BCH, BSV double currency halved, the subsequent impact on BTC geometry?

Text: Huang Xuejiao

Publisher: Odaily Planet Daily

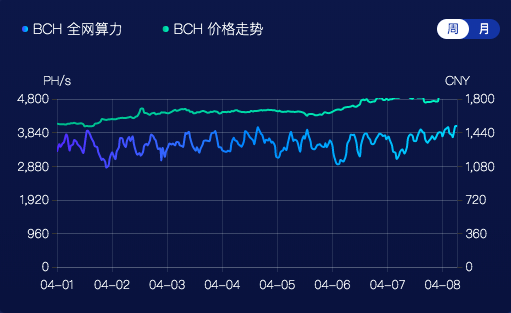

At 20:19 on April 8th, Beijing time, the BCH block with a height of 630,000 was excavated by the Antpool mining pool. The block reward changed from the original 12.5 BCH to 6.25 BCH, announcing the completion of the BCH production reduction.

The current hash rate of the entire BCH network is about 3.69 EH / s, the difficulty of mining is 523.62 G, and the price of BCH is above 265 US dollars, which is nearly 5% lower than the 24-hour high.

- Looking at the crypto market from the stock market: What can we learn from the uneven distribution of capital?

- In-depth exploration of Forbes blockchain 50 product data: Which two fields are most concerned about?

- TOP 30 series observations: Q1 average holding income range is 148%, halving the market shows power

Can the BCH spotted by bears still have "halving the market"?

Can the BCH spotted by bears still have "halving the market"?

This is the first time that BCH has halved since BTC left in 2017, so there is no "history" for reference.

However, as Bitcoin's "Prince", it halved one month before Bitcoin, and the price performance of BCH (and its forked currency BSV) has been highly expected by many people.

Starting this morning, the prices of BCH and BSV started to rise, leading the rise of mainstream cryptocurrencies.

At 10 am, BCH rose all the way from US $ 251 to its highest point of US $ 280, with a maximum increase of 11.55%; BSV was also not willing to show weakness, almost simultaneously pulling from US $ 184 to around US $ 220, with a maximum increase of 19.5%.

The most important question for investors is whether such a rise can continue after halving, or will it turn around?

Odaily Planet Daily interviewed some BCH supporters and currency holders, and it is not rare that BCH will fall in the future.

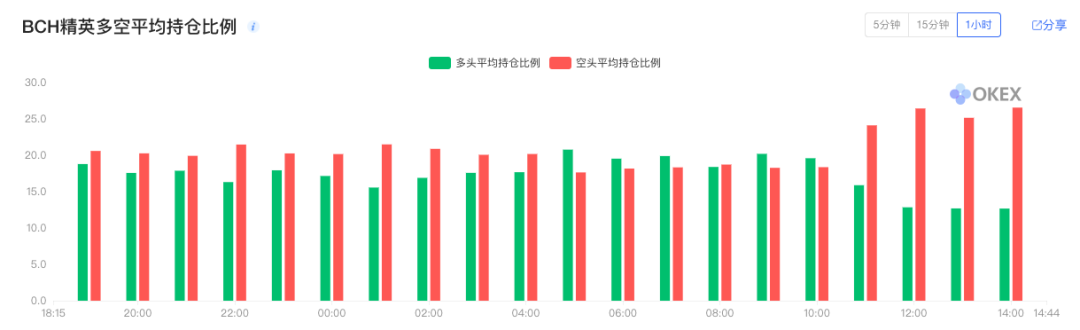

Observing the contract situation of BCH on OKEx from the perspective of long-short ratio. In the past two consecutive days (4.6-4.7), the proportion of short positions was greater than that of long positions; and as of 5-10 today, the short position was briefly overwhelmed by the short position; It started to rise at 10 o'clock and the bears once again gained the upper hand. OKEx data shows that the number of short accounts for BCH delivery contracts has reached 1.5 times that of long accounts.

Data from: OKEx, collection time: 14:00 on April 8

Data from: OKEx, collection time: 14:00 on April 8

Data from: OKEx, collection time: 14:00 on April 8

Data from: OKEx, collection time: 14:00 on April 8

OKEx investment research director "Kye" analyzed that the bearish sentiment is stronger, mainly because many investors friends are more worried about the "boots landing" market. Having such a sense of risk is the basic quality of a qualified investor. After all, Litecoin's production cut has been less than a year in the past, and everyone still remembers it.

LTC halved the situation last August, and crypto analyst "Blockchain William" made a detailed review in the blog.

"The first is a slight increase before the halving, which is not a big reaction. Everyone generally thinks that the" halving has no market ". Unexpectedly there was a" bright spot "after the halving. The market suddenly pulled up and broke through 100 US dollars, but then I have n’t gone back until I inserted a pin. However, there is also an important factor that the general environment is going down. "

"History is always surprisingly similar, but it may not be similar one after another. This time, you may see that the historical stage is the A program, or the B program, C program, these programs have appeared in the history. At this time, to judge whether There will be a 'boots landing' market, I don't think it makes much sense, because accurate prediction of short-term price movements is really difficult. "Lord K told Odaily Planet Daily.

Some people are more pessimistic about the market after the BCH halving, and some people think that the halving market may not exist at all, and even if it is, it may be consumed in advance like LTC.

"The so-called halving is so there is a market. This statement is from beginning to end. It is the confidence and consensus brought by Bitcoin. Other coins do not have such a consensus basis, and there is no significant decline in the market supply caused by Bitcoin halving. "William Blockchain pointed out.

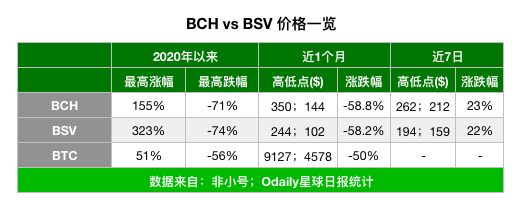

From the statistical data, since 2020, BCH and BSV have generally shown an upward trend and then a downward trend. Many currency holders believe that behind the overall price increase, the impact factor of the halving effect has contributed greatly.

BCH once reached an annual high of US $ 495 on February 15, with a cumulative increase of 155%, but continued to "retrace" in the following month, and bottomed out on March 13, with a cumulative decrease of 71%.

There have been two big rises in BSV this year, the first happened on the independent market on January 10, and BSV recorded a 280% increase in 4 days, which is a 320% increase from the beginning of the year, but a big plunge in March China also withdrew nearly 75%.

After several ups and downs, BitUniverse data shows that BCH and BSV are still the mainstream coins with few digits in Q1, with increases of 6.9% and 73%, respectively.

Does this mean that the "halving benefit" has been burned out?

Lord K ’s view is quite optimistic, “We want to divide the halving into two impact stages, one is the short-term“ bubble blowing ”stage, and the other is the long-term“ base brick ”stage. Supply and demand have an impact, so the halving will not end prematurely. "

"Blockchain William" combines the experience of LTC and holds a negative view. "The mainstream currency halves usually follow the big trend, and it is likely that there will be no independent market." But he added that the difference between BCH, BSV and LTC is that the halved dual currency has a strong "main force ".

After halving, will BCH lack computing power?

After halving, will BCH lack computing power?

The most direct negative effect of halving is the impact on mining revenue.

With the decrease in income, some miners leave the field or switch to BTC mining, which results in a short-term decline in computing power (half a month-1 month), which is normal.

But if you are worried that the BCH network will be insecure because of this, you have to worry too much.

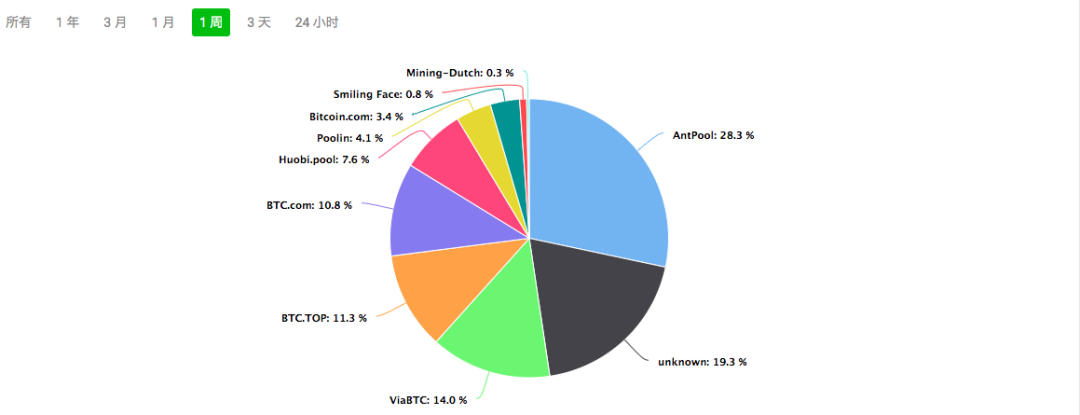

Data from: BTC.com, collection time: 16:00 on April 8

Data from: BTC.com, collection time: 16:00 on April 8

The top five mining pools of BCH, except for an "unknown", all other mining pools are world mining pools that have explicitly supported BCH in the bifurcation of BTC or BCH & BSV computing power, including Bitmain's AntPool, BTC.com, Bit The mainland-invested micro-bit mining pool ViaBTC and Jiangzhuoer's lebit mining pool BTC.TOP.

Among them, Jiang Zhuoer voted against in the "BCH Miner Donation Plan" not long ago, and said that he will use his personal holding power of 3500P (about equal to the halving of the entire network power of BCH) to defend the interests of BCH . Therefore, if BCH encounters a computing power attack, these mining tyrants will not sit idly by.

Data from: F2Pool, collection time: 20:00 on April 8

In addition to the well-known "thighs", BCH's current mainstream client ABC also has a setting called "rolling checkpoints". Its function is that when a block gets more than 10 confirmations, it cannot be rolled back. To prevent double-flower attacks.

How does the halving of dual currency affect BTC?

How does the halving of dual currency affect BTC?

From the perspective of the transfer of miners, how much competition will the double currency halving theoretically bring to BTC mining?

Assuming that half of the computing power of BCH and BSV is turned to mining BTC, we can see that BTC will increase the computing power by 3%. This increase is also common for Bitcoin. But at the moment when the mining profit is meager, this increase is still a big burden for BTC miners.

On the other hand, the price trend of the halving of the dual currency this time will also become one of the reference systems for the halving of BTC.

"Every halving of the market trend has reference significance for the future halving of the market, because you need to experience the A, B, and C programs to obtain experience and reference data. Especially very similar events are forming very similar price trends. Time. "Ye K, director of investment research at OKEx, thinks.

How to solve the slow development of BCH when the donation plan for miners is put on hold?

How to solve the slow development of BCH when the donation plan for miners is put on hold?

In addition to price and network security, judging the value scale of the public chain, it also depends on the development progress and on-chain ecology.

In this respect, BCH is often compared with BSV, the "brother".

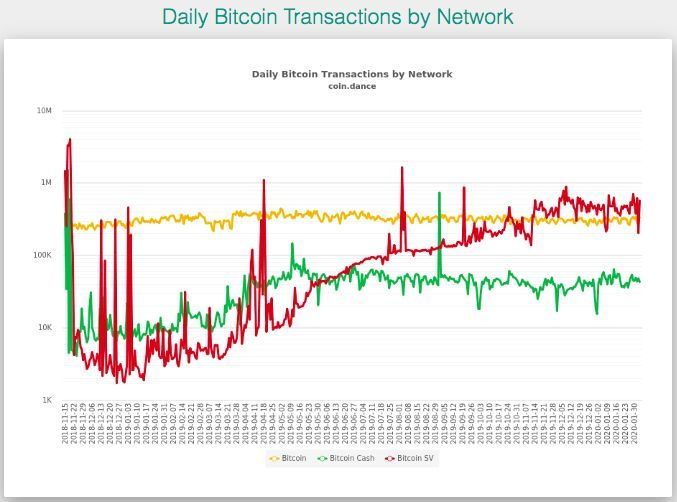

Both have similar large block expansion routes and payment public chain visions, but after the separation of the two at the end of 2018, BSV's on-chain applications and transaction volume soon exceeded BCH, so the question of "slow development of BCH" is constantly heard. .

The following figure shows the daily trading volume of BTC (yellow line), BCH (green line), and BSV (red line). As can be seen from the figure, in addition to the stress test, BSV's trading volume has overwhelmed the previous two.

Of course, many BCH supporters do not recognize this "leading" of BSV.

BCH enthusiast BruceLee once said in the blog, "The act of storing data such as weather on the blockchain to generate a large amount of TX (on-chain transactions) like some coins (referring to BSV) can only be said to be pure brushing data Even if there are more TXs, it will not be connected with killer apps. "

If the ecological application of BSV is not actually applied, as a public chain, BCH may be even worse, because there are few applications on it.

The reason is that the Odaily Planet Daily previously introduced an intuitive problem. The BCH development team's fundraising method is inefficient and unsustainable.

In order to avoid the development of food shortages and further strengthen the ecology, in January this year, Jiang Zuoer published a blog post to announce a "BCH Infrastructure Finance Plan" (hereinafter referred to as the "plan"), which aims to donate block rewards through miners To continuously raise funds for the development team.

This "plan" was rejected by many community members as a "dictatorship" because of its tendency to achieve "joint implementation of several large mining pools" and "voting power vote". In the end, Jiang Zhuoer, one of the main promoters, announced Just stop.

But unexpectedly, on February 19th, in the new version of the client released by the ABC team, the default miners can only vote for the "plan". If you don't want to vote or vote for No, you must have some programming knowledge and modify the code yourself.

According to BCH supporter "Walking Translation C", this version of the software is called "malware" by the community. Subsequently, the former ABC team founding member freetrader announced that the new version of the client BCH Node (BCHN) does not contain the "plan". And gradually get support.

At the same time, the community has insufficient trust in the main development team, ABC, and the risk of community fragmentation remains.

"At present, as long as there is no malicious computing power to vote for that 'plan', then it will basically not be activated." Walking's translation C thinks.

On the bright side, the walking translation C believes that while the "plan" is controversial, overseas communities have launched many alternatives, and a new full-node client BCHN and new financing tool Flipstarter have been born to make the BCH ecology more The region is robust and diverse, and development is more decentralized, which is still good for the development of BCH in the long run.

In addition to the donation plan, on March 20th, Tether announced that it will issue USDT on BCH through the SLP protocol. This is the fifth public chain selected by USDT after the underlying public chains such as BTC and ETH. The "money printing" bank in this circle recognized the community.

According to BruceLee, the SLP protocol (a token protocol running on the BCH network) launched in early 2019 has released 7,530 currencies. According to statistics, the TX generated on SLP accounts for more than 10% of the total currency of BCH.

In addition, in early April, the developers of General Protocols announced that they will launch Anyhedge, a derivatives platform based on BCH, which is expected to become the first DeFi protocol on BCH. On April 5, Cashfusion, a mixed currency solution, also successfully raised $ 51,000 in BCH in the community, which will help the team to continue to develop and provide exclusive privacy trading solutions for BCH.

In the past month, we have indeed seen a lot of important progress, which may indicate that the ecological application of BCH is achieving a leap from 0 to 1.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After bitcoin cash halved, the hash rate dropped and prices moved smoothly

- How to choose cryptography technology? Final exploration of the security model of quantum computing communication

- The money circle of the currency circle is eyeing a short video: dozens of "fire bull" platforms have been born, claiming to be "500 per month lying"

- Ali & JD.com ’s blockchain war, Jack Ma: 100 billion is not enough, I will invest 200 billion

- U.S. Congressional Oversight Agency Says Very Interested in Blockchain Technology

- Babbitt column | stocks inward, tokens outward

- Viewpoint | Blockchain can improve data governance transparency and efficiency, privacy protection still faces challenges