Depth | How to invest in blockchain infrastructure in a macro cycle?

Author | Zheng Jialiang, Research Director of HashKey Capital

This article mainly elaborates our views on blockchain industry investment, especially infrastructure investment. From historical data and deductions, it can be concluded that blockchain infrastructure investment is the epitome of the macro cycle, which is affected by the global credit expansion-contraction cycle.

Blockchain projects should be prepared for a long time, and resources can be rationally optimized from the perspective of cycle and anti-fragility. Investment institutions can also sort out investment strategies from the perspective of final thinking, redundant preparation, and looking for positive black swans.

We optimistically expect that the next 1-2 years will provide rare opportunities for truly prepared investment institutions. This article is the first one on this topic, and the next one will classify and comment on the blockchain infrastructure.

- Yangchun has arrived in April, and cryptocurrencies continue to rise against the trend?

- Staking this year: have you made money?

- The report shows that the Ethereum DeFi project has grown by nearly 800% over last year

The blockchain investment cycle is the epitome of the macro cycle

For more than 10 years, the blockchain world has grown from scratch, established a decentralized value network system, and also cast a crypto asset market that once reached 800 billion US dollars. The "The Times 03 / Jan / 2009 Chancellor on brink of second bailout for banks." Recorded in the Bitcoin genesis block may suggest the inextricable relationship between the blockchain industry and the economic cycle.

Over the past 10 years, the blockchain industry has continued to have small cycles. From the perspective of users, technological progress, business form, and investment, the industry as a whole has maintained an upward trend. It can be said that it has never really experienced a complete macro cycle.

But the melody of music will be tense and relieved. The true macro cycle still dominates every industry. Our judgment is that the investment boom in the blockchain industry may enter a relatively low point in the next 1-2 years.

Some people say that the cycle is the inevitable development of the industry, there will be a bubble burst. We think it's true, but we want to elaborate: Although the blockchain industry is a brand-new industry, its cycle will not be unique, and it will still be affected by the macro cycle.

Let's look at a few pictures:

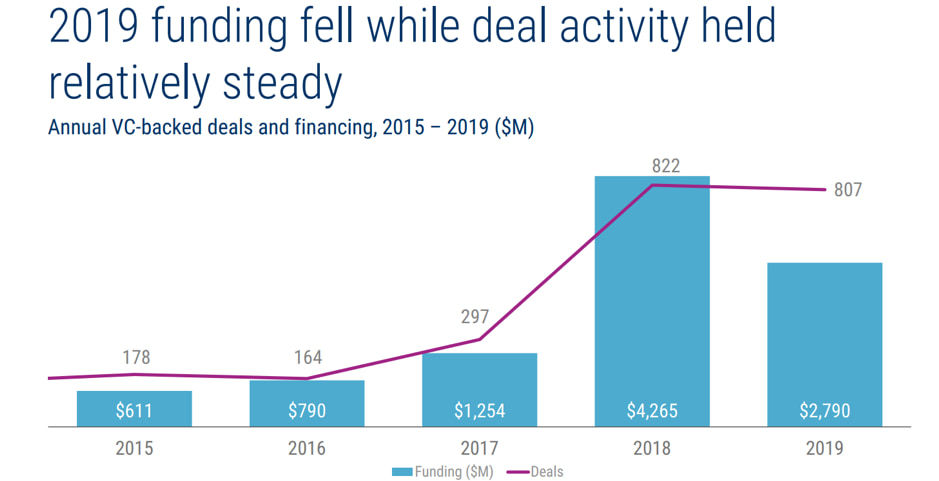

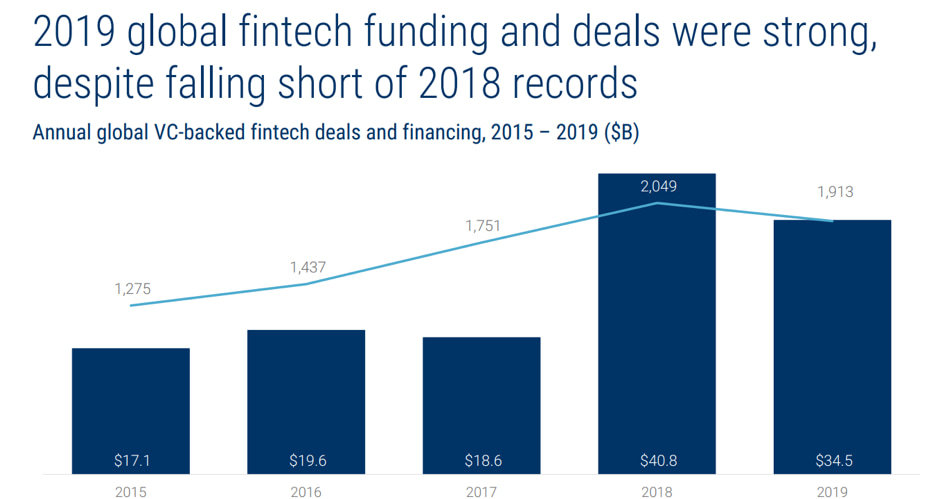

Both figures are from CBinsights. Although Venture Capital (VC) investment in the blockchain industry accounts for only a small portion of fintech VC investment in terms of investment, in terms of trends, no matter the amount of investment or the number of transactions, blockchain VC investment and fintech After VC investment peaked in 2018, it began to decline in 2019.

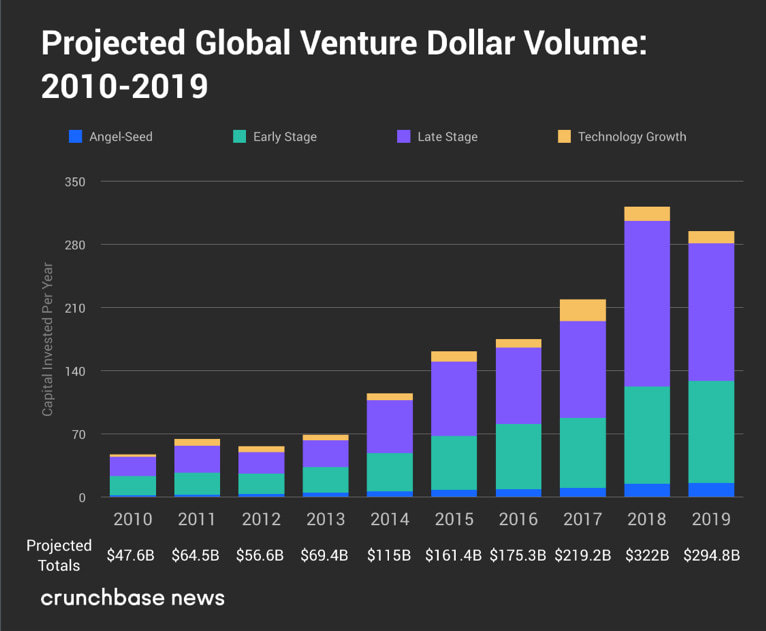

This is not over yet. If fintech investment is put in a larger industry-wide perspective, global VC investment will also decline in 2019.

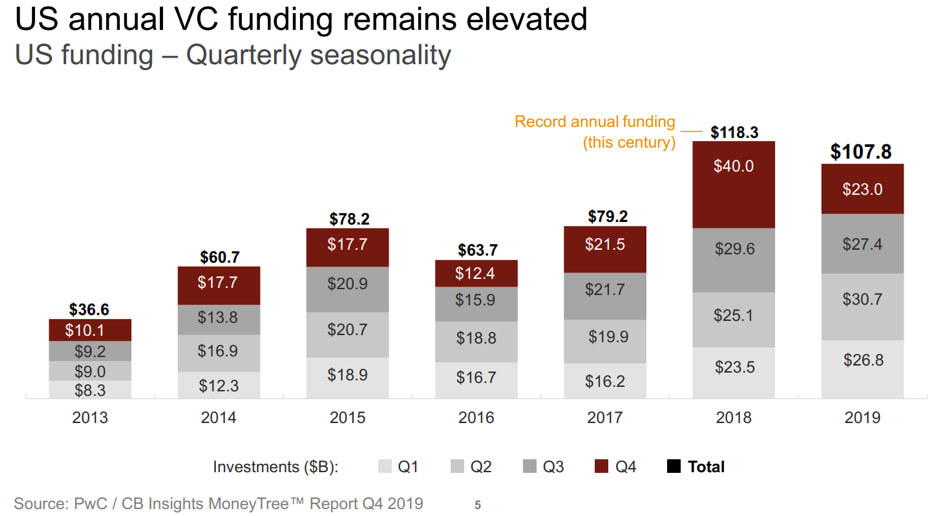

We did not find the global VC investment situation in CBinsights, but we used its statistical US VC investment quota as an alternative, which can also be used as an example, and began to decline after 18 years.

Various data sizes may be controversial, but we believe that big trends should not be wrong. In terms of investment, not only the blockchain, Venture Capital's bets on all emerging industries basically peaked in 2018 and declined in 2019.

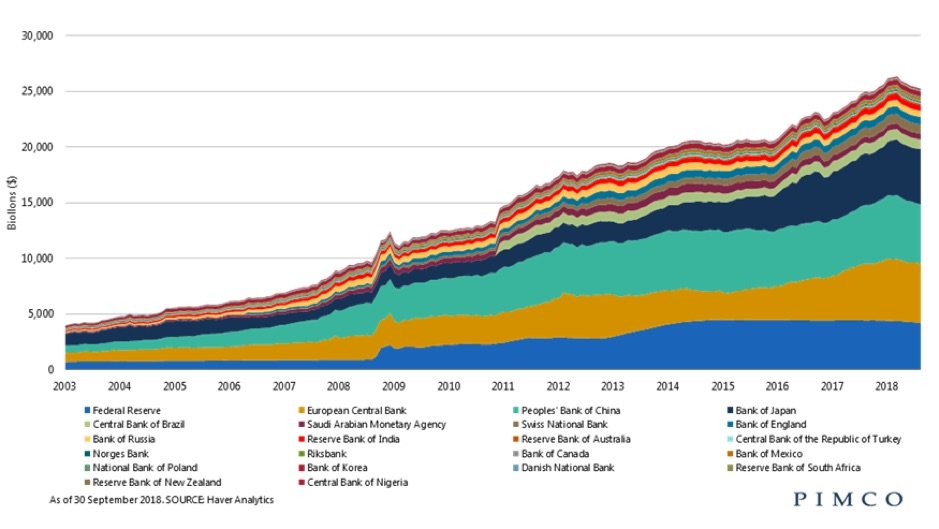

So why did VC investment peak in 2018? We believe that a reasonable explanation is the result of credit contraction. According to the statistics of Pacific Asset Management Company PIMCO (Figure 5), the global central bank's total balance sheet continued to expand after the financial crisis in 2008 and peaked in 2018, which is why the global VC investment in 2018 also caused Reached the peak, because the reservoir behind it continues to provide liquidity through credit expansion.

In the second half of 19th, credit began to recover slowly, but space was also extremely limited. However, by 2020, due to the sudden outbreak, no matter how the central bank expands its balance sheet, global credit will definitely continue to shrink, and credit contraction will definitely lead to a reduction in investment.

The epidemic situation is also accelerating the cycle. Based on the current situation, global VC investment will continue to decline in 2020. We expect the same in the blockchain industry, and the investment in 2020 will definitely decline.

The market is accustomed to using the currency price as a measure of the industry's ups and downs, which is actually only one level. In the first quarter of 2020, the average bitcoin price is at least more than double that of the first quarter of 2019, but according to research by The Block, financing cases in the first quarter of 2020 have dropped by 50% compared with the same period in 2019. Therefore, we feel that we must look at the cycle from the perspective of financing, especially institutional financing. And our current microscopic perception of the industry is basically in line with this trend.

Now we basically outline our ideas: it is the investment in the blockchain industry. In essence, a microcosm of global VC investment will follow the global cycle fluctuations. From a logical deduction point of view, if the blockchain industry is to grow, it will definitely be supported by mainstream VCs in the world, and will eventually converge with global investment trends.

Therefore, as soon as possible to realize this situation, rather than simply taking the internal small cycle of the industry as the main dimension, the industry operation can be understood from the macro framework earlier.

Crypto assets in the secondary market and VC investments in the primary market are all parts of the global cycle machine.

The current so-called resonance of crypto assets and other risky assets is only a manifestation of long-term credit contraction. Its framework has long been defined and is not a superficial phenomenon. The reason for discussing cycles is that the behavior of projects and investment institutions under different cycles will be very different.

In the up-cycle, the industry is very lively, and the “10,000” chain is issued at the same time, financing is easy, and even some investors write cheques are no greater than the determination to buy a VR device. In the downward cycle, the illusion disappears, the project team must speed up research and development and product speed, the use of funds should be more reasonable, the allocation of resources should be intensively cultivated, refinancing will face intense competition of the same kind, and the valuation may not grow as expected. This will be the status quo facing the industry in the future. But for investment institutions, it may be a spring.

So understanding the meaning of the cycle is to avoid risks and grasp opportunities.

Cross-cycle, anti-fragile blockchain infrastructure construction

At present, most blockchain projects can actually be regarded as broad-based infrastructure. For upper-layer applications, especially the decentralized applications native to the blockchain, most of them have not reached the Internet after several years of exploration The level of application.

The foundation of the lower layer is the infrastructure, and the so-called building block, there is no way to prove to be reliable, universal and extensible.

Therefore, the current infrastructure seems to be ecologically diverse, but it is still far from the scale of large-scale commercial applications, and it needs to continue to invest more. Although it is constrained by the cycle, the successful infrastructure can traverse the cycle, the effect of the time span is long, and investment in one cycle often shows explosiveness in the next cycle.

In addition, in the downward cycle of investment, the black swan will also appear in the blockchain world disturbed by the external world. We will eventually face the test of various extreme events, so anti-fragility is also a very interesting dimension in the current cycle.

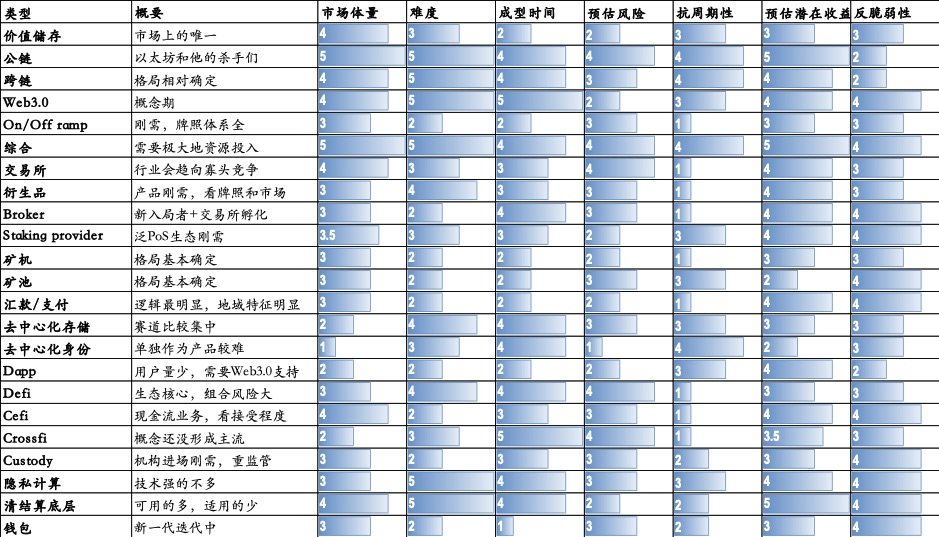

How to find out the infrastructure opportunities that can traverse the cycle in the future and can resist the black swan time to a certain extent from the current blockchain infrastructure map? Let us first make a simple classification of infrastructure:

Here are divided into several dimensions:

- Market volume, which represents the proportion of the total size of the estimated final market infrastructure

- Difficulty / time, which represents the estimated development difficulty and the time of molding products and molding market

- Estimated risk, which represents estimated sub-industry risk, regulatory risk, product risk, revenue risk, valuation risk, etc.

- Estimated potential income, which represents project cash flow income and other financial income

- Anti-cyclical, representing our ability to anticipate cycle crossing

- Anti-fragility represents our expected ability to resist black swans (of course black swans are unpredictable, this is just a conceptual assumption)

The above table represents our conceptual model of infrastructure investment. Starting from this conceptual model, we have proposed five possible directions. How can blockchain projects build a relatively stable and long-term infrastructure ecosystem to resist periodic downturns risk.

Address existing pain points instead of simply copying

Take the public chain as an example. Although the track of the public chain was crowded in the first two years, the development has now become gradually clear, and the competitors on the scene have become scarce. The simple classification is Ethereum and his killers.

We believe that there are now four major factors that support Ethereum's lead in the public chain:

- The largest developer community;

- The largest DeFi product library;

- The high value of Ether tokens provides qualified collateral for DeFi;

- The largest smart contract platform and relatively secure underlying architecture.

If Ethereum is successfully upgraded to 2.0, the scalability issue is resolved and the leading edge will continue to expand. What is the reason why other public chain or public chain project teams are still investing? The process of upgrading Ethereum is long and complicated, leaving a large time window and variability. It also left some market space for some so-called dedicated public chains.

Therefore, if other public chains are currently one step ahead in terms of theoretical scalability, the public chain should focus on the developer community and Dapp application libraries and scenarios. The sinking step is the developer ’s development environment (such as IDEs that use mainstream programming languages) , And continuous help to the development team.

To complete these public chains, at least the following conditions are required:

- There is a relatively large fund bank to support long-term development;

- Excellent community culture shaping;

- Universal development kit;

- Introduce rich mortgage assets (whether native assets or mapped assets) that support DeFi and Dapp.

Screening with these criteria, we still see that some public chains or underlying facilities have great potential.

Building barriers to diversity

Take DeFi as an example here. It is no exaggeration to say that DeFi is currently equivalent to half of Ethereum, but DeFi will eventually adapt to other public chains. The idea of migration is not new, but it has been shelved for various reasons. The reason why we now propose that DeFi needs to rethink the issue of diversity is because the high-performance public chain will basically be on the mainnet this year.

Another issue that cannot be ignored, ETH1.x will slowly migrate to ETH2.0. During the migration process, the Ether on ETH1.x will be gradually mortgaged to the beacon chain, then the PoW-type Ether, which is the bottom collateral of DeFi, will gradually decrease, and DeFi will also be migrated to ETH2.0. Therefore, ETH2.0 is also a new chain for DeFi, similar to other public chains.

The migration process is bound to be more complicated. It will be two years after the ETH2.0 is stabilized. At that time, DeFi, which is not scaling, has a terrible prospect. Therefore, assuming that DeFi of multi-chain contracts will appear in the future, it is actually a very big advantage compared to single-chain DeFi.

The development of DeFi will not slow down any more, because a problem that is easily overlooked is CeFi.

In comparison, CeFi is easy to adapt to various chains, Ethereum upgrade is basically not a problem, adjustments will be quick. For example, many people in the DeFi world are trying to introduce Bitcoin into the DeFi system. And CeFi has been doing it for a long time. The financing right of Bitcoin is actually in the hands of CeFi, which is one of the reasons why DeFi is still niche. When the market value of Ethereum is large enough, CeFi will still extend its tentacles.

Regardless of the concept (whether or not it is decentralized), it is most important to occupy users first. I believe that after those new public chains go online, as long as the scale is sufficient to support their profits, CeFi will also be covered. Therefore, barriers to diversity are very important, both on the level of time and the level of competition.

Building an ecosystem

In addition to re-injecting a single type of functional facility, another possible method is to build a system. Simple systems can deal with simple risks, and complex systems can handle complex risks.

Cycles and black swans are bound to appear, and they are unpredictable. A complex system must have complex redundancy and a feedback mechanism that is relatively robust.

Still taking Ethereum as an example. Why is the system of Ethereum more robust. In 2016, the famous Dao bifurcation occurred, and the concept of code is law was different, which caused Ethereum to eventually split into two chains. The two communities have objectively said that the development is relatively good, and Ethereum and Ethereum Classic There are also some signs of cooperation.

Why can Ethereum be like this, and we feel that other public chains may not have undergone division? Because the Ethereum community is large enough and complex enough to be so large that even if it is split, it will not affect the basic market.

But some other public chain communities are not necessarily. For example, many of the top 20 cryptocurrencies by market capitalization are also forked coins, or are in the process of "soft forks". Not all markets and communities are very optimistic.

Therefore, to compete with Ethereum, the surface is technology, and the essence is the ecology behind. Of course, the current public chain adopts PoS-like consensus, and the interests of users, verifiers, and developers are more consistent with the PoW-like public chain, and the establishment of ecology is relatively easy.

Another direction to build a complex ecosystem is to use investment as a tool to rapidly expand the ecosystem.

Taking Digital Currency Group (DCG) as an example, it has invested in more than 170 projects from 2013 to the present, basically covering all the tracks of the blockchain and cryptocurrency and the head projects that used to be and now constitute the Very complex system, and DCG itself does not consider itself as a financial investor, as stated

"DCG is not a venture fund. We are a strategic investor … We aim to support the best teams in our target markets by providing capital through a company's lifecycle, connecting them to our network, and using our collective knowledge and insights to help companies grow and scale. "

The three concepts of DCG's Build-Support-Network are very enlightening, with the concept of center-expansion-extension three circles.

DCG's Build mentioned that "wide-range risk exposure and selective business concentration is a successful strategy." Therefore, under its complicated investment portfolio, DCG reinvests in three subsidiaries, Genesis Trading (OTC business) , Grayscale (asset management) and CoinDesk (media, events and research), these three companies have all achieved the industry ’s first echelon or even top-level, and are all cash flow or resource-based businesses: Genesis Trading is for traders, and Grayscale is for traditional investors. , CoinDesk is media-oriented, mastering vocalization, information channels and global network reach.

Support is similar to Network. Support is a project that supports its own investment companies. Network is a broader support for related people, projects, companies, investors, governments, academic institutions, etc. in the ecosystem. Such an ecosystem, coupled with the support of cash flow, is very robust, and no matter how big the risk is, even if a dozen investment projects fail, it will not shake the foundation.

If you look at it from another angle, instead of treating DCG as an ordinary investment institution, the three institutions under Build are regarded as the main business of DCG, and venture capital is regarded as CVC (Corporate Venture Capital). The structure is also very clear. The main business is still a cash flow business, through the expanding investment network to increase investment income, expand the main business, in order to obtain risk and cycle resistance.

HashKey Group is also an example of comprehensive ecology, but the path is different. I believe friends are very familiar with us, but I will not elaborate too much.

Mature infrastructure can also be disrupted, keep your sense of smell and watch for overtaking opportunities

Another risk of infrastructure lies in the chance of being overtaken when upgrading. This is not alarmist. For example, China's mobile communication network is a very good example.

In the 2G era, China Mobile is almost the dominant company. In the 3G era, China Unicom monopolized the 3G era for about 5 years because of the rise of WCDMA bands and the rise of smart phones. And in the 4G era, it has become the world of China Mobile, and China Telecom has become a very strong competitor.

In the 5G era, because of the division of spectrum, Unicom and Telecom have obtained easier frequency bands for commercial use, so they have dragged competition into the unknown field. The temporary dominance of infrastructure does not mean that it can last forever.

However, during the prosperous period, the profits were also quite rich. Unicom's five-year net profit from 2011 to 2015 reached 45 billion yuan. This is the characteristic of infrastructure and has a large enough market and profits.

Taking the Internet as an example, infrastructure giants also have their own styles in different eras. Before 2004, they were portals. After 2005, they became search engines. After the development of smart phones, mobile phone operating systems and large-scale apps have taken the lead. Enterprise services In terms of cloud services, Microsoft, Amazon and Google have divided it, and Ali in China is gradually catching up.

The infrastructure of the Internet is changing every ten years or so, which is inspiring to the blockchain industry. Preserving strength and observing with a keen eye will capture the opportunity for overtaking in a corner. Recently we have observed how many new players have emerged in the crypto wallet industry. For the current wallet pattern, there may also be an opportunity to overtake.

Learn the underlying facilities of traditional financial architecture and attach importance to risk management

It is also a way to build or improve the structure from the existing traditional financial experience.

In April 2012, the Payment and Market Infrastructure Committee CPMI and the International Securities Regulatory Commission organization IOSCO jointly issued the Financial Market Infrastructure Principles PFMI, which regulates the design and operation of major financial market infrastructure and urges to improve its safety and efficiency. Prevent systemic risks and promote transparency and financial stability.

The PFMI principle places great emphasis on:

- Systematic and comprehensive risk management;

- The role of payment settlement institutions for financial stability;

- Hard constraints of principle landing.

PFMI summarizes 24 very important principles, which can also be used in the future blockchain infrastructure, especially for public chain, clearing settlement bottom layer, and decentralized financial-oriented projects.

The core of PFMI is risk management, which is also a significant shortcoming of the current infrastructure. In contrast, all aspects of DeFi are insufficient, including credit, liquidity, transparency, efficiency and so on. The concept of building block still lacks a systematic design. The industry is satisfied with the calling of functions and the display of a variety of functions, but it ignores the stress test. These principles provide very good guidance.

The market volatility on March 12 not only disturbed the cryptocurrency market, but also exposed some DeFi tool issues. In fact, in the 2008 financial crisis, the United States has strengthened supervision and efforts in various directions regarding the cumulative risks of derivatives and the classification of financial industries, including:

- In view of the opaque supervision of separate industries, the Federal Reserve is given greater authority to conduct comprehensive supervision on financial infrastructure such as banks, insurance, and securities;

- In response to systemic risks, a financial stability committee was set up to restrict high-risk investments and raise the capital requirements of financial institutions;

- Implement the "Walker Rule" to restrict bank proprietary trading and prohibit banks from investing in hedge funds and private equity funds;

- Financial derivatives strengthened supervision and increased disclosure requirements. Therefore, the turmoil in the capital market in early 2020 did not cause problems in banks or derivatives and led to an increase in system risk.

Similarly, for the crypto market, the disorderly growth of the derivatives market has also paved the way for the next crisis. Therefore, for the blockchain industry, it is necessary to manage risks and even introduce the concept of supervision or similar supervision, which helps to strengthen its own system under different cycles.

How to make a good investment in blockchain infrastructure under the macro cycle

Why there must be cycles, human irrationality is the real reason. Professor Robert Schiller mentioned in "Irrational Prosperity": "Investor sentiment, media, and experts superimpose into market sentiment, forming a feedback loop with stock price changes. Eventually a bubble is formed." And the cycle repeats because "In the case of uncertainty, people assume that the future pattern will be similar to the past and look for familiar patterns to make judgments, and do not consider the reasons for this pattern or the probability of repetition.

Starting from a certain type of financing boom in 2017, the myth of wealth creation led to the irrational entry of different types of teams, making various "changeable world" projects that lacked viability, swarming funds and FOMO mentality At that time, the project was basically lack of verification, which brought great difficulties to analysis, judgment and investment.

As a result, various public chain projects are flooded, and various slogans known as third-generation, fourth-generation, and fifth-generation public chains are constantly being proposed. Just as stocks choose to list or issue more shares when there is a good relationship, it will certainly cause bubbles and investors' losses. But there is no way to avoid it. The instincts of human nature internalize and externalize into cycles, making history repeat.

Since the investment in the blockchain is also a microcosm of the cycle, the route of the investment perspective is relatively obvious-the traditional value investment method provides the most correct method.

As Venture Capital, it is necessary to have a stable and active layout at the time of the cycle trough, especially for investment in infrastructure. The true value finder will certainly build a safety margin in the trough. Venture Capital must also bear the responsibility of building the next generation system. The direction that is still worthwhile is the unbreakable underlying structure in the future. If resource allocation deviates from the right direction, it will have an impact on the industry for up to 5-10 years.

In addition to the classic value investment method of VC, we focus on blockchain infrastructure investment and believe that investment institutions can think more in the following three directions:

There must be end-game thinking, at least in stages

Any industry is easily biased by various phenomena, especially confusing surges, trends and irrationality. "Irrational Prosperity" also mentioned that "most of the ideas that lead to people's behavior are not quantitative, but appear in the form of" telling stories "and" finding reasons ". "

Various so-called narratives disperse the mind if they are not talking about things. The unique storytelling ability of human beings constantly finds explanations for various realities and compiles stories. Compared with data, good stories can break through the barriers of human emotion.

Rather than wasting energy to explain the current competition, it is better to look backwards, at least think about the situation after 5 years. The blockchain infrastructure, due to rapid iteration, has actually prepared for the future picture.

The so-called final thinking is from the back to the front. For example, with the current financial and Internet infrastructure, the smartphone industry is oligarchic, with more than 500 million users. There are very many applications of various types, and there are very many to B services. Less, few stock exchanges and many investment banks / brokers, and many banks have fewer insurance companies. This pattern is caused by fewer enterprises, more users, and diverse needs, so there will be more services for to C and fewer services for to B.

In fact, the blockchain can also be briefly analogized. There will be more wallets, more brokerages, fewer exchanges, less clearing and settlement bottom layers, fewer custody services, and fewer public chains, but there will be many applications above, to C's financial There will be many, not many data services. Overall, if market estimates and layouts are conducted according to to C and to B layouts, there should be no major resource mismatch.

Prepare for redundancy

Redundancy is not superfluous. Redundancy is necessary in the natural evolution process. Redundancy can be divided into three forms: content redundancy, functional redundancy, and structural redundancy. The blockchain is inherently content-redundant. For example, multi-party record ledgers are a form of content redundancy, which endows records with no tampering. Functional redundancy, increase the basic functions of the system, and add additional additional functions. The structure is redundant and provides more upper layer support.

The role of redundancy is to increase the fault tolerance of the system.

The redundancy of investment, in our understanding, is to reduce the probability of making mistakes and increase the probability of correctness.

The first is to keep sufficient funds. Liquidity problems may occur at any time during the downward cycle, including poor financing and unsatisfactory exit. So leaving sufficient funds is important for recycling.

The second is the layout of the track, on the one hand, you can increase the win rate based on various due diligence. It is believed that many VCs do this with this method under the circumstances of limited resources. But on the other hand, everything is possible, so on the same track, it is not wrong to distinguish between primary and secondary, and use a small bet to suppress a chance with a small probability.

The third is to always be prepared to pay for the mistakes. If you are wrong, you should stop loss in time, which is better than dragging on. The fourth is to actively manage and increase the winning rate. When we look at history, many companies are often one step away from dawn, and there are many high-quality companies. If VC can take advantage of its own advantages, and actively manage at the market, customer, and cooperation levels, it can win the opportunity to accelerate the progress of the project. In addition to various fundamentals, the risk of this variable of time is minimized.

Looking for opportunities for positive black swans

Investing naturally does not like black swans, but black swans are inevitable, so we need to treat black swans as an inevitable thing in some cases, and do not give up any opportunity to generate potentially huge benefits Black swan).

Taleb mentioned a barbell strategy in "Anti-fragility", which is to invest 80% -90% of personal funds in zero-risk investments and 10% -20% of high-risk investments. If it is applied to blockchain investment, when we allocate most of the resources on mainstream platforms and a small part on potentially explosive platforms, we have the opportunity to obtain a large amount of revenue.

We will finally observe that on a certain track of the blockchain, players will eventually be born and go to the end, but there is also a very small probability that they will be turned over by a later project or pose a great threat to the first place, such as in a In areas where the market is relatively large but competition is not fierce, such as Defi or Dapp, the probability of black swan is relatively high. Moreover, the early project will assume the role of trying various risks, and the design of the later project can avoid such risks.

Quantitatively, it is to compare two probabilities, the probability of the white horse falling behind and the probability of the black horse overtaking. These examples have been made in the short history of blockchain, and there are all kinds of tracks. For example, many of the so-called next-generation public chains with amazing market value in 2017 have once had the market value of the top 20 or even the top 10 of CMC. An example of dark horse overtaking is a class represented by C2C exchanges.

Outlook

This article first discusses the link between the periodicity of the blockchain industry and the macrocycle. Infrastructure investment in the blockchain industry is inevitably affected by the macro cycle. If our general direction is not bad, the investment and financing boom will decline in the next two years. Prosperity is not a bad thing for investment institutions. Natural cycle replacement will leave those projects that really shine, and it is they who will create the most generous returns for investment institutions.

The recent performance of the market shows that there are many unexpected problems in risk management. In the future, the situation will be particularly serious when the prosperity declines. However, the structure of the secondary market in the short term has not seen substantial changes. Liquidity will continue to be decentralized, derivatives concentrated, high leverage, and arbitrage mechanisms to maintain prices will continue. So the infrastructure will still be plagued by risks. Therefore, whether it is a project perspective or an investment institution, it is necessary to be prepared from multiple perspectives. Our suggestions mentioned above may be used for reference.

We also make a few prospects here, and the classification and review of the blockchain infrastructure will be placed in our next chapter.

- Recognizing the existence of cycles, it is most important to survive as a company or project.

- The recovery time will take 1-2 years, the project will receive less financing, the market clearing will speed up, and the valuation will be affected.

- The project must reevaluate the expenditure plan, reduce expenditure, remove unnecessary functions, and seize core customers and core markets. Cash flow is the most important. Save strength to survive. Revenue is very important, cost will be more important.

- Financing should try to evaluate the ecological attributes of investment institutions, and strategic support or ecological inclusion will be more helpful. In addition to the necessary operating funds, it can also help in the market, users and communities.

- The project has to think about what is the real infrastructure.

- Mergers, reorganizations, and acquisitions will accelerate. This is an opportunity, please consider carefully the feasibility if it appears.

- The construction of infrastructure has a long way to go, requires significant investment, has high risks and high returns. Part of the current infrastructure may be reconstructed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New “anti-epidemic” tactics: WHO, IBM, Oracle, and Microsoft build an open data blockchain project

- Blockchain payment company Sila completes $ 7.7 million seed round of financing to welcome the next generation of global financial system innovation

- Cryptocommercial bank Galaxy Digital's latest earnings report: Q4 2019 loss of 32.9 million US dollars, stock price fell 65%

- To improve the efficiency of cargo release, shipping giants and Tesla jointly piloted blockchain applications

- Market analysis: BCH halved, the market bulls are still expected to test

- Do crypto scams target charity donations for the new crown epidemic? Texas regulator halts emergency

- Viewpoint | Helping National Governance, Industry Self-Discipline, and Social Credit-the transformative power contained in blockchain