. have even adopted a passive wealth management model, that is, users can passively obtain Staking income as long as they deposit to the account and do not need other operations.

Partially listed exchanges with Staking business

Honeycomb Finance consulted multiple Staking node service providers for 2 projects. They told Honeycomb Finance that the operation of the node was profitable in a year. Among them, some trading platform nodes even regard Staking nodes as the main means of increasing bear market revenue.

"When the market is not good, it is difficult to maintain the team by relying on spot fee income."

A wallet operator who provided staking services told Honeycomb Finance that their revenue mainly comes from service fees. "No matter how the currency price drops, as long as there are users who come to the platform for staking mining, we can charge service fees. According to personnel, they belong to a smaller service provider, "the net profit of running a node for one month is about 10,000 yuan.

It seems that the decline in currency prices has little effect on node operators earning service fees. However, some organizations have dismissed the idea of operating Staking nodes,

"We thought about being a staking node in the middle of last year, but then due to the instability of the currency price, the amount of fiat currency income fluctuated greatly, and it was gone."

The above-mentioned people agree with the profit statement of the operator of the Staking node, "This is the effect of scale." He believes that the loss mainly occurs in retail investors.

"When Staking was on fire last year, many people participated in the token dividend because of the bull market making money and the bear market making money. Who ever wanted the market to bear for so long. Of course, if they are currency holders, they participated in Staking mining The mine can at least buy more coins, but if you become a long-term currency holder because of staking, there is a high probability of losing money in the short term. "

High inflation + bear market accelerates project value dilution

It is difficult for ordinary investors to make money. In one year, the wealth effect of Staking wealth management has not yet been shown.

In March of this year, TwoBitIdiot, the founder of crypto research company Messari, pointed out, "Staking is the most stupid thing I have ever seen in the industry. It is the dilution of the value of tokens." He believes that some projects are designed to avoid market value decline and decrease. Token circulation is encouraged to be held by users. The opening of Staking will accelerate the demise of tokens.

At present, the incentive coin for staking comes from the issuance of tokens, so PoS tokens are also often regarded as inflation tokens. Users who participate in Staking can obtain the benefits of additional issuance, but for those who are not participating in Staking and are active in the secondary market, the value of their tokens is diluted due to the large amount.

As the rating agency Tokeninsight described last October, no matter how the market value of the project changes, users participating in Staking can always obtain inflation gains, and those who have not participated must always bear the losses. Too high inflation rate will cause the token price to drop sharply, and the inflation rate is too low to bring staking users to participate. The agency reminded investors that “users cannot rely solely on the rate of return to determine project investment, but also need to start with project quality.”

"Some projects attract investors with high returns. In fact, there is an inflation rate higher than the market. When a large number of investors pledge tokens, the circulation of tokens will become smaller, which will cause the price of the currency to rise in a short time. Illusion. "TwoBitIdiot said.

The worse situation today is that not only does the Staking project have built-in dilution of value hidden by high inflation rates, the cryptocurrency market has also entered a downward channel. When the price of the currency drops, high inflation becomes worse.

On the other hand, the large-scale token pledge also makes the governance model of the public chain network misshapen. Messari research shows that individual mainstream exchanges currently control more than 50% of the total amount of pledged tokens in the Staking project, which has greatly increased the possibility of malicious actors colluding to disrupt the normal governance vote on the chain. The turmoil between the Steem community and Sun Yuchen showed the negative impact of the "large currency holding" node on network governance.

After a year of development, Staking's token pledge rate has increased significantly. But the data also shows that when the currency price drops, the staking gains of most projects are erased. If you are a fiat currency investor, at least from the current perspective, Staking is not a good investment model. In addition to poor returns, the industry's forecast of inflation, node centralization, and other issues seems to be gradually exposed. Participants may need to rethink this model.

Are you still optimistic about Staking mode?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cryptocommercial bank Galaxy Digital's latest earnings report: Q4 2019 loss of 32.9 million US dollars, stock price fell 65%

- To improve the efficiency of cargo release, shipping giants and Tesla jointly piloted blockchain applications

- Market analysis: BCH halved, the market bulls are still expected to test

- Do crypto scams target charity donations for the new crown epidemic? Texas regulator halts emergency

- Viewpoint | Helping National Governance, Industry Self-Discipline, and Social Credit-the transformative power contained in blockchain

- Partner of A16Z Cryptocurrency Venture School: Bitcoin and Ethereum are difficult to replace

- BCH, BSV double currency halved, the subsequent impact on BTC geometry?